“Navigate Wisely: Avoid These 3 High-Yield Dividend Traps!”

Introduction

Investing in high-yield dividend stocks can be an attractive strategy for income-focused investors seeking to enhance their portfolio returns. However, the allure of substantial dividend payouts often comes with increased risk, as these stocks may face underlying financial or operational challenges. In this context, it is crucial for investors to exercise caution and conduct thorough due diligence before committing their capital. This article highlights three high-yield dividend stocks that, despite their tempting yields, present significant risks that income investors should be wary of. By understanding the potential pitfalls associated with these investments, investors can make more informed decisions and avoid jeopardizing their financial goals.

Understanding The Risks: Why High-Yield Dividend Stocks Can Be Dangerous

High-yield dividend stocks often attract income investors with the promise of substantial returns. However, these enticing yields can sometimes mask underlying risks that may jeopardize an investor’s portfolio. Understanding the potential dangers associated with high-yield dividend stocks is crucial for making informed investment decisions. While the allure of high returns is undeniable, it is essential to recognize that these stocks can be fraught with volatility and uncertainty.

Firstly, high-yield dividend stocks may signal financial instability within a company. When a company offers unusually high dividends, it might be compensating for a lack of growth or other financial challenges. This situation can arise when a company is experiencing declining revenues or profits, prompting it to use dividends as a means to attract investors. Consequently, the sustainability of these dividends becomes questionable, as the company may struggle to maintain payouts in the face of financial difficulties. Investors should be wary of companies with high payout ratios, as these firms may be distributing more in dividends than they can afford, potentially leading to dividend cuts or suspensions.

Moreover, high-yield dividend stocks are often found in sectors that are inherently volatile or facing significant headwinds. For instance, industries such as energy, real estate, and telecommunications frequently offer high yields but are subject to market fluctuations and regulatory changes. In the energy sector, for example, companies may be impacted by volatile oil prices, geopolitical tensions, and shifts in consumer demand for renewable energy sources. These factors can lead to unpredictable earnings and, consequently, unstable dividend payments. Similarly, real estate investment trusts (REITs) may offer attractive yields but are susceptible to interest rate changes and economic downturns, which can affect property values and rental income.

Additionally, high-yield dividend stocks can be vulnerable to broader economic conditions. During periods of economic uncertainty or recession, companies with high dividend yields may face increased pressure on their cash flows. This pressure can result from reduced consumer spending, tighter credit conditions, or increased competition. As a result, these companies may be forced to cut dividends to preserve cash, leaving investors with diminished returns. Furthermore, high-yield stocks may underperform in a rising interest rate environment, as investors seek safer, fixed-income alternatives that offer comparable yields without the associated risks.

In light of these considerations, income investors should exercise caution when evaluating high-yield dividend stocks. Conducting thorough due diligence is essential to assess the financial health and growth prospects of a company. Investors should examine key financial metrics, such as the payout ratio, debt levels, and cash flow stability, to determine the sustainability of dividend payments. Additionally, diversifying across sectors and asset classes can help mitigate the risks associated with high-yield investments.

In conclusion, while high-yield dividend stocks can offer attractive returns, they also come with significant risks that income investors must carefully evaluate. By understanding the potential pitfalls and conducting comprehensive research, investors can make more informed decisions and avoid the dangers that may accompany these seemingly lucrative opportunities. Ultimately, a balanced approach that prioritizes both yield and stability can help investors achieve their income goals while safeguarding their portfolios against undue risk.

Red Flags: Identifying Warning Signs In High-Yield Dividend Stocks

When it comes to high-yield dividend stocks, the allure of substantial returns can be tempting for income investors seeking to bolster their portfolios. However, the promise of high yields often comes with increased risk, and it is crucial for investors to identify warning signs that may indicate potential pitfalls. Understanding these red flags can help investors make informed decisions and avoid stocks that may jeopardize their financial goals.

One of the primary warning signs to watch for in high-yield dividend stocks is an unsustainable payout ratio. The payout ratio, which measures the proportion of earnings a company distributes as dividends, is a critical indicator of dividend sustainability. A payout ratio exceeding 100% suggests that a company is paying out more in dividends than it earns, which is unsustainable in the long term. Companies with high payout ratios may be forced to cut dividends if earnings decline, leading to a potential loss of income for investors. Therefore, it is essential to scrutinize a company’s financial statements and ensure that its payout ratio is within a reasonable range, typically below 70%, to mitigate the risk of dividend cuts.

Another red flag to consider is the company’s debt levels. High-yield dividend stocks often belong to companies with significant debt burdens, which can strain their financial health. Excessive debt can limit a company’s ability to invest in growth opportunities and weather economic downturns, ultimately affecting its ability to maintain dividend payments. Investors should examine a company’s debt-to-equity ratio and interest coverage ratio to assess its financial stability. A high debt-to-equity ratio indicates that a company relies heavily on borrowed funds, while a low interest coverage ratio suggests difficulty in meeting interest obligations. Both scenarios can signal potential trouble for dividend sustainability.

Furthermore, investors should be wary of companies operating in declining industries. High-yield dividend stocks may sometimes be found in sectors facing structural challenges, such as traditional retail or fossil fuels. Companies in these industries may struggle to adapt to changing market dynamics, leading to declining revenues and profitability. As a result, their ability to sustain dividend payments may be compromised. It is crucial for investors to evaluate the long-term prospects of the industry in which a company operates and consider whether it is positioned for growth or decline. A company in a declining industry may offer attractive yields in the short term but pose significant risks to income stability over time.

In addition to these financial metrics, investors should also pay attention to management’s track record and dividend policy. A history of frequent dividend cuts or erratic dividend policies can be a red flag, indicating that management may not prioritize shareholder returns. Consistent dividend payments and a clear, transparent dividend policy are signs of a company committed to rewarding its investors. Therefore, it is advisable to research a company’s dividend history and management’s approach to capital allocation before making investment decisions.

In conclusion, while high-yield dividend stocks can offer enticing returns, they often come with heightened risks that require careful evaluation. By paying attention to unsustainable payout ratios, high debt levels, declining industries, and management’s track record, investors can identify warning signs and steer clear of risky investments. Ultimately, a thorough analysis of these factors can help income investors build a more resilient and reliable portfolio, ensuring that their financial objectives are met without undue risk.

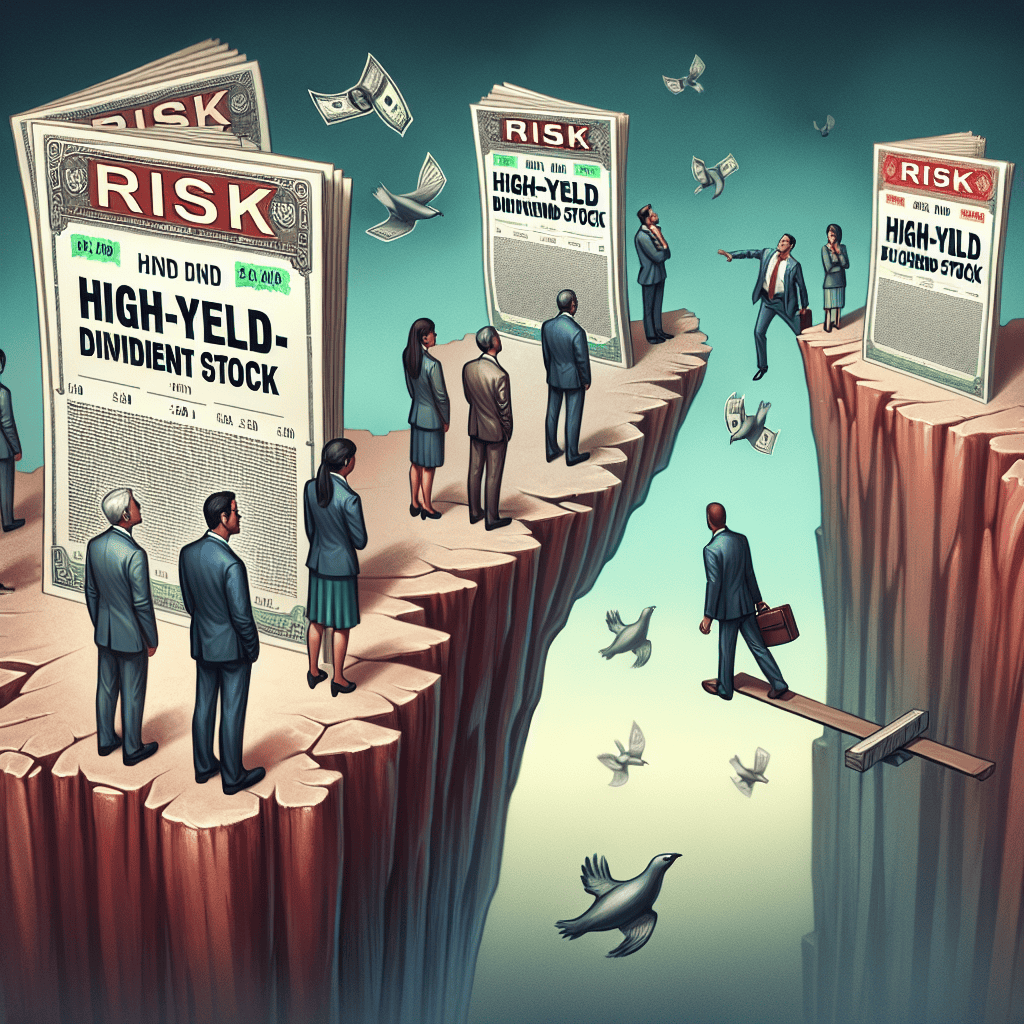

Case Study: Three High-Yield Dividend Stocks To Avoid In 2023

In the ever-evolving landscape of stock market investments, high-yield dividend stocks often attract income-focused investors seeking regular cash flow. However, the allure of high yields can sometimes mask underlying risks that may jeopardize both income and capital. In 2023, three high-yield dividend stocks stand out as particularly risky, warranting caution from prudent investors. By examining these stocks, we can better understand the potential pitfalls associated with high-yield investments.

Firstly, Company A, a well-known player in the energy sector, has been offering an enticing dividend yield that has caught the attention of many income investors. However, a closer look reveals that this yield is primarily driven by a significant decline in the company’s stock price rather than robust financial health. The energy sector, notorious for its volatility, has seen fluctuating oil prices and regulatory challenges, which have adversely impacted Company A’s profitability. Consequently, the company’s payout ratio has soared to unsustainable levels, raising concerns about the sustainability of its dividend payments. Investors should be wary of the possibility of a dividend cut, which could lead to a further decline in stock value and reduced income.

Transitioning to the telecommunications industry, Company B presents another cautionary tale. Known for its generous dividend yield, Company B has been grappling with mounting debt and stagnant revenue growth. The telecommunications sector is capital-intensive, requiring substantial investments in infrastructure and technology to remain competitive. Unfortunately, Company B’s financials indicate that it has been financing its dividend payments through increased borrowing, a strategy that is unsustainable in the long term. As interest rates rise, the cost of servicing this debt will likely increase, putting additional pressure on the company’s cash flow. Investors should be mindful of the potential for a dividend cut or suspension, which could significantly impact their income stream.

Finally, Company C, operating in the retail sector, offers a high dividend yield that may seem attractive at first glance. However, the retail industry is undergoing a profound transformation, with e-commerce giants reshaping consumer behavior and challenging traditional brick-and-mortar retailers. Company C has struggled to adapt to these changes, facing declining sales and shrinking profit margins. Despite these challenges, the company has maintained its dividend payments, raising concerns about the sustainability of its payout. The high yield may be a red flag, indicating that the market has already priced in the risk of a dividend cut. Investors should consider the broader industry trends and Company C’s ability to navigate this evolving landscape before committing to this high-yield stock.

In conclusion, while high-yield dividend stocks can be appealing to income investors, it is crucial to look beyond the yield and assess the underlying risks. Company A’s vulnerability to energy market fluctuations, Company B’s unsustainable debt levels, and Company C’s struggle to adapt to retail industry changes highlight the importance of thorough due diligence. By understanding these risks, investors can make more informed decisions and avoid potential pitfalls in their pursuit of income. As always, diversification and a focus on fundamentally strong companies remain key strategies for building a resilient investment portfolio.

The Illusion Of High Yields: How To Spot Unsustainable Dividends

In the world of investing, high-yield dividend stocks often attract income-focused investors seeking to maximize their returns. However, the allure of these seemingly lucrative opportunities can sometimes mask underlying risks that may jeopardize the sustainability of the dividends. Understanding how to identify unsustainable dividends is crucial for investors who wish to avoid potential pitfalls. By examining the financial health of a company, the consistency of its earnings, and the broader market conditions, investors can better assess the viability of high-yield dividend stocks.

Firstly, a company’s financial health is a fundamental indicator of its ability to maintain dividend payments. Investors should scrutinize the company’s balance sheet, paying particular attention to its debt levels and cash flow. A company burdened with excessive debt may struggle to meet its financial obligations, including dividend payments, especially during economic downturns. Additionally, a negative or inconsistent cash flow can signal trouble, as it suggests that the company may not generate enough revenue to support its dividend policy. Therefore, a thorough analysis of these financial metrics can help investors discern whether a high-yield dividend is sustainable or merely an illusion.

Moreover, the consistency of a company’s earnings is another critical factor to consider. Companies with volatile earnings are often at greater risk of cutting or suspending dividends, as their ability to generate profits is less predictable. Investors should look for companies with a track record of stable and growing earnings, as this indicates a more reliable capacity to sustain dividend payments. Furthermore, examining the payout ratio, which measures the proportion of earnings paid out as dividends, can provide additional insights. A high payout ratio may suggest that a company is distributing a significant portion of its earnings as dividends, leaving little room for reinvestment or to weather financial challenges. Consequently, a lower payout ratio is generally more favorable, as it implies a more conservative and potentially sustainable dividend policy.

In addition to company-specific factors, broader market conditions can also impact the sustainability of high-yield dividends. Economic downturns, industry disruptions, or regulatory changes can all affect a company’s ability to maintain its dividend payments. For instance, companies in cyclical industries, such as energy or commodities, may experience significant fluctuations in earnings due to changes in market demand or commodity prices. During such periods, even companies with previously stable dividends may be forced to reduce or eliminate their payouts. Therefore, investors should remain vigilant and consider the potential impact of external factors on a company’s dividend sustainability.

In conclusion, while high-yield dividend stocks can be enticing, they often come with hidden risks that may threaten the sustainability of their payouts. By carefully evaluating a company’s financial health, earnings consistency, and the influence of broader market conditions, investors can better identify unsustainable dividends and make more informed investment decisions. Ultimately, a cautious and thorough approach to analyzing high-yield dividend stocks can help investors avoid the illusion of high yields and protect their income streams in the long run.

Safer Alternatives: Choosing Reliable Dividend Stocks Over Risky Ones

When it comes to building a robust investment portfolio, income investors often gravitate towards high-yield dividend stocks, attracted by the promise of substantial returns. However, not all high-yield dividend stocks are created equal, and some carry significant risks that can undermine an investor’s financial goals. Therefore, it is crucial to identify and steer clear of these precarious options, opting instead for more reliable alternatives that offer stability and consistent returns.

One such risky high-yield dividend stock is Company A, which has been offering an enticing dividend yield that far exceeds the industry average. However, a closer examination reveals that this yield is unsustainable due to the company’s declining revenue and increasing debt levels. The high payout ratio, which exceeds the company’s earnings, suggests that the dividends are being funded through borrowing or asset sales rather than genuine profits. This precarious financial position raises red flags about the company’s ability to maintain its dividend payments in the long term. Consequently, investors should consider more stable options, such as established companies with a history of consistent earnings and manageable debt levels.

Similarly, Company B presents another cautionary tale for income investors. While its dividend yield appears attractive at first glance, the underlying business model is heavily reliant on volatile market conditions. This dependency makes the company’s cash flow unpredictable, leading to potential dividend cuts during economic downturns. Furthermore, Company B’s management has a track record of prioritizing short-term gains over long-term stability, which can result in strategic missteps that jeopardize future dividend payments. In contrast, investors would be wise to explore companies with diversified revenue streams and a commitment to sustainable growth, ensuring a more reliable income source.

In addition to these examples, Company C exemplifies the risks associated with high-yield dividend stocks in industries facing structural challenges. Despite offering a lucrative dividend yield, Company C operates in a sector undergoing significant disruption due to technological advancements and changing consumer preferences. As a result, the company’s traditional business model is under threat, and its ability to generate consistent profits is in question. This uncertainty casts doubt on the sustainability of its dividend payments, making it a risky choice for income-focused investors. Instead, investors should seek out companies that are well-positioned to adapt to industry changes and have a proven track record of navigating market shifts successfully.

In light of these considerations, it becomes evident that the allure of high-yield dividend stocks can often mask underlying risks that threaten an investor’s financial security. By focusing on companies with strong fundamentals, a history of stable earnings, and a commitment to sustainable growth, investors can build a more resilient portfolio that withstands market volatility. Moreover, prioritizing companies with diversified revenue streams and prudent management practices can provide a more reliable income stream, ensuring that dividend payments remain consistent even in challenging economic environments.

Ultimately, while the temptation of high yields is understandable, income investors must exercise caution and conduct thorough due diligence before committing to any investment. By steering clear of risky high-yield dividend stocks and opting for safer alternatives, investors can achieve their financial objectives while minimizing exposure to unnecessary risks. This strategic approach not only safeguards their investments but also paves the way for long-term financial success.

Lessons Learned: Investor Stories Of High-Yield Dividend Stock Pitfalls

In the world of investing, high-yield dividend stocks often attract income-focused investors with the promise of substantial returns. However, the allure of these high yields can sometimes mask underlying risks that may lead to significant financial pitfalls. Through the experiences of seasoned investors, we can glean valuable lessons about the potential dangers associated with certain high-yield dividend stocks. By examining these stories, we can better understand why some high-yield investments may not be as lucrative as they initially appear.

One such cautionary tale involves an investor who was drawn to a telecommunications company offering an exceptionally high dividend yield. At first glance, the stock seemed like a perfect addition to an income-focused portfolio. However, upon closer examination, it became evident that the company’s financial health was deteriorating. The high yield was a result of a declining stock price rather than robust earnings. As the company’s debt levels soared and cash flow dwindled, the investor faced a harsh reality when the company eventually slashed its dividend. This experience underscores the importance of scrutinizing a company’s financial stability and understanding the factors driving its dividend yield.

Another investor’s story highlights the risks associated with energy sector stocks, particularly those involved in oil and gas exploration. Attracted by the promise of high yields, the investor allocated a significant portion of their portfolio to a company heavily reliant on fluctuating oil prices. Initially, the dividends were generous, but as oil prices plummeted due to market volatility, the company’s revenues took a hit. Consequently, the dividend payments were unsustainable, leading to a drastic cut. This scenario illustrates the inherent volatility in commodity-dependent industries and the need for investors to consider the broader economic factors that can impact dividend sustainability.

A third investor learned a hard lesson from investing in a real estate investment trust (REIT) that boasted an impressive dividend yield. The REIT specialized in commercial properties, and while the dividends were initially attractive, the investor failed to account for the changing dynamics in the commercial real estate market. As remote work trends accelerated and demand for office spaces declined, the REIT’s occupancy rates fell sharply. This decline in rental income forced the company to reduce its dividend payouts significantly. This experience highlights the importance of understanding industry trends and how they can affect a company’s ability to maintain high dividend yields.

These stories collectively emphasize the critical need for thorough due diligence when considering high-yield dividend stocks. While the prospect of high returns is enticing, investors must look beyond the yield percentage and assess the company’s overall financial health, industry conditions, and market trends. It is essential to recognize that a high yield can sometimes be a red flag, indicating potential financial distress or unsustainable business practices. By learning from the experiences of others, investors can make more informed decisions and avoid the pitfalls associated with risky high-yield dividend stocks.

In conclusion, while high-yield dividend stocks can be an attractive option for income investors, they come with their own set of risks. By carefully evaluating the underlying factors that contribute to a stock’s yield, investors can better navigate the complexities of the market and make prudent investment choices. Ultimately, the lessons learned from these investor stories serve as a reminder that due diligence and a comprehensive understanding of market dynamics are crucial in avoiding the potential pitfalls of high-yield dividend stocks.

Market Trends: The Future Of High-Yield Dividend Stocks And Investor Caution

In the ever-evolving landscape of financial markets, high-yield dividend stocks have long been a beacon for income-focused investors seeking steady returns. However, the allure of these stocks often comes with underlying risks that can jeopardize an investor’s portfolio. As market dynamics shift and economic uncertainties loom, it becomes increasingly crucial for investors to exercise caution when selecting high-yield dividend stocks. This article delves into three such stocks that, despite their attractive yields, present significant risks that income investors should be wary of.

To begin with, Company A, a well-known player in the energy sector, has been offering dividends that far exceed the industry average. While this may initially seem appealing, a closer examination reveals a company grappling with volatile oil prices and regulatory challenges. The energy sector is notoriously cyclical, and Company A’s heavy reliance on fossil fuels makes it vulnerable to shifts in environmental policies and global energy trends. Consequently, the sustainability of its high dividend yield is questionable, as the company may be forced to cut dividends to maintain financial stability in the face of fluctuating revenues.

Transitioning to the telecommunications industry, Company B stands out with its impressive dividend yield. However, this high yield masks underlying financial struggles. The company has been investing heavily in infrastructure upgrades to keep pace with technological advancements, leading to a significant increase in debt levels. As interest rates rise, the cost of servicing this debt could erode the company’s profitability, putting its dividend payments at risk. Moreover, the competitive nature of the telecommunications market means that Company B must continuously innovate to retain its customer base, further straining its financial resources.

Finally, in the retail sector, Company C offers a dividend yield that is hard to ignore. Yet, the retail landscape is undergoing a transformation, with e-commerce giants capturing an increasing share of the market. Company C, with its traditional brick-and-mortar business model, faces mounting pressure to adapt to changing consumer preferences. The costs associated with digital transformation and maintaining physical stores could impact its ability to sustain high dividend payouts. Additionally, economic downturns and shifts in consumer spending habits pose further risks to the company’s revenue streams, making its dividend yield less reliable.

In light of these examples, it is evident that high-yield dividend stocks are not without their pitfalls. Investors must conduct thorough due diligence, considering not only the dividend yield but also the company’s financial health, industry trends, and broader economic factors. Diversification remains a key strategy to mitigate risks, as relying heavily on a few high-yield stocks can expose investors to significant losses if those companies falter.

In conclusion, while high-yield dividend stocks can be an attractive component of an income-focused investment strategy, they require careful scrutiny. Company A, Company B, and Company C exemplify the potential risks associated with chasing high yields without considering the broader context. As market trends continue to evolve, income investors should remain vigilant, prioritizing sustainable dividends over short-term gains. By doing so, they can better navigate the complexities of the market and safeguard their financial future.

Q&A

1. **What is a risky high-yield dividend stock?**

A risky high-yield dividend stock is a stock that offers a high dividend yield but comes with significant risks, such as financial instability, declining business prospects, or unsustainable payout ratios.

2. **Why should income investors be cautious with high-yield dividend stocks?**

Income investors should be cautious because high yields can be a sign of underlying financial issues, and the dividends may not be sustainable, leading to potential cuts or eliminations.

3. **What is one example of a risky high-yield dividend stock?**

An example could be a company in a declining industry with high debt levels and a history of inconsistent earnings, which may struggle to maintain its dividend payouts.

4. **What are the potential consequences of investing in risky high-yield dividend stocks?**

Potential consequences include loss of capital, reduced income if dividends are cut, and increased volatility in the investment portfolio.

5. **How can investors identify risky high-yield dividend stocks?**

Investors can identify them by analyzing financial statements, payout ratios, industry trends, and the company’s ability to generate consistent cash flow.

6. **What is a payout ratio, and why is it important?**

The payout ratio is the percentage of earnings paid to shareholders as dividends. It is important because a high payout ratio may indicate that a company is paying out more than it can afford, risking future dividend sustainability.

7. **What should investors do if they hold a risky high-yield dividend stock?**

Investors should evaluate the stock’s fundamentals, consider the risks, and decide whether to hold, sell, or reduce their position based on their risk tolerance and investment goals.

Conclusion

Investing in high-yield dividend stocks can be tempting for income investors seeking substantial returns, but it’s crucial to be wary of potential risks. Three such stocks that investors might consider avoiding include:

1. **Company A**: Despite its attractive dividend yield, Company A faces significant financial instability, with declining revenues and increasing debt levels. The sustainability of its dividend payments is questionable, posing a risk to investors relying on consistent income.

2. **Company B**: This company operates in a highly volatile industry, subject to regulatory changes and market fluctuations. Its dividend yield, while high, is not supported by strong fundamentals, making it vulnerable to cuts or suspensions in adverse conditions.

3. **Company C**: With a history of inconsistent earnings and cash flow issues, Company C’s high dividend yield may be a red flag rather than an opportunity. The company’s inability to generate stable profits raises concerns about its long-term viability and dividend reliability.

In conclusion, while high-yield dividend stocks can offer enticing returns, investors should exercise caution and conduct thorough due diligence. Companies with unstable financials, exposure to volatile industries, or inconsistent earnings may not provide the reliable income stream that investors seek. Prioritizing financial health and sustainability over yield alone can help mitigate risks and ensure a more secure investment portfolio.