-

Table of Contents

- Introduction

- Understanding 3DS: A Comprehensive Guide for Card Issuers

- The Evolution of 3DS: What Card Issuers Should Expect

- Benefits of 3DS for Card Issuers and Their Customers

- Implementing 3DS: Key Considerations for Card Issuers

- 3DS and Fraud Prevention: How Card Issuers Can Stay Ahead

- Enhancing Customer Experience with 3DS: Tips for Card Issuers

- Regulatory Compliance and 3DS: What Card Issuers Need to Know

- The Role of 3DS in Secure Online Transactions for Card Issuers

- Common Challenges Card Issuers Face with 3DS Implementation

- Future Trends in 3DS: Insights for Card Issuers

- Q&A

- Conclusion

“Empower Secure Transactions: Unlock the Potential of 3DS for Card Issuers.”

Introduction

3D Secure (3DS) is a critical protocol for card issuers aiming to enhance the security of online transactions and reduce fraud. As e-commerce continues to grow, the need for robust authentication mechanisms becomes increasingly important. 3DS provides an additional layer of verification by requiring cardholders to complete an extra step of authentication during the checkout process, typically through a password, SMS code, or biometric verification. This not only helps in verifying the identity of the cardholder but also shifts the liability for fraudulent transactions away from merchants and onto the card issuer, provided the authentication is successful. Card issuers must understand the intricacies of implementing 3DS, including its impact on user experience, the balance between security and convenience, and the integration with existing payment systems. Additionally, with the advent of 3DS 2.0, issuers need to be aware of the improvements over the original protocol, such as better mobile support and a more seamless user experience, which can lead to higher transaction approval rates and reduced cart abandonment. Understanding these aspects is crucial for card issuers to effectively leverage 3DS in safeguarding transactions and maintaining customer trust.

Understanding 3DS: A Comprehensive Guide for Card Issuers

In the rapidly evolving landscape of digital payments, card issuers are continually seeking ways to enhance security while maintaining a seamless user experience. One of the pivotal technologies in this domain is 3D Secure (3DS), a protocol designed to provide an additional layer of authentication for online card transactions. Understanding the intricacies of 3DS is crucial for card issuers aiming to balance security and convenience for their customers.

3DS, originally developed by Visa and now adopted by other major card networks, functions by redirecting cardholders to an authentication page during the checkout process. This page typically requires the cardholder to enter a password or a one-time code sent to their mobile device, thereby verifying their identity. The primary objective of 3DS is to reduce fraud and chargebacks by ensuring that the person making the transaction is indeed the cardholder. However, the implementation of 3DS is not without its challenges, and card issuers must navigate these carefully to optimize both security and user experience.

One of the key considerations for card issuers is the version of 3DS they choose to implement. The original version, 3DS 1.0, has been criticized for its cumbersome user experience, often leading to cart abandonment. In response, 3DS 2.0 was introduced, offering a more streamlined and user-friendly process. This newer version supports biometric authentication and leverages risk-based analysis to determine the necessity of additional authentication steps. By adopting 3DS 2.0, card issuers can significantly enhance the user experience, reducing friction and improving conversion rates.

Moreover, the regulatory landscape surrounding 3DS is another critical factor for card issuers to consider. In regions such as the European Union, regulations like the Revised Payment Services Directive (PSD2) mandate strong customer authentication (SCA) for online transactions, making 3DS an essential component of compliance strategies. Card issuers must ensure that their 3DS implementation aligns with these regulatory requirements to avoid penalties and maintain customer trust.

In addition to regulatory compliance, card issuers must also focus on the technological integration of 3DS with their existing systems. This involves collaborating with merchants and payment gateways to ensure a seamless transaction flow. Effective integration can minimize transaction declines and enhance the overall payment experience for cardholders. Furthermore, card issuers should invest in educating their customers about the benefits and processes of 3DS. Clear communication can alleviate concerns about security and privacy, fostering greater acceptance and usage of the protocol.

As the digital payment ecosystem continues to evolve, card issuers must remain vigilant and proactive in their approach to 3DS. This involves staying abreast of technological advancements and emerging threats in the cybersecurity landscape. By continuously refining their 3DS strategies, card issuers can not only mitigate fraud but also build stronger relationships with their customers through enhanced security and convenience.

In conclusion, 3DS represents a critical tool for card issuers in the fight against online fraud. By understanding its nuances and implementing it effectively, card issuers can achieve a delicate balance between security and user experience. As they navigate the complexities of 3DS, card issuers must remain adaptable, ensuring that their strategies evolve in tandem with technological advancements and regulatory changes. Through diligent efforts, they can safeguard their customers’ transactions while fostering trust and loyalty in an increasingly digital world.

The Evolution of 3DS: What Card Issuers Should Expect

The evolution of 3D Secure (3DS) technology has been a significant development in the realm of online payment security, and card issuers must stay informed about its advancements to effectively protect their customers and reduce fraud. Initially introduced by Visa in 1999, 3DS was designed to add an additional layer of security for online credit and debit card transactions. Over the years, this protocol has undergone several iterations, each aimed at enhancing user experience and bolstering security measures. As card issuers navigate this evolving landscape, understanding the nuances of 3DS and its implications is crucial.

The original version of 3DS, often referred to as 3DS1, was a groundbreaking step in online transaction security. However, it was not without its challenges. The protocol required cardholders to complete an additional authentication step, typically by entering a password or a code sent via SMS. While this added security, it also introduced friction into the checkout process, leading to higher cart abandonment rates. Recognizing these limitations, the payments industry sought to refine the protocol, resulting in the development of 3DS2.

3DS2, or EMV 3-D Secure, represents a significant leap forward in addressing the shortcomings of its predecessor. One of the most notable improvements is its focus on a seamless user experience. By leveraging risk-based authentication, 3DS2 allows for frictionless transactions for low-risk purchases, thereby reducing the likelihood of cart abandonment. This is achieved through the collection of over 100 data points during the transaction process, enabling issuers to make more informed decisions about the legitimacy of a transaction without requiring additional input from the cardholder.

Moreover, 3DS2 is designed to be mobile-friendly, addressing the growing trend of consumers making purchases via smartphones and tablets. The protocol supports biometric authentication methods, such as fingerprint and facial recognition, which are not only more secure but also more convenient for users. This adaptability to mobile platforms is essential for card issuers, as it aligns with the increasing consumer demand for mobile commerce solutions.

As card issuers prepare for the widespread adoption of 3DS2, it is important to consider the regulatory landscape. In regions such as the European Union, the Revised Payment Services Directive (PSD2) mandates strong customer authentication (SCA) for online transactions, making 3DS2 compliance not just a competitive advantage but a legal requirement. Card issuers must ensure that their systems are equipped to handle these regulatory demands while maintaining a focus on user experience and security.

Furthermore, collaboration between card issuers, merchants, and payment service providers is essential to the successful implementation of 3DS2. By working together, these stakeholders can ensure that the protocol is effectively integrated into existing systems, minimizing disruptions and maximizing the benefits of enhanced security and user experience.

In conclusion, the evolution of 3DS technology presents both challenges and opportunities for card issuers. By staying informed about the latest developments and understanding the implications of 3DS2, issuers can better protect their customers, reduce fraud, and enhance the overall payment experience. As the digital payments landscape continues to evolve, embracing these advancements will be key to maintaining a competitive edge and ensuring the security and satisfaction of cardholders.

Benefits of 3DS for Card Issuers and Their Customers

The implementation of 3D Secure (3DS) technology has become increasingly significant for card issuers seeking to enhance security and improve customer satisfaction. As the digital landscape evolves, the need for robust security measures in online transactions has never been more critical. 3DS, a protocol designed to be an additional security layer for online credit and debit card transactions, offers numerous benefits for both card issuers and their customers. Understanding these advantages is essential for card issuers aiming to stay competitive and foster trust among their clientele.

One of the primary benefits of 3DS for card issuers is the reduction in fraudulent transactions. By requiring cardholders to authenticate their identity through a password or a one-time code sent to their mobile device, 3DS adds an extra layer of security that significantly decreases the likelihood of unauthorized transactions. This reduction in fraud not only protects the cardholder but also minimizes the financial losses and reputational damage that card issuers might incur from fraudulent activities. Consequently, card issuers can allocate fewer resources to fraud management and focus more on enhancing their services.

Moreover, 3DS can lead to increased customer confidence in online shopping. As consumers become more aware of the risks associated with online transactions, they are more likely to engage with platforms that offer enhanced security measures. By implementing 3DS, card issuers can reassure their customers that their transactions are secure, thereby encouraging more frequent use of their cards for online purchases. This increase in transaction volume can translate into higher revenue for card issuers, as they benefit from transaction fees and interest charges.

In addition to boosting security and customer confidence, 3DS also facilitates compliance with regulatory requirements. With the introduction of regulations such as the Payment Services Directive 2 (PSD2) in Europe, which mandates strong customer authentication for online transactions, card issuers are compelled to adopt technologies like 3DS to remain compliant. By doing so, they not only avoid potential fines and penalties but also demonstrate their commitment to safeguarding customer data, which can enhance their reputation in the market.

Furthermore, the latest version of 3DS, known as 3DS 2.0, offers improved user experience compared to its predecessor. It addresses many of the friction points associated with the original 3DS protocol by enabling a more seamless authentication process. For instance, 3DS 2.0 supports biometric authentication and leverages contextual data to assess transaction risk, allowing for a frictionless experience for low-risk transactions. This improvement in user experience can lead to higher customer satisfaction and reduced cart abandonment rates, which are crucial for maintaining a competitive edge in the digital marketplace.

In conclusion, the adoption of 3D Secure technology presents a multitude of benefits for card issuers and their customers. By enhancing security, fostering customer confidence, ensuring regulatory compliance, and improving user experience, 3DS serves as a valuable tool in the arsenal of card issuers. As the digital economy continues to expand, embracing such technologies will be pivotal for card issuers aiming to protect their interests and those of their customers, ultimately leading to sustained growth and success in the financial sector.

Implementing 3DS: Key Considerations for Card Issuers

In the rapidly evolving landscape of digital payments, card issuers are increasingly turning to 3D Secure (3DS) as a means to enhance transaction security and reduce fraud. As the digital economy expands, the implementation of 3DS has become a critical consideration for card issuers aiming to protect both their customers and their bottom line. Understanding the key aspects of 3DS and its implementation is essential for card issuers to effectively leverage this technology.

To begin with, 3DS is an authentication protocol designed to provide an additional layer of security for online credit and debit card transactions. By requiring cardholders to complete an extra verification step, such as entering a password or a one-time code, 3DS helps to confirm the identity of the cardholder and reduce the risk of unauthorized transactions. This added security measure not only protects consumers but also helps issuers mitigate the financial losses associated with fraudulent activities.

However, implementing 3DS is not without its challenges. One of the primary considerations for card issuers is ensuring a seamless user experience. While security is paramount, it is equally important to minimize friction during the checkout process. A cumbersome authentication process can lead to cart abandonment and a negative customer experience. Therefore, issuers must strike a balance between security and convenience, possibly by adopting the latest version of the protocol, 3DS 2.0, which offers a more streamlined and user-friendly experience compared to its predecessor.

Moreover, card issuers need to consider the integration of 3DS with their existing systems. This involves technical adjustments and collaboration with merchants and payment gateways to ensure compatibility and smooth operation. It is crucial for issuers to work closely with their technology partners to address any integration challenges and to ensure that the 3DS implementation aligns with their overall payment strategy.

Another important aspect is the regulatory environment. Card issuers must stay informed about the regulatory requirements related to 3DS in the regions where they operate. For instance, the European Union’s Revised Payment Services Directive (PSD2) mandates strong customer authentication for online transactions, making 3DS a necessary component for compliance. Understanding these regulatory frameworks is essential for issuers to avoid potential penalties and to ensure that their 3DS implementation meets all necessary legal standards.

Furthermore, card issuers should consider the impact of 3DS on fraud detection and prevention strategies. While 3DS significantly reduces the risk of unauthorized transactions, it is not a standalone solution. Issuers should integrate 3DS with other fraud detection tools and analytics to create a comprehensive security strategy. By leveraging data analytics and machine learning, issuers can enhance their ability to detect and respond to fraudulent activities in real-time, thereby providing an additional layer of protection for their customers.

In conclusion, the implementation of 3D Secure is a multifaceted process that requires careful consideration and planning by card issuers. By focusing on user experience, system integration, regulatory compliance, and fraud prevention, issuers can effectively harness the benefits of 3DS to enhance transaction security and build trust with their customers. As the digital payment landscape continues to evolve, staying ahead of security challenges through the strategic implementation of 3DS will be crucial for card issuers aiming to maintain a competitive edge in the market.

3DS and Fraud Prevention: How Card Issuers Can Stay Ahead

In the ever-evolving landscape of digital payments, card issuers face the constant challenge of balancing security with user experience. One of the most effective tools in their arsenal is the 3D Secure (3DS) protocol, a security measure designed to prevent fraud in online transactions. As fraudsters become increasingly sophisticated, understanding and effectively implementing 3DS is crucial for card issuers aiming to stay ahead in the fight against fraud.

3DS, originally developed by Visa and now adopted by other major card networks, adds an additional layer of authentication for online card transactions. By requiring cardholders to verify their identity through a password, SMS code, or biometric data, 3DS helps ensure that the person making the transaction is indeed the cardholder. This additional step significantly reduces the risk of unauthorized transactions, thereby protecting both consumers and card issuers from potential losses.

However, the implementation of 3DS is not without its challenges. One of the primary concerns for card issuers is the potential impact on user experience. The additional authentication step can lead to friction in the checkout process, potentially resulting in cart abandonment and lost sales. To mitigate this, the latest version of the protocol, 3DS 2.0, was introduced. This version offers a more seamless experience by leveraging risk-based authentication, which assesses the risk level of a transaction in real-time and only prompts for additional verification when necessary. By doing so, 3DS 2.0 aims to strike a balance between security and convenience, allowing low-risk transactions to proceed without interruption.

Moreover, card issuers must also consider the integration of 3DS with their existing systems. Ensuring compatibility and smooth operation requires collaboration with merchants and payment service providers. This collaboration is essential to ensure that the 3DS protocol is effectively implemented and that any potential issues are promptly addressed. Additionally, card issuers should invest in educating their customers about the benefits and processes of 3DS. By raising awareness and providing clear instructions, issuers can help alleviate any concerns or confusion that cardholders may have, thereby enhancing the overall user experience.

Furthermore, as fraud prevention is a dynamic field, card issuers must remain vigilant and adaptable. This involves staying informed about the latest developments in fraud tactics and continuously updating their security measures. Regularly reviewing and analyzing transaction data can help issuers identify patterns and potential vulnerabilities, allowing them to proactively address emerging threats. In this context, leveraging advanced technologies such as artificial intelligence and machine learning can provide valuable insights and enhance the effectiveness of fraud detection systems.

In conclusion, while 3DS is a powerful tool in the fight against online fraud, its successful implementation requires careful consideration and ongoing effort from card issuers. By embracing the latest advancements in the protocol, fostering collaboration with key stakeholders, and maintaining a proactive approach to fraud prevention, card issuers can effectively protect their customers and themselves from the ever-present threat of fraud. As the digital payment landscape continues to evolve, staying ahead of fraudsters will remain a top priority, and 3DS will undoubtedly play a pivotal role in achieving this goal.

Enhancing Customer Experience with 3DS: Tips for Card Issuers

In the rapidly evolving landscape of digital payments, card issuers are continually seeking ways to enhance the customer experience while ensuring robust security measures. One such advancement that has gained significant traction is the implementation of 3D Secure (3DS) technology. As card issuers strive to balance the dual objectives of security and user convenience, understanding the nuances of 3DS becomes imperative. This article delves into how card issuers can leverage 3DS to enhance customer experience, offering practical insights and strategies for effective implementation.

To begin with, 3DS is a security protocol designed to prevent fraud in online credit and debit card transactions. By adding an additional layer of authentication, it helps verify the cardholder’s identity before the transaction is approved. This not only reduces the risk of fraudulent activities but also instills a sense of confidence among consumers. However, the challenge for card issuers lies in implementing 3DS in a manner that does not compromise the seamlessness of the customer journey. Therefore, it is crucial for issuers to adopt a customer-centric approach when integrating 3DS into their systems.

One effective strategy is to employ risk-based authentication (RBA) within the 3DS framework. RBA allows issuers to assess the risk level of each transaction in real-time, using data analytics and machine learning algorithms. By doing so, issuers can determine whether a transaction requires additional authentication or can be processed seamlessly. This approach not only enhances security but also minimizes friction for low-risk transactions, thereby improving the overall customer experience. Furthermore, by continuously refining their risk assessment models, issuers can adapt to emerging threats and maintain a high level of security without inconveniencing customers.

In addition to RBA, card issuers should focus on optimizing the user interface and experience during the authentication process. A cumbersome or confusing authentication step can lead to cart abandonment and customer dissatisfaction. Therefore, it is essential to design a user-friendly interface that guides customers through the authentication process with clear instructions and minimal steps. Implementing biometric authentication methods, such as fingerprint or facial recognition, can further streamline the process, offering a quick and secure way for customers to verify their identity.

Moreover, communication plays a pivotal role in enhancing the customer experience with 3DS. Card issuers should proactively educate their customers about the benefits and workings of 3DS, emphasizing how it protects them from fraud. Clear and transparent communication can alleviate any concerns customers may have about the additional authentication step, fostering trust and acceptance. Additionally, providing prompt and efficient customer support for any issues related to 3DS can further enhance customer satisfaction and loyalty.

Finally, card issuers must remain agile and responsive to technological advancements and regulatory changes in the payments industry. As 3DS continues to evolve, staying informed about the latest updates and best practices is crucial for maintaining a competitive edge. By participating in industry forums and collaborating with technology partners, issuers can ensure that their 3DS implementation remains cutting-edge and aligned with customer expectations.

In conclusion, while 3DS offers significant benefits in terms of security, its successful implementation hinges on a delicate balance between protection and user experience. By adopting risk-based authentication, optimizing the user interface, communicating effectively with customers, and staying abreast of industry developments, card issuers can harness the full potential of 3DS to enhance the customer experience. As the digital payments landscape continues to evolve, those who prioritize both security and convenience will be best positioned to thrive in this dynamic environment.

Regulatory Compliance and 3DS: What Card Issuers Need to Know

In the rapidly evolving landscape of digital payments, card issuers are increasingly tasked with ensuring secure and seamless transactions for their customers. One of the pivotal tools in achieving this balance is the 3D Secure (3DS) protocol, which has become a cornerstone in the fight against online fraud. As regulatory frameworks tighten and consumer expectations rise, understanding the intricacies of 3DS is essential for card issuers aiming to maintain compliance and enhance user experience.

3DS, originally developed by Visa and now adopted by major card networks, is an authentication protocol designed to add an additional layer of security for online credit and debit card transactions. The protocol’s primary objective is to verify the cardholder’s identity before the transaction is approved, thereby reducing the risk of fraudulent activities. With the advent of 3DS 2.0, the protocol has evolved to address the limitations of its predecessor, offering a more frictionless experience for users while maintaining robust security measures.

Regulatory compliance is a critical aspect that card issuers must consider when implementing 3DS. In regions such as the European Union, the Revised Payment Services Directive (PSD2) mandates Strong Customer Authentication (SCA) for electronic payments, making 3DS an essential component for compliance. Failure to adhere to these regulations can result in significant penalties and reputational damage. Therefore, card issuers must ensure that their 3DS implementation aligns with the regulatory requirements to avoid potential pitfalls.

Moreover, the transition to 3DS 2.0 offers card issuers an opportunity to enhance the customer experience. Unlike its predecessor, 3DS 2.0 supports a wider range of data points, enabling more accurate risk assessments and reducing the likelihood of false declines. This is particularly important as consumers increasingly demand seamless and swift online transactions. By leveraging the advanced capabilities of 3DS 2.0, card issuers can strike a balance between security and convenience, fostering customer trust and loyalty.

However, the implementation of 3DS is not without its challenges. Card issuers must navigate technical complexities and ensure interoperability across various platforms and devices. This requires a strategic approach, involving collaboration with technology providers and continuous monitoring of the system’s performance. Additionally, issuers must remain vigilant to emerging threats and adapt their security measures accordingly. As cybercriminals become more sophisticated, staying ahead of potential vulnerabilities is crucial to safeguarding both the issuer and the cardholder.

Furthermore, education and communication play a vital role in the successful adoption of 3DS. Card issuers should proactively inform their customers about the benefits and functionalities of the protocol, addressing any concerns related to privacy and data security. By fostering transparency and understanding, issuers can mitigate resistance and encourage widespread acceptance of 3DS.

In conclusion, as the digital payment ecosystem continues to expand, card issuers must prioritize the implementation of 3DS to ensure regulatory compliance and enhance transaction security. By embracing the advancements of 3DS 2.0 and addressing the associated challenges, issuers can provide a secure and user-friendly experience that meets the demands of both regulators and consumers. Through strategic planning, collaboration, and effective communication, card issuers can navigate the complexities of 3DS and position themselves as leaders in the digital payment space.

The Role of 3DS in Secure Online Transactions for Card Issuers

In the rapidly evolving landscape of online transactions, card issuers face the dual challenge of facilitating seamless customer experiences while ensuring robust security measures. One pivotal tool in achieving this balance is the 3D Secure (3DS) protocol, which has become integral to secure online transactions. Understanding the role of 3DS is essential for card issuers aiming to protect their customers and reduce fraud-related losses.

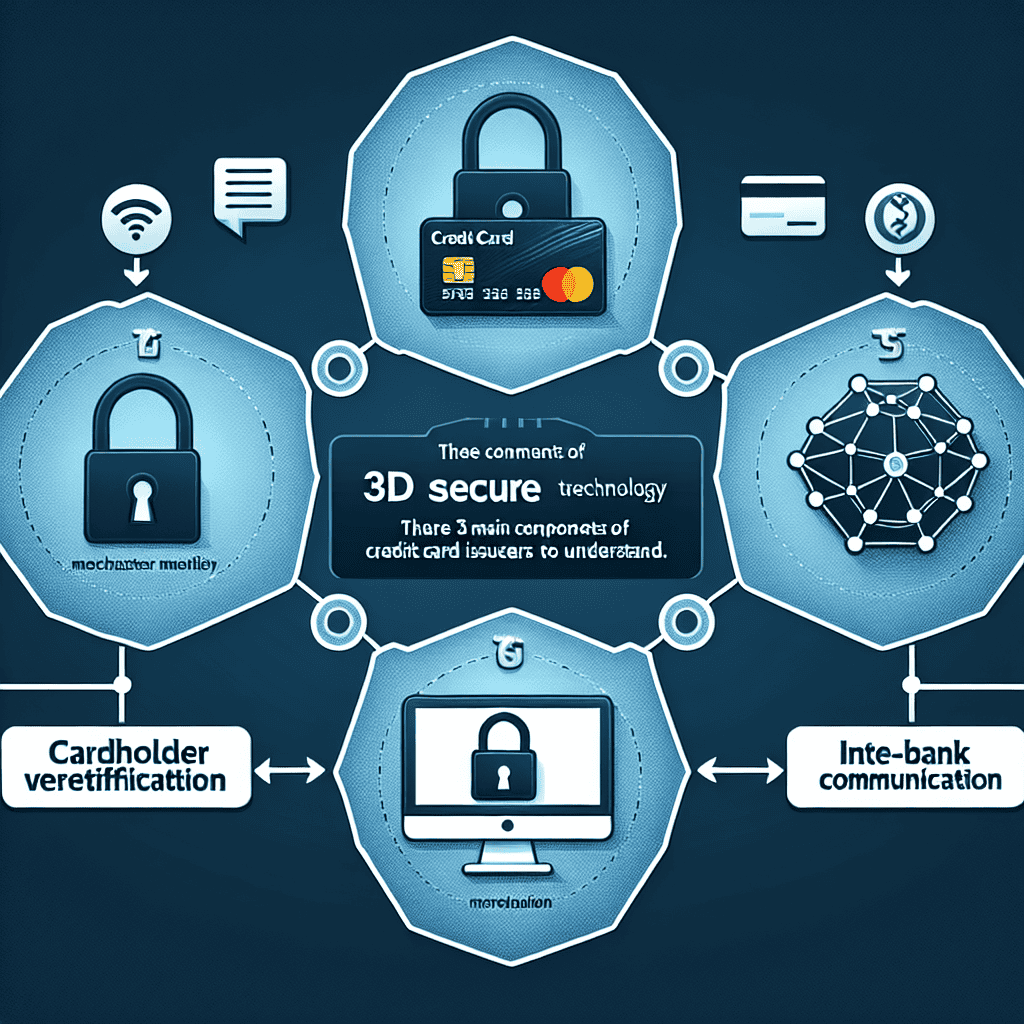

3DS, short for Three-Domain Secure, is an authentication protocol designed to enhance the security of online card transactions. It involves three domains: the merchant/acquirer domain, the issuer domain, and the interoperability domain, which is facilitated by the payment system. By requiring cardholders to complete an additional verification step during the checkout process, 3DS adds a layer of security that helps confirm the identity of the cardholder. This verification often involves entering a password, a one-time code sent to the cardholder’s mobile device, or using biometric authentication methods.

For card issuers, implementing 3DS offers several advantages. Primarily, it significantly reduces the risk of fraudulent transactions. By ensuring that the person making the purchase is indeed the cardholder, issuers can prevent unauthorized use of cards, thereby protecting both their customers and their own financial interests. Moreover, the liability shift associated with 3DS transactions means that, in the event of a fraudulent transaction, the liability often shifts from the merchant to the issuer if the issuer has not implemented 3DS. This shift incentivizes issuers to adopt the protocol to minimize potential losses.

Furthermore, 3DS can enhance customer trust and satisfaction. In an era where data breaches and cyber threats are prevalent, customers are increasingly concerned about the security of their online transactions. By offering an additional layer of protection, issuers can reassure their customers that their financial information is secure, thereby fostering loyalty and confidence in their services. However, it is crucial for issuers to balance security with user experience. The additional authentication step should be as seamless as possible to avoid frustrating customers and potentially leading to cart abandonment.

The evolution of 3DS into its latest version, 3DS 2.0, addresses some of these user experience concerns. 3DS 2.0 offers a more frictionless experience by leveraging risk-based authentication. This means that low-risk transactions can be approved without additional input from the cardholder, while higher-risk transactions still require further verification. This approach not only enhances security but also improves the overall user experience by reducing unnecessary interruptions during the checkout process.

Card issuers must also consider the regulatory landscape when implementing 3DS. In regions such as the European Union, regulations like the Revised Payment Services Directive (PSD2) mandate strong customer authentication for online transactions, making 3DS an essential component of compliance strategies. By aligning with these regulations, issuers can avoid potential penalties and ensure that they are meeting the required security standards.

In conclusion, 3DS plays a crucial role in securing online transactions for card issuers. By reducing fraud, enhancing customer trust, and ensuring regulatory compliance, 3DS is an indispensable tool in the modern digital economy. As online transactions continue to grow, card issuers must remain vigilant and proactive in adopting and optimizing 3DS to protect their customers and maintain their competitive edge in the financial services industry.

Common Challenges Card Issuers Face with 3DS Implementation

The implementation of 3D Secure (3DS) technology has become a pivotal aspect of enhancing online transaction security for card issuers. However, despite its potential to significantly reduce fraud, the adoption of 3DS is not without its challenges. Card issuers must navigate a complex landscape of technical, operational, and customer experience hurdles to fully leverage the benefits of this authentication protocol.

One of the primary challenges card issuers face with 3DS implementation is the integration with existing systems. Many issuers operate on legacy systems that may not seamlessly support the latest version of 3DS, known as 3DS2. This version introduces a more sophisticated authentication process, requiring issuers to upgrade their infrastructure to accommodate new data fields and communication protocols. The transition can be resource-intensive, demanding significant investment in both time and technology. Moreover, ensuring compatibility with various merchant platforms adds another layer of complexity, as issuers must work closely with merchants to facilitate a smooth integration process.

In addition to technical hurdles, card issuers must also address operational challenges. The implementation of 3DS necessitates changes in transaction processing workflows, which can disrupt established procedures. Issuers need to train their staff to handle new authentication processes and manage exceptions effectively. Furthermore, the increased data exchange between issuers, merchants, and cardholders requires robust data management practices to ensure compliance with data protection regulations. This necessitates a comprehensive review of data handling policies and the implementation of stringent security measures to safeguard sensitive information.

Another significant challenge is maintaining a balance between security and user experience. While 3DS aims to enhance security, it can inadvertently introduce friction into the customer journey. Cardholders may encounter additional authentication steps, which, if not implemented smoothly, can lead to transaction abandonment. To mitigate this risk, issuers must focus on optimizing the user experience by leveraging risk-based authentication. This approach allows for a seamless transaction process for low-risk transactions while applying additional scrutiny to high-risk ones. By doing so, issuers can minimize disruptions for cardholders while maintaining robust security measures.

Furthermore, card issuers must also consider the global nature of online transactions. Implementing 3DS across different regions involves navigating varying regulatory requirements and consumer expectations. Issuers must ensure that their 3DS solutions are compliant with local regulations, such as the European Union’s Revised Payment Services Directive (PSD2), which mandates strong customer authentication for online transactions. This requires a nuanced understanding of regional regulatory landscapes and the ability to adapt 3DS implementations accordingly.

Lastly, effective communication with cardholders is crucial for successful 3DS implementation. Cardholders need to be informed about the benefits of 3DS and how it enhances the security of their online transactions. Clear communication can help alleviate concerns about additional authentication steps and encourage cardholders to embrace the enhanced security measures. Issuers should invest in educational campaigns to raise awareness and provide guidance on navigating the 3DS authentication process.

In conclusion, while the implementation of 3DS presents several challenges for card issuers, addressing these issues is essential for enhancing online transaction security. By focusing on seamless integration, operational efficiency, user experience optimization, regulatory compliance, and effective communication, issuers can overcome these challenges and fully realize the benefits of 3DS technology. As the digital payment landscape continues to evolve, embracing 3DS will be a critical step for card issuers in safeguarding their customers and maintaining trust in the online marketplace.

Future Trends in 3DS: Insights for Card Issuers

As the digital landscape continues to evolve, card issuers are increasingly focusing on enhancing security measures to protect against fraud while ensuring a seamless customer experience. One of the pivotal technologies in this domain is 3D Secure (3DS), a protocol designed to provide an additional layer of authentication for online card transactions. Understanding the future trends in 3DS is crucial for card issuers aiming to stay ahead in the competitive financial services market.

To begin with, the evolution of 3DS is marked by the transition from the original 3DS 1.0 to the more advanced 3DS 2.0. This shift is driven by the need to address the limitations of the earlier version, which often resulted in poor user experiences due to cumbersome authentication processes. 3DS 2.0, on the other hand, offers a more streamlined and user-friendly approach by leveraging biometric authentication and risk-based analysis. This not only enhances security but also reduces friction during the checkout process, thereby improving customer satisfaction.

Moreover, as e-commerce continues to grow, the demand for secure and efficient payment solutions is more pressing than ever. Card issuers must recognize that the future of 3DS lies in its ability to adapt to the changing dynamics of online shopping. This includes accommodating the rise of mobile commerce, where consumers increasingly use smartphones for transactions. 3DS 2.0 is designed with mobile optimization in mind, ensuring that authentication processes are seamless across various devices and platforms. This adaptability is crucial for card issuers looking to capture the growing segment of mobile shoppers.

In addition to mobile optimization, another trend shaping the future of 3DS is the integration of artificial intelligence (AI) and machine learning. These technologies enable more sophisticated risk assessments by analyzing vast amounts of transaction data in real-time. For card issuers, this means the ability to detect and prevent fraudulent activities with greater accuracy, thereby reducing chargebacks and associated costs. Furthermore, AI-driven insights can help issuers personalize the authentication process, offering tailored security measures based on individual user behavior and transaction history.

As card issuers navigate these trends, it is essential to consider the regulatory landscape surrounding 3DS. Compliance with standards such as the Payment Services Directive 2 (PSD2) in Europe, which mandates strong customer authentication, is critical. Staying informed about regulatory changes and ensuring that 3DS implementations meet these requirements will be vital for issuers to avoid penalties and maintain customer trust.

Looking ahead, collaboration between card issuers, merchants, and technology providers will be key to the successful adoption and evolution of 3DS. By working together, these stakeholders can address common challenges, such as interoperability and data privacy concerns, while fostering innovation in authentication technologies. This collaborative approach will not only enhance security but also drive the development of new features and functionalities that cater to the evolving needs of consumers.

In conclusion, the future of 3DS presents both opportunities and challenges for card issuers. By embracing advancements such as 3DS 2.0, mobile optimization, AI integration, and regulatory compliance, issuers can enhance security, improve user experiences, and maintain a competitive edge in the digital payments landscape. As the industry continues to evolve, staying informed and adaptable will be crucial for card issuers seeking to leverage the full potential of 3DS in safeguarding online transactions.

Q&A

1. **What is 3DS?**

3DS, or 3D Secure, is a security protocol designed to prevent fraud in online credit and debit card transactions by adding an additional layer of authentication.

2. **Why is 3DS important for card issuers?**

3DS helps reduce fraudulent transactions and chargebacks, enhancing security and customer trust, which is crucial for card issuers.

3. **How does 3DS work?**

During an online transaction, 3DS prompts the cardholder to verify their identity through a password, SMS code, or biometric authentication before the transaction is approved.

4. **What are the versions of 3DS?**

The main versions are 3DS 1.0 and 3DS 2.0 (also known as EMV 3DS), with 3DS 2.0 offering improved user experience and mobile compatibility.

5. **What improvements does 3DS 2.0 offer over 3DS 1.0?**

3DS 2.0 provides a frictionless authentication process, better integration with mobile devices, and supports biometric authentication, reducing cart abandonment.

6. **What role do card issuers play in 3DS?**

Card issuers are responsible for authenticating the cardholder during a 3DS transaction and ensuring the security of the authentication process.

7. **How does 3DS impact customer experience?**

While 3DS adds a step to the checkout process, 3DS 2.0 aims to minimize friction and improve the overall customer experience with smoother authentication methods.

8. **What are the regulatory requirements related to 3DS?**

In regions like the EU, regulations such as PSD2 mandate strong customer authentication (SCA), which 3DS can help fulfill.

9. **How can card issuers implement 3DS?**

Card issuers can implement 3DS by partnering with a 3DS service provider or integrating 3DS solutions into their existing systems.

10. **What challenges might card issuers face with 3DS?**

Challenges include ensuring seamless integration, maintaining a balance between security and user experience, and keeping up with evolving fraud tactics.

Conclusion

3D Secure (3DS) is a security protocol designed to prevent fraud in online credit and debit card transactions. Card issuers need to understand several key aspects of 3DS to effectively implement and manage it. Firstly, they should be aware of the different versions of 3DS, with 3DS 2.0 offering improved user experience and security features compared to the original version. This includes better integration with mobile devices and a more seamless authentication process. Secondly, issuers must ensure compliance with regulatory requirements, such as the Payment Services Directive 2 (PSD2) in Europe, which mandates strong customer authentication. Additionally, they should focus on balancing security with user experience to minimize cart abandonment rates. This involves leveraging risk-based authentication to allow low-risk transactions to proceed without additional verification steps. Finally, card issuers should stay informed about emerging trends and technologies in digital payments to continuously enhance their 3DS strategies and protect against evolving fraud tactics.