“Chime and Atleos: Expanding ATM Access for Everyone, Everywhere.”

Introduction

Chime, a leading financial technology company known for its innovative approach to banking, has partnered with Atleos, a prominent provider of ATM network solutions, to significantly enhance ATM accessibility across the United States. This strategic collaboration aims to expand Chime’s ATM network, providing its customers with greater convenience and access to cash withdrawal services without incurring additional fees. By leveraging Atleos’ extensive network and expertise in ATM deployment, Chime seeks to improve its service offerings and reinforce its commitment to customer-centric banking solutions. This partnership underscores both companies’ dedication to leveraging technology and strategic alliances to meet the evolving needs of consumers in the digital banking landscape.

Expansion Of ATM Network Through Chime And Atleos Partnership

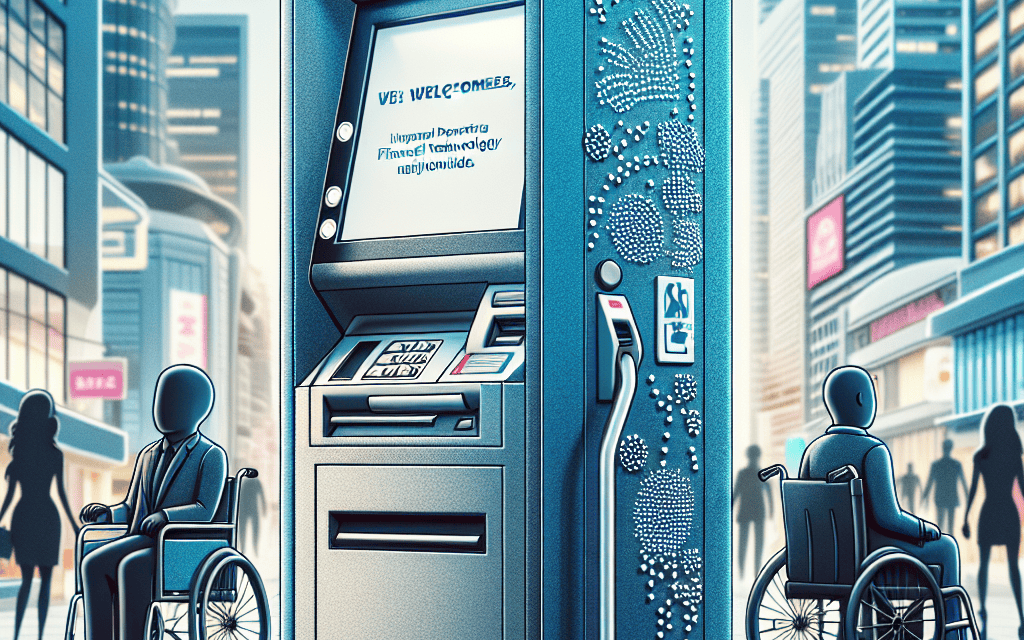

In a significant move to enhance financial accessibility, Chime, a leading financial technology company, has announced a strategic partnership with Atleos, a prominent ATM network provider. This collaboration aims to expand ATM accessibility nationwide, thereby offering Chime’s growing customer base greater convenience and flexibility in managing their finances. As digital banking continues to gain traction, the need for physical touchpoints like ATMs remains crucial, especially for cash withdrawals and deposits. By joining forces with Atleos, Chime is poised to bridge the gap between digital and physical banking, ensuring that its services are more accessible to users across the country.

The partnership between Chime and Atleos is set to significantly increase the number of ATMs available to Chime customers. Atleos, known for its extensive network of ATMs strategically located in urban and rural areas, provides an ideal platform for Chime to enhance its service offerings. This expansion is particularly beneficial for customers in underserved regions where access to traditional banking services is limited. By leveraging Atleos’s infrastructure, Chime can offer its customers fee-free access to a vast network of ATMs, thereby reducing the financial burden often associated with ATM usage.

Moreover, this collaboration underscores Chime’s commitment to financial inclusion. As a company that prides itself on offering no-fee banking services, Chime’s partnership with Atleos aligns with its mission to provide affordable and accessible financial solutions to all. The increased ATM accessibility will not only benefit existing customers but also attract new users who seek a more flexible and cost-effective banking experience. This move is expected to enhance customer satisfaction and loyalty, as users can now enjoy the convenience of accessing their funds without incurring additional charges.

In addition to expanding ATM access, the partnership with Atleos also presents opportunities for technological innovation. Both companies are committed to integrating advanced technologies to improve the user experience at ATMs. This includes the potential for contactless transactions, enhanced security features, and real-time account updates. By incorporating these innovations, Chime and Atleos aim to set a new standard for ATM services, ensuring that customers can conduct their transactions with ease and confidence.

Furthermore, the collaboration is likely to have a positive impact on the broader financial ecosystem. As more consumers gain access to convenient and affordable banking services, there is potential for increased economic activity and financial empowerment. This is particularly relevant in communities where traditional banking infrastructure is lacking, and residents rely heavily on alternative financial services. By providing a reliable and cost-effective solution, Chime and Atleos are contributing to the democratization of financial services, fostering greater economic inclusion.

In conclusion, the partnership between Chime and Atleos marks a significant step forward in the expansion of ATM accessibility nationwide. By combining Chime’s innovative approach to digital banking with Atleos’s extensive ATM network, the collaboration promises to deliver enhanced convenience and financial inclusion for customers across the United States. As the partnership unfolds, it is expected to drive further advancements in ATM technology and set a precedent for future collaborations in the financial sector. Ultimately, this initiative reflects a shared vision of making banking services more accessible and affordable for all, paving the way for a more inclusive financial future.

How Chime And Atleos Are Revolutionizing ATM Accessibility

In an era where digital banking is rapidly transforming the financial landscape, the partnership between Chime and Atleos marks a significant step forward in enhancing ATM accessibility nationwide. This collaboration aims to address the growing demand for convenient and widespread access to cash withdrawal services, a need that persists despite the increasing popularity of cashless transactions. By leveraging their respective strengths, Chime and Atleos are poised to revolutionize the way consumers interact with ATMs, ensuring that financial services remain inclusive and accessible to all.

Chime, a leading financial technology company known for its innovative approach to banking, has consistently prioritized customer convenience and accessibility. With a user base that spans millions, Chime has established itself as a pioneer in offering fee-free banking services, including no-fee overdrafts and early direct deposit features. However, recognizing that physical cash remains an essential component of many consumers’ financial lives, Chime has sought to expand its ATM network to better serve its customers. This is where Atleos, a company specializing in ATM network solutions, enters the picture.

Atleos brings to the table a wealth of experience in optimizing ATM networks for maximum efficiency and reach. With a robust infrastructure and a commitment to technological innovation, Atleos is well-equipped to enhance Chime’s ATM offerings. The partnership between these two companies is set to significantly increase the number of ATMs available to Chime users, thereby reducing the inconvenience of searching for accessible machines and minimizing the associated costs. This expansion is particularly beneficial for individuals residing in rural or underserved areas, where ATM access can often be limited.

Moreover, the collaboration between Chime and Atleos is not just about increasing the number of ATMs; it is also about improving the quality of service provided. By integrating advanced technologies, such as real-time data analytics and machine learning, the partnership aims to optimize ATM locations based on user demand and transaction patterns. This data-driven approach ensures that ATMs are strategically placed in areas where they are most needed, thereby enhancing user satisfaction and convenience.

In addition to expanding and optimizing the ATM network, Chime and Atleos are committed to maintaining high standards of security and reliability. As cyber threats continue to evolve, safeguarding customer data and ensuring secure transactions are paramount. Both companies are investing in cutting-edge security measures, including encryption technologies and fraud detection systems, to protect users from potential risks. This focus on security not only builds trust among consumers but also reinforces the partnership’s commitment to providing a safe and reliable banking experience.

Furthermore, the partnership aligns with broader industry trends towards financial inclusion and accessibility. By making ATMs more accessible, Chime and Atleos are contributing to a more inclusive financial ecosystem, where individuals from diverse backgrounds can access essential banking services without barriers. This initiative is particularly significant in promoting financial literacy and empowerment, as it enables more people to participate in the formal financial system.

In conclusion, the partnership between Chime and Atleos represents a forward-thinking approach to enhancing ATM accessibility nationwide. By combining Chime’s customer-centric banking solutions with Atleos’s expertise in ATM network optimization, the collaboration promises to deliver a seamless and secure banking experience for users across the country. As the financial landscape continues to evolve, such partnerships are crucial in ensuring that technological advancements translate into tangible benefits for consumers, ultimately fostering a more inclusive and accessible financial future.

The Impact Of Chime And Atleos Collaboration On Banking Convenience

The recent partnership between Chime, a leading financial technology company, and Atleos, a prominent ATM network provider, marks a significant advancement in the realm of banking convenience. This collaboration aims to enhance ATM accessibility nationwide, thereby addressing a critical need for consumers who rely on cash transactions and face challenges in accessing traditional banking services. By leveraging Atleos’s extensive network of ATMs, Chime is poised to offer its customers unprecedented access to cash withdrawal services without the burden of exorbitant fees, a common issue faced by many in the digital banking sector.

To understand the impact of this partnership, it is essential to consider the current landscape of banking accessibility. Many consumers, particularly those in rural or underserved urban areas, encounter difficulties in accessing ATMs that do not charge excessive fees. This often results in a financial burden for individuals who are already managing tight budgets. Chime’s collaboration with Atleos directly addresses this issue by providing fee-free access to a vast network of ATMs, thereby alleviating a significant pain point for its users. This move not only enhances customer satisfaction but also positions Chime as a leader in customer-centric financial solutions.

Moreover, the partnership underscores a broader trend in the financial industry towards increased collaboration between fintech companies and traditional banking service providers. By joining forces, Chime and Atleos exemplify how strategic alliances can lead to innovative solutions that benefit consumers. This collaboration is particularly timely, as the demand for digital banking services continues to rise, driven by the convenience and flexibility they offer. As more consumers shift towards online banking, the need for accessible cash withdrawal options remains critical, and this partnership effectively bridges that gap.

In addition to improving ATM accessibility, the collaboration between Chime and Atleos is likely to have a ripple effect on the financial industry as a whole. Other fintech companies may be inspired to pursue similar partnerships, recognizing the value of combining digital innovation with traditional banking infrastructure. This could lead to a more integrated financial ecosystem, where consumers enjoy the best of both worlds: the convenience of digital banking and the reliability of established ATM networks.

Furthermore, the partnership aligns with Chime’s mission to provide financial peace of mind to its users. By eliminating ATM fees, Chime not only enhances the user experience but also promotes financial inclusivity. This is particularly important for individuals who are unbanked or underbanked, as it provides them with greater access to essential financial services. As a result, the collaboration has the potential to contribute to a more equitable financial landscape, where all individuals have the opportunity to manage their finances effectively.

In conclusion, the partnership between Chime and Atleos represents a significant step forward in enhancing banking convenience and accessibility. By providing fee-free access to a nationwide network of ATMs, this collaboration addresses a critical need for consumers and sets a precedent for future innovations in the financial industry. As the partnership unfolds, it will be interesting to observe its impact on both Chime’s customer base and the broader financial ecosystem. Ultimately, this collaboration exemplifies the power of strategic alliances in driving positive change and improving the financial well-being of consumers across the nation.

Enhancing Financial Inclusion With Chime And Atleos’ Nationwide ATM Access

In an era where financial inclusion is increasingly recognized as a critical component of economic development, the recent partnership between Chime and Atleos marks a significant step forward in enhancing ATM accessibility across the United States. This collaboration aims to address the challenges faced by many individuals who struggle to access basic financial services, thereby promoting greater financial inclusion. By leveraging Atleos’ extensive network of ATMs and Chime’s innovative digital banking platform, this partnership seeks to provide seamless and convenient access to cash withdrawals for millions of Americans.

Chime, a leading financial technology company, has been at the forefront of revolutionizing the banking experience by offering fee-free banking services through its mobile app. Its commitment to eliminating traditional banking fees and providing user-friendly financial solutions has garnered a substantial customer base. However, one of the persistent challenges for digital banks like Chime has been ensuring that their customers have easy access to cash, especially in areas where traditional bank branches are scarce. This is where Atleos, a prominent ATM network provider, comes into play.

Atleos boasts a vast network of ATMs strategically located across urban and rural areas, making it an ideal partner for Chime in its mission to enhance financial accessibility. By integrating Chime’s services with Atleos’ ATM network, customers will be able to withdraw cash without incurring additional fees, thus removing a significant barrier to accessing their funds. This collaboration not only benefits Chime’s existing customers but also has the potential to attract new users who are seeking more flexible and cost-effective banking solutions.

Moreover, the partnership between Chime and Atleos is poised to have a broader impact on the financial landscape by setting a precedent for other financial institutions. As more banks and fintech companies recognize the importance of ATM accessibility in promoting financial inclusion, similar collaborations may emerge, further expanding the reach of essential financial services. This trend could lead to a more inclusive financial system where individuals, regardless of their geographic location or socioeconomic status, have equal access to banking services.

In addition to enhancing ATM accessibility, this partnership underscores the importance of collaboration between fintech companies and traditional financial service providers. By working together, these entities can leverage their respective strengths to create innovative solutions that address the evolving needs of consumers. This collaborative approach not only benefits individual customers but also contributes to the overall stability and resilience of the financial system.

Furthermore, the increased accessibility to ATMs facilitated by this partnership aligns with broader efforts to promote financial literacy and empowerment. By providing individuals with easier access to their funds, Chime and Atleos are enabling them to manage their finances more effectively, make informed financial decisions, and ultimately improve their financial well-being. This empowerment is particularly crucial for underserved communities that have historically been excluded from mainstream financial services.

In conclusion, the partnership between Chime and Atleos represents a significant advancement in the quest for financial inclusion. By enhancing ATM accessibility nationwide, this collaboration not only addresses a critical need for Chime’s customers but also sets a positive example for the financial industry as a whole. As the partnership unfolds, it holds the promise of transforming the way individuals access and interact with their finances, paving the way for a more inclusive and equitable financial future.

Chime And Atleos: A New Era Of Seamless ATM Transactions

In a significant move to revolutionize the landscape of financial accessibility, Chime, a leading financial technology company, has announced a strategic partnership with Atleos, a prominent ATM network provider. This collaboration aims to enhance ATM accessibility nationwide, offering seamless transactions to millions of users. As the financial industry continues to evolve, the partnership between Chime and Atleos represents a pivotal step towards bridging the gap between digital banking and physical cash access, ensuring that customers can enjoy the benefits of both worlds.

Chime, known for its innovative approach to banking, has consistently prioritized customer convenience and financial inclusivity. By eliminating traditional banking fees and offering user-friendly mobile banking solutions, Chime has garnered a substantial user base. However, one of the challenges faced by digital banks is providing customers with easy access to cash. This is where Atleos comes into play. As a leading ATM network provider, Atleos boasts an extensive network of ATMs across the country, making it an ideal partner for Chime in its quest to enhance cash accessibility for its users.

The partnership between Chime and Atleos is set to transform the way customers interact with ATMs. By integrating Chime’s digital banking platform with Atleos’ expansive ATM network, users will be able to access their funds with unprecedented ease. This integration will allow Chime customers to withdraw cash from thousands of ATMs nationwide without incurring additional fees, a significant advantage in an era where ATM surcharges are a common grievance among bank customers. Moreover, this collaboration will enable Chime to expand its reach, attracting new users who value the convenience of having widespread access to their funds.

Furthermore, the partnership is expected to drive innovation in ATM technology. Both Chime and Atleos are committed to leveraging cutting-edge technology to enhance the user experience. This includes the implementation of advanced security features to protect users’ financial information and the development of user-friendly interfaces that simplify the transaction process. By prioritizing security and ease of use, Chime and Atleos aim to set a new standard for ATM transactions, ensuring that customers can access their funds quickly and securely.

In addition to improving ATM accessibility, this partnership underscores a broader trend in the financial industry: the convergence of digital and traditional banking services. As consumers increasingly demand flexibility and convenience, financial institutions are compelled to adapt by offering integrated solutions that cater to diverse needs. The collaboration between Chime and Atleos exemplifies this trend, demonstrating how digital banks can effectively partner with traditional service providers to deliver comprehensive financial solutions.

Looking ahead, the partnership between Chime and Atleos holds the potential to reshape the financial landscape by setting a precedent for future collaborations between digital and traditional banking entities. As the financial industry continues to evolve, such partnerships will likely become more prevalent, driving innovation and enhancing customer experiences. Ultimately, the collaboration between Chime and Atleos represents a new era of seamless ATM transactions, one that promises to make financial services more accessible and convenient for all. By prioritizing customer needs and embracing technological advancements, Chime and Atleos are poised to lead the way in redefining the future of banking.

The Role Of Technology In Chime And Atleos’ ATM Accessibility Initiative

In an era where digital banking is rapidly transforming the financial landscape, the partnership between Chime and Atleos marks a significant step forward in enhancing ATM accessibility nationwide. This collaboration underscores the pivotal role of technology in bridging the gap between digital and physical banking services, ensuring that customers have seamless access to their funds whenever and wherever they need them. As financial institutions increasingly embrace technological advancements, the integration of innovative solutions becomes essential in meeting the evolving needs of consumers.

Chime, a leading digital bank known for its customer-centric approach, has consistently prioritized accessibility and convenience for its users. By partnering with Atleos, a company renowned for its cutting-edge ATM technology, Chime aims to expand its network of ATMs, thereby providing its customers with greater flexibility and ease of access. This initiative is particularly significant in a time when the demand for cashless transactions is on the rise, yet the need for cash access remains prevalent in various communities across the nation.

The role of technology in this initiative cannot be overstated. Atleos brings to the table a suite of advanced technological solutions that enhance the functionality and security of ATMs. These innovations include biometric authentication, real-time transaction monitoring, and enhanced encryption protocols, all of which contribute to a safer and more efficient user experience. By leveraging these technologies, Chime can offer its customers a level of service that aligns with the expectations of modern banking, where security and convenience are paramount.

Moreover, the partnership between Chime and Atleos highlights the importance of interoperability in the financial sector. As digital banks like Chime continue to grow, the ability to integrate with existing financial infrastructure becomes crucial. Atleos’ technology facilitates this integration, allowing Chime to seamlessly connect its digital platform with a physical network of ATMs. This not only enhances the user experience but also ensures that Chime can reach a broader audience, including those who may not yet be fully comfortable with digital-only banking solutions.

In addition to improving accessibility, this initiative also addresses the issue of financial inclusion. By expanding ATM access, Chime and Atleos are making strides toward ensuring that underserved communities have the same opportunities to access financial services as those in more urbanized areas. This is particularly important in rural regions, where traditional banking infrastructure may be limited. Through strategic placement of ATMs and the use of mobile technology, Chime and Atleos are working to eliminate barriers that have historically hindered access to financial services.

Furthermore, the collaboration between Chime and Atleos serves as a model for how technology can be harnessed to create a more inclusive financial ecosystem. As other financial institutions observe the success of this partnership, it is likely that similar initiatives will emerge, further driving the adoption of technology in the banking sector. This, in turn, will lead to a more connected and accessible financial landscape, benefiting consumers and businesses alike.

In conclusion, the partnership between Chime and Atleos represents a forward-thinking approach to enhancing ATM accessibility through the strategic use of technology. By focusing on security, interoperability, and financial inclusion, this initiative not only meets the immediate needs of consumers but also sets the stage for a more inclusive and technologically advanced future in banking. As the financial industry continues to evolve, collaborations like this will play a crucial role in shaping the way we access and interact with our money.

Customer Benefits From The Chime And Atleos ATM Partnership

The recent partnership between Chime, a leading financial technology company, and Atleos, a prominent ATM network provider, marks a significant advancement in enhancing ATM accessibility for customers nationwide. This collaboration is poised to deliver a range of benefits to Chime users, fundamentally transforming their banking experience. By leveraging Atleos’s extensive network of ATMs, Chime aims to provide its customers with unprecedented access to cash withdrawal services, thereby addressing a critical need in the digital banking landscape.

One of the primary advantages of this partnership is the expansion of fee-free ATM access for Chime customers. Traditionally, digital banking users have faced challenges in accessing cash without incurring additional fees, which can accumulate over time and become a financial burden. However, with Atleos’s widespread network, Chime users can now enjoy the convenience of withdrawing cash from thousands of ATMs across the country without worrying about extra charges. This development not only enhances the financial flexibility of Chime customers but also aligns with the company’s mission to make banking more accessible and affordable for everyone.

Moreover, the partnership with Atleos is expected to significantly improve the geographical reach of Chime’s services. Many customers, particularly those in rural or underserved areas, often encounter difficulties in finding ATMs that are compatible with their banking services. By integrating with Atleos’s network, Chime can now offer its customers a broader range of locations where they can access their funds. This increased accessibility is particularly beneficial for individuals who rely on cash transactions for their daily needs, ensuring that they are not left behind in the digital banking revolution.

In addition to expanding ATM access, the collaboration between Chime and Atleos is set to enhance the overall security of cash transactions. Atleos is renowned for its state-of-the-art security measures, which include advanced encryption technologies and real-time monitoring systems. By partnering with Atleos, Chime can assure its customers that their transactions are protected by some of the most robust security protocols in the industry. This focus on security is crucial in building trust with customers, especially in an era where digital fraud and cyber threats are on the rise.

Furthermore, the partnership is likely to foster innovation in the ATM services offered to Chime customers. As both companies are committed to leveraging technology to improve customer experiences, there is potential for the introduction of new features and services at ATMs. These could include enhanced user interfaces, personalized transaction options, and even financial education resources available directly at the ATM. Such innovations would not only improve the convenience of using ATMs but also empower customers to make informed financial decisions.

In conclusion, the partnership between Chime and Atleos represents a strategic move to enhance ATM accessibility and improve the overall banking experience for Chime customers. By providing fee-free access to a vast network of ATMs, expanding geographical reach, ensuring transaction security, and fostering innovation, this collaboration addresses several key challenges faced by digital banking users. As a result, Chime customers can look forward to a more seamless and secure banking experience, reinforcing Chime’s commitment to making financial services more inclusive and customer-centric.

Q&A

1. **What is the partnership between Chime and Atleos about?**

The partnership aims to enhance ATM accessibility nationwide for Chime users by leveraging Atleos’ extensive ATM network.

2. **Who are Chime and Atleos?**

Chime is a financial technology company offering banking services, while Atleos is a company specializing in ATM network solutions.

3. **What benefits does this partnership offer to Chime users?**

Chime users will have increased access to a larger network of ATMs, potentially reducing fees and improving convenience.

4. **How does Atleos contribute to this partnership?**

Atleos provides its extensive network of ATMs, which Chime users can access, thereby expanding Chime’s ATM reach.

5. **Will there be any changes in fees for Chime users due to this partnership?**

The partnership may lead to reduced or eliminated ATM fees for Chime users at participating ATMs in the Atleos network.

6. **Is this partnership available nationwide?**

Yes, the partnership is designed to enhance ATM accessibility for Chime users across the United States.

7. **When was this partnership announced?**

The specific announcement date is not provided, but it is a recent development aimed at improving service for Chime customers.

Conclusion

Chime and Atleos have partnered to enhance ATM accessibility nationwide, aiming to improve financial inclusion and convenience for users. This collaboration leverages Atleos’ extensive ATM network and Chime’s digital banking platform to provide customers with greater access to cash withdrawal services without incurring additional fees. By expanding ATM access, the partnership addresses a critical need for seamless and cost-effective banking solutions, particularly benefiting those in underserved or remote areas. This initiative underscores both companies’ commitment to innovation and customer-centric services, ultimately contributing to a more inclusive financial ecosystem.