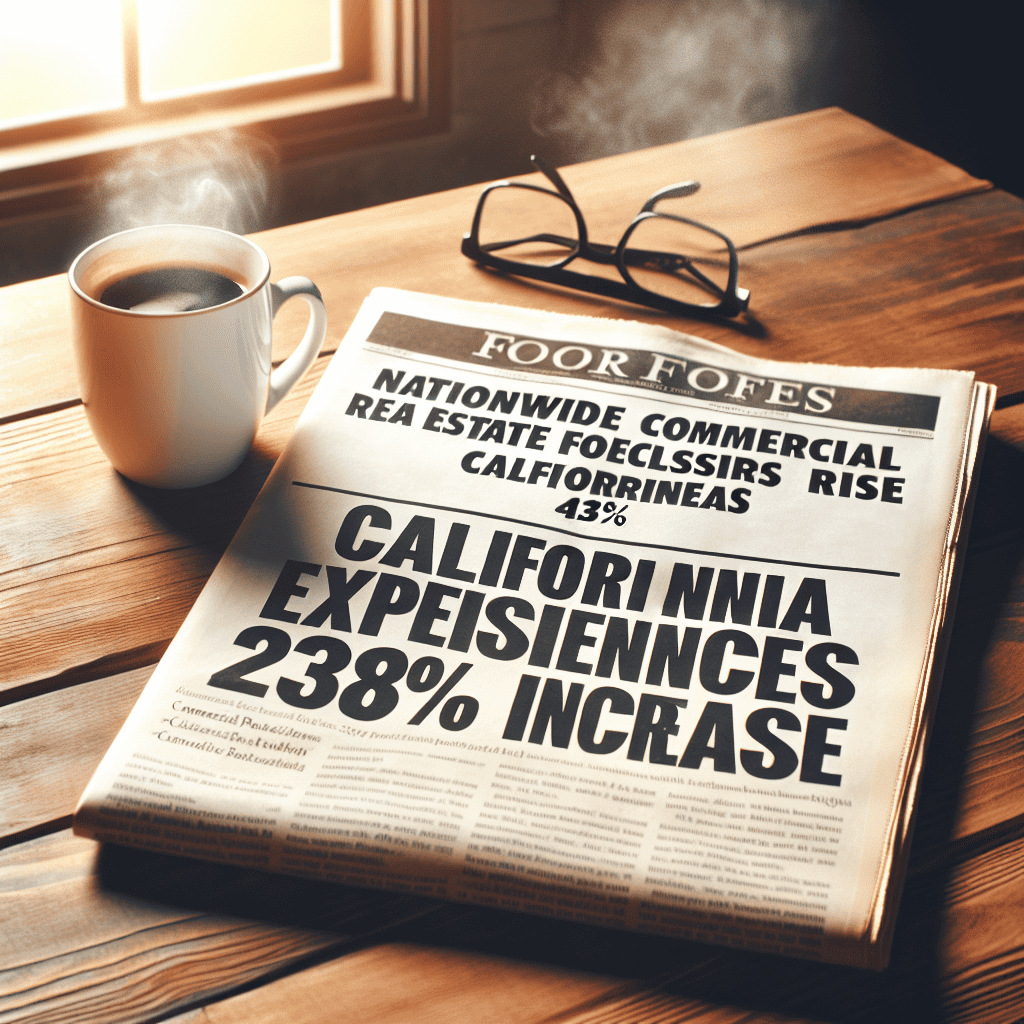

“Foreclosure Surge: California’s Commercial Real Estate Crisis Leads Nationwide Spike”

Introduction

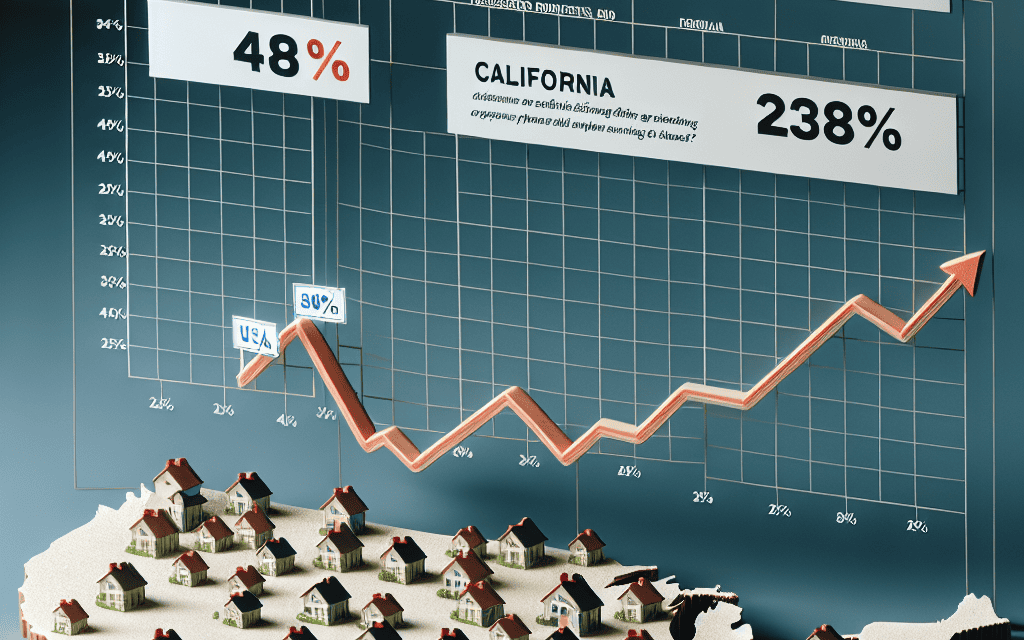

In recent months, the commercial real estate sector has faced significant challenges, as evidenced by a nationwide surge in foreclosures. Data indicates a 48% increase in commercial real estate foreclosures across the United States, highlighting the growing financial strain on property owners and investors. Particularly alarming is the situation in California, where foreclosures have skyrocketed by 238%, underscoring the state’s acute economic pressures and the broader implications for the real estate market. This trend reflects a confluence of factors, including economic uncertainty, shifts in market demand, and the lingering impacts of the pandemic, which continue to reshape the commercial real estate landscape.

Impact Of Rising Foreclosures On Nationwide Commercial Real Estate Market

The recent surge in commercial real estate foreclosures across the United States has sent ripples through the market, with a nationwide increase of 48% and a staggering 238% rise in California alone. This trend is reshaping the landscape of commercial real estate, prompting stakeholders to reassess their strategies and adapt to the evolving economic environment. As the market grapples with these changes, it is crucial to understand the underlying factors contributing to this phenomenon and its broader implications.

To begin with, the increase in foreclosures can be attributed to several interrelated factors. The lingering effects of the COVID-19 pandemic have left many businesses struggling to recover, leading to a decline in demand for commercial spaces. Additionally, the shift towards remote work has reduced the need for office spaces, further exacerbating the challenges faced by property owners. As businesses continue to adapt to new operational models, the demand for traditional commercial real estate has diminished, leaving many properties vacant and financially unviable.

Moreover, rising interest rates have compounded these challenges, making it more difficult for property owners to refinance existing loans or secure new financing. As borrowing costs increase, the financial burden on property owners intensifies, leading to a higher likelihood of default. This situation is particularly pronounced in California, where the real estate market is characterized by high property values and significant competition. The state’s dramatic 238% increase in foreclosures underscores the vulnerability of its commercial real estate sector to economic fluctuations and financial pressures.

The impact of rising foreclosures extends beyond property owners and lenders, affecting a wide range of stakeholders in the commercial real estate market. Investors, for instance, are faced with increased uncertainty and risk, prompting a reevaluation of investment strategies. As foreclosures rise, property values may decline, leading to potential losses for investors and a more cautious approach to future investments. This shift in investor sentiment can have a cascading effect on the market, influencing the availability of capital and the overall health of the sector.

Furthermore, the increase in foreclosures has significant implications for local economies and communities. As commercial properties become vacant or change ownership, there can be a disruption in local business ecosystems, affecting employment and economic activity. The loss of businesses and jobs can lead to a decline in consumer spending, further impacting the economic vitality of affected areas. In California, where the rise in foreclosures is particularly pronounced, these effects are likely to be felt acutely, with potential long-term consequences for the state’s economic landscape.

In response to these challenges, stakeholders in the commercial real estate market are exploring various strategies to mitigate the impact of rising foreclosures. Some property owners are seeking to repurpose or redevelop vacant spaces to align with changing market demands, such as converting office buildings into residential units or mixed-use developments. Others are exploring partnerships and collaborations to share resources and reduce financial burdens. Additionally, policymakers and industry leaders are advocating for measures to support struggling businesses and stabilize the market, such as providing financial assistance or implementing regulatory reforms.

In conclusion, the rise in commercial real estate foreclosures presents significant challenges and opportunities for the market. As stakeholders navigate this complex landscape, it is essential to adopt innovative strategies and collaborative approaches to address the underlying issues and foster a resilient and sustainable commercial real estate sector. By understanding the factors driving this trend and its broader implications, stakeholders can better position themselves to adapt and thrive in an ever-changing economic environment.

California’s Dramatic 238% Increase In Commercial Real Estate Foreclosures

The commercial real estate sector, a cornerstone of economic stability, is currently experiencing a significant upheaval. Nationwide, foreclosures in this sector have surged by 48%, a figure that underscores the broader economic challenges facing the industry. However, the situation in California is particularly alarming, with a staggering 238% increase in commercial real estate foreclosures. This dramatic rise in California not only highlights the state’s unique economic pressures but also serves as a bellwether for potential trends in other regions.

To understand the factors contributing to this surge, it is essential to consider the broader economic context. The commercial real estate market has been grappling with the aftershocks of the COVID-19 pandemic, which fundamentally altered business operations and consumer behaviors. Remote work, for instance, has reduced the demand for office spaces, while the rise of e-commerce has impacted retail properties. These shifts have left many commercial property owners struggling to maintain occupancy rates and rental income, leading to financial distress and, ultimately, foreclosures.

California, with its diverse economy and significant real estate market, has been particularly vulnerable to these changes. The state’s tech-heavy economy, which initially adapted well to remote work, has seen companies reevaluating their need for physical office spaces. This reevaluation has resulted in a surplus of vacant office buildings, particularly in urban centers like San Francisco and Los Angeles. Additionally, the retail sector in California has faced its own set of challenges, as changing consumer preferences and increased competition from online retailers have led to declining foot traffic in traditional shopping areas.

Moreover, California’s real estate market is characterized by high property values and significant investment activity, which can exacerbate the impact of economic downturns. Investors who purchased properties at peak prices are now facing the harsh reality of declining property values and rental incomes, making it difficult to meet mortgage obligations. This situation is further compounded by rising interest rates, which increase the cost of borrowing and place additional financial strain on property owners.

In response to these challenges, some property owners have sought to renegotiate loan terms or explore alternative financing options. However, not all have been successful, leading to an increase in foreclosures as lenders seek to recoup their investments. The ripple effects of these foreclosures are far-reaching, impacting not only property owners and lenders but also local communities and economies. Vacant properties can lead to decreased property values in surrounding areas, reduced tax revenues for local governments, and a decline in economic activity.

As California grapples with this foreclosure crisis, policymakers and industry stakeholders are exploring potential solutions to stabilize the market. These efforts include initiatives to repurpose vacant properties for alternative uses, such as affordable housing or community spaces, as well as programs to support struggling property owners. Additionally, there is a growing recognition of the need for more flexible and adaptive real estate strategies that can better withstand economic fluctuations.

In conclusion, the 238% increase in commercial real estate foreclosures in California is a stark reminder of the challenges facing the sector. While the situation is particularly acute in California, it reflects broader trends that could have implications for other regions. As the commercial real estate market continues to navigate these turbulent times, a combination of innovative solutions and strategic planning will be essential to mitigate the impact of foreclosures and foster long-term stability.

Factors Contributing To The 48% Rise In Nationwide Commercial Real Estate Foreclosures

The recent surge in nationwide commercial real estate foreclosures, marked by a staggering 48% increase, has raised significant concerns among investors, policymakers, and economic analysts. This trend, particularly pronounced in California with an alarming 238% rise, underscores a complex interplay of factors contributing to the current state of the commercial real estate market. Understanding these factors is crucial for stakeholders aiming to navigate the challenges and mitigate potential risks associated with this development.

To begin with, the economic repercussions of the COVID-19 pandemic have left an indelible mark on the commercial real estate sector. The pandemic-induced shift towards remote work and e-commerce has led to a decreased demand for office spaces and retail properties. Consequently, many businesses have downsized or closed, resulting in increased vacancies and reduced rental income for property owners. This decline in revenue has made it increasingly difficult for property owners to meet their mortgage obligations, thereby contributing to the rise in foreclosures.

Moreover, the tightening of credit conditions has exacerbated the situation. Financial institutions, wary of the uncertain economic environment, have adopted more stringent lending criteria. This has made it challenging for property owners to refinance existing loans or secure new financing, further straining their financial capabilities. As a result, property owners who are unable to access necessary capital are more likely to default on their loans, leading to an uptick in foreclosures.

In addition to these economic factors, the rise in interest rates has played a significant role in the increase in foreclosures. The Federal Reserve’s efforts to combat inflation through interest rate hikes have led to higher borrowing costs. For property owners with variable-rate loans, these increased costs have translated into higher monthly payments, placing additional financial pressure on them. This has been particularly detrimental for those already struggling with reduced income due to high vacancy rates.

Furthermore, the regulatory environment has also influenced the foreclosure landscape. In some regions, eviction moratoriums and tenant protection laws, while essential for safeguarding tenants during the pandemic, have inadvertently impacted property owners’ cash flow. These regulations have limited property owners’ ability to evict non-paying tenants, thereby reducing their rental income and increasing the likelihood of foreclosure.

California’s dramatic 238% increase in commercial real estate foreclosures can be attributed to several state-specific factors. The state’s high cost of living and stringent regulatory environment have long posed challenges for businesses. The pandemic exacerbated these issues, leading to a significant number of business closures and relocations. Additionally, California’s reliance on industries heavily impacted by the pandemic, such as tourism and entertainment, has further strained the commercial real estate market.

In conclusion, the 48% rise in nationwide commercial real estate foreclosures is the result of a confluence of economic, financial, and regulatory factors. The pandemic’s lasting impact on business operations, coupled with tightening credit conditions and rising interest rates, has created a challenging environment for property owners. As stakeholders seek to address these challenges, a comprehensive understanding of these contributing factors is essential. By doing so, they can develop strategies to stabilize the market and prevent further foreclosures, ultimately fostering a more resilient commercial real estate sector.

Economic Implications Of Increased Foreclosures In California’s Commercial Real Estate Sector

The recent surge in commercial real estate foreclosures across the United States, with a staggering 48% increase nationwide, has raised significant concerns among economists and industry stakeholders. Particularly alarming is the situation in California, where foreclosures have skyrocketed by an astonishing 238%. This dramatic rise in foreclosures is not merely a statistic but a reflection of deeper economic challenges that could have far-reaching implications for the state’s economy and beyond.

To understand the economic implications of this trend, it is essential to consider the factors contributing to the increase in foreclosures. The commercial real estate sector has been grappling with several challenges, including the lingering effects of the COVID-19 pandemic, which disrupted business operations and altered consumer behavior. Many businesses, especially those in retail and hospitality, faced unprecedented financial strain, leading to an inability to meet lease obligations. Consequently, property owners have struggled to maintain mortgage payments, resulting in a surge of foreclosures.

Moreover, the rise in interest rates has compounded these challenges. As borrowing costs increase, refinancing becomes less viable, and property owners find themselves unable to restructure their debt. This situation is particularly acute in California, where property values are among the highest in the nation. The combination of high property values and rising interest rates creates a precarious environment for property owners, making foreclosure a more likely outcome.

The economic implications of increased foreclosures in California’s commercial real estate sector are multifaceted. Firstly, the rise in foreclosures can lead to a decline in property values. As more properties enter foreclosure, the market becomes saturated with distressed assets, driving down prices. This depreciation can have a ripple effect, affecting not only property owners but also investors and financial institutions with significant exposure to the real estate market.

Furthermore, the increase in foreclosures can lead to a reduction in local government revenues. Property taxes are a critical source of funding for local governments, and as property values decline, so too does the tax base. This reduction in revenue can result in budget shortfalls, forcing local governments to cut essential services or seek alternative funding sources, which can further strain the local economy.

Additionally, the rise in foreclosures can have broader implications for employment. The commercial real estate sector is a significant employer, providing jobs in construction, property management, and real estate services. As foreclosures increase, new construction projects may be delayed or canceled, leading to job losses and reduced economic activity. This contraction can have a cascading effect, impacting other sectors reliant on the commercial real estate industry.

In light of these challenges, policymakers and industry leaders must consider strategies to mitigate the impact of rising foreclosures. Potential solutions could include providing financial assistance to struggling property owners, encouraging refinancing options, or implementing policies to stabilize property values. By addressing the root causes of the foreclosure crisis, stakeholders can work towards a more resilient commercial real estate sector.

In conclusion, the significant increase in commercial real estate foreclosures, particularly in California, underscores the need for a comprehensive approach to address the underlying economic challenges. The implications of this trend are far-reaching, affecting property values, local government revenues, and employment. As such, it is imperative for stakeholders to collaborate and develop strategies to stabilize the market and support economic recovery.

Strategies For Investors Amidst Rising Commercial Real Estate Foreclosures

The recent surge in commercial real estate foreclosures, with a nationwide increase of 48% and a staggering 238% rise in California, has sent ripples through the investment community. This dramatic shift in the market landscape presents both challenges and opportunities for investors. As the commercial real estate sector grapples with these changes, strategic approaches are essential for navigating the evolving environment.

To begin with, understanding the underlying causes of this foreclosure wave is crucial. The pandemic-induced economic downturn, coupled with changing work patterns and consumer behaviors, has significantly impacted the demand for commercial spaces. Many businesses have downsized or shifted to remote operations, leading to increased vacancies and reduced rental income for property owners. Consequently, some investors have struggled to meet their financial obligations, resulting in a rise in foreclosures. Recognizing these factors allows investors to make informed decisions and adapt their strategies accordingly.

In light of these challenges, diversification emerges as a key strategy for investors. By spreading investments across different asset classes and geographic locations, investors can mitigate risks associated with localized economic downturns. For instance, while California has experienced a sharp increase in foreclosures, other regions may present more stable opportunities. Diversifying portfolios can help investors balance potential losses in one area with gains in another, thereby enhancing overall resilience.

Moreover, investors should consider exploring distressed asset opportunities. The current market conditions have led to a rise in distressed properties, which can be acquired at a significant discount. These properties, often in need of renovation or repositioning, offer the potential for substantial returns once market conditions stabilize. However, it is essential for investors to conduct thorough due diligence and assess the feasibility of such investments, taking into account factors like location, market demand, and renovation costs.

In addition to diversification and distressed asset acquisition, investors should also focus on strengthening their financial positions. This involves maintaining adequate liquidity to weather potential downturns and capitalizing on emerging opportunities. By ensuring access to capital, either through cash reserves or lines of credit, investors can act swiftly when attractive deals arise. Furthermore, maintaining strong relationships with financial institutions can facilitate favorable financing terms, which are crucial in a volatile market.

Another important consideration is the adoption of technology and data analytics. Leveraging advanced tools can provide investors with valuable insights into market trends, property performance, and tenant behaviors. By utilizing data-driven strategies, investors can make more informed decisions, optimize property management, and enhance tenant satisfaction. This proactive approach not only improves operational efficiency but also positions investors to better anticipate and respond to market shifts.

Finally, collaboration with experienced professionals can be invaluable. Engaging with real estate advisors, legal experts, and property managers can provide investors with the expertise needed to navigate complex transactions and regulatory environments. These professionals can offer guidance on structuring deals, managing properties, and mitigating risks, thereby enhancing the likelihood of successful outcomes.

In conclusion, the rise in commercial real estate foreclosures presents a challenging yet potentially rewarding landscape for investors. By adopting strategies such as diversification, exploring distressed assets, strengthening financial positions, leveraging technology, and collaborating with experts, investors can effectively navigate the current market dynamics. As the commercial real estate sector continues to evolve, these strategic approaches will be essential for capitalizing on opportunities and achieving long-term success.

Regional Analysis: Why California Is Leading In Foreclosure Increases

The recent surge in commercial real estate foreclosures across the United States has captured the attention of investors, policymakers, and industry stakeholders alike. With a nationwide increase of 48%, the situation is particularly pronounced in California, where foreclosures have skyrocketed by an alarming 238%. This dramatic rise in California can be attributed to a confluence of economic, regulatory, and market-specific factors that have uniquely positioned the state at the forefront of this troubling trend.

To begin with, California’s economy, while robust in many sectors, has faced significant challenges in recent years. The state, known for its dynamic tech industry and vibrant entertainment sector, has not been immune to the broader economic disruptions caused by the COVID-19 pandemic. The pandemic-induced shift to remote work has led to a decreased demand for office spaces, particularly in urban centers like San Francisco and Los Angeles. As companies reassess their real estate needs, many have downsized or opted for flexible work arrangements, leaving a glut of vacant commercial properties in their wake. This oversupply has exerted downward pressure on property values, making it difficult for owners to meet mortgage obligations, thereby contributing to the rise in foreclosures.

Moreover, California’s regulatory environment has also played a role in exacerbating the foreclosure crisis. The state is known for its stringent zoning laws and complex permitting processes, which can delay new developments and increase costs for property owners. These regulatory hurdles, while intended to ensure sustainable growth and environmental protection, have inadvertently added financial strain on commercial property owners, particularly those already struggling with reduced rental income. Consequently, some owners find themselves unable to navigate these challenges, leading to an increase in foreclosures.

In addition to economic and regulatory factors, market-specific dynamics have further intensified the situation in California. The state’s commercial real estate market is characterized by high property values and competitive bidding, which have historically attracted significant investment. However, as interest rates have risen in response to inflationary pressures, the cost of borrowing has increased, making it more expensive for investors to finance new acquisitions or refinance existing properties. This shift has led to a tightening of credit conditions, leaving some property owners unable to secure the necessary funding to stave off foreclosure.

Furthermore, California’s unique geographic and demographic landscape has contributed to the current foreclosure trend. The state is home to a diverse population with varying needs and preferences, which has influenced the types of commercial properties in demand. Retail spaces, for instance, have been particularly hard hit as consumer behavior shifts increasingly towards online shopping. This change has left many brick-and-mortar establishments struggling to attract tenants, further compounding the financial difficulties faced by property owners.

In conclusion, the 238% increase in commercial real estate foreclosures in California is the result of a complex interplay of economic, regulatory, and market-specific factors. While the nationwide rise of 48% is concerning, California’s situation is particularly acute due to its unique challenges. As stakeholders seek solutions to this growing problem, it is essential to consider the multifaceted nature of the crisis and address the underlying issues that have led to this unprecedented increase in foreclosures. By doing so, California can work towards stabilizing its commercial real estate market and mitigating the impact on its economy.

Future Outlook: Nationwide Trends In Commercial Real Estate Foreclosures

The commercial real estate sector, a cornerstone of the national economy, is currently experiencing a significant upheaval. Recent data indicates a 48% increase in nationwide commercial real estate foreclosures, a trend that has sent ripples of concern throughout the industry. This surge is even more pronounced in California, where foreclosures have skyrocketed by an alarming 238%. These figures underscore a growing unease about the future stability of the commercial real estate market, prompting stakeholders to reassess their strategies and expectations.

Several factors contribute to this upward trend in foreclosures. The lingering effects of the COVID-19 pandemic continue to play a pivotal role, as many businesses have not fully recovered from the economic disruptions caused by prolonged lockdowns and shifts in consumer behavior. The pandemic accelerated the adoption of remote work, leading to a reduced demand for office spaces. Consequently, property owners are grappling with higher vacancy rates and declining rental incomes, making it increasingly difficult to meet mortgage obligations.

Moreover, the rise in interest rates has compounded these challenges. As the Federal Reserve tightens monetary policy to combat inflation, borrowing costs have increased, placing additional financial strain on property owners. Higher interest rates not only affect new loans but also impact existing adjustable-rate mortgages, leading to higher monthly payments. This financial pressure is particularly acute for those who acquired properties at the height of the market, often at inflated prices, and are now facing a market correction.

In California, the situation is exacerbated by unique regional factors. The state has long been a hub for technology and innovation, attracting businesses and investors alike. However, the tech sector’s recent volatility, marked by layoffs and reduced venture capital funding, has led to a contraction in demand for commercial spaces. Additionally, California’s stringent regulatory environment and high taxes have prompted some businesses to relocate to more business-friendly states, further diminishing the demand for commercial real estate.

Despite these challenges, there are glimmers of hope on the horizon. Some industry experts believe that the current downturn could lead to a market correction, ultimately stabilizing prices and creating opportunities for savvy investors. As distressed properties become available at lower prices, investors with strong capital reserves may find lucrative opportunities to acquire assets at a discount. This potential for market recalibration could pave the way for a more sustainable and balanced commercial real estate landscape in the long term.

Furthermore, the evolving nature of work and commerce presents new opportunities for adaptive reuse of commercial spaces. As traditional office demand wanes, there is potential for repurposing these properties into mixed-use developments, residential units, or community spaces. This shift could not only mitigate the impact of foreclosures but also contribute to urban revitalization efforts.

In conclusion, while the current rise in commercial real estate foreclosures presents significant challenges, it also offers a chance for transformation and innovation within the industry. Stakeholders must remain vigilant and adaptable, leveraging emerging trends and opportunities to navigate this complex landscape. As the market continues to evolve, a proactive approach will be essential in shaping a resilient and dynamic future for commercial real estate.

Q&A

1. **What is the percentage increase in nationwide commercial real estate foreclosures?**

– Nationwide commercial real estate foreclosures have risen by 48%.

2. **Which state experienced the highest increase in commercial real estate foreclosures?**

– California experienced the highest increase.

3. **What is the percentage increase in commercial real estate foreclosures in California?**

– California saw a 238% increase in commercial real estate foreclosures.

4. **What factors might contribute to the rise in commercial real estate foreclosures?**

– Potential factors include economic downturns, rising interest rates, and decreased demand for commercial spaces.

5. **How does the increase in California compare to the national average?**

– California’s increase of 238% is significantly higher than the national average of 48%.

6. **What types of properties are most affected by these foreclosures?**

– Office spaces, retail properties, and hospitality venues are often most affected.

7. **What impact could this trend have on the real estate market?**

– This trend could lead to decreased property values, increased inventory, and potential opportunities for investors.

Conclusion

The significant rise in nationwide commercial real estate foreclosures by 48%, coupled with a dramatic 238% increase in California, indicates a severe downturn in the commercial real estate market. This trend suggests underlying economic challenges, such as increased interest rates, reduced demand for commercial spaces, or broader financial instability. The disproportionate impact on California may reflect specific regional factors, such as higher property values, stricter regulatory environments, or economic shifts affecting key industries. This situation could lead to broader economic repercussions, including job losses, decreased property values, and reduced investment in commercial real estate. Stakeholders must address these challenges through policy interventions, financial support, and strategic planning to stabilize the market and mitigate further economic impact.