“Super Micro Soars: Navigating the Path to Market Stability”

Introduction

Super Micro Computer, Inc. has recently experienced a significant surge in its stock price, driven by investor optimism surrounding the company’s anticipated filing to avoid delisting from major stock exchanges. This development has captured the attention of market participants, as Super Micro seeks to address compliance issues and maintain its listing status. The company’s proactive measures to rectify any discrepancies and align with regulatory requirements have instilled confidence among shareholders, leading to increased trading activity and a notable uptick in stock value. As Super Micro navigates this critical juncture, the market remains watchful of its strategic maneuvers to secure its position and sustain investor trust.

Impact Of Delisting Avoidance On Super Micro Stock Prices

Super Micro Computer, Inc., a global leader in high-performance, high-efficiency server technology and innovation, has recently experienced a significant surge in its stock prices. This upward trajectory is largely attributed to the anticipation surrounding the company’s efforts to avoid delisting from major stock exchanges. Delisting, a process where a company’s stock is removed from a stock exchange, can have severe implications for both the company and its investors. It often results in reduced liquidity, diminished investor confidence, and a potential decline in stock value. Therefore, Super Micro’s proactive measures to prevent such an outcome have been met with optimism by the market.

The anticipation of a delisting avoidance filing has sparked renewed interest among investors, who view this as a positive indicator of the company’s commitment to maintaining its market presence and shareholder value. This sentiment is reflected in the recent surge in Super Micro’s stock prices, as investors are eager to capitalize on the potential stability and growth that the company may achieve by remaining listed. Moreover, the company’s strategic initiatives to address the underlying issues that could lead to delisting have further bolstered investor confidence. These initiatives may include improving financial reporting practices, enhancing corporate governance, and ensuring compliance with regulatory requirements.

In addition to these internal measures, Super Micro’s strong market position and innovative product offerings have also contributed to the positive outlook. The company has consistently demonstrated its ability to adapt to changing market demands and technological advancements, which has solidified its reputation as a leader in the server technology industry. This adaptability, coupled with a robust product pipeline, positions Super Micro favorably in the eyes of investors who are keen on long-term growth prospects.

Furthermore, the broader market environment has also played a role in the recent stock surge. As global economic conditions continue to evolve, investors are increasingly seeking opportunities in companies that exhibit resilience and potential for growth. Super Micro’s efforts to avoid delisting align with this investment strategy, as it underscores the company’s dedication to sustaining its market position and delivering value to shareholders. Consequently, the anticipation of a successful delisting avoidance filing has not only driven up stock prices but also attracted a new wave of investors who are optimistic about the company’s future.

While the current surge in stock prices is promising, it is essential for Super Micro to maintain momentum by executing its strategic initiatives effectively. The company must continue to prioritize transparency, regulatory compliance, and innovation to ensure sustained investor confidence and market stability. By doing so, Super Micro can mitigate the risks associated with potential delisting and reinforce its standing as a reliable and forward-thinking player in the technology sector.

In conclusion, the anticipation of Super Micro’s delisting avoidance filing has had a significant impact on its stock prices, reflecting the market’s positive response to the company’s proactive measures and strategic initiatives. As investors remain optimistic about the company’s future prospects, it is crucial for Super Micro to continue building on this momentum by upholding its commitment to excellence and innovation. Through these efforts, the company can not only avoid the pitfalls of delisting but also pave the way for sustained growth and success in the competitive landscape of server technology.

Investor Reactions To Super Micro’s Delisting Avoidance Filing

Super Micro’s stock has experienced a significant surge, capturing the attention of investors and market analysts alike. This upward trajectory is largely attributed to the anticipation surrounding the company’s forthcoming delisting avoidance filing. As investors keenly await this critical development, the market is abuzz with speculation and analysis regarding the potential implications for Super Micro’s future.

The anticipation of the delisting avoidance filing has created a palpable sense of optimism among investors. This optimism is not unfounded, as the filing represents a crucial step for Super Micro in maintaining its listing status on major stock exchanges. Delisting can have severe consequences for a company, including reduced liquidity, diminished investor confidence, and a potential decline in stock value. Therefore, the company’s proactive approach in addressing this issue has been met with a positive response from the market.

In recent weeks, Super Micro has been under scrutiny due to concerns about its compliance with certain regulatory requirements. These concerns have raised the specter of delisting, which would be a significant setback for the company. However, the anticipated filing is expected to address these compliance issues, thereby alleviating investor concerns and reinforcing confidence in the company’s management and governance practices.

The surge in Super Micro’s stock price is indicative of the market’s confidence in the company’s ability to navigate these challenges successfully. Investors are evidently betting on a favorable outcome, which would not only avert the immediate threat of delisting but also position Super Micro for future growth and stability. This optimism is further bolstered by the company’s strong fundamentals and its track record of innovation and resilience in the face of adversity.

Moreover, the broader market context has also played a role in shaping investor reactions. In an environment characterized by volatility and uncertainty, companies that demonstrate proactive measures to safeguard their market position are often rewarded by investors. Super Micro’s anticipated filing is seen as a strategic move that underscores its commitment to maintaining its standing in the market, thereby enhancing its appeal to both current and potential investors.

As the filing date approaches, market analysts are closely monitoring Super Micro’s stock performance and investor sentiment. The outcome of the filing will undoubtedly have a significant impact on the company’s stock trajectory in the near term. A successful avoidance of delisting could lead to further gains, as investor confidence is likely to be reinforced. Conversely, any setbacks or delays in the filing process could result in heightened volatility and uncertainty.

In conclusion, the anticipation surrounding Super Micro’s delisting avoidance filing has generated a wave of investor optimism, reflected in the recent surge in the company’s stock price. This development highlights the critical importance of regulatory compliance and proactive management in maintaining investor confidence and market stability. As the situation unfolds, all eyes will be on Super Micro to see how it navigates this pivotal moment in its corporate journey. The outcome will not only determine the company’s immediate market standing but also shape its long-term prospects in an increasingly competitive and dynamic industry landscape.

Analyzing Super Micro’s Strategic Moves To Prevent Delisting

Super Micro’s stock has recently experienced a significant surge, capturing the attention of investors and market analysts alike. This upward trajectory is largely attributed to the company’s strategic maneuvers aimed at avoiding potential delisting from major stock exchanges. As the anticipation builds around Super Micro’s forthcoming filing, it is crucial to examine the strategic steps the company is taking to maintain its listing status and the implications these actions may have on its future.

To begin with, Super Micro has been under scrutiny due to concerns over its compliance with listing requirements, which has put the company at risk of delisting. Delisting can have severe consequences, including reduced liquidity, diminished investor confidence, and a potential decline in stock value. Recognizing these risks, Super Micro has embarked on a series of strategic initiatives designed to address compliance issues and reassure stakeholders of its commitment to maintaining its exchange listing.

One of the primary strategies employed by Super Micro involves enhancing its corporate governance practices. By strengthening its board of directors and implementing more rigorous oversight mechanisms, the company aims to ensure greater transparency and accountability. This move is expected to not only satisfy regulatory requirements but also bolster investor confidence by demonstrating a commitment to high standards of governance.

In addition to governance improvements, Super Micro is focusing on financial reporting accuracy and timeliness. The company has invested in upgrading its financial reporting systems and processes to ensure that all financial statements are prepared in accordance with the highest standards of accuracy and compliance. This proactive approach is intended to address any past discrepancies and prevent future issues that could jeopardize its listing status.

Moreover, Super Micro is actively engaging with regulatory bodies to demonstrate its commitment to compliance and to seek guidance on any additional measures that may be necessary. By maintaining open lines of communication with regulators, the company is positioning itself as a cooperative and responsible entity, which could play a crucial role in its efforts to avoid delisting.

Furthermore, Super Micro is also exploring strategic partnerships and collaborations to strengthen its market position and enhance its financial performance. By aligning with industry leaders and leveraging synergies, the company aims to drive growth and innovation, thereby reinforcing its value proposition to investors. These partnerships are expected to not only improve Super Micro’s competitive edge but also contribute positively to its financial health, which is a critical factor in maintaining its listing status.

As the market eagerly awaits Super Micro’s anticipated filing, it is evident that the company’s strategic moves are designed to address both immediate compliance concerns and long-term business sustainability. The recent surge in stock price reflects investor optimism and confidence in Super Micro’s ability to navigate these challenges successfully. However, it is important to note that while these strategies are promising, their effectiveness will ultimately depend on the company’s execution and the broader market environment.

In conclusion, Super Micro’s proactive approach to preventing delisting underscores its commitment to maintaining its position on major stock exchanges. By focusing on corporate governance, financial reporting, regulatory engagement, and strategic partnerships, the company is taking comprehensive steps to safeguard its listing status. As the situation unfolds, stakeholders will be closely monitoring Super Micro’s progress and the impact of these strategic initiatives on its overall performance and market standing.

The Role Of Regulatory Compliance In Super Micro’s Stock Surge

Super Micro’s stock has experienced a significant surge recently, driven by investor optimism surrounding the company’s anticipated filing to avoid delisting. This development underscores the critical role that regulatory compliance plays in the financial markets, particularly for companies navigating complex regulatory landscapes. As investors closely monitor Super Micro’s actions, the broader implications of regulatory adherence become increasingly apparent, highlighting the intricate relationship between compliance and market performance.

To understand the recent surge in Super Micro’s stock, it is essential to consider the context of regulatory compliance and its impact on investor confidence. Companies listed on major stock exchanges are required to adhere to stringent regulatory standards, which are designed to ensure transparency, protect investors, and maintain market integrity. Failure to comply with these regulations can result in severe consequences, including delisting from the exchange, which can significantly diminish a company’s market value and investor appeal.

In the case of Super Micro, the anticipation of a filing to avoid delisting has been a pivotal factor in the recent stock surge. Investors are optimistic that the company will successfully address any compliance issues, thereby maintaining its listing status and preserving shareholder value. This optimism is reflected in the increased demand for Super Micro’s shares, as market participants anticipate a favorable outcome that will reinforce the company’s standing in the market.

Moreover, the situation with Super Micro highlights the broader importance of regulatory compliance as a cornerstone of corporate governance. Companies that prioritize compliance are better positioned to build trust with investors, regulators, and other stakeholders. This trust is crucial in fostering a stable investment environment, as it reduces the perceived risk associated with the company’s operations and financial reporting. Consequently, firms that demonstrate a strong commitment to regulatory adherence are often rewarded with enhanced investor confidence and, by extension, improved stock performance.

Furthermore, the anticipation surrounding Super Micro’s filing serves as a reminder of the dynamic nature of regulatory environments. As regulations evolve, companies must remain vigilant in their compliance efforts, adapting to new requirements and ensuring that their practices align with the latest standards. This adaptability is essential for maintaining market credibility and avoiding potential pitfalls that could jeopardize a company’s listing status.

In addition to the immediate impact on stock performance, regulatory compliance also plays a crucial role in shaping a company’s long-term strategic direction. By fostering a culture of compliance, companies can mitigate risks, enhance operational efficiency, and create a sustainable foundation for growth. This proactive approach not only benefits the company but also contributes to the overall stability and integrity of the financial markets.

In conclusion, the recent surge in Super Micro’s stock amid anticipation of a delisting avoidance filing underscores the vital role of regulatory compliance in shaping market dynamics. As investors remain focused on the company’s efforts to address compliance issues, the broader implications of regulatory adherence become increasingly evident. By prioritizing compliance, companies can build trust, enhance investor confidence, and secure their position in the market, ultimately contributing to a more robust and resilient financial ecosystem. As such, the case of Super Micro serves as a compelling example of the intricate interplay between regulatory compliance and market performance, offering valuable insights for companies and investors alike.

Market Speculation And Its Effect On Super Micro’s Stock Performance

Super Micro’s stock has recently experienced a significant surge, capturing the attention of investors and market analysts alike. This upward trajectory is largely attributed to the anticipation surrounding the company’s potential filing to avoid delisting from major stock exchanges. The market’s response to such speculation underscores the profound impact that investor sentiment and regulatory compliance can have on a company’s stock performance.

To understand the current situation, it is essential to consider the context in which Super Micro operates. As a prominent player in the technology sector, Super Micro has consistently been under the scrutiny of both investors and regulatory bodies. The company’s adherence to financial reporting standards and compliance with exchange regulations are critical factors that influence its market standing. In recent months, concerns about potential delisting have loomed over Super Micro, primarily due to delays in financial filings. Such delays often trigger apprehension among investors, as they may indicate underlying issues within the company.

However, the recent surge in Super Micro’s stock suggests a shift in market sentiment. Investors appear optimistic about the company’s ability to address these concerns and remain listed on major exchanges. This optimism is fueled by reports that Super Micro is preparing to file the necessary documentation to rectify its compliance status. The anticipation of this filing has created a wave of speculative trading, driving up the stock price as investors position themselves to capitalize on potential positive outcomes.

The phenomenon of market speculation is not uncommon, particularly in situations where regulatory compliance is at stake. Investors often react to news and rumors, leading to fluctuations in stock prices. In the case of Super Micro, the anticipation of a delisting avoidance filing has generated a sense of urgency among investors, prompting increased trading activity. This heightened activity reflects the market’s belief in the company’s ability to navigate regulatory challenges successfully.

Moreover, the impact of market speculation extends beyond immediate stock price movements. It also influences investor confidence and the company’s overall market perception. A successful filing to avoid delisting would not only stabilize Super Micro’s stock but also reinforce its reputation as a reliable and compliant entity. This, in turn, could attract new investors and bolster long-term growth prospects.

Nevertheless, it is important to acknowledge the inherent risks associated with speculative trading. While the anticipation of positive developments can drive stock prices upward, any deviation from expected outcomes can lead to significant volatility. Investors must exercise caution and conduct thorough due diligence to mitigate potential risks. The case of Super Micro serves as a reminder of the delicate balance between market speculation and informed investment decisions.

In conclusion, the recent surge in Super Micro’s stock highlights the profound influence of market speculation on stock performance. The anticipation of a delisting avoidance filing has created a wave of optimism among investors, driving up the stock price and reflecting confidence in the company’s ability to address regulatory concerns. However, it is crucial for investors to remain vigilant and consider the potential risks associated with speculative trading. As Super Micro navigates this critical juncture, its actions will undoubtedly shape its future trajectory and market standing.

Super Micro’s Financial Health Amid Delisting Concerns

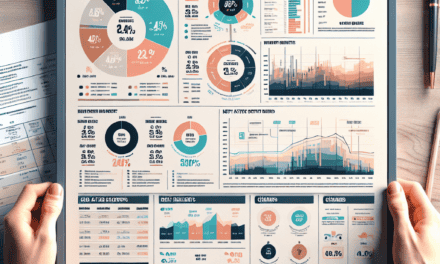

Super Micro’s stock has recently experienced a significant surge, capturing the attention of investors and market analysts alike. This upward momentum comes amid growing anticipation that the company will soon file the necessary documentation to avoid delisting from the stock exchange. The potential delisting has been a looming concern for stakeholders, primarily due to compliance issues related to financial reporting. However, recent developments suggest that Super Micro is taking decisive steps to address these challenges, thereby restoring investor confidence and stabilizing its market position.

The company’s financial health has been under scrutiny, with analysts closely monitoring its ability to meet regulatory requirements. Super Micro’s commitment to transparency and adherence to financial standards is crucial in this context. The anticipated filing is expected to demonstrate the company’s compliance with the necessary regulations, thereby alleviating fears of delisting. This move is likely to reassure investors about the company’s operational integrity and long-term viability, which are essential for maintaining its stock market presence.

In addition to regulatory compliance, Super Micro’s financial performance has been a focal point for investors. The company has shown resilience in navigating a competitive market environment, leveraging its technological expertise and innovative product offerings. By focusing on expanding its product portfolio and enhancing customer satisfaction, Super Micro has managed to sustain revenue growth despite external pressures. This strategic approach has not only bolstered its financial standing but also positioned the company as a formidable player in the technology sector.

Moreover, Super Micro’s efforts to strengthen its financial health are evident in its recent initiatives aimed at cost optimization and operational efficiency. By streamlining processes and reducing overheads, the company has improved its profit margins, thereby enhancing its overall financial stability. These measures are indicative of a proactive approach to financial management, which is critical in mitigating risks associated with potential delisting.

Furthermore, the company’s leadership has played a pivotal role in steering Super Micro through this challenging period. The management’s commitment to upholding corporate governance standards and fostering a culture of accountability has been instrumental in addressing the concerns surrounding financial reporting. By prioritizing transparency and ethical business practices, Super Micro’s leadership has reinforced the company’s reputation as a trustworthy entity in the eyes of investors and regulators.

As the market eagerly awaits the filing that could prevent delisting, the recent surge in Super Micro’s stock reflects a renewed sense of optimism among investors. This positive sentiment is underpinned by the company’s demonstrated ability to adapt to regulatory demands and maintain financial robustness. The anticipated filing is expected to serve as a testament to Super Micro’s dedication to compliance and its strategic focus on sustainable growth.

In conclusion, Super Micro’s financial health amid delisting concerns is a multifaceted issue that encompasses regulatory compliance, operational efficiency, and strategic leadership. The company’s proactive measures to address these aspects have not only mitigated the risk of delisting but also reinforced its market position. As Super Micro continues to navigate this complex landscape, its commitment to financial integrity and innovation will be crucial in sustaining investor confidence and driving future growth. The recent stock surge is a clear indication of the market’s faith in Super Micro’s ability to overcome challenges and thrive in a dynamic business environment.

Future Prospects For Super Micro Post-Delisting Avoidance Filing

Super Micro Computer, Inc., a global leader in high-performance, high-efficiency server technology and innovation, has recently experienced a significant surge in its stock prices. This upward trajectory is largely attributed to the anticipation surrounding the company’s forthcoming delisting avoidance filing. Investors and market analysts alike are closely monitoring Super Micro’s strategic maneuvers, as the company seeks to navigate the complex regulatory landscape and maintain its listing status on major stock exchanges. The potential avoidance of delisting is not only crucial for preserving shareholder value but also for sustaining the company’s reputation and operational stability.

In recent months, Super Micro has faced challenges that have put its listing status at risk. These challenges have included regulatory scrutiny and compliance issues, which have raised concerns among investors about the company’s future prospects. However, the anticipation of a delisting avoidance filing has injected a renewed sense of optimism into the market. This optimism is reflected in the surge of Super Micro’s stock, as investors speculate on the company’s ability to address these challenges effectively and secure its position in the market.

The potential success of the delisting avoidance filing could have far-reaching implications for Super Micro’s future. Firstly, maintaining its listing status would enable the company to continue accessing capital markets, which is essential for funding its growth initiatives and expanding its product offerings. This access to capital is particularly important in the highly competitive technology sector, where innovation and agility are key drivers of success. Furthermore, avoiding delisting would help Super Micro preserve its relationships with key stakeholders, including customers, suppliers, and partners, who may have been concerned about the company’s regulatory challenges.

Moreover, the successful avoidance of delisting could enhance Super Micro’s credibility and reputation in the market. This enhanced reputation could, in turn, attract new investors and bolster the confidence of existing shareholders. As a result, the company may experience increased demand for its stock, further driving up its market value. Additionally, a stable listing status would allow Super Micro to focus on its core business operations and strategic objectives, rather than being distracted by regulatory compliance issues.

Looking ahead, Super Micro’s future prospects appear promising, provided that the company can successfully navigate the delisting avoidance process. The company’s commitment to innovation and excellence in server technology positions it well to capitalize on emerging trends in the technology sector, such as the growing demand for cloud computing and data center solutions. By leveraging its expertise and maintaining its market presence, Super Micro is poised to capture new opportunities and drive sustainable growth.

In conclusion, the anticipation of Super Micro’s delisting avoidance filing has sparked a surge in its stock prices, reflecting investor confidence in the company’s ability to address regulatory challenges and secure its listing status. The successful avoidance of delisting would not only preserve shareholder value but also enhance Super Micro’s reputation and market position. As the company continues to innovate and expand its offerings, it is well-positioned to capitalize on future growth opportunities and maintain its leadership in the technology sector. The coming months will be critical for Super Micro, as it seeks to solidify its standing and chart a course for long-term success.

Q&A

1. **What caused Super Micro’s stock to surge?**

Super Micro’s stock surged due to investor anticipation that the company would file necessary documents to avoid being delisted from the stock exchange.

2. **What is the significance of the delisting avoidance filing?**

The delisting avoidance filing is significant because it demonstrates the company’s compliance with exchange regulations, which can prevent its removal from the stock market and maintain investor confidence.

3. **How did investors react to the news of the potential filing?**

Investors reacted positively, leading to a surge in the stock price as they anticipated that the company would successfully avoid delisting.

4. **What are the potential consequences of a company being delisted?**

If a company is delisted, it can lose access to capital markets, face reduced liquidity for its shares, and suffer a loss of investor confidence.

5. **What steps might Super Micro need to take to avoid delisting?**

Super Micro might need to file overdue financial reports, address any regulatory compliance issues, and meet specific listing standards set by the stock exchange.

6. **What impact does avoiding delisting have on a company’s reputation?**

Successfully avoiding delisting can enhance a company’s reputation by demonstrating its commitment to transparency, regulatory compliance, and financial stability.

7. **What are the broader market implications of Super Micro’s stock surge?**

The stock surge could signal increased investor confidence in the tech sector and may influence the performance of similar companies facing regulatory challenges.

Conclusion

Super Micro’s stock experienced a significant surge due to investor optimism surrounding the company’s anticipated filing to avoid delisting. This positive market reaction reflects confidence in Super Micro’s ability to meet regulatory requirements and maintain its listing status, which is crucial for its market credibility and investor trust. The surge underscores the importance of compliance and strategic communication in maintaining shareholder value and market stability.