“Shein Expands Financial Horizons: London Listing Gains Momentum with New Banking Partners”

Introduction

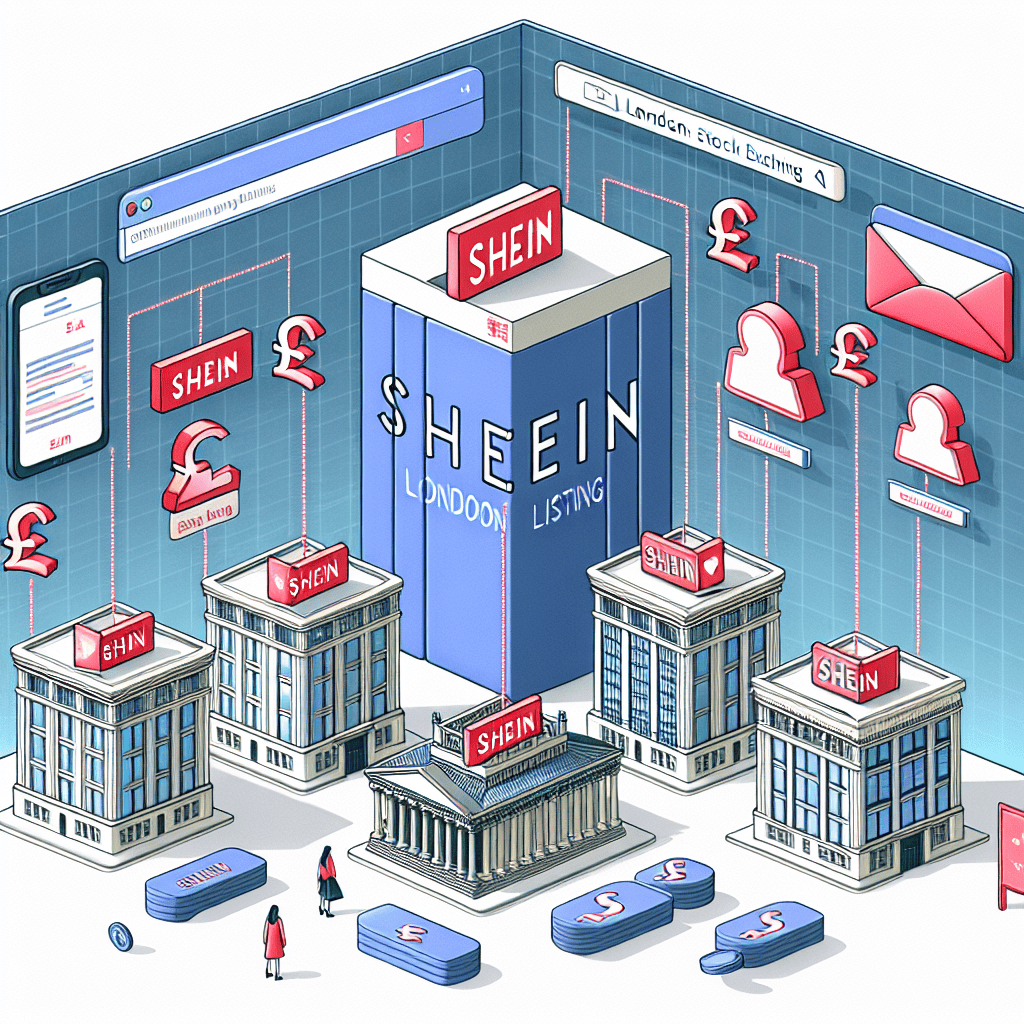

Shein, the fast-fashion giant known for its rapid production and affordable pricing, is making significant strides towards its anticipated public debut in London. The company has recently expanded its roster of financial institutions to manage its initial public offering (IPO), signaling a strategic move to bolster its market entry. By enlisting additional banks, Shein aims to leverage their expertise and networks to ensure a successful listing on the London Stock Exchange. This development underscores Shein’s ambition to solidify its presence in the global fashion market and attract a diverse range of investors. As the company prepares for this pivotal step, the expansion of its banking consortium highlights its commitment to navigating the complexities of the public market with precision and confidence.

Shein’s Strategic Move: Expanding Financial Partnerships for London Listing

Shein, the fast-fashion giant known for its rapid production cycles and affordable pricing, is making significant strides in its quest to go public. The company has recently announced the addition of more banks to arrange its much-anticipated London listing, a move that underscores its strategic intent to solidify its financial standing and expand its global footprint. This development comes at a time when Shein is seeking to capitalize on its burgeoning popularity and secure a stronger position in the competitive fashion industry.

The decision to list in London is a calculated one, reflecting Shein’s ambition to tap into the European market and attract a diverse pool of investors. By expanding its financial partnerships, Shein aims to leverage the expertise and networks of these banks to ensure a successful initial public offering (IPO). This strategic move is indicative of Shein’s commitment to enhancing its financial infrastructure and optimizing its market entry strategy. Moreover, the inclusion of additional banks is expected to provide Shein with a broader range of financial services and advisory support, which are crucial for navigating the complexities of a public listing.

In recent years, Shein has experienced exponential growth, driven by its innovative business model and adept use of digital platforms. The company’s ability to quickly adapt to changing fashion trends and consumer preferences has been a key factor in its success. As Shein prepares for its London listing, it is imperative for the company to maintain this momentum and continue to deliver value to its stakeholders. By strengthening its financial partnerships, Shein is positioning itself to achieve these objectives and sustain its growth trajectory.

Furthermore, the decision to list in London aligns with Shein’s broader strategic goals of increasing its brand visibility and enhancing its reputation in the global market. London, as a leading financial hub, offers a robust regulatory framework and a dynamic investment environment, making it an attractive destination for companies seeking to go public. By choosing London for its IPO, Shein is signaling its confidence in the city’s financial ecosystem and its commitment to adhering to international standards of corporate governance and transparency.

In addition to expanding its financial partnerships, Shein is also focusing on enhancing its operational capabilities and strengthening its supply chain. The company recognizes that a successful public listing requires not only financial acumen but also operational excellence. To this end, Shein is investing in technology and infrastructure to improve its production processes and ensure timely delivery of its products. These efforts are aimed at reinforcing Shein’s competitive advantage and supporting its long-term growth objectives.

As Shein moves forward with its plans for a London listing, the company is poised to enter a new phase of its corporate journey. The addition of more banks to arrange the listing is a testament to Shein’s proactive approach to managing its financial affairs and its determination to achieve a successful IPO. By leveraging the expertise of its financial partners and capitalizing on the opportunities presented by the London market, Shein is well-positioned to enhance its market presence and deliver sustainable value to its investors. As the company continues to evolve, it will be interesting to observe how Shein navigates the challenges and opportunities of being a publicly listed entity.

The Impact of Shein’s London Listing on Global Fashion Markets

Shein, the fast-fashion giant known for its rapid production cycles and affordable pricing, has recently made headlines by expanding its roster of banks to facilitate a much-anticipated London listing. This strategic move is poised to have significant implications for global fashion markets, as it underscores the company’s ambition to solidify its presence on the international stage. By choosing London, a city renowned for its financial prowess and vibrant fashion scene, Shein is positioning itself to attract a diverse array of investors while simultaneously enhancing its brand visibility.

The decision to list in London is not merely a financial maneuver but also a strategic alignment with the city’s reputation as a global fashion hub. London Fashion Week, for instance, is a testament to the city’s influence in setting trends and showcasing innovative designs. By aligning itself with such a prestigious locale, Shein is likely to gain increased credibility and recognition within the fashion industry. This move could potentially elevate the brand’s status from a fast-fashion retailer to a more established player in the global market.

Moreover, the inclusion of additional banks in arranging the listing suggests that Shein is keen on ensuring a smooth and successful public offering. This expansion of financial partners not only diversifies the expertise and resources available to Shein but also signals the company’s commitment to transparency and robust financial practices. As a result, potential investors may view this as a positive indicator of Shein’s long-term growth prospects and financial stability.

The impact of Shein’s London listing on global fashion markets is multifaceted. Firstly, it could intensify competition among fast-fashion retailers, prompting rivals to innovate and adapt to maintain their market share. Companies like Zara and H&M, which have long dominated the fast-fashion sector, may need to reassess their strategies in response to Shein’s growing influence. This could lead to a wave of new trends and business models as companies strive to differentiate themselves in an increasingly crowded market.

Furthermore, Shein’s listing could also have implications for sustainability within the fashion industry. The company has faced criticism in the past for its environmental impact and labor practices. By going public, Shein may be subject to greater scrutiny from investors and regulators, potentially prompting the company to adopt more sustainable practices. This shift could set a precedent for other fast-fashion brands, encouraging them to prioritize sustainability in their operations.

In addition to these industry-wide effects, Shein’s London listing could also influence consumer behavior. As the brand gains more visibility and credibility, it may attract a broader customer base, including those who were previously hesitant to purchase from fast-fashion retailers. This could lead to an increase in demand for Shein’s products, further solidifying its position in the market.

In conclusion, Shein’s decision to add more banks to arrange its London listing is a strategic move with far-reaching implications for global fashion markets. By aligning itself with London’s financial and fashion prestige, Shein is poised to enhance its brand visibility and credibility. This move could intensify competition, prompt a shift towards sustainability, and influence consumer behavior, ultimately reshaping the landscape of the fast-fashion industry. As Shein continues to expand its global footprint, its actions will undoubtedly be closely watched by industry stakeholders and consumers alike.

How Shein’s New Banking Partners Could Influence Its IPO Success

Shein, the fast-fashion giant known for its rapid production cycles and affordable pricing, is making significant strides toward its anticipated initial public offering (IPO) in London. Recently, the company has expanded its roster of banking partners, a strategic move that could play a pivotal role in the success of its public debut. By enlisting more banks to arrange its London listing, Shein is not only diversifying its financial advisory but also enhancing its credibility and appeal to potential investors.

The decision to add more banks to its IPO arrangement is a calculated effort by Shein to leverage the diverse expertise and networks that these financial institutions bring. Each bank offers unique insights into market trends, investor behavior, and regulatory landscapes, which are crucial for a company like Shein that operates on a global scale. By collaborating with a broader array of banks, Shein can tap into a wider pool of resources and knowledge, thereby optimizing its IPO strategy. This approach is particularly important given the competitive nature of the fashion industry and the scrutiny that comes with going public.

Moreover, the inclusion of additional banks can significantly enhance Shein’s market positioning. A well-rounded consortium of banks can provide a more comprehensive market analysis, helping Shein to better understand investor sentiment and tailor its offering accordingly. This is especially relevant in the current economic climate, where market volatility and investor caution are prevalent. By having a diverse team of banking partners, Shein can mitigate risks and ensure a more stable and successful IPO process.

In addition to strategic advantages, the expansion of banking partners also signals Shein’s commitment to transparency and governance. The involvement of multiple reputable banks can serve as a testament to Shein’s financial health and operational integrity, which are critical factors for investors considering participation in an IPO. This move can help build investor confidence, as it demonstrates Shein’s willingness to adhere to stringent financial standards and regulatory requirements. Consequently, this could lead to a more favorable reception in the market and potentially higher valuations.

Furthermore, the choice of London as the listing venue is noteworthy. London has long been a hub for international finance, offering a robust regulatory framework and a diverse investor base. By choosing to list in London, Shein is positioning itself to attract a wide range of institutional and retail investors, thereby broadening its capital-raising potential. The addition of more banks to facilitate this process underscores Shein’s strategic intent to maximize its reach and impact in the global market.

In conclusion, Shein’s decision to expand its banking partners for its London IPO is a multifaceted strategy aimed at ensuring a successful public offering. By leveraging the expertise and networks of a diverse group of banks, Shein is better equipped to navigate the complexities of the IPO process and capitalize on market opportunities. This move not only enhances Shein’s market positioning but also reinforces its commitment to transparency and governance. As Shein prepares for its public debut, the expanded banking consortium will likely play a crucial role in shaping the company’s future trajectory and success in the public market.

Analyzing Shein’s Decision to Add More Banks for Its London Debut

Shein, the fast-fashion giant known for its rapid production cycles and affordable pricing, has recently made headlines with its decision to expand the roster of banks managing its anticipated London stock market debut. This strategic move underscores the company’s ambition to ensure a successful initial public offering (IPO) and reflects its commitment to navigating the complexities of the global financial landscape. By enlisting additional financial institutions, Shein aims to leverage a broader range of expertise and resources, thereby enhancing its prospects for a favorable market entry.

The decision to add more banks to its IPO arrangement is not merely a logistical adjustment but a calculated strategy to bolster investor confidence. In the competitive world of fashion retail, where market dynamics are constantly evolving, Shein’s proactive approach signals its intent to establish a strong foothold in the public market. By diversifying its banking partners, the company is poised to tap into a wider network of potential investors, thereby increasing its visibility and appeal. This move is particularly significant given the current economic climate, where investor sentiment can be volatile and unpredictable.

Moreover, Shein’s choice to list in London is a testament to the city’s enduring status as a global financial hub. Despite the uncertainties posed by Brexit and other geopolitical factors, London continues to attract international companies seeking to capitalize on its deep capital markets and robust regulatory framework. For Shein, a London listing offers not only access to a diverse pool of investors but also the prestige associated with being part of one of the world’s leading financial centers. This decision aligns with Shein’s broader strategy of expanding its global footprint and reinforcing its brand presence across key markets.

In addition to enhancing its financial strategy, Shein’s move to involve more banks also reflects its commitment to corporate governance and transparency. By engaging multiple financial institutions, the company is subjecting itself to rigorous scrutiny and due diligence processes, which can help mitigate potential risks and ensure compliance with regulatory standards. This level of oversight is crucial for maintaining investor trust and safeguarding the company’s reputation in the long term. Furthermore, it demonstrates Shein’s willingness to adapt to the expectations of public market participants, who demand greater accountability and transparency from listed companies.

As Shein prepares for its London debut, the addition of more banks to its IPO arrangement is likely to have a ripple effect on its operational and strategic initiatives. With increased financial backing and a more diversified investor base, the company is well-positioned to pursue growth opportunities and enhance its competitive edge. This could involve expanding its product offerings, investing in sustainable practices, or exploring new markets to drive revenue growth. Ultimately, Shein’s decision to fortify its banking consortium is a reflection of its ambition to not only succeed in the public market but also to solidify its status as a leading player in the fast-fashion industry.

In conclusion, Shein’s strategic move to add more banks for its London listing is a multifaceted decision that underscores its commitment to achieving a successful IPO. By leveraging the expertise of additional financial institutions, the company aims to enhance investor confidence, navigate market complexities, and reinforce its corporate governance practices. As Shein embarks on this new chapter, its proactive approach and strategic foresight are likely to play a pivotal role in shaping its future trajectory and ensuring its continued success in the global fashion landscape.

The Role of Financial Institutions in Shein’s London Stock Market Entry

Shein, the fast-fashion giant known for its rapid production cycles and affordable pricing, is making significant strides towards its anticipated entry into the London Stock Exchange. This move marks a pivotal moment in the company’s evolution from an online retail powerhouse to a publicly traded entity. Central to this transition is the role of financial institutions, which are instrumental in orchestrating Shein’s initial public offering (IPO). Recently, Shein has expanded its roster of banking partners to facilitate this complex process, underscoring the critical function these institutions play in ensuring a successful market debut.

The decision to list in London is strategic, reflecting Shein’s ambition to solidify its presence in the European market while leveraging the city’s status as a global financial hub. By adding more banks to its team, Shein aims to harness a diverse range of expertise and resources, which are essential for navigating the intricacies of the IPO process. These financial institutions are tasked with a multitude of responsibilities, from underwriting the offering to advising on regulatory compliance and market conditions. Their involvement is crucial in setting the stage for Shein’s entry into the public market, as they provide the necessary financial acumen and strategic guidance.

Moreover, the inclusion of additional banks is indicative of Shein’s commitment to ensuring a robust and well-supported IPO. By collaborating with a broader array of financial partners, Shein can benefit from a wider pool of insights and perspectives, which can enhance the company’s ability to address potential challenges and capitalize on opportunities. This collaborative approach not only strengthens Shein’s position but also instills confidence among potential investors, who are likely to view the involvement of reputable financial institutions as a positive endorsement of the company’s prospects.

In addition to underwriting and advisory roles, these banks are also pivotal in shaping the narrative around Shein’s market entry. They play a key role in crafting the company’s investment story, highlighting its growth trajectory, competitive advantages, and future potential. This narrative is crucial in attracting investor interest and securing the necessary capital to fuel Shein’s continued expansion. By leveraging their extensive networks and market knowledge, these financial institutions can effectively communicate Shein’s value proposition to a global audience, thereby maximizing the impact of the IPO.

Furthermore, the banks’ involvement extends beyond the initial offering, as they continue to provide support in the post-IPO phase. This includes offering guidance on investor relations, market positioning, and strategic initiatives that can drive long-term shareholder value. Their ongoing engagement ensures that Shein remains well-positioned to navigate the dynamic landscape of the public markets, adapting to changing conditions and seizing new opportunities as they arise.

In conclusion, the addition of more banks to arrange Shein’s London listing underscores the vital role that financial institutions play in facilitating a successful stock market entry. Their expertise, resources, and strategic insights are indispensable in guiding Shein through the complexities of the IPO process and beyond. As Shein prepares to make its mark on the London Stock Exchange, the collaboration with these financial partners will be instrumental in shaping the company’s future trajectory and ensuring its continued success in the global marketplace.

Shein’s London Listing: A Game Changer for Fast Fashion Retailers

Shein, the fast fashion giant known for its rapid production cycles and affordable pricing, is making significant strides towards a public listing in London. This move is poised to be a game changer for the fast fashion industry, as it underscores the growing influence and financial clout of online retailers in the global market. Recently, Shein has expanded its roster of financial institutions to manage this ambitious listing, a strategic decision that highlights the company’s commitment to ensuring a successful market debut.

The decision to list in London is particularly noteworthy, given the city’s status as a leading global financial hub. By choosing London, Shein is not only tapping into a deep pool of international investors but also aligning itself with a market that has a rich history of supporting retail giants. This move is expected to enhance Shein’s visibility and credibility, providing a robust platform for future growth. Moreover, the inclusion of additional banks in the arrangement process signals Shein’s intent to leverage diverse expertise and resources, thereby optimizing its listing strategy.

In recent years, Shein has experienced exponential growth, driven by its innovative business model that leverages data analytics and supply chain efficiencies to deliver trendy apparel at breakneck speed. This approach has resonated with a global audience, particularly among younger consumers who value both style and affordability. As Shein prepares for its London listing, the company is likely to emphasize its technological prowess and market adaptability, key factors that have contributed to its rapid ascent in the fast fashion sector.

The addition of more banks to the listing process is a strategic maneuver that reflects Shein’s understanding of the complexities involved in going public. By engaging multiple financial institutions, Shein can benefit from a broader range of insights and expertise, which can be instrumental in navigating the regulatory and market challenges associated with a public offering. This collaborative approach not only mitigates risks but also enhances the potential for a successful listing, thereby maximizing shareholder value.

Furthermore, Shein’s decision to pursue a London listing comes at a time when the fast fashion industry is under increasing scrutiny for its environmental impact and labor practices. By going public, Shein will be subject to greater transparency and accountability, which could serve as a catalyst for positive change within the industry. Investors and consumers alike will be keenly observing how Shein addresses these challenges, as sustainability and ethical practices become increasingly important in the retail landscape.

In conclusion, Shein’s move to add more banks to arrange its London listing is a strategic step that underscores the company’s ambition and foresight. As the fast fashion retailer prepares to enter the public market, it is poised to set new benchmarks for the industry, both in terms of financial performance and corporate responsibility. The success of Shein’s listing could pave the way for other online retailers to follow suit, further transforming the retail sector and redefining the dynamics of fast fashion. As such, all eyes will be on Shein as it embarks on this pivotal journey, with the potential to reshape the future of fashion retailing on a global scale.

What Shein’s Expanded Banking Network Means for Investors

Shein, the fast-fashion giant known for its rapid production cycles and affordable pricing, has recently made headlines by expanding its banking network in preparation for a potential listing on the London Stock Exchange. This strategic move has piqued the interest of investors worldwide, as it signals the company’s intent to solidify its presence in the global market. By adding more banks to its roster, Shein is not only diversifying its financial partnerships but also enhancing its credibility and appeal to a broader range of investors.

The decision to expand its banking network comes at a crucial time for Shein, as the company seeks to capitalize on its growing popularity and market share. By collaborating with a diverse group of financial institutions, Shein aims to leverage their expertise and resources to ensure a successful public offering. This approach not only provides the company with a robust support system but also instills confidence in potential investors who are keen to participate in its growth journey.

Moreover, the inclusion of additional banks in the arrangement process underscores Shein’s commitment to transparency and accountability. By engaging with multiple financial entities, the company is subjecting itself to rigorous scrutiny and due diligence, which can help mitigate potential risks associated with the listing. This level of oversight is particularly important in today’s investment climate, where stakeholders are increasingly concerned about corporate governance and ethical business practices.

Furthermore, the expanded banking network is likely to enhance Shein’s ability to attract a diverse pool of investors. With more banks involved, the company can tap into a wider range of financial markets and investor bases, thereby increasing its chances of securing substantial capital. This diversification is crucial for Shein, as it seeks to maintain its competitive edge in the fast-paced fashion industry. By broadening its investor base, the company can ensure a steady influx of funds to support its ambitious expansion plans and innovative initiatives.

In addition to these benefits, the move to include more banks in the listing process may also have positive implications for Shein’s valuation. A well-structured and widely supported public offering can lead to a more favorable assessment of the company’s worth, which in turn can attract even more investors. This potential increase in valuation is an attractive prospect for both existing and prospective shareholders, as it promises enhanced returns on their investments.

However, it is important to note that while the expansion of Shein’s banking network is a promising development, it also presents certain challenges. Coordinating efforts among multiple financial institutions can be complex and time-consuming, requiring meticulous planning and execution. Additionally, the company must ensure that all parties involved are aligned with its strategic objectives and vision for the future. Despite these challenges, the potential rewards of a successful listing far outweigh the risks, making this a calculated and strategic move for Shein.

In conclusion, Shein’s decision to add more banks to arrange its London listing is a significant step forward in its quest for global prominence. By expanding its banking network, the company is not only enhancing its credibility and appeal to investors but also positioning itself for long-term success. As Shein continues to navigate the complexities of the financial landscape, its commitment to transparency, accountability, and strategic growth will undoubtedly play a pivotal role in shaping its future trajectory. For investors, this development represents an exciting opportunity to be part of a dynamic and rapidly evolving industry leader.

Q&A

1. **What is Shein planning?**

Shein is planning a public listing in London.

2. **Why is Shein adding more banks?**

Shein is adding more banks to strengthen its financial advisory team for the upcoming London listing.

3. **Which banks are involved in Shein’s London listing?**

Specific banks involved have not been disclosed, but Shein is expanding its roster of financial institutions.

4. **What is the purpose of the London listing for Shein?**

The London listing aims to raise capital and increase Shein’s market presence in Europe.

5. **When is the London listing expected to occur?**

The exact timing of the listing has not been publicly announced.

6. **How might the London listing impact Shein’s business?**

The listing could provide Shein with additional funds for expansion and enhance its brand visibility.

7. **What challenges might Shein face with the London listing?**

Potential challenges include market volatility, regulatory hurdles, and competition in the fast-fashion industry.

Conclusion

Shein’s decision to add more banks to arrange its London listing suggests a strategic move to bolster its initial public offering (IPO) process, potentially enhancing its market positioning and investor confidence. By involving additional financial institutions, Shein aims to leverage their expertise and networks to ensure a successful listing, reflecting its ambition to expand its global presence and capitalize on the robust financial ecosystem in London. This move could also indicate Shein’s commitment to transparency and governance, aligning with international market standards, and positioning itself for sustainable growth in the competitive fast-fashion industry.