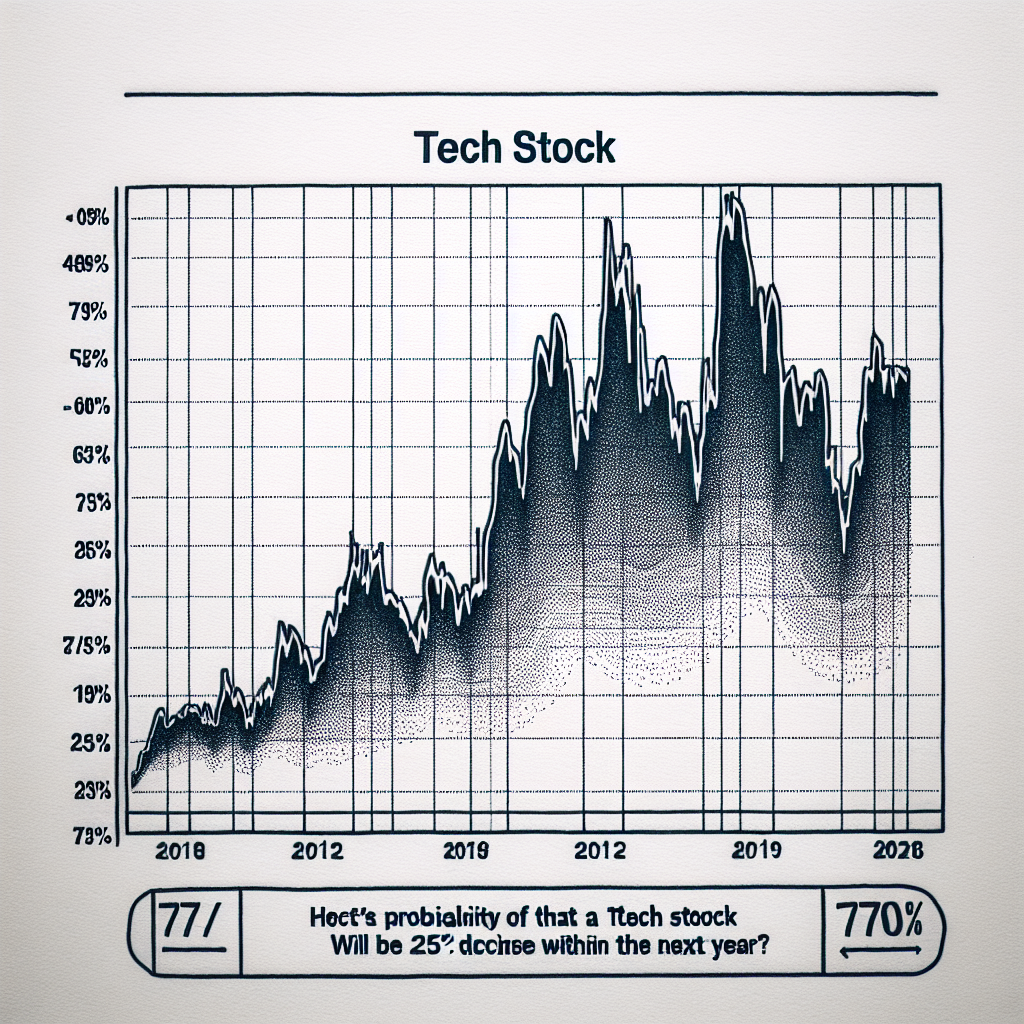

“Palantir Stock: Historical Trends Signal a 79% Chance of a 25% Drop in the Coming Year.”

Introduction

Palantir Technologies Inc., a prominent player in the data analytics and software industry, is currently under scrutiny as historical data analysis suggests a significant probability of a substantial decline in its stock value. According to recent assessments, there is a 79% likelihood that Palantir’s stock could experience a 25% drop within the next year. This projection is based on historical market trends and performance metrics, which indicate potential vulnerabilities in the company’s stock trajectory. Investors and market analysts are closely monitoring these developments, as they could have substantial implications for Palantir’s market position and investor confidence.

Understanding Palantir’s Stock Volatility: A Historical Perspective

Palantir Technologies, a company renowned for its data analytics platforms, has been a focal point of interest for investors since its public debut. However, the stock’s journey has been anything but smooth, characterized by significant volatility that has left many investors wary. Historical data suggests that Palantir’s stock faces a 79% probability of experiencing a 25% decline within a year, a statistic that underscores the inherent risks associated with investing in this tech giant. To understand the factors contributing to this volatility, it is essential to delve into the historical performance of Palantir’s stock and the broader market dynamics at play.

Since its initial public offering (IPO) in September 2020, Palantir’s stock has experienced dramatic fluctuations. The company’s innovative approach to data analytics and its high-profile government contracts initially fueled investor enthusiasm, driving the stock price to impressive heights. However, this optimism has often been tempered by broader market trends and company-specific challenges. For instance, the tech sector’s overall volatility, driven by factors such as interest rate changes and regulatory scrutiny, has had a pronounced impact on Palantir’s stock performance. Additionally, the company’s reliance on government contracts, which can be subject to political and budgetary shifts, adds another layer of uncertainty.

Moreover, Palantir’s financial performance has been a double-edged sword for investors. On one hand, the company has demonstrated robust revenue growth, driven by its expanding customer base and innovative product offerings. On the other hand, concerns about profitability and high operating costs have raised questions about the sustainability of this growth. These financial dynamics have contributed to the stock’s volatility, as investors weigh the potential for future gains against the risks of continued losses.

In addition to these company-specific factors, broader market conditions have also played a significant role in shaping Palantir’s stock trajectory. The tech sector, in particular, has been subject to cyclical trends that can lead to rapid shifts in investor sentiment. For example, periods of economic uncertainty or shifts in monetary policy can lead to increased market volatility, disproportionately affecting high-growth tech stocks like Palantir. Furthermore, the rise of retail investors and the influence of social media platforms have introduced new dynamics into the market, leading to sudden and unpredictable price movements.

Given these factors, it is not surprising that historical data indicates a high probability of a significant decline in Palantir’s stock price within a year. However, it is important to note that this statistic does not necessarily predict a negative outcome for the company in the long term. Instead, it highlights the need for investors to approach Palantir with a clear understanding of the risks involved and a willingness to navigate the inherent volatility.

In conclusion, Palantir’s stock volatility is a product of both company-specific challenges and broader market dynamics. While the historical probability of a 25% decline within a year may seem daunting, it also reflects the complex interplay of factors that define the tech sector’s investment landscape. For investors, the key lies in balancing the potential rewards of investing in a pioneering company like Palantir with the risks posed by its volatile stock performance. By maintaining a long-term perspective and staying informed about market trends, investors can better position themselves to navigate the uncertainties that come with investing in high-growth tech stocks.

Analyzing the 79% Probability of Palantir’s Stock Decline

Palantir Technologies, a company renowned for its data analytics platforms, has been a focal point of interest for investors since its public debut. However, recent analyses suggest a concerning probability of a significant decline in its stock value. Specifically, historical data indicates a 79% chance that Palantir’s stock could experience a 25% drop within the next year. This projection, while alarming, is rooted in a comprehensive examination of market trends and the company’s financial performance.

To understand the basis of this prediction, it is essential to delve into the historical performance of Palantir’s stock. Since its initial public offering, the stock has experienced considerable volatility, a characteristic not uncommon among technology companies. This volatility can be attributed to several factors, including market sentiment, the company’s financial disclosures, and broader economic conditions. By analyzing these elements, one can discern patterns that may foreshadow future movements in the stock’s value.

One of the primary factors contributing to the projected decline is the company’s financial health. While Palantir has demonstrated impressive revenue growth, it has yet to achieve consistent profitability. This lack of profitability raises concerns among investors, particularly in an economic climate where financial stability is paramount. Furthermore, the company’s reliance on government contracts, which constitute a significant portion of its revenue, introduces an element of uncertainty. Changes in government spending priorities or contract renewals could adversely impact Palantir’s financial outlook.

In addition to financial considerations, market sentiment plays a crucial role in stock performance. Palantir’s stock has been subject to speculative trading, with investors often reacting to news and rumors rather than fundamental analysis. This speculative nature can exacerbate price swings, leading to potential declines when investor sentiment shifts. Moreover, the broader technology sector has faced headwinds, with concerns over regulatory scrutiny and market saturation affecting investor confidence. These sector-wide challenges could further influence Palantir’s stock trajectory.

Transitioning from company-specific factors to broader market dynamics, it is important to consider the impact of macroeconomic conditions. Inflationary pressures, interest rate hikes, and geopolitical tensions have created an environment of uncertainty in global markets. Such conditions often lead investors to adopt a risk-averse approach, favoring stable, established companies over those with volatile prospects. In this context, Palantir’s stock may be perceived as a higher-risk investment, contributing to the likelihood of a decline.

While the 79% probability of a 25% decline is significant, it is crucial to recognize that stock market predictions are inherently uncertain. Various unforeseen factors, such as technological advancements or strategic partnerships, could alter Palantir’s trajectory. Additionally, investor sentiment can shift rapidly, influenced by new information or changes in market conditions. Therefore, while historical data provides valuable insights, it should not be the sole determinant of investment decisions.

In conclusion, the analysis of Palantir’s stock suggests a high probability of a decline, driven by financial performance, market sentiment, and macroeconomic factors. Investors should approach this information with caution, considering both the potential risks and opportunities associated with Palantir’s stock. By maintaining a balanced perspective and staying informed about market developments, investors can make more informed decisions in navigating the complexities of the stock market.

Factors Contributing to Palantir’s Potential 25% Stock Drop

Palantir Technologies, a company renowned for its data analytics platforms, has been a focal point of investor interest since its public debut. However, recent analyses suggest that the stock faces a 79% probability of experiencing a 25% decline within the next year. This projection, grounded in historical data, raises questions about the factors contributing to such a potential downturn. Understanding these elements is crucial for investors seeking to navigate the complexities of the stock market.

To begin with, the volatility inherent in the technology sector plays a significant role in the potential decline of Palantir’s stock. The tech industry is characterized by rapid innovation and intense competition, which can lead to swift changes in market dynamics. Companies like Palantir, which operate at the intersection of technology and data, are particularly susceptible to these fluctuations. As competitors develop new technologies and solutions, Palantir must continuously innovate to maintain its market position. Failure to do so could result in a loss of market share, adversely affecting its stock price.

Moreover, Palantir’s reliance on government contracts introduces another layer of risk. While these contracts provide a stable revenue stream, they are subject to political and budgetary changes. Any shift in government priorities or budget cuts could impact Palantir’s financial performance. Additionally, the company’s dependence on a limited number of large contracts means that the loss of even a single contract could have significant repercussions. This concentration risk is a critical factor that investors must consider when evaluating the potential for a stock decline.

In addition to these industry-specific risks, broader economic conditions also play a pivotal role. The global economy is currently facing uncertainties, including inflationary pressures, interest rate hikes, and geopolitical tensions. These factors can lead to market volatility, affecting investor sentiment and stock valuations. In such an environment, companies with high valuations, like Palantir, may be particularly vulnerable to corrections. Investors may become more risk-averse, leading to a sell-off in high-growth stocks, which could contribute to the projected decline.

Furthermore, Palantir’s financial performance and growth prospects are essential considerations. While the company has demonstrated impressive revenue growth, it has yet to achieve consistent profitability. Investors often scrutinize the balance between growth and profitability, especially in uncertain economic times. If Palantir fails to meet market expectations for revenue growth or profitability, it could lead to a reevaluation of its stock price. This potential reassessment could be a driving force behind the anticipated decline.

Lastly, investor sentiment and market psychology cannot be overlooked. The stock market is influenced by perceptions and expectations, which can sometimes deviate from fundamental analysis. If investors perceive Palantir’s growth prospects as diminishing or become concerned about its ability to navigate industry challenges, it could lead to a negative feedback loop. This shift in sentiment could exacerbate the stock’s decline, as investors may choose to exit their positions in anticipation of further losses.

In conclusion, the potential 25% decline in Palantir’s stock within the next year is influenced by a confluence of factors. Industry volatility, reliance on government contracts, economic uncertainties, financial performance, and investor sentiment all contribute to this projection. While historical data provides a basis for this analysis, it is essential for investors to remain vigilant and consider these factors when making investment decisions. By understanding the complexities surrounding Palantir’s stock, investors can better navigate the challenges and opportunities that lie ahead.

Historical Data Insights: Palantir’s Stock Performance Trends

Palantir Technologies, a company renowned for its data analytics platforms, has been a focal point of interest for investors since its public debut. However, recent analyses of historical data suggest that Palantir’s stock faces a 79% probability of experiencing a 25% decline within the next year. This projection, while concerning for some, is rooted in a comprehensive examination of the company’s past stock performance trends and broader market conditions.

To understand the potential trajectory of Palantir’s stock, it is essential to delve into its historical performance. Since its initial public offering (IPO) in September 2020, Palantir’s stock has experienced significant volatility. This volatility is not uncommon for technology companies, particularly those that are relatively new to the public market. Palantir’s stock price has been influenced by a myriad of factors, including market sentiment, investor expectations, and broader economic conditions. By analyzing these elements, one can discern patterns that may inform future performance.

Historically, Palantir’s stock has shown a tendency to react sharply to both positive and negative news. For instance, announcements of new government contracts or partnerships often lead to short-term spikes in stock price. Conversely, broader market downturns or concerns about the company’s profitability can result in steep declines. This pattern of volatility is not unique to Palantir but is characteristic of many technology stocks, which are often subject to rapid shifts in investor sentiment.

Moreover, the broader market environment plays a crucial role in shaping Palantir’s stock performance. The technology sector, in particular, is highly sensitive to changes in interest rates, inflation expectations, and economic growth forecasts. In periods of economic uncertainty or tightening monetary policy, technology stocks, including Palantir, may face increased pressure. This is because higher interest rates can lead to a re-evaluation of growth stocks, as future cash flows are discounted at a higher rate, potentially reducing their present value.

In addition to these external factors, Palantir’s internal financial health and strategic decisions are pivotal in determining its stock performance. Investors closely scrutinize the company’s revenue growth, profitability, and ability to scale its operations. While Palantir has demonstrated robust revenue growth, concerns about its path to sustained profitability remain. The company’s heavy reliance on government contracts, while lucrative, also poses risks, as changes in government spending priorities could impact future revenues.

Given these considerations, the projection of a 79% probability of a 25% decline in Palantir’s stock within a year is not without precedent. Historical data indicates that similar patterns have occurred in the past, particularly during periods of heightened market volatility or economic uncertainty. However, it is important to note that such projections are inherently probabilistic and subject to change based on new information or shifts in market dynamics.

In conclusion, while the potential for a significant decline in Palantir’s stock may be unsettling for some investors, it is crucial to approach such projections with a nuanced understanding of the underlying factors. By examining historical performance trends, market conditions, and the company’s strategic direction, investors can make more informed decisions. Ultimately, while past performance is not always indicative of future results, it provides valuable insights into the potential risks and opportunities that lie ahead for Palantir’s stock.

Risk Assessment: Investing in Palantir Amid Decline Predictions

Investing in the stock market inherently involves a degree of risk, and understanding these risks is crucial for making informed decisions. Palantir Technologies, a company known for its data analytics platforms, has been a focal point for investors due to its innovative approach and potential for growth. However, recent analyses suggest that Palantir stock faces a 79% probability of a 25% decline within the next year, based on historical data. This prediction raises important considerations for investors contemplating their positions in the company.

To begin with, it is essential to understand the basis of these predictions. Historical data analysis involves examining past stock performance to identify patterns and trends that may indicate future movements. In the case of Palantir, analysts have scrutinized its stock behavior since its public debut, noting periods of volatility and significant price fluctuations. Such analyses often employ statistical models that consider various factors, including market conditions, company performance, and broader economic indicators. The 79% probability figure emerges from these models, suggesting a high likelihood of a substantial decline.

Transitioning to the implications of this prediction, investors must weigh the potential risks against the rewards. A 25% decline in stock value can significantly impact an investment portfolio, particularly for those heavily invested in Palantir. This potential downturn could be attributed to several factors, including market saturation, increased competition, or shifts in demand for Palantir’s services. Moreover, macroeconomic conditions, such as interest rate changes or geopolitical tensions, could exacerbate these risks, further influencing stock performance.

Despite these concerns, it is important to consider the potential for growth that Palantir still holds. The company has carved out a niche in the data analytics sector, providing solutions to both government and commercial clients. Its innovative technology and strategic partnerships could drive future growth, potentially offsetting the predicted decline. Investors with a long-term perspective might view this as an opportunity to acquire shares at a lower price, banking on Palantir’s ability to rebound and thrive in the evolving tech landscape.

Furthermore, diversification remains a key strategy for mitigating risk. By spreading investments across various sectors and asset classes, investors can reduce their exposure to any single stock’s volatility. In the context of Palantir, this means balancing investments in technology with those in more stable industries, thereby cushioning potential losses.

In addition, staying informed about Palantir’s strategic initiatives and market developments is crucial. Regularly reviewing company announcements, earnings reports, and industry news can provide valuable insights into its performance and future prospects. This proactive approach enables investors to make timely decisions, whether it involves adjusting their holdings or exploring alternative investment opportunities.

In conclusion, while the prediction of a 79% probability of a 25% decline in Palantir stock within a year is concerning, it is not a definitive outcome. Investors must carefully assess the risks and rewards, considering both the potential for short-term losses and long-term gains. By employing strategies such as diversification and staying informed, they can navigate the uncertainties of the stock market and make decisions aligned with their financial goals. Ultimately, understanding the nuances of risk assessment is key to successful investing, particularly in a dynamic and unpredictable market environment.

Market Reactions to Palantir’s Stock Forecasts

Palantir Technologies, a company renowned for its data analytics and software solutions, has recently been the subject of intense scrutiny in the financial markets. Investors and analysts alike are closely examining the company’s stock performance, particularly in light of a recent forecast suggesting a 79% probability of a 25% decline within the next year. This prediction, grounded in historical data, has sparked a wave of reactions across the market, prompting stakeholders to reassess their positions and strategies.

To understand the implications of this forecast, it is essential to delve into the historical performance of Palantir’s stock. Since its public debut in September 2020, Palantir has experienced significant volatility, a characteristic not uncommon among technology companies. The stock’s trajectory has been influenced by a myriad of factors, including market sentiment, macroeconomic conditions, and the company’s own financial performance. Historically, Palantir’s stock has shown a pattern of sharp rises followed by equally steep declines, a trend that has been a source of both opportunity and risk for investors.

The current forecast of a potential 25% decline is not without precedent. In the past, Palantir’s stock has undergone similar downturns, often triggered by broader market corrections or shifts in investor sentiment. For instance, during periods of heightened market volatility, technology stocks, including Palantir, have been particularly susceptible to sharp declines. This vulnerability is often exacerbated by the high valuations typically associated with tech companies, which can lead to significant price adjustments when market conditions change.

Moreover, the forecast is based on a comprehensive analysis of historical data, which takes into account various market indicators and trends. By examining past performance and correlating it with current market conditions, analysts have been able to identify patterns that suggest a high probability of a decline. This approach, while not infallible, provides a data-driven perspective that can help investors make informed decisions.

In response to this forecast, market reactions have been mixed. Some investors view the potential decline as an opportunity to buy Palantir stock at a lower price, banking on the company’s long-term growth prospects. They argue that Palantir’s innovative technology and strategic partnerships position it well for future success, despite short-term fluctuations. On the other hand, more cautious investors are reevaluating their portfolios, considering the potential risks associated with holding Palantir stock in the face of a possible downturn.

Furthermore, the broader market context cannot be ignored. The technology sector as a whole is navigating a complex landscape, characterized by rapid innovation, regulatory challenges, and shifting consumer preferences. These factors contribute to the uncertainty surrounding tech stocks, including Palantir, and underscore the importance of a nuanced approach to investment decisions.

In conclusion, the forecast of a 79% probability of a 25% decline in Palantir’s stock within a year has elicited varied reactions from the market. While historical data provides valuable insights into potential future trends, it is crucial for investors to consider a range of factors, including market conditions and the company’s strategic direction. As Palantir continues to evolve and adapt to the changing landscape, its stock performance will likely remain a focal point for investors seeking to navigate the complexities of the technology sector.

Strategic Investment Decisions in Light of Palantir’s Stock Outlook

In the realm of strategic investment decisions, the evaluation of potential risks and rewards is paramount. Investors are constantly seeking to balance these elements, particularly when considering stocks with volatile histories. Palantir Technologies, a company renowned for its data analytics platforms, has recently come under scrutiny due to a statistical analysis suggesting a 79% probability of a 25% decline in its stock value within the next year. This projection, grounded in historical data, necessitates a closer examination of the factors influencing such a forecast and the implications for investors.

To begin with, understanding the basis of this prediction requires a look at Palantir’s historical stock performance. Since its public debut in 2020, Palantir’s stock has experienced significant fluctuations, driven by both market conditions and company-specific developments. The company’s innovative approach to data analytics and its high-profile government contracts have attracted considerable investor interest. However, this has also led to heightened volatility, as market sentiment can shift rapidly in response to news about contract renewals, competitive pressures, or broader economic trends.

Moreover, the statistical model predicting a potential decline in Palantir’s stock incorporates various historical data points, including past price movements, trading volumes, and macroeconomic indicators. By analyzing these factors, the model aims to provide a probabilistic assessment of future stock performance. While such models are not infallible, they offer valuable insights that can inform investment strategies. It is crucial for investors to recognize that these predictions are not certainties but rather informed estimates based on available data.

In light of this forecast, investors must consider their risk tolerance and investment objectives. For those with a higher risk appetite, the potential for a significant decline might be viewed as an opportunity to acquire shares at a lower price, with the expectation of long-term gains. Conversely, risk-averse investors may opt to reduce their exposure to Palantir, seeking to preserve capital in the face of potential downturns. This decision-making process underscores the importance of aligning investment choices with individual financial goals and risk profiles.

Furthermore, it is essential to contextualize Palantir’s stock outlook within the broader market environment. The technology sector, in particular, has been subject to increased scrutiny and regulatory challenges, which can impact stock valuations. Additionally, macroeconomic factors such as interest rate changes, inflationary pressures, and geopolitical tensions can influence investor sentiment and market dynamics. By considering these external factors, investors can better assess the potential risks and rewards associated with Palantir’s stock.

In conclusion, the prediction of a 79% probability of a 25% decline in Palantir’s stock within a year serves as a reminder of the inherent uncertainties in the stock market. While historical data provides a valuable framework for assessing potential outcomes, it is ultimately one of many tools investors must use in their decision-making process. By carefully weighing the risks and opportunities, and considering both company-specific and broader market factors, investors can make more informed strategic investment decisions. As always, maintaining a diversified portfolio and staying informed about market developments are key strategies for navigating the complexities of investing in volatile stocks like Palantir.

Q&A

1. **What is the main prediction about Palantir stock?**

Palantir stock faces a 79% probability of a 25% decline within a year.

2. **What is the basis for this prediction?**

The prediction is based on historical data analysis.

3. **What is the time frame for the predicted decline?**

The decline is expected to occur within a year.

4. **What percentage decline is predicted for Palantir stock?**

A 25% decline is predicted.

5. **What is the probability of the predicted decline occurring?**

There is a 79% probability of the decline occurring.

6. **What type of data was used to make this prediction?**

Historical data was used to make the prediction.

7. **Is the prediction about Palantir stock positive or negative?**

The prediction is negative, indicating a potential decline in stock value.

Conclusion

Based on historical data analysis, Palantir stock faces a significant risk, with a 79% probability of experiencing a 25% decline within the next year. This suggests that investors should exercise caution and consider the potential for substantial downside when evaluating their investment strategies in relation to Palantir. The historical trends indicate a high likelihood of volatility, underscoring the importance of risk management and thorough market analysis for stakeholders.