“Powering the Future: Sayona Mining Unites with Piedmont Lithium for a Sustainable Tomorrow”

Introduction

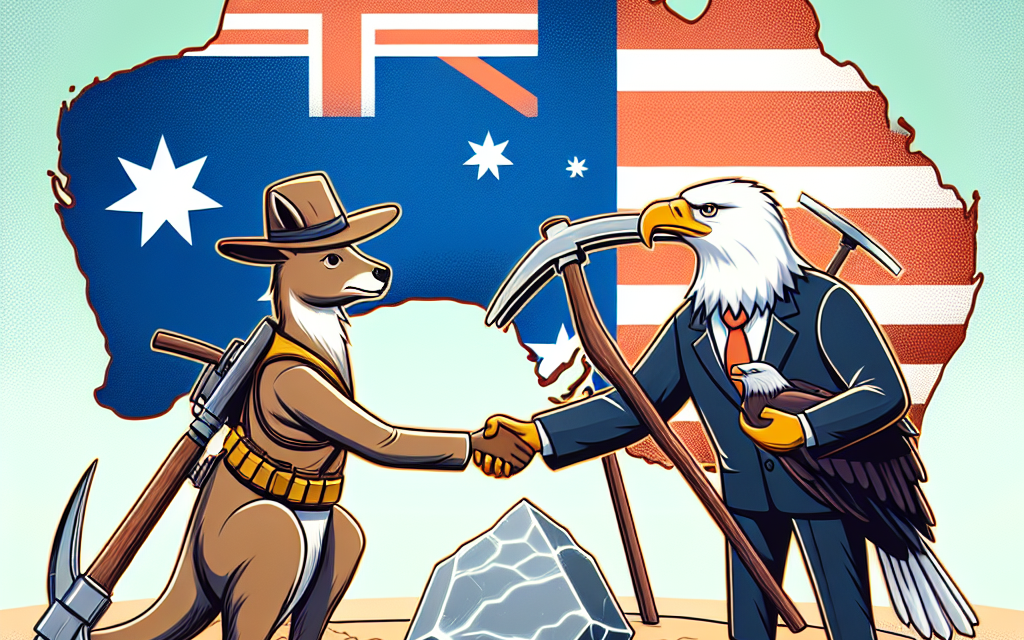

Sayona Mining, an Australian-based lithium producer, has announced its strategic acquisition of Piedmont Lithium, a prominent lithium company in the United States. This acquisition marks a significant expansion for Sayona Mining, enhancing its position in the global lithium market. By integrating Piedmont Lithium’s assets and expertise, Sayona aims to bolster its supply chain capabilities and capitalize on the growing demand for lithium, driven by the burgeoning electric vehicle and renewable energy sectors. The merger is expected to create synergies that will accelerate the development of lithium projects and strengthen Sayona’s foothold in the North American market, positioning the company as a key player in the transition to sustainable energy solutions.

Strategic Implications of Sayona Mining’s Acquisition of Piedmont Lithium

The acquisition of Piedmont Lithium by Sayona Mining marks a significant strategic maneuver in the global mining industry, particularly within the burgeoning lithium sector. This move is poised to reshape the landscape of lithium production and supply, with far-reaching implications for both companies and the broader market. As the demand for lithium continues to surge, driven by the rapid expansion of electric vehicles and renewable energy technologies, this acquisition positions Sayona Mining to capitalize on these emerging opportunities.

To begin with, the acquisition provides Sayona Mining with a substantial foothold in the United States, a market that is increasingly prioritizing domestic sources of critical minerals. Piedmont Lithium, with its strategic location in North Carolina, offers Sayona a direct entry into the U.S. lithium market, which is expected to grow exponentially in the coming years. This geographical diversification not only mitigates risks associated with reliance on a single market but also aligns with the U.S. government’s initiatives to secure domestic supply chains for essential minerals.

Moreover, the integration of Piedmont Lithium’s assets and expertise into Sayona Mining’s operations is likely to enhance the latter’s production capabilities and technological prowess. Piedmont’s advanced lithium processing techniques and its commitment to sustainable mining practices complement Sayona’s existing operations, potentially leading to increased efficiency and reduced environmental impact. This synergy is crucial as the industry faces mounting pressure to adopt greener practices and reduce carbon footprints.

In addition to operational benefits, the acquisition is expected to yield significant financial advantages. By consolidating resources and streamlining operations, Sayona Mining can achieve economies of scale, thereby reducing production costs and increasing profitability. Furthermore, the combined entity is likely to attract greater investor interest, given the strategic importance of lithium in the global transition to clean energy. This could result in enhanced access to capital, facilitating further expansion and innovation.

The acquisition also holds strategic implications for the competitive dynamics within the lithium market. As Sayona Mining strengthens its position, it may prompt other players in the industry to pursue similar mergers and acquisitions to maintain their competitive edge. This could lead to a wave of consolidation, reshaping the market landscape and potentially driving innovation and efficiency improvements across the sector.

However, the acquisition is not without its challenges. Integrating two companies with distinct corporate cultures and operational practices can be complex and may require careful management to ensure a smooth transition. Additionally, regulatory hurdles and potential opposition from stakeholders could pose obstacles that need to be navigated with strategic foresight and diplomacy.

In conclusion, Sayona Mining’s acquisition of Piedmont Lithium represents a strategic leap forward in the quest to secure a dominant position in the global lithium market. By expanding its geographical reach, enhancing its operational capabilities, and strengthening its financial standing, Sayona is well-positioned to capitalize on the growing demand for lithium. As the world continues to pivot towards sustainable energy solutions, this acquisition underscores the critical role that strategic partnerships and acquisitions will play in shaping the future of the mining industry. The implications of this move will likely reverberate across the sector, influencing competitive strategies and driving further innovation in the pursuit of a sustainable energy future.

Financial Analysis of Sayona Mining’s Expansion into the US Market

Sayona Mining, an Australian-based company, has recently announced its strategic decision to acquire Piedmont Lithium, a prominent player in the United States lithium market. This acquisition marks a significant milestone in Sayona Mining’s expansion strategy, as it seeks to establish a stronger foothold in the burgeoning lithium industry. The financial implications of this move are multifaceted, offering both opportunities and challenges that warrant a comprehensive analysis.

To begin with, the acquisition of Piedmont Lithium provides Sayona Mining with immediate access to the U.S. market, which is one of the largest and fastest-growing markets for lithium. This is particularly advantageous given the increasing demand for lithium-ion batteries, driven by the rapid adoption of electric vehicles and renewable energy storage solutions. By acquiring Piedmont Lithium, Sayona Mining can leverage existing infrastructure and customer relationships, thereby accelerating its market entry and reducing the time and resources required to establish a new presence from scratch.

Moreover, the acquisition is expected to enhance Sayona Mining’s production capabilities. Piedmont Lithium’s assets include significant lithium reserves, which will bolster Sayona’s resource base and potentially increase its production output. This expansion in production capacity is crucial for meeting the anticipated rise in demand and for positioning Sayona Mining as a competitive player in the global lithium market. Additionally, the integration of Piedmont’s advanced extraction technologies and expertise could lead to operational efficiencies and cost reductions, further strengthening Sayona’s financial position.

However, the acquisition also presents certain financial challenges that Sayona Mining must navigate. The initial cost of acquiring Piedmont Lithium is substantial, and financing this transaction may require Sayona to take on additional debt or issue new equity. This could impact the company’s balance sheet and potentially dilute existing shareholders’ equity. Therefore, it is imperative for Sayona Mining to carefully manage its financial resources and ensure that the acquisition generates sufficient returns to justify the investment.

Furthermore, the integration of Piedmont Lithium into Sayona’s operations will require careful planning and execution. Merging two companies with distinct corporate cultures and operational practices can be complex and may lead to unforeseen challenges. Sayona Mining must ensure that the integration process is smooth and that synergies are realized in a timely manner to maximize the financial benefits of the acquisition.

In addition to these considerations, Sayona Mining must remain cognizant of the regulatory environment in the United States. The acquisition of a U.S.-based company involves navigating a complex web of federal and state regulations, which can be time-consuming and costly. Compliance with these regulations is essential to avoid legal complications and to ensure the long-term success of the acquisition.

In conclusion, Sayona Mining’s acquisition of Piedmont Lithium represents a strategic move to capitalize on the growing demand for lithium in the United States. While the acquisition offers significant opportunities for market expansion and increased production capacity, it also presents financial and operational challenges that must be carefully managed. By effectively addressing these challenges, Sayona Mining can enhance its competitive position and achieve sustainable growth in the global lithium market.

Impact on the Global Lithium Supply Chain from Sayona’s Acquisition

The acquisition of Piedmont Lithium by Sayona Mining, an Australian company, marks a significant development in the global lithium supply chain, with potential implications for the industry at large. As the demand for lithium continues to surge, driven by the rapid expansion of electric vehicles and renewable energy storage solutions, this strategic move by Sayona Mining is poised to reshape the landscape of lithium production and distribution.

To begin with, the acquisition enhances Sayona Mining’s position in the global lithium market by expanding its resource base and production capabilities. Piedmont Lithium, based in the United States, holds substantial lithium reserves and has been a key player in the North American market. By integrating Piedmont’s assets, Sayona not only diversifies its geographical footprint but also strengthens its supply chain resilience. This is particularly crucial in an era where geopolitical tensions and trade uncertainties can disrupt the flow of critical minerals.

Moreover, the acquisition aligns with Sayona’s long-term strategy to become a leading supplier of lithium to the burgeoning electric vehicle industry. As automakers worldwide accelerate their transition to electric vehicles, the demand for lithium-ion batteries is expected to skyrocket. Sayona’s expanded capacity will enable it to meet this growing demand more effectively, thereby securing its position as a vital player in the supply chain. Furthermore, the acquisition provides Sayona with access to Piedmont’s established relationships with major automakers and battery manufacturers, facilitating smoother integration into the existing supply networks.

In addition to bolstering Sayona’s market position, the acquisition is likely to have broader implications for the global lithium supply chain. By consolidating resources and expertise, Sayona can achieve economies of scale, potentially leading to more efficient production processes and cost reductions. This could, in turn, influence global lithium prices, making the mineral more accessible to a wider range of industries. Additionally, the increased production capacity may alleviate some of the supply constraints that have plagued the industry in recent years, thereby stabilizing the market and fostering further innovation in lithium-based technologies.

However, it is important to consider the potential challenges that may arise from this acquisition. Integrating two companies with distinct corporate cultures and operational practices can be complex, requiring careful management to ensure a seamless transition. Moreover, regulatory approvals and compliance with environmental standards will be critical factors in the successful execution of this acquisition. Sayona will need to navigate these hurdles diligently to realize the full potential of its expanded operations.

In conclusion, Sayona Mining’s acquisition of Piedmont Lithium represents a strategic maneuver with far-reaching implications for the global lithium supply chain. By enhancing its resource base and production capabilities, Sayona is well-positioned to capitalize on the growing demand for lithium in the electric vehicle and renewable energy sectors. While challenges remain, the potential benefits of this acquisition, including increased supply chain resilience and market stability, underscore its significance in shaping the future of the lithium industry. As the world continues to transition towards sustainable energy solutions, the role of companies like Sayona Mining in ensuring a reliable supply of critical minerals will be more important than ever.

Regulatory Challenges in Sayona Mining’s Acquisition of Piedmont Lithium

The acquisition of Piedmont Lithium by Sayona Mining, an Australian company, marks a significant development in the global lithium market, yet it is not without its regulatory challenges. As the demand for lithium surges, driven by the burgeoning electric vehicle industry and the global shift towards renewable energy, companies like Sayona Mining are strategically positioning themselves to capitalize on this trend. However, the path to acquiring Piedmont Lithium, a key player in the United States, is fraught with regulatory hurdles that must be navigated with precision and foresight.

To begin with, the acquisition process is subject to scrutiny by various regulatory bodies in both Australia and the United States. In Australia, Sayona Mining must comply with the Foreign Investment Review Board (FIRB) regulations, which assess the national interest implications of foreign investments. This involves a thorough examination of the potential impacts on Australia’s economic and strategic interests. The FIRB’s approval is crucial, as it ensures that the acquisition aligns with national policies and does not pose any undue risks to the country’s resources sector.

Simultaneously, in the United States, the acquisition is subject to review by the Committee on Foreign Investment in the United States (CFIUS). This interagency committee evaluates the national security implications of foreign investments in U.S. companies. Given the strategic importance of lithium as a critical mineral for national security and technological advancement, CFIUS’s assessment is pivotal. The committee will scrutinize the transaction to ensure that it does not compromise U.S. access to lithium resources or technology.

Moreover, environmental regulations present another layer of complexity in this acquisition. Both countries have stringent environmental standards that must be adhered to, particularly in the mining sector. Sayona Mining will need to demonstrate its commitment to sustainable practices and compliance with environmental laws. This includes addressing concerns related to land use, water management, and emissions, which are critical factors in obtaining the necessary permits and approvals.

In addition to these regulatory challenges, Sayona Mining must also navigate the intricacies of corporate governance and shareholder interests. The acquisition requires the approval of both companies’ boards and shareholders, necessitating transparent communication and negotiation to align interests and secure support. This involves addressing any concerns related to valuation, strategic fit, and potential synergies that the acquisition may bring.

Furthermore, geopolitical considerations cannot be overlooked. The acquisition occurs against a backdrop of heightened geopolitical tensions and trade dynamics, particularly between the United States and China. As lithium is a strategic resource, the transaction may attract attention from policymakers and stakeholders concerned about the global supply chain’s security and resilience. Sayona Mining must be prepared to engage with these stakeholders and articulate the benefits of the acquisition in terms of enhancing supply chain stability and fostering bilateral cooperation.

In conclusion, while the acquisition of Piedmont Lithium by Sayona Mining presents a promising opportunity to strengthen its position in the global lithium market, it is accompanied by a myriad of regulatory challenges. Successfully navigating these challenges requires a comprehensive understanding of the regulatory landscape, proactive engagement with stakeholders, and a commitment to sustainable and transparent business practices. As the acquisition progresses, it will serve as a litmus test for the evolving dynamics of cross-border investments in critical minerals, setting a precedent for future transactions in this vital sector.

Potential Benefits for Australian and US Economies from the Acquisition

The acquisition of Piedmont Lithium by Sayona Mining, an Australian company, marks a significant development in the mining sector, with potential benefits extending to both the Australian and US economies. This strategic move is poised to enhance the lithium supply chain, a critical component in the burgeoning electric vehicle (EV) market and renewable energy storage solutions. As the world increasingly shifts towards sustainable energy sources, the demand for lithium, a key element in battery production, continues to rise. Consequently, this acquisition could play a pivotal role in meeting the growing global demand for lithium, thereby fostering economic growth in both countries.

To begin with, the acquisition is likely to bolster Australia’s position as a leading player in the global lithium market. Australia is already the world’s largest producer of lithium, and Sayona Mining’s expansion into the US market through Piedmont Lithium could further solidify this status. By integrating Piedmont’s resources and expertise, Sayona can enhance its production capabilities and technological advancements. This, in turn, could lead to increased exports, thereby contributing to Australia’s economic growth. Moreover, the acquisition could stimulate job creation within the mining sector, providing employment opportunities and supporting local communities.

In addition to benefiting Australia, the acquisition holds significant promise for the US economy. Piedmont Lithium’s operations in the United States are strategically located in North Carolina, a region with a rich history of mining and manufacturing. By leveraging Sayona’s expertise and resources, Piedmont can potentially increase its production capacity, thereby contributing to the domestic supply of lithium. This is particularly important for the US, as it seeks to reduce its reliance on foreign sources of critical minerals. Strengthening the domestic supply chain not only enhances national security but also supports the growth of the US EV industry, which is a key component of the country’s efforts to transition to a low-carbon economy.

Furthermore, the acquisition could foster technological innovation and collaboration between the two countries. By combining Sayona’s advanced mining techniques with Piedmont’s local knowledge and expertise, there is potential for the development of more efficient and sustainable mining practices. This collaboration could lead to breakthroughs in lithium extraction and processing technologies, which could be shared across the industry, benefiting both Australian and US companies. Additionally, such advancements could position both countries as leaders in sustainable mining practices, setting a benchmark for the global industry.

Moreover, the acquisition aligns with broader geopolitical and economic trends, as countries seek to secure critical mineral supplies in the face of increasing global competition. By strengthening ties between Australia and the US, the acquisition could pave the way for further bilateral cooperation in the mining sector and beyond. This partnership could extend to research and development initiatives, policy alignment, and investment opportunities, fostering a mutually beneficial relationship that supports economic growth and sustainability.

In conclusion, Sayona Mining’s acquisition of Piedmont Lithium presents a range of potential benefits for both the Australian and US economies. By enhancing the lithium supply chain, supporting job creation, fostering technological innovation, and strengthening bilateral ties, this strategic move could play a crucial role in meeting the growing global demand for lithium. As the world continues to transition towards sustainable energy solutions, such collaborations are essential in ensuring a stable and secure supply of critical minerals, ultimately contributing to economic prosperity and environmental sustainability.

Sayona Mining’s Growth Strategy: Lessons from the Piedmont Lithium Deal

Sayona Mining’s recent decision to acquire Piedmont Lithium marks a significant milestone in the company’s growth strategy, reflecting a broader trend of consolidation within the mining industry. This acquisition is not merely a transaction but a strategic maneuver that underscores Sayona’s commitment to expanding its footprint in the global lithium market. As the demand for lithium continues to surge, driven by the rapid growth of electric vehicles and renewable energy technologies, Sayona’s move to acquire Piedmont Lithium is both timely and strategic.

The acquisition of Piedmont Lithium, a prominent player in the United States, provides Sayona Mining with a robust platform to enhance its operational capabilities and market reach. Piedmont’s assets, particularly its lithium projects in North Carolina, are strategically located in proximity to major automotive and battery manufacturing hubs. This geographical advantage is crucial as it allows Sayona to tap into the burgeoning North American market, which is increasingly prioritizing local sourcing of critical minerals to reduce supply chain vulnerabilities.

Moreover, the acquisition aligns with Sayona’s long-term vision of becoming a leading integrated producer of lithium. By incorporating Piedmont’s advanced projects and expertise, Sayona can accelerate its development timeline and bring products to market more efficiently. This integration is expected to yield significant synergies, enhancing operational efficiencies and reducing costs. Furthermore, the combined entity will benefit from a diversified portfolio of assets, which mitigates risks associated with reliance on a single project or region.

In addition to operational synergies, the acquisition presents an opportunity for Sayona to leverage Piedmont’s established relationships with key stakeholders in the United States. These relationships are invaluable as they provide Sayona with insights into regulatory frameworks, market dynamics, and potential partnerships. By building on Piedmont’s existing networks, Sayona can navigate the complexities of the U.S. market more effectively, ensuring compliance and fostering goodwill among local communities and regulators.

The acquisition also highlights the importance of strategic foresight in the mining industry. As global demand for lithium continues to outpace supply, companies that proactively position themselves to capitalize on this trend are likely to emerge as industry leaders. Sayona’s decision to acquire Piedmont is a testament to its proactive approach, demonstrating an acute awareness of market trends and a willingness to invest in growth opportunities.

Furthermore, this acquisition serves as a case study for other mining companies seeking to expand their global presence. It underscores the importance of identifying strategic assets that complement existing operations and offer potential for growth. Additionally, it highlights the value of cross-border acquisitions as a means of accessing new markets and diversifying risk.

In conclusion, Sayona Mining’s acquisition of Piedmont Lithium is a strategic move that positions the company for long-term success in the rapidly evolving lithium market. By expanding its geographical footprint and enhancing its operational capabilities, Sayona is well-positioned to meet the growing demand for lithium and capitalize on emerging opportunities. This acquisition not only strengthens Sayona’s competitive position but also provides valuable lessons for other companies in the mining sector seeking to navigate the complexities of global expansion. As the industry continues to evolve, strategic acquisitions like this one will play a crucial role in shaping the future landscape of the mining sector.

Future Prospects for Sayona Mining Post-Acquisition of Piedmont Lithium

The acquisition of Piedmont Lithium by Sayona Mining marks a significant milestone in the strategic expansion of the Australian mining company. This move is poised to reshape the landscape of lithium production, not only in Australia but also in the United States, where Piedmont has established a strong foothold. As the global demand for lithium continues to surge, driven by the rapid growth of electric vehicles and renewable energy storage solutions, Sayona Mining’s acquisition positions the company to capitalize on these burgeoning markets.

In the wake of this acquisition, Sayona Mining is expected to leverage Piedmont Lithium’s existing infrastructure and expertise in the United States. Piedmont’s operations, particularly in North Carolina, are strategically located in proximity to major automotive and battery manufacturing hubs. This geographical advantage is likely to facilitate streamlined supply chains and reduce logistical costs, thereby enhancing Sayona’s competitive edge in the lithium market. Furthermore, Piedmont’s established relationships with key stakeholders in the U.S. market will provide Sayona with valuable insights and opportunities for collaboration, fostering a more integrated approach to lithium production and distribution.

Moreover, the acquisition aligns with Sayona Mining’s broader strategic objectives of diversifying its asset portfolio and expanding its global presence. By integrating Piedmont’s operations, Sayona can mitigate risks associated with market volatility and regulatory changes in any single region. This diversification is particularly crucial in the mining industry, where geopolitical factors and environmental regulations can significantly impact operations. Additionally, the acquisition is expected to enhance Sayona’s financial performance by increasing its production capacity and revenue streams, thereby providing a more stable foundation for future growth.

Transitioning to the technological implications, Sayona Mining stands to benefit from Piedmont Lithium’s commitment to sustainable and innovative mining practices. Piedmont has been at the forefront of developing environmentally responsible extraction techniques, which align with the growing emphasis on sustainability within the industry. By adopting these practices, Sayona can not only reduce its environmental footprint but also appeal to environmentally conscious investors and consumers. This focus on sustainability is increasingly becoming a differentiating factor in the competitive mining sector, where stakeholders are demanding greater transparency and accountability.

Furthermore, the acquisition is likely to spur further research and development initiatives within Sayona Mining. By combining resources and expertise, the company can accelerate the development of new technologies and processes that enhance the efficiency and sustainability of lithium extraction and processing. This collaborative approach to innovation is expected to yield significant long-term benefits, positioning Sayona as a leader in the next generation of mining technologies.

In conclusion, the acquisition of Piedmont Lithium by Sayona Mining represents a strategic move that is set to unlock numerous opportunities for growth and innovation. By expanding its operations into the United States, Sayona can tap into new markets and strengthen its position in the global lithium industry. The integration of Piedmont’s sustainable practices and technological advancements will further enhance Sayona’s competitive advantage, enabling the company to meet the evolving demands of the market. As Sayona Mining embarks on this new chapter, the future prospects appear promising, with the potential to drive significant value for shareholders and contribute to the sustainable development of the lithium sector.

Q&A

1. **What is Sayona Mining?**

Sayona Mining is an Australian company focused on the exploration and development of lithium and graphite resources, primarily in Australia and Canada.

2. **What is Piedmont Lithium?**

Piedmont Lithium is a U.S.-based company engaged in the development of lithium resources, particularly in North Carolina, to support the growing demand for lithium in electric vehicle batteries.

3. **Why is Sayona Mining interested in acquiring Piedmont Lithium?**

Sayona Mining is interested in acquiring Piedmont Lithium to expand its lithium resource base, enhance its position in the North American market, and capitalize on the growing demand for lithium in the electric vehicle and energy storage sectors.

4. **What are the potential benefits of this acquisition for Sayona Mining?**

The acquisition could provide Sayona Mining with increased access to high-quality lithium resources, strengthen its supply chain, and offer strategic advantages in the rapidly growing North American lithium market.

5. **How might this acquisition impact the lithium market?**

The acquisition could lead to increased production capacity and supply of lithium, potentially stabilizing prices and meeting the rising demand from the electric vehicle industry.

6. **What are the strategic goals of Sayona Mining with this acquisition?**

Sayona Mining aims to become a leading supplier of lithium in North America, diversify its asset portfolio, and enhance its capabilities in lithium production and processing.

7. **What challenges might Sayona Mining face in acquiring Piedmont Lithium?**

Challenges could include regulatory approvals, integration of operations, potential opposition from stakeholders, and ensuring the acquisition aligns with long-term strategic goals.

Conclusion

As of my last update, there is no public information or announcement regarding Sayona Mining of Australia acquiring Piedmont Lithium in the US. Therefore, I cannot provide a conclusion on this specific acquisition. If this is a recent development, I recommend checking the latest news sources or official press releases from the companies involved for accurate and up-to-date information.