“Dividend Cut Digs Deep: Materials Stock Tumbles in S&P 500 Rankings”

Introduction

In a surprising turn of events, a prominent materials stock has experienced a significant decline in its S&P 500 rankings following an unexpected dividend cut. This development has sent ripples through the investment community, as shareholders and analysts alike scramble to understand the implications of this financial decision. The dividend cut, often seen as a red flag for investors, has raised concerns about the company’s financial health and future growth prospects. As the market reacts to this news, stakeholders are keenly observing how the company plans to navigate this challenging period and restore investor confidence.

Impact Of Dividend Cuts On Stock Performance

The recent decision by a prominent materials stock to cut its dividend has sent ripples through the financial markets, leading to a significant drop in its ranking within the S&P 500 index. This development has sparked a broader discussion about the impact of dividend cuts on stock performance, particularly within the materials sector. Understanding the implications of such financial maneuvers is crucial for investors seeking to navigate the complexities of the stock market.

Dividend cuts are often perceived as a red flag by investors, signaling potential financial distress or a strategic shift in a company’s priorities. In the case of this materials stock, the decision to reduce its dividend payout was primarily driven by the need to conserve cash amid challenging market conditions. The materials sector, known for its cyclical nature, is particularly susceptible to fluctuations in global demand and commodity prices. Consequently, companies within this sector must carefully manage their financial resources to weather economic downturns.

The immediate impact of a dividend cut is typically a decline in the stock’s price, as investors react to the perceived negative signal. This reaction is often exacerbated by the fact that dividend-paying stocks are generally favored by income-focused investors who rely on regular payouts as a source of income. When a company reduces its dividend, it not only diminishes the immediate income potential for these investors but also raises concerns about the company’s future earnings prospects. As a result, many investors may choose to divest their holdings, leading to increased selling pressure and a subsequent drop in the stock’s market value.

Moreover, the decision to cut dividends can have longer-term implications for a company’s stock performance. A reduced dividend may alter the company’s attractiveness to certain investor segments, particularly those seeking stable and predictable returns. This shift in investor sentiment can lead to a reevaluation of the stock’s valuation, potentially resulting in a lower price-to-earnings ratio and diminished market capitalization. In the context of the S&P 500, where rankings are influenced by market capitalization, a significant decline in a company’s stock price can lead to a drop in its position within the index.

However, it is important to note that not all dividend cuts are indicative of underlying financial weakness. In some cases, companies may choose to reduce dividends as part of a broader strategic realignment, redirecting resources towards growth initiatives or debt reduction. For instance, a materials company facing declining demand for its products may opt to invest in research and development to diversify its offerings or enhance operational efficiency. While such moves may initially unsettle investors, they can ultimately strengthen the company’s competitive position and drive long-term value creation.

In conclusion, the recent dividend cut by a materials stock and its subsequent decline in S&P 500 rankings underscore the complex interplay between dividend policies and stock performance. While dividend cuts are often viewed negatively by the market, they can also reflect strategic decisions aimed at ensuring a company’s long-term viability. Investors must therefore carefully assess the underlying reasons for a dividend cut and consider the broader context in which it occurs. By doing so, they can make more informed decisions and better navigate the challenges and opportunities presented by the ever-evolving financial landscape.

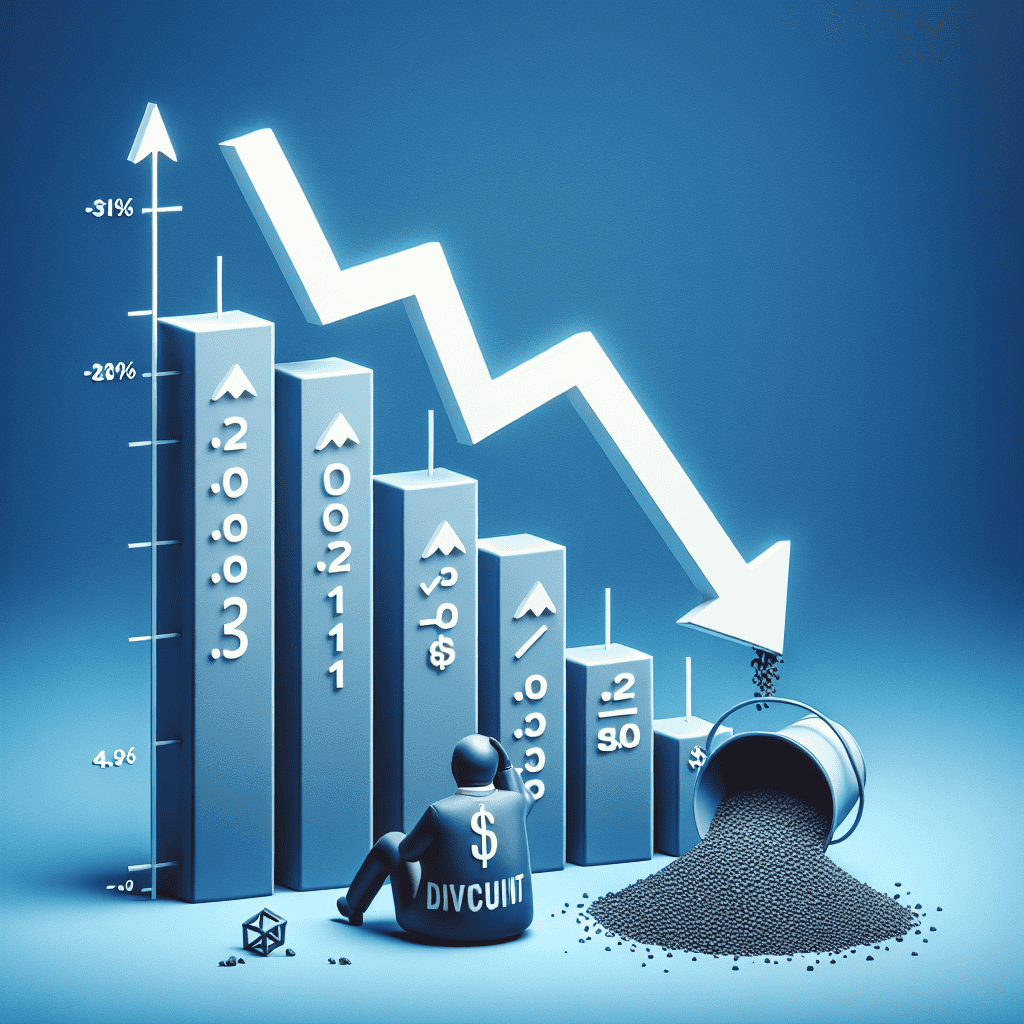

Analyzing The S&P 500 Rankings Shift

In recent weeks, the S&P 500 has witnessed a notable shift in its rankings, primarily driven by the unexpected decline of a prominent materials stock. This decline has been largely attributed to the company’s decision to cut its dividend, a move that has sent ripples through the investment community. As investors and analysts scramble to understand the implications of this development, it is essential to delve into the factors that have contributed to this dramatic change and explore the broader impact on the S&P 500.

The materials sector, known for its cyclical nature, often experiences fluctuations based on economic conditions and market demand. However, the recent downturn of this particular stock was not solely due to external market forces. The company’s decision to reduce its dividend payout was a significant catalyst, signaling potential financial strain or a strategic shift in capital allocation. Dividends are a critical component of shareholder returns, and any alteration in dividend policy can have profound effects on investor sentiment. In this case, the dividend cut was perceived as a red flag, prompting a sell-off that led to the stock’s plummet in the S&P 500 rankings.

Transitioning to the broader implications, the decline of this materials stock has raised questions about the stability and future prospects of the sector as a whole. Investors are now reevaluating their positions, considering whether other companies within the sector might follow suit. This reassessment is compounded by ongoing economic uncertainties, including fluctuating commodity prices and potential shifts in global trade policies. As a result, the materials sector is under increased scrutiny, with market participants closely monitoring earnings reports and management guidance for any signs of similar financial adjustments.

Moreover, the impact of this stock’s decline extends beyond the materials sector, influencing the overall composition of the S&P 500. As one of the key indices representing the U.S. stock market, the S&P 500 is often viewed as a barometer of economic health. Changes in its rankings can affect investor confidence and market dynamics. The removal or demotion of a significant player within the index can lead to a reallocation of capital, as index funds and institutional investors adjust their portfolios to reflect the new rankings. This, in turn, can create volatility and affect the performance of other stocks within the index.

In light of these developments, it is crucial for investors to adopt a proactive approach, staying informed about potential risks and opportunities within the materials sector and the broader market. Diversification remains a key strategy, allowing investors to mitigate risks associated with sector-specific downturns. Additionally, keeping an eye on macroeconomic indicators and geopolitical developments can provide valuable insights into potential market shifts.

In conclusion, the recent decline of a materials stock in the S&P 500 rankings, following a dividend cut, underscores the interconnectedness of corporate decisions, investor sentiment, and market dynamics. While the immediate impact has been felt within the materials sector, the broader implications for the S&P 500 and the investment landscape are significant. As the market continues to evolve, staying informed and adaptable will be essential for investors seeking to navigate these changes effectively.

Investor Reactions To Dividend Reductions

In the ever-evolving landscape of the stock market, investors are constantly on the lookout for signs that might indicate a shift in a company’s financial health. One such indicator is the decision by a company to cut its dividend, a move that often sends ripples through the investor community. Recently, a materials stock within the S&P 500 experienced a significant drop in its rankings following an unexpected dividend reduction. This development has sparked a range of reactions from investors, who are now reassessing their positions and strategies in light of the company’s altered financial outlook.

Dividend cuts are typically perceived as a red flag, signaling potential financial distress or a strategic pivot that necessitates the reallocation of resources. In this particular case, the materials company cited the need to preserve cash and reinvest in core operations as the primary reasons for the dividend reduction. While such a rationale might be understandable from a business perspective, it has nonetheless led to a wave of concern among investors who rely on dividends as a source of steady income. Consequently, the company’s stock has suffered a decline, reflecting the market’s apprehension about its future performance.

Investors’ reactions to dividend cuts can vary widely, depending on their individual investment goals and risk tolerance. For income-focused investors, a dividend reduction can be particularly unsettling, as it directly impacts their expected cash flow. These investors may choose to divest from the stock in search of more reliable income-generating opportunities. On the other hand, some investors may view the dividend cut as a necessary step for the company to strengthen its balance sheet and position itself for long-term growth. These individuals might opt to hold onto their shares, anticipating a potential rebound in the company’s fortunes.

Moreover, the broader market context can also influence investor sentiment. In a volatile economic environment, where uncertainty looms large, any indication of financial instability can exacerbate fears and lead to more pronounced market reactions. In this instance, the materials sector has been facing headwinds due to fluctuating commodity prices and supply chain disruptions, which have compounded the challenges for companies operating within this space. As a result, investors are scrutinizing the sector more closely, and any negative news, such as a dividend cut, is likely to be met with heightened sensitivity.

In addition to individual investor responses, institutional investors and analysts play a crucial role in shaping market perceptions. Their assessments and recommendations can significantly impact a stock’s performance following a dividend cut. Analysts may revise their ratings and price targets based on the company’s revised financial outlook, influencing the decisions of other market participants. Institutional investors, with their substantial holdings, can also sway market sentiment through their buying or selling actions.

In conclusion, the recent dividend cut by this materials stock has triggered a complex array of reactions from investors, reflecting the multifaceted nature of investment decision-making. While some investors may choose to exit their positions in search of more stable opportunities, others may see potential in the company’s strategic shift and opt to remain invested. Ultimately, the company’s ability to navigate its current challenges and deliver on its long-term objectives will be crucial in determining whether it can regain investor confidence and improve its standing within the S&P 500. As the situation unfolds, investors will continue to monitor developments closely, weighing the risks and rewards associated with their investment choices.

Long-Term Implications For Materials Stocks

The recent decline in the rankings of a prominent materials stock within the S&P 500 has sent ripples through the investment community, particularly following the company’s unexpected decision to cut its dividend. This move has raised concerns about the long-term implications for materials stocks, prompting investors to reassess their strategies in this sector. As the materials industry is inherently tied to economic cycles, understanding the broader impact of such a decision is crucial for stakeholders.

To begin with, the materials sector is often seen as a bellwether for economic health, given its reliance on industries such as construction, manufacturing, and infrastructure development. When a leading company within this sector decides to reduce its dividend, it can signal underlying financial stress or a strategic pivot to conserve cash. This decision, therefore, not only affects the company’s stock price but also influences investor sentiment across the sector. The immediate consequence is a reevaluation of risk, as dividend cuts are typically viewed as a red flag, suggesting potential challenges in maintaining profitability or cash flow.

Moreover, the implications of this dividend cut extend beyond immediate market reactions. For long-term investors, dividends are a critical component of total returns, providing a steady income stream and a measure of financial health. A reduction in dividends can lead to a reassessment of the stock’s valuation, as investors may demand a higher risk premium. This shift can result in a lower stock price, further affecting the company’s market capitalization and its standing within indices like the S&P 500. Consequently, other companies in the materials sector may face increased scrutiny, as investors become more cautious and selective in their investment choices.

In addition to affecting investor sentiment, the dividend cut may also have strategic implications for the company itself. By conserving cash, the company might be positioning itself to weather economic uncertainties or to invest in growth opportunities that could enhance its competitive position in the long run. However, this strategy carries its own risks, as it may signal to the market that the company is facing challenges that require immediate attention. The balance between maintaining investor confidence and pursuing long-term growth becomes a delicate act, with significant implications for the company’s future performance.

Furthermore, the broader materials sector may experience shifts in capital allocation as a result of this development. Investors seeking stability and income may redirect their investments towards companies with a more consistent dividend history or those perceived as having stronger financial fundamentals. This reallocation of capital can lead to increased volatility within the sector, as companies vie for investor attention and confidence. In turn, this could spur innovation and efficiency improvements, as companies strive to differentiate themselves and demonstrate their resilience in a competitive market.

In conclusion, the recent dividend cut by a leading materials stock has far-reaching implications for the sector as a whole. While the immediate impact is evident in the company’s declining S&P 500 ranking and stock price, the long-term effects are more nuanced. Investors must carefully consider the balance between risk and reward, as well as the strategic decisions made by companies in response to economic challenges. As the materials sector continues to evolve, understanding these dynamics will be essential for making informed investment decisions and navigating the complexities of this critical industry.

Strategies For Navigating Dividend Cuts

In the ever-evolving landscape of the stock market, investors are constantly on the lookout for signs that could indicate shifts in the financial health of companies. One such indicator is the decision by a company to cut its dividend, a move that often sends ripples through the market and can significantly impact investor sentiment. Recently, a materials stock within the S&P 500 experienced a sharp decline in its rankings following an unexpected dividend cut, prompting investors to reassess their strategies in navigating such scenarios.

Dividend cuts can be a red flag for investors, signaling potential financial distress or a strategic shift in a company’s priorities. When a company reduces its dividend, it may be reallocating resources to address pressing financial obligations, invest in growth opportunities, or simply conserve cash in uncertain economic times. For investors, this can be a double-edged sword. On one hand, it may indicate that the company is taking prudent steps to ensure long-term stability. On the other hand, it can also suggest underlying issues that could affect future profitability.

In light of this recent development, it is crucial for investors to adopt strategies that can help them navigate the complexities of dividend cuts. First and foremost, conducting thorough research is essential. Investors should delve into the reasons behind the dividend cut, examining the company’s financial statements, management commentary, and industry trends. Understanding the context can provide valuable insights into whether the cut is a temporary measure or indicative of deeper problems.

Moreover, diversification remains a key strategy in mitigating the risks associated with dividend cuts. By spreading investments across various sectors and asset classes, investors can reduce their exposure to any single company’s financial decisions. This approach not only helps in cushioning the impact of a dividend cut but also enhances the potential for overall portfolio growth.

Additionally, investors should consider the long-term implications of a dividend cut. While the immediate reaction may be negative, it is important to assess whether the company’s strategic realignment could lead to improved financial health and growth prospects in the future. Engaging with financial advisors or utilizing analytical tools can aid in evaluating the potential outcomes and making informed decisions.

Furthermore, maintaining a balanced perspective is crucial. While dividend cuts can be unsettling, they are not uncommon in the corporate world. Companies may face cyclical challenges or external pressures that necessitate such measures. Therefore, investors should avoid making hasty decisions based solely on the announcement of a dividend cut. Instead, they should weigh the broader economic environment, industry dynamics, and the company’s competitive position.

In conclusion, the recent decline of a materials stock in the S&P 500 rankings following a dividend cut serves as a reminder of the importance of strategic planning in investment portfolios. By conducting thorough research, diversifying investments, considering long-term implications, and maintaining a balanced perspective, investors can navigate the challenges posed by dividend cuts more effectively. While these events can be unsettling, they also present opportunities for investors to reassess their strategies and align their portfolios with their financial goals. As the market continues to evolve, staying informed and adaptable will be key to successfully managing the complexities of dividend cuts and other market fluctuations.

Comparing Dividend Policies Across Sectors

In the ever-evolving landscape of the stock market, dividend policies play a crucial role in shaping investor sentiment and influencing stock rankings. Recently, a notable materials stock experienced a significant drop in its S&P 500 rankings following a decision to cut its dividend. This development has sparked discussions among investors and analysts, prompting a closer examination of dividend policies across various sectors.

To understand the implications of this dividend cut, it is essential to first consider the role dividends play in the investment strategies of many market participants. Dividends are a portion of a company’s earnings distributed to shareholders, often serving as a signal of financial health and stability. For income-focused investors, dividends provide a steady stream of income, making them an attractive feature of certain stocks. Consequently, when a company decides to reduce or eliminate its dividend, it can lead to a reassessment of its financial standing and future prospects.

In the case of the materials stock in question, the decision to cut its dividend was driven by a combination of internal and external factors. Internally, the company faced rising operational costs and a challenging economic environment, which put pressure on its profit margins. Externally, fluctuations in commodity prices and global supply chain disruptions further exacerbated the situation. As a result, the company opted to preserve cash by reducing its dividend payout, a move that was met with disappointment by investors who had come to rely on the stock for its consistent dividend yield.

This scenario is not unique to the materials sector. Across different industries, companies periodically adjust their dividend policies in response to changing market conditions. For instance, in the technology sector, where growth and reinvestment are often prioritized over immediate returns to shareholders, dividend cuts or suspensions are not uncommon. Conversely, in more stable sectors such as utilities and consumer staples, companies tend to maintain steady or even increasing dividends, reflecting their predictable cash flows and lower exposure to economic volatility.

Comparing dividend policies across sectors reveals distinct patterns and strategies. In the financial sector, for example, banks and insurance companies often distribute a significant portion of their earnings as dividends, reflecting their mature business models and regulatory requirements. Meanwhile, in the healthcare sector, companies may adopt a more conservative approach, balancing dividend payments with the need to invest in research and development.

The recent dividend cut by the materials stock serves as a reminder of the dynamic nature of dividend policies and their impact on stock performance. Investors must remain vigilant, considering not only the current dividend yield but also the sustainability of such payouts in the face of economic uncertainties. Moreover, understanding the broader sectoral trends can provide valuable insights into the potential risks and rewards associated with dividend-paying stocks.

In conclusion, while the materials stock’s decline in S&P 500 rankings highlights the immediate consequences of a dividend cut, it also underscores the importance of a comprehensive analysis of dividend policies across sectors. By examining the factors that drive these decisions and their implications for investors, one can better navigate the complexities of the stock market and make informed investment choices. As the economic landscape continues to evolve, staying attuned to these developments will be crucial for investors seeking to optimize their portfolios and achieve their financial goals.

Future Outlook For The Materials Industry

The materials industry, a cornerstone of global economic infrastructure, has recently faced significant challenges, as evidenced by the dramatic decline of a prominent materials stock in the S&P 500 rankings following a substantial dividend cut. This development has sparked widespread concern among investors and industry analysts, prompting a closer examination of the future outlook for the materials sector. As we delve into the factors contributing to this downturn, it is essential to consider the broader implications for the industry and the potential strategies that companies might adopt to navigate these turbulent times.

To begin with, the materials industry is inherently cyclical, heavily influenced by macroeconomic trends and global demand fluctuations. The recent dividend cut by the aforementioned materials company can be attributed to a confluence of factors, including rising production costs, supply chain disruptions, and a slowdown in key markets. These challenges have been exacerbated by geopolitical tensions and trade uncertainties, which have further strained the industry’s ability to maintain profitability. Consequently, companies within the sector are under increasing pressure to reassess their financial strategies and operational efficiencies to remain competitive.

In light of these challenges, it is crucial to explore the potential avenues for growth and resilience within the materials industry. One promising area is the increasing emphasis on sustainability and environmental responsibility. As global awareness of climate change and resource depletion intensifies, there is a growing demand for materials that are not only efficient but also environmentally friendly. Companies that invest in sustainable practices and innovative technologies are likely to gain a competitive edge, as they align with the evolving preferences of consumers and regulatory bodies. This shift towards sustainability presents an opportunity for the materials industry to reinvent itself and drive long-term growth.

Moreover, technological advancements are poised to play a pivotal role in shaping the future of the materials sector. The integration of digital technologies, such as artificial intelligence and the Internet of Things, can enhance operational efficiencies, optimize supply chains, and improve decision-making processes. By leveraging these technologies, companies can better anticipate market trends, reduce waste, and increase productivity. This digital transformation is expected to be a key driver of innovation and competitiveness in the industry, enabling companies to adapt to changing market dynamics more effectively.

Furthermore, strategic partnerships and collaborations are likely to become increasingly important as companies seek to mitigate risks and capitalize on new opportunities. By forming alliances with other industry players, research institutions, and technology providers, materials companies can pool resources, share expertise, and accelerate the development of new products and solutions. These collaborative efforts can help companies overcome the challenges posed by market volatility and position themselves for future success.

In conclusion, while the recent decline of a major materials stock in the S&P 500 rankings highlights the current challenges facing the industry, it also underscores the need for strategic adaptation and innovation. By embracing sustainability, harnessing technological advancements, and fostering strategic partnerships, the materials sector can navigate the complexities of the modern economic landscape and emerge stronger. As the industry continues to evolve, stakeholders must remain vigilant and proactive in identifying and seizing opportunities that will drive growth and resilience in the years to come.

Q&A

1. **What is the name of the materials stock that plummeted in S&P 500 rankings?**

– The specific name of the stock is not provided in the prompt.

2. **Why did the materials stock plummet in the S&P 500 rankings?**

– The stock plummeted due to a dividend cut.

3. **What is a dividend cut?**

– A dividend cut occurs when a company reduces or eliminates the dividend payments it distributes to shareholders.

4. **How does a dividend cut affect a company’s stock price?**

– A dividend cut often leads to a decrease in stock price as it may signal financial trouble or a shift in company strategy, reducing investor confidence.

5. **What is the S&P 500?**

– The S&P 500 is a stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the United States.

6. **Why is being part of the S&P 500 significant for a company?**

– Being part of the S&P 500 is significant because it reflects a company’s size, stability, and importance in the market, often leading to increased visibility and investment.

7. **What might a company do after a dividend cut to regain investor confidence?**

– A company might focus on improving financial performance, restructuring operations, or communicating a clear strategic plan to regain investor confidence.

Conclusion

The materials stock’s significant drop in the S&P 500 rankings following a dividend cut highlights investor sensitivity to changes in dividend policies, which are often seen as indicators of a company’s financial health and future prospects. The dividend cut likely signals underlying financial challenges or strategic shifts within the company, prompting investors to reassess their positions and leading to a decline in stock value. This situation underscores the importance of maintaining investor confidence through stable or growing dividends, as any reduction can lead to negative market reactions and impact a company’s standing in major indices like the S&P 500.