“Nvidia’s Shift: A Storm on the Horizon for Supermicro Investors”

Introduction

Nvidia’s recent strategic decision has sent ripples through the tech industry, casting a shadow over Supermicro shareholders. As Nvidia continues to assert its dominance in the semiconductor and AI markets, its evolving partnerships and supply chain strategies are poised to impact key players like Supermicro. This development raises concerns about Supermicro’s future growth prospects and market positioning, as Nvidia’s choices could potentially redirect business opportunities and influence investor confidence. The unfolding scenario underscores the intricate dynamics of the tech ecosystem, where shifts in alliances and strategic priorities can have profound implications for stakeholders.

Impact Of Nvidia’s Decision On Supermicro’s Market Position

Nvidia’s recent decision to diversify its supply chain has sent ripples through the tech industry, particularly affecting Supermicro, a company that has long been a significant player in the server manufacturing sector. This strategic move by Nvidia, a leader in graphics processing units and artificial intelligence hardware, is poised to reshape the competitive landscape, leaving Supermicro shareholders in a precarious position. As Nvidia seeks to mitigate risks associated with supply chain disruptions, it has opted to expand its partnerships with other manufacturers, thereby reducing its reliance on Supermicro. This decision is not only a response to the global semiconductor shortage but also a strategic maneuver to enhance Nvidia’s resilience against future uncertainties.

The implications of Nvidia’s decision are multifaceted. For Supermicro, the immediate concern is the potential loss of a substantial portion of its business. Nvidia has been a key client, and the reduction in orders could lead to a significant decline in Supermicro’s revenue. This development is likely to unsettle investors, as the company’s financial health is closely tied to its relationship with major clients like Nvidia. Consequently, Supermicro’s market position may weaken, as it faces the dual challenge of replacing lost business and maintaining investor confidence.

Moreover, the decision underscores the increasing importance of supply chain diversification in the tech industry. Companies are recognizing the need to build more robust and flexible supply chains to withstand global disruptions. Nvidia’s move serves as a reminder that reliance on a limited number of suppliers can pose significant risks. For Supermicro, this means that it must now navigate a more competitive environment, where clients are actively seeking to diversify their supplier base. This shift in industry dynamics could compel Supermicro to innovate and adapt its business strategies to remain competitive.

In addition to the immediate financial impact, Nvidia’s decision may also influence Supermicro’s long-term strategic planning. The company will need to reassess its market position and explore new avenues for growth. This could involve expanding its product offerings, entering new markets, or forming strategic alliances with other tech companies. However, these strategies come with their own set of challenges and risks, requiring careful consideration and execution.

Furthermore, the broader market perception of Supermicro could be affected by Nvidia’s decision. Investors and analysts may view the reduced reliance on Supermicro as a signal of potential vulnerabilities within the company. This perception could lead to increased scrutiny of Supermicro’s operations and financial performance, potentially impacting its stock price and market valuation. To counteract this, Supermicro will need to demonstrate its ability to adapt and thrive in a changing market landscape.

In conclusion, Nvidia’s recent decision to diversify its supply chain presents significant challenges for Supermicro and its shareholders. The potential loss of business from a major client like Nvidia could have far-reaching implications for Supermicro’s market position and financial health. As the tech industry continues to evolve, companies like Supermicro must adapt to new realities and find innovative ways to maintain their competitive edge. While the road ahead may be fraught with challenges, it also presents opportunities for growth and transformation. Supermicro’s ability to navigate this complex landscape will ultimately determine its future success and stability in the market.

Financial Implications For Supermicro Shareholders

Nvidia’s recent strategic decision to diversify its supply chain has sent ripples through the financial markets, particularly affecting Supermicro shareholders. As Nvidia seeks to mitigate risks associated with supply chain disruptions, it has opted to expand its partnerships with other hardware manufacturers. This move, while prudent for Nvidia, poses significant challenges for Supermicro, a company that has long been a key supplier for Nvidia’s high-performance computing needs. Consequently, Supermicro shareholders are now faced with the potential financial implications of this shift in business dynamics.

To understand the gravity of the situation, it is essential to consider the historical relationship between Nvidia and Supermicro. For years, Supermicro has been a trusted partner, providing the necessary infrastructure to support Nvidia’s cutting-edge graphics processing units (GPUs). This partnership has been mutually beneficial, with Supermicro enjoying a steady stream of revenue from Nvidia’s growing demand for advanced computing solutions. However, Nvidia’s decision to broaden its supplier base introduces an element of uncertainty for Supermicro’s future revenue streams.

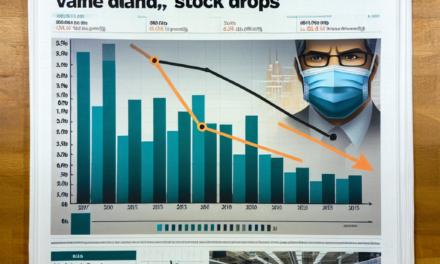

The immediate impact of Nvidia’s decision is reflected in Supermicro’s stock performance. Following the announcement, Supermicro’s shares experienced a noticeable decline, as investors reacted to the potential loss of business from one of its major clients. This market response underscores the reliance of Supermicro on Nvidia’s business and highlights the vulnerability of companies that depend heavily on a limited number of clients for their revenue. For shareholders, this development raises concerns about the company’s ability to maintain its growth trajectory in the face of increased competition and reduced business from Nvidia.

Moreover, the financial implications extend beyond the immediate stock market reaction. Supermicro may need to reassess its strategic priorities and explore new avenues for growth to compensate for the potential reduction in orders from Nvidia. This could involve diversifying its client base, investing in research and development to innovate new products, or even pursuing strategic partnerships with other technology firms. Each of these strategies carries its own set of risks and rewards, and the effectiveness of Supermicro’s response will be closely scrutinized by shareholders and market analysts alike.

In addition to strategic adjustments, Supermicro may also face increased pressure on its profit margins. As Nvidia diversifies its supplier network, it is likely to leverage its purchasing power to negotiate more favorable terms with its partners. This could result in tighter margins for Supermicro, further impacting its financial performance. Shareholders will need to monitor how the company manages its cost structure and operational efficiency in response to these challenges.

While the situation presents significant hurdles for Supermicro, it also offers an opportunity for the company to demonstrate resilience and adaptability. By proactively addressing the challenges posed by Nvidia’s decision, Supermicro can potentially emerge stronger and more diversified. For shareholders, the key will be to remain vigilant and informed about the company’s strategic initiatives and financial health.

In conclusion, Nvidia’s recent decision to diversify its supply chain has introduced a new set of challenges for Supermicro and its shareholders. The financial implications are multifaceted, affecting stock performance, revenue streams, and profit margins. However, with careful strategic planning and execution, Supermicro has the potential to navigate these challenges and continue to deliver value to its shareholders. As the situation unfolds, stakeholders will be keenly observing how the company adapts to this evolving landscape.

Strategic Missteps Leading To Supermicro’s Current Predicament

Nvidia’s recent decision to diversify its supply chain has sent ripples through the tech industry, particularly affecting Supermicro, a company that has long been a key supplier of high-performance computing solutions. This strategic shift by Nvidia, a leader in the graphics processing unit (GPU) market, underscores a broader trend in the industry where companies are seeking to mitigate risks associated with over-reliance on a single supplier. For Supermicro shareholders, this move spells potential trouble, as it highlights vulnerabilities in the company’s business model and raises questions about its future growth prospects.

Historically, Supermicro has enjoyed a strong partnership with Nvidia, supplying critical components for Nvidia’s data centers and AI-driven projects. This relationship has been mutually beneficial, with Supermicro leveraging Nvidia’s technological advancements to enhance its own product offerings. However, Nvidia’s decision to expand its supplier base is a strategic maneuver aimed at ensuring greater flexibility and resilience in its supply chain. By doing so, Nvidia can better navigate the uncertainties of global trade dynamics, geopolitical tensions, and potential disruptions caused by unforeseen events such as pandemics or natural disasters.

For Supermicro, this development is a wake-up call that highlights the risks of dependency on a single major client. While the company has made strides in diversifying its customer base, Nvidia has remained a cornerstone of its revenue stream. Consequently, any reduction in orders from Nvidia could have a significant impact on Supermicro’s financial performance. This potential downturn is likely to concern shareholders, who may see the company’s stock value fluctuate as a result of these changes.

Moreover, Nvidia’s decision could prompt other tech giants to reevaluate their own supply chain strategies, potentially leading to a broader industry shift that could further challenge Supermicro’s market position. As companies increasingly prioritize supply chain resilience, Supermicro may find itself under pressure to innovate and adapt to maintain its competitive edge. This could involve investing in new technologies, expanding into emerging markets, or forming strategic alliances with other industry players.

In addition to these external pressures, Supermicro must also contend with internal challenges. The company has faced scrutiny in the past over issues related to quality control and cybersecurity, which have occasionally tarnished its reputation. Addressing these concerns will be crucial for Supermicro as it seeks to reassure both existing and potential clients of its reliability and commitment to excellence. Strengthening its internal processes and enhancing transparency could help the company rebuild trust and solidify its standing in the industry.

Furthermore, Supermicro’s leadership will need to articulate a clear and compelling vision for the future to instill confidence among shareholders and stakeholders. This may involve outlining a strategic roadmap that emphasizes innovation, diversification, and sustainable growth. By demonstrating a proactive approach to navigating the evolving tech landscape, Supermicro can position itself as a resilient and forward-thinking player in the market.

In conclusion, Nvidia’s recent decision to diversify its supply chain presents both challenges and opportunities for Supermicro. While the immediate impact may be unsettling for shareholders, it also serves as a catalyst for the company to reassess its strategic priorities and adapt to the changing industry dynamics. By embracing innovation and addressing internal and external challenges, Supermicro can chart a path toward sustained success and reassure its shareholders of its long-term viability.

Nvidia’s Competitive Edge And Its Consequences For Supermicro

Nvidia’s recent strategic maneuvers have sent ripples through the technology sector, particularly affecting companies like Supermicro. As Nvidia continues to solidify its position as a leader in the semiconductor industry, its decisions are increasingly influencing the market dynamics and competitive landscape. This development is particularly concerning for Supermicro shareholders, who are now facing potential challenges due to Nvidia’s growing dominance.

Nvidia’s competitive edge is largely attributed to its innovative advancements in graphics processing units (GPUs) and artificial intelligence (AI) technologies. The company’s focus on high-performance computing has allowed it to capture significant market share, especially in sectors that demand robust computational power, such as gaming, data centers, and autonomous vehicles. As Nvidia continues to push the boundaries of technology, it is not only enhancing its product offerings but also expanding its influence across various industries.

One of the key factors contributing to Nvidia’s success is its strategic partnerships and acquisitions. By aligning with other tech giants and acquiring companies that complement its core competencies, Nvidia has been able to integrate cutting-edge technologies into its portfolio. This approach not only strengthens its market position but also creates barriers for competitors attempting to enter or expand within the same space. Consequently, companies like Supermicro, which rely on partnerships and collaborations to enhance their product lines, may find themselves at a disadvantage as Nvidia’s influence grows.

Moreover, Nvidia’s decision to focus on developing its own ecosystem of products and services poses a direct challenge to Supermicro. By creating a comprehensive suite of solutions that cater to a wide range of applications, Nvidia is effectively reducing the dependency on third-party suppliers and partners. This shift towards a more self-reliant business model could potentially limit Supermicro’s opportunities to collaborate with Nvidia, thereby impacting its ability to leverage Nvidia’s technological advancements for its own growth.

In addition to these strategic moves, Nvidia’s financial performance has been impressive, further solidifying its competitive edge. The company’s strong revenue growth and profitability have enabled it to invest heavily in research and development, ensuring a continuous pipeline of innovative products. This financial strength not only enhances Nvidia’s market position but also puts pressure on competitors like Supermicro, which may struggle to match Nvidia’s investment capabilities and pace of innovation.

Furthermore, Nvidia’s influence extends beyond its immediate industry, as its technologies are increasingly being adopted in emerging fields such as AI-driven healthcare, smart cities, and edge computing. This diversification into new markets not only broadens Nvidia’s revenue streams but also reinforces its status as a pivotal player in the tech ecosystem. For Supermicro, this means facing intensified competition not only in its traditional markets but also in new areas where Nvidia is establishing a foothold.

In conclusion, Nvidia’s recent decisions and strategic direction are reshaping the competitive landscape in ways that could spell trouble for Supermicro shareholders. As Nvidia continues to leverage its technological prowess, strategic partnerships, and financial strength, it is creating an environment where companies like Supermicro must adapt quickly to remain relevant. For Supermicro shareholders, this means closely monitoring Nvidia’s moves and assessing their potential impact on Supermicro’s market position and growth prospects. The evolving dynamics underscore the importance of strategic agility and innovation in navigating the challenges posed by a rapidly changing tech industry.

Analyzing Supermicro’s Response To Nvidia’s Recent Move

Nvidia’s recent decision to diversify its supply chain has sent ripples through the tech industry, particularly affecting Supermicro, a company that has long been a key supplier for Nvidia’s high-performance computing needs. This strategic shift by Nvidia, aimed at reducing dependency on a single supplier and enhancing its supply chain resilience, poses significant challenges for Supermicro and its shareholders. As the market grapples with the implications of this move, it is crucial to analyze how Supermicro is responding to this development and what it means for its future.

Supermicro, known for its robust server and storage solutions, has enjoyed a fruitful partnership with Nvidia, supplying critical components for Nvidia’s data centers and AI-driven projects. However, Nvidia’s decision to expand its supplier base is a clear signal that it seeks to mitigate risks associated with supply chain disruptions, a lesson learned from the global semiconductor shortages and geopolitical tensions that have plagued the industry in recent years. Consequently, Supermicro faces the daunting task of reassessing its business strategy to maintain its competitive edge and reassure its investors.

In response to Nvidia’s move, Supermicro has embarked on a multi-faceted strategy to adapt to the changing landscape. Firstly, the company is intensifying its efforts to diversify its own customer base. By expanding its reach into new markets and industries, Supermicro aims to reduce its reliance on Nvidia and stabilize its revenue streams. This approach not only helps cushion the impact of Nvidia’s decision but also positions Supermicro to tap into emerging opportunities in sectors such as cloud computing, edge computing, and 5G infrastructure.

Moreover, Supermicro is investing heavily in research and development to innovate and enhance its product offerings. By focusing on cutting-edge technologies and solutions, the company seeks to differentiate itself from competitors and attract a broader range of clients. This commitment to innovation is crucial in maintaining Supermicro’s reputation as a leader in high-performance computing solutions, even as it navigates the challenges posed by Nvidia’s strategic shift.

Additionally, Supermicro is strengthening its supply chain management to ensure greater flexibility and resilience. By optimizing its procurement processes and building strategic partnerships with multiple suppliers, the company aims to mitigate risks associated with supply chain disruptions. This proactive approach not only aligns with industry best practices but also demonstrates Supermicro’s commitment to maintaining operational stability and meeting customer demands.

While these strategic initiatives are promising, they are not without challenges. Supermicro must execute these plans effectively to regain investor confidence and sustain its growth trajectory. The company’s ability to adapt to the evolving market dynamics will be closely scrutinized by shareholders, who are understandably concerned about the potential impact on Supermicro’s financial performance.

In conclusion, Nvidia’s decision to diversify its supply chain presents a significant challenge for Supermicro and its shareholders. However, by diversifying its customer base, investing in innovation, and enhancing supply chain resilience, Supermicro is taking proactive steps to address these challenges. The company’s response will be critical in determining its future success and its ability to navigate the complexities of the tech industry. As the situation unfolds, stakeholders will be keenly observing Supermicro’s progress and its ability to adapt to the new realities of the market.

Long-term Effects On Supermicro’s Business Model

Nvidia’s recent decision to diversify its supply chain has sent ripples through the tech industry, particularly affecting Supermicro, a company that has long been a key supplier of server hardware for Nvidia’s high-performance computing needs. This strategic shift by Nvidia is poised to have significant long-term effects on Supermicro’s business model, raising concerns among its shareholders about the company’s future profitability and market position. As Nvidia seeks to mitigate risks associated with supply chain disruptions and geopolitical tensions, it has opted to broaden its supplier base, thereby reducing its reliance on any single partner. This move, while prudent from Nvidia’s perspective, poses a challenge for Supermicro, which has historically benefited from a close relationship with the graphics processing unit (GPU) giant.

In the short term, Supermicro may experience a decline in revenue as Nvidia’s orders become less frequent and potentially smaller in volume. This immediate impact could pressure Supermicro to reassess its operational strategies and explore new avenues for growth. However, the long-term implications are more profound, as they necessitate a fundamental reevaluation of Supermicro’s business model. The company must now consider diversifying its own client base to reduce dependency on Nvidia and other major clients, thereby ensuring a more stable revenue stream. This strategic pivot could involve targeting emerging markets or expanding its product offerings to cater to a broader range of industries beyond high-performance computing.

Moreover, Supermicro’s need to innovate and differentiate its products becomes increasingly critical in this new landscape. As competition intensifies, the company must invest in research and development to maintain its competitive edge and appeal to a wider array of customers. This focus on innovation could lead to the development of cutting-edge technologies that not only meet the evolving demands of existing clients but also attract new business opportunities. However, such investments require substantial financial resources and a willingness to take calculated risks, which may not sit well with all shareholders, particularly those with a more conservative outlook.

In addition to diversifying its client base and investing in innovation, Supermicro must also enhance its operational efficiency to remain competitive. Streamlining production processes, optimizing supply chain management, and reducing costs are essential steps in maintaining profitability in the face of reduced orders from Nvidia. By improving operational efficiency, Supermicro can better weather the financial impact of Nvidia’s decision and position itself for long-term success.

Furthermore, Supermicro’s ability to adapt to changing market dynamics will be crucial in maintaining shareholder confidence. Transparent communication with investors about the company’s strategic plans and progress will be vital in reassuring stakeholders of Supermicro’s resilience and growth potential. By demonstrating a proactive approach to addressing the challenges posed by Nvidia’s decision, Supermicro can foster trust and support among its shareholders.

In conclusion, Nvidia’s recent decision to diversify its supply chain presents significant challenges for Supermicro, necessitating a reevaluation of its business model. By diversifying its client base, investing in innovation, enhancing operational efficiency, and maintaining transparent communication with shareholders, Supermicro can navigate these challenges and emerge stronger in the long term. While the road ahead may be fraught with difficulties, the company’s ability to adapt and evolve will ultimately determine its success in this rapidly changing industry landscape.

Shareholder Reactions To Nvidia’s Strategic Shift

Nvidia’s recent strategic decision to diversify its supply chain has sent ripples through the tech industry, particularly affecting Supermicro shareholders. As Nvidia seeks to mitigate risks associated with supply chain disruptions, it has opted to expand its partnerships with other hardware manufacturers. This move, while prudent from a business continuity perspective, has raised concerns among Supermicro investors who have long relied on the close relationship between the two companies.

Historically, Supermicro has been a key supplier for Nvidia, providing essential components for its high-performance computing systems. This partnership has been mutually beneficial, with Nvidia gaining access to reliable hardware solutions and Supermicro enjoying a steady stream of revenue. However, Nvidia’s decision to broaden its supplier base is seen as a strategic shift aimed at reducing dependency on any single supplier, thereby enhancing its resilience against potential supply chain bottlenecks.

For Supermicro shareholders, this development is troubling. The company’s stock has experienced volatility in the wake of Nvidia’s announcement, reflecting investor anxiety over the potential loss of business. While Supermicro remains a significant player in the industry, the prospect of reduced orders from Nvidia could impact its financial performance. Shareholders are now faced with the challenge of reassessing the company’s growth prospects in light of this new reality.

Moreover, Nvidia’s decision underscores a broader trend within the tech industry, where companies are increasingly prioritizing supply chain diversification. This trend has been accelerated by recent global events, such as the COVID-19 pandemic and geopolitical tensions, which have highlighted the vulnerabilities of relying on a limited number of suppliers. As a result, many tech giants are reevaluating their supply chain strategies to ensure greater flexibility and security.

In response to Nvidia’s move, Supermicro has sought to reassure its investors by emphasizing its commitment to innovation and customer satisfaction. The company has highlighted its efforts to expand its product offerings and explore new markets, aiming to offset any potential decline in business from Nvidia. Additionally, Supermicro has pointed to its strong track record of adapting to industry changes and maintaining robust relationships with a diverse range of clients.

Nevertheless, the uncertainty surrounding the future of the Nvidia-Supermicro partnership has left some shareholders uneasy. The potential for reduced revenue from one of its largest clients poses a significant challenge for Supermicro, which must now navigate a rapidly evolving market landscape. Investors are closely monitoring the situation, eager for any signs of how the company plans to address these challenges and sustain its growth trajectory.

In conclusion, Nvidia’s strategic shift has created a complex situation for Supermicro shareholders, who must grapple with the implications of a changing business relationship. While the move reflects a broader industry trend towards supply chain diversification, it also highlights the risks associated with over-reliance on key partnerships. As Supermicro works to adapt to this new environment, its ability to innovate and expand its market presence will be crucial in maintaining investor confidence. Ultimately, the company’s response to these challenges will determine its future success and the satisfaction of its shareholders.

Q&A

1. **What decision did Nvidia make?**

Nvidia decided to reduce its reliance on Supermicro for its hardware needs, opting to diversify its supply chain and work with other manufacturers.

2. **Why is this decision significant for Supermicro?**

Supermicro has been a key supplier for Nvidia, and losing a major client like Nvidia could significantly impact its revenue and market position.

3. **How might this decision affect Supermicro’s stock price?**

The decision could lead to a decline in Supermicro’s stock price as investors react to the potential loss of business and future revenue from Nvidia.

4. **What are the potential long-term impacts on Supermicro?**

Long-term impacts could include reduced market share, decreased bargaining power with other clients, and the need to find new clients to replace lost revenue.

5. **How could Supermicro mitigate the impact of Nvidia’s decision?**

Supermicro could mitigate the impact by diversifying its client base, improving its product offerings, and seeking partnerships with other major tech companies.

6. **What does this decision indicate about Nvidia’s strategy?**

Nvidia’s decision indicates a strategy to reduce dependency on a single supplier, enhance supply chain resilience, and potentially lower costs by working with multiple manufacturers.

7. **How might this decision affect the tech industry as a whole?**

This decision could prompt other tech companies to reassess their supply chain strategies, leading to increased competition among suppliers and potential shifts in industry dynamics.

Conclusion

Nvidia’s recent decision to diversify its supply chain and reduce reliance on Supermicro could spell trouble for Supermicro shareholders. As Nvidia is a significant customer, any reduction in orders could lead to decreased revenue and profit margins for Supermicro. This shift may also signal potential challenges in maintaining competitive pricing and technological alignment with Nvidia’s evolving needs. Consequently, Supermicro’s stock could face downward pressure as investors reassess the company’s growth prospects and market position in light of this strategic change by Nvidia.