“Steady Growth, Unwavering Dividends: SCHD Delivers Stability.”

Introduction

SCHD, or the Schwab U.S. Dividend Equity ETF, is a prominent exchange-traded fund that focuses on providing investors with exposure to high-quality U.S. companies known for paying consistent and robust dividends. Managed by Charles Schwab, this ETF seeks to track the performance of the Dow Jones U.S. Dividend 100 Index, which comprises 100 high-dividend-yielding U.S. stocks with a record of strong financial health and reliable dividend payments. SCHD is particularly appealing to income-focused investors due to its emphasis on dividend growth and sustainability, making it a popular choice for those seeking a balance between income generation and capital appreciation. The fund’s diversified portfolio spans various sectors, offering a blend of stability and growth potential. As of now, SCHD has not undergone any stock splits, maintaining its share price and structure since inception, which reflects its strategic focus on long-term value and income generation for its investors.

Understanding SCHD: An Overview of Its Dividend Strategy

SCHD, or the Schwab U.S. Dividend Equity ETF, has garnered significant attention from investors seeking a reliable source of income through dividends. This exchange-traded fund is designed to track the performance of the Dow Jones U.S. Dividend 100 Index, which comprises high dividend-yielding U.S. stocks. The primary objective of SCHD is to provide investors with a robust dividend income while also offering the potential for capital appreciation. To achieve this, the fund employs a strategic approach that focuses on quality and sustainability of dividends, making it an attractive option for income-focused investors.

One of the key aspects of SCHD’s dividend strategy is its emphasis on selecting companies with a strong track record of dividend payments. The fund targets firms that have consistently paid dividends for at least ten consecutive years, ensuring that the companies included in the portfolio have a history of rewarding shareholders. This criterion helps mitigate the risk of investing in companies that may cut or suspend dividends during economic downturns. Furthermore, SCHD places a significant weight on dividend growth, favoring companies that have demonstrated the ability to increase their dividend payouts over time. This focus on dividend growth not only enhances the potential for income generation but also provides a hedge against inflation, as rising dividends can help maintain the purchasing power of the income received.

In addition to its emphasis on dividend history and growth, SCHD also considers the financial health and stability of the companies it invests in. The fund employs a rigorous screening process that evaluates factors such as return on equity, debt-to-equity ratio, and cash flow generation. By prioritizing financially sound companies, SCHD aims to reduce the risk of investing in firms that may face financial difficulties, which could jeopardize their ability to maintain or grow dividend payments. This prudent approach to stock selection contributes to the overall resilience of the fund, making it a reliable choice for investors seeking steady income.

Moreover, SCHD’s diversified portfolio further enhances its appeal as a dividend-focused investment. The fund holds a broad array of stocks across various sectors, including consumer goods, healthcare, technology, and financials. This diversification helps spread risk and reduces the impact of sector-specific downturns on the fund’s overall performance. By investing in a wide range of industries, SCHD can capitalize on different economic cycles and trends, providing a more stable income stream for investors.

While some investors may wonder about the potential impact of a stock split on SCHD’s performance, it is important to note that a split does not inherently affect the value of the investment. A stock split merely increases the number of shares outstanding while proportionally reducing the price per share, leaving the overall market capitalization unchanged. Therefore, whether or not SCHD undergoes a split, its core strategy and objectives remain intact, continuing to focus on delivering a reliable dividend income.

In conclusion, SCHD’s robust dividend strategy, characterized by its focus on dividend history, growth, financial stability, and diversification, makes it a compelling choice for income-seeking investors. By adhering to a disciplined approach to stock selection and maintaining a diversified portfolio, SCHD offers the potential for both income generation and capital appreciation. Whether or not a stock split occurs, the fund’s commitment to providing a stable and growing dividend income remains unwavering, solidifying its position as a reliable dividend ETF.

The Pros and Cons of SCHD Splitting

The Schwab U.S. Dividend Equity ETF (SCHD) has garnered significant attention from investors seeking a reliable source of dividend income. As discussions about the potential for SCHD to undergo a stock split arise, it is essential to weigh the pros and cons of such a move. A stock split, while not altering the intrinsic value of an investment, can have various implications for both current and prospective investors.

To begin with, one of the primary advantages of a stock split is increased accessibility. By reducing the price per share, a split can make SCHD more affordable for individual investors, particularly those with limited capital. This increased affordability can lead to a broader investor base, potentially enhancing liquidity. Enhanced liquidity often results in tighter bid-ask spreads, which can be beneficial for investors looking to buy or sell shares with minimal price impact. Moreover, a stock split can create a perception of growth and success, as companies typically split their stock when they believe the price has risen to a level that might deter smaller investors.

On the other hand, it is crucial to consider the potential downsides of a stock split. One significant concern is the possibility of increased volatility. With more shares available at a lower price, the ETF might attract short-term traders, leading to heightened price fluctuations. This increased volatility can be unsettling for long-term investors who prioritize stability and consistent dividend income. Furthermore, while a stock split can make shares more accessible, it does not inherently improve the underlying fundamentals of the ETF. Investors must remain vigilant and focus on the quality of the holdings within SCHD, rather than being swayed by the psychological impact of a lower share price.

Additionally, it is important to recognize that a stock split does not affect the dividend yield in percentage terms. Although the number of shares increases, the total dividend payout remains unchanged, meaning the yield remains constant. For income-focused investors, the primary concern should be the sustainability and growth of dividends, rather than the nominal price of the shares. Therefore, while a split might make SCHD more appealing to a broader audience, it does not directly enhance the income-generating potential of the ETF.

In light of these considerations, investors must carefully evaluate their own investment goals and strategies when contemplating the implications of a potential SCHD stock split. For those prioritizing accessibility and liquidity, a split could present an attractive opportunity. However, for investors focused on long-term stability and dividend growth, the decision to invest should be based on the ETF’s underlying fundamentals and the quality of its holdings.

In conclusion, while a stock split for SCHD could offer certain advantages, such as increased accessibility and liquidity, it is not without its drawbacks, including potential volatility and the unchanged nature of dividend yields. Investors must weigh these factors carefully, considering their own financial objectives and risk tolerance. Ultimately, the decision to invest in SCHD, split or not, should be grounded in a thorough understanding of the ETF’s performance, strategy, and long-term potential. By maintaining a focus on these critical elements, investors can make informed decisions that align with their financial goals.

SCHD’s Performance: A Historical Analysis

SCHD, the Schwab U.S. Dividend Equity ETF, has garnered significant attention from investors seeking a reliable source of dividend income coupled with potential capital appreciation. Since its inception, SCHD has established itself as a formidable player in the realm of dividend-focused exchange-traded funds (ETFs). To understand its appeal, it is essential to delve into its historical performance, which provides insights into its resilience and growth potential.

Initially launched in 2011, SCHD has consistently demonstrated robust performance, driven by its strategic focus on high-quality U.S. companies with a strong track record of dividend payments. The ETF’s methodology involves selecting stocks based on criteria such as dividend yield, dividend growth, and return on equity, ensuring that only financially sound companies are included. This disciplined approach has contributed to SCHD’s ability to deliver consistent returns over the years.

Moreover, SCHD’s performance can be attributed to its diversified portfolio, which spans various sectors, including technology, healthcare, and consumer goods. This diversification mitigates risks associated with sector-specific downturns, thereby enhancing the ETF’s stability. For instance, during periods of market volatility, SCHD has often outperformed broader market indices, underscoring its defensive characteristics. This resilience is particularly appealing to investors seeking a steady income stream without excessive exposure to market fluctuations.

In addition to its sector diversification, SCHD’s focus on companies with a history of dividend growth has been a key driver of its performance. By prioritizing firms that consistently increase their dividend payouts, SCHD not only provides investors with a reliable income source but also offers the potential for capital appreciation. This dual benefit is a significant factor in the ETF’s popularity among income-focused investors.

Furthermore, SCHD’s expense ratio is notably low compared to other dividend-focused ETFs, making it an attractive option for cost-conscious investors. The low fees enhance the net returns for investors, allowing them to retain a larger portion of their earnings. This cost efficiency, combined with the ETF’s strong performance, has contributed to its growing assets under management, reflecting investor confidence in its long-term prospects.

While some investors have speculated about the possibility of a stock split for SCHD, it is important to note that such an event would not inherently alter the ETF’s value or performance. A stock split merely increases the number of shares while proportionally reducing the price per share, leaving the overall market capitalization unchanged. Therefore, whether or not SCHD undergoes a split, its historical performance and strategic approach remain the primary factors influencing its attractiveness to investors.

In conclusion, SCHD’s historical performance underscores its status as a robust dividend ETF, characterized by its strategic focus on high-quality, dividend-paying companies. Its diversified portfolio, emphasis on dividend growth, and cost efficiency have collectively contributed to its appeal among income-focused investors. While the prospect of a stock split may intrigue some, it is the ETF’s consistent track record and disciplined investment approach that truly define its value proposition. As investors continue to seek reliable income sources in an ever-evolving market landscape, SCHD stands out as a compelling option, offering both stability and growth potential.

Comparing SCHD with Other Dividend ETFs

When evaluating dividend-focused exchange-traded funds (ETFs), investors often seek options that offer both stability and growth potential. The Schwab U.S. Dividend Equity ETF (SCHD) has emerged as a popular choice among dividend investors, known for its robust performance and attractive yield. However, to fully appreciate SCHD’s standing in the market, it is essential to compare it with other dividend ETFs, examining factors such as yield, expense ratio, and portfolio composition.

To begin with, SCHD is designed to track the performance of the Dow Jones U.S. Dividend 100 Index, which comprises high dividend-yielding U.S. stocks with a record of consistent dividend payments. This focus on quality and reliability sets SCHD apart from many of its peers. For instance, when compared to the Vanguard High Dividend Yield ETF (VYM), SCHD tends to have a slightly higher yield, although VYM offers a broader exposure to the market with a larger number of holdings. This difference in strategy highlights the importance of understanding an ETF’s underlying index and its selection criteria.

Moreover, SCHD’s expense ratio is another factor that contributes to its appeal. With a low expense ratio, SCHD is cost-effective, allowing investors to retain more of their returns. In contrast, some other dividend ETFs, such as the iShares Select Dividend ETF (DVY), have higher expense ratios, which can erode returns over time. This cost efficiency is particularly advantageous for long-term investors who are focused on compounding their returns through reinvested dividends.

In addition to yield and cost, the composition of an ETF’s portfolio is crucial in assessing its suitability for an investor’s needs. SCHD’s portfolio is characterized by a concentration in sectors such as information technology, consumer staples, and healthcare, which are known for their resilience and growth potential. This sector allocation can be compared to that of the SPDR S&P Dividend ETF (SDY), which has a more significant emphasis on utilities and financials. Such differences in sector weightings can influence an ETF’s performance during various market cycles, making it essential for investors to align their choices with their market outlook and risk tolerance.

Furthermore, the question of whether SCHD might undergo a stock split is a topic of interest for many investors. While a split does not inherently change the value of an investment, it can increase liquidity and make the ETF more accessible to a broader range of investors. However, it is important to note that a split is not a determinant of an ETF’s quality or performance. Instead, investors should focus on the ETF’s fundamentals and how it fits into their overall investment strategy.

In conclusion, when comparing SCHD with other dividend ETFs, it is evident that its combination of a competitive yield, low expense ratio, and strategic sector allocation makes it a compelling choice for dividend-focused investors. While other ETFs may offer different advantages, such as broader diversification or alternative sector exposures, SCHD’s emphasis on quality and cost efficiency positions it as a robust option in the dividend ETF landscape. As with any investment decision, investors should carefully consider their individual goals and conduct thorough research to ensure that their chosen ETF aligns with their financial objectives.

The Impact of a Split on SCHD’s Dividend Yield

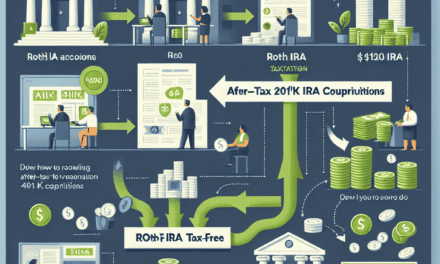

The Schwab U.S. Dividend Equity ETF (SCHD) has long been a popular choice among investors seeking a reliable source of dividend income. Known for its focus on high-quality U.S. companies with a strong track record of paying dividends, SCHD has consistently attracted attention for its robust dividend yield. However, the potential impact of a stock split on this ETF’s dividend yield is a topic that warrants careful consideration. Understanding the mechanics of a stock split is essential to grasp its implications on dividend yield. A stock split occurs when a company increases the number of its outstanding shares, thereby reducing the price per share. Importantly, a stock split does not alter the company’s market capitalization or the total value of an investor’s holdings. Consequently, the dividend per share is adjusted proportionally to reflect the increased number of shares, leaving the overall dividend yield unchanged.

In the context of SCHD, a stock split would not directly affect the ETF’s dividend yield. This is because the dividend yield is calculated as the annual dividend payment divided by the share price. Since a stock split reduces the share price while simultaneously adjusting the dividend per share, the yield remains constant. Therefore, investors in SCHD can rest assured that a stock split would not diminish the income they receive from their investment. However, while the immediate impact of a stock split on dividend yield is neutral, there are indirect effects that could influence SCHD’s yield over time. One potential outcome of a stock split is increased liquidity and accessibility. By lowering the share price, a stock split can make shares more affordable to a broader range of investors. This increased demand can lead to higher trading volumes and potentially greater interest in the ETF.

As more investors flock to SCHD, the fund may experience an influx of capital, which could be used to acquire additional dividend-paying stocks. This, in turn, could enhance the ETF’s ability to generate income and potentially lead to an increase in its dividend yield over time. Furthermore, a stock split can signal management’s confidence in the company’s future prospects. When a company decides to split its stock, it often indicates that management believes the stock price will continue to rise. This positive sentiment can extend to the ETF’s holdings, as companies within SCHD may also be more likely to split their stocks. As these companies grow and increase their dividend payments, SCHD’s overall dividend yield could benefit.

Nevertheless, it is crucial for investors to remain vigilant and not rely solely on the potential benefits of a stock split. While a split can enhance liquidity and signal positive sentiment, it does not guarantee improved financial performance or increased dividends. Investors should continue to evaluate SCHD based on its underlying fundamentals, such as the quality of its holdings and the sustainability of its dividend payments. In conclusion, while a stock split does not directly impact SCHD’s dividend yield, it can have indirect effects that may influence the yield over time. Increased liquidity, potential capital inflows, and positive sentiment are factors that could contribute to a higher yield in the future. However, investors should remain focused on the ETF’s fundamentals and not rely solely on the potential benefits of a stock split. By maintaining a comprehensive understanding of SCHD’s underlying assets and market conditions, investors can make informed decisions that align with their financial goals.

Investor Sentiment: Should SCHD Split?

Investor sentiment surrounding the Schwab U.S. Dividend Equity ETF (SCHD) has been a topic of considerable discussion, particularly regarding whether a stock split would be beneficial. SCHD, known for its robust dividend yield and strong performance, has attracted a diverse group of investors seeking both income and growth. As the ETF continues to gain popularity, the question of a potential split becomes increasingly relevant. However, understanding the implications of such a move requires a nuanced analysis of investor sentiment and market dynamics.

To begin with, it is essential to recognize the primary reasons investors are drawn to SCHD. The ETF is lauded for its focus on high-quality U.S. companies with a history of consistent dividend payments. This focus not only provides a steady income stream but also offers a degree of stability in volatile markets. As a result, SCHD has become a staple in the portfolios of income-focused investors, particularly those nearing retirement or seeking to supplement their income. The ETF’s performance has been impressive, often outpacing broader market indices, which further solidifies its appeal.

Given this context, the idea of a stock split might seem appealing to some investors. A split could potentially make SCHD more accessible by lowering the price per share, thereby attracting a broader base of retail investors. This increased accessibility could, in theory, lead to greater liquidity and potentially enhance the ETF’s marketability. Moreover, a split might create a psychological perception of affordability, encouraging more investors to enter the market.

However, it is crucial to consider the counterarguments. A stock split does not inherently change the underlying value of the ETF or its holdings. The total market capitalization remains the same, and the dividend yield is unaffected. Therefore, while a split might make shares appear more affordable, it does not alter the fundamental characteristics that make SCHD attractive. Additionally, the ETF’s current investor base, which is largely composed of long-term, income-focused individuals, may not prioritize share price accessibility as a significant factor in their investment decisions.

Furthermore, the administrative and logistical considerations of executing a stock split cannot be overlooked. The process involves costs and complexities that may not justify the potential benefits, especially if the primary goal is to maintain the ETF’s reputation as a stable, income-generating investment. Moreover, the current market environment, characterized by economic uncertainties and fluctuating interest rates, may not be conducive to such a structural change.

In conclusion, while the notion of a stock split for SCHD might generate interest and debate among investors, it is essential to weigh the potential advantages against the inherent limitations. The ETF’s strength lies in its consistent dividend performance and the quality of its holdings, attributes that remain unchanged by a split. As investor sentiment continues to evolve, it is crucial for stakeholders to focus on the long-term value and stability that SCHD offers, rather than short-term market perceptions. Ultimately, the decision to split or not should be guided by a comprehensive understanding of investor needs and market conditions, ensuring that SCHD continues to fulfill its role as a reliable dividend-focused investment.

SCHD’s Role in a Diversified Investment Portfolio

SCHD, the Schwab U.S. Dividend Equity ETF, has garnered significant attention from investors seeking a reliable source of income through dividends while also aiming for capital appreciation. As part of a diversified investment portfolio, SCHD plays a crucial role in balancing risk and reward, offering a blend of stability and growth potential. This ETF is designed to track the performance of the Dow Jones U.S. Dividend 100 Index, which comprises high dividend-yielding U.S. stocks with a history of consistent dividend payments. Consequently, SCHD provides investors with exposure to a curated selection of companies that have demonstrated financial resilience and a commitment to returning value to shareholders.

Incorporating SCHD into a diversified portfolio can enhance income generation, particularly in a low-interest-rate environment where traditional fixed-income investments may offer limited returns. The ETF’s focus on dividend-paying stocks means that investors can benefit from a steady stream of income, which can be particularly appealing for those in or approaching retirement. Moreover, the reinvestment of dividends can compound returns over time, further enhancing the growth potential of the investment. This aspect of SCHD makes it an attractive option for long-term investors who are looking to build wealth gradually while maintaining a level of income stability.

Furthermore, SCHD’s inclusion in a diversified portfolio can help mitigate risk through its exposure to a wide range of sectors. By investing in companies across various industries, SCHD reduces the impact of sector-specific downturns on the overall portfolio. This diversification is crucial in managing volatility and ensuring that the portfolio is not overly reliant on the performance of a single sector. Additionally, the ETF’s emphasis on quality companies with strong fundamentals provides a layer of protection against market fluctuations, as these firms are generally better equipped to weather economic uncertainties.

While some investors may be concerned about the potential for SCHD to undergo a stock split, it is important to understand that such an event does not inherently alter the value of the investment. A stock split merely increases the number of shares outstanding while proportionally reducing the price per share, leaving the overall market capitalization unchanged. Therefore, whether or not SCHD undergoes a split should not be a primary concern for investors focused on the ETF’s role in their portfolio. Instead, the emphasis should remain on the ETF’s ability to deliver consistent dividends and its contribution to the portfolio’s diversification strategy.

In conclusion, SCHD serves as a robust component of a diversified investment portfolio, offering both income and growth potential. Its focus on high-quality, dividend-paying stocks provides investors with a reliable source of income, while its diversified holdings help mitigate risk. The potential for a stock split should not detract from the ETF’s fundamental strengths, as such events do not impact the intrinsic value of the investment. By maintaining a long-term perspective and focusing on the ETF’s role in achieving financial goals, investors can effectively leverage SCHD to enhance their portfolio’s performance and stability. As with any investment decision, it is essential to consider individual financial objectives and risk tolerance when incorporating SCHD into a broader investment strategy.

Q&A

1. **What is SCHD?**

SCHD is the Schwab U.S. Dividend Equity ETF, which focuses on high-dividend-yielding U.S. stocks.

2. **What is the investment objective of SCHD?**

SCHD aims to track the performance of the Dow Jones U.S. Dividend 100 Index, which includes high-dividend-yielding companies with a strong track record of dividend payments.

3. **What are the key features of SCHD?**

SCHD offers exposure to quality dividend-paying U.S. stocks, low expense ratio, and a focus on companies with strong financial health and consistent dividend payments.

4. **Has SCHD ever undergone a stock split?**

As of the latest available data, SCHD has not undergone a stock split.

5. **What is the expense ratio of SCHD?**

SCHD has a low expense ratio, typically around 0.06%, making it cost-effective for investors.

6. **What type of investors might be interested in SCHD?**

SCHD is suitable for income-focused investors seeking dividend income and potential capital appreciation from U.S. equities.

7. **How does SCHD select its holdings?**

SCHD selects its holdings based on criteria such as dividend yield, financial strength, and dividend growth, focusing on companies with a history of reliable dividend payments.

Conclusion

SCHD, the Schwab U.S. Dividend Equity ETF, is a robust dividend-focused exchange-traded fund that has garnered attention for its strong performance and reliable income generation. It is designed to track the performance of the Dow Jones U.S. Dividend 100 Index, which includes high-dividend-yielding U.S. stocks with a history of consistent dividend payments. SCHD’s appeal lies in its low expense ratio, diversified portfolio, and focus on quality companies with sustainable dividends. Whether or not SCHD undergoes a stock split does not fundamentally alter its investment strategy or the underlying value of its holdings. A split might make the ETF more accessible to smaller investors by lowering the price per share, but it does not impact the overall market capitalization or the dividend yield. Therefore, SCHD remains a solid choice for investors seeking dividend income and long-term growth, regardless of any potential stock split.