“Boost Your Nest Egg with Unconventional Investments—Proceed with Prudence!”

Introduction

In the quest for a financially secure retirement, many individuals are exploring unconventional investment strategies as a means to potentially enhance their savings. These strategies, which often deviate from traditional investment approaches, can offer unique opportunities for growth and diversification. However, they also come with their own set of risks and complexities. As such, it is crucial for investors to exercise caution and conduct thorough research before integrating these alternative methods into their retirement planning. Understanding the potential benefits and pitfalls of unconventional investments can help ensure that they complement, rather than compromise, one’s long-term financial goals.

Exploring Alternative Assets: Diversifying Beyond Traditional Investments

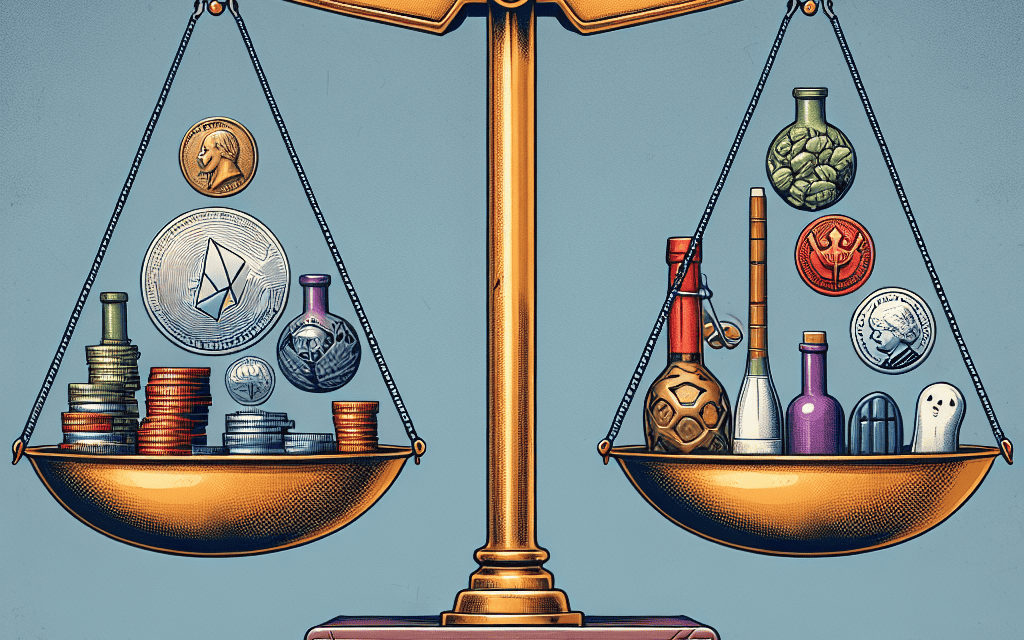

In the ever-evolving landscape of financial planning, the quest for a robust retirement savings strategy has led many investors to explore unconventional investment avenues. While traditional assets such as stocks, bonds, and mutual funds have long been the cornerstone of retirement portfolios, a growing number of individuals are considering alternative assets to diversify their holdings and potentially enhance returns. However, as with any investment strategy, it is crucial to exercise caution and conduct thorough research before venturing into these less conventional territories.

Alternative assets encompass a wide range of investment opportunities, including real estate, commodities, private equity, hedge funds, and even cryptocurrencies. These assets often exhibit different risk and return characteristics compared to traditional investments, which can provide a hedge against market volatility and inflation. For instance, real estate investments can offer a steady income stream through rental yields, while commodities like gold and silver are often viewed as safe havens during economic downturns. Moreover, private equity and hedge funds can provide access to unique investment opportunities that are not available in public markets, potentially leading to higher returns.

Despite the allure of these alternative assets, it is essential to recognize the inherent risks associated with them. Unlike traditional investments, alternative assets often lack liquidity, meaning they cannot be easily converted into cash without a significant loss in value. This illiquidity can pose a challenge for investors who may need to access their funds quickly. Additionally, alternative investments can be complex and require a higher level of expertise to manage effectively. The lack of transparency and regulatory oversight in some alternative markets can also increase the risk of fraud and mismanagement.

Furthermore, the performance of alternative assets can be highly unpredictable, influenced by factors such as geopolitical events, regulatory changes, and market sentiment. For example, the value of cryptocurrencies can fluctuate wildly within short periods, making them a high-risk investment option. Similarly, the success of private equity investments often hinges on the ability of fund managers to identify and capitalize on lucrative opportunities, which is not guaranteed.

Given these considerations, it is imperative for investors to approach alternative assets with a well-thought-out strategy. Diversification remains a key principle, as spreading investments across various asset classes can mitigate risk and enhance the potential for returns. Investors should also assess their risk tolerance and investment horizon, ensuring that their portfolio aligns with their long-term financial goals. Consulting with a financial advisor who has expertise in alternative investments can provide valuable insights and guidance, helping investors make informed decisions.

Moreover, staying informed about market trends and developments is crucial for those considering alternative assets. As the financial landscape continues to evolve, new opportunities and challenges will inevitably arise. By keeping abreast of these changes, investors can better position themselves to capitalize on emerging trends while avoiding potential pitfalls.

In conclusion, while unconventional investment strategies can offer promising avenues for enhancing retirement savings, they are not without their risks. A cautious and informed approach is essential for navigating the complexities of alternative assets. By carefully evaluating the potential benefits and drawbacks, investors can make strategic decisions that align with their financial objectives, ultimately contributing to a more secure and prosperous retirement.

The Role Of Cryptocurrencies In Retirement Portfolios

As the financial landscape continues to evolve, investors are increasingly exploring unconventional strategies to enhance their retirement savings. Among these emerging options, cryptocurrencies have garnered significant attention. While traditional investment vehicles such as stocks, bonds, and mutual funds have long been the cornerstone of retirement portfolios, the allure of cryptocurrencies lies in their potential for high returns and diversification benefits. However, it is crucial to exercise caution and conduct thorough research before integrating these digital assets into a retirement strategy.

Cryptocurrencies, such as Bitcoin and Ethereum, have experienced meteoric rises in value over the past decade, capturing the interest of both individual and institutional investors. Their decentralized nature and potential to hedge against inflation make them an attractive option for those seeking to diversify their portfolios. Moreover, the increasing acceptance of cryptocurrencies by major financial institutions and corporations has further legitimized their role in the global economy. Consequently, some financial advisors are beginning to recommend a modest allocation of cryptocurrencies in retirement portfolios, typically ranging from 1% to 5%.

Despite their potential benefits, cryptocurrencies are inherently volatile and speculative. Their prices can fluctuate dramatically within short periods, driven by factors such as regulatory changes, technological advancements, and market sentiment. This volatility poses a significant risk to retirement savings, which are typically intended to provide stable, long-term growth. Therefore, it is essential for investors to carefully assess their risk tolerance and investment horizon before incorporating cryptocurrencies into their retirement plans.

In addition to volatility, the regulatory environment surrounding cryptocurrencies remains uncertain. Governments worldwide are grappling with how to regulate these digital assets, and future regulatory changes could impact their value and accessibility. Investors must stay informed about the evolving legal landscape and be prepared to adapt their strategies accordingly. Furthermore, the security of cryptocurrency investments is a critical concern. The digital nature of these assets makes them susceptible to hacking and fraud, necessitating robust security measures to protect one’s holdings.

To mitigate these risks, investors should consider diversifying their cryptocurrency holdings across multiple assets and platforms. This approach can help reduce exposure to any single asset’s volatility and potential regulatory challenges. Additionally, employing a dollar-cost averaging strategy—investing a fixed amount at regular intervals—can help smooth out the effects of market fluctuations over time.

It is also advisable for investors to seek guidance from financial professionals who are knowledgeable about cryptocurrencies and their role in retirement planning. These experts can provide valuable insights into the potential risks and rewards of incorporating digital assets into a retirement portfolio, as well as recommend appropriate allocation strategies based on individual financial goals and risk tolerance.

In conclusion, while cryptocurrencies present an intriguing opportunity for enhancing retirement savings, they are not without significant risks. Investors must exercise caution and conduct thorough due diligence before integrating these digital assets into their portfolios. By carefully considering their risk tolerance, staying informed about regulatory developments, and seeking professional advice, investors can make informed decisions about the role of cryptocurrencies in their retirement planning. Ultimately, a balanced approach that combines traditional investment vehicles with a modest allocation of cryptocurrencies may offer the potential for enhanced returns while safeguarding long-term financial security.

Real Estate Crowdfunding: A New Avenue For Retirement Savings

In recent years, the landscape of investment opportunities has expanded significantly, offering individuals a plethora of options to enhance their retirement savings. Among these emerging avenues, real estate crowdfunding has garnered attention as an unconventional yet potentially lucrative strategy. This innovative approach allows investors to pool their resources to collectively invest in real estate projects, thereby democratizing access to an asset class traditionally reserved for institutional investors or those with substantial capital. However, while real estate crowdfunding presents enticing prospects, it is imperative to exercise caution and conduct thorough due diligence before committing funds.

Real estate crowdfunding platforms have proliferated, providing investors with opportunities to invest in a diverse range of properties, from residential and commercial developments to niche markets such as student housing and senior living facilities. This diversification can be particularly appealing for those seeking to mitigate risk and enhance their retirement portfolios. By spreading investments across various projects and geographic locations, investors can potentially reduce the impact of localized market downturns. Moreover, the relatively low entry barriers associated with crowdfunding platforms enable individuals to participate in real estate investments with smaller amounts of capital, making it accessible to a broader audience.

Despite these advantages, it is crucial to recognize the inherent risks associated with real estate crowdfunding. Unlike traditional real estate investments, where investors have direct ownership and control over properties, crowdfunding involves a degree of separation between the investor and the asset. This lack of control can be a double-edged sword; while it alleviates the burden of property management, it also means that investors must rely on the expertise and integrity of platform operators and project developers. Consequently, conducting comprehensive research on the platform’s track record, the credibility of developers, and the specifics of each investment opportunity is essential.

Furthermore, real estate crowdfunding investments are often illiquid, meaning that investors may not be able to easily sell their shares or withdraw their funds before the project’s completion. This illiquidity can pose a challenge for those who may need to access their retirement savings unexpectedly. Therefore, it is advisable to consider one’s liquidity needs and investment horizon before allocating a significant portion of retirement savings to this asset class.

In addition to these considerations, potential investors should be aware of the regulatory environment surrounding real estate crowdfunding. While regulations have evolved to provide greater transparency and protection for investors, the level of oversight can vary significantly between jurisdictions and platforms. As such, understanding the legal framework and ensuring compliance with relevant regulations is paramount to safeguarding one’s investments.

In conclusion, real estate crowdfunding offers a novel and potentially rewarding avenue for enhancing retirement savings. Its ability to provide diversification and access to real estate markets with relatively low capital requirements makes it an attractive option for many investors. However, the associated risks, including lack of control, illiquidity, and regulatory complexities, necessitate a cautious approach. By conducting thorough research, understanding the nuances of each investment opportunity, and aligning investments with one’s financial goals and risk tolerance, individuals can make informed decisions that may enhance their retirement savings while mitigating potential pitfalls. As with any investment strategy, a balanced and prudent approach is key to achieving long-term financial security.

Peer-To-Peer Lending: High Returns With High Risks

Peer-to-peer lending, often abbreviated as P2P lending, has emerged as an intriguing alternative investment strategy that promises potentially high returns, making it an attractive option for those looking to enhance their retirement savings. This innovative financial model connects individual borrowers with investors through online platforms, bypassing traditional financial institutions. As a result, it offers a unique opportunity for investors to earn interest on their capital by funding personal loans. However, while the allure of high returns is undeniable, it is crucial to exercise caution due to the inherent risks associated with this investment approach.

To begin with, the appeal of peer-to-peer lending lies in its potential for higher yields compared to conventional savings accounts or fixed-income investments. Investors can often earn interest rates that significantly exceed those offered by traditional banks. This is particularly enticing in a low-interest-rate environment, where traditional savings vehicles may not provide sufficient growth to meet long-term retirement goals. Moreover, P2P lending platforms typically offer a range of loan grades, allowing investors to choose their risk tolerance and potentially diversify their portfolios by investing in multiple loans.

Despite these advantages, it is essential to recognize the risks involved in peer-to-peer lending. One of the primary concerns is the credit risk associated with lending to individual borrowers. Unlike traditional banks, which have extensive resources and expertise to assess creditworthiness, P2P platforms may not have the same level of rigor in their underwriting processes. Consequently, there is a higher likelihood of borrower default, which can result in significant losses for investors. Furthermore, the lack of government-backed insurance, such as the Federal Deposit Insurance Corporation (FDIC) protection for bank deposits, means that investors bear the full brunt of any defaults.

In addition to credit risk, liquidity risk is another factor that investors must consider. Unlike stocks or bonds, which can be easily bought or sold on public exchanges, P2P loans are relatively illiquid. Once an investment is made, it is typically locked in for the duration of the loan term, which can range from a few months to several years. This lack of liquidity can pose challenges for investors who may need to access their funds quickly in response to unforeseen financial needs or changes in market conditions.

Moreover, regulatory risk is an ever-present concern in the evolving landscape of peer-to-peer lending. As this industry continues to grow, it is subject to increasing scrutiny from regulatory bodies. Changes in regulations could impact the operations of P2P platforms, potentially affecting the returns and risks associated with these investments. Investors must stay informed about regulatory developments and be prepared to adapt their strategies accordingly.

In conclusion, while peer-to-peer lending offers an unconventional yet potentially rewarding avenue for enhancing retirement savings, it is imperative to approach this investment strategy with caution. The promise of high returns must be weighed against the risks of borrower default, illiquidity, and regulatory changes. Investors should conduct thorough due diligence, diversify their investments across multiple loans and platforms, and consider their overall risk tolerance before committing funds to P2P lending. By doing so, they can better position themselves to capitalize on the opportunities presented by this innovative financial model while safeguarding their retirement savings against potential pitfalls.

Investing In Art And Collectibles: A Unique Approach To Retirement Planning

Investing in art and collectibles has emerged as an unconventional yet intriguing strategy for enhancing retirement savings. As traditional investment avenues such as stocks, bonds, and real estate become increasingly competitive and volatile, individuals are exploring alternative options to diversify their portfolios. Art and collectibles, with their potential for significant appreciation, offer a unique approach to retirement planning. However, this strategy requires careful consideration and a thorough understanding of the market dynamics involved.

To begin with, art and collectibles have historically demonstrated the potential for substantial returns. High-profile sales at auction houses often capture headlines, showcasing the impressive appreciation of certain pieces over time. For instance, works by renowned artists like Picasso or rare collectibles such as vintage cars have fetched millions, underscoring the lucrative possibilities within this market. Moreover, art and collectibles can serve as a hedge against inflation, as their value often rises in tandem with or even outpaces inflationary pressures. This characteristic makes them an attractive option for those seeking to preserve and grow their wealth over the long term.

Nevertheless, investing in art and collectibles is not without its challenges. Unlike traditional financial assets, these items lack liquidity, meaning they cannot be easily converted into cash. This illiquidity can pose a significant risk, particularly if an investor needs to access funds quickly. Additionally, the art and collectibles market is highly subjective and influenced by trends, tastes, and the reputation of artists or creators. As a result, predicting future value can be complex and uncertain. Therefore, potential investors must exercise caution and conduct thorough research before committing to this investment strategy.

Furthermore, the art and collectibles market is fraught with potential pitfalls, including the risk of forgeries and misattributions. The authenticity of a piece is paramount to its value, and the prevalence of counterfeit items can lead to significant financial losses. Engaging with reputable dealers, auction houses, and experts is essential to mitigate these risks. Additionally, investors should consider the costs associated with acquiring, insuring, and maintaining these assets, as they can be substantial and impact overall returns.

Despite these challenges, there are strategies to enhance the likelihood of success when investing in art and collectibles. Diversification is key; by spreading investments across different types of art and collectibles, investors can reduce risk and increase the potential for returns. Moreover, staying informed about market trends and developments is crucial. Attending art fairs, auctions, and exhibitions can provide valuable insights into emerging artists and shifting market dynamics. Building a network of knowledgeable professionals, including appraisers and advisors, can also offer guidance and support in navigating this complex market.

In conclusion, while investing in art and collectibles presents a unique approach to retirement planning, it is not without its risks and challenges. The potential for significant appreciation and inflation hedging makes it an attractive option for diversifying a retirement portfolio. However, the illiquidity, market subjectivity, and risk of forgeries necessitate a cautious and informed approach. By conducting thorough research, engaging with reputable professionals, and diversifying investments, individuals can enhance their chances of success in this unconventional investment strategy. As with any investment, careful consideration and due diligence are paramount to achieving long-term financial goals.

The Potential Of Green Investments In Retirement Portfolios

As the global economy increasingly shifts towards sustainability, green investments have emerged as a compelling option for enhancing retirement portfolios. These investments, which focus on environmentally friendly and socially responsible companies, offer the potential for significant financial returns while contributing to a more sustainable future. However, as with any investment strategy, it is crucial to exercise caution and conduct thorough research before integrating green investments into your retirement savings plan.

To begin with, green investments encompass a wide range of sectors, including renewable energy, sustainable agriculture, and clean technology. These sectors are experiencing rapid growth due to increasing consumer demand for sustainable products and services, as well as supportive government policies aimed at reducing carbon emissions. Consequently, companies operating within these sectors often exhibit strong growth potential, making them attractive candidates for inclusion in retirement portfolios. Moreover, investing in green companies can provide a sense of personal satisfaction, as investors contribute to the development of a more sustainable and equitable world.

Despite the promising prospects of green investments, it is essential to recognize the inherent risks associated with this unconventional investment strategy. The green sector is still relatively young and can be subject to volatility, as market dynamics and regulatory environments continue to evolve. For instance, changes in government policies or technological advancements can significantly impact the performance of green companies, leading to fluctuations in stock prices. Therefore, investors must remain vigilant and stay informed about industry trends and developments to mitigate potential risks.

Furthermore, it is important to consider the potential for greenwashing, a practice where companies exaggerate or falsely claim their environmental credentials to attract environmentally conscious investors. This deceptive practice can lead to misguided investment decisions, as investors may unknowingly support companies that do not genuinely adhere to sustainable practices. To avoid falling victim to greenwashing, investors should conduct thorough due diligence, examining a company’s environmental, social, and governance (ESG) performance and seeking third-party verification of its sustainability claims.

In addition to these considerations, diversification remains a key principle in managing investment risk. While green investments can play a valuable role in a retirement portfolio, they should not constitute the entirety of one’s investment strategy. Instead, investors should aim to create a balanced portfolio that includes a mix of asset classes, such as stocks, bonds, and real estate, to ensure long-term financial stability. By diversifying their investments, individuals can reduce their exposure to sector-specific risks and enhance the overall resilience of their retirement savings.

Moreover, it is advisable for investors to consult with financial advisors who specialize in sustainable investing. These professionals can provide valuable insights and guidance on selecting suitable green investments that align with an individual’s financial goals and risk tolerance. By leveraging the expertise of financial advisors, investors can make informed decisions and optimize their retirement portfolios for both financial returns and positive environmental impact.

In conclusion, green investments present a promising opportunity for enhancing retirement savings while supporting the transition to a more sustainable economy. However, investors must exercise caution and conduct thorough research to navigate the risks associated with this unconventional investment strategy. By remaining informed, avoiding greenwashing, and maintaining a diversified portfolio, individuals can effectively integrate green investments into their retirement plans and contribute to a more sustainable future.

Understanding The Risks Of Leveraged ETFs In Retirement Savings

Leveraged exchange-traded funds (ETFs) have gained popularity among investors seeking to amplify their returns. These financial instruments use derivatives and debt to multiply the performance of an underlying index, often by two or three times. While the allure of potentially higher returns can be tempting, especially for those looking to bolster their retirement savings, it is crucial to understand the inherent risks associated with leveraged ETFs before incorporating them into a retirement portfolio.

To begin with, leveraged ETFs are designed to achieve their stated objectives on a daily basis. This means that their performance is reset at the end of each trading day, which can lead to significant discrepancies over longer periods. For instance, if an index experiences volatility, the compounding effect of daily resets can result in returns that deviate substantially from the expected multiple of the index’s performance. Consequently, investors who hold leveraged ETFs for extended periods may find that their returns do not align with their initial expectations.

Moreover, the volatility inherent in leveraged ETFs can exacerbate losses during market downturns. While traditional ETFs track an index and reflect its performance, leveraged ETFs magnify both gains and losses. In a volatile market, this can lead to rapid erosion of capital, which is particularly concerning for those nearing retirement who may not have the time to recover from significant losses. Therefore, it is essential for investors to carefully consider their risk tolerance and investment horizon before venturing into leveraged ETFs.

In addition to volatility, the cost structure of leveraged ETFs can also impact returns. These funds typically have higher expense ratios compared to traditional ETFs due to the complex financial instruments they employ. Over time, these costs can erode the potential gains, making it imperative for investors to weigh the benefits against the expenses. Furthermore, the use of derivatives and debt introduces counterparty risk, which can add another layer of complexity and potential loss.

Despite these risks, some investors may still find leveraged ETFs appealing as a short-term tactical tool. For those with a high risk tolerance and a keen understanding of market dynamics, these instruments can offer opportunities to capitalize on short-term market movements. However, it is crucial to approach such strategies with caution and to have a well-defined exit plan to mitigate potential losses.

To navigate the complexities of leveraged ETFs, investors should consider consulting with a financial advisor who can provide personalized guidance based on individual financial goals and risk profiles. A professional can help assess whether these instruments align with one’s overall retirement strategy and suggest alternative investment options if necessary.

In conclusion, while leveraged ETFs may offer the potential for enhanced returns, they come with significant risks that can undermine retirement savings if not managed carefully. The daily reset feature, heightened volatility, and higher costs all contribute to the complexity of these financial products. Therefore, it is imperative for investors to thoroughly understand these risks and exercise caution when considering leveraged ETFs as part of their retirement strategy. By doing so, they can make informed decisions that align with their long-term financial objectives, ensuring a more secure and stable retirement.

Q&A

1. **What is an unconventional investment strategy?**

An unconventional investment strategy involves using non-traditional methods or assets, such as alternative investments, to potentially enhance returns and diversify a portfolio.

2. **Why might someone consider an unconventional investment strategy for retirement savings?**

Individuals may consider these strategies to potentially achieve higher returns, hedge against market volatility, or diversify their retirement portfolio beyond traditional stocks and bonds.

3. **What are some examples of unconventional investments?**

Examples include real estate, commodities, private equity, hedge funds, cryptocurrencies, and collectibles like art or wine.

4. **What are the risks associated with unconventional investment strategies?**

These strategies can be riskier due to factors like market volatility, lack of liquidity, higher fees, and less regulatory oversight, which can lead to potential losses.

5. **How can one mitigate the risks of unconventional investments?**

Mitigation strategies include thorough research, diversification, consulting with financial advisors, and only allocating a small portion of the portfolio to these investments.

6. **What role does due diligence play in unconventional investing?**

Due diligence is crucial as it involves researching and understanding the investment, assessing risks, and ensuring it aligns with one’s financial goals and risk tolerance.

7. **Why is it important to exercise caution with unconventional investment strategies?**

Caution is important because these investments can be complex and volatile, potentially leading to significant financial losses if not carefully managed.

Conclusion

Unconventional investment strategies can potentially enhance retirement savings by offering opportunities for higher returns and diversification beyond traditional asset classes. These strategies, which may include alternative investments such as real estate, commodities, private equity, or hedge funds, can provide a hedge against market volatility and inflation. However, they also come with increased risks, including lack of liquidity, higher fees, and greater complexity. It is crucial for investors to exercise caution by thoroughly researching these options, understanding their risk profiles, and considering their own risk tolerance and financial goals. Consulting with a financial advisor can help in making informed decisions and ensuring that such strategies align with a comprehensive retirement plan.