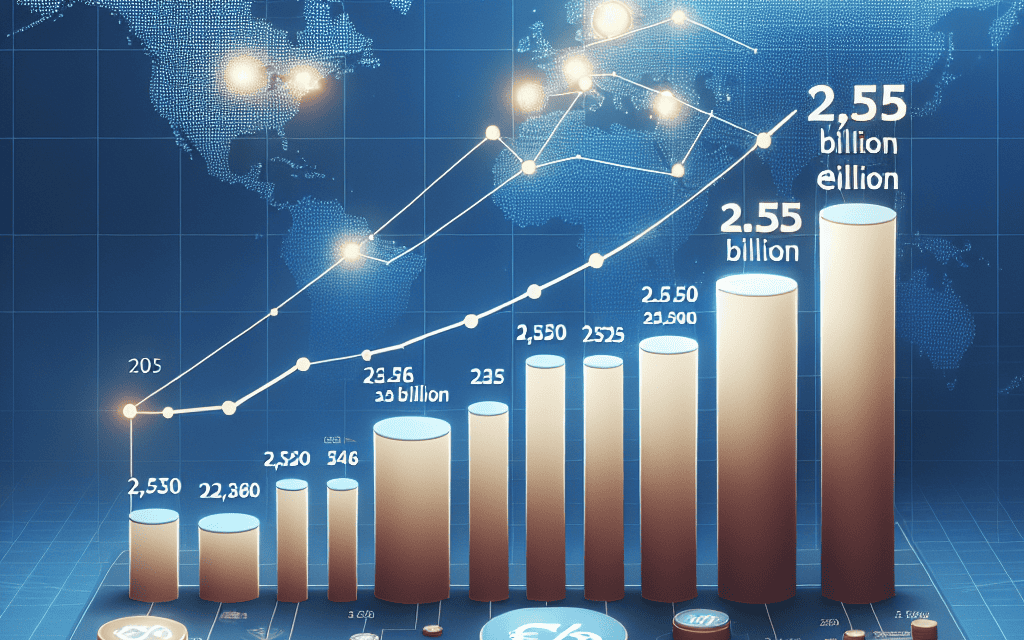

“Eni: Fueling the Future with Strategic Asset Sales and a €2.5 Billion Vision for 2025.”

Introduction

Eni, a global energy company, has projected net proceeds of 2.5 billion euros from asset sales by 2025. This strategic move is part of Eni’s broader plan to optimize its portfolio and enhance financial flexibility. The anticipated asset sales are expected to streamline operations and support the company’s transition towards more sustainable energy solutions. By divesting certain assets, Eni aims to reallocate resources to areas with higher growth potential and align with its long-term objectives of reducing carbon emissions and increasing investments in renewable energy. This initiative underscores Eni’s commitment to adapting to the evolving energy landscape while maintaining robust financial health.

Impact of Eni’s Asset Sales on the Energy Market

Eni, the Italian multinational oil and gas company, has recently announced its projection of generating 2.5 billion euros in net proceeds from asset sales by 2025. This strategic move is poised to have significant implications for the energy market, reflecting broader trends in the industry as companies adapt to evolving economic and environmental landscapes. As Eni embarks on this path, it is essential to consider the potential impacts on both the company and the wider energy sector.

To begin with, Eni’s decision to divest certain assets aligns with a growing trend among energy companies to streamline operations and focus on core business areas. By shedding non-essential assets, Eni aims to enhance its financial flexibility, allowing it to allocate resources more efficiently towards strategic investments. This approach is particularly relevant in an era where the energy market is undergoing a profound transformation, driven by the global shift towards sustainable and renewable energy sources. As such, Eni’s asset sales could be seen as a proactive measure to reposition itself in a rapidly changing market environment.

Moreover, the anticipated proceeds from these asset sales are likely to bolster Eni’s balance sheet, providing the company with the necessary capital to invest in new technologies and projects. This financial reinforcement is crucial as Eni seeks to expand its footprint in the renewable energy sector. The company has already made significant strides in this direction, with investments in solar, wind, and biofuel projects. By reallocating capital from asset sales, Eni can accelerate its transition towards cleaner energy solutions, thereby contributing to global efforts to reduce carbon emissions and combat climate change.

In addition to strengthening Eni’s financial position, the asset sales are expected to have ripple effects across the energy market. As Eni divests certain assets, these may become available to other players in the industry, potentially leading to increased competition and innovation. New entrants or existing companies acquiring these assets could bring fresh perspectives and technologies, further driving the evolution of the energy sector. This dynamic could foster a more diverse and resilient energy market, better equipped to meet the demands of a low-carbon future.

Furthermore, Eni’s asset sales may influence investor sentiment and market perceptions. By demonstrating a commitment to strategic realignment and sustainability, Eni could enhance its appeal to environmentally conscious investors. This shift in investor focus is becoming increasingly important as environmental, social, and governance (ESG) criteria gain prominence in investment decisions. Consequently, Eni’s actions could set a precedent for other energy companies, encouraging them to adopt similar strategies to attract investment and remain competitive.

However, it is important to acknowledge potential challenges associated with Eni’s asset sales. The divestment process may involve complexities related to asset valuation, regulatory approvals, and market conditions. Additionally, the company must ensure that the proceeds are effectively utilized to achieve its strategic objectives, avoiding potential pitfalls that could undermine its long-term growth prospects.

In conclusion, Eni’s projection of 2.5 billion euros in net proceeds from asset sales by 2025 represents a significant development in the energy market. This strategic move not only underscores Eni’s commitment to adapting to changing industry dynamics but also highlights the broader trend of energy companies repositioning themselves for a sustainable future. As Eni navigates this transition, its actions will likely have far-reaching implications, influencing market competition, investor sentiment, and the overall trajectory of the energy sector.

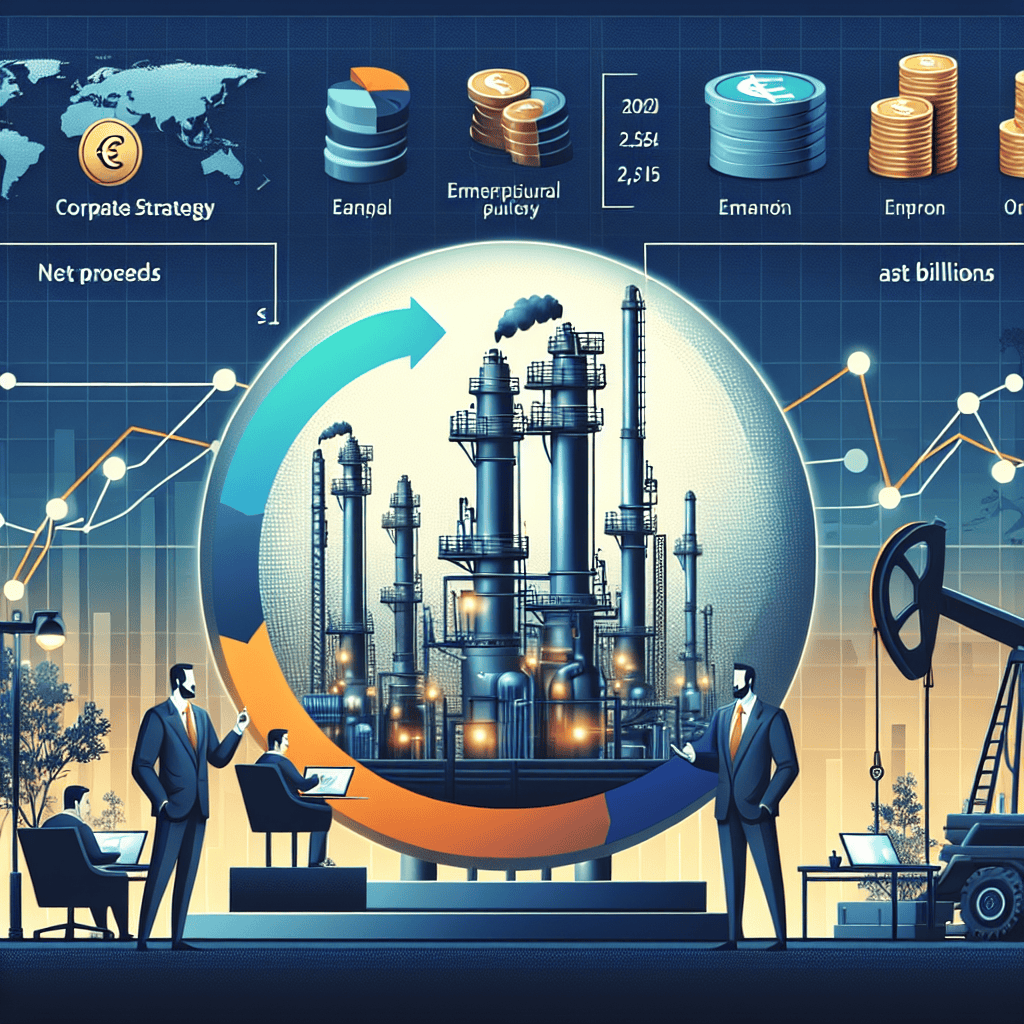

Strategic Reasons Behind Eni’s 2025 Asset Sales

Eni, the Italian multinational oil and gas company, has announced its strategic plan to generate 2.5 billion euros in net proceeds from asset sales by 2025. This decision is part of a broader strategy to streamline operations and focus on core business areas that align with the company’s long-term objectives. The move is not merely a financial maneuver but a calculated step towards enhancing operational efficiency and sustainability in an increasingly competitive and environmentally conscious market.

One of the primary reasons behind Eni’s decision to divest certain assets is the need to optimize its portfolio. By shedding non-core assets, Eni aims to concentrate its resources on areas with the highest potential for growth and profitability. This strategic focus allows the company to allocate capital more effectively, ensuring that investments are directed towards projects that offer the greatest returns. Moreover, this approach enables Eni to adapt more swiftly to market changes, maintaining its competitive edge in the dynamic energy sector.

In addition to optimizing its portfolio, Eni’s asset sales are driven by the imperative to enhance financial flexibility. The proceeds from these sales will provide the company with additional liquidity, which can be used to reduce debt, invest in new projects, or return value to shareholders. This financial agility is crucial in an industry characterized by volatility and uncertainty, where the ability to respond quickly to market fluctuations can significantly impact a company’s success.

Furthermore, Eni’s asset sales align with its commitment to sustainability and the energy transition. As the world increasingly shifts towards cleaner energy sources, traditional oil and gas companies face mounting pressure to reduce their carbon footprint and invest in renewable energy. By divesting from certain assets, Eni can reallocate resources towards sustainable initiatives, such as the development of renewable energy projects and the implementation of innovative technologies aimed at reducing emissions. This strategic pivot not only supports global efforts to combat climate change but also positions Eni as a forward-thinking leader in the energy transition.

Another strategic reason for Eni’s asset sales is the opportunity to strengthen partnerships and collaborations. By selling certain assets, Eni can forge alliances with other companies that may be better positioned to maximize the value of these assets. Such partnerships can lead to synergies that benefit all parties involved, enhancing operational efficiency and driving innovation. Additionally, these collaborations can open new avenues for growth, allowing Eni to expand its reach and influence in the global energy market.

Moreover, Eni’s decision to sell assets by 2025 reflects a proactive approach to risk management. In an industry subject to geopolitical tensions, regulatory changes, and fluctuating commodity prices, divesting from certain assets can mitigate potential risks and stabilize the company’s financial performance. By carefully selecting which assets to sell, Eni can reduce its exposure to volatile markets and focus on more stable and predictable revenue streams.

In conclusion, Eni’s plan to generate 2.5 billion euros in net proceeds from asset sales by 2025 is a multifaceted strategy aimed at optimizing its portfolio, enhancing financial flexibility, supporting sustainability initiatives, strengthening partnerships, and managing risks. This strategic move underscores Eni’s commitment to adapting to the evolving energy landscape while maintaining its position as a leading player in the industry. As the company navigates the challenges and opportunities of the energy transition, these asset sales will play a crucial role in shaping Eni’s future trajectory.

How Eni Plans to Utilize 2.5 Billion Euros in Net Proceeds

Eni, the Italian multinational oil and gas company, has announced its strategic plan to generate 2.5 billion euros in net proceeds from asset sales by 2025. This ambitious initiative is part of Eni’s broader strategy to streamline its operations and focus on core areas that promise sustainable growth and profitability. The proceeds from these asset sales are earmarked for reinvestment into projects that align with Eni’s long-term vision of transitioning towards a more sustainable energy future. As the global energy landscape undergoes significant transformation, Eni’s approach reflects a proactive adaptation to emerging trends and challenges.

The decision to divest certain assets is driven by Eni’s commitment to optimizing its portfolio. By shedding non-core assets, the company aims to enhance operational efficiency and concentrate resources on high-value projects. This strategic realignment is expected to bolster Eni’s financial position, providing the necessary capital to invest in areas with higher growth potential. Moreover, the asset sales will enable Eni to reduce its carbon footprint, as the company seeks to divest from operations that are less aligned with its sustainability goals.

Eni plans to channel a significant portion of the 2.5 billion euros into renewable energy projects. This move is in line with the company’s pledge to achieve net-zero carbon emissions by 2050. By investing in solar, wind, and other renewable energy sources, Eni aims to diversify its energy portfolio and reduce its reliance on fossil fuels. The transition to renewable energy is not only a response to regulatory pressures but also a strategic opportunity to capture a share of the growing market for clean energy solutions. Eni’s investments in renewables are expected to drive innovation and create new business opportunities, positioning the company as a leader in the energy transition.

In addition to renewable energy, Eni intends to allocate funds towards technological innovation and digital transformation. By embracing cutting-edge technologies, Eni seeks to enhance its operational capabilities and improve efficiency across its value chain. Investments in digital solutions, such as advanced data analytics and automation, are expected to optimize production processes and reduce operational costs. Furthermore, Eni’s focus on technology will enable the company to better manage risks and adapt to changing market dynamics, ensuring long-term competitiveness.

Another key area of investment for Eni is the development of sustainable mobility solutions. As the transportation sector undergoes a paradigm shift towards electrification and alternative fuels, Eni is poised to capitalize on this trend by investing in infrastructure and technologies that support sustainable transportation. This includes the development of electric vehicle charging networks and the production of biofuels, which are essential components of a low-carbon transportation ecosystem. By investing in sustainable mobility, Eni aims to contribute to the reduction of greenhouse gas emissions and support the global transition to cleaner transportation options.

In conclusion, Eni’s plan to generate 2.5 billion euros in net proceeds from asset sales by 2025 is a strategic move that underscores the company’s commitment to sustainability and innovation. By reinvesting these proceeds into renewable energy, technological advancements, and sustainable mobility, Eni is positioning itself to thrive in a rapidly evolving energy landscape. This forward-looking approach not only aligns with global efforts to combat climate change but also ensures that Eni remains a competitive and resilient player in the energy sector. As Eni embarks on this transformative journey, the company is set to play a pivotal role in shaping the future of energy.

Eni’s Asset Sales: A Step Towards Sustainable Energy Transition

Eni, the Italian multinational oil and gas company, has announced its ambitious plan to generate 2.5 billion euros in net proceeds from asset sales by 2025. This strategic move is part of Eni’s broader commitment to transitioning towards a more sustainable energy future. As the global energy landscape undergoes significant transformation, driven by the urgent need to address climate change and reduce carbon emissions, Eni’s decision reflects a growing trend among major energy companies to realign their portfolios and invest in cleaner energy sources.

The decision to divest certain assets is not merely a financial maneuver but a calculated step towards achieving Eni’s long-term sustainability goals. By reallocating capital from traditional oil and gas operations to renewable energy projects, Eni aims to reduce its carbon footprint and enhance its position in the evolving energy market. This shift is in line with the company’s strategic plan, which emphasizes decarbonization and the development of low-carbon technologies. As Eni seeks to balance its portfolio, the proceeds from these asset sales will be instrumental in funding new investments in renewable energy, such as wind, solar, and biofuels.

Moreover, Eni’s asset sales strategy is designed to optimize its operational efficiency and focus on core areas that promise higher returns and growth potential. By shedding non-core assets, Eni can streamline its operations and concentrate resources on projects that align with its sustainability objectives. This approach not only supports the company’s financial health but also reinforces its commitment to environmental stewardship. As the energy sector faces increasing pressure from stakeholders, including investors, regulators, and consumers, to adopt more sustainable practices, Eni’s proactive measures demonstrate its responsiveness to these demands.

In addition to financial and environmental considerations, Eni’s asset sales are also influenced by geopolitical factors. The global energy market is characterized by volatility and uncertainty, with fluctuating oil prices and shifting regulatory landscapes. By diversifying its energy portfolio and reducing reliance on fossil fuels, Eni can mitigate risks associated with geopolitical tensions and market fluctuations. This strategic diversification is crucial for ensuring the company’s resilience and adaptability in a rapidly changing world.

Furthermore, Eni’s commitment to sustainability extends beyond asset sales and investment in renewables. The company is actively engaged in research and development initiatives aimed at advancing clean energy technologies. Collaborations with academic institutions, industry partners, and government agencies are central to Eni’s efforts to drive innovation and accelerate the transition to a low-carbon economy. By fostering a culture of innovation, Eni is positioning itself as a leader in the energy transition, capable of delivering sustainable solutions that meet the needs of future generations.

In conclusion, Eni’s plan to generate 2.5 billion euros from asset sales by 2025 is a pivotal component of its strategy to transition towards sustainable energy. This initiative underscores the company’s commitment to reducing its environmental impact, optimizing its operations, and navigating the complexities of the global energy market. As Eni continues to evolve and adapt, its focus on sustainability and innovation will be key to its success in the energy transition. Through strategic asset sales and investments in renewable energy, Eni is not only contributing to a more sustainable future but also ensuring its long-term viability in an increasingly competitive industry.

Financial Implications of Eni’s 2025 Asset Sales

Eni, the Italian multinational oil and gas company, has recently announced its projection of generating 2.5 billion euros in net proceeds from asset sales by 2025. This strategic move is part of Eni’s broader plan to streamline its operations and focus on core areas that promise sustainable growth and profitability. The anticipated asset sales are expected to have significant financial implications for the company, influencing its balance sheet, investment strategies, and overall market position.

To begin with, the decision to divest certain assets aligns with Eni’s ongoing efforts to optimize its portfolio. By shedding non-core assets, Eni aims to concentrate its resources on high-value projects that are more aligned with its long-term strategic goals. This approach not only enhances operational efficiency but also allows the company to allocate capital more effectively, ensuring that investments are directed towards areas with the highest potential returns. Consequently, the proceeds from these asset sales will provide Eni with the financial flexibility needed to pursue new opportunities and adapt to the rapidly changing energy landscape.

Moreover, the projected 2.5 billion euros in net proceeds will play a crucial role in strengthening Eni’s financial position. By reducing debt and improving liquidity, the company can enhance its credit profile, which is vital for maintaining investor confidence and securing favorable financing terms in the future. This improved financial health will also enable Eni to withstand market volatility and economic uncertainties, thereby safeguarding its long-term sustainability.

In addition to bolstering its financial stability, Eni’s asset sales strategy is expected to support its transition towards cleaner energy sources. As the global energy sector undergoes a significant transformation, driven by the urgent need to address climate change, Eni is committed to reducing its carbon footprint and investing in renewable energy projects. The funds generated from asset sales will be instrumental in financing these initiatives, allowing Eni to accelerate its shift towards a more sustainable energy portfolio. This transition not only aligns with global environmental goals but also positions Eni as a forward-thinking leader in the energy industry.

Furthermore, the divestment of certain assets will enable Eni to focus on enhancing its core competencies and expanding its presence in key markets. By concentrating on areas where it has a competitive advantage, Eni can drive innovation and improve operational performance, ultimately leading to increased profitability. This strategic focus will also allow the company to better navigate the complexities of the energy sector, ensuring that it remains agile and responsive to emerging trends and challenges.

In conclusion, Eni’s projection of 2.5 billion euros in net proceeds from asset sales by 2025 is a pivotal component of its strategic plan to optimize its portfolio, strengthen its financial position, and support its transition towards sustainable energy solutions. By divesting non-core assets, Eni can concentrate on high-value projects, reduce debt, and invest in renewable energy initiatives, thereby enhancing its long-term growth prospects and market competitiveness. As the company continues to adapt to the evolving energy landscape, these asset sales will play a critical role in ensuring that Eni remains a resilient and innovative leader in the global energy industry.

Eni’s Asset Sales and Its Influence on Shareholder Value

Eni, the Italian multinational oil and gas company, has recently announced its projection of 2.5 billion euros in net proceeds from asset sales by 2025. This strategic move is part of Eni’s broader plan to optimize its portfolio and enhance shareholder value. As the energy sector undergoes significant transformations, driven by the global shift towards sustainable energy sources, Eni’s decision to divest certain assets reflects its commitment to adapting to these changes while maintaining financial robustness.

The anticipated asset sales are expected to streamline Eni’s operations, allowing the company to focus on its core areas of growth and innovation. By divesting non-core assets, Eni aims to reallocate resources towards more strategic investments, particularly in renewable energy and decarbonization technologies. This approach not only aligns with global environmental goals but also positions Eni as a forward-thinking leader in the energy transition. Consequently, the proceeds from these sales are likely to be reinvested in projects that promise higher returns and long-term sustainability.

Moreover, Eni’s asset sales strategy is designed to enhance shareholder value by improving the company’s financial metrics. The influx of 2.5 billion euros in net proceeds will bolster Eni’s balance sheet, potentially reducing debt levels and increasing liquidity. This financial strengthening is expected to provide Eni with greater flexibility to navigate market fluctuations and invest in high-growth opportunities. Additionally, the improved financial health of the company could lead to higher dividends or share buybacks, directly benefiting shareholders.

In the context of the energy industry’s evolving landscape, Eni’s asset sales are also a response to the increasing pressure from investors and regulatory bodies to prioritize environmental, social, and governance (ESG) criteria. By divesting from assets that may not align with these criteria, Eni is demonstrating its commitment to sustainable business practices. This move is likely to enhance the company’s reputation among ESG-conscious investors, potentially attracting new investment and boosting its stock performance.

Furthermore, Eni’s strategic divestment plan is indicative of a broader trend within the energy sector, where companies are increasingly focusing on asset optimization to drive growth and shareholder value. As traditional energy companies face mounting challenges from renewable energy competitors, the ability to adapt and innovate becomes crucial. Eni’s proactive approach in reshaping its asset portfolio underscores its recognition of these challenges and its determination to remain competitive in a rapidly changing market.

In conclusion, Eni’s projection of 2.5 billion euros in net proceeds from asset sales by 2025 is a significant step towards enhancing shareholder value and positioning the company for future success. By strategically divesting non-core assets, Eni is not only strengthening its financial position but also aligning itself with global sustainability goals. This move reflects a broader industry trend towards asset optimization and underscores the importance of adaptability in the face of an evolving energy landscape. As Eni continues to navigate these changes, its commitment to innovation and sustainability will likely play a pivotal role in shaping its future trajectory and maintaining its status as a leader in the energy sector.

Future Prospects for Eni Post-Asset Sales in 2025

Eni, the Italian multinational oil and gas company, has announced its projection of generating 2.5 billion euros in net proceeds from asset sales by 2025. This strategic move is part of Eni’s broader plan to streamline its operations and focus on core areas that promise sustainable growth and profitability. As the energy sector undergoes significant transformation, driven by the global shift towards renewable energy and decarbonization, Eni’s decision to divest certain assets aligns with its commitment to adapt to these changes and enhance its competitive edge.

The anticipated asset sales are expected to provide Eni with the financial flexibility to invest in new technologies and projects that support its transition to a low-carbon future. By reallocating resources from non-core assets, Eni aims to strengthen its portfolio in areas such as renewable energy, biofuels, and sustainable mobility solutions. This strategic reorientation is crucial as the company seeks to meet its ambitious targets for reducing greenhouse gas emissions and increasing the share of renewables in its energy mix.

Moreover, the proceeds from these asset sales will enable Eni to reduce its debt levels, thereby improving its financial stability and resilience in a volatile market environment. Lower debt levels will not only enhance Eni’s credit profile but also provide the company with greater capacity to pursue strategic acquisitions and partnerships that align with its long-term vision. In this context, Eni’s focus on financial discipline and prudent capital allocation is expected to yield significant benefits, both in terms of operational efficiency and shareholder value.

In addition to financial considerations, Eni’s asset sales strategy reflects its commitment to environmental, social, and governance (ESG) principles. By divesting from assets that do not align with its sustainability goals, Eni is taking a proactive approach to managing environmental risks and enhancing its reputation as a responsible corporate citizen. This focus on ESG factors is increasingly important as investors and stakeholders demand greater transparency and accountability from companies in the energy sector.

Furthermore, Eni’s strategic shift is likely to have positive implications for its workforce and communities. By investing in new growth areas, Eni can create job opportunities and contribute to economic development in regions where it operates. This aligns with the company’s broader commitment to social responsibility and its efforts to support the transition to a more sustainable energy system.

As Eni moves forward with its asset sales plan, it will be essential for the company to effectively communicate its strategy to stakeholders and ensure a smooth transition for affected employees and communities. By engaging with stakeholders and maintaining open lines of communication, Eni can build trust and support for its strategic initiatives, thereby facilitating the successful execution of its plans.

In conclusion, Eni’s projection of 2.5 billion euros in net proceeds from asset sales by 2025 represents a significant step in its journey towards a more sustainable and resilient future. By focusing on core areas that align with its strategic priorities, Eni is well-positioned to navigate the challenges and opportunities of the evolving energy landscape. As the company continues to implement its strategy, it will be crucial for Eni to maintain its focus on financial discipline, ESG principles, and stakeholder engagement to achieve its long-term objectives and deliver value to shareholders and society at large.

Q&A

1. **What is the main focus of Eni’s asset sales plan?**

Eni plans to focus on divesting non-core assets to streamline operations and focus on its core business areas.

2. **How much does Eni expect to generate from these asset sales?**

Eni expects to generate 2.5 billion euros in net proceeds from the asset sales by 2025.

3. **What is the timeline for Eni’s asset sales?**

The asset sales are planned to be completed by 2025.

4. **Why is Eni selling these assets?**

Eni is selling these assets to optimize its portfolio, improve financial flexibility, and support its transition towards more sustainable energy solutions.

5. **Which sectors might be affected by Eni’s asset sales?**

The sectors likely affected include upstream oil and gas, refining, and possibly renewable energy projects that are not aligned with Eni’s strategic focus.

6. **How will the proceeds from the asset sales be used?**

The proceeds will be used to reduce debt, invest in strategic growth areas, and support Eni’s energy transition initiatives.

7. **What impact will these sales have on Eni’s overall strategy?**

The sales will help Eni focus on its core strengths, enhance its financial position, and accelerate its shift towards sustainable energy solutions.

Conclusion

Eni’s projection of 2.5 billion euros in net proceeds from asset sales by 2025 indicates a strategic move to optimize its portfolio and enhance financial flexibility. This initiative likely reflects Eni’s focus on divesting non-core assets to streamline operations and potentially reinvest in areas aligned with its long-term growth and sustainability objectives. The anticipated proceeds could bolster Eni’s balance sheet, support debt reduction, or fund new investments, positioning the company to better navigate the evolving energy landscape and capitalize on emerging opportunities.