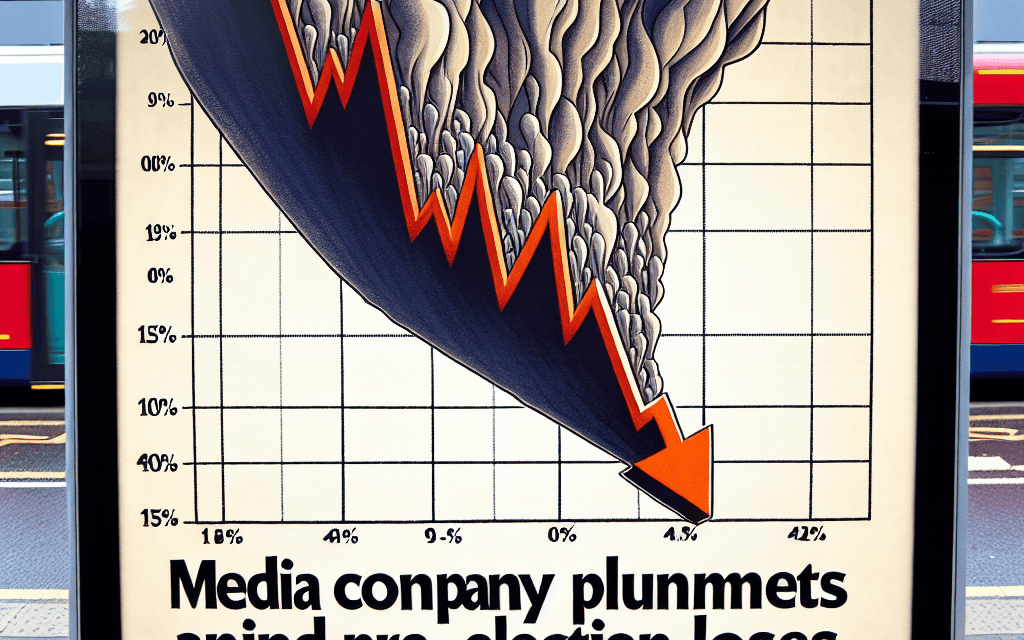

“Trump Media Faces Turbulence: Stock Dives 15% as Pre-Election Challenges Mount”

Introduction

Trump Media & Technology Group, the company behind the social media platform Truth Social, recently experienced a significant decline in its stock value, plummeting 15% as it faces mounting financial challenges ahead of the upcoming elections. This downturn reflects growing investor concerns over the company’s ability to sustain its operations and expand its user base in a highly competitive digital landscape. The pre-election period has intensified scrutiny on the platform’s financial health and strategic direction, raising questions about its long-term viability and impact on the media and technology sectors. As the political climate heats up, Trump Media’s financial struggles underscore the broader challenges faced by emerging social media companies in securing market confidence and achieving profitability.

Impact Of Pre-Election Uncertainty On Trump Media Stock

The financial landscape surrounding Trump Media & Technology Group has recently experienced significant turbulence, as evidenced by a notable 15% decline in its stock value. This downturn is largely attributed to the growing uncertainty that typically accompanies the pre-election period, a time when investors often reassess their portfolios in anticipation of potential political and economic shifts. As the nation inches closer to the upcoming elections, the market’s reaction underscores the intricate relationship between political developments and financial markets, particularly for companies with strong political affiliations.

In the case of Trump Media, the company’s fortunes are closely tied to the political climate, given its association with former President Donald Trump. This connection has historically influenced investor sentiment, with stock performance often mirroring the ebb and flow of Trump’s political fortunes. As the election season heats up, the heightened scrutiny and speculation surrounding Trump’s potential candidacy have introduced a layer of unpredictability that investors are finding difficult to navigate. Consequently, this has led to a sell-off, as market participants seek to mitigate risk in an environment fraught with uncertainty.

Moreover, the broader media landscape is undergoing rapid transformation, with digital platforms and social media giants continually reshaping the way information is consumed and disseminated. Trump Media, which positions itself as an alternative to mainstream media outlets, faces the dual challenge of carving out a niche in a saturated market while also contending with the regulatory and competitive pressures that come with operating in the digital space. This confluence of factors has further compounded investor concerns, contributing to the recent decline in stock value.

Adding to the complexity is the ongoing debate over content moderation and the role of media companies in shaping public discourse. Trump Media’s commitment to providing a platform for free speech has been both a selling point and a source of controversy, attracting a diverse user base while also drawing criticism from those who argue that such platforms can become breeding grounds for misinformation. This contentious issue has the potential to impact the company’s reputation and, by extension, its financial performance, as advertisers and partners weigh the risks of association.

In light of these challenges, Trump Media’s leadership faces the daunting task of reassuring investors and charting a course through the volatile pre-election period. Strategic decisions regarding content policies, partnerships, and platform development will be crucial in stabilizing the company’s stock and restoring investor confidence. Furthermore, effective communication with stakeholders will be essential in managing expectations and mitigating the impact of external factors beyond the company’s control.

As the election draws nearer, the interplay between political dynamics and market forces will likely continue to influence Trump Media’s stock performance. Investors will be closely monitoring developments on the campaign trail, as well as any regulatory changes that could affect the media industry at large. In this context, the recent 15% drop in stock value serves as a stark reminder of the inherent volatility that accompanies politically charged investments. Ultimately, the ability of Trump Media to navigate these challenges will play a pivotal role in determining its long-term viability and success in an ever-evolving media landscape.

Analyzing The 15% Drop In Trump Media Stock

The recent 15% decline in Trump Media stock has captured the attention of investors and analysts alike, raising questions about the underlying factors contributing to this significant drop. As the pre-election period intensifies, the financial landscape for media companies associated with political figures becomes increasingly volatile. This decline in stock value is not merely a reflection of market fluctuations but rather a confluence of several critical elements that warrant a closer examination.

To begin with, the political climate plays a pivotal role in shaping the fortunes of media companies linked to prominent political figures. As the election season approaches, the scrutiny on such entities intensifies, often leading to heightened volatility in their stock prices. In the case of Trump Media, the company’s close association with former President Donald Trump makes it particularly susceptible to the ebbs and flows of political sentiment. Investors, wary of potential controversies or shifts in public opinion, may react swiftly, leading to abrupt changes in stock valuation.

Moreover, the financial performance of Trump Media has been under the microscope, with growing pre-election losses raising concerns among stakeholders. The company’s financial health is a crucial determinant of investor confidence, and any indication of declining revenues or increasing expenses can trigger a sell-off. In recent months, Trump Media has faced challenges in maintaining its revenue streams, partly due to the competitive nature of the media industry and the evolving preferences of its audience. As traditional media outlets grapple with the rise of digital platforms, companies like Trump Media must adapt to remain relevant and financially viable.

In addition to these internal challenges, external market conditions have also contributed to the stock’s decline. The broader economic environment, characterized by inflationary pressures and interest rate hikes, has created a challenging backdrop for media companies. Investors, seeking to mitigate risk, may opt to divest from stocks perceived as vulnerable to economic downturns. Consequently, Trump Media’s stock has not been immune to these broader market dynamics, further exacerbating its recent decline.

Furthermore, regulatory scrutiny has emerged as another factor influencing investor sentiment. Media companies, particularly those with political affiliations, often find themselves under the watchful eye of regulatory bodies. Any potential investigations or legal challenges can cast a shadow over a company’s prospects, prompting investors to reassess their positions. In the case of Trump Media, ongoing regulatory inquiries have added an additional layer of uncertainty, contributing to the stock’s downward trajectory.

Despite these challenges, it is essential to recognize that stock market fluctuations are not uncommon, especially in the media sector. While the recent 15% drop in Trump Media stock is significant, it is not necessarily indicative of the company’s long-term prospects. Investors and analysts will be closely monitoring the company’s strategic initiatives and financial performance in the coming months, as these factors will play a crucial role in determining its future trajectory.

In conclusion, the 15% decline in Trump Media stock is a multifaceted issue, influenced by a combination of political, financial, and regulatory factors. As the pre-election period unfolds, the company must navigate these challenges while striving to bolster investor confidence. By addressing its financial performance, adapting to market conditions, and mitigating regulatory risks, Trump Media can work towards stabilizing its stock value and securing its position in the competitive media landscape.

Investor Reactions To Trump Media’s Financial Decline

In recent weeks, the financial landscape surrounding Trump Media & Technology Group has been marked by significant turbulence, as evidenced by a notable 15% decline in its stock value. This downturn has sparked considerable concern among investors, who are now grappling with the implications of the company’s growing pre-election losses. As the political climate intensifies with the approach of the upcoming elections, the financial health of Trump Media has become a focal point for stakeholders seeking to understand the broader impact on their investments.

The decline in stock value can be attributed to several factors, chief among them being the mounting operational losses that Trump Media has reported in the lead-up to the elections. These losses have raised questions about the company’s ability to sustain its operations and maintain investor confidence in a highly competitive media landscape. Furthermore, the political affiliations of the company have added an additional layer of complexity, as investors weigh the potential risks and rewards associated with its unique positioning.

In light of these developments, investor reactions have been varied, reflecting a spectrum of perspectives on the future trajectory of Trump Media. Some investors have expressed concern over the company’s financial viability, citing the need for a more robust business strategy to counteract the current losses. They argue that without a clear path to profitability, the company’s stock may continue to face downward pressure, potentially eroding shareholder value further.

Conversely, there are investors who remain optimistic about the long-term prospects of Trump Media, viewing the current financial challenges as temporary setbacks. These investors point to the company’s strong brand recognition and its potential to capitalize on a loyal audience base as key factors that could drive future growth. They believe that with strategic adjustments and a focus on expanding its market reach, Trump Media could overcome its present difficulties and emerge as a formidable player in the media industry.

Moreover, the broader economic environment has also played a role in shaping investor sentiment. With inflationary pressures and market volatility affecting various sectors, media companies like Trump Media are not immune to these external influences. As a result, investors are closely monitoring macroeconomic indicators and their potential impact on the company’s financial performance.

In response to the stock’s decline, Trump Media has sought to reassure investors by emphasizing its commitment to innovation and content diversification. The company has announced plans to explore new revenue streams and enhance its digital offerings, aiming to strengthen its competitive position. These initiatives are intended to address investor concerns and demonstrate the company’s proactive approach to navigating the current challenges.

As the election season progresses, the interplay between political dynamics and financial performance will likely continue to shape investor reactions to Trump Media’s stock. The outcome of the elections could have significant implications for the company’s strategic direction and its ability to attract and retain investors. Consequently, stakeholders will be closely watching for any developments that could influence the company’s financial outlook.

In conclusion, the recent 15% drop in Trump Media’s stock has underscored the complexities facing the company as it contends with pre-election losses and a challenging market environment. Investor reactions have been mixed, reflecting both apprehension and optimism about the company’s future. As Trump Media navigates these turbulent times, its ability to adapt and innovate will be crucial in determining its long-term success and stability in the media industry.

Factors Contributing To Trump Media’s Stock Plummet

The recent 15% decline in Trump Media’s stock has raised eyebrows among investors and analysts alike, prompting a closer examination of the factors contributing to this downturn. As the pre-election period intensifies, the financial landscape for media companies associated with political figures becomes increasingly volatile. Trump Media, a company intrinsically linked to former President Donald Trump, is no exception. The stock’s plummet can be attributed to a confluence of factors, each playing a significant role in shaping investor sentiment and market dynamics.

Firstly, the political climate is a critical factor influencing Trump Media’s stock performance. As the nation approaches another election cycle, the media landscape becomes a battleground for competing narratives. Companies like Trump Media, which are closely tied to political figures, often experience heightened scrutiny and volatility. Investors may perceive these companies as riskier investments due to their potential exposure to political controversies and regulatory challenges. Consequently, the uncertainty surrounding the upcoming elections has likely contributed to the recent decline in Trump Media’s stock value.

In addition to the political environment, financial performance and market expectations are pivotal in understanding the stock’s downturn. Trump Media’s financial health is under the microscope as investors assess its ability to generate sustainable revenue and profit. Reports of growing pre-election losses have raised concerns about the company’s financial stability. These losses may be attributed to increased operational costs, declining advertising revenue, or strategic missteps. As a result, investors may be reevaluating their positions, leading to a sell-off and subsequent decline in stock value.

Moreover, competition within the media industry cannot be overlooked. The media sector is highly competitive, with numerous players vying for audience attention and advertising dollars. Trump Media faces stiff competition from established media giants and emerging digital platforms. This competitive pressure can impact the company’s market share and revenue potential, further influencing investor confidence. As competitors innovate and adapt to changing consumer preferences, Trump Media must navigate these challenges to maintain its relevance and financial performance.

Furthermore, regulatory and legal challenges present another layer of complexity for Trump Media. Companies associated with high-profile political figures often attract regulatory scrutiny, which can lead to legal battles and financial penalties. Such challenges can create uncertainty and negatively impact investor sentiment. Trump Media’s association with Donald Trump may expose it to heightened regulatory risks, contributing to the stock’s recent decline.

Lastly, market sentiment and investor perception play a crucial role in stock performance. The media industry is subject to rapid shifts in public opinion, and companies must manage their reputations carefully. Any negative publicity or perceived misalignment with audience values can lead to a loss of consumer trust and investor confidence. In the case of Trump Media, its association with a polarizing political figure may influence public perception and, consequently, investor behavior.

In conclusion, the 15% decline in Trump Media’s stock is the result of a complex interplay of factors, including the political climate, financial performance, competition, regulatory challenges, and market sentiment. As the pre-election period unfolds, these factors will continue to shape the company’s financial trajectory and investor outlook. Understanding these dynamics is essential for investors seeking to navigate the volatile landscape of media stocks associated with political figures.

Market Trends Influencing Trump Media’s Stock Performance

In recent weeks, the financial markets have been closely monitoring the performance of Trump Media & Technology Group (TMTG), particularly as its stock has experienced a significant decline. The company’s stock plummeted by 15%, a drop that has raised eyebrows among investors and analysts alike. This downturn comes at a critical juncture, as the nation approaches another election cycle, a period often characterized by heightened market volatility and investor anxiety. Understanding the factors contributing to this decline requires a comprehensive examination of both the internal dynamics of Trump Media and the broader market trends that are influencing its stock performance.

To begin with, one of the primary factors affecting Trump Media’s stock is the company’s financial health. Recent reports have indicated growing pre-election losses, which have undoubtedly contributed to investor unease. These losses can be attributed to a combination of increased operational costs and challenges in monetizing the platform effectively. As the company seeks to expand its user base and enhance its technological infrastructure, it has encountered significant expenses that have not yet been offset by corresponding revenue growth. Consequently, this financial strain has led to a reevaluation of the company’s valuation, prompting some investors to reconsider their positions.

Moreover, the political landscape plays a crucial role in shaping market perceptions of Trump Media. As the company is closely associated with former President Donald Trump, its fortunes are often intertwined with his political trajectory. With the upcoming elections, there is an inherent uncertainty regarding the potential outcomes and their implications for Trump Media. Investors are acutely aware that any shifts in the political climate could have a direct impact on the company’s operations and, by extension, its stock performance. This uncertainty has led to a cautious approach among investors, contributing to the recent decline in stock value.

In addition to these internal and political factors, broader market trends are also exerting pressure on Trump Media’s stock. The technology sector, in particular, has been experiencing a period of volatility, with many companies facing challenges related to regulatory scrutiny and changing consumer preferences. As a player in the digital media space, Trump Media is not immune to these industry-wide trends. The increasing competition from established social media giants and emerging platforms has intensified the battle for user engagement and advertising dollars. This competitive landscape necessitates continuous innovation and strategic positioning, areas where Trump Media must demonstrate resilience to regain investor confidence.

Furthermore, macroeconomic conditions are influencing investor sentiment across the board. Rising interest rates, inflationary pressures, and geopolitical tensions have created an environment of uncertainty that affects all sectors, including media and technology. Investors are becoming more risk-averse, seeking stability in their portfolios amid these turbulent times. As a result, companies perceived as having higher risk profiles, such as Trump Media, may experience more pronounced stock fluctuations.

In conclusion, the 15% decline in Trump Media’s stock is a reflection of a confluence of factors, including the company’s financial challenges, political uncertainties, industry competition, and broader economic conditions. As the election approaches, the company will need to navigate these complexities with strategic acumen to reassure investors and stabilize its stock performance. While the road ahead may be fraught with challenges, understanding these market trends provides valuable insights into the dynamics influencing Trump Media’s stock trajectory.

Future Projections For Trump Media Amid Stock Losses

The recent 15% decline in Trump Media’s stock has raised significant concerns about the company’s future, especially as it navigates the turbulent waters of pre-election dynamics. This downturn is not merely a reflection of market volatility but also indicative of deeper issues that could affect the company’s long-term viability. As investors and analysts scrutinize the factors contributing to this decline, it becomes crucial to explore the potential future projections for Trump Media amid these growing pre-election losses.

To begin with, the political landscape plays a pivotal role in shaping the fortunes of media companies, particularly those with strong affiliations to political figures. Trump Media, closely associated with former President Donald Trump, finds itself at the intersection of media influence and political allegiance. As the nation approaches another election cycle, the company’s performance is inevitably tied to the political climate. The stock’s recent plummet suggests that investors are wary of the uncertainties surrounding the upcoming elections and their potential impact on media consumption patterns.

Moreover, the competitive nature of the media industry cannot be overlooked. Trump Media operates in a crowded space where traditional media giants and emerging digital platforms vie for audience attention. The company’s ability to differentiate itself and maintain a loyal user base is critical for its survival. However, the recent stock decline indicates that Trump Media may be struggling to achieve this differentiation. As competitors continue to innovate and adapt to changing consumer preferences, Trump Media must find ways to enhance its content offerings and technological capabilities to remain relevant.

In addition to external pressures, internal challenges also contribute to the company’s current predicament. Leadership decisions, strategic direction, and operational efficiency are all factors that influence investor confidence. The recent stock drop could be a reflection of concerns about the company’s management and its ability to navigate the complexities of the media landscape. To address these concerns, Trump Media may need to reassess its leadership strategies and consider bringing in fresh perspectives that can drive innovation and growth.

Furthermore, the financial health of Trump Media is a critical aspect that cannot be ignored. The pre-election losses have undoubtedly put a strain on the company’s financial resources, raising questions about its ability to sustain operations and invest in future growth. To mitigate these challenges, Trump Media may need to explore alternative revenue streams and cost-cutting measures. Diversifying its business model and exploring partnerships or collaborations could provide the necessary financial cushion to weather the current storm.

Looking ahead, the future projections for Trump Media are contingent upon its ability to adapt to the evolving media landscape and political environment. While the recent stock decline is concerning, it also presents an opportunity for the company to reassess its strategies and make necessary adjustments. By focusing on innovation, audience engagement, and financial sustainability, Trump Media can position itself for long-term success. However, this will require a concerted effort from leadership, a willingness to embrace change, and a commitment to delivering value to its stakeholders.

In conclusion, the 15% drop in Trump Media’s stock amid growing pre-election losses serves as a wake-up call for the company. It underscores the need for strategic realignment and proactive measures to address both internal and external challenges. As the company navigates this critical juncture, its future will depend on its ability to adapt, innovate, and maintain relevance in an increasingly competitive media landscape.

Comparing Trump Media’s Stock Volatility With Competitors

In recent months, the financial landscape surrounding Trump Media & Technology Group has been marked by significant volatility, with its stock experiencing a notable 15% decline. This downturn comes amid growing pre-election losses, raising questions about the company’s stability and its position within the competitive media industry. To better understand the implications of this decline, it is essential to compare Trump Media’s stock volatility with that of its competitors, examining the factors contributing to these fluctuations and the broader market dynamics at play.

Firstly, it is important to consider the unique challenges faced by Trump Media. As a company closely associated with a polarizing political figure, its fortunes are often tied to the political climate and public sentiment. This connection can lead to heightened volatility, particularly in the lead-up to elections when political tensions are at their peak. In contrast, many of its competitors, such as established media conglomerates, benefit from a more diversified portfolio of assets and revenue streams, which can provide a buffer against market fluctuations. This diversification allows them to maintain a more stable stock performance, even in turbulent times.

Moreover, the media industry as a whole is undergoing a period of transformation, driven by rapid technological advancements and shifting consumer preferences. Traditional media companies are increasingly investing in digital platforms and content to capture the attention of a tech-savvy audience. In this context, Trump Media’s focus on niche markets and its reliance on a specific demographic may limit its ability to adapt to these changes, further contributing to its stock volatility. Competitors that have successfully embraced digital transformation are better positioned to weather market uncertainties, as they can leverage their digital assets to drive growth and innovation.

Another factor influencing Trump Media’s stock performance is the regulatory environment. The media industry is subject to a complex web of regulations, which can impact companies’ operations and profitability. Trump Media, given its high-profile nature, may face increased scrutiny from regulators, adding another layer of uncertainty to its stock performance. In contrast, larger media companies with established compliance frameworks may be better equipped to navigate regulatory challenges, thereby reducing their exposure to stock volatility.

Furthermore, investor sentiment plays a crucial role in shaping stock performance. Trump Media’s association with a controversial political figure can lead to polarized investor opinions, resulting in sharp price swings. This sentiment-driven volatility is less pronounced among its competitors, which often enjoy broader investor support due to their established market presence and diversified business models. As a result, these companies may experience more stable stock performance, even in the face of market headwinds.

In conclusion, the 15% decline in Trump Media’s stock highlights the unique challenges it faces in a competitive and rapidly evolving media landscape. By comparing its stock volatility with that of its competitors, it becomes evident that factors such as political associations, market diversification, digital transformation, regulatory pressures, and investor sentiment all play a significant role in shaping stock performance. As the media industry continues to evolve, companies that can effectively navigate these challenges and adapt to changing market dynamics are likely to emerge as leaders, while those that struggle to do so may face ongoing volatility and uncertainty.

Q&A

1. **What caused Trump Media’s stock to plummet by 15%?**

The stock plummeted due to growing pre-election losses and investor concerns about the company’s financial stability and future prospects.

2. **How have pre-election losses impacted Trump Media?**

Pre-election losses have raised doubts about the company’s ability to sustain operations and meet financial obligations, leading to decreased investor confidence.

3. **What are investors concerned about regarding Trump Media?**

Investors are worried about the company’s financial health, potential regulatory challenges, and its ability to generate revenue in a competitive media landscape.

4. **Has Trump Media faced any regulatory challenges?**

Yes, Trump Media has faced scrutiny from regulatory bodies, which has contributed to uncertainty and volatility in its stock performance.

5. **What is the market’s reaction to Trump Media’s financial situation?**

The market has reacted negatively, with a significant drop in stock value reflecting investor skepticism and caution.

6. **Are there any strategic changes Trump Media is considering to address these issues?**

While specific strategies have not been disclosed, the company may need to explore cost-cutting measures, strategic partnerships, or new revenue streams to stabilize its financial position.

7. **How might the upcoming election impact Trump Media’s future?**

The upcoming election could further influence the company’s performance, as political dynamics and public sentiment may affect its audience engagement and advertising revenue.

Conclusion

The 15% decline in Trump Media’s stock reflects growing investor concerns over the company’s financial health and strategic direction, particularly in the context of pre-election uncertainties. This drop may indicate waning confidence in the company’s ability to navigate the volatile political landscape and maintain its market position. The losses could also suggest broader challenges in the media sector, especially for entities closely tied to political figures, as they face heightened scrutiny and fluctuating public sentiment. Overall, the stock’s performance underscores the need for Trump Media to address these challenges to stabilize its financial outlook and reassure investors.