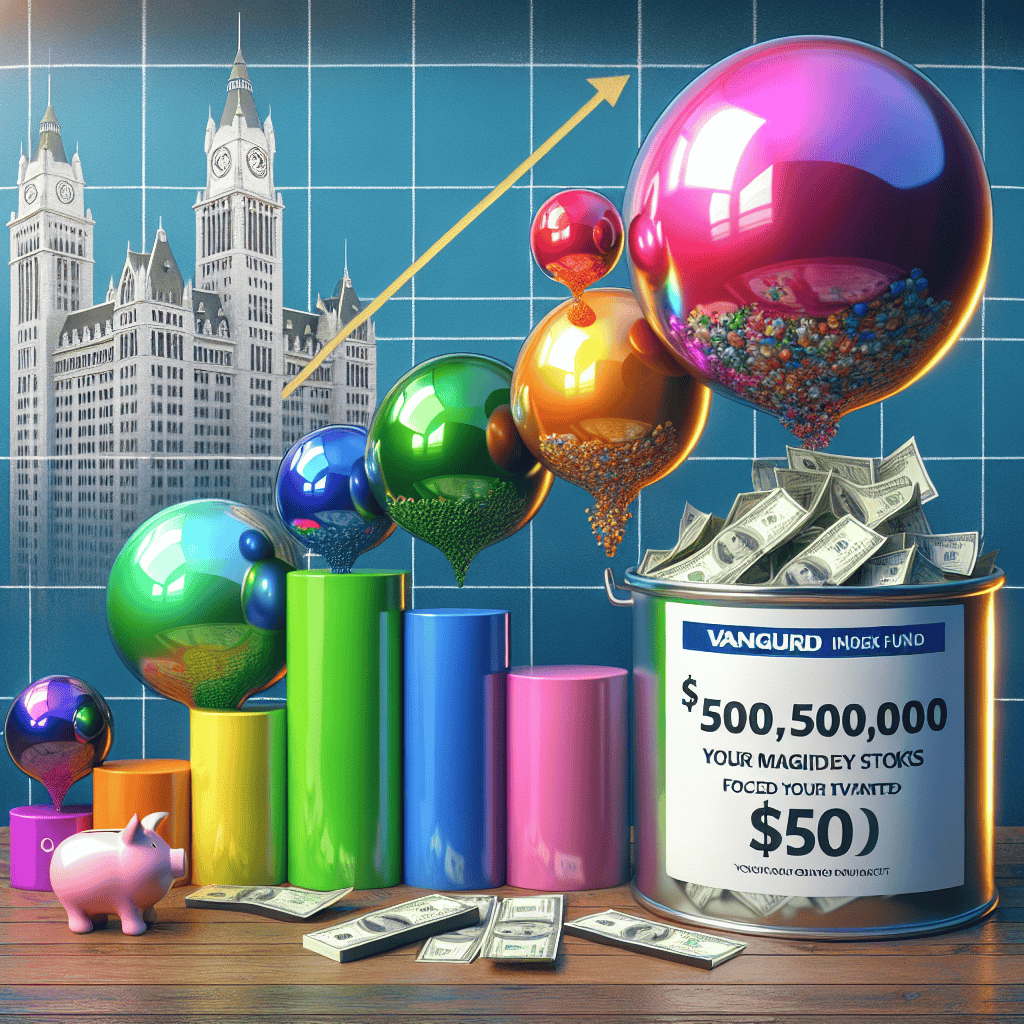

“Turn $500 a Month into $500,000: Harness the Power of Vanguard’s Magnificent Seven Index Fund!”

Introduction

Investing in the stock market can be a powerful way to build wealth over time, and with the right strategy, even modest monthly contributions can grow into substantial sums. One such strategy involves leveraging the potential of index funds, particularly those that focus on high-performing stocks. This guide explores how you can transform a monthly investment of $500 into a significant nest egg of $500,000 by focusing on a Vanguard index fund that targets the “Magnificent Seven” stocks—an elite group of companies known for their robust growth and market influence. By understanding the principles of compounding, diversification, and strategic investment, you can harness the power of these leading stocks to achieve your financial goals.

Understanding the Magnificent Seven Stocks: A Beginner’s Guide

Investing in the stock market can seem daunting, especially for beginners. However, with the right approach and understanding, it is possible to transform a modest monthly investment into a substantial nest egg over time. One effective strategy involves focusing on the “Magnificent Seven” stocks through a Vanguard index fund. These stocks, which include some of the most influential and innovative companies in the world, have shown remarkable growth and resilience, making them an attractive option for long-term investors.

The Magnificent Seven stocks refer to a group of leading technology and consumer companies that have consistently outperformed the broader market. These companies are often characterized by their strong market positions, innovative products, and robust financial performance. By investing in a Vanguard index fund that includes these stocks, investors can gain exposure to their potential growth while benefiting from the diversification that an index fund offers. This approach not only mitigates risk but also simplifies the investment process for beginners.

To understand the potential of transforming $500 monthly into $500,000, it is essential to consider the power of compound interest. When you invest in a Vanguard index fund, your money is not only working for you through capital appreciation but also through the reinvestment of dividends. Over time, this compounding effect can significantly enhance the value of your investment. For instance, assuming an average annual return of 8%, a $500 monthly investment could grow to approximately $500,000 in 30 years. This example illustrates the importance of starting early and maintaining a consistent investment strategy.

Moreover, the Magnificent Seven stocks are often at the forefront of technological advancements and consumer trends, which positions them well for future growth. Companies within this group are leaders in areas such as artificial intelligence, cloud computing, and digital entertainment, all of which are expected to drive significant economic growth in the coming decades. By investing in a Vanguard index fund that includes these stocks, you are effectively betting on the continued success and innovation of these industry leaders.

It is also important to recognize the role of diversification in managing investment risk. While the Magnificent Seven stocks have shown impressive performance, investing in a single stock or a small group of stocks can be risky. An index fund, however, spreads your investment across a broader range of companies, reducing the impact of any single stock’s poor performance on your overall portfolio. This diversification is particularly beneficial for beginners who may not have the expertise to select individual stocks.

In addition to diversification, investing through a Vanguard index fund offers the advantage of low fees. Vanguard is known for its cost-effective investment options, which means that more of your money is working for you rather than being eaten up by management fees. This cost efficiency, combined with the potential growth of the Magnificent Seven stocks, makes a Vanguard index fund an appealing choice for those looking to build wealth over the long term.

In conclusion, transforming $500 monthly into $500,000 is a realistic goal with the right investment strategy. By focusing on a Vanguard index fund that includes the Magnificent Seven stocks, beginners can benefit from the growth potential of leading companies while enjoying the advantages of diversification and low fees. With patience and discipline, this approach can pave the way to significant financial success.

The Power of Compound Interest: How $500 Monthly Can Grow Exponentially

Investing in the stock market has long been heralded as a powerful means of building wealth over time. One of the most effective strategies for achieving substantial financial growth is harnessing the power of compound interest. By consistently investing a modest sum, such as $500 monthly, into a well-chosen index fund, investors can potentially transform their contributions into a significant nest egg. A particularly promising approach involves focusing on a Vanguard index fund that emphasizes the “Magnificent Seven” stocks, a group of leading technology and innovation-driven companies that have demonstrated robust growth potential.

The concept of compound interest is fundamental to understanding how small, regular investments can accumulate into a substantial sum. Essentially, compound interest allows investors to earn returns not only on their initial principal but also on the accumulated interest from previous periods. This snowball effect can lead to exponential growth over time, especially when investments are made consistently and left to grow over the long term. By investing $500 each month, individuals can take advantage of this powerful financial mechanism, allowing their money to work for them and grow at an accelerating pace.

Choosing the right investment vehicle is crucial to maximizing the benefits of compound interest. Vanguard index funds are renowned for their low fees and broad market exposure, making them an attractive option for investors seeking steady growth. By focusing on an index fund that includes the Magnificent Seven stocks—companies such as Apple, Microsoft, Amazon, Alphabet, Meta Platforms, Tesla, and Nvidia—investors can tap into the potential of some of the most dynamic and innovative firms in the market. These companies have consistently demonstrated strong performance and are well-positioned to continue driving technological advancements and capturing market share in their respective industries.

Moreover, investing in an index fund that emphasizes these leading stocks provides diversification benefits, reducing the risk associated with investing in individual companies. While the Magnificent Seven stocks are known for their growth potential, they also represent a range of sectors within the technology and innovation space, from consumer electronics and cloud computing to social media and electric vehicles. This diversification helps mitigate the impact of any single company’s underperformance on the overall investment portfolio, providing a more stable and resilient path to wealth accumulation.

To illustrate the potential of this investment strategy, consider the historical performance of the stock market. Over the past several decades, the average annual return of the S&P 500 has been approximately 7% after adjusting for inflation. By investing $500 monthly into a Vanguard index fund with a similar return profile, an investor could potentially amass over $500,000 in 30 years. This impressive growth underscores the importance of starting early and maintaining a disciplined investment approach.

In conclusion, the power of compound interest, when combined with a strategic investment in a Vanguard index fund focused on the Magnificent Seven stocks, offers a compelling opportunity for individuals to grow their wealth significantly over time. By committing to a consistent investment plan and leveraging the growth potential of leading technology companies, investors can transform a modest monthly contribution into a substantial financial asset. This approach not only capitalizes on the strengths of some of the most innovative firms in the market but also provides a diversified and resilient investment strategy that can withstand market fluctuations and deliver long-term financial success.

Why Choose Vanguard Index Funds for Long-Term Wealth Building

Investing in the stock market has long been heralded as a pathway to wealth accumulation, and for good reason. Among the myriad of investment vehicles available, index funds have emerged as a popular choice for both novice and seasoned investors. Vanguard, a pioneer in this domain, offers a range of index funds that cater to various investment goals. One compelling strategy for long-term wealth building involves focusing on a Vanguard index fund that includes the “Magnificent Seven” stocks—Apple, Microsoft, Amazon, Alphabet, Meta, Tesla, and Nvidia. These companies, known for their robust growth and innovation, have consistently delivered impressive returns, making them a cornerstone of many successful investment portfolios.

The appeal of Vanguard index funds lies in their simplicity, cost-effectiveness, and diversification. By investing in a Vanguard index fund, you gain exposure to a broad spectrum of the market, which inherently reduces risk compared to investing in individual stocks. This diversification is particularly advantageous when focusing on the Magnificent Seven, as it allows investors to benefit from the growth of these tech giants while mitigating the volatility associated with single-stock investments. Moreover, Vanguard is renowned for its low expense ratios, which means that more of your money is working for you rather than being eroded by fees.

To illustrate the potential of this investment strategy, consider the scenario of investing $500 monthly into a Vanguard index fund that includes the Magnificent Seven. Over time, the power of compounding can transform these modest monthly contributions into a substantial nest egg. Assuming an average annual return of 10%, which is consistent with historical stock market performance, an investor could amass approximately $500,000 in 30 years. This example underscores the importance of patience and consistency in investing, as the true power of compounding becomes evident over the long term.

Furthermore, the Magnificent Seven stocks are not just any companies; they are leaders in their respective industries, driving innovation and shaping the future of technology. Their influence extends beyond their market capitalization, as they are often at the forefront of technological advancements that redefine how we live and work. By investing in a Vanguard index fund that includes these stocks, you are effectively betting on the continued success and growth of these industry titans. This strategic alignment with market leaders can enhance the potential for superior returns, especially as these companies continue to expand their reach and influence.

In addition to the financial benefits, investing in a Vanguard index fund focused on the Magnificent Seven aligns with a broader investment philosophy that emphasizes long-term growth over short-term gains. This approach encourages investors to remain committed to their financial goals, even amidst market fluctuations. By maintaining a disciplined investment strategy, individuals can avoid the pitfalls of emotional decision-making, which often leads to suboptimal outcomes.

In conclusion, choosing a Vanguard index fund that includes the Magnificent Seven stocks offers a compelling pathway to long-term wealth building. The combination of diversification, low costs, and exposure to industry-leading companies provides a solid foundation for achieving financial independence. By consistently investing $500 monthly and harnessing the power of compounding, investors can potentially transform their modest contributions into a significant financial legacy. This strategy not only capitalizes on the growth potential of some of the world’s most influential companies but also embodies a prudent approach to wealth accumulation that can withstand the test of time.

Diversification vs. Concentration: The Role of the Magnificent Seven in Your Portfolio

Investing in the stock market has long been a favored strategy for building wealth over time. However, the debate between diversification and concentration remains a pivotal consideration for investors. The concept of diversification involves spreading investments across various assets to mitigate risk, while concentration focuses on investing in a select few stocks with the potential for substantial returns. In recent years, the “Magnificent Seven” stocks—Apple, Microsoft, Amazon, Alphabet, Meta Platforms, Tesla, and Nvidia—have emerged as dominant players in the market, capturing the attention of investors worldwide. These tech giants have demonstrated remarkable growth and resilience, making them attractive options for those considering a more concentrated investment approach.

Investing in a Vanguard index fund that focuses on these seven stocks offers a unique opportunity to harness their potential while maintaining a level of diversification. Vanguard, known for its low-cost index funds, provides a platform for investors to gain exposure to these leading companies without the need to purchase individual stocks. By allocating $500 monthly into such a fund, investors can systematically build their portfolio over time, leveraging the power of compounding to potentially transform their initial investments into substantial wealth.

The Magnificent Seven stocks have consistently outperformed the broader market, driven by their innovative products, strong financials, and dominant market positions. For instance, Apple and Microsoft have maintained their status as leaders in the technology sector, while Amazon continues to revolutionize e-commerce and cloud computing. Alphabet, the parent company of Google, remains a powerhouse in digital advertising and artificial intelligence. Meta Platforms, formerly Facebook, is at the forefront of social media and virtual reality, while Tesla is pioneering the electric vehicle industry. Nvidia, a leader in graphics processing units, is capitalizing on the growing demand for gaming and artificial intelligence applications.

While the potential for high returns is enticing, it is essential to consider the risks associated with a concentrated investment strategy. The performance of the Magnificent Seven is closely tied to the technology sector, which can be volatile and subject to rapid changes. Economic downturns, regulatory challenges, and technological disruptions could impact these companies, potentially affecting the value of an index fund focused on them. Therefore, investors must weigh the benefits of concentration against the inherent risks and consider their risk tolerance and investment goals.

Moreover, the role of the Magnificent Seven in a portfolio should be evaluated in the context of an investor’s overall financial strategy. While these stocks offer significant growth potential, they should complement, rather than replace, a well-diversified portfolio. Diversification remains a fundamental principle of investing, providing a buffer against market fluctuations and reducing the impact of poor performance in any single asset or sector.

In conclusion, investing $500 monthly in a Vanguard index fund centered on the Magnificent Seven stocks presents an intriguing opportunity for investors seeking to capitalize on the growth of these industry leaders. By balancing concentration with diversification, investors can potentially achieve substantial returns while managing risk. As with any investment decision, it is crucial to conduct thorough research, assess individual financial goals, and consult with financial advisors to ensure that this strategy aligns with one’s long-term objectives. Through careful planning and disciplined investing, the dream of transforming a modest monthly investment into $500,000 can become a reality.

Step-by-Step Guide to Setting Up Automatic Investments with Vanguard

Investing in the stock market can seem daunting, especially for those new to the world of finance. However, with the right approach and tools, it is possible to transform a modest monthly investment into a substantial nest egg over time. One effective strategy is to invest in a Vanguard index fund that focuses on the “Magnificent Seven” stocks, a group of leading technology companies known for their robust growth potential. By setting up automatic investments, you can systematically build your wealth with minimal effort. This article will guide you through the process of establishing automatic investments with Vanguard, ensuring a seamless and disciplined approach to growing your financial future.

To begin, it is essential to understand the concept of index funds. These funds are designed to track the performance of a specific market index, such as the S&P 500, by holding a diversified portfolio of stocks that mirror the index’s composition. Vanguard, a pioneer in low-cost index investing, offers a variety of funds that cater to different investment goals. Among these, a fund focused on the Magnificent Seven stocks—Apple, Microsoft, Amazon, Alphabet, Meta Platforms, Tesla, and Nvidia—can provide exposure to some of the most innovative and high-performing companies in the market.

Once you have selected the appropriate Vanguard index fund, the next step is to open a brokerage account with Vanguard. This process is straightforward and can be completed online. You will need to provide personal information, such as your Social Security number and employment details, as well as link a bank account to facilitate fund transfers. After your account is set up, you can proceed to purchase shares of your chosen index fund.

To maximize the benefits of compounding returns, it is advisable to set up automatic monthly investments. This strategy not only ensures consistent contributions to your investment portfolio but also helps mitigate the impact of market volatility through dollar-cost averaging. By investing a fixed amount each month, you purchase more shares when prices are low and fewer shares when prices are high, ultimately reducing the average cost per share over time.

To establish automatic investments with Vanguard, log into your account and navigate to the “Automatic Investments” section. Here, you can specify the amount you wish to invest each month, as well as the date on which the investment should be made. It is recommended to align this date with your pay schedule to ensure funds are available for transfer. Additionally, you can choose to allocate your investment across multiple funds if desired, allowing for further diversification.

As you embark on this investment journey, it is crucial to maintain a long-term perspective. The stock market is inherently volatile, and short-term fluctuations are inevitable. However, by adhering to a disciplined investment strategy and consistently contributing to your portfolio, you can harness the power of compounding to achieve significant growth over time. Historical data suggests that investing $500 monthly in a diversified portfolio of high-performing stocks can potentially grow to $500,000 or more over several decades, assuming an average annual return of 7-8%.

In conclusion, setting up automatic investments with a Vanguard index fund focused on the Magnificent Seven stocks is a prudent and effective way to build wealth over time. By following the steps outlined in this guide, you can establish a systematic investment plan that leverages the growth potential of leading technology companies while minimizing the impact of market volatility. With patience and discipline, you can transform a modest monthly investment into a substantial financial legacy.

Risk Management: Balancing High-Growth Stocks with Index Funds

Investing in the stock market can be a daunting endeavor, especially when attempting to balance the allure of high-growth stocks with the stability of index funds. However, with a strategic approach, it is possible to transform a modest monthly investment into a substantial nest egg over time. One such strategy involves investing $500 monthly into a Vanguard index fund that focuses on the so-called “Magnificent Seven” stocks, a group of high-performing technology companies that have shown remarkable growth potential. This approach not only capitalizes on the growth prospects of these companies but also mitigates risk through diversification inherent in index funds.

The “Magnificent Seven” stocks, which include industry giants such as Apple, Microsoft, Amazon, Alphabet, Meta Platforms, Tesla, and Nvidia, have been at the forefront of technological innovation and market expansion. These companies have consistently demonstrated robust financial performance, driven by their ability to adapt to changing market dynamics and consumer preferences. By investing in an index fund that includes these stocks, investors can gain exposure to their growth potential without the need to pick individual winners, thereby reducing the risk associated with investing in single stocks.

Moreover, Vanguard index funds are renowned for their low-cost structure and broad market exposure, making them an attractive option for investors seeking to balance risk and return. By investing in a Vanguard index fund that tracks a benchmark including the Magnificent Seven, investors can benefit from the growth of these companies while also enjoying the diversification benefits that come with holding a wide array of stocks. This diversification helps to cushion the portfolio against volatility, as the performance of individual stocks is less likely to have a significant impact on the overall portfolio.

In addition to diversification, the power of compounding plays a crucial role in transforming a $500 monthly investment into a substantial sum over time. By consistently investing each month, investors can take advantage of compounding returns, where the earnings on investments are reinvested to generate additional earnings. Over a long investment horizon, this compounding effect can significantly amplify the growth of the portfolio, turning a modest monthly contribution into a sizable retirement fund.

However, it is important to acknowledge that investing in high-growth stocks, even within an index fund, carries inherent risks. The technology sector, while offering substantial growth opportunities, is also subject to rapid changes and disruptions. Therefore, investors must be prepared for potential fluctuations in the value of their investments. To manage these risks, it is advisable to maintain a long-term perspective and avoid making impulsive decisions based on short-term market movements.

Furthermore, investors should regularly review their investment strategy to ensure it aligns with their financial goals and risk tolerance. This may involve adjusting the allocation between high-growth stocks and more stable investments as market conditions and personal circumstances evolve. By maintaining a disciplined approach and staying informed about market trends, investors can effectively manage risk while pursuing the growth potential offered by the Magnificent Seven stocks.

In conclusion, transforming a $500 monthly investment into $500,000 through a Vanguard index fund focused on the Magnificent Seven stocks is a feasible strategy for those willing to embrace a long-term investment horizon and the associated risks. By leveraging the growth potential of these leading technology companies while benefiting from the diversification and cost-efficiency of index funds, investors can strike a balance between risk and reward, ultimately achieving their financial objectives.

Real-Life Success Stories: Investors Who Transformed Small Investments into Wealth

Investing in the stock market has long been heralded as a pathway to financial prosperity, yet many individuals remain hesitant, often due to perceived complexities or the misconception that substantial capital is required to begin. However, real-life success stories abound, illustrating how disciplined, small-scale investments can yield significant wealth over time. One such strategy involves investing $500 monthly into a Vanguard index fund that focuses on the “Magnificent Seven” stocks, a group of leading technology companies that have consistently driven market growth.

The “Magnificent Seven” refers to a select group of tech giants that have become synonymous with innovation and market leadership. These companies, which include Apple, Microsoft, Amazon, Google (Alphabet), Facebook (Meta Platforms), Tesla, and Nvidia, have demonstrated remarkable resilience and growth potential. By investing in a Vanguard index fund that emphasizes these stocks, investors can tap into the collective strength of these industry leaders, thereby enhancing their potential for long-term wealth accumulation.

Consider the story of Jane, a middle-income earner who embarked on her investment journey with modest means. Jane began by allocating $500 each month into a Vanguard index fund that prioritized the Magnificent Seven. Her approach was simple yet effective: consistent contributions, regardless of market fluctuations, and a steadfast commitment to her long-term financial goals. Over the years, Jane witnessed the power of compound interest and the robust performance of her chosen stocks. As these companies continued to innovate and expand their market dominance, the value of her investments grew exponentially.

Jane’s success can be attributed to several key factors. First, her disciplined approach to investing allowed her to benefit from dollar-cost averaging, a strategy that involves regularly investing a fixed amount of money, thereby reducing the impact of market volatility. This method enabled her to purchase more shares when prices were low and fewer when prices were high, ultimately lowering her average cost per share over time. Additionally, by focusing on an index fund that included the Magnificent Seven, Jane capitalized on the growth trajectories of these tech titans, which have consistently outperformed broader market indices.

Moreover, Jane’s story underscores the importance of patience and a long-term perspective. While the stock market can be unpredictable in the short term, historical data suggests that it tends to yield positive returns over extended periods. By maintaining her investment strategy through market ups and downs, Jane allowed her portfolio to recover from temporary setbacks and benefit from subsequent rallies.

Furthermore, Jane’s experience highlights the accessibility of index funds as an investment vehicle. Vanguard, known for its low-cost, diversified funds, offers investors an opportunity to gain exposure to a broad array of stocks with minimal fees. This cost-effectiveness, combined with the inherent diversification of index funds, makes them an attractive option for individuals seeking to build wealth without the need for extensive financial expertise.

In conclusion, Jane’s journey from modest monthly investments to substantial wealth exemplifies the transformative potential of disciplined investing in a Vanguard index fund focused on the Magnificent Seven stocks. Her story serves as a testament to the power of consistency, patience, and strategic fund selection in achieving financial success. As more individuals recognize the viability of such investment strategies, the path to financial independence becomes increasingly attainable, even for those starting with limited resources.

Q&A

1. **What is the “Magnificent Seven”?**

The “Magnificent Seven” refers to seven major tech companies: Apple, Microsoft, Amazon, Alphabet (Google), Meta Platforms (Facebook), Tesla, and Nvidia.

2. **What is a Vanguard Index Fund?**

A Vanguard Index Fund is a type of mutual fund or ETF offered by Vanguard that aims to replicate the performance of a specific market index, such as the S&P 500.

3. **How can investing $500 monthly grow to $500,000?**

By consistently investing $500 monthly in a high-performing index fund, compounded returns over time can potentially grow the investment to $500,000, assuming a certain average annual return rate.

4. **What average annual return is needed to reach $500,000?**

Assuming a 30-year investment period, an average annual return of approximately 8-10% could potentially grow $500 monthly contributions to $500,000.

5. **Why focus on the “Magnificent Seven” stocks?**

These stocks are considered leaders in innovation and technology, often driving significant growth in the stock market, which can enhance the performance of an index fund heavily weighted in these companies.

6. **What are the risks of investing in an index fund focused on these stocks?**

Concentration risk is a key concern, as poor performance by these large-cap tech stocks could significantly impact the fund’s overall returns.

7. **How does compounding affect investment growth?**

Compounding allows investment earnings to generate additional earnings over time, significantly increasing the total value of the investment through reinvestment of returns.

Conclusion

Investing $500 monthly in a Vanguard index fund that focuses on the “Magnificent Seven” stocks—Apple, Microsoft, Amazon, Alphabet, Meta, Tesla, and Nvidia—can potentially grow to $500,000 over time, depending on market conditions and the fund’s performance. These stocks have historically shown strong growth, contributing significantly to the overall market’s returns. By consistently investing and leveraging the power of compound interest, investors can benefit from the long-term appreciation of these leading tech companies. However, it’s important to consider market volatility, diversification, and individual risk tolerance when pursuing such a strategy.