“Tesla Takes Off, Yields Ease: Markets Ride the Morning Wave!”

Introduction

In today’s Morning Market Update, investors are greeted with a wave of optimism as Tesla’s stock experiences a significant surge, propelling the electric vehicle giant to new heights. This upward momentum in Tesla’s shares is contributing to a broader market rally, as declining bond yields provide additional support to equities. The easing of yields is alleviating some of the pressure on growth stocks, allowing markets to regain their footing after recent volatility. As traders digest these developments, the focus remains on how these dynamics will shape the trading day ahead, with attention on key economic indicators and corporate earnings reports that could further influence market sentiment.

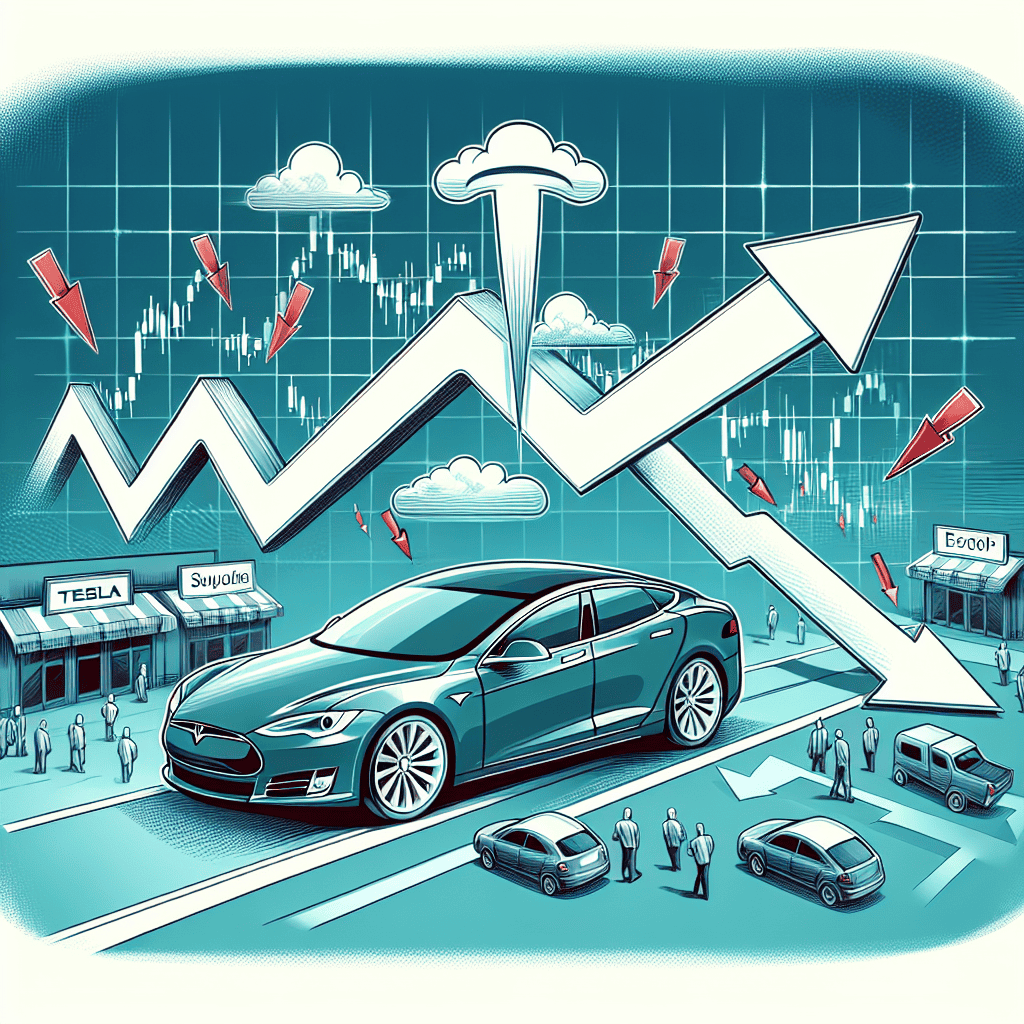

Tesla’s Stock Surge: Analyzing the Factors Behind the Rise

In the latest morning market update, Tesla’s stock has experienced a significant surge, capturing the attention of investors and analysts alike. This remarkable rise in Tesla’s stock price can be attributed to a confluence of factors that have collectively bolstered investor confidence and driven market enthusiasm. As we delve into the underlying reasons for this upward trajectory, it becomes evident that a combination of strong financial performance, strategic initiatives, and broader market dynamics have played pivotal roles.

To begin with, Tesla’s recent quarterly earnings report exceeded market expectations, showcasing robust revenue growth and improved profit margins. The company’s ability to consistently deliver strong financial results has reinforced investor trust in its long-term growth prospects. Moreover, Tesla’s impressive vehicle delivery numbers have further solidified its position as a leader in the electric vehicle (EV) market. The increasing global demand for EVs, driven by heightened environmental awareness and supportive government policies, has provided a favorable backdrop for Tesla’s continued expansion.

In addition to its financial performance, Tesla’s strategic initiatives have also contributed to the surge in its stock price. The company’s ongoing efforts to diversify its product offerings and expand its manufacturing capabilities have been well-received by the market. Notably, Tesla’s advancements in battery technology and its plans to scale up production at its Gigafactories have been viewed as significant steps towards achieving greater operational efficiency and cost-effectiveness. These initiatives not only enhance Tesla’s competitive edge but also position it to capitalize on the growing demand for sustainable energy solutions.

Furthermore, the broader market environment has played a crucial role in Tesla’s stock surge. A decline in bond yields has provided a supportive backdrop for equities, particularly growth stocks like Tesla. Lower yields have made stocks more attractive relative to bonds, prompting investors to seek higher returns in the equity markets. This shift in investor sentiment has been further amplified by expectations of continued accommodative monetary policies from central banks, which have bolstered market confidence and fueled risk appetite.

Moreover, Tesla’s stock surge can also be attributed to positive sentiment surrounding the company’s future prospects. The market’s optimism is underpinned by Tesla’s ambitious plans for expansion into new markets and its commitment to innovation. The company’s foray into autonomous driving technology and its exploration of energy storage solutions have generated excitement among investors, who view these initiatives as potential catalysts for future growth. Additionally, Tesla’s strong brand recognition and its ability to attract a loyal customer base have further contributed to its stock’s upward momentum.

In conclusion, Tesla’s stock surge can be attributed to a combination of strong financial performance, strategic initiatives, and favorable market dynamics. The company’s ability to consistently deliver impressive results, coupled with its commitment to innovation and expansion, has instilled confidence in investors and driven market enthusiasm. As Tesla continues to navigate the evolving landscape of the automotive and energy industries, its stock remains a focal point for investors seeking exposure to the burgeoning electric vehicle market. With a confluence of factors working in its favor, Tesla’s stock surge serves as a testament to the company’s resilience and its potential for sustained growth in the years to come.

Impact of Declining Yields on Global Markets

In the ever-evolving landscape of global financial markets, the interplay between various economic indicators often dictates the direction of investor sentiment and market performance. Recently, a notable shift has been observed as declining yields have begun to exert a significant influence on global markets. This development comes at a time when Tesla, a major player in the automotive and technology sectors, has experienced a remarkable surge in its stock price, further amplifying the positive momentum across financial markets.

To understand the impact of declining yields, it is essential to consider the broader economic context. Yields, particularly those on government bonds, serve as a barometer for investor expectations regarding future interest rates and economic growth. When yields decline, it often signals a shift in investor sentiment towards a more accommodative monetary policy environment. This can be attributed to central banks’ efforts to stimulate economic activity by lowering interest rates, thereby making borrowing more attractive for businesses and consumers alike.

The recent decline in yields has been driven by a confluence of factors, including subdued inflationary pressures and a cautious approach by central banks in response to global economic uncertainties. As yields fall, the cost of borrowing decreases, providing a boost to economic activity. This, in turn, has a ripple effect on various asset classes, including equities, as investors seek higher returns in a low-yield environment. Consequently, stock markets have experienced a surge in buying activity, with investors reallocating their portfolios towards riskier assets in search of better returns.

Tesla’s recent performance exemplifies the positive impact of declining yields on equities. As a company at the forefront of innovation in the electric vehicle and renewable energy sectors, Tesla has captured the imagination of investors worldwide. The decline in yields has made Tesla’s growth prospects even more attractive, as lower borrowing costs enhance the company’s ability to invest in research and development, expand production capabilities, and explore new markets. This has led to a surge in Tesla’s stock price, further buoying investor confidence and contributing to the overall positive sentiment in the market.

Moreover, the impact of declining yields extends beyond equities, influencing other asset classes such as currencies and commodities. In the currency markets, lower yields can lead to a depreciation of the domestic currency as investors seek higher returns elsewhere. This can have implications for international trade and competitiveness, as a weaker currency makes exports more attractive. Similarly, in the commodities market, lower yields can drive up demand for raw materials, as lower borrowing costs encourage investment in infrastructure and development projects.

In conclusion, the recent decline in yields has had a profound impact on global markets, fostering a favorable environment for equities and other risk assets. Tesla’s impressive performance serves as a testament to the positive sentiment generated by lower yields, as investors increasingly seek opportunities in growth-oriented sectors. As central banks continue to navigate the complexities of the global economic landscape, the interplay between yields and market dynamics will remain a critical factor in shaping investor behavior and market outcomes. The ongoing developments in this area warrant close attention, as they hold the potential to influence the trajectory of global financial markets in the months to come.

How Tesla’s Performance Influences the Broader Market

In the ever-evolving landscape of global financial markets, the performance of individual companies can have a profound impact on broader market trends. Tesla, Inc., a leading player in the electric vehicle industry, serves as a prime example of this phenomenon. Recently, Tesla’s stock has experienced a significant surge, capturing the attention of investors and analysts alike. This upward trajectory not only reflects the company’s robust business strategies and innovative advancements but also exerts a considerable influence on the broader market.

Tesla’s remarkable performance can be attributed to several key factors. First and foremost, the company’s consistent delivery of strong quarterly earnings has bolstered investor confidence. By surpassing market expectations, Tesla has demonstrated its ability to navigate challenges and capitalize on opportunities within the competitive automotive sector. Furthermore, the company’s strategic expansion into international markets, coupled with its commitment to sustainable energy solutions, has positioned it as a leader in the transition towards a greener future. As a result, Tesla’s stock has become a barometer for investor sentiment, with its movements often mirroring broader market trends.

The ripple effect of Tesla’s success extends beyond its own stock performance. As one of the most valuable companies in the world, Tesla’s influence on major stock indices is substantial. When Tesla’s stock price rises, it contributes to the overall upward momentum of indices such as the S&P 500 and the Nasdaq Composite. This, in turn, can create a positive feedback loop, encouraging further investment and driving market gains. Consequently, Tesla’s performance is closely monitored by market participants, who view it as an indicator of broader economic health and investor confidence.

Moreover, Tesla’s impact on the market is not limited to its direct contributions to stock indices. The company’s success has also spurred increased interest and investment in the electric vehicle sector as a whole. As Tesla continues to innovate and expand its product offerings, other automakers are compelled to follow suit, leading to heightened competition and technological advancements across the industry. This dynamic has attracted significant capital inflows into the sector, further boosting market performance and encouraging the development of sustainable transportation solutions.

In addition to Tesla’s influence, recent declines in bond yields have provided an additional tailwind for the market. Lower yields make equities more attractive relative to fixed-income investments, prompting investors to allocate more capital to stocks. This shift in investor preference has been particularly beneficial for growth-oriented companies like Tesla, which are often more sensitive to changes in interest rates. As yields decline, the cost of borrowing decreases, enabling companies to invest in expansion and innovation, thereby enhancing their growth prospects.

In conclusion, Tesla’s soaring stock price and the concurrent decline in bond yields have created a favorable environment for the broader market. The company’s strong performance not only reflects its own strategic successes but also serves as a catalyst for market gains. As Tesla continues to lead the charge in the electric vehicle industry, its influence on market dynamics is likely to persist. Investors and analysts will undoubtedly keep a close eye on Tesla’s trajectory, recognizing its pivotal role in shaping the future of both the automotive sector and the global financial markets.

The Role of Interest Rates in Market Movements

In the ever-evolving landscape of financial markets, interest rates play a pivotal role in shaping investor sentiment and influencing market movements. As we delve into the intricacies of this dynamic, it is essential to understand how fluctuations in interest rates can impact various asset classes, including equities, bonds, and commodities. Recently, the financial markets have been buoyed by a notable decline in yields, which has provided a much-needed boost to investor confidence. This decline in yields has coincided with a remarkable surge in Tesla’s stock, underscoring the interconnectedness of interest rates and market performance.

Interest rates, set by central banks, serve as a benchmark for borrowing costs across the economy. When interest rates are low, borrowing becomes more affordable, encouraging businesses to invest and consumers to spend. This, in turn, stimulates economic growth and can lead to higher corporate earnings, which are often reflected in rising stock prices. Conversely, when interest rates rise, borrowing costs increase, potentially dampening economic activity and exerting downward pressure on stock valuations. Therefore, the recent decline in yields has been a welcome development for equity markets, as it suggests a more accommodative monetary environment.

The relationship between interest rates and bond prices is also crucial to understanding market dynamics. Bond prices and yields move inversely; when yields fall, bond prices rise. This inverse relationship is particularly significant for fixed-income investors, who seek to capitalize on price appreciation in a declining yield environment. As yields have declined, bondholders have experienced gains, further enhancing the attractiveness of bonds as an investment option. This shift in investor preference can lead to a reallocation of capital from equities to bonds, influencing overall market performance.

Moreover, the decline in yields has had a pronounced effect on growth stocks, such as Tesla. Growth stocks are typically more sensitive to changes in interest rates due to their reliance on future earnings potential. Lower yields reduce the discount rate applied to these future earnings, effectively increasing the present value of growth stocks. Consequently, Tesla’s recent surge can be attributed, in part, to the favorable interest rate environment, which has amplified investor enthusiasm for growth-oriented companies.

In addition to equities and bonds, interest rates also impact the commodities market. Lower interest rates can weaken a currency, making commodities priced in that currency more attractive to foreign buyers. This can lead to increased demand and higher prices for commodities such as gold and oil. However, the current market scenario has seen a more pronounced effect on equities, particularly in the technology sector, where companies like Tesla have thrived amid declining yields.

As we navigate the complexities of financial markets, it is evident that interest rates serve as a critical barometer for investor sentiment and market direction. The recent decline in yields has provided a tailwind for equities, particularly growth stocks, while also benefiting bondholders. This interplay between interest rates and market movements underscores the importance of monitoring central bank policies and economic indicators. As investors continue to assess the implications of interest rate changes, the ability to adapt to evolving market conditions will remain paramount. In this context, the surge in Tesla’s stock serves as a testament to the profound impact that interest rates can have on market dynamics, offering valuable insights for investors seeking to navigate the complexities of today’s financial landscape.

Investor Sentiment: Reactions to Tesla’s Growth and Yield Changes

In the ever-evolving landscape of global financial markets, investor sentiment often hinges on a confluence of factors that can shift rapidly. Today, the spotlight is on Tesla’s remarkable ascent and the concurrent decline in bond yields, both of which are significantly influencing market dynamics. As investors digest these developments, their reactions are shaping the broader market sentiment, providing a fascinating glimpse into the interplay between corporate performance and macroeconomic indicators.

Tesla’s recent surge in stock price has captured the attention of investors worldwide. The electric vehicle giant’s impressive growth trajectory is underpinned by robust quarterly earnings, which exceeded analysts’ expectations. This performance is attributed to a combination of increased production capacity, strategic market expansion, and continued innovation in battery technology. As a result, Tesla’s stock has soared, instilling confidence among investors who view the company as a bellwether for the broader tech and automotive sectors. The ripple effect of Tesla’s success is palpable, as it not only boosts the company’s market capitalization but also enhances investor sentiment across related industries.

Simultaneously, the decline in bond yields is playing a crucial role in shaping market sentiment. Lower yields are often indicative of investor expectations for slower economic growth or reduced inflationary pressures. In this context, the recent decline suggests a shift in market perceptions, potentially driven by central bank policies or macroeconomic data releases. For equity markets, lower yields can be a boon, as they reduce the cost of borrowing and make stocks more attractive relative to fixed-income investments. Consequently, the decline in yields is providing an additional tailwind for equities, complementing the positive sentiment generated by Tesla’s performance.

The interplay between Tesla’s stock surge and declining yields is creating a favorable environment for investors, who are increasingly optimistic about the prospects for continued market growth. This optimism is reflected in the broader indices, which are experiencing upward momentum as a result of these dual catalysts. Moreover, the positive sentiment is not confined to the United States; global markets are also benefiting from the buoyant mood, as investors seek opportunities in international equities that stand to gain from these developments.

However, it is important to note that while the current sentiment is largely positive, investors remain vigilant about potential risks. Geopolitical tensions, unexpected shifts in monetary policy, or unforeseen economic disruptions could alter the current trajectory. As such, market participants are closely monitoring developments on multiple fronts, ready to adjust their strategies in response to changing conditions.

In conclusion, the current investor sentiment is being shaped by the impressive performance of Tesla and the decline in bond yields, both of which are contributing to a positive market outlook. As these factors continue to unfold, they offer valuable insights into the complex dynamics that drive financial markets. Investors, buoyed by the current environment, are navigating this landscape with a mix of optimism and caution, aware of the opportunities and challenges that lie ahead. The interplay between corporate success and macroeconomic indicators remains a key theme, underscoring the importance of staying informed and adaptable in an ever-changing market environment.

Comparing Tesla’s Market Impact to Other Tech Giants

In the ever-evolving landscape of the stock market, the influence of major tech companies cannot be overstated. Among these giants, Tesla has emerged as a formidable player, often drawing comparisons to other industry titans such as Apple, Amazon, and Microsoft. Today, Tesla’s remarkable surge in stock price has captured the attention of investors and analysts alike, prompting a closer examination of its market impact relative to its peers.

Tesla’s ascent in the market is not merely a reflection of its innovative electric vehicles but also a testament to its strategic positioning in the broader tech ecosystem. Unlike traditional automakers, Tesla has successfully positioned itself as a technology company, leveraging advancements in battery technology, autonomous driving, and renewable energy solutions. This multifaceted approach has allowed Tesla to capture a significant share of the market’s attention, much like Apple did with its ecosystem of devices and services.

Moreover, Tesla’s influence extends beyond its core business operations. The company’s charismatic CEO, Elon Musk, plays a pivotal role in shaping market perceptions. His ability to generate excitement and anticipation around Tesla’s future projects often results in significant stock price movements. This phenomenon is reminiscent of how Steve Jobs’ visionary leadership propelled Apple to new heights, underscoring the importance of strong leadership in driving market impact.

In comparison to other tech giants, Tesla’s market capitalization has grown at an unprecedented rate. While Apple and Microsoft have long been considered stalwarts of the tech industry, Tesla’s rapid rise has challenged the traditional hierarchy. This shift is indicative of a broader trend where investors are increasingly valuing companies that are at the forefront of technological innovation and sustainability. As a result, Tesla’s market impact is not only measured by its financial performance but also by its ability to shape the future of transportation and energy.

Furthermore, Tesla’s influence on the market is amplified by its role in the broader economic context. The recent decline in bond yields has provided a favorable environment for growth stocks, including Tesla, to thrive. Lower yields often lead investors to seek higher returns in equities, particularly those with strong growth potential. This dynamic has contributed to Tesla’s soaring stock price, as investors anticipate continued expansion and profitability.

In contrast, other tech giants such as Amazon and Google have experienced more stable growth trajectories, driven by their dominance in e-commerce and digital advertising, respectively. While these companies continue to exert significant influence over the market, Tesla’s unique position as a disruptor in the automotive and energy sectors sets it apart. This distinction highlights the diverse ways in which tech companies can impact the market, each leveraging their strengths to capture investor interest.

In conclusion, Tesla’s soaring stock price and its subsequent impact on the market underscore the company’s growing influence among tech giants. By comparing Tesla’s market impact to that of other industry leaders, it becomes evident that Tesla’s innovative approach and strategic positioning have allowed it to carve out a unique niche. As the market continues to evolve, Tesla’s role as a catalyst for change will likely persist, further solidifying its status as a key player in the tech industry.

Future Market Predictions: What to Expect After Tesla’s Surge and Yield Decline

In the wake of Tesla’s remarkable surge and the concurrent decline in bond yields, market analysts are keenly observing the potential implications for future market dynamics. Tesla’s recent performance has been nothing short of extraordinary, with its stock price experiencing a significant uptick. This surge can be attributed to a combination of robust quarterly earnings, optimistic forward guidance, and strategic advancements in technology and production capabilities. As a result, investor sentiment surrounding Tesla has been overwhelmingly positive, contributing to a broader uplift in market indices.

Simultaneously, the decline in bond yields has played a pivotal role in shaping the current market landscape. Lower yields often signal a shift in investor preference towards equities, as the relative attractiveness of fixed-income securities diminishes. This environment typically encourages risk-taking, prompting investors to seek higher returns in the stock market. Consequently, the dual impact of Tesla’s ascent and declining yields has created a fertile ground for bullish market behavior.

Looking ahead, the interplay between these two factors is likely to influence market trends in the coming months. Tesla’s continued innovation and expansion into new markets, such as energy storage and autonomous driving, are expected to sustain its growth trajectory. Moreover, the company’s ability to navigate supply chain challenges and maintain competitive pricing will be crucial in solidifying its market position. As Tesla continues to capture investor attention, its performance could serve as a bellwether for the broader technology sector, potentially driving further gains in tech-heavy indices.

On the other hand, the trajectory of bond yields will be closely monitored by market participants. Should yields remain low, the appeal of equities is likely to persist, supporting sustained market momentum. However, any unexpected shifts in monetary policy or inflationary pressures could alter this dynamic, prompting a reevaluation of asset allocations. Investors will need to remain vigilant, assessing macroeconomic indicators and central bank communications to gauge the future direction of yields.

In addition to these primary factors, geopolitical developments and regulatory changes could also impact market sentiment. For instance, evolving trade relations and policy decisions in major economies may introduce volatility, influencing investor confidence. Furthermore, regulatory scrutiny on technology companies, including Tesla, could pose challenges, necessitating strategic adjustments to maintain compliance and growth.

In conclusion, the recent surge in Tesla’s stock and the decline in bond yields have set the stage for an intriguing period in the financial markets. As investors navigate this landscape, they will need to balance optimism with caution, considering both the opportunities and risks that lie ahead. The interplay between corporate performance, macroeconomic conditions, and external factors will be critical in shaping future market predictions. By staying informed and adaptable, investors can position themselves to capitalize on potential gains while mitigating downside risks. As the market evolves, the ability to anticipate and respond to changing dynamics will be paramount in achieving long-term investment success.

Q&A

1. **What caused Tesla’s stock to soar?**

Tesla’s stock soared due to strong quarterly earnings and optimistic future guidance.

2. **How did declining yields impact the market?**

Declining yields made equities more attractive, leading to a boost in stock market indices.

3. **Which sectors benefited the most from the market boost?**

Technology and consumer discretionary sectors benefited the most from the market boost.

4. **What was the reaction of the broader market to Tesla’s performance?**

The broader market reacted positively, with major indices rising as investor sentiment improved.

5. **How did other automakers’ stocks respond to Tesla’s surge?**

Other automakers’ stocks experienced a mixed response, with some gaining due to sector optimism and others remaining flat.

6. **What role did economic data play in the market update?**

Positive economic data contributed to the market’s upward momentum by reinforcing investor confidence.

7. **Were there any geopolitical factors influencing the market?**

Geopolitical factors were relatively stable, allowing market focus to remain on corporate earnings and economic indicators.

Conclusion

The morning market update highlights a positive shift in the financial landscape, driven by a significant surge in Tesla’s stock and a decline in bond yields. Tesla’s impressive performance has likely instilled investor confidence, contributing to broader market gains. Meanwhile, the decrease in yields suggests a more favorable borrowing environment, potentially stimulating economic activity and further supporting market optimism. Together, these factors create a conducive atmosphere for continued market growth and investor enthusiasm.