“Tesla’s Triumph: Short Sellers Stung by $4 Billion Blow as Stock Soars Post-Earnings”

Introduction

Tesla short sellers have encountered significant financial setbacks, facing losses exceeding $4 billion following a substantial surge in the company’s stock price post-earnings announcement. This development highlights the volatile nature of betting against Tesla, a company known for its unpredictable market movements and strong investor sentiment. The recent earnings report, which exceeded market expectations, fueled a rally in Tesla’s stock, catching short sellers off guard and leading to a rapid escalation in their financial liabilities. This scenario underscores the inherent risks associated with short selling, particularly in the context of high-profile, innovative companies like Tesla that continue to defy conventional market predictions.

Impact Of Tesla’s Earnings On Short Sellers

Tesla’s recent earnings report has sent ripples through the financial markets, particularly impacting those who have bet against the electric vehicle giant. Short sellers, who profit when a stock’s price declines, have faced significant losses as Tesla’s stock surged following its earnings announcement. The company’s robust financial performance and optimistic future outlook have contributed to a dramatic increase in its stock price, leaving short sellers in a precarious position.

The earnings report revealed that Tesla had exceeded market expectations, showcasing strong revenue growth and improved profit margins. This positive financial performance was driven by increased vehicle deliveries, advancements in battery technology, and expansion into new markets. As a result, investor confidence in Tesla’s long-term growth prospects has been bolstered, leading to a surge in the stock price. Consequently, short sellers, who had anticipated a decline in Tesla’s value, have found themselves facing substantial losses.

In the wake of the earnings announcement, Tesla’s stock price experienced a significant upward trajectory, exacerbating the financial strain on short sellers. The rapid appreciation in value has forced many to cover their positions, buying back shares at higher prices to mitigate further losses. This phenomenon, known as a short squeeze, has intensified the upward pressure on Tesla’s stock, creating a self-reinforcing cycle that has further amplified the losses for those betting against the company.

Moreover, the broader market sentiment towards Tesla has shifted, with many investors viewing the company as a leader in the transition to sustainable energy. This perception has been reinforced by Tesla’s continued innovation in electric vehicles and renewable energy solutions, positioning it as a key player in the global shift towards sustainability. As a result, the stock has attracted a new wave of investors, further driving up its price and compounding the challenges faced by short sellers.

In addition to the immediate financial impact, the situation has broader implications for the practice of short selling itself. The significant losses incurred by those betting against Tesla have sparked a debate about the risks and ethics of short selling, particularly in the context of companies that are perceived as driving positive societal change. Critics argue that short selling can undermine the growth of innovative companies by creating downward pressure on their stock prices, potentially stifling investment and innovation.

On the other hand, proponents of short selling contend that it plays a vital role in maintaining market efficiency by identifying overvalued stocks and providing liquidity. They argue that the losses faced by Tesla short sellers are a natural consequence of market dynamics and should not be viewed as a failure of the practice itself. Instead, they suggest that it highlights the importance of thorough research and risk management when engaging in short selling.

As Tesla continues to defy expectations and solidify its position as a leader in the electric vehicle market, the challenges faced by short sellers serve as a cautionary tale for those looking to bet against the company. The recent surge in Tesla’s stock price underscores the importance of understanding market trends and the potential risks associated with short selling. Ultimately, the situation highlights the dynamic nature of financial markets and the need for investors to remain adaptable in the face of changing circumstances.

Analyzing The $4 Billion Loss For Tesla Short Sellers

In the wake of Tesla’s recent earnings report, short sellers have found themselves grappling with significant financial losses, amounting to over $4 billion. This development has sent ripples through the financial markets, highlighting the inherent risks associated with short selling, particularly in the volatile landscape of technology and automotive stocks. The surge in Tesla’s stock price following the earnings announcement has underscored the challenges faced by investors betting against the electric vehicle giant.

To understand the magnitude of this loss, it is essential to delve into the mechanics of short selling. Short sellers borrow shares of a stock they believe will decrease in value, sell them at the current market price, and aim to repurchase them at a lower price to return to the lender, pocketing the difference. However, when the stock price rises instead of falling, short sellers are forced to buy back the shares at a higher price, resulting in a loss. In Tesla’s case, the post-earnings stock surge caught many short sellers off guard, leading to substantial financial repercussions.

The recent earnings report from Tesla exceeded market expectations, showcasing robust revenue growth and improved profit margins. This positive performance was driven by increased vehicle deliveries, advancements in battery technology, and expansion into new markets. Consequently, investor confidence soared, propelling the stock price upward. For short sellers, this unexpected turn of events translated into a scramble to cover their positions, further fueling the stock’s upward momentum.

Moreover, the broader market context has played a crucial role in exacerbating the losses for Tesla short sellers. The electric vehicle sector has been experiencing a renaissance, with growing consumer demand and supportive government policies driving stock prices higher. Tesla, as a leader in this space, has been a primary beneficiary of this trend. Short sellers, who anticipated a market correction or slowdown, found themselves on the wrong side of this bullish sentiment.

In addition to market dynamics, the influence of retail investors cannot be overlooked. Platforms like Reddit’s WallStreetBets have empowered individual investors to collectively target heavily shorted stocks, creating short squeezes that drive prices even higher. Tesla, with its high-profile status and significant short interest, has been a frequent target of such coordinated efforts. This phenomenon has added another layer of complexity for short sellers, who must now contend with both institutional and retail forces.

While the $4 billion loss is staggering, it serves as a cautionary tale for investors considering short selling as a strategy. The volatility and unpredictability of stock markets, especially in sectors undergoing rapid transformation, can lead to substantial financial risks. For Tesla short sellers, the recent events underscore the importance of thorough research, risk management, and the ability to adapt to changing market conditions.

In conclusion, the $4 billion loss faced by Tesla short sellers in the wake of the company’s post-earnings stock surge highlights the challenges and risks inherent in short selling. The combination of strong earnings performance, favorable market trends, and the influence of retail investors has created a perfect storm for those betting against Tesla. As the electric vehicle market continues to evolve, investors must remain vigilant and adaptable, recognizing that the dynamics of short selling can lead to significant financial consequences.

Tesla’s Stock Surge: A Short Seller’s Nightmare

Tesla’s recent financial performance has sent shockwaves through the investment community, particularly among short sellers who have faced significant losses. Following the release of its latest earnings report, Tesla’s stock experienced a substantial surge, leading to over $4 billion in losses for those betting against the company. This development underscores the inherent risks associated with short selling, especially in the volatile world of technology and innovation-driven stocks.

The electric vehicle giant’s earnings report exceeded market expectations, showcasing robust revenue growth and improved profit margins. This positive financial performance was driven by increased vehicle deliveries, expansion into new markets, and advancements in battery technology. As a result, investor confidence in Tesla’s long-term growth prospects has been bolstered, prompting a rally in its stock price. Consequently, short sellers, who had anticipated a decline in Tesla’s valuation, found themselves in a precarious position.

Short selling involves borrowing shares of a stock and selling them with the hope of repurchasing them at a lower price, thereby profiting from the difference. However, this strategy carries significant risk, as potential losses are theoretically unlimited if the stock price rises instead of falls. In Tesla’s case, the unexpected surge in stock price has forced short sellers to cover their positions at a loss, contributing to the staggering $4 billion in losses.

The situation highlights the challenges faced by short sellers in accurately predicting market movements, particularly in the case of a company like Tesla, which operates at the intersection of technology, sustainability, and automotive innovation. Tesla’s ability to consistently defy skeptics and deliver strong financial results has made it a formidable opponent for those betting against it. Moreover, the company’s charismatic CEO, Elon Musk, has a track record of making bold promises and achieving ambitious goals, further complicating the task of short sellers.

In addition to the financial implications, the recent developments have sparked a broader discussion about the role of short selling in the stock market. Proponents argue that short selling provides liquidity and helps to identify overvalued stocks, thereby contributing to market efficiency. Critics, however, contend that it can lead to excessive volatility and may be used to manipulate stock prices. The Tesla case serves as a reminder of the delicate balance between these perspectives and the need for careful consideration of the potential consequences of short selling.

As Tesla continues to innovate and expand its market presence, the company’s stock is likely to remain a focal point for both investors and short sellers. The recent surge in stock price, while painful for those betting against it, underscores the importance of thorough research and risk management in investment strategies. For short sellers, the lesson is clear: betting against a company with a track record of defying expectations and a strong growth trajectory can be a perilous endeavor.

In conclusion, Tesla’s post-earnings stock surge has resulted in significant losses for short sellers, highlighting the risks associated with this investment strategy. The company’s strong financial performance and continued innovation have reinforced investor confidence, making it a challenging target for those seeking to profit from a decline in its stock price. As the debate over the role of short selling in the market continues, the Tesla case serves as a poignant example of the complexities and potential pitfalls involved in this high-stakes financial maneuver.

Lessons From Tesla’s Post-Earnings Stock Performance

Tesla’s recent post-earnings stock surge has left short sellers facing significant financial losses, estimated at over $4 billion. This development offers several lessons for investors and market analysts alike, highlighting the inherent risks and potential rewards associated with short selling, as well as the unpredictable nature of stock market movements. Understanding these dynamics is crucial for anyone involved in financial markets, whether they are seasoned investors or newcomers.

To begin with, the substantial losses incurred by Tesla short sellers underscore the volatility that can accompany high-profile stocks. Tesla, known for its innovative approach to the automotive industry and its charismatic CEO Elon Musk, has long been a focal point for both bullish investors and skeptical short sellers. The company’s ability to consistently defy expectations, whether through groundbreaking technological advancements or unexpected financial results, makes it a challenging target for those betting against its success. This unpredictability is a key factor that short sellers must consider, as it can lead to rapid and significant financial repercussions.

Moreover, the recent surge in Tesla’s stock price following its earnings report illustrates the impact that corporate performance and market sentiment can have on stock valuations. Tesla’s earnings exceeded analysts’ expectations, driven by strong sales figures and improved profit margins. This positive financial performance not only bolstered investor confidence but also triggered a wave of buying activity, further driving up the stock price. For short sellers, this scenario highlights the importance of closely monitoring a company’s financial health and market position, as well as the broader economic environment, to anticipate potential shifts in stock value.

In addition to financial performance, the role of market sentiment cannot be overstated. Tesla’s brand and its leadership have cultivated a dedicated following, which can amplify stock movements in response to news and events. This phenomenon, often referred to as the “Tesla effect,” demonstrates how investor sentiment can sometimes outweigh traditional financial metrics in influencing stock prices. Short sellers, therefore, must be acutely aware of the narrative surrounding a company and how it might sway investor behavior, potentially leading to unexpected market outcomes.

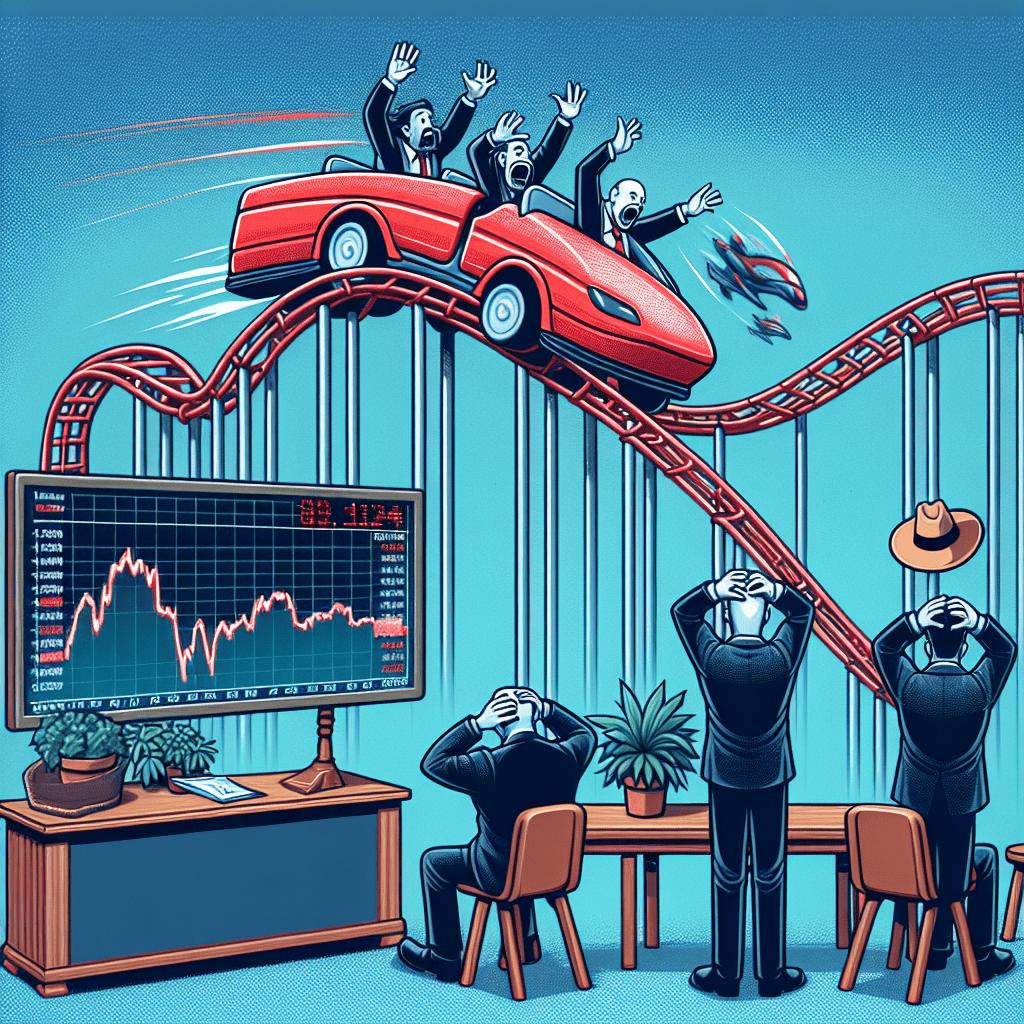

Furthermore, the experience of Tesla short sellers serves as a reminder of the importance of risk management in investment strategies. Short selling, by its nature, involves significant risk, as potential losses are theoretically unlimited. Investors engaging in this practice must employ robust risk management techniques, such as setting stop-loss orders or diversifying their portfolios, to mitigate potential losses. The recent events surrounding Tesla’s stock emphasize the need for caution and preparedness when engaging in high-risk investment activities.

Finally, the situation with Tesla highlights the broader implications of technological innovation and market disruption. As a leader in electric vehicles and renewable energy, Tesla represents a shift in the automotive industry that has far-reaching consequences for traditional automakers and investors alike. The company’s success challenges conventional wisdom and compels market participants to reassess their assumptions about industry dynamics and future growth prospects. This broader context is essential for understanding the forces at play in Tesla’s stock performance and the challenges faced by those who bet against it.

In conclusion, the significant losses experienced by Tesla short sellers following the company’s post-earnings stock surge offer valuable insights into the complexities of stock market investing. By examining the factors that contributed to this outcome, investors can better appreciate the risks and opportunities inherent in high-profile stocks, the influence of market sentiment, and the critical importance of effective risk management strategies.

The Risks Of Short Selling Tesla: A Case Study

In the volatile world of stock trading, short selling has always been a high-risk, high-reward strategy. This approach involves borrowing shares of a stock and selling them with the hope of buying them back at a lower price, thus profiting from the difference. However, when the market moves against short sellers, the financial repercussions can be severe. A recent case in point is the significant losses faced by those who bet against Tesla, Inc. Following the company’s latest earnings report, Tesla’s stock experienced a substantial surge, leading to over $4 billion in losses for short sellers. This scenario underscores the inherent risks associated with short selling, particularly in the context of a company as dynamic and unpredictable as Tesla.

Tesla, led by the enigmatic Elon Musk, has long been a focal point for both investors and short sellers. The company’s innovative approach to electric vehicles and renewable energy has attracted a fervent following, while its volatile stock price has made it a popular target for short sellers. However, the recent post-earnings rally serves as a stark reminder of the potential pitfalls of betting against a company with such a strong market presence and growth potential. The earnings report, which exceeded analysts’ expectations, highlighted Tesla’s robust financial performance and strategic advancements, including increased production capacity and expansion into new markets. These positive developments fueled investor optimism, driving the stock price upward and catching short sellers off guard.

The losses incurred by Tesla short sellers illustrate the broader risks associated with short selling, particularly in a market characterized by rapid technological advancements and shifting consumer preferences. Short selling inherently involves a high degree of speculation, as it requires accurately predicting not only a company’s future performance but also broader market trends. In the case of Tesla, short sellers may have underestimated the company’s ability to innovate and adapt, as well as the strong brand loyalty it commands among consumers. Furthermore, the unpredictable nature of external factors, such as regulatory changes and economic conditions, can further complicate the short selling strategy.

Moreover, the financial implications of short selling extend beyond the immediate losses incurred. Short sellers are also subject to margin calls, which occur when the value of the borrowed stock rises, requiring them to deposit additional funds to maintain their positions. This can lead to a vicious cycle, as rising stock prices force short sellers to cover their positions by buying back shares at higher prices, further driving up the stock price and exacerbating their losses. In the case of Tesla, the post-earnings surge likely triggered a wave of margin calls, compounding the financial strain on short sellers.

In light of these challenges, the case of Tesla serves as a cautionary tale for investors considering short selling as a strategy. While the potential for profit is undeniable, the risks are equally significant, particularly when dealing with a company that defies conventional market expectations. Investors must carefully weigh these risks against potential rewards and consider alternative strategies that may offer more predictable outcomes. As the financial landscape continues to evolve, the lessons learned from Tesla’s recent stock surge will undoubtedly inform future approaches to short selling and investment strategies more broadly.

How Tesla’s Earnings Report Affected Market Dynamics

Tesla’s recent earnings report has sent ripples through the financial markets, significantly impacting both investors and short sellers. The electric vehicle giant’s performance exceeded Wall Street’s expectations, leading to a substantial surge in its stock price. This unexpected upswing has resulted in considerable losses for short sellers, who collectively face over $4 billion in losses. The dynamics of the market have shifted dramatically, illustrating the volatile nature of investing in high-profile technology companies.

The earnings report revealed that Tesla had not only met but surpassed its projected revenue and profit margins. This achievement was largely attributed to increased vehicle deliveries and improved operational efficiencies. As a result, investor confidence soared, driving the stock price upward. The market’s reaction was swift and pronounced, with Tesla’s shares experiencing a significant rally. This surge caught many short sellers off guard, as they had bet against the company’s success, anticipating a decline in stock value.

Short selling, a strategy where investors borrow shares to sell them with the hope of buying them back at a lower price, can be highly lucrative but also fraught with risk. In Tesla’s case, the risk materialized into substantial financial losses for those who had underestimated the company’s potential. The $4 billion loss underscores the inherent dangers of short selling, particularly in a market characterized by rapid technological advancements and unpredictable consumer trends.

Moreover, the impact of Tesla’s earnings report extends beyond the immediate financial implications for short sellers. It has also influenced broader market dynamics, affecting investor sentiment and the valuation of other companies within the electric vehicle sector. As Tesla continues to demonstrate its ability to innovate and expand its market share, other automakers are under pressure to accelerate their own electric vehicle initiatives. This competitive landscape is reshaping the automotive industry, prompting traditional manufacturers to rethink their strategies and invest heavily in electric technology.

In addition to affecting the automotive sector, Tesla’s performance has implications for the technology and energy markets. The company’s advancements in battery technology and renewable energy solutions are setting new standards, encouraging further investment and research in these areas. As a result, companies involved in the production of batteries, solar panels, and related technologies are experiencing increased interest from investors seeking to capitalize on the growing demand for sustainable energy solutions.

Furthermore, Tesla’s success story serves as a reminder of the importance of innovation and adaptability in today’s fast-paced market environment. Companies that can effectively leverage technology to meet evolving consumer needs are more likely to thrive, while those that fail to do so may struggle to maintain their competitive edge. This dynamic is evident not only in the automotive industry but across various sectors, as businesses strive to remain relevant in an increasingly digital and environmentally conscious world.

In conclusion, Tesla’s recent earnings report has had a profound impact on market dynamics, highlighting the risks and rewards associated with investing in high-growth companies. The significant losses faced by short sellers serve as a cautionary tale, emphasizing the need for careful analysis and strategic decision-making in the ever-changing financial landscape. As Tesla continues to push the boundaries of innovation, its influence on the market is likely to persist, shaping the future of the automotive, technology, and energy sectors.

Strategies For Short Sellers In Volatile Markets Like Tesla

In the ever-evolving landscape of financial markets, short sellers often find themselves navigating turbulent waters, particularly when dealing with volatile stocks like Tesla. Recently, Tesla short sellers have faced significant challenges, culminating in a staggering loss of over $4 billion following a post-earnings stock surge. This scenario underscores the inherent risks associated with short selling, especially in markets characterized by high volatility and unpredictable price movements. Consequently, it is imperative for short sellers to adopt robust strategies to mitigate potential losses and capitalize on market opportunities.

To begin with, understanding the fundamental and technical aspects of a stock is crucial for short sellers. In the case of Tesla, the company’s innovative approach to electric vehicles, coupled with its charismatic leadership and ambitious growth plans, often results in significant market speculation. Short sellers must, therefore, conduct thorough research and analysis to discern whether the stock is overvalued or if there are underlying issues that could lead to a price decline. This involves scrutinizing financial statements, monitoring industry trends, and keeping abreast of any news that could impact the company’s performance.

Moreover, timing plays a pivotal role in short selling strategies. Given the volatile nature of stocks like Tesla, short sellers must be adept at identifying the right entry and exit points. This requires a keen understanding of market sentiment and the ability to anticipate potential catalysts that could trigger a price movement. Utilizing technical analysis tools, such as moving averages and relative strength indicators, can aid in making informed decisions about when to initiate or close a short position.

In addition to timing, risk management is a critical component of successful short selling. The potential for unlimited losses necessitates the implementation of protective measures, such as stop-loss orders, to limit exposure. Diversification is another effective strategy, as it allows short sellers to spread their risk across multiple positions rather than concentrating on a single stock. By doing so, they can cushion the impact of adverse price movements in any one security.

Furthermore, maintaining a flexible approach is essential in volatile markets. Short sellers must be prepared to adapt their strategies in response to changing market conditions. This may involve adjusting position sizes, altering stop-loss levels, or even reversing positions if the market dynamics shift unexpectedly. Flexibility enables short sellers to respond swiftly to new information and capitalize on emerging opportunities.

Additionally, leveraging options can provide short sellers with an alternative means of managing risk. By purchasing put options, they can gain downside exposure while limiting potential losses to the premium paid for the option. This strategy offers a more controlled risk profile compared to traditional short selling, making it an attractive option for those operating in volatile markets.

Finally, it is important for short sellers to maintain a disciplined mindset and avoid emotional decision-making. The psychological pressures of short selling, particularly in a stock as polarizing as Tesla, can lead to impulsive actions that exacerbate losses. By adhering to a well-defined strategy and remaining focused on their analysis, short sellers can navigate the complexities of volatile markets with greater confidence.

In conclusion, while the recent $4 billion loss faced by Tesla short sellers highlights the challenges inherent in short selling, it also underscores the importance of employing effective strategies. By conducting thorough research, timing their trades carefully, managing risk prudently, maintaining flexibility, leveraging options, and staying disciplined, short sellers can better position themselves to succeed in volatile markets like Tesla.

Q&A

1. **What caused Tesla short sellers to face significant losses?**

Tesla’s stock surged following a positive earnings report, leading to substantial losses for short sellers.

2. **How much did Tesla short sellers lose?**

Tesla short sellers faced losses exceeding $4 billion.

3. **What was the catalyst for the stock surge?**

The stock surge was primarily driven by Tesla’s strong earnings performance.

4. **How did Tesla’s earnings report impact investor sentiment?**

The positive earnings report boosted investor confidence, leading to increased buying activity.

5. **What is short selling?**

Short selling involves borrowing and selling a stock with the expectation of buying it back at a lower price to make a profit.

6. **Why do investors short sell stocks like Tesla?**

Investors short sell stocks like Tesla if they anticipate the stock price will decline, allowing them to profit from the difference.

7. **What are the risks associated with short selling?**

Short selling carries the risk of unlimited losses if the stock price rises instead of falling.

Conclusion

Tesla short sellers faced significant financial losses exceeding $4 billion following a surge in the company’s stock price after its earnings report. This situation underscores the inherent risks associated with short selling, particularly in volatile and high-profile stocks like Tesla. The post-earnings rally likely caught many short sellers off guard, leading to substantial losses as they were forced to cover their positions at higher prices. This event highlights the potential for rapid market movements to impact short sellers and serves as a reminder of the unpredictable nature of stock markets, especially in the context of companies with strong investor interest and media attention.