“Spirit Airlines Shares Plummet: Turbulence Ahead with Bankruptcy Clouds Looming”

Introduction

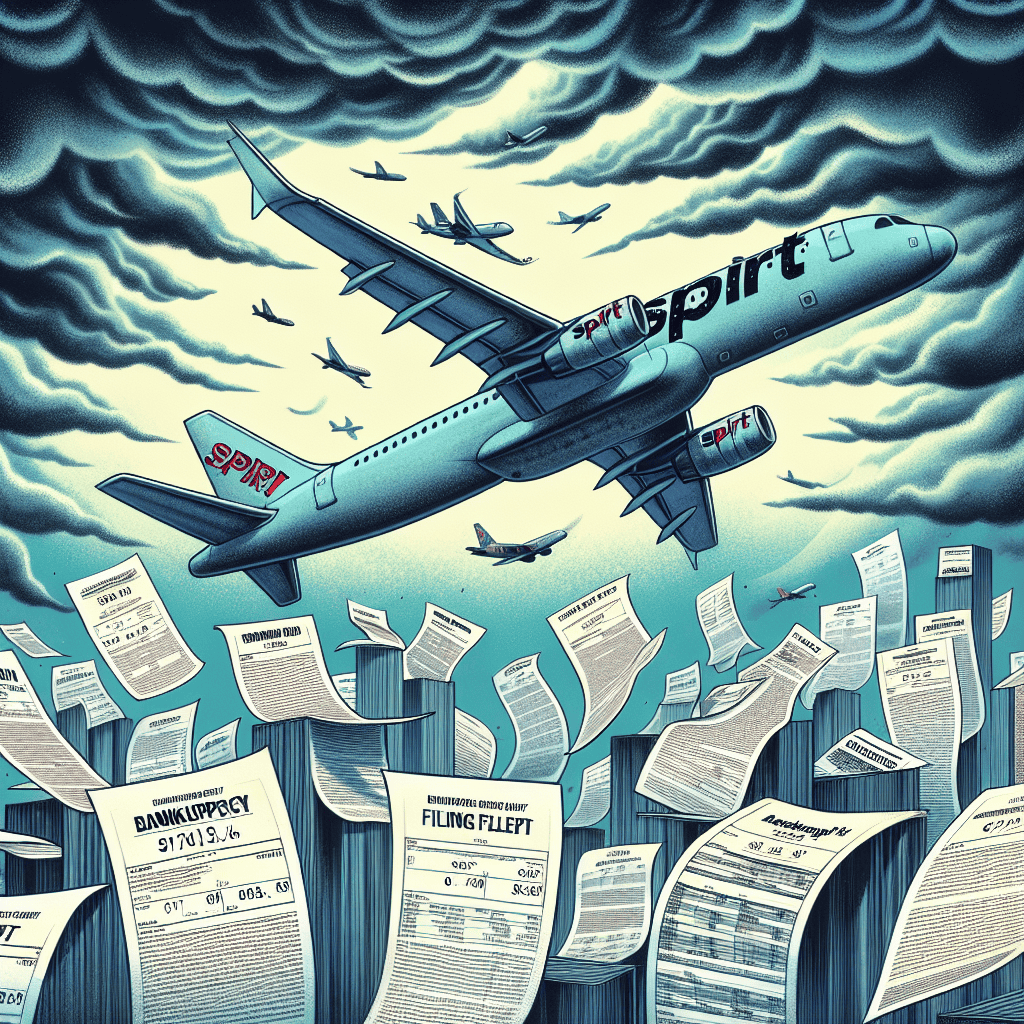

Spirit Airlines recently faced a significant financial setback as its shares plummeted by 58% following reports of a potential bankruptcy filing. The budget airline, known for its low-cost travel options, has been grappling with financial challenges exacerbated by fluctuating fuel prices, operational disruptions, and increased competition in the airline industry. The sharp decline in share value reflects investor concerns over the airline’s ability to navigate its financial difficulties and sustain operations. As the situation unfolds, stakeholders are closely monitoring Spirit Airlines’ strategic decisions and potential restructuring efforts to address its financial woes and restore investor confidence.

Impact Of Bankruptcy Rumors On Spirit Airlines’ Stock Price

Spirit Airlines, a prominent player in the low-cost carrier segment, has recently found itself at the center of financial turbulence, as reports of a potential bankruptcy filing have sent shockwaves through the market. The airline’s stock price has plummeted by a staggering 58%, reflecting investor anxiety and uncertainty about the company’s future. This dramatic decline underscores the profound impact that bankruptcy rumors can have on a company’s financial standing and market perception.

The airline industry, known for its cyclical nature and susceptibility to economic fluctuations, has been particularly vulnerable in recent years. The COVID-19 pandemic dealt a severe blow to airlines worldwide, leading to unprecedented disruptions in travel demand. Although the industry has shown signs of recovery, challenges such as fluctuating fuel prices, labor shortages, and increased competition continue to pose significant hurdles. In this context, Spirit Airlines’ reported financial struggles have raised concerns about its ability to navigate these challenges effectively.

The precipitous drop in Spirit Airlines’ stock price can be attributed to several factors. First and foremost, the mere mention of bankruptcy can trigger panic among investors, leading to a sell-off of shares. This reaction is often driven by fears of potential losses, as bankruptcy proceedings can result in significant devaluation of a company’s assets and equity. Moreover, the uncertainty surrounding the outcome of such proceedings can further exacerbate investor apprehension, prompting them to divest their holdings in search of more stable investment opportunities.

Additionally, the airline’s financial health has been under scrutiny for some time. Reports of mounting debt and dwindling cash reserves have fueled speculation about its ability to sustain operations in the long term. In an industry where liquidity is paramount, any indication of financial instability can have a cascading effect on investor confidence. Consequently, the bankruptcy rumors have intensified existing concerns, leading to a sharp decline in the company’s stock price.

Furthermore, the competitive landscape in the airline industry has added to Spirit Airlines’ woes. The emergence of new low-cost carriers and the expansion of established players have heightened competition, putting pressure on Spirit to maintain its market share. In such a fiercely competitive environment, any hint of financial distress can be perceived as a vulnerability, potentially eroding customer trust and loyalty. This perception can, in turn, impact the airline’s revenue streams, further compounding its financial challenges.

In response to the stock price decline, Spirit Airlines has sought to reassure stakeholders by emphasizing its commitment to operational efficiency and customer satisfaction. The company has highlighted its efforts to streamline operations, optimize routes, and enhance the overall travel experience. However, these assurances have done little to quell investor concerns, as the specter of bankruptcy looms large.

In conclusion, the recent reports of a potential bankruptcy filing have had a profound impact on Spirit Airlines’ stock price, underscoring the sensitivity of financial markets to such rumors. The airline’s precipitous stock decline reflects broader concerns about its financial health and ability to navigate a challenging industry landscape. As Spirit Airlines endeavors to address these challenges and restore investor confidence, the coming months will be critical in determining its trajectory. The situation serves as a stark reminder of the intricate interplay between market perception, financial stability, and the broader economic environment in shaping the fortunes of companies in the airline industry.

Analyzing The Financial Health Of Spirit Airlines Amid Bankruptcy Concerns

Spirit Airlines, a prominent player in the low-cost carrier segment, has recently found itself at the center of financial turbulence, as reports of a potential bankruptcy filing have emerged. The airline’s shares have plummeted by 58%, raising concerns among investors and stakeholders about its financial health and future viability. This dramatic decline in share value underscores the urgency of understanding the factors contributing to Spirit Airlines’ current predicament and evaluating its financial stability.

To begin with, the airline industry has been grappling with a myriad of challenges over the past few years, including fluctuating fuel prices, labor shortages, and the lingering effects of the COVID-19 pandemic. These factors have collectively strained the financial resources of many airlines, including Spirit. As a low-cost carrier, Spirit Airlines operates on thin profit margins, making it particularly vulnerable to economic disruptions. The recent surge in fuel prices has further exacerbated the situation, significantly increasing operational costs and squeezing profit margins even tighter.

Moreover, Spirit Airlines has faced operational challenges that have impacted its financial performance. The airline has experienced a series of flight cancellations and delays, which have not only inconvenienced passengers but also led to increased compensation costs and reputational damage. These operational hiccups have contributed to a decline in customer confidence, potentially affecting future bookings and revenue streams. Consequently, the combination of rising costs and operational inefficiencies has placed additional pressure on the airline’s financial health.

In addition to these operational challenges, Spirit Airlines has been navigating a highly competitive market environment. The airline industry is characterized by intense competition, with numerous carriers vying for market share. Spirit’s business model, which focuses on offering low fares with additional fees for services, has been successful in attracting cost-conscious travelers. However, this model also limits the airline’s ability to generate ancillary revenue, especially when compared to full-service carriers that offer a broader range of services and amenities. As competitors continue to innovate and adapt to changing consumer preferences, Spirit Airlines must find ways to differentiate itself and maintain its competitive edge.

Furthermore, the potential bankruptcy filing raises questions about Spirit Airlines’ ability to manage its debt obligations. The airline has accumulated significant debt over the years, partly due to fleet expansion and modernization efforts. While these investments are crucial for maintaining operational efficiency and competitiveness, they also increase financial risk, particularly in an uncertain economic climate. The prospect of bankruptcy suggests that Spirit may be struggling to meet its debt obligations, prompting concerns about its long-term financial sustainability.

In light of these challenges, Spirit Airlines must take decisive action to stabilize its financial position and restore investor confidence. This may involve restructuring its debt, optimizing operational efficiency, and exploring strategic partnerships or alliances to enhance its market presence. Additionally, the airline must focus on improving customer experience and addressing operational issues to rebuild trust and loyalty among passengers.

In conclusion, the recent reports of a potential bankruptcy filing and the subsequent decline in Spirit Airlines’ share value highlight the pressing need to assess the airline’s financial health. While the challenges facing Spirit are significant, they are not insurmountable. By implementing strategic measures and adapting to the evolving industry landscape, Spirit Airlines can navigate this turbulent period and emerge as a more resilient and competitive player in the aviation sector.

How Spirit Airlines’ Potential Bankruptcy Affects The Aviation Industry

The aviation industry, a sector characterized by its volatility and susceptibility to economic fluctuations, is once again facing turbulence as Spirit Airlines’ shares plummet by 58% amid reports of a potential bankruptcy filing. This development has sent ripples through the industry, raising concerns about the broader implications for airlines, passengers, and stakeholders. As Spirit Airlines grapples with financial instability, the potential bankruptcy could have far-reaching consequences, affecting not only the airline itself but also the competitive dynamics within the aviation sector.

To begin with, Spirit Airlines has long been recognized as a pioneer in the ultra-low-cost carrier (ULCC) model, offering no-frills services at competitive prices. This approach has allowed it to capture a significant market share, particularly among budget-conscious travelers. However, the airline’s financial woes underscore the challenges inherent in maintaining profitability within this business model, especially in the face of rising fuel costs, fluctuating demand, and increased competition. The potential bankruptcy of Spirit Airlines could lead to a reevaluation of the ULCC model’s viability, prompting other carriers to reassess their strategies and cost structures.

Moreover, the potential exit of Spirit Airlines from the market could have significant implications for competition within the aviation industry. Spirit’s aggressive pricing strategies have historically exerted downward pressure on fares, forcing legacy carriers and other low-cost airlines to adjust their pricing to remain competitive. Should Spirit Airlines cease operations, this competitive pressure may diminish, potentially leading to higher airfares for consumers. Consequently, passengers who have come to rely on Spirit’s affordable options may find themselves with fewer choices, impacting travel accessibility and affordability.

In addition to affecting competition and pricing, Spirit Airlines’ potential bankruptcy could have a cascading effect on its employees, suppliers, and partners. The airline employs thousands of individuals, and its financial instability raises concerns about job security and potential layoffs. Furthermore, Spirit’s extensive network of suppliers and service providers, ranging from aircraft manufacturers to catering companies, could face disruptions and financial losses. This interconnectedness highlights the broader economic impact that a single airline’s financial distress can have on the aviation ecosystem.

Furthermore, Spirit Airlines’ potential bankruptcy filing may prompt regulatory scrutiny and intervention. Government agencies and industry regulators may need to assess the implications for consumer protection, particularly regarding ticket refunds and passenger rights. Additionally, regulators may examine the competitive landscape to ensure that the potential reduction in market players does not lead to monopolistic practices or reduced service quality.

While Spirit Airlines’ financial challenges are a cause for concern, they also present an opportunity for industry stakeholders to reflect on the resilience and adaptability of the aviation sector. Airlines may need to explore innovative strategies to enhance operational efficiency, diversify revenue streams, and mitigate risks associated with economic downturns. Moreover, this situation underscores the importance of robust financial planning and risk management practices to navigate the uncertainties inherent in the aviation industry.

In conclusion, the potential bankruptcy of Spirit Airlines serves as a stark reminder of the challenges facing the aviation industry. As the sector grapples with the implications of this development, it is crucial for airlines, regulators, and stakeholders to collaborate in addressing the immediate and long-term impacts. By fostering a resilient and competitive aviation landscape, the industry can better withstand future disruptions and continue to provide safe, reliable, and affordable air travel for passengers worldwide.

Investor Reactions To Spirit Airlines’ Stock Plunge

Spirit Airlines has recently found itself at the center of a financial storm, as reports of a potential bankruptcy filing have sent shockwaves through the investment community. The airline, known for its ultra-low-cost model, has seen its shares plummet by a staggering 58%, leaving investors grappling with uncertainty and concern. This dramatic decline in stock value has prompted a flurry of reactions from investors, who are now reevaluating their positions and strategies in light of the unfolding situation.

To begin with, the news of a possible bankruptcy filing has understandably triggered a wave of panic among Spirit Airlines’ shareholders. Many investors, particularly those with significant holdings in the airline, are now faced with the daunting task of reassessing their portfolios. The sudden drop in share price has not only eroded the value of their investments but has also raised questions about the airline’s long-term viability. Consequently, some investors are opting to cut their losses and divest from Spirit Airlines, while others are adopting a more cautious approach, choosing to hold onto their shares in the hope of a potential recovery.

Moreover, the broader market has also been affected by the turbulence surrounding Spirit Airlines. The airline industry, already grappling with the lingering effects of the COVID-19 pandemic, is now facing additional scrutiny from investors. The uncertainty surrounding Spirit Airlines has led to increased volatility in airline stocks, as investors weigh the potential risks and rewards of maintaining their positions in the sector. This heightened volatility has, in turn, prompted some investors to seek refuge in more stable industries, further exacerbating the pressure on airline stocks.

In addition to individual investors, institutional investors are also closely monitoring the situation. Hedge funds and other large investment firms, which often hold substantial stakes in airlines, are now reevaluating their exposure to Spirit Airlines. These institutional investors are likely to conduct thorough analyses of the airline’s financial health and prospects before making any significant moves. Their decisions could have a profound impact on the airline’s stock price, as large-scale buying or selling by institutional investors can significantly influence market dynamics.

Furthermore, the potential bankruptcy filing has also raised concerns about the future of Spirit Airlines’ operations. Investors are keenly aware that a bankruptcy filing could lead to significant restructuring, which may involve cost-cutting measures, route reductions, and potential layoffs. Such developments could have far-reaching implications for the airline’s ability to compete in an already challenging market. As a result, investors are closely watching for any announcements from Spirit Airlines regarding its plans to address its financial challenges and restore investor confidence.

In light of these developments, it is clear that Spirit Airlines’ stock plunge has elicited a wide range of reactions from investors. While some are choosing to exit their positions, others are adopting a wait-and-see approach, hoping for a turnaround. The situation remains fluid, and investors will undoubtedly continue to monitor the airline’s financial health and strategic decisions in the coming weeks and months. As the story unfolds, it will be crucial for Spirit Airlines to communicate transparently with its investors and stakeholders, providing them with the information they need to make informed decisions. Ultimately, the airline’s ability to navigate this crisis will determine its future trajectory and the extent to which it can regain the trust and confidence of its investors.

The Future Of Low-Cost Carriers In Light Of Spirit Airlines’ Challenges

The recent reports of Spirit Airlines potentially filing for bankruptcy have sent shockwaves through the aviation industry, particularly affecting the low-cost carrier segment. With Spirit Airlines’ shares plummeting by 58%, stakeholders and industry analysts are now questioning the sustainability and future of budget airlines. This development raises significant concerns about the viability of the low-cost business model, which has been both a disruptor and a savior for budget-conscious travelers over the past few decades.

Spirit Airlines, known for its ultra-low-cost fares, has long been a favorite among travelers looking to save on airfare. However, the airline’s business model, which relies heavily on ancillary fees and high passenger volumes, has come under scrutiny. The recent financial turmoil suggests that the model may not be as resilient as once thought, especially in the face of economic downturns and fluctuating fuel prices. As Spirit grapples with these challenges, other low-cost carriers are also likely to reassess their strategies to ensure long-term sustainability.

The potential bankruptcy of Spirit Airlines could have far-reaching implications for the low-cost carrier market. For one, it may lead to a consolidation within the industry, as larger airlines might seek to acquire struggling competitors to expand their market share. This could result in reduced competition, ultimately affecting fare prices and consumer choice. Moreover, the financial instability of a major player like Spirit could deter new entrants from venturing into the low-cost segment, further stifling competition and innovation.

In addition to market consolidation, the challenges faced by Spirit Airlines may prompt a reevaluation of operational strategies among low-cost carriers. Many of these airlines have traditionally focused on cost-cutting measures, such as operating a single aircraft type to reduce maintenance costs and offering minimal in-flight services. However, as consumer expectations evolve and demand for more comprehensive travel experiences grows, low-cost carriers may need to strike a balance between maintaining low fares and enhancing service quality. This could involve investing in newer, more fuel-efficient aircraft, expanding route networks, or offering more flexible ticketing options.

Furthermore, the environmental impact of air travel is becoming an increasingly important consideration for both airlines and consumers. As governments worldwide implement stricter regulations to curb carbon emissions, low-cost carriers may face additional financial pressures to comply with these standards. This could necessitate significant investments in sustainable technologies and practices, further challenging the traditional low-cost model.

Despite these challenges, the demand for affordable air travel is unlikely to diminish. The rise of remote work and the increasing desire for leisure travel suggest that there will always be a market for budget-friendly options. However, low-cost carriers will need to adapt to changing market dynamics and consumer preferences to remain competitive. This may involve exploring new revenue streams, such as partnerships with other travel service providers or offering subscription-based travel plans.

In conclusion, the potential bankruptcy of Spirit Airlines serves as a wake-up call for the low-cost carrier industry. While the demand for affordable air travel remains strong, the challenges faced by Spirit highlight the need for a more resilient and adaptable business model. As the industry navigates these turbulent times, low-cost carriers must innovate and evolve to ensure their survival and continued success in the ever-changing aviation landscape.

Comparing Spirit Airlines’ Situation To Past Airline Bankruptcies

Spirit Airlines has recently found itself in turbulent skies, with its shares plummeting by 58% amid reports of a potential bankruptcy filing. This dramatic downturn has sent shockwaves through the aviation industry, prompting comparisons to past airline bankruptcies. To understand the implications of Spirit Airlines’ current predicament, it is essential to examine the broader context of airline bankruptcies and the factors that have historically contributed to such financial distress.

Historically, the airline industry has been characterized by its cyclical nature, with periods of profitability often followed by financial turbulence. Several airlines have faced bankruptcy over the years, each with its unique set of challenges and circumstances. For instance, the bankruptcy of Pan American World Airways in 1991 marked the end of an era for one of the most iconic names in aviation. Pan Am’s downfall was attributed to a combination of rising fuel costs, increased competition, and the inability to adapt to a rapidly changing market. Similarly, the bankruptcy of Trans World Airlines (TWA) in 2001 was the result of mounting debt and operational inefficiencies, exacerbated by the economic downturn following the September 11 attacks.

In comparing Spirit Airlines’ situation to these past bankruptcies, several parallels and distinctions emerge. Like Pan Am and TWA, Spirit Airlines has faced intense competition from both legacy carriers and low-cost rivals. The airline’s ultra-low-cost business model, which relies heavily on ancillary fees, has been both a strength and a vulnerability. While it has allowed Spirit to offer competitive base fares, it has also left the airline susceptible to fluctuations in consumer demand and economic conditions. Moreover, the recent surge in fuel prices and operational costs has further strained Spirit’s financial position, echoing the challenges faced by its predecessors.

However, Spirit Airlines’ current predicament also reflects some unique aspects of the modern aviation landscape. The COVID-19 pandemic has had a profound impact on the industry, leading to unprecedented disruptions in travel demand and operational capacity. While many airlines have managed to navigate these challenges through government support and strategic restructuring, Spirit’s reliance on leisure travel and its limited international network have made it particularly vulnerable to the pandemic’s lingering effects. Additionally, the airline’s recent attempts to merge with other carriers, such as the failed merger with Frontier Airlines, have added complexity to its financial situation.

Despite these challenges, it is important to note that bankruptcy does not necessarily spell the end for an airline. Many carriers have successfully emerged from bankruptcy as leaner and more competitive entities. For example, Delta Air Lines and United Airlines both filed for bankruptcy in the early 2000s but have since restructured and regained their positions as industry leaders. The key to successful emergence often lies in the ability to renegotiate debt, streamline operations, and adapt to changing market dynamics.

In conclusion, while Spirit Airlines’ current financial distress is reminiscent of past airline bankruptcies, it also reflects the unique challenges of the contemporary aviation environment. As the airline navigates this turbulent period, its ability to adapt and restructure will be crucial in determining its future trajectory. The lessons learned from past bankruptcies offer valuable insights, but Spirit’s path forward will ultimately depend on its capacity to innovate and respond to the evolving demands of the industry.

Strategies For Spirit Airlines To Recover From Financial Turmoil

Spirit Airlines, a prominent player in the low-cost carrier segment, has recently faced a significant financial setback, with its shares plummeting by 58% amid reports of a potential bankruptcy filing. This development has sent shockwaves through the aviation industry and raised concerns among investors and stakeholders. In light of these challenges, it is imperative to explore strategic avenues that Spirit Airlines could pursue to navigate this financial turmoil and potentially recover its standing in the market.

To begin with, Spirit Airlines must undertake a comprehensive assessment of its current financial situation. This involves a detailed analysis of its revenue streams, cost structures, and debt obligations. By gaining a clear understanding of its financial health, the airline can identify areas where cost-cutting measures can be implemented without compromising service quality. For instance, renegotiating contracts with suppliers and lessors could provide immediate financial relief. Additionally, optimizing fuel efficiency and streamlining operations could contribute to reducing operational costs, thereby improving the airline’s bottom line.

Moreover, Spirit Airlines should consider diversifying its revenue streams to mitigate the impact of fluctuating market conditions. Expanding ancillary services, such as offering premium seating options, in-flight entertainment, and enhanced baggage services, could generate additional income. Furthermore, exploring partnerships with other airlines or travel companies could open new avenues for revenue generation. By leveraging its existing network and customer base, Spirit Airlines can create synergies that enhance its competitive edge and financial stability.

In parallel, Spirit Airlines must focus on enhancing its customer experience to retain and attract passengers. In an industry where customer loyalty is paramount, providing exceptional service can differentiate the airline from its competitors. Implementing a robust customer feedback mechanism will allow Spirit Airlines to identify pain points and address them proactively. By investing in staff training and technology upgrades, the airline can ensure a seamless and enjoyable travel experience for its passengers, fostering brand loyalty and repeat business.

Furthermore, Spirit Airlines should explore strategic alliances and mergers as a means to strengthen its market position. Collaborating with other carriers could provide access to new markets and resources, enabling the airline to expand its reach and operational capabilities. Such partnerships could also facilitate knowledge sharing and best practices, enhancing Spirit Airlines’ ability to adapt to changing industry dynamics. However, it is crucial for the airline to conduct thorough due diligence and ensure that any potential alliance aligns with its long-term strategic goals.

In addition to these strategies, Spirit Airlines must engage in transparent communication with its stakeholders, including investors, employees, and customers. By providing regular updates on its financial status and recovery plans, the airline can build trust and confidence among its stakeholders. This transparency will be instrumental in garnering support and cooperation during the recovery process.

Lastly, Spirit Airlines should seek expert financial and legal advice to navigate the complexities of bankruptcy proceedings, if necessary. Engaging with experienced professionals will enable the airline to explore all available options and make informed decisions that align with its long-term objectives. By adopting a proactive and strategic approach, Spirit Airlines can position itself for a successful recovery and emerge stronger from this financial turmoil.

In conclusion, while the current financial challenges facing Spirit Airlines are significant, they are not insurmountable. By implementing a combination of cost-cutting measures, revenue diversification, customer experience enhancement, strategic alliances, transparent communication, and expert guidance, Spirit Airlines can chart a path towards recovery and regain its foothold in the competitive aviation industry.

Q&A

1. **What caused Spirit Airlines shares to tumble 58%?**

Reports of a potential bankruptcy filing led to the sharp decline in Spirit Airlines’ share price.

2. **When did the reports about Spirit Airlines’ bankruptcy filing emerge?**

The reports emerged recently, causing immediate concern among investors and stakeholders.

3. **How did the market react to the bankruptcy filing reports?**

The market reacted negatively, with Spirit Airlines’ shares plummeting by 58%.

4. **What are the implications of a bankruptcy filing for Spirit Airlines?**

A bankruptcy filing could lead to restructuring, potential asset sales, and significant operational changes for Spirit Airlines.

5. **How might Spirit Airlines’ bankruptcy affect its customers?**

Customers could face disruptions in service, changes in flight schedules, or potential loss of booked flights.

6. **What are the potential reasons behind Spirit Airlines considering bankruptcy?**

Potential reasons could include financial struggles, high debt levels, increased competition, or operational challenges.

7. **What steps might Spirit Airlines take following the bankruptcy reports?**

Spirit Airlines might engage in negotiations with creditors, seek new financing, or implement cost-cutting measures to stabilize its financial situation.

Conclusion

Spirit Airlines shares plummeted by 58% following reports of a potential bankruptcy filing, reflecting significant investor concern and market instability. This dramatic decline underscores the financial challenges facing the airline, likely exacerbated by operational disruptions, competitive pressures, and possibly unsustainable debt levels. The market reaction indicates a lack of confidence in Spirit Airlines’ ability to navigate its current financial difficulties without resorting to bankruptcy protection. This situation highlights the broader vulnerabilities within the airline industry, particularly for low-cost carriers operating on thin margins. Moving forward, Spirit Airlines will need to address its financial health and operational strategies to regain investor trust and stabilize its market position.