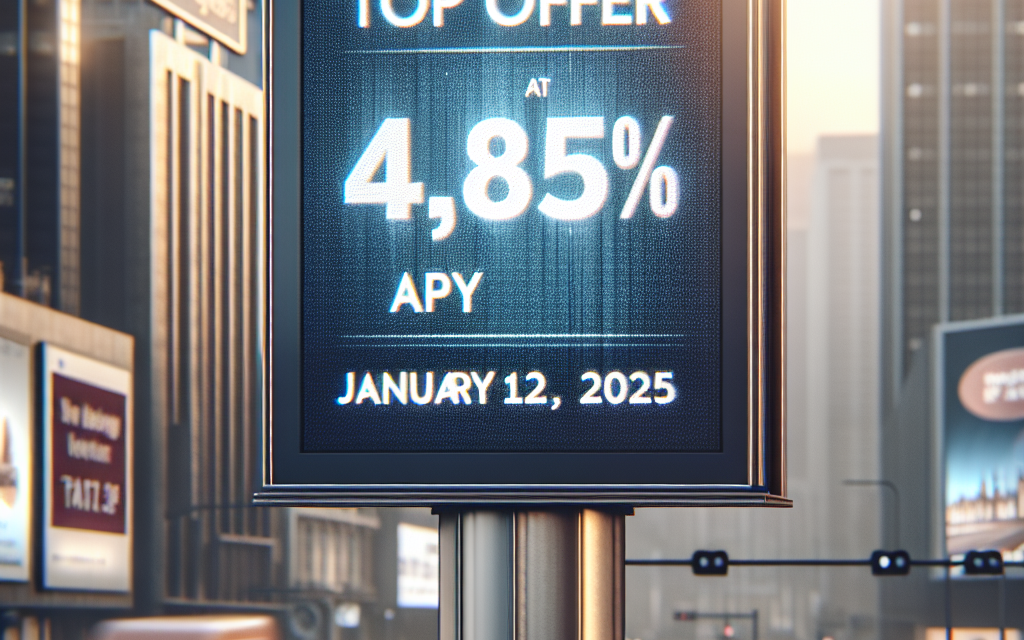

“Maximize Your Savings: Today’s Money Market Account Offers an Unbeatable 4.85% APY!”

Introduction

As of January 12, 2025, today’s money market account rates are showcasing competitive offers, with the top rate reaching an impressive 4.85% APY. This rate reflects the current economic landscape, where financial institutions are striving to attract savers with higher yields. Money market accounts provide a blend of liquidity and interest earnings, making them an appealing option for individuals looking to grow their savings while maintaining easy access to their funds. With rates like 4.85% APY, now is an opportune time for consumers to explore their options and maximize their savings potential.

Current Trends in Money Market Account Rates

As of January 12, 2025, the landscape of money market account rates has shown notable trends, particularly with the top offer reaching an impressive 4.85% Annual Percentage Yield (APY). This figure reflects a broader movement in the financial sector, where interest rates have been influenced by various economic factors, including inflation, Federal Reserve policies, and overall market conditions. Consequently, consumers are increasingly drawn to money market accounts as a viable option for both savings and liquidity.

In recent months, the Federal Reserve has maintained a cautious approach to interest rate adjustments, responding to fluctuating inflation rates and economic growth indicators. As a result, many financial institutions have begun to offer competitive rates on money market accounts to attract depositors seeking higher yields. This trend is particularly significant in a low-interest-rate environment, where traditional savings accounts often fail to provide substantial returns. The current top rate of 4.85% APY stands out as a compelling option for individuals looking to maximize their savings while maintaining easy access to their funds.

Moreover, the appeal of money market accounts lies not only in their attractive interest rates but also in their inherent flexibility. Unlike certificates of deposit (CDs), which typically require funds to be locked away for a specified term, money market accounts allow for more fluid access to cash. This feature is particularly advantageous for consumers who may need to withdraw funds for unexpected expenses or investment opportunities. As such, the combination of high yields and liquidity has made money market accounts an increasingly popular choice among savers.

In addition to the competitive rates, many financial institutions are enhancing their money market account offerings by incorporating features that cater to the needs of modern consumers. For instance, some banks are providing online and mobile banking options, enabling customers to manage their accounts conveniently from their devices. This technological integration not only simplifies account management but also fosters a more engaging banking experience. As consumers become more tech-savvy, the demand for such features is likely to grow, prompting banks to innovate further in their product offerings.

Furthermore, it is essential to consider the impact of economic conditions on money market account rates. As inflation continues to be a concern, consumers are increasingly aware of the importance of earning a competitive return on their savings. In this context, money market accounts serve as an attractive alternative to traditional savings accounts, which often yield minimal interest. The current rate of 4.85% APY is a response to this demand, reflecting the financial institutions’ efforts to provide a product that meets the needs of a more discerning clientele.

In conclusion, the current trends in money market account rates indicate a shift towards higher yields and enhanced features that cater to the evolving preferences of consumers. With the top offer at 4.85% APY, individuals are presented with a compelling opportunity to grow their savings while retaining access to their funds. As the economic landscape continues to evolve, it is likely that money market accounts will remain a popular choice for those seeking a balance between yield and liquidity. As consumers navigate their financial options, staying informed about these trends will be crucial in making sound decisions that align with their financial goals.

Benefits of Choosing a High-Interest Money Market Account

In today’s financial landscape, the allure of high-interest money market accounts has become increasingly pronounced, particularly with rates reaching as high as 4.85% APY as of January 12, 2025. This competitive rate not only captures the attention of savers but also highlights the numerous benefits associated with choosing a high-interest money market account over traditional savings options.

One of the primary advantages of a high-interest money market account is the potential for greater returns on your savings. Unlike standard savings accounts, which often offer minimal interest rates, money market accounts typically provide higher yields, allowing your funds to grow more significantly over time. This is particularly beneficial for individuals looking to maximize their savings without taking on the risks associated with investments in the stock market. By opting for a high-interest money market account, savers can enjoy the peace of mind that comes with a stable and predictable return on their deposits.

Moreover, high-interest money market accounts often come with the added benefit of liquidity. This means that while your money is earning a competitive interest rate, you still have access to your funds when needed. Many money market accounts allow for a limited number of transactions each month, which strikes a balance between earning interest and maintaining accessibility. This feature is particularly advantageous for those who may need to withdraw funds for unexpected expenses or emergencies, as it provides a safety net without sacrificing the opportunity for growth.

In addition to competitive interest rates and liquidity, high-interest money market accounts typically offer a level of security that is appealing to many savers. Most money market accounts are insured by the Federal Deposit Insurance Corporation (FDIC) up to the applicable limits, which means that your deposits are protected even in the event of a bank failure. This assurance can be particularly comforting for individuals who prioritize the safety of their savings, as it mitigates the risks associated with other investment vehicles.

Furthermore, many financial institutions that offer high-interest money market accounts provide additional features that enhance the overall banking experience. For instance, online banking capabilities, mobile apps, and easy fund transfers can make managing your account more convenient. These technological advancements allow account holders to monitor their balances, track interest earnings, and make transactions with ease, thereby fostering a more user-friendly experience.

Transitioning from traditional savings accounts to high-interest money market accounts can also encourage better financial habits. The higher interest rates can motivate individuals to save more, as they see their money working harder for them. This shift in mindset can lead to increased financial discipline, ultimately contributing to long-term financial stability and growth.

In conclusion, the benefits of choosing a high-interest money market account are manifold. With attractive rates such as 4.85% APY, these accounts not only offer the potential for higher returns but also provide liquidity, security, and enhanced banking features. As savers seek to optimize their financial strategies, high-interest money market accounts present a compelling option that balances the need for growth with the desire for accessibility and safety. By considering these factors, individuals can make informed decisions that align with their financial goals, paving the way for a more secure financial future.

How to Maximize Your Earnings with a 4.85% APY

In today’s financial landscape, securing a competitive interest rate on your savings is more important than ever. With money market accounts (MMAs) offering rates as high as 4.85% APY, it is essential to understand how to maximize your earnings in this environment. By strategically managing your funds and understanding the features of these accounts, you can make the most of your investment.

To begin with, it is crucial to recognize the benefits of a money market account. Unlike traditional savings accounts, MMAs typically offer higher interest rates while still providing easy access to your funds. This combination of liquidity and competitive returns makes them an attractive option for savers. However, to truly capitalize on the 4.85% APY, you should consider maintaining a higher balance. Many financial institutions offer tiered interest rates, meaning that the more you deposit, the higher your potential earnings. Therefore, if you can afford to do so, aim to keep your balance above the minimum threshold required to earn the top rate.

In addition to maintaining a higher balance, it is wise to shop around for the best money market account options. While the 4.85% APY is certainly appealing, not all financial institutions offer the same terms and conditions. Some may impose monthly maintenance fees or require a minimum balance that could diminish your overall returns. By comparing different accounts, you can find one that not only offers a competitive interest rate but also aligns with your financial habits and goals. This diligence can significantly enhance your earning potential.

Moreover, consider the frequency of interest compounding when selecting a money market account. Interest compounding refers to the process of earning interest on both your initial deposit and the interest that accumulates over time. Accounts that compound interest daily or monthly can yield higher returns compared to those that compound quarterly or annually. Therefore, when evaluating your options, pay close attention to how often interest is compounded, as this can have a substantial impact on your overall earnings.

Another effective strategy for maximizing your earnings is to automate your savings. By setting up automatic transfers from your checking account to your money market account, you can consistently contribute to your savings without having to think about it. This not only helps you build your balance over time but also takes advantage of the high APY consistently. Additionally, consider making lump-sum deposits whenever possible, such as from tax refunds or bonuses, to further boost your account balance and, consequently, your interest earnings.

Furthermore, it is essential to remain informed about any changes in interest rates or account terms. Financial institutions may adjust their rates in response to market conditions, and staying updated can help you make timely decisions about your savings strategy. If you notice that your current account is no longer offering competitive rates, it may be worth exploring other options to ensure that your money continues to work for you.

In conclusion, maximizing your earnings with a 4.85% APY in a money market account requires a proactive approach. By maintaining a higher balance, comparing account options, understanding compounding frequency, automating your savings, and staying informed about market changes, you can significantly enhance your financial growth. In a world where every percentage point counts, these strategies can help you make the most of your savings and achieve your financial goals.

Comparing Money Market Accounts: What to Look For

When considering a money market account, it is essential to understand the various factors that can influence your decision. Money market accounts are often seen as a hybrid between traditional savings accounts and checking accounts, offering higher interest rates than standard savings while providing some check-writing capabilities. As of January 12, 2025, the top offer stands at an impressive 4.85% APY, making it a compelling option for those looking to maximize their savings. However, before committing to a specific account, it is crucial to compare several key features that can significantly impact your overall experience and returns.

First and foremost, the interest rate is a primary consideration. While the current top rate is attractive, it is important to examine whether this rate is promotional or if it will remain competitive over time. Some financial institutions may offer high introductory rates that decrease after a certain period, so it is wise to read the fine print and understand the terms associated with the advertised APY. Additionally, consider how often the interest is compounded, as more frequent compounding can lead to greater earnings over time.

Another critical aspect to evaluate is the minimum balance requirement. Many money market accounts require a minimum deposit to open the account and maintain a certain balance to avoid fees. If you anticipate fluctuations in your account balance, it is prudent to choose an account with a lower minimum requirement or one that offers flexibility without incurring penalties. This consideration is particularly important for individuals who may not have a large sum to deposit initially or who prefer to keep their savings fluid.

Fees associated with money market accounts can also vary significantly between institutions. While some accounts may offer no monthly maintenance fees, others may impose charges that can erode your interest earnings. It is advisable to look for accounts that provide fee waivers under certain conditions, such as maintaining a minimum balance or setting up direct deposits. By minimizing fees, you can ensure that more of your money is working for you, rather than being siphoned off by account maintenance costs.

In addition to interest rates and fees, the accessibility of funds is another vital factor to consider. Money market accounts typically allow for a limited number of transactions each month, including withdrawals and transfers. Understanding these limitations is essential, as exceeding the allowed number of transactions can result in fees or account conversion to a different type of account. Therefore, if you anticipate needing frequent access to your funds, it may be beneficial to choose an account with more lenient transaction limits.

Furthermore, the reputation and customer service of the financial institution should not be overlooked. Researching customer reviews and ratings can provide insight into the overall experience of account holders. A bank or credit union with a strong track record of customer service can make a significant difference, especially when you need assistance or have questions regarding your account.

In conclusion, while the current money market account rates, such as the top offer of 4.85% APY, are certainly enticing, it is essential to conduct a thorough comparison of various accounts. By considering factors such as interest rates, minimum balance requirements, fees, accessibility, and the institution’s reputation, you can make an informed decision that aligns with your financial goals. Ultimately, a well-chosen money market account can serve as a valuable tool in your savings strategy, providing both growth potential and liquidity.

The Impact of Economic Factors on Money Market Rates

The landscape of money market account rates is significantly influenced by various economic factors, which can lead to fluctuations in the annual percentage yield (APY) offered by financial institutions. As of January 12, 2025, the top money market account rate stands at an impressive 4.85% APY, a figure that reflects the current economic climate and the decisions made by the Federal Reserve. Understanding the interplay between these economic elements and money market rates is essential for consumers seeking to maximize their savings.

One of the primary drivers of money market account rates is the Federal Reserve’s monetary policy. When the Fed adjusts the federal funds rate, it directly impacts the interest rates that banks offer to consumers. For instance, in a rising interest rate environment, banks are likely to increase their money market account rates to attract deposits, as they can earn more from lending those funds at higher rates. Conversely, when the Fed lowers rates, banks may reduce their offerings, leading to lower APYs for consumers. This relationship underscores the importance of monitoring the Fed’s actions and statements, as they provide valuable insights into future rate movements.

In addition to the Federal Reserve’s policies, inflation plays a crucial role in shaping money market account rates. When inflation rises, the purchasing power of money decreases, prompting consumers to seek higher returns on their savings to maintain their financial stability. As a result, banks may respond by increasing their money market rates to remain competitive and attract depositors. Conversely, during periods of low inflation, the urgency for higher yields diminishes, which can lead to stagnant or declining rates. Therefore, understanding the inflationary environment is vital for consumers looking to make informed decisions about where to place their savings.

Another significant factor influencing money market account rates is the overall economic growth and stability. In a robust economy characterized by low unemployment and rising consumer confidence, banks may feel more inclined to offer competitive rates to attract deposits. This is because they anticipate increased lending opportunities and a higher demand for credit. On the other hand, during economic downturns or periods of uncertainty, banks may become more conservative in their lending practices, leading to lower money market rates. Consequently, consumers should pay attention to economic indicators such as GDP growth, employment rates, and consumer sentiment, as these can provide clues about the direction of money market rates.

Furthermore, competition among financial institutions also plays a pivotal role in determining money market account rates. In a crowded marketplace, banks and credit unions often strive to differentiate themselves by offering attractive rates to entice new customers. This competitive dynamic can lead to higher APYs, as institutions seek to capture a larger share of the deposit market. Therefore, consumers are encouraged to shop around and compare rates from various providers, as this can lead to better returns on their savings.

In conclusion, the current money market account rate of 4.85% APY is a reflection of the complex interplay between economic factors such as Federal Reserve policies, inflation, economic growth, and competition among financial institutions. By understanding these influences, consumers can make more informed decisions about their savings strategies, ensuring that they take full advantage of the opportunities available in the ever-evolving financial landscape. As the economy continues to change, staying informed about these factors will be crucial for maximizing returns on money market accounts.

Strategies for Saving with a Money Market Account

In today’s financial landscape, money market accounts (MMAs) have emerged as a popular choice for individuals seeking to maximize their savings while maintaining liquidity. With current rates reaching as high as 4.85% APY, these accounts offer an attractive alternative to traditional savings accounts, which often yield significantly lower interest rates. To effectively leverage the benefits of a money market account, it is essential to adopt strategic saving practices that can enhance your overall financial health.

One of the primary advantages of a money market account is its ability to provide higher interest rates compared to standard savings accounts. This feature makes it an ideal vehicle for individuals looking to grow their savings over time. To capitalize on this benefit, it is advisable to regularly deposit funds into the account. By establishing a consistent savings habit, you can take full advantage of compound interest, which allows your money to grow exponentially over time. Setting up automatic transfers from your checking account to your money market account can simplify this process, ensuring that you consistently contribute to your savings without the temptation to spend.

Moreover, it is crucial to understand the terms and conditions associated with money market accounts. Many institutions impose minimum balance requirements to qualify for the highest interest rates. Therefore, maintaining a balance that meets or exceeds these thresholds is essential for maximizing your earnings. Additionally, being aware of any fees associated with the account can help you avoid unnecessary charges that could diminish your interest earnings. By carefully managing your account and adhering to the institution’s guidelines, you can ensure that your savings continue to grow at an optimal rate.

In addition to regular deposits and balance management, diversifying your savings strategy can further enhance your financial position. While a money market account is an excellent option for short-term savings goals, it is also wise to consider other investment vehicles for long-term growth. For instance, allocating a portion of your savings to stocks, bonds, or mutual funds can provide higher returns over time, albeit with increased risk. By balancing your portfolio with a mix of low-risk and higher-risk investments, you can create a comprehensive financial strategy that aligns with your individual goals and risk tolerance.

Furthermore, it is important to remain vigilant about market trends and interest rate fluctuations. As economic conditions change, so too can the rates offered by financial institutions. Regularly reviewing your money market account and comparing it with other available options can help you identify opportunities for better returns. If you find that your current account is no longer competitive, consider switching to a different institution that offers a more favorable rate. This proactive approach can significantly impact your overall savings growth.

Lastly, setting specific savings goals can provide motivation and direction for your financial journey. Whether you are saving for a vacation, a down payment on a home, or an emergency fund, having clear objectives can help you stay focused and committed to your savings plan. By utilizing a money market account as part of your broader financial strategy, you can effectively work towards achieving these goals while enjoying the benefits of higher interest rates and liquidity.

In conclusion, adopting strategic saving practices with a money market account can significantly enhance your financial well-being. By making regular deposits, managing your balance, diversifying your investments, staying informed about market trends, and setting clear savings goals, you can maximize the potential of your money market account and secure a brighter financial future.

Future Predictions for Money Market Account Rates in 2025

As we look ahead to 2025, the landscape of money market account rates is poised for potential shifts influenced by various economic factors. Currently, the top offer stands at an impressive 4.85% APY, reflecting a competitive environment that has emerged in response to changing monetary policies and market conditions. However, predicting the trajectory of these rates requires an understanding of the broader economic context, including interest rate trends, inflation expectations, and the overall health of the financial system.

One of the primary drivers of money market account rates is the Federal Reserve’s monetary policy. As of early 2025, the Fed’s stance on interest rates will play a crucial role in determining how financial institutions set their rates. If the Federal Reserve continues to adopt a hawkish approach, raising rates to combat inflation, we may see money market account rates rise further. Conversely, if economic indicators suggest a slowdown or if inflation begins to stabilize, the Fed may opt for a more dovish stance, potentially leading to a decrease in rates. Therefore, monitoring the Fed’s actions and statements will be essential for predicting future money market account rates.

In addition to Federal Reserve policies, inflation expectations will significantly impact money market account rates in 2025. If inflation remains elevated, consumers and investors will seek higher returns to preserve their purchasing power. This demand for better yields could prompt financial institutions to offer more attractive rates on money market accounts. On the other hand, if inflation rates begin to decline, the urgency for higher yields may diminish, leading to a stabilization or even a reduction in money market account rates. Thus, the interplay between inflation and interest rates will be a critical factor to watch in the coming year.

Moreover, the competitive landscape among financial institutions will also shape the future of money market account rates. As banks and credit unions strive to attract deposits, they may engage in rate wars, offering higher yields to entice customers. This competition can lead to favorable outcomes for consumers, as institutions may be willing to increase rates beyond what is dictated by the Federal Reserve. However, if the economic environment becomes more uncertain, institutions may prioritize stability over aggressive rate offerings, which could result in a more conservative approach to rate adjustments.

Furthermore, technological advancements and the rise of fintech companies are transforming the financial services industry. These innovative platforms often provide higher yields on money market accounts due to lower overhead costs and a focus on customer acquisition. As these fintech companies continue to gain traction, traditional banks may feel pressured to enhance their offerings, potentially leading to more competitive rates in the money market space.

In conclusion, while the current top offer of 4.85% APY is promising, the future of money market account rates in 2025 will depend on a confluence of factors, including Federal Reserve policies, inflation trends, competitive dynamics among financial institutions, and the influence of fintech innovations. As consumers navigate this evolving landscape, staying informed about these elements will be crucial for making sound financial decisions. Ultimately, the interplay of these factors will determine whether money market account rates will rise, stabilize, or decline in the coming year, shaping the savings strategies of countless individuals and families.

Q&A

1. **What is the top offer for money market account rates as of January 12, 2025?**

The top offer is 4.85% APY.

2. **What does APY stand for?**

APY stands for Annual Percentage Yield.

3. **Are money market accounts typically insured?**

Yes, money market accounts are typically insured by the FDIC up to $250,000 per depositor.

4. **Can the interest rate on a money market account change?**

Yes, the interest rate on a money market account can change based on market conditions.

5. **What is the minimum deposit required for the top money market account rate?**

Minimum deposit requirements vary by institution; check with the specific bank for details.

6. **Is there a limit on the number of transactions for money market accounts?**

Yes, money market accounts typically limit certain types of transactions to six per month.

7. **What are the benefits of a money market account compared to a regular savings account?**

Money market accounts often offer higher interest rates and may provide check-writing privileges.

Conclusion

As of January 12, 2025, today’s money market account rates are competitive, with the top offer reaching 4.85% APY. This rate reflects a favorable environment for savers seeking higher returns on their deposits, making money market accounts an attractive option for those looking to earn interest while maintaining liquidity.