“Boost Your Nest Egg: Unlock the Power of Catch-Up Contributions at 55 with $1.2 Million Saved!”

Introduction

Maximizing retirement savings is a crucial financial strategy for ensuring a comfortable and secure future. For individuals approaching retirement age, the opportunity to enhance their savings through catch-up contributions becomes increasingly significant. At age 55, those with $1.2 million already saved can leverage these additional contributions to bolster their retirement funds, potentially increasing their financial stability and flexibility in later years. Catch-up contributions allow individuals to exceed standard contribution limits to retirement accounts, providing a valuable tool for those who may have started saving later or wish to maximize their retirement nest egg. Understanding the impact of these contributions can empower individuals to make informed decisions, optimize their savings strategy, and ultimately achieve their retirement goals with greater confidence.

Understanding Catch-Up Contributions: A Key Strategy for Boosting Retirement Savings

As individuals approach retirement, the importance of maximizing savings becomes increasingly apparent. For those who have diligently saved and accumulated a substantial nest egg, such as $1.2 million, the focus often shifts to strategies that can further enhance their financial security. One such strategy is the utilization of catch-up contributions, a provision that allows individuals aged 50 and older to contribute additional funds to their retirement accounts. Understanding the impact of these contributions is crucial for those seeking to bolster their retirement savings.

Catch-up contributions were introduced as part of the Economic Growth and Tax Relief Reconciliation Act of 2001, with the aim of providing older workers the opportunity to accelerate their savings as they near retirement. For individuals aged 55 and above, this provision becomes particularly significant. At this stage, many are in their peak earning years, often with fewer financial obligations such as mortgage payments or child-rearing expenses. This financial flexibility allows them to allocate more resources towards their retirement savings.

The primary advantage of catch-up contributions lies in their ability to significantly increase the amount of money that can be saved in tax-advantaged accounts. For instance, in 2023, the standard contribution limit for a 401(k) plan is $22,500. However, individuals aged 50 and older can contribute an additional $7,500, bringing the total to $30,000. Similarly, for IRAs, the standard limit is $6,500, with an additional $1,000 allowed for catch-up contributions, totaling $7,500. These increased limits provide a valuable opportunity to enhance retirement savings, particularly for those who may have started saving later in life or experienced interruptions in their savings journey.

Moreover, the tax benefits associated with catch-up contributions can further amplify their impact. Contributions to traditional 401(k) plans and IRAs are typically tax-deductible, reducing taxable income in the year they are made. This can result in significant tax savings, especially for those in higher income brackets. Additionally, the growth of these contributions is tax-deferred, meaning that taxes are only paid upon withdrawal during retirement. This allows the investments to compound over time, potentially leading to a larger retirement fund.

For individuals with $1.2 million already saved, the addition of catch-up contributions can provide a substantial boost to their retirement portfolio. Assuming a conservative annual return of 5%, an additional $7,500 contributed annually to a 401(k) plan over a decade could grow to approximately $94,000. This figure underscores the potential impact of catch-up contributions, particularly when combined with existing savings and investment strategies.

In conclusion, catch-up contributions represent a pivotal strategy for individuals aged 55 and older who are seeking to maximize their retirement savings. By taking advantage of the increased contribution limits and associated tax benefits, individuals can significantly enhance their financial security in retirement. For those with a substantial nest egg, such as $1.2 million, these contributions can serve as a powerful tool to ensure a comfortable and financially stable retirement. As retirement approaches, it is essential to explore all available options to optimize savings and secure a prosperous future.

The Financial Impact of Catch-Up Contributions at Age 55

As individuals approach the age of 55, the prospect of retirement becomes increasingly tangible, prompting many to reassess their financial strategies to ensure a comfortable and secure future. For those who have diligently saved and accumulated a substantial nest egg, such as $1.2 million, the introduction of catch-up contributions presents a valuable opportunity to further bolster their retirement savings. Understanding the financial impact of these contributions is crucial for maximizing the benefits they offer.

Catch-up contributions are designed to allow individuals aged 50 and older to make additional contributions to their retirement accounts, such as 401(k)s and IRAs. This provision acknowledges that many people may not have been able to save as much as they would have liked during their earlier working years due to various financial obligations. By permitting higher contribution limits, catch-up contributions provide a mechanism to accelerate savings as retirement approaches. For those at age 55 with a significant amount already saved, this can be a strategic tool to enhance their financial security.

To illustrate the potential impact, consider an individual who has saved $1.2 million by age 55. Assuming they are still employed and have access to a 401(k) plan, they can contribute the standard limit of $22,500 per year as of 2023. However, with the catch-up provision, they can contribute an additional $7,500, bringing their total annual contribution to $30,000. Over a decade, this additional contribution could amount to an extra $75,000, not accounting for any investment growth. When compounded over time, this can significantly increase the overall retirement fund.

Moreover, the benefits of catch-up contributions extend beyond merely increasing the total savings. These contributions can also provide tax advantages, as they are typically made on a pre-tax basis, reducing the individual’s taxable income for the year. This can be particularly advantageous for those in higher tax brackets, as it may result in substantial tax savings. Additionally, the growth of these contributions within the retirement account is tax-deferred, allowing the investments to compound more effectively over time.

Furthermore, catch-up contributions can serve as a buffer against potential market volatility. As individuals near retirement, they may become more risk-averse, seeking to preserve their capital while still achieving growth. By increasing their contributions, they can potentially offset any market downturns, ensuring that their retirement savings remain robust. This is especially pertinent for those who have already accumulated a significant amount, as preserving and growing this wealth becomes paramount.

In addition to the financial benefits, catch-up contributions can also provide peace of mind. Knowing that they are taking proactive steps to secure their financial future can alleviate some of the anxiety associated with retirement planning. This sense of security can be invaluable, allowing individuals to focus on other aspects of their retirement, such as lifestyle planning and personal goals.

In conclusion, for individuals aged 55 with $1.2 million saved, catch-up contributions offer a strategic opportunity to enhance their retirement savings. By taking advantage of higher contribution limits, they can significantly increase their nest egg, benefit from tax advantages, and mitigate potential market risks. As retirement approaches, these contributions can play a crucial role in ensuring financial stability and peace of mind, ultimately paving the way for a more secure and fulfilling retirement.

How to Maximize Your $1.2 Million Nest Egg with Catch-Up Contributions

As individuals approach retirement, the focus often shifts from accumulating wealth to ensuring that the existing nest egg is maximized for a comfortable future. For those who have diligently saved and amassed a substantial sum, such as $1.2 million, the introduction of catch-up contributions at age 55 presents a strategic opportunity to further enhance their retirement savings. Understanding the impact of these contributions is crucial for optimizing financial security in the golden years.

Catch-up contributions are designed to allow individuals aged 50 and older to contribute additional funds to their retirement accounts beyond the standard limits. This provision acknowledges that many people may not have been able to save as much as they would have liked earlier in their careers due to various financial obligations. By taking advantage of catch-up contributions, individuals can significantly bolster their retirement savings in the years leading up to retirement.

For those with $1.2 million already saved, the potential benefits of catch-up contributions are substantial. Firstly, these additional contributions can help mitigate the effects of inflation, which can erode the purchasing power of savings over time. By increasing the amount saved, individuals can better preserve their wealth and maintain their standard of living throughout retirement. Moreover, catch-up contributions can provide a buffer against unexpected expenses, such as healthcare costs, which tend to rise with age.

In addition to these financial advantages, catch-up contributions offer tax benefits that can further enhance retirement savings. Contributions to traditional retirement accounts, such as a 401(k) or IRA, are typically tax-deductible, reducing taxable income in the year they are made. This can be particularly advantageous for individuals in higher tax brackets, as it allows them to defer taxes until they withdraw the funds in retirement, potentially at a lower tax rate. Furthermore, for those who opt for Roth accounts, catch-up contributions grow tax-free, providing tax-free income in retirement.

To maximize the impact of catch-up contributions, it is essential to adopt a strategic approach. This involves evaluating one’s current financial situation, retirement goals, and risk tolerance. For instance, individuals should consider diversifying their investment portfolio to balance growth potential with risk management. This might include a mix of stocks, bonds, and other assets that align with their long-term objectives. Additionally, consulting with a financial advisor can provide valuable insights and personalized strategies to optimize retirement savings.

Moreover, it is important to remain informed about the annual contribution limits and any changes in tax laws that may affect retirement planning. Staying updated ensures that individuals can make the most of the opportunities available to them and adjust their strategies as needed. Furthermore, regularly reviewing and adjusting one’s retirement plan can help address any changes in personal circumstances or financial markets, ensuring that the plan remains aligned with one’s goals.

In conclusion, catch-up contributions offer a powerful tool for individuals aged 55 and older to maximize their retirement savings. For those with $1.2 million saved, these contributions can provide significant financial and tax benefits, enhancing the security and comfort of their retirement years. By adopting a strategic approach and staying informed, individuals can effectively leverage catch-up contributions to safeguard their financial future and enjoy a fulfilling retirement.

Catch-Up Contributions: A Game Changer for Late Retirement Planning

As individuals approach the age of 55, the prospect of retirement becomes increasingly tangible, prompting many to reassess their financial strategies. For those who have diligently saved and accumulated $1.2 million, the concept of catch-up contributions can serve as a pivotal tool in enhancing their retirement savings. This financial mechanism, designed to allow individuals aged 50 and above to contribute additional funds to their retirement accounts, can significantly impact the overall retirement portfolio, offering a strategic advantage for those seeking to maximize their savings in the final stretch before retirement.

Catch-up contributions are particularly beneficial for individuals who may have started saving later in life or experienced interruptions in their savings journey. By allowing an increase in the annual contribution limits for retirement accounts such as 401(k)s and IRAs, these contributions provide an opportunity to bolster retirement funds during the critical years leading up to retirement. For instance, in 2023, individuals aged 50 and over can contribute an additional $7,500 to their 401(k) accounts, on top of the standard $22,500 limit. Similarly, for IRAs, the catch-up contribution allows an extra $1,000 beyond the regular $6,500 limit. These additional contributions can accumulate significantly over time, especially when combined with the power of compounding interest.

For someone with $1.2 million already saved, the impact of catch-up contributions can be substantial. By maximizing these contributions, individuals can potentially increase their retirement savings by tens of thousands of dollars over a relatively short period. This increase not only enhances the financial security of their retirement but also provides a buffer against unforeseen expenses or market volatility. Moreover, the additional funds can be strategically allocated to diversify the investment portfolio, thereby optimizing the balance between risk and return as retirement approaches.

Furthermore, catch-up contributions offer tax advantages that can further enhance retirement savings. Contributions to traditional 401(k)s and IRAs are typically tax-deductible, reducing taxable income in the year they are made. This reduction can be particularly advantageous for individuals in higher tax brackets, allowing them to save more effectively while deferring taxes until withdrawal during retirement, when they may be in a lower tax bracket. On the other hand, for those opting for Roth accounts, catch-up contributions are made with after-tax dollars, but withdrawals during retirement are tax-free, providing a different set of tax benefits.

In addition to the financial benefits, catch-up contributions can also offer psychological reassurance. Knowing that one is taking proactive steps to secure their financial future can alleviate some of the anxiety associated with retirement planning. This sense of control and preparedness can be invaluable, particularly as individuals transition from their working years to retirement.

In conclusion, catch-up contributions represent a strategic opportunity for individuals aged 55 and above to enhance their retirement savings, particularly for those who have already accumulated a substantial nest egg of $1.2 million. By taking advantage of these additional contributions, individuals can significantly bolster their retirement funds, optimize their investment strategies, and enjoy the associated tax benefits. As retirement looms on the horizon, the ability to make catch-up contributions can be a game changer, providing both financial and psychological benefits that pave the way for a more secure and fulfilling retirement.

Strategies for Implementing Catch-Up Contributions in Your Retirement Plan

As individuals approach the age of 55, the prospect of retirement becomes increasingly tangible, prompting a reassessment of financial strategies to ensure a comfortable and secure future. For those who have diligently saved and accumulated $1.2 million, the introduction of catch-up contributions presents a valuable opportunity to further bolster retirement savings. Understanding the nuances of these contributions and effectively integrating them into a retirement plan can significantly enhance financial security in the later years of life.

Catch-up contributions are designed to allow individuals aged 50 and older to contribute additional funds to their retirement accounts beyond the standard contribution limits. This provision acknowledges the reality that many people may not have been able to maximize their retirement savings earlier in their careers due to various financial obligations. By taking advantage of catch-up contributions, individuals can accelerate their savings during the critical years leading up to retirement.

For those with $1.2 million already saved, the strategic implementation of catch-up contributions can serve as a powerful tool to mitigate potential risks and uncertainties associated with retirement. One of the primary benefits of catch-up contributions is the ability to leverage the power of compound interest. By contributing additional funds, individuals can increase the principal amount in their retirement accounts, thereby enhancing the potential for growth over time. This is particularly advantageous for those who have a longer investment horizon, as the compounding effect can significantly amplify the value of the savings.

Moreover, catch-up contributions offer a means to diversify investment portfolios. With the additional funds, individuals can explore a broader range of investment options, potentially increasing their exposure to different asset classes. This diversification can help manage risk and improve the overall resilience of the retirement portfolio against market volatility. By strategically allocating catch-up contributions, individuals can align their investment strategy with their risk tolerance and retirement goals.

In addition to the financial benefits, catch-up contributions can also provide peace of mind. Knowing that one is taking proactive steps to enhance retirement savings can alleviate anxiety about the future. This sense of security is invaluable, as it allows individuals to focus on other aspects of retirement planning, such as healthcare and lifestyle considerations, without the constant worry of financial inadequacy.

To effectively implement catch-up contributions, it is essential to have a comprehensive understanding of the contribution limits and rules associated with different retirement accounts. For instance, in 2023, individuals can contribute an additional $7,500 to their 401(k) plans and an extra $1,000 to their IRAs as catch-up contributions. Being aware of these limits ensures that individuals can maximize their contributions without inadvertently exceeding the allowable amounts.

Furthermore, consulting with a financial advisor can provide personalized guidance tailored to individual circumstances. A financial advisor can help assess the current financial situation, project future needs, and develop a strategy that optimizes the use of catch-up contributions. This professional insight can be instrumental in making informed decisions that align with long-term retirement objectives.

In conclusion, for individuals aged 55 with $1.2 million saved, catch-up contributions represent a strategic opportunity to enhance retirement savings. By understanding the benefits and effectively integrating these contributions into a comprehensive retirement plan, individuals can strengthen their financial position and approach retirement with confidence and peace of mind.

The Role of Catch-Up Contributions in Achieving Financial Security in Retirement

As individuals approach the age of 55, the prospect of retirement becomes increasingly tangible, prompting a reassessment of financial strategies to ensure a secure and comfortable future. For those who have diligently saved and accumulated $1.2 million, the introduction of catch-up contributions presents a valuable opportunity to further bolster retirement savings. These contributions, designed specifically for individuals aged 50 and older, allow for additional deposits into retirement accounts beyond the standard contribution limits. Understanding the role of catch-up contributions in achieving financial security in retirement is crucial for maximizing the potential of one’s savings.

Catch-up contributions serve as a strategic tool for those who may have started saving later in life or who wish to enhance their retirement nest egg. For individuals with $1.2 million already saved, these contributions can significantly impact the overall growth of their retirement funds. By allowing an additional $7,500 per year into 401(k) plans and $1,000 into IRAs, catch-up contributions provide a means to accelerate savings during the final years of one’s career. This is particularly beneficial given the power of compound interest, which can amplify the value of these additional contributions over time.

Moreover, catch-up contributions offer a unique advantage in terms of tax efficiency. Contributions to traditional retirement accounts are typically tax-deferred, meaning that they reduce taxable income in the year they are made. This can be especially advantageous for individuals in their peak earning years, as it may result in significant tax savings. Additionally, the growth of these contributions is not subject to taxation until withdrawal, allowing for potentially greater accumulation of wealth. For those with $1.2 million saved, leveraging catch-up contributions can thus enhance both the size and tax efficiency of their retirement portfolio.

In addition to the financial benefits, catch-up contributions can also provide peace of mind. As retirement approaches, concerns about outliving one’s savings or facing unexpected expenses can be daunting. By maximizing contributions during the final working years, individuals can create a more robust financial cushion, thereby reducing anxiety about future financial stability. This sense of security is invaluable, as it allows individuals to focus on enjoying their retirement years rather than worrying about financial constraints.

Furthermore, the strategic use of catch-up contributions can also facilitate a more flexible retirement plan. With additional savings, individuals may have the option to retire earlier than initially planned or to pursue part-time work or volunteer opportunities without financial strain. This flexibility can lead to a more fulfilling and personalized retirement experience, tailored to individual preferences and goals.

In conclusion, catch-up contributions play a pivotal role in achieving financial security in retirement, particularly for those who have already amassed significant savings. By taking advantage of these additional contributions, individuals can enhance the growth and tax efficiency of their retirement funds, providing both financial and emotional benefits. As retirement nears, the strategic use of catch-up contributions can offer a pathway to a more secure and enjoyable future, ensuring that individuals can fully embrace the opportunities and experiences that retirement has to offer.

Comparing Retirement Outcomes: With and Without Catch-Up Contributions at 55

As individuals approach the age of 55, the prospect of retirement becomes increasingly tangible, prompting many to reassess their financial strategies to ensure a comfortable future. For those who have diligently saved and accumulated $1.2 million by this milestone, the opportunity to make catch-up contributions to retirement accounts presents a significant advantage. Understanding the impact of these additional contributions can illuminate the path to a more secure retirement, highlighting the differences in outcomes for those who choose to utilize this option versus those who do not.

Catch-up contributions are designed to allow individuals aged 50 and older to contribute more than the standard limit to their retirement accounts, such as 401(k)s and IRAs. For 2023, the catch-up contribution limit for a 401(k) is an additional $7,500, while for an IRA, it is $1,000. These increased limits provide a valuable opportunity for individuals to bolster their retirement savings during the final years of their careers. For someone with $1.2 million already saved, the decision to make catch-up contributions can significantly enhance their financial security in retirement.

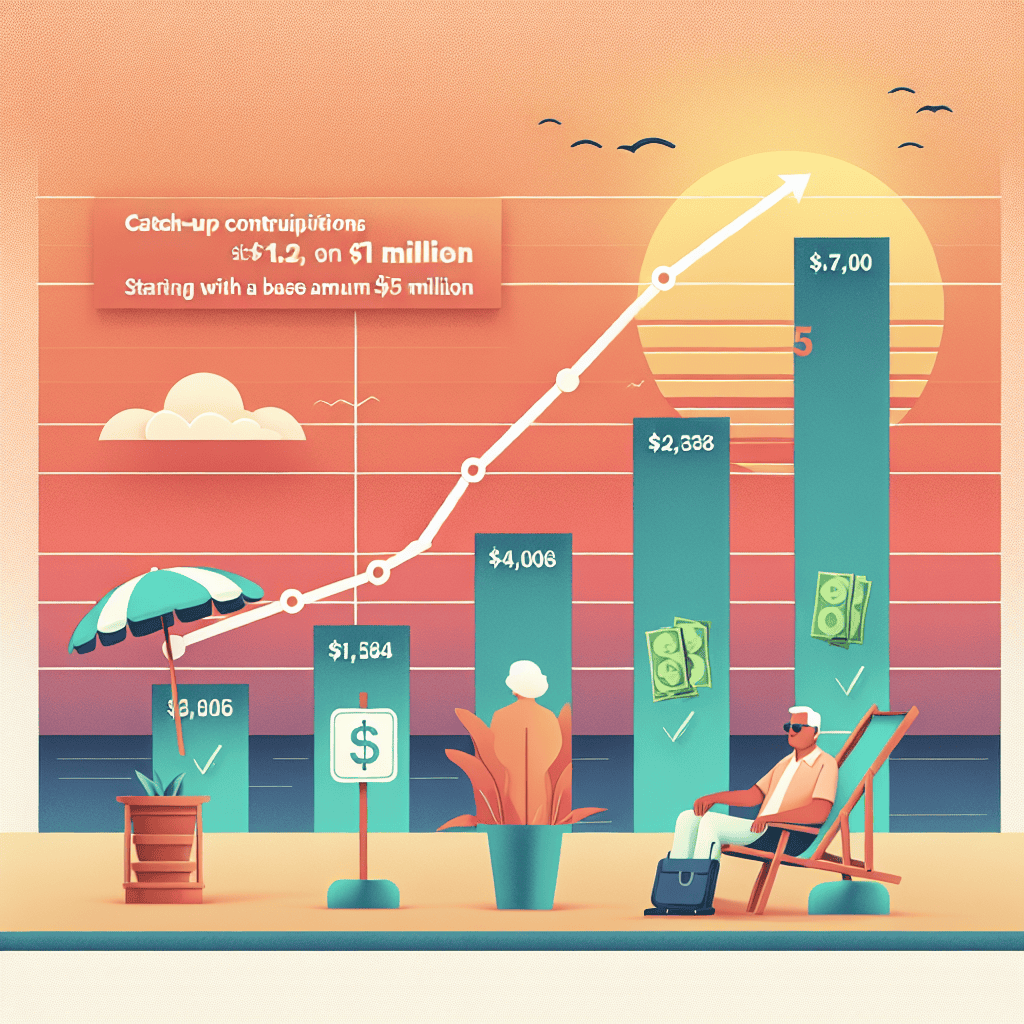

To illustrate the potential impact, consider two scenarios: one where an individual with $1.2 million saved at age 55 opts to make catch-up contributions, and another where they do not. In the first scenario, by maximizing catch-up contributions to both a 401(k) and an IRA over a decade, the individual could potentially add over $100,000 to their retirement savings, assuming a modest annual return on investment. This additional capital not only increases the total savings but also benefits from compounding growth, further amplifying the retirement fund.

Conversely, in the second scenario, where the individual chooses not to make catch-up contributions, the retirement savings remain at the mercy of market fluctuations and the existing growth rate. While $1.2 million is a substantial amount, the absence of additional contributions may limit the potential for growth, especially in the face of inflation and rising living costs. Without the buffer provided by catch-up contributions, the individual may find themselves more vulnerable to financial uncertainties in retirement.

Moreover, catch-up contributions can offer psychological benefits, providing a sense of control and proactive engagement in one’s financial future. Knowing that they are taking tangible steps to enhance their retirement readiness can alleviate anxiety and foster a greater sense of confidence as retirement approaches. This peace of mind is invaluable, as it allows individuals to focus on other aspects of retirement planning, such as healthcare and lifestyle considerations.

In conclusion, the decision to make catch-up contributions at age 55 can have a profound impact on retirement outcomes for those with $1.2 million saved. By taking advantage of these additional contributions, individuals can significantly increase their retirement savings, benefiting from both the immediate financial boost and the long-term effects of compounding growth. While the choice ultimately depends on individual circumstances and financial goals, the potential advantages of catch-up contributions make them a compelling option for those seeking to maximize their retirement security. As retirement looms on the horizon, making informed decisions about catch-up contributions can pave the way for a more comfortable and financially stable future.

Q&A

1. **What are catch-up contributions?**

Catch-up contributions are additional contributions that individuals aged 50 and older can make to their retirement accounts, such as 401(k)s and IRAs, beyond the standard contribution limits.

2. **How much can you contribute as a catch-up in a 401(k) plan at age 55?**

As of 2023, individuals aged 50 and older can contribute an additional $7,500 as a catch-up contribution to their 401(k) plan, on top of the standard contribution limit of $22,500.

3. **What is the impact of catch-up contributions on retirement savings?**

Catch-up contributions allow individuals to increase their retirement savings significantly, potentially growing their nest egg through compound interest and investment returns, thus enhancing financial security in retirement.

4. **How does having $1.2 million saved by age 55 affect retirement planning?**

Having $1.2 million saved by age 55 provides a strong foundation for retirement, allowing for more flexibility in investment strategies, potential early retirement, and the ability to withstand market fluctuations.

5. **What strategies can maximize retirement savings at age 55?**

Strategies include maximizing catch-up contributions, diversifying investments, reducing unnecessary expenses, considering tax-efficient withdrawal strategies, and possibly delaying Social Security benefits to increase future payouts.

6. **How do catch-up contributions affect tax planning?**

Catch-up contributions can reduce taxable income in the year they are made, potentially lowering the individual’s tax liability and allowing more money to grow tax-deferred in retirement accounts.

7. **What role does investment growth play in maximizing retirement savings with catch-up contributions?**

Investment growth is crucial as it compounds over time, increasing the value of both regular and catch-up contributions, thereby significantly enhancing the overall retirement savings and providing a larger financial cushion in retirement.

Conclusion

Maximizing retirement savings through catch-up contributions at age 55 can significantly enhance financial security for individuals with $1.2 million already saved. Catch-up contributions allow individuals aged 50 and older to contribute additional amounts to their retirement accounts, such as 401(k)s and IRAs, beyond the standard contribution limits. For someone with $1.2 million saved, these additional contributions can compound over the years, potentially increasing the retirement nest egg substantially. This strategy not only boosts the total savings but also provides a buffer against market volatility and inflation, ensuring a more comfortable and secure retirement. By taking advantage of catch-up contributions, individuals can better align their savings with their retirement goals, potentially allowing for a more flexible and fulfilling retirement lifestyle.