“Blackstone Bites into Growth: Jersey Mike’s Set for a Flavorful Future”

Introduction

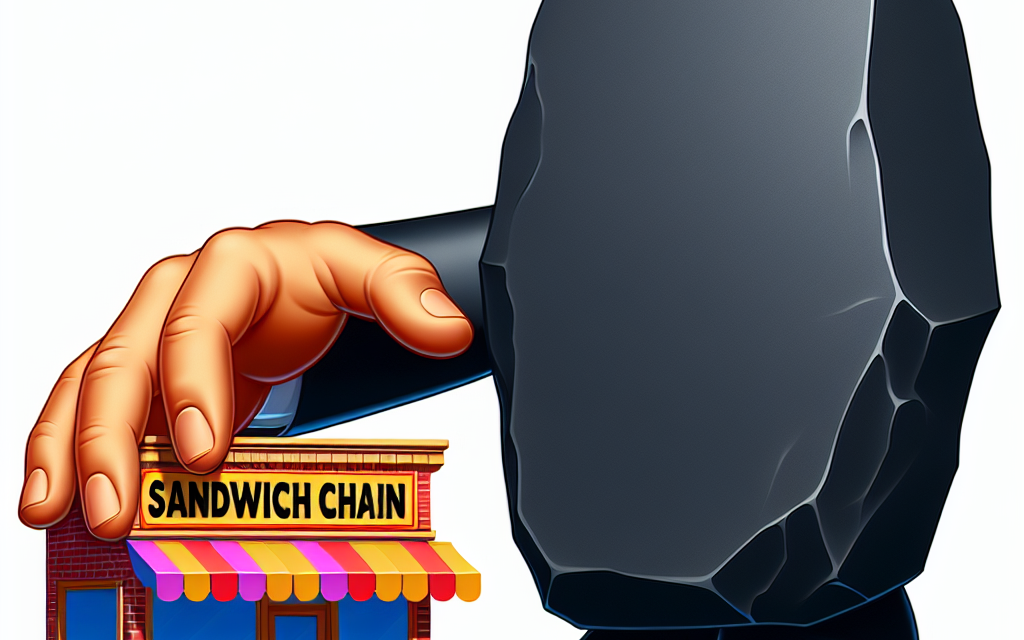

Blackstone, a leading global investment firm, is reportedly nearing a deal to acquire Jersey Mike’s, a popular sandwich chain known for its fresh ingredients and authentic submarine sandwiches. This potential acquisition underscores Blackstone’s strategic interest in expanding its portfolio within the fast-casual dining sector, capitalizing on Jersey Mike’s strong brand presence and loyal customer base. The move aligns with Blackstone’s investment strategy of targeting high-growth companies with robust market potential. Jersey Mike’s, with its extensive network of franchises and a reputation for quality, presents a promising opportunity for Blackstone to enhance its footprint in the competitive food service industry.

Blackstone’s Strategic Move: Acquiring Jersey Mike’s Sandwich Chain

Blackstone, one of the world’s leading investment firms, is reportedly on the verge of acquiring Jersey Mike’s, a popular sandwich chain known for its fresh ingredients and authentic taste. This potential acquisition marks a significant move in Blackstone’s strategic expansion into the fast-casual dining sector, a market that has shown resilience and growth potential even amidst economic fluctuations. As the demand for quick, yet quality dining experiences continues to rise, Blackstone’s interest in Jersey Mike’s underscores a broader trend of private equity firms investing in established food brands with strong customer loyalty and growth prospects.

Jersey Mike’s, founded in 1956 in Point Pleasant, New Jersey, has grown from a single neighborhood shop to a nationwide franchise with over 2,000 locations. The chain’s commitment to using fresh, high-quality ingredients and its unique approach to sandwich-making have earned it a dedicated customer base. This reputation for quality and consistency is likely a key factor in attracting Blackstone’s interest. Moreover, Jersey Mike’s has demonstrated robust growth, with plans for further expansion, making it an attractive investment opportunity for a firm looking to capitalize on the fast-casual dining trend.

The potential acquisition aligns with Blackstone’s strategy of investing in companies with strong brand recognition and growth potential. By acquiring Jersey Mike’s, Blackstone would not only gain a foothold in the competitive fast-casual dining market but also leverage the chain’s established brand to drive further expansion. This move could involve opening new locations, enhancing digital ordering capabilities, and exploring international markets, thereby increasing Jersey Mike’s market share and profitability.

Furthermore, Blackstone’s extensive resources and expertise in scaling businesses could provide Jersey Mike’s with the necessary support to navigate challenges and seize new opportunities. The investment firm’s track record of successful acquisitions and its ability to drive operational improvements could help Jersey Mike’s optimize its supply chain, enhance customer experience, and implement innovative marketing strategies. This partnership could also facilitate the introduction of new menu items and the adoption of sustainable practices, aligning with consumer preferences for variety and environmental responsibility.

In addition to the potential benefits for Jersey Mike’s, this acquisition could have broader implications for the fast-casual dining industry. As private equity firms like Blackstone continue to invest in established food brands, the industry may see increased competition and innovation. This trend could lead to improved dining experiences for consumers, as companies strive to differentiate themselves through quality, convenience, and unique offerings.

However, the acquisition is not without its challenges. Integrating Jersey Mike’s into Blackstone’s portfolio will require careful management to preserve the chain’s brand identity and customer loyalty. Additionally, the fast-casual dining market is highly competitive, with numerous players vying for consumer attention. Blackstone will need to navigate these challenges while ensuring that Jersey Mike’s continues to deliver the quality and service that its customers expect.

In conclusion, Blackstone’s reported acquisition of Jersey Mike’s represents a strategic move into the fast-casual dining sector, offering potential benefits for both parties. By leveraging Jersey Mike’s strong brand and growth potential, Blackstone aims to enhance its presence in the food industry while providing the sandwich chain with the resources and expertise needed to thrive. As this acquisition unfolds, it will be interesting to observe how Blackstone and Jersey Mike’s navigate the opportunities and challenges ahead, potentially setting new standards in the fast-casual dining market.

Impact of Blackstone’s Acquisition on the Fast-Food Industry

The fast-food industry, a dynamic and ever-evolving sector, is poised for another significant shift as Blackstone, a leading global investment firm, reportedly nears the acquisition of Jersey Mike’s, a popular sandwich chain. This potential acquisition underscores the growing trend of private equity firms investing in the fast-food industry, a move that could have far-reaching implications for the sector. As Blackstone prepares to integrate Jersey Mike’s into its portfolio, industry analysts are keenly observing the potential impacts on market competition, operational strategies, and consumer experiences.

To begin with, Blackstone’s acquisition of Jersey Mike’s could intensify competition within the fast-food industry. Jersey Mike’s, known for its fresh ingredients and customizable sandwiches, has carved out a niche in the market, appealing to health-conscious consumers seeking quick yet nutritious meal options. With Blackstone’s financial backing, Jersey Mike’s could expand its footprint more aggressively, challenging established players like Subway and Jimmy John’s. This increased competition may drive innovation across the industry, prompting other chains to enhance their offerings and improve customer service to maintain market share.

Moreover, Blackstone’s involvement could lead to significant operational changes within Jersey Mike’s. Private equity firms often seek to optimize the efficiency and profitability of their acquisitions, and Blackstone is no exception. By leveraging its extensive resources and expertise, Blackstone may implement new technologies and streamline operations to reduce costs and improve service delivery. This could include adopting advanced point-of-sale systems, enhancing supply chain logistics, and investing in employee training programs. Such improvements could set new standards for operational excellence in the fast-food industry, encouraging other chains to follow suit.

In addition to operational enhancements, Blackstone’s acquisition of Jersey Mike’s could also influence consumer experiences. With increased capital, Jersey Mike’s may have the opportunity to revamp its restaurant ambiance, introduce new menu items, and expand its digital presence. For instance, the chain could invest in mobile app development to facilitate online ordering and delivery services, catering to the growing demand for convenience among consumers. These changes could enhance customer satisfaction and loyalty, setting a benchmark for other fast-food chains to emulate.

Furthermore, the acquisition highlights the broader trend of consolidation within the fast-food industry. As private equity firms like Blackstone continue to invest in established brands, the industry may witness a wave of mergers and acquisitions. This consolidation could lead to a more homogenized market, where a few large entities dominate the landscape. While this may result in economies of scale and lower prices for consumers, it could also stifle innovation and limit choices in the long run.

In conclusion, Blackstone’s reported acquisition of Jersey Mike’s is poised to have a significant impact on the fast-food industry. By intensifying competition, driving operational improvements, and enhancing consumer experiences, this acquisition could reshape the industry’s landscape. As private equity firms continue to play a pivotal role in the sector, stakeholders must remain vigilant to ensure that these changes ultimately benefit consumers and foster a vibrant, competitive market. The fast-food industry, with its ever-evolving dynamics, will undoubtedly continue to adapt and transform in response to these developments, shaping the future of dining experiences worldwide.

Jersey Mike’s Growth Potential Under Blackstone’s Ownership

Blackstone, a leading global investment firm, is reportedly on the verge of acquiring Jersey Mike’s, a popular sandwich chain known for its fresh ingredients and authentic flavors. This potential acquisition has sparked considerable interest in the business community, as it could significantly impact Jersey Mike’s growth trajectory. Under Blackstone’s ownership, the sandwich chain may experience a new phase of expansion and innovation, leveraging the investment firm’s vast resources and strategic expertise.

Jersey Mike’s has already established itself as a formidable player in the fast-casual dining sector, with a strong brand identity and a loyal customer base. The chain’s commitment to quality and consistency has been instrumental in its success, allowing it to compete effectively against other major players in the industry. However, with Blackstone’s involvement, Jersey Mike’s could further enhance its market position by accelerating its growth plans and exploring new opportunities.

One of the primary advantages of Blackstone’s potential acquisition is the firm’s extensive experience in scaling businesses. Blackstone has a proven track record of nurturing companies and helping them achieve their full potential. By applying its strategic insights and operational expertise, Blackstone could assist Jersey Mike’s in optimizing its supply chain, enhancing its marketing efforts, and expanding its footprint both domestically and internationally. This could lead to increased brand visibility and a broader customer reach, ultimately driving revenue growth.

Moreover, Blackstone’s financial strength could provide Jersey Mike’s with the necessary capital to invest in technology and innovation. In today’s competitive landscape, leveraging technology is crucial for enhancing customer experience and streamlining operations. With Blackstone’s backing, Jersey Mike’s could invest in digital platforms, mobile applications, and data analytics to better understand customer preferences and tailor its offerings accordingly. This technological advancement could not only improve operational efficiency but also foster customer loyalty by providing a more personalized dining experience.

In addition to technological investments, Blackstone’s ownership could facilitate Jersey Mike’s entry into new markets. The sandwich chain has already made significant strides in expanding its presence across the United States, but there remains untapped potential in international markets. Blackstone’s global network and market insights could prove invaluable in identifying and capitalizing on these opportunities. By strategically entering new regions, Jersey Mike’s could diversify its revenue streams and mitigate risks associated with market saturation in its existing locations.

Furthermore, Blackstone’s emphasis on sustainability and corporate responsibility aligns well with Jersey Mike’s values. The investment firm has demonstrated a commitment to environmental, social, and governance (ESG) principles, which could enhance Jersey Mike’s reputation as a socially responsible brand. By adopting sustainable practices and engaging in community initiatives, Jersey Mike’s could strengthen its brand image and appeal to a growing segment of socially conscious consumers.

In conclusion, Blackstone’s potential acquisition of Jersey Mike’s presents a promising opportunity for the sandwich chain to unlock its growth potential. With Blackstone’s strategic guidance, financial resources, and global reach, Jersey Mike’s could embark on a new chapter of expansion and innovation. By leveraging technology, exploring new markets, and embracing sustainability, the chain could solidify its position as a leader in the fast-casual dining industry. As the acquisition unfolds, industry observers will be keenly watching how this partnership shapes the future of Jersey Mike’s and influences the broader market dynamics.

Financial Implications of Blackstone’s Jersey Mike’s Deal

The potential acquisition of Jersey Mike’s by Blackstone, a leading global investment firm, has generated significant interest within the financial community. This move, if finalized, could have substantial implications for both the private equity landscape and the fast-casual dining sector. Blackstone’s interest in Jersey Mike’s underscores the firm’s strategic focus on expanding its portfolio within the food and beverage industry, a sector that has shown resilience and growth potential even amidst economic uncertainties.

Jersey Mike’s, known for its authentic submarine sandwiches, has experienced remarkable growth over the past decade. With a strong brand presence and a loyal customer base, the chain has expanded its footprint across the United States, boasting over 2,000 locations. This growth trajectory makes Jersey Mike’s an attractive target for Blackstone, which seeks to capitalize on the brand’s momentum and further accelerate its expansion. By leveraging its extensive resources and expertise, Blackstone aims to enhance Jersey Mike’s operational efficiencies and market reach, potentially increasing the chain’s valuation and profitability.

From a financial perspective, the acquisition aligns with Blackstone’s strategy of investing in high-growth companies with scalable business models. The fast-casual dining segment, in particular, has shown robust performance, driven by changing consumer preferences towards convenient and quality dining experiences. Jersey Mike’s, with its emphasis on fresh ingredients and customer service, fits well within this trend. Consequently, Blackstone’s investment could yield significant returns, especially if the firm successfully implements strategies to optimize supply chain operations and expand digital and delivery capabilities.

Moreover, the acquisition could have broader implications for the private equity market. Blackstone’s move may signal increased interest in the fast-casual sector, prompting other investment firms to explore similar opportunities. This could lead to heightened competition for high-performing brands, potentially driving up valuations and deal activity within the industry. Additionally, the deal could set a precedent for future transactions, influencing how private equity firms assess and approach investments in the food and beverage space.

However, the acquisition is not without its challenges. Integrating Jersey Mike’s into Blackstone’s portfolio will require careful consideration of the chain’s existing operations and culture. Maintaining the brand’s identity and customer loyalty while implementing changes to drive growth will be crucial. Furthermore, the fast-casual dining sector is not immune to external pressures, such as rising food costs and labor shortages, which could impact profitability. Blackstone will need to navigate these challenges effectively to ensure the long-term success of its investment.

In conclusion, Blackstone’s reported acquisition of Jersey Mike’s represents a strategic move with significant financial implications. By investing in a high-growth brand within the fast-casual dining sector, Blackstone aims to capitalize on favorable market trends and enhance its portfolio’s value. The deal could influence the broader private equity landscape, potentially sparking increased interest and competition in the food and beverage industry. Nevertheless, the success of this acquisition will depend on Blackstone’s ability to integrate Jersey Mike’s operations and address industry challenges. As the deal progresses, stakeholders will be keenly observing how Blackstone navigates these complexities to achieve its investment objectives.

How Blackstone’s Acquisition Could Transform Jersey Mike’s Brand

Blackstone, a leading global investment firm, is reportedly on the verge of acquiring Jersey Mike’s, a popular sandwich chain known for its fresh ingredients and authentic taste. This potential acquisition could mark a significant turning point for Jersey Mike’s, as it aligns with Blackstone’s strategy of investing in high-growth companies with strong brand recognition. The acquisition could provide Jersey Mike’s with the resources and expertise needed to expand its footprint and enhance its market position in the competitive fast-casual dining sector.

Jersey Mike’s has built a loyal customer base by emphasizing quality and consistency, offering a menu that features freshly sliced meats and cheeses, along with bread baked in-store daily. This commitment to quality has distinguished Jersey Mike’s from its competitors, allowing it to grow steadily over the years. However, with the backing of Blackstone, the chain could accelerate its growth trajectory, potentially opening new locations both domestically and internationally. This expansion could be facilitated by Blackstone’s extensive network and experience in scaling businesses, which would enable Jersey Mike’s to reach new markets and demographics.

Moreover, Blackstone’s acquisition could lead to operational improvements within Jersey Mike’s. By leveraging Blackstone’s expertise in optimizing business processes, Jersey Mike’s could enhance its supply chain efficiency, reduce costs, and improve overall profitability. This operational refinement could also translate into better customer experiences, as streamlined processes often lead to faster service and improved product quality. Additionally, Blackstone’s financial resources could be used to invest in technology and innovation, further modernizing Jersey Mike’s operations and enabling it to stay ahead of industry trends.

In addition to operational enhancements, the acquisition could also bolster Jersey Mike’s marketing efforts. With Blackstone’s support, Jersey Mike’s could launch more comprehensive and targeted marketing campaigns, increasing brand awareness and attracting new customers. This could involve leveraging digital marketing strategies, such as social media and influencer partnerships, to engage with younger audiences who are increasingly seeking convenient and high-quality dining options. Furthermore, Blackstone’s experience in brand management could help Jersey Mike’s refine its brand identity, ensuring it resonates with a broader audience while maintaining its core values.

The potential acquisition also raises questions about how Jersey Mike’s will maintain its unique brand ethos under new ownership. While Blackstone’s involvement could bring numerous benefits, it is crucial for Jersey Mike’s to preserve the qualities that have endeared it to customers. This includes maintaining its commitment to quality ingredients and community involvement, which have been integral to its success. Striking a balance between growth and authenticity will be essential for Jersey Mike’s as it navigates this new chapter.

In conclusion, Blackstone’s reported acquisition of Jersey Mike’s presents a promising opportunity for the sandwich chain to enhance its market presence and operational efficiency. By leveraging Blackstone’s resources and expertise, Jersey Mike’s could accelerate its growth, improve its operations, and expand its marketing reach. However, it will be important for Jersey Mike’s to maintain its brand integrity and continue delivering the quality and service that its customers have come to expect. As the acquisition unfolds, it will be interesting to observe how Jersey Mike’s evolves and adapts to the changing landscape of the fast-casual dining industry.

Competitive Landscape: Blackstone’s Entry into the Sandwich Market

In a significant development within the competitive landscape of the fast-casual dining sector, Blackstone, one of the world’s leading investment firms, is reportedly on the verge of acquiring Jersey Mike’s, a popular sandwich chain known for its fresh ingredients and authentic flavors. This potential acquisition marks Blackstone’s strategic entry into the sandwich market, a move that could reshape the dynamics of the industry. As the fast-casual dining segment continues to grow, driven by consumer demand for quick yet quality dining experiences, Blackstone’s interest in Jersey Mike’s underscores the investment firm’s recognition of the sector’s potential for robust returns.

Jersey Mike’s, with its roots tracing back to 1956, has established a strong brand presence with over 2,000 locations across the United States. The chain’s commitment to quality, characterized by its use of fresh-baked bread, premium meats, and cheeses sliced to order, has garnered a loyal customer base. This dedication to quality aligns with current consumer trends that favor transparency and authenticity in food sourcing and preparation. Consequently, Jersey Mike’s has positioned itself as a formidable player in the sandwich market, competing with other established brands such as Subway and Jimmy John’s.

The potential acquisition by Blackstone is indicative of a broader trend where private equity firms are increasingly investing in the food and beverage industry. This trend is driven by the sector’s resilience and adaptability, even in the face of economic uncertainties. By acquiring Jersey Mike’s, Blackstone would not only gain a foothold in the fast-casual dining market but also leverage the chain’s established brand equity and operational expertise to drive further growth. Moreover, Blackstone’s extensive resources and strategic acumen could facilitate Jersey Mike’s expansion into new markets, both domestically and internationally, thereby enhancing its competitive edge.

Furthermore, Blackstone’s entry into the sandwich market through Jersey Mike’s could stimulate increased competition among existing players. This heightened competition may lead to innovations in menu offerings, customer service, and digital engagement as brands strive to differentiate themselves and capture a larger share of the market. Additionally, Blackstone’s involvement could potentially lead to operational efficiencies and enhanced supply chain management for Jersey Mike’s, further solidifying its position in the industry.

However, the acquisition also presents certain challenges. Integrating Jersey Mike’s into Blackstone’s portfolio will require careful consideration of the chain’s unique brand identity and operational model. Maintaining the authenticity and quality that have been central to Jersey Mike’s success will be crucial in ensuring a seamless transition and continued customer loyalty. Moreover, navigating the complexities of the fast-casual dining sector, characterized by rapidly changing consumer preferences and competitive pressures, will necessitate strategic foresight and agility.

In conclusion, Blackstone’s reported acquisition of Jersey Mike’s represents a significant development in the competitive landscape of the sandwich market. This move not only highlights the growing appeal of the fast-casual dining sector to private equity investors but also sets the stage for potential shifts in market dynamics. As Blackstone seeks to capitalize on Jersey Mike’s established brand and operational strengths, the industry may witness increased competition and innovation. Ultimately, the success of this acquisition will hinge on Blackstone’s ability to preserve Jersey Mike’s core values while leveraging its resources to drive growth and expansion.

What Blackstone’s Jersey Mike’s Acquisition Means for Investors

Blackstone, one of the world’s leading investment firms, is reportedly on the verge of acquiring Jersey Mike’s, a popular sandwich chain known for its fresh ingredients and authentic taste. This potential acquisition has sparked considerable interest among investors, as it represents a significant move in the fast-casual dining sector. Understanding the implications of this acquisition is crucial for investors looking to capitalize on emerging trends in the food industry.

To begin with, Blackstone’s interest in Jersey Mike’s underscores the growing appeal of fast-casual dining establishments. Unlike traditional fast-food chains, fast-casual restaurants offer higher-quality ingredients and a more personalized dining experience, which have become increasingly attractive to consumers seeking healthier and more diverse options. Jersey Mike’s, with its emphasis on freshly sliced meats and cheeses, aligns well with these consumer preferences. Consequently, Blackstone’s acquisition could position the firm to benefit from the continued growth of this segment.

Moreover, the acquisition of Jersey Mike’s by Blackstone could lead to significant operational and strategic enhancements for the sandwich chain. Blackstone’s extensive resources and expertise in scaling businesses could facilitate Jersey Mike’s expansion into new markets, both domestically and internationally. This expansion potential is particularly appealing given the brand’s strong reputation and loyal customer base. By leveraging Blackstone’s financial strength and strategic guidance, Jersey Mike’s could accelerate its growth trajectory, thereby increasing its market share and profitability.

In addition to expansion opportunities, Blackstone’s involvement could also drive innovation within Jersey Mike’s. Investment firms like Blackstone often bring a wealth of experience in optimizing business operations and implementing technological advancements. For Jersey Mike’s, this could mean the introduction of new technologies to enhance customer experience, such as improved online ordering systems or loyalty programs. Furthermore, Blackstone’s focus on sustainability and corporate responsibility could lead to initiatives that align with the growing consumer demand for environmentally conscious business practices.

From an investor’s perspective, the acquisition of Jersey Mike’s by Blackstone presents a compelling opportunity to gain exposure to a thriving sector. The fast-casual dining industry has demonstrated resilience and adaptability, even in challenging economic conditions. As consumers continue to prioritize convenience and quality, businesses like Jersey Mike’s are well-positioned to capture a larger share of the dining market. Investors who recognize the potential of this acquisition may find it to be a strategic addition to their portfolios, offering both growth potential and diversification.

However, it is important for investors to consider potential risks associated with this acquisition. The restaurant industry is highly competitive, and Jersey Mike’s will need to maintain its brand differentiation to succeed. Additionally, economic fluctuations and changes in consumer spending habits could impact the chain’s performance. Therefore, investors should conduct thorough due diligence and consider these factors when evaluating the potential benefits of this acquisition.

In conclusion, Blackstone’s reported acquisition of Jersey Mike’s represents a significant development in the fast-casual dining sector. For investors, this move highlights the potential for growth and innovation within the industry. By leveraging Blackstone’s resources and expertise, Jersey Mike’s could enhance its market position and drive long-term value. As with any investment, careful consideration of the associated risks and opportunities is essential. Nonetheless, this acquisition offers a promising avenue for investors seeking to capitalize on the evolving landscape of the food industry.

Q&A

1. **What is Blackstone?**

Blackstone is a leading global investment firm specializing in private equity, real estate, credit, and hedge fund investment strategies.

2. **What is Jersey Mike’s?**

Jersey Mike’s is a popular American submarine sandwich chain known for its fresh ingredients and authentic East Coast-style subs.

3. **Why is Blackstone interested in acquiring Jersey Mike’s?**

Blackstone is likely interested in acquiring Jersey Mike’s due to its strong brand presence, growth potential, and profitability in the fast-casual dining sector.

4. **How much is the acquisition deal worth?**

The specific financial details of the acquisition deal have not been publicly disclosed.

5. **What impact could this acquisition have on Jersey Mike’s?**

The acquisition could provide Jersey Mike’s with additional resources for expansion, operational improvements, and enhanced market reach.

6. **Has the acquisition been finalized?**

As of the latest reports, the acquisition is reportedly close but has not yet been finalized.

7. **What are the potential benefits for Blackstone in acquiring Jersey Mike’s?**

The potential benefits for Blackstone include diversifying its investment portfolio, capitalizing on the growing fast-casual dining market, and leveraging Jersey Mike’s brand for further growth and profitability.

Conclusion

Blackstone’s potential acquisition of Jersey Mike’s Sandwich Chain represents a significant move in the private equity firm’s strategy to expand its portfolio in the fast-casual dining sector. This acquisition could provide Jersey Mike’s with the financial backing and strategic resources needed to accelerate its growth and enhance its competitive position in the market. For Blackstone, acquiring a well-established and popular brand like Jersey Mike’s aligns with its investment approach of targeting high-growth potential businesses. If finalized, this deal could lead to increased market presence and operational efficiencies for Jersey Mike’s, while offering Blackstone a valuable asset in the food and beverage industry.