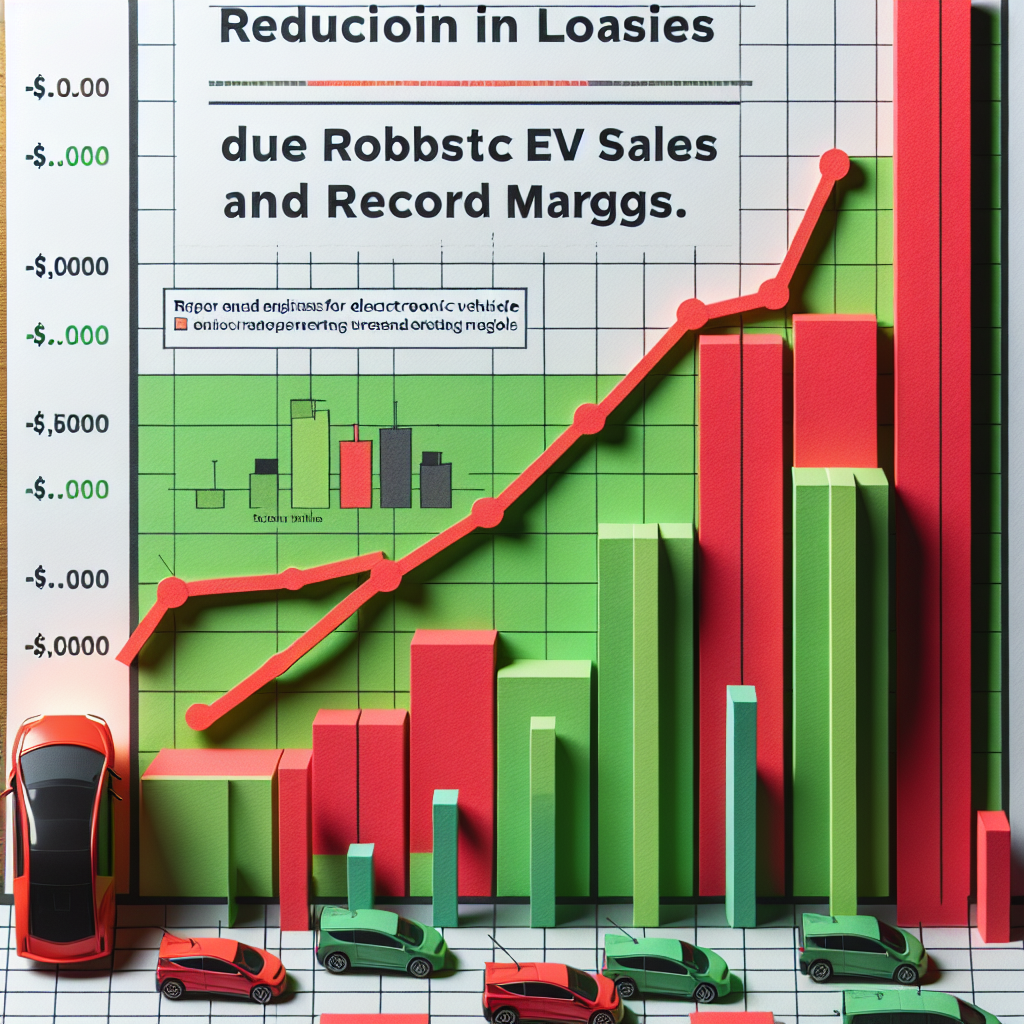

“XPeng Powers Ahead: Cutting Losses with Record-Breaking EV Sales and Margins”

Introduction

XPeng, a leading Chinese electric vehicle (EV) manufacturer, has reported a significant reduction in its financial losses, driven by strong sales performance and record-breaking profit margins. The company’s latest financial results highlight a robust increase in EV deliveries, underscoring its growing market presence and consumer demand for its innovative vehicle lineup. This positive financial trajectory is further bolstered by XPeng’s strategic focus on operational efficiency and cost management, enabling the company to achieve unprecedented margins. As XPeng continues to expand its footprint in the competitive EV market, these developments mark a pivotal step in its journey towards sustainable profitability and long-term growth.

XPeng’s Strategic Moves: How Robust EV Sales Are Reducing Losses

XPeng, a prominent player in the electric vehicle (EV) market, has recently reported a significant reduction in its financial losses, driven by robust sales and record margins. This development marks a pivotal moment for the company, which has been striving to establish itself as a leader in the competitive EV industry. The strategic moves undertaken by XPeng have not only bolstered its financial standing but also positioned it favorably in the rapidly evolving automotive landscape.

One of the key factors contributing to XPeng’s improved financial performance is its impressive sales growth. The company has experienced a surge in demand for its electric vehicles, which can be attributed to several factors. Firstly, XPeng has successfully expanded its product lineup, offering a range of models that cater to diverse consumer preferences. This strategic diversification has enabled the company to capture a broader market share, appealing to both budget-conscious buyers and those seeking premium features. Furthermore, XPeng’s commitment to innovation and technology has resonated with consumers, who are increasingly prioritizing advanced features and sustainable mobility solutions.

In addition to expanding its product offerings, XPeng has also focused on enhancing its production capabilities. By investing in state-of-the-art manufacturing facilities and streamlining its production processes, the company has been able to increase its output and meet the growing demand for its vehicles. This operational efficiency has not only contributed to higher sales volumes but has also allowed XPeng to achieve record margins. The ability to produce vehicles at a lower cost while maintaining high quality has been instrumental in reducing the company’s overall losses.

Moreover, XPeng’s strategic partnerships and collaborations have played a crucial role in its recent success. By forging alliances with key industry players, the company has been able to leverage synergies and access new markets. These partnerships have facilitated the sharing of technology and expertise, enabling XPeng to enhance its product offerings and improve its competitive edge. Additionally, collaborations with suppliers have ensured a steady supply of critical components, mitigating potential disruptions in the production process.

Another significant aspect of XPeng’s strategy is its focus on expanding its presence in international markets. Recognizing the immense potential of the global EV market, the company has made concerted efforts to establish a foothold in key regions. By tailoring its products to meet the specific needs and preferences of international consumers, XPeng has been able to penetrate new markets and drive sales growth. This international expansion has not only diversified the company’s revenue streams but has also reduced its reliance on the domestic market, thereby mitigating risks associated with market fluctuations.

Furthermore, XPeng’s commitment to sustainability and environmental responsibility has resonated with consumers and investors alike. The company’s emphasis on producing eco-friendly vehicles aligns with the growing global demand for sustainable transportation solutions. By prioritizing sustainability, XPeng has not only enhanced its brand image but has also attracted environmentally conscious consumers who are willing to invest in green technologies.

In conclusion, XPeng’s strategic moves have been instrumental in reducing its financial losses and positioning the company for future success. Through robust sales growth, operational efficiency, strategic partnerships, international expansion, and a commitment to sustainability, XPeng has demonstrated its ability to navigate the challenges of the EV market. As the company continues to innovate and adapt to changing market dynamics, it is well-positioned to capitalize on the growing demand for electric vehicles and solidify its position as a leader in the industry.

Record Margins: The Financial Turnaround of XPeng

XPeng, a prominent player in the electric vehicle (EV) industry, has recently reported a significant reduction in its financial losses, driven by robust sales and record margins. This development marks a pivotal moment in the company’s journey towards profitability and underscores the growing demand for electric vehicles globally. As the EV market continues to expand, XPeng’s strategic initiatives and operational efficiencies have played a crucial role in enhancing its financial performance.

The company’s latest financial results reveal a marked improvement in its bottom line, attributed to a combination of increased vehicle deliveries and cost management strategies. XPeng’s ability to scale its production while maintaining quality has been instrumental in achieving these results. The company has successfully navigated the challenges posed by supply chain disruptions and rising material costs, which have affected the broader automotive industry. By optimizing its supply chain and leveraging economies of scale, XPeng has managed to keep production costs in check, thereby improving its profit margins.

Moreover, XPeng’s focus on innovation and technology has set it apart from its competitors. The company’s commitment to research and development has resulted in the introduction of cutting-edge features in its vehicles, enhancing their appeal to consumers. This emphasis on technological advancement has not only bolstered sales but also strengthened XPeng’s brand reputation as a leader in the EV sector. As a result, the company has been able to command higher prices for its vehicles, further contributing to its improved financial performance.

In addition to its domestic success, XPeng has made significant strides in expanding its presence in international markets. The company’s strategic entry into Europe and other regions has opened new avenues for growth, allowing it to tap into a broader customer base. This international expansion has been supported by a robust distribution network and strategic partnerships, which have facilitated the seamless introduction of XPeng’s vehicles to new markets. Consequently, the company’s global sales have seen a substantial uptick, reinforcing its position as a formidable player in the EV industry.

Furthermore, XPeng’s financial turnaround can be attributed to its prudent financial management and strategic investments. The company has been judicious in allocating resources towards high-impact areas, such as battery technology and autonomous driving capabilities. These investments have not only enhanced the performance and efficiency of XPeng’s vehicles but have also positioned the company at the forefront of the next wave of automotive innovation. By prioritizing long-term growth over short-term gains, XPeng has laid a solid foundation for sustained financial success.

As XPeng continues to build on its recent achievements, the company remains focused on its mission to accelerate the transition to sustainable transportation. The positive financial results serve as a testament to XPeng’s resilience and adaptability in a rapidly evolving industry. Looking ahead, the company is well-positioned to capitalize on the growing demand for electric vehicles, driven by increasing environmental awareness and supportive government policies worldwide.

In conclusion, XPeng’s reduction in losses and record margins highlight the effectiveness of its strategic initiatives and operational efficiencies. The company’s ability to deliver strong financial results amidst challenging market conditions underscores its potential for continued growth and success in the electric vehicle industry. As XPeng continues to innovate and expand its global footprint, it is poised to play a pivotal role in shaping the future of sustainable transportation.

XPeng’s Path to Profitability: Analyzing the Impact of Strong EV Sales

XPeng, a prominent player in the electric vehicle (EV) market, has recently made significant strides towards profitability, driven by robust sales and record margins. This development marks a pivotal moment for the company, which has been striving to establish itself as a leader in the competitive EV industry. The reduction in losses is a testament to XPeng’s strategic initiatives and operational efficiencies, which have collectively contributed to its improved financial performance.

To begin with, XPeng’s strong EV sales have been a crucial factor in its journey towards profitability. The company has experienced a surge in demand for its innovative and technologically advanced vehicles, which has translated into increased revenue. This growth in sales can be attributed to several factors, including the rising consumer preference for environmentally friendly transportation options and XPeng’s ability to deliver high-quality products that meet these expectations. Furthermore, the company’s strategic expansion into international markets has broadened its customer base, thereby enhancing its revenue streams.

In addition to robust sales, XPeng has achieved record margins, which have played a significant role in reducing its losses. The company has implemented various cost-control measures and operational efficiencies that have contributed to this achievement. For instance, XPeng has optimized its supply chain management, resulting in reduced production costs and improved profit margins. Moreover, the company’s focus on research and development has led to technological advancements that have enhanced the efficiency of its manufacturing processes. These efforts have collectively enabled XPeng to achieve economies of scale, further bolstering its financial performance.

Another critical aspect of XPeng’s path to profitability is its strategic partnerships and collaborations. By aligning with key industry players, XPeng has been able to leverage shared resources and expertise, which has facilitated its growth and development. These partnerships have not only provided XPeng with access to cutting-edge technology but have also enabled the company to expand its market reach. As a result, XPeng has been able to strengthen its competitive position in the EV market, thereby driving its sales and profitability.

Moreover, XPeng’s commitment to innovation has been instrumental in its success. The company has consistently invested in research and development to enhance its product offerings and stay ahead of industry trends. This focus on innovation has allowed XPeng to introduce new features and technologies that have resonated with consumers, thereby boosting its sales. Additionally, XPeng’s emphasis on sustainability and environmental responsibility has further enhanced its brand image, attracting environmentally conscious consumers and investors alike.

In conclusion, XPeng’s reduction in losses and progress towards profitability can be attributed to a combination of robust EV sales, record margins, strategic partnerships, and a commitment to innovation. These factors have collectively strengthened XPeng’s position in the competitive EV market and set the stage for continued growth and success. As the company continues to execute its strategic initiatives and capitalize on emerging opportunities, it is well-positioned to achieve its long-term financial goals and solidify its status as a leader in the electric vehicle industry.

The Role of Innovation in XPeng’s Improved Financial Performance

XPeng, a prominent player in the electric vehicle (EV) market, has recently reported a significant reduction in its financial losses, driven by robust sales and record margins. This improvement in financial performance can be largely attributed to the company’s commitment to innovation, which has played a pivotal role in enhancing its competitive edge. By focusing on technological advancements and strategic initiatives, XPeng has managed to navigate the challenges of the rapidly evolving EV industry, positioning itself as a formidable contender in the global market.

One of the key factors contributing to XPeng’s improved financial performance is its relentless pursuit of innovation in vehicle design and technology. The company has invested heavily in research and development, resulting in the creation of cutting-edge EV models that appeal to a broad range of consumers. These vehicles are equipped with advanced features such as autonomous driving capabilities, smart connectivity, and energy-efficient powertrains, which not only enhance the driving experience but also align with the growing consumer demand for sustainable and intelligent transportation solutions.

Moreover, XPeng’s focus on innovation extends beyond the vehicles themselves. The company has also made significant strides in optimizing its manufacturing processes, thereby achieving greater operational efficiency and cost-effectiveness. By leveraging state-of-the-art production techniques and automation, XPeng has been able to reduce production costs while maintaining high-quality standards. This has enabled the company to offer competitively priced vehicles, thereby attracting a larger customer base and boosting sales volumes.

In addition to technological advancements, XPeng’s strategic partnerships have played a crucial role in its financial turnaround. Collaborations with leading technology firms and suppliers have facilitated the integration of cutting-edge technologies into XPeng’s vehicles, further enhancing their appeal. These partnerships have also enabled XPeng to access new markets and distribution channels, thereby expanding its global footprint and increasing its revenue streams.

Furthermore, XPeng’s commitment to innovation is evident in its approach to customer engagement and service. The company has implemented a comprehensive digital ecosystem that enhances the customer experience through seamless connectivity and personalized services. This ecosystem includes a user-friendly mobile app that allows customers to remotely monitor and control their vehicles, access real-time updates, and receive tailored recommendations. By prioritizing customer satisfaction and loyalty, XPeng has been able to foster a strong brand reputation, which has translated into increased sales and market share.

As XPeng continues to innovate and adapt to the evolving demands of the EV market, it is well-positioned to sustain its financial momentum. The company’s focus on developing next-generation technologies, such as solid-state batteries and advanced driver-assistance systems, underscores its commitment to staying at the forefront of the industry. These innovations not only promise to enhance vehicle performance and safety but also have the potential to revolutionize the EV landscape, further solidifying XPeng’s position as a leader in the sector.

In conclusion, XPeng’s improved financial performance can be largely attributed to its unwavering commitment to innovation. By investing in cutting-edge technologies, optimizing manufacturing processes, and fostering strategic partnerships, the company has successfully reduced its losses and achieved record margins. As XPeng continues to push the boundaries of innovation, it is poised to capitalize on the growing demand for electric vehicles and maintain its trajectory of financial success.

XPeng’s Market Strategy: Achieving Record Margins in the EV Sector

XPeng, a prominent player in the electric vehicle (EV) sector, has recently made significant strides in reducing its financial losses, driven by robust sales and record margins. This achievement underscores the effectiveness of XPeng’s market strategy, which has been meticulously crafted to navigate the competitive landscape of the EV industry. As the company continues to expand its footprint, it is essential to examine the key elements that have contributed to its recent success.

One of the primary factors behind XPeng’s improved financial performance is its strategic focus on innovation and technology. By investing heavily in research and development, XPeng has been able to introduce cutting-edge features in its vehicles, which have resonated well with consumers. This commitment to innovation has not only enhanced the appeal of XPeng’s product lineup but has also allowed the company to differentiate itself from competitors. As a result, XPeng has seen a surge in demand for its vehicles, which has been instrumental in driving sales growth.

In addition to technological advancements, XPeng’s market strategy has also emphasized the importance of operational efficiency. By streamlining its manufacturing processes and optimizing its supply chain, XPeng has been able to achieve significant cost savings. These efforts have translated into improved profit margins, which have reached record levels for the company. This focus on efficiency has been particularly crucial in an industry where cost management is a key determinant of success.

Furthermore, XPeng’s strategic expansion into international markets has played a vital role in its recent achievements. By entering new markets, XPeng has been able to tap into a broader customer base, thereby increasing its sales volume. This international expansion has not only diversified XPeng’s revenue streams but has also mitigated risks associated with market fluctuations in its home country. As XPeng continues to establish its presence in global markets, it is well-positioned to capitalize on the growing demand for electric vehicles worldwide.

Another critical aspect of XPeng’s market strategy is its focus on customer experience. By prioritizing customer satisfaction, XPeng has been able to build a loyal customer base, which has contributed to repeat sales and positive word-of-mouth referrals. This customer-centric approach has been supported by XPeng’s investment in after-sales services and its commitment to providing a seamless ownership experience. As a result, XPeng has been able to foster strong brand loyalty, which is a valuable asset in the competitive EV market.

Moreover, XPeng’s strategic partnerships have also been instrumental in its success. By collaborating with key industry players, XPeng has been able to leverage synergies and access new technologies, which have further strengthened its market position. These partnerships have enabled XPeng to enhance its product offerings and expand its reach, thereby contributing to its overall growth.

In conclusion, XPeng’s ability to reduce losses and achieve record margins can be attributed to its comprehensive market strategy, which encompasses innovation, operational efficiency, international expansion, customer experience, and strategic partnerships. As the company continues to execute its strategy, it is poised to maintain its upward trajectory in the EV sector. With a strong foundation in place, XPeng is well-equipped to navigate the challenges and opportunities that lie ahead, ensuring its continued success in the rapidly evolving electric vehicle market.

How XPeng’s Sales Growth is Driving Financial Stability

XPeng, a prominent player in the electric vehicle (EV) market, has recently reported a significant reduction in its financial losses, driven by robust sales growth and record margins. This development marks a pivotal moment for the company, as it continues to solidify its position in the competitive EV landscape. The impressive sales figures and improved financial metrics underscore XPeng’s strategic initiatives and operational efficiencies, which have collectively contributed to its enhanced financial stability.

To begin with, XPeng’s sales growth has been nothing short of remarkable. The company has successfully capitalized on the increasing global demand for electric vehicles, leveraging its innovative product lineup and advanced technology to attract a growing customer base. The introduction of new models, coupled with strategic marketing efforts, has enabled XPeng to capture a significant share of the market. This surge in sales has not only bolstered the company’s revenue streams but also provided a solid foundation for future growth.

Moreover, XPeng’s focus on operational efficiency has played a crucial role in reducing its financial losses. By optimizing its production processes and supply chain management, the company has managed to lower its cost structure, thereby improving its profit margins. This emphasis on efficiency has allowed XPeng to achieve record margins, a testament to its ability to balance growth with financial prudence. As a result, the company is better positioned to navigate the challenges of the EV industry while maintaining a competitive edge.

In addition to operational efficiencies, XPeng’s strategic partnerships have been instrumental in driving its financial stability. Collaborations with key industry players have facilitated access to cutting-edge technology and resources, enabling XPeng to enhance its product offerings and expand its market reach. These partnerships have not only strengthened XPeng’s competitive position but also contributed to its financial resilience by diversifying its revenue streams and mitigating risks associated with market fluctuations.

Furthermore, XPeng’s commitment to innovation has been a driving force behind its sales growth and financial success. The company’s investment in research and development has resulted in the creation of state-of-the-art vehicles that appeal to a wide range of consumers. By prioritizing technological advancements and customer-centric design, XPeng has differentiated itself from competitors, thereby attracting a loyal customer base and driving repeat sales. This focus on innovation has not only fueled XPeng’s sales growth but also reinforced its reputation as a leader in the EV industry.

As XPeng continues to build on its recent successes, the company remains focused on sustaining its financial stability through strategic initiatives and prudent financial management. By maintaining a strong emphasis on sales growth, operational efficiency, and innovation, XPeng is well-positioned to capitalize on the burgeoning demand for electric vehicles and achieve long-term profitability. The company’s ability to adapt to changing market dynamics and leverage its strengths will be critical in ensuring its continued success in the evolving EV landscape.

In conclusion, XPeng’s reduction in financial losses, driven by robust sales growth and record margins, highlights the company’s strategic acumen and operational excellence. As it continues to navigate the challenges and opportunities of the EV market, XPeng’s commitment to innovation, efficiency, and strategic partnerships will be key to sustaining its financial stability and achieving long-term success. This promising trajectory not only bodes well for XPeng’s future but also underscores the transformative potential of the electric vehicle industry as a whole.

The Future of XPeng: Sustaining Growth and Profitability in the EV Market

XPeng, a prominent player in the electric vehicle (EV) market, has recently made significant strides in reducing its financial losses, driven by robust sales and record margins. This development marks a pivotal moment for the company as it navigates the competitive landscape of the EV industry. As XPeng continues to expand its market presence, understanding the factors contributing to its improved financial performance is crucial for assessing its future growth and profitability.

One of the primary drivers behind XPeng’s reduced losses is its impressive sales performance. The company has seen a substantial increase in the demand for its vehicles, particularly in its home market of China, which remains the largest EV market globally. This surge in sales can be attributed to several factors, including the growing consumer preference for environmentally friendly transportation options and the Chinese government’s supportive policies for the EV sector. Moreover, XPeng’s strategic focus on innovation and technology has enabled it to offer vehicles that appeal to tech-savvy consumers, further boosting its sales figures.

In addition to strong sales, XPeng has achieved record margins, which have played a crucial role in narrowing its financial losses. The company’s ability to enhance its profit margins can be linked to its efficient production processes and cost management strategies. By optimizing its supply chain and leveraging economies of scale, XPeng has managed to reduce production costs, thereby improving its overall profitability. Furthermore, the company’s investment in research and development has led to technological advancements that not only enhance vehicle performance but also contribute to cost savings.

As XPeng looks to sustain its growth trajectory, it faces several challenges that could impact its long-term profitability. The EV market is becoming increasingly competitive, with both established automakers and new entrants vying for market share. To maintain its competitive edge, XPeng must continue to innovate and differentiate its products from those of its competitors. This requires ongoing investment in research and development, as well as a keen understanding of consumer preferences and market trends.

Another critical factor for XPeng’s future success is its ability to expand its presence in international markets. While the company has made inroads into markets such as Europe, further expansion will be essential for diversifying its revenue streams and reducing its reliance on the Chinese market. However, entering new markets presents its own set of challenges, including navigating regulatory environments, establishing distribution networks, and building brand recognition. XPeng’s ability to effectively address these challenges will be instrumental in sustaining its growth and profitability.

Moreover, XPeng must also focus on building a robust charging infrastructure to support the widespread adoption of its vehicles. As range anxiety remains a significant concern for potential EV buyers, ensuring convenient access to charging stations is vital for increasing consumer confidence and driving sales. Collaborating with governments and other stakeholders to develop a comprehensive charging network will be crucial for XPeng’s long-term success.

In conclusion, XPeng’s recent achievements in reducing losses through strong sales and record margins highlight its potential for sustained growth in the EV market. However, the company must navigate a complex landscape of challenges, including intense competition, international expansion, and infrastructure development, to ensure its continued profitability. By leveraging its strengths in innovation and technology, XPeng is well-positioned to capitalize on the growing demand for electric vehicles and secure its place as a leader in the industry.

Q&A

1. **What is XPeng?**

XPeng is a Chinese electric vehicle (EV) manufacturer known for producing smart, innovative electric cars.

2. **How did XPeng reduce its losses?**

XPeng reduced its losses through increased sales of its electric vehicles and achieving record profit margins.

3. **What contributed to XPeng’s robust EV sales?**

Factors contributing to XPeng’s robust EV sales include strong demand for their new models, effective marketing strategies, and expansion into new markets.

4. **What are record margins in the context of XPeng?**

Record margins refer to the highest profit margins XPeng has achieved, indicating improved efficiency and cost management in their operations.

5. **What impact did the robust EV sales have on XPeng’s financial performance?**

The robust EV sales positively impacted XPeng’s financial performance by increasing revenue and reducing overall financial losses.

6. **What strategies did XPeng employ to achieve record margins?**

XPeng employed strategies such as optimizing production processes, reducing costs, and enhancing supply chain efficiency to achieve record margins.

7. **What is the significance of XPeng’s financial improvement for the EV industry?**

XPeng’s financial improvement signifies growing consumer acceptance of EVs, increased competition in the market, and the potential for further innovation and investment in the EV industry.

Conclusion

XPeng’s recent financial performance highlights a significant improvement, driven by strong electric vehicle (EV) sales and record profit margins. The company’s strategic focus on expanding its product lineup and enhancing operational efficiency has contributed to a reduction in losses. By capitalizing on growing consumer demand for EVs and optimizing production processes, XPeng has managed to achieve better cost management and increased revenue. This positive trend not only underscores XPeng’s competitive position in the EV market but also sets a promising foundation for future growth and profitability.