“Unlocking the Potential of Crypto: Dive into Yield Farming and Discover How It Works!”

Introduction

Yield farming, also known as liquidity mining, is a process in the decentralized finance (DeFi) ecosystem where cryptocurrency holders lend their assets to earn rewards, typically in the form of additional cryptocurrency. This practice leverages smart contracts on blockchain platforms, primarily Ethereum, to facilitate lending and borrowing without intermediaries. Participants provide liquidity to decentralized exchanges or lending platforms, and in return, they receive interest or fees generated from the platform’s operations. Yield farming often involves complex strategies, including staking, lending, and borrowing across multiple platforms to maximize returns. However, it also carries significant risks, such as smart contract vulnerabilities, market volatility, and potential loss of funds. Despite these risks, yield farming has gained popularity for its potential to generate high returns in the rapidly evolving DeFi landscape.

Introduction To Yield Farming: Understanding The Basics

Yield farming, a term that has gained significant traction in the world of decentralized finance (DeFi), represents a novel way for cryptocurrency holders to earn rewards on their assets. At its core, yield farming involves lending or staking cryptocurrency in exchange for interest or additional tokens. This process is facilitated by smart contracts on decentralized platforms, which automate the distribution of rewards. As the DeFi ecosystem continues to expand, understanding the basics of yield farming becomes essential for anyone looking to navigate this innovative financial landscape.

To begin with, yield farming is primarily conducted on Ethereum-based platforms, although other blockchains are increasingly supporting similar activities. Participants, often referred to as liquidity providers, supply their assets to a liquidity pool. These pools are essentially smart contracts that hold funds and facilitate trading by providing liquidity to decentralized exchanges (DEXs). In return for their contribution, liquidity providers earn a portion of the transaction fees generated by the pool, as well as additional tokens, which are often native to the platform.

The appeal of yield farming lies in its potential for high returns, which can surpass those offered by traditional financial instruments. However, these returns are not without risk. The volatility of cryptocurrency markets, coupled with the complexities of smart contracts, can lead to significant financial losses. Therefore, it is crucial for participants to conduct thorough research and understand the risks involved before engaging in yield farming.

One of the key components of yield farming is the annual percentage yield (APY), which represents the potential return on investment over a year. APY calculations can vary significantly depending on the platform and the specific pool, as they are influenced by factors such as the total value locked (TVL) in the pool and the demand for the underlying assets. As a result, yield farmers must continuously monitor their investments and adjust their strategies to optimize returns.

Moreover, yield farming strategies can be complex and multifaceted. Some participants engage in “liquidity mining,” where they earn additional tokens by providing liquidity to specific pools. Others may employ “yield optimization” techniques, which involve moving assets between different pools or platforms to maximize returns. These strategies require a deep understanding of the DeFi ecosystem and the ability to adapt to rapidly changing market conditions.

In addition to the financial risks, yield farming also poses technical challenges. Smart contract vulnerabilities, such as coding errors or security breaches, can result in the loss of funds. To mitigate these risks, participants should consider using audited platforms and diversifying their investments across multiple pools and protocols.

Despite these challenges, yield farming continues to attract a growing number of participants, driven by the allure of high returns and the opportunity to participate in the burgeoning DeFi movement. As the sector evolves, new platforms and innovations are likely to emerge, offering even more opportunities for yield farmers.

In conclusion, yield farming represents a dynamic and potentially lucrative aspect of the DeFi ecosystem. By providing liquidity to decentralized platforms, participants can earn rewards and contribute to the growth of decentralized finance. However, the complexities and risks associated with yield farming necessitate a thorough understanding of the underlying mechanisms and a cautious approach to investment. As with any financial endeavor, due diligence and risk management are paramount to success in the world of yield farming.

Key Components Of Yield Farming: Platforms, Tokens, And Pools

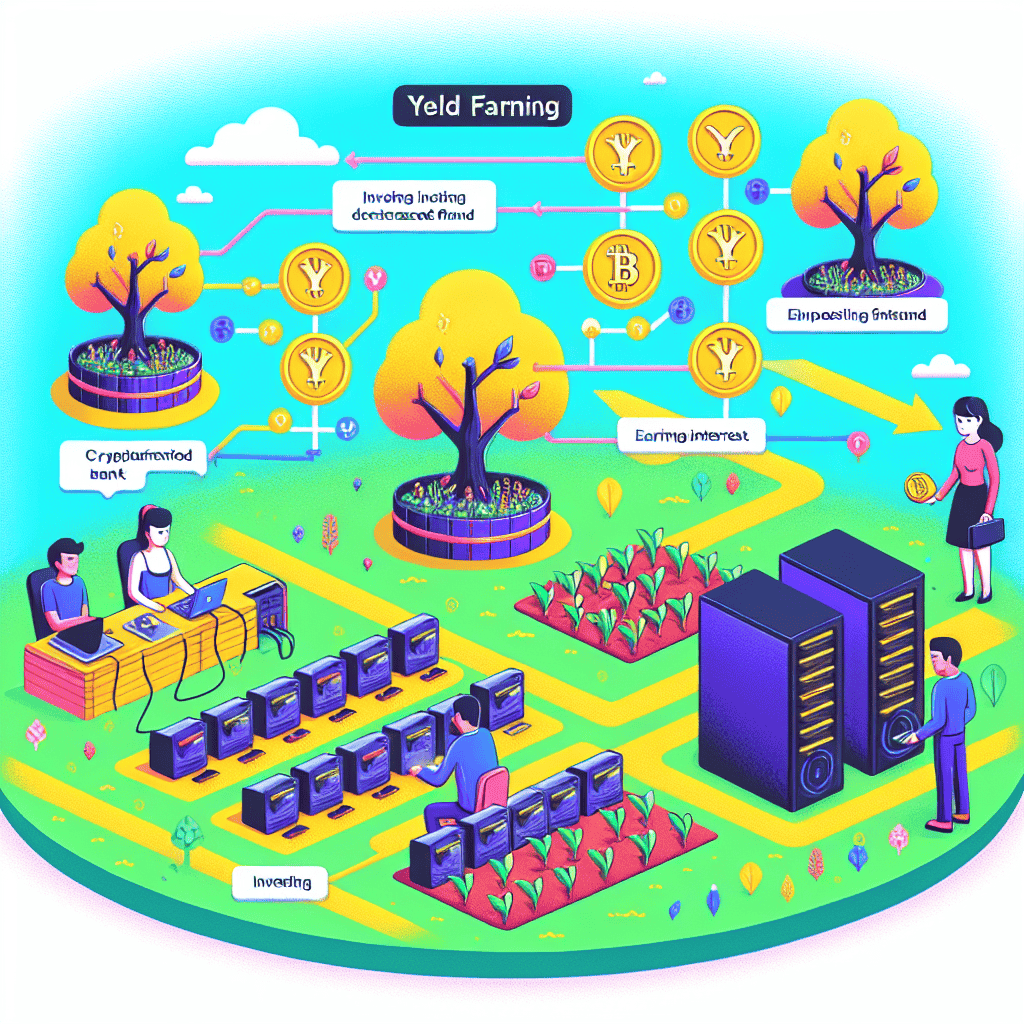

Yield farming, a concept that has gained significant traction in the decentralized finance (DeFi) space, involves earning rewards by providing liquidity to DeFi protocols. To understand the key components of yield farming, it is essential to explore the platforms, tokens, and pools that form the backbone of this innovative financial mechanism. These elements work in tandem to facilitate the seamless operation of yield farming, offering users the opportunity to earn returns on their crypto assets.

Platforms are the foundational infrastructure of yield farming, serving as the digital marketplaces where users can lend, borrow, or trade cryptocurrencies. These platforms, such as Uniswap, Aave, and Compound, provide the necessary tools and interfaces for users to engage in yield farming activities. They are built on blockchain technology, ensuring transparency, security, and decentralization. By leveraging smart contracts, these platforms automate transactions and reward distributions, minimizing the need for intermediaries and reducing operational costs. As a result, users can participate in yield farming with confidence, knowing that their assets are managed by secure and reliable systems.

Tokens play a crucial role in yield farming, acting as the medium of exchange and reward within the DeFi ecosystem. When users provide liquidity to a platform, they receive liquidity provider (LP) tokens in return. These tokens represent the user’s share in the liquidity pool and can be used to claim rewards or reinvest in other yield farming opportunities. Additionally, governance tokens are often distributed as part of the reward system, granting holders voting rights on protocol decisions. This incentivizes users to participate actively in the platform’s development and governance, fostering a sense of community and shared ownership. The interplay between LP tokens and governance tokens creates a dynamic environment where users can maximize their returns while contributing to the platform’s growth.

Pools are the aggregators of liquidity within yield farming platforms, bringing together assets from multiple users to facilitate efficient trading and lending. These pools are essential for maintaining liquidity in the DeFi ecosystem, enabling users to execute transactions without significant price slippage. By contributing to these pools, users earn a portion of the transaction fees generated by the platform, as well as additional rewards in the form of tokens. The size and composition of a pool can influence the potential returns for yield farmers, as larger pools tend to offer more stable returns, while smaller pools may present higher risks and rewards. Consequently, users must carefully assess the characteristics of each pool before committing their assets, balancing the potential for profit with the associated risks.

In conclusion, the key components of yield farming—platforms, tokens, and pools—are intricately linked, each playing a vital role in the overall functioning of the DeFi ecosystem. Platforms provide the infrastructure and tools necessary for yield farming activities, while tokens serve as the medium of exchange and reward. Pools aggregate liquidity, enabling efficient transactions and generating returns for participants. Together, these elements create a robust and dynamic environment for yield farming, offering users the opportunity to earn returns on their crypto assets while contributing to the growth and development of the DeFi space. As the landscape of decentralized finance continues to evolve, understanding these components will be crucial for anyone looking to participate in yield farming and capitalize on its potential benefits.

How Yield Farming Generates Returns: A Deep Dive Into Mechanisms

Yield farming, a concept that has gained significant traction in the decentralized finance (DeFi) space, offers a novel way for investors to generate returns on their cryptocurrency holdings. At its core, yield farming involves providing liquidity to decentralized platforms in exchange for rewards, typically in the form of additional cryptocurrency tokens. This process is facilitated through smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. To understand how yield farming generates returns, it is essential to delve into the mechanisms that underpin this innovative financial strategy.

Initially, yield farming emerged as a means to incentivize liquidity provision on decentralized exchanges (DEXs). These platforms rely on liquidity pools, which are collections of funds locked in a smart contract, to facilitate trading without the need for a traditional order book. By contributing their assets to these pools, yield farmers enable seamless transactions between different cryptocurrencies. In return, they receive a portion of the trading fees generated by the platform. This fee-sharing model is one of the primary ways yield farming generates returns for participants.

Moreover, yield farming often involves the distribution of governance tokens as an additional incentive. These tokens grant holders voting rights on protocol decisions, thereby decentralizing control and fostering community engagement. The distribution of governance tokens not only rewards liquidity providers but also aligns their interests with the long-term success of the platform. As the value of these tokens appreciates, yield farmers can realize significant returns on their initial investments.

Another mechanism through which yield farming generates returns is through the practice of “staking.” In this context, staking refers to the process of locking up a certain amount of cryptocurrency in a protocol to support its operations, such as validating transactions or securing the network. In exchange for their commitment, stakers receive rewards, often in the form of additional tokens. This process not only incentivizes participation but also enhances the security and stability of the underlying blockchain network.

Furthermore, yield farming strategies often involve the use of leverage to amplify returns. By borrowing additional assets against their existing holdings, yield farmers can increase their exposure to potential gains. However, this approach also introduces additional risk, as it can lead to significant losses if the value of the borrowed assets declines. As such, yield farming with leverage requires careful risk management and a thorough understanding of market dynamics.

In addition to these mechanisms, yield farming can also generate returns through the practice of “yield optimization.” This involves strategically moving assets between different protocols to maximize returns. Yield optimizers, often in the form of automated platforms or decentralized applications (dApps), continuously scan the DeFi ecosystem for the most lucrative opportunities. By reallocating assets to higher-yielding pools or protocols, these tools help yield farmers enhance their overall returns.

In conclusion, yield farming generates returns through a combination of liquidity provision, governance token distribution, staking, leverage, and yield optimization. Each of these mechanisms plays a crucial role in the broader DeFi ecosystem, offering participants the opportunity to earn passive income on their cryptocurrency holdings. However, it is important to recognize that yield farming is not without its risks, including market volatility, smart contract vulnerabilities, and potential regulatory challenges. As such, prospective yield farmers should conduct thorough research and exercise caution when engaging in this complex and rapidly evolving financial landscape.

Risks And Rewards: Evaluating The Pros And Cons Of Yield Farming

Yield farming, a concept that has gained significant traction in the decentralized finance (DeFi) space, offers both enticing rewards and notable risks. As investors seek to maximize their returns in the burgeoning world of cryptocurrencies, understanding the intricacies of yield farming becomes crucial. At its core, yield farming involves lending or staking cryptocurrency assets in DeFi protocols to earn returns, often in the form of additional cryptocurrency tokens. This process is akin to earning interest on a traditional savings account, but with potentially higher yields and, consequently, higher risks.

One of the primary rewards of yield farming is the potential for substantial returns. In contrast to traditional financial systems, where interest rates are often modest, yield farming can offer significantly higher yields. This is particularly appealing in a low-interest-rate environment, where traditional savings vehicles may not provide sufficient returns to meet investors’ financial goals. Moreover, yield farming can offer a diversified income stream, as investors can earn returns from multiple DeFi platforms simultaneously. This diversification can help mitigate risks associated with any single platform’s failure or underperformance.

However, the high rewards of yield farming are accompanied by equally high risks. One of the most significant risks is the volatility of cryptocurrency markets. The value of the tokens earned through yield farming can fluctuate dramatically, potentially eroding the returns or even resulting in losses. Additionally, the DeFi space is still relatively nascent and lacks the regulatory oversight present in traditional financial markets. This lack of regulation can expose investors to fraudulent schemes or poorly designed protocols that may collapse, leading to substantial financial losses.

Another risk associated with yield farming is smart contract vulnerabilities. DeFi platforms rely on smart contracts to automate transactions and yield distribution. While these contracts are designed to be secure, they are not immune to bugs or exploits. A single vulnerability in a smart contract can be exploited by malicious actors, resulting in the loss of funds for all participants involved. Therefore, it is imperative for investors to conduct thorough due diligence and assess the security measures implemented by the platforms they choose to engage with.

Furthermore, yield farming often involves complex strategies that may not be suitable for all investors. The process requires a deep understanding of various DeFi protocols, liquidity pools, and tokenomics. For those unfamiliar with these concepts, the learning curve can be steep, and mistakes can be costly. Additionally, transaction fees on blockchain networks, particularly Ethereum, can be prohibitively high during periods of network congestion, eating into the profits generated from yield farming activities.

In conclusion, while yield farming presents an opportunity for investors to earn attractive returns in the DeFi space, it is not without its challenges. The potential for high rewards is counterbalanced by significant risks, including market volatility, regulatory uncertainty, smart contract vulnerabilities, and the complexity of the strategies involved. As such, investors must carefully weigh these factors and consider their risk tolerance before engaging in yield farming. By doing so, they can make informed decisions that align with their financial objectives and risk appetite, ultimately navigating the dynamic landscape of decentralized finance with greater confidence.

Popular Yield Farming Strategies: Maximizing Your Crypto Earnings

Yield farming has emerged as a prominent strategy within the decentralized finance (DeFi) ecosystem, offering crypto enthusiasts the opportunity to maximize their earnings through various innovative methods. As the DeFi landscape continues to evolve, understanding popular yield farming strategies becomes crucial for those looking to optimize their returns. By exploring these strategies, investors can make informed decisions and potentially enhance their crypto portfolios.

One of the most common yield farming strategies involves liquidity provision. In this approach, investors supply their cryptocurrencies to decentralized exchanges (DEXs) or liquidity pools, facilitating trading activities on these platforms. In return, they receive a portion of the transaction fees generated by the exchange. This method not only provides liquidity to the market but also allows investors to earn passive income. However, it is essential to consider the risks associated with impermanent loss, which occurs when the value of the deposited assets fluctuates relative to each other.

Another popular strategy is staking, where investors lock up their cryptocurrencies in a blockchain network to support its operations, such as validating transactions. In exchange for their contribution, stakers receive rewards in the form of additional tokens. This method is particularly appealing for those who prefer a more stable and predictable income stream, as staking rewards are often fixed or determined by the network’s protocol. Nevertheless, it is important to be aware of the potential risks, such as network vulnerabilities or changes in staking rewards.

Yield aggregators have also gained traction as a strategy for maximizing crypto earnings. These platforms automatically move investors’ funds across various yield farming opportunities to optimize returns. By leveraging smart contracts, yield aggregators can efficiently allocate assets to the most profitable pools or strategies, saving investors time and effort. While this approach can enhance returns, it is crucial to consider the risks associated with smart contract vulnerabilities and platform reliability.

Furthermore, lending and borrowing platforms offer another avenue for yield farming. Investors can lend their cryptocurrencies to others in exchange for interest payments, effectively earning a yield on their assets. Conversely, borrowing allows users to leverage their holdings to access additional capital. This strategy can be particularly lucrative in a bull market, where the value of collateralized assets appreciates. However, it is vital to be cautious of liquidation risks, especially in volatile market conditions.

Token farming, or liquidity mining, is another strategy that has gained popularity. In this approach, investors earn native tokens of a DeFi platform by providing liquidity or participating in specific activities. These tokens can often be staked or used within the platform’s ecosystem, potentially increasing their value over time. While token farming can offer substantial rewards, it is important to assess the long-term viability and utility of the tokens being farmed.

In conclusion, yield farming presents a myriad of strategies for maximizing crypto earnings, each with its own set of benefits and risks. By understanding and carefully evaluating these strategies, investors can make informed decisions that align with their financial goals and risk tolerance. As the DeFi space continues to innovate, staying informed about emerging trends and strategies will be key to navigating this dynamic landscape successfully.

Yield Farming Vs. Traditional Investing: A Comparative Analysis

Yield farming, a concept that has gained significant traction in the decentralized finance (DeFi) space, presents a novel approach to earning returns on cryptocurrency holdings. Unlike traditional investing, which often involves purchasing stocks, bonds, or real estate with the expectation of long-term appreciation or income generation, yield farming leverages the unique mechanisms of blockchain technology to offer potentially high returns. To understand the distinctions between yield farming and traditional investing, it is essential to explore the underlying principles and risk profiles associated with each.

At its core, yield farming involves providing liquidity to decentralized exchanges or lending platforms in exchange for rewards, typically in the form of additional cryptocurrency tokens. This process is facilitated by smart contracts, which automate the distribution of rewards based on the amount of liquidity provided. In contrast, traditional investing relies on established financial institutions and markets, where returns are often generated through dividends, interest payments, or capital gains. The decentralized nature of yield farming allows for greater accessibility and flexibility, as participants can engage in these activities without the need for intermediaries.

However, the potential for high returns in yield farming is accompanied by a commensurate level of risk. The volatility of cryptocurrency markets, coupled with the nascent state of DeFi platforms, can lead to significant fluctuations in the value of assets. Additionally, smart contract vulnerabilities and the risk of impermanent loss—where the value of staked assets changes relative to the market—pose challenges that are less prevalent in traditional investing. In contrast, traditional investments are often perceived as more stable, with regulatory frameworks and established market practices providing a degree of security and predictability.

Despite these risks, yield farming offers unique opportunities for diversification and innovation. The ability to earn rewards in a variety of tokens allows investors to explore different projects and ecosystems, potentially uncovering new avenues for growth. Moreover, the rapid pace of development in the DeFi space means that yield farming strategies are continually evolving, offering participants the chance to capitalize on emerging trends. Traditional investing, while offering a more stable environment, may not provide the same level of dynamism or access to cutting-edge financial products.

Furthermore, the liquidity and transparency inherent in yield farming can be seen as advantages over traditional investing. The decentralized nature of blockchain technology ensures that transactions are recorded on a public ledger, providing a level of transparency that is often lacking in conventional financial markets. This transparency can foster trust and enable more informed decision-making. On the other hand, traditional investments are often subject to opaque processes and limited disclosure, which can obscure the true state of an investment.

In conclusion, while yield farming and traditional investing each have their own merits and drawbacks, they cater to different investor profiles and risk appetites. Yield farming appeals to those seeking high returns and willing to navigate the complexities and risks of the DeFi landscape. Traditional investing, with its established practices and regulatory oversight, offers a more conservative approach for those prioritizing stability and long-term growth. As the financial landscape continues to evolve, understanding the nuances of each approach will be crucial for investors looking to optimize their portfolios and achieve their financial goals.

The Future Of Yield Farming: Trends And Innovations To Watch

Yield farming, a practice that has gained significant traction within the decentralized finance (DeFi) ecosystem, continues to evolve as new trends and innovations emerge. As the DeFi landscape matures, yield farming is poised to undergo transformative changes that could redefine its role in the financial sector. To understand the future of yield farming, it is essential to explore the current trends and innovations that are shaping its trajectory.

One of the most notable trends in yield farming is the increasing integration of artificial intelligence (AI) and machine learning. These technologies are being leveraged to optimize yield farming strategies, allowing participants to maximize their returns while minimizing risks. By analyzing vast amounts of data, AI algorithms can identify patterns and predict market movements with greater accuracy than traditional methods. This not only enhances the efficiency of yield farming but also makes it more accessible to a broader audience, including those who may not have extensive financial expertise.

In addition to AI, the rise of cross-chain yield farming is another significant development. As the DeFi ecosystem expands beyond the Ethereum blockchain, yield farmers are seeking opportunities across multiple platforms. Cross-chain yield farming enables participants to leverage assets from different blockchains, thereby diversifying their portfolios and potentially increasing their returns. This trend is facilitated by the development of interoperability protocols, which allow seamless asset transfers between blockchains. As these protocols become more sophisticated, cross-chain yield farming is expected to become a standard practice within the DeFi community.

Moreover, the introduction of decentralized autonomous organizations (DAOs) is revolutionizing the governance of yield farming projects. DAOs enable community-driven decision-making, allowing yield farmers to have a say in the development and management of the platforms they use. This democratization of governance not only fosters greater transparency but also aligns the interests of all stakeholders. As DAOs become more prevalent, they are likely to play a crucial role in shaping the future of yield farming by ensuring that projects remain responsive to the needs of their users.

Another innovation to watch is the development of insurance products tailored specifically for yield farming. Given the inherent risks associated with DeFi, including smart contract vulnerabilities and market volatility, insurance solutions are becoming increasingly important. These products provide yield farmers with a safety net, protecting their investments from unforeseen events. As the insurance market for DeFi matures, it is expected to attract more participants to yield farming by mitigating some of the risks involved.

Furthermore, the concept of sustainable yield farming is gaining traction as environmental concerns become more prominent. Traditional yield farming practices can be resource-intensive, leading to significant energy consumption. In response, some projects are exploring eco-friendly alternatives, such as utilizing proof-of-stake (PoS) consensus mechanisms, which are less energy-intensive than proof-of-work (PoW) systems. By prioritizing sustainability, these projects aim to attract environmentally conscious investors and contribute to the broader goal of reducing the carbon footprint of blockchain technologies.

In conclusion, the future of yield farming is being shaped by a confluence of technological advancements and evolving market dynamics. As AI and machine learning optimize strategies, cross-chain capabilities expand opportunities, DAOs enhance governance, insurance products mitigate risks, and sustainable practices address environmental concerns, yield farming is set to become an even more integral part of the DeFi ecosystem. These trends and innovations not only promise to enhance the efficiency and accessibility of yield farming but also ensure its continued relevance in the rapidly changing world of decentralized finance.

Q&A

1. **What is yield farming?**

Yield farming is a process in decentralized finance (DeFi) where users lend or stake their cryptocurrency assets in exchange for rewards, typically in the form of interest or additional cryptocurrency.

2. **How does yield farming work?**

Yield farming works by utilizing smart contracts on blockchain platforms to automate the lending or staking of assets. Users provide liquidity to DeFi protocols, which then use these assets for various financial activities, generating returns that are distributed back to the users.

3. **What are liquidity pools in yield farming?**

Liquidity pools are collections of funds locked in a smart contract, used to facilitate trading on decentralized exchanges (DEXs). Yield farmers contribute to these pools and earn a share of the transaction fees or other incentives.

4. **What are the risks associated with yield farming?**

Risks include smart contract vulnerabilities, impermanent loss, market volatility, and potential scams or rug pulls. These risks can lead to significant financial losses for yield farmers.

5. **What is impermanent loss in yield farming?**

Impermanent loss occurs when the value of assets in a liquidity pool changes compared to holding them outside the pool, potentially leading to a lower value when withdrawn, especially if the price of the assets diverges significantly.

6. **How do yield farmers earn rewards?**

Yield farmers earn rewards through interest, transaction fees, or additional tokens provided by the DeFi protocols. These rewards are often distributed based on the proportion of liquidity a user contributes to the pool.

7. **What platforms are popular for yield farming?**

Popular platforms for yield farming include Uniswap, Aave, Compound, Yearn Finance, and SushiSwap. These platforms offer various opportunities for users to earn returns on their crypto assets.

Conclusion

Yield farming is a decentralized finance (DeFi) strategy that involves lending or staking cryptocurrency assets in order to generate high returns or rewards in the form of additional cryptocurrency. It operates primarily on Ethereum and other blockchain platforms that support smart contracts. Users provide liquidity to DeFi protocols, which then use these funds to facilitate various financial services like lending, borrowing, or trading. In return, users earn interest, fees, or governance tokens. The process often involves moving assets between different protocols to maximize returns, a practice known as “yield optimization.” While yield farming can offer substantial profits, it also carries significant risks, including smart contract vulnerabilities, market volatility, and potential loss of funds. As such, it requires careful consideration and risk management by participants.