“Yen Falls, Stocks Rise: Navigating Japan’s Election-Driven Market Shifts”

Introduction

The recent fluctuations in Japan’s financial markets have drawn significant attention, as the yen experiences a notable decline while Japanese stocks exhibit a robust climb. This dynamic shift is largely attributed to the political landscape, with the latest election outcomes playing a pivotal role in shaping investor sentiment and market trajectories. The depreciation of the yen, often seen as a double-edged sword, has sparked discussions on its implications for Japan’s export-driven economy, potentially enhancing the competitiveness of Japanese goods abroad. Simultaneously, the buoyancy in the stock market reflects investor optimism, driven by expectations of policy continuity and economic reforms promised by the newly elected government. This analysis delves into the intricate interplay between currency movements and stock market performance, exploring the broader economic and political factors influencing these trends in the wake of Japan’s recent electoral developments.

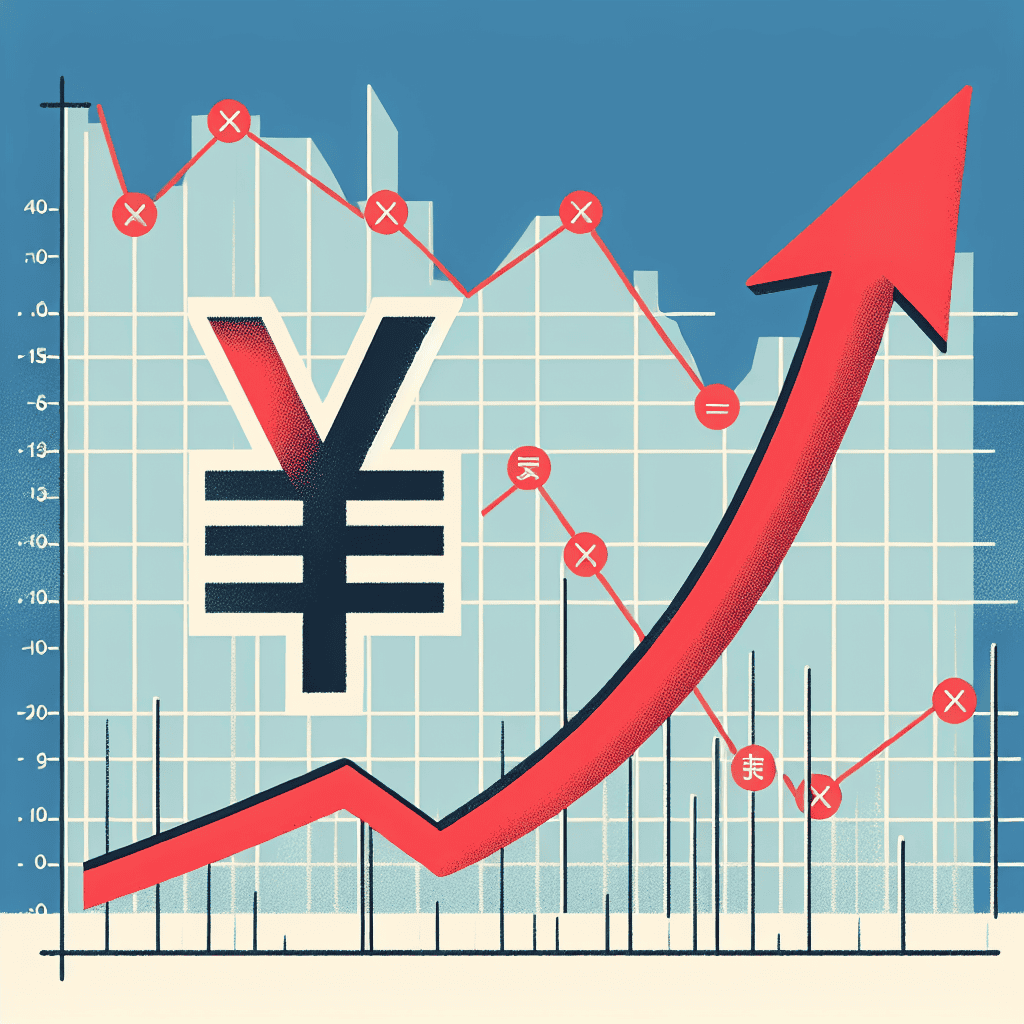

Yen Declines: Understanding the Economic Implications

The recent decline of the Japanese yen has captured the attention of global financial markets, particularly as it coincides with a notable rise in Japanese stock indices. This phenomenon, occurring in the wake of Japan’s latest election results, presents a complex interplay of economic factors that warrant a closer examination. Understanding the implications of the yen’s depreciation requires an analysis of both domestic and international influences, as well as the potential long-term effects on Japan’s economy.

To begin with, the yen’s decline can be attributed to several key factors. Domestically, the election results have reinforced the current government’s economic policies, which include a commitment to maintaining low interest rates. This monetary stance, aimed at stimulating economic growth, has inadvertently contributed to the yen’s weakening. Low interest rates tend to make a currency less attractive to foreign investors seeking higher returns, thereby exerting downward pressure on its value. Furthermore, the Bank of Japan’s continued adherence to its ultra-loose monetary policy, despite global trends towards tightening, has exacerbated this depreciation.

Internationally, the yen’s decline is also influenced by the strength of the U.S. dollar. As the Federal Reserve has signaled its intent to raise interest rates to combat inflation, the dollar has appreciated against a basket of currencies, including the yen. This dynamic has further widened the interest rate differential between Japan and the United States, making the yen less appealing to investors and contributing to its downward trajectory.

While the yen’s depreciation poses challenges, it also presents opportunities, particularly for Japanese exporters. A weaker yen makes Japanese goods more competitively priced in international markets, potentially boosting export volumes and improving trade balances. This export-driven growth can have a positive impact on corporate earnings, which is reflected in the rising Japanese stock indices. Investors, anticipating stronger performance from export-oriented companies, have driven up stock prices, contributing to the overall bullish sentiment in the Japanese equity market.

However, the benefits of a weaker yen are not without their drawbacks. Import-dependent sectors may face increased costs, as the price of imported goods and raw materials rises with the yen’s decline. This could lead to higher production costs and, ultimately, inflationary pressures within the domestic economy. Moreover, consumers may experience a decrease in purchasing power, as imported goods become more expensive, potentially dampening domestic consumption.

In the broader context, the yen’s decline and the concurrent rise in Japanese stocks highlight the delicate balance policymakers must maintain. While a weaker yen can stimulate export growth, it also necessitates careful management to mitigate inflationary risks and protect consumer interests. The Japanese government and the Bank of Japan must navigate these challenges while remaining responsive to global economic shifts.

In conclusion, the yen’s recent decline, juxtaposed with the rise in Japanese stocks, underscores the complex economic landscape shaped by both domestic policy decisions and international market forces. As Japan continues to grapple with these dynamics, the implications for its economy will depend on the ability of policymakers to adapt and respond effectively. The interplay between currency valuation, stock market performance, and economic policy will remain a focal point for analysts and investors alike, as they seek to understand and anticipate the future trajectory of Japan’s economic landscape.

Japanese Stocks Surge: Analyzing the Election Impact

The recent decline of the Japanese yen, juxtaposed with the surge in Japanese stocks, has captured the attention of investors and analysts alike, particularly in the context of the recent election outcomes. This intriguing financial phenomenon can be attributed to a confluence of factors, including market sentiment, economic policies, and geopolitical considerations. As the yen weakens, Japanese exporters find themselves in a favorable position, as their goods become more competitively priced on the global market. This, in turn, has bolstered investor confidence in Japanese equities, leading to a notable uptick in stock prices.

The election results have played a pivotal role in shaping market dynamics, as they have provided a clearer picture of Japan’s future economic policies. The ruling party’s victory has been interpreted as a mandate to continue with its existing economic strategies, which include a focus on fiscal stimulus and structural reforms. These policies are designed to invigorate the Japanese economy, which has been grappling with stagnation for years. Consequently, investors are optimistic about the potential for economic growth, which has contributed to the buoyancy of the stock market.

Moreover, the election has also alleviated some of the political uncertainties that had been weighing on the market. With a stable government in place, there is a renewed sense of predictability and stability, which is always a welcome development for investors. This political clarity has further fueled the rally in Japanese stocks, as market participants are more willing to take on risk in a stable environment.

In addition to domestic factors, global economic conditions have also played a role in the yen’s decline and the rise of Japanese stocks. The ongoing monetary policy divergence between Japan and other major economies, particularly the United States, has exerted downward pressure on the yen. While the Bank of Japan has maintained its accommodative stance, other central banks have been tightening their monetary policies, leading to a widening interest rate differential. This has made the yen less attractive to investors seeking higher yields, contributing to its depreciation.

Furthermore, the global supply chain disruptions and energy price fluctuations have had mixed effects on the Japanese economy. On one hand, higher energy costs have increased the import bill, putting additional pressure on the yen. On the other hand, Japanese companies that are integral to global supply chains have seen increased demand for their products, which has supported their stock prices. This dual impact underscores the complexity of the current economic landscape and highlights the interconnectedness of global markets.

In conclusion, the interplay between the yen’s decline and the rise in Japanese stocks is a multifaceted phenomenon influenced by both domestic and international factors. The recent election has provided a degree of political stability and clarity, which has been positively received by investors. At the same time, global economic conditions, including monetary policy divergence and supply chain dynamics, have also played a significant role. As these factors continue to evolve, market participants will be closely monitoring their impact on Japan’s financial markets, seeking to navigate the opportunities and challenges that lie ahead.

Currency Fluctuations: How Yen Declines Affect Global Markets

The recent decline of the Japanese yen has captured the attention of global markets, as investors and analysts alike seek to understand the implications of this currency fluctuation. The yen’s depreciation, occurring in tandem with a notable rise in Japanese stock prices, has been influenced by a complex interplay of domestic political developments and international economic factors. As Japan navigates its political landscape following recent elections, the impact on its currency and stock market provides a compelling case study of how political events can reverberate through financial markets.

The yen’s decline can be attributed to several factors, with the recent elections playing a pivotal role. Political stability, or the lack thereof, often influences investor confidence, and Japan’s elections have introduced a degree of uncertainty. The ruling party’s ability to maintain or strengthen its position can affect economic policy directions, which in turn impact currency valuations. In this instance, the election results have led to speculation about potential shifts in fiscal and monetary policies, prompting investors to reassess their positions in the yen.

Moreover, the yen’s depreciation has been exacerbated by broader global economic trends. The ongoing divergence in monetary policy between Japan and other major economies, particularly the United States, has contributed to the yen’s weakness. As the U.S. Federal Reserve continues to signal interest rate hikes to combat inflation, the Bank of Japan’s commitment to maintaining ultra-loose monetary policy has widened the interest rate differential. This divergence makes the yen less attractive to investors seeking higher yields, further pressuring its value.

In contrast, Japanese stocks have experienced a surge, buoyed by the yen’s decline and the potential for favorable economic policies post-election. A weaker yen benefits Japanese exporters by making their goods more competitive in international markets, thereby boosting corporate profits. This dynamic has led to increased investor interest in Japanese equities, as companies stand to gain from improved export performance. Additionally, the prospect of political stability and potential economic reforms has injected optimism into the stock market, driving up share prices.

The interplay between the yen’s decline and the rise in Japanese stocks highlights the interconnectedness of currency markets and equity markets. As investors adjust their portfolios in response to currency movements, the effects ripple through various asset classes. The yen’s depreciation not only impacts Japanese companies but also has broader implications for global trade and investment flows. Countries that import goods from Japan may experience changes in trade balances, while multinational corporations with significant operations in Japan must navigate the challenges posed by currency fluctuations.

Furthermore, the yen’s decline has implications for central banks and policymakers worldwide. As one of the world’s major reserve currencies, the yen’s movements can influence global financial stability. Central banks may need to consider the impact of yen fluctuations on their own economies, particularly in terms of inflation and trade competitiveness. Policymakers must also weigh the potential consequences of currency interventions or adjustments to monetary policy in response to the yen’s trajectory.

In conclusion, the decline of the Japanese yen amid rising stock prices underscores the intricate relationship between political events, currency markets, and equity markets. As Japan’s political landscape evolves, the effects on its currency and stock market will continue to be closely monitored by investors and policymakers alike. Understanding these dynamics is crucial for navigating the complexities of global financial markets and anticipating the potential ripple effects on economies worldwide.

Election Outcomes: Driving Forces Behind Japanese Stock Market Gains

The recent decline of the Japanese yen juxtaposed with the ascent of Japanese stocks has captured the attention of investors and analysts alike, prompting a closer examination of the underlying factors driving these market dynamics. Central to this phenomenon is the impact of Japan’s recent election outcomes, which have played a pivotal role in shaping investor sentiment and influencing market behavior. As the political landscape in Japan undergoes significant shifts, the interplay between currency valuation and stock market performance becomes increasingly evident.

In the aftermath of the elections, the ruling party’s consolidation of power has instilled a sense of stability and continuity in economic policy, which has been positively received by the stock market. Investors, reassured by the prospect of sustained economic reforms and fiscal policies, have shown increased confidence in Japanese equities. This optimism is reflected in the upward trajectory of stock indices, as market participants anticipate that the government’s pro-business stance will foster a conducive environment for corporate growth and profitability.

Moreover, the election results have also had a pronounced impact on the yen, which has experienced a decline in value against major currencies. This depreciation can be attributed to several factors, including the anticipation of continued monetary easing by the Bank of Japan. The central bank’s commitment to maintaining an accommodative monetary policy, aimed at stimulating economic growth and combating deflationary pressures, has contributed to the yen’s weakness. Consequently, a weaker yen has bolstered the competitiveness of Japanese exports, providing a further boost to the stock market as export-oriented companies stand to benefit from improved profit margins.

In addition to domestic factors, global economic conditions have also played a role in shaping the current market landscape. The ongoing recovery from the pandemic-induced economic downturn has led to increased demand for Japanese goods and services, further enhancing the appeal of Japanese stocks. As international trade volumes rebound, Japanese companies with strong export portfolios are well-positioned to capitalize on these opportunities, thereby attracting foreign investment and driving stock prices higher.

Furthermore, the interplay between geopolitical developments and market dynamics cannot be overlooked. Japan’s strategic positioning in the Asia-Pacific region, coupled with its robust trade relationships, has heightened its significance in the global economic arena. As geopolitical tensions and trade negotiations continue to evolve, investors are keenly attuned to how these factors may influence Japan’s economic prospects and, by extension, its stock market performance.

While the current market environment presents opportunities, it also poses challenges that warrant careful consideration. The potential for volatility remains, as fluctuations in currency markets and shifts in investor sentiment can impact stock valuations. Additionally, the trajectory of global economic recovery and the pace of policy implementation will be critical determinants of Japan’s economic outlook.

In conclusion, the recent election outcomes have undeniably played a significant role in shaping the trajectory of the Japanese stock market and the valuation of the yen. As investors navigate this complex landscape, the interplay between domestic political developments, monetary policy, and global economic conditions will continue to be key drivers of market behavior. By closely monitoring these factors, market participants can better position themselves to capitalize on emerging opportunities while mitigating potential risks.

Investment Strategies: Navigating Yen Weakness and Stock Strength

The recent decline of the Japanese yen, juxtaposed with the ascent of Japanese stocks, presents a unique landscape for investors seeking to navigate these shifting economic currents. This dynamic scenario is further complicated by the political undertones of the recent election, which has had a significant impact on market sentiment and investment strategies. As the yen weakens, it is crucial for investors to understand the underlying factors driving these changes and to develop strategies that capitalize on the opportunities presented by the strengthening stock market.

To begin with, the depreciation of the yen can be attributed to several macroeconomic factors, including the Bank of Japan’s continued commitment to its ultra-loose monetary policy. This approach, aimed at stimulating economic growth and combating deflation, has resulted in lower interest rates, making the yen less attractive to foreign investors seeking higher returns elsewhere. Additionally, global economic uncertainties and the relative strength of the U.S. dollar have further pressured the yen, leading to its decline.

In contrast, Japanese stocks have experienced a notable upswing, buoyed by a combination of domestic and international factors. The recent election has played a pivotal role in this regard, as the ruling party’s victory has been perceived as a mandate for continued economic reforms and stability. This political continuity has reassured investors, leading to increased confidence in the Japanese market. Moreover, the weaker yen has provided a competitive edge to Japanese exporters, boosting their profitability and, in turn, driving up stock prices.

Given this backdrop, investors are faced with the challenge of formulating strategies that effectively leverage the current economic environment. One potential approach is to focus on export-oriented companies that stand to benefit from the yen’s depreciation. These firms, particularly in sectors such as automotive and electronics, are likely to see enhanced earnings as their products become more competitively priced in international markets. Consequently, investing in these stocks could yield substantial returns as they capitalize on favorable exchange rate dynamics.

Furthermore, diversification remains a key strategy for mitigating risks associated with currency fluctuations. By spreading investments across a range of sectors and asset classes, investors can reduce their exposure to any single economic variable. This approach not only provides a buffer against potential losses but also allows for participation in various growth opportunities within the Japanese market.

In addition to these strategies, it is essential for investors to remain vigilant and informed about ongoing economic and political developments. The interplay between monetary policy, global economic trends, and domestic political shifts can have profound implications for both the yen and Japanese stocks. By staying abreast of these factors, investors can make more informed decisions and adjust their strategies accordingly.

In conclusion, the current environment of yen weakness and stock strength, influenced by the recent election, offers both challenges and opportunities for investors. By understanding the underlying drivers of these trends and employing strategic investment approaches, investors can navigate this complex landscape effectively. As always, a balanced and informed perspective will be crucial in capitalizing on the potential gains while managing the inherent risks associated with currency and market fluctuations.

Economic Policies: The Role of Government in Currency and Stock Movements

The recent fluctuations in the Japanese yen and the concurrent rise in Japanese stock markets have drawn significant attention from economists and investors alike. These movements are intricately linked to the political landscape, particularly in the wake of Japan’s recent elections. Understanding the role of government in influencing currency and stock market dynamics is crucial for comprehending these developments. The yen’s decline can be attributed to several factors, including the government’s monetary policies and market expectations regarding future economic strategies. The Bank of Japan’s commitment to maintaining ultra-loose monetary policies, such as negative interest rates and extensive asset purchases, has played a pivotal role in weakening the yen. These measures are designed to stimulate economic growth by encouraging borrowing and spending, yet they also tend to reduce the currency’s value in the foreign exchange market. Consequently, as the yen depreciates, Japanese exports become more competitive globally, potentially boosting corporate profits and, by extension, stock prices.

Simultaneously, the recent elections have introduced a degree of political stability, which is often viewed favorably by investors. The ruling party’s victory is perceived as a mandate to continue with its economic agenda, which includes structural reforms and fiscal stimulus measures. This political continuity reassures investors, leading to increased confidence in the market. As a result, Japanese stocks have experienced an upward trajectory, reflecting optimism about the country’s economic prospects. Moreover, the government’s role extends beyond monetary policy to include fiscal measures that can impact both currency and stock markets. For instance, government spending on infrastructure projects can stimulate economic activity, potentially leading to higher corporate earnings and stock market gains. Additionally, tax policies and regulatory changes can influence investor sentiment and market performance. In this context, the government’s ability to implement effective economic policies is crucial for maintaining market stability and fostering growth.

Furthermore, the interplay between currency movements and stock market performance is complex and multifaceted. A weaker yen can enhance the competitiveness of Japanese exports, benefiting companies with significant overseas sales. This, in turn, can lead to higher stock prices for export-oriented firms. However, it is essential to consider the potential downsides of a depreciating currency, such as increased import costs and inflationary pressures, which could offset some of the benefits. In light of these dynamics, the government’s role in managing economic policies becomes even more critical. Policymakers must strike a delicate balance between supporting growth and maintaining financial stability. This involves carefully calibrating monetary and fiscal measures to address both domestic and international challenges. As global economic conditions evolve, the Japanese government will need to remain vigilant and responsive to ensure that its policies continue to support a stable and prosperous economic environment.

In conclusion, the recent decline in the yen and the rise in Japanese stocks underscore the significant influence of government policies on currency and stock market movements. The interplay between political stability, monetary policy, and fiscal measures highlights the complexity of managing an economy in a globalized world. As Japan navigates these challenges, the government’s ability to implement effective and balanced economic policies will be crucial in shaping the country’s financial landscape. Investors and economists will undoubtedly continue to monitor these developments closely, as they hold important implications for both domestic and international markets.

Future Projections: Yen and Japanese Stocks in a Post-Election Landscape

In the wake of Japan’s recent elections, the financial landscape has experienced notable shifts, particularly in the currency and stock markets. The yen has seen a decline, while Japanese stocks have climbed, reflecting investor sentiment and market expectations. This dynamic interplay between currency depreciation and stock market appreciation offers a complex picture of Japan’s economic future. As we delve into future projections, it is essential to consider the underlying factors driving these movements and their potential implications.

The yen’s decline can be attributed to several factors, including the election results, which have reinforced the current government’s mandate. This continuity in leadership suggests a sustained commitment to existing economic policies, including monetary easing. The Bank of Japan’s accommodative stance, characterized by low interest rates and asset purchases, has historically exerted downward pressure on the yen. Consequently, investors anticipate that these policies will persist, further weakening the currency. Moreover, the global economic environment, marked by rising interest rates in other major economies, has exacerbated the yen’s depreciation as investors seek higher returns elsewhere.

Conversely, Japanese stocks have experienced an upward trajectory, buoyed by the election’s outcome and the anticipated stability in economic policy. The government’s focus on structural reforms and fiscal stimulus is expected to bolster corporate earnings and economic growth. Additionally, the weaker yen enhances the competitiveness of Japanese exports, benefiting companies with significant overseas operations. This positive outlook has attracted both domestic and international investors, driving stock prices higher.

Looking ahead, the interplay between the yen and Japanese stocks will likely continue to evolve, influenced by both domestic and international factors. On the domestic front, the government’s ability to implement its economic agenda will be crucial. Successful execution of structural reforms, such as labor market adjustments and deregulation, could enhance productivity and long-term growth prospects. However, any delays or setbacks in these initiatives may dampen investor confidence and impact market performance.

Internationally, the trajectory of global interest rates and economic conditions will play a significant role. Should major economies continue to tighten monetary policy, the yen may face further depreciation pressures. This scenario could support Japanese stocks in the short term, as export-oriented companies benefit from a competitive currency. However, prolonged yen weakness may raise concerns about inflation and purchasing power, potentially affecting consumer sentiment and domestic demand.

In conclusion, the post-election landscape presents a nuanced picture for the yen and Japanese stocks. While the yen’s decline and stock market gains reflect current market sentiment, future projections hinge on a myriad of factors. The government’s ability to implement its economic policies, coupled with global economic trends, will shape the trajectory of these financial indicators. Investors and policymakers alike must navigate this complex environment, balancing short-term opportunities with long-term challenges. As Japan moves forward, the interplay between currency and stock markets will remain a focal point, offering insights into the broader economic landscape.

Q&A

1. **Question:** What factors contributed to the decline of the Japanese yen?

– **Answer:** The decline of the Japanese yen can be attributed to factors such as monetary policy divergence between Japan and other major economies, Japan’s continued low interest rates, and external economic pressures like global trade dynamics.

2. **Question:** How did the recent elections in Japan impact the stock market?

– **Answer:** The recent elections in Japan led to increased investor confidence, as the ruling party’s victory was seen as a sign of political stability and continuity in economic policies, which positively impacted Japanese stocks.

3. **Question:** Which sectors in the Japanese stock market benefited the most from the yen’s decline?

– **Answer:** Export-oriented sectors, such as automotive and electronics, benefited the most from the yen’s decline as a weaker yen makes Japanese goods more competitive abroad.

4. **Question:** What role did the Bank of Japan’s monetary policy play in the yen’s decline?

– **Answer:** The Bank of Japan’s commitment to maintaining ultra-loose monetary policy, including negative interest rates and asset purchases, contributed to the yen’s decline by widening the interest rate differential with other countries.

5. **Question:** How does a weaker yen affect Japan’s trade balance?

– **Answer:** A weaker yen generally improves Japan’s trade balance by making exports cheaper and more attractive to foreign buyers, potentially increasing export volumes.

6. **Question:** What are the potential risks associated with a declining yen for the Japanese economy?

– **Answer:** Potential risks include increased import costs leading to inflationary pressures, reduced purchasing power for Japanese consumers, and potential capital outflows as investors seek higher returns elsewhere.

7. **Question:** How might future political developments in Japan influence the yen and stock market?

– **Answer:** Future political developments, such as changes in government leadership or policy shifts, could influence investor sentiment and economic expectations, potentially impacting both the yen’s value and stock market performance.

Conclusion

The decline of the yen, coupled with the rise in Japanese stocks, can be attributed to the political and economic implications of recent election outcomes. A weaker yen typically benefits Japanese exporters by making their goods more competitive abroad, which can lead to increased corporate profits and, consequently, a boost in stock prices. The election results may have reinforced investor confidence in the government’s economic policies, potentially leading to expectations of continued fiscal stimulus or structural reforms. This combination of a favorable exchange rate environment and political stability likely contributed to the positive performance of Japanese equities. Overall, the interplay between currency depreciation and stock market gains highlights the complex dynamics of investor sentiment and economic policy in the wake of electoral developments.