“Driving Growth: Unveiling Market Insights for SNY, CME, HOG, PCAR, LEA, VLTO.”

Introduction

Market Insights: SNY, CME, HOG, PCAR, LEA, VLTO

In the ever-evolving landscape of global markets, understanding the dynamics of key players is crucial for investors and analysts alike. This report delves into the market insights of six prominent companies: Sanofi (SNY), CME Group (CME), Harley-Davidson (HOG), PACCAR Inc (PCAR), Lear Corporation (LEA), and Veralto Corporation (VLTO). Each of these companies operates within distinct sectors, ranging from pharmaceuticals and financial services to automotive manufacturing and technology solutions. By examining their market positions, financial performance, and strategic initiatives, this analysis aims to provide a comprehensive overview of their current standing and future prospects. Whether it’s Sanofi’s innovations in healthcare, CME Group’s influence in financial markets, Harley-Davidson’s iconic brand presence, PACCAR’s leadership in commercial vehicles, Lear’s advancements in automotive seating and electrical systems, or Veralto’s contributions to industrial technology, these companies offer valuable insights into their respective industries.

Strategic Growth Analysis: SNY’s Market Position and Future Prospects

Sanofi (SNY), a global healthcare leader, has consistently demonstrated its strategic prowess in navigating the complex pharmaceutical landscape. As the company continues to expand its market presence, understanding its current position and future prospects becomes crucial for stakeholders. Sanofi’s robust portfolio, which spans prescription medicines, consumer healthcare products, and vaccines, provides a solid foundation for sustained growth. The company’s focus on innovation, particularly in specialty care and vaccines, has positioned it favorably in the competitive pharmaceutical industry.

In recent years, Sanofi has made significant strides in enhancing its research and development capabilities. By investing in cutting-edge technologies and forming strategic partnerships, the company aims to accelerate the development of novel therapies. This commitment to innovation is evident in its pipeline, which includes promising candidates in areas such as oncology, immunology, and rare diseases. As these therapies progress through clinical trials, they hold the potential to drive substantial revenue growth and reinforce Sanofi’s market position.

Moreover, Sanofi’s strategic acquisitions have played a pivotal role in bolstering its competitive edge. The acquisition of companies with complementary expertise has enabled Sanofi to diversify its product offerings and enter new therapeutic areas. For instance, the acquisition of Bioverativ and Ablynx has strengthened Sanofi’s presence in the rare blood disorders market, providing a platform for future growth. These strategic moves not only enhance Sanofi’s product pipeline but also expand its global reach, allowing it to tap into emerging markets with high growth potential.

In addition to its focus on innovation and strategic acquisitions, Sanofi has been proactive in optimizing its operational efficiency. The company has implemented cost-saving initiatives aimed at streamlining its supply chain and reducing manufacturing expenses. By enhancing operational efficiency, Sanofi can allocate more resources towards research and development, thereby fueling its innovation engine. This approach not only improves profitability but also ensures that the company remains agile in responding to market dynamics.

Furthermore, Sanofi’s commitment to sustainability and corporate social responsibility has garnered positive attention from investors and consumers alike. The company’s efforts to reduce its environmental footprint and improve access to healthcare in underserved regions align with the growing emphasis on sustainable business practices. By integrating sustainability into its core operations, Sanofi not only enhances its brand reputation but also mitigates risks associated with regulatory changes and shifting consumer preferences.

Looking ahead, Sanofi’s future prospects appear promising, driven by its strategic focus on innovation, operational efficiency, and sustainability. The company’s ability to adapt to evolving market trends and capitalize on emerging opportunities will be crucial in maintaining its competitive advantage. As the global healthcare landscape continues to evolve, Sanofi’s strategic initiatives position it well to address unmet medical needs and deliver value to patients and shareholders alike.

In conclusion, Sanofi’s market position is underpinned by its strong portfolio, commitment to innovation, and strategic acquisitions. By leveraging these strengths, the company is well-equipped to navigate the challenges and opportunities that lie ahead. As Sanofi continues to execute its growth strategy, it remains a key player in the pharmaceutical industry, poised for long-term success.

CME Group’s Role in Shaping Global Financial Markets

CME Group, a leading global derivatives marketplace, plays a pivotal role in shaping the landscape of global financial markets. As a central hub for risk management and price discovery, CME Group offers a diverse range of products, including futures and options based on interest rates, equity indexes, foreign exchange, energy, agricultural commodities, and metals. This extensive portfolio not only provides market participants with the tools necessary to hedge against various risks but also facilitates the efficient allocation of resources across the global economy.

One of the key aspects of CME Group’s influence is its ability to provide liquidity and transparency in the markets it serves. By offering a centralized platform for trading, CME Group ensures that market participants can execute trades with confidence, knowing that they are operating in a fair and transparent environment. This is particularly important in times of market volatility, where the need for reliable price information and the ability to manage risk becomes even more critical. Moreover, the group’s commitment to innovation and technology has enabled it to maintain its position as a leader in the industry, continually adapting to the evolving needs of its clients.

In addition to its role in providing liquidity and transparency, CME Group also plays a crucial part in the price discovery process. By bringing together a diverse range of market participants, including commercial hedgers, institutional investors, and speculators, the group facilitates the exchange of information and opinions about future price movements. This collective input helps to establish a consensus on the fair value of various assets, which in turn informs decision-making across the global financial system. Furthermore, the group’s robust risk management framework ensures that market participants can confidently engage in these activities, knowing that their positions are backed by a strong clearinghouse.

CME Group’s influence extends beyond the markets it directly serves, as its products often serve as benchmarks for other financial instruments. For instance, the group’s interest rate futures are widely used as a reference point for pricing other fixed-income securities, while its equity index futures provide a basis for numerous exchange-traded funds and other investment products. This widespread adoption of CME Group’s benchmarks underscores the trust and confidence that market participants place in the group’s ability to provide accurate and reliable pricing information.

Moreover, CME Group’s global reach is further enhanced by its strategic partnerships and collaborations with other exchanges and financial institutions. By forging alliances with key players in different regions, the group is able to expand its product offerings and tap into new markets, thereby increasing its influence on a global scale. These partnerships also facilitate the sharing of knowledge and expertise, which in turn helps to drive innovation and improve the overall efficiency of the financial markets.

In conclusion, CME Group’s role in shaping global financial markets is multifaceted and far-reaching. Through its provision of liquidity, transparency, and price discovery, the group enables market participants to manage risk effectively and make informed decisions. Its products serve as vital benchmarks for other financial instruments, while its strategic partnerships help to extend its influence across the globe. As the financial landscape continues to evolve, CME Group’s commitment to innovation and excellence will undoubtedly ensure its continued prominence in the industry.

Harley-Davidson (HOG): Navigating Market Trends and Consumer Preferences

Harley-Davidson (HOG) has long been an iconic name in the motorcycle industry, synonymous with freedom, adventure, and a distinct American spirit. However, like many companies in the automotive sector, Harley-Davidson faces the challenge of navigating evolving market trends and shifting consumer preferences. As the landscape of transportation and leisure activities changes, the company must adapt to maintain its relevance and appeal to both traditional enthusiasts and new demographics.

One of the most significant trends impacting Harley-Davidson is the growing emphasis on sustainability and environmental consciousness. With increasing awareness of climate change and the environmental impact of fossil fuels, consumers are gravitating towards more sustainable modes of transportation. In response, Harley-Davidson has made strides in developing electric motorcycles, such as the LiveWire, which represents a bold step towards a greener future. This move not only aligns with global sustainability goals but also positions the company to capture a share of the burgeoning electric vehicle market.

Moreover, the demographic profile of motorcycle riders is shifting. Traditionally, Harley-Davidson’s core customer base has been older, predominantly male riders. However, younger generations, including millennials and Gen Z, are becoming more influential in the market. These younger consumers often prioritize experiences over ownership and are drawn to brands that reflect their values and lifestyle. To appeal to this demographic, Harley-Davidson has been working to diversify its product offerings and marketing strategies. By introducing models that are more accessible and versatile, the company aims to attract a broader audience while retaining its loyal customer base.

In addition to product innovation, Harley-Davidson is also focusing on enhancing the customer experience. The rise of digital technology has transformed how consumers interact with brands, and Harley-Davidson is leveraging this trend by investing in digital platforms and e-commerce solutions. By creating a seamless online experience, the company can engage with customers more effectively, offering personalized services and fostering a sense of community among riders. This digital transformation is crucial for building brand loyalty and ensuring long-term success in a competitive market.

Furthermore, global expansion presents both opportunities and challenges for Harley-Davidson. While the company has a strong presence in the United States, international markets offer significant growth potential. However, expanding globally requires navigating diverse regulatory environments, cultural differences, and economic conditions. To address these challenges, Harley-Davidson is tailoring its strategies to meet the specific needs of different regions. By understanding local preferences and adapting its offerings accordingly, the company can strengthen its global footprint and drive growth.

Despite these efforts, Harley-Davidson faces competition from both traditional motorcycle manufacturers and new entrants in the electric vehicle space. To maintain its competitive edge, the company must continue to innovate and differentiate itself from rivals. This involves not only advancing its product line but also reinforcing its brand identity as a symbol of freedom and adventure. By staying true to its heritage while embracing change, Harley-Davidson can navigate the complexities of the modern market.

In conclusion, Harley-Davidson is at a pivotal moment in its history, as it seeks to balance tradition with innovation. By addressing sustainability concerns, appealing to new demographics, enhancing the customer experience, and expanding globally, the company is positioning itself for future success. As market trends and consumer preferences continue to evolve, Harley-Davidson’s ability to adapt and lead will determine its place in the ever-changing landscape of the motorcycle industry.

PACCAR Inc (PCAR): Innovations Driving the Trucking Industry

PACCAR Inc (PCAR) has long been a stalwart in the trucking industry, consistently demonstrating a commitment to innovation and excellence. As the global demand for efficient and sustainable transportation solutions continues to rise, PACCAR’s strategic initiatives and technological advancements position it as a leader in the sector. The company’s focus on integrating cutting-edge technology into its product offerings is a testament to its forward-thinking approach, which not only enhances operational efficiency but also addresses the evolving needs of its diverse clientele.

One of the key areas where PACCAR has made significant strides is in the development of electric and hybrid trucks. As environmental concerns become increasingly prominent, the trucking industry faces mounting pressure to reduce its carbon footprint. PACCAR has responded to this challenge by investing heavily in research and development to produce vehicles that are not only environmentally friendly but also economically viable. The introduction of electric powertrains in its trucks is a clear indication of PACCAR’s commitment to sustainability, offering customers a cleaner alternative without compromising on performance.

Moreover, PACCAR’s dedication to innovation extends beyond just vehicle electrification. The company has also been at the forefront of integrating advanced driver-assistance systems (ADAS) into its trucks. These systems enhance safety and efficiency by providing features such as adaptive cruise control, lane-keeping assistance, and automated braking. By incorporating these technologies, PACCAR not only improves the safety of its vehicles but also contributes to reducing the overall cost of ownership for its customers. This focus on safety and efficiency is crucial in an industry where operational costs and driver safety are paramount concerns.

In addition to technological advancements, PACCAR has also embraced digital transformation to streamline its operations and improve customer service. The use of data analytics and telematics has enabled the company to offer predictive maintenance solutions, which help in minimizing downtime and optimizing fleet performance. By leveraging data-driven insights, PACCAR can provide its customers with tailored solutions that enhance productivity and reduce operational costs. This proactive approach to maintenance and service is a significant value addition for fleet operators, who can now make informed decisions based on real-time data.

Furthermore, PACCAR’s commitment to innovation is reflected in its strategic partnerships and collaborations. By working closely with technology companies and research institutions, PACCAR is able to stay ahead of industry trends and incorporate the latest advancements into its product offerings. These collaborations not only foster innovation but also ensure that PACCAR remains competitive in a rapidly evolving market. The company’s ability to adapt and innovate is a key factor in its sustained success and growth.

In conclusion, PACCAR Inc’s focus on innovation and technology is driving significant advancements in the trucking industry. By prioritizing sustainability, safety, and efficiency, the company is well-positioned to meet the challenges of a changing market landscape. Its commitment to integrating cutting-edge technology into its vehicles and operations underscores its role as a leader in the industry. As PACCAR continues to innovate and adapt, it sets a benchmark for excellence, ensuring that it remains at the forefront of the trucking sector for years to come.

Lear Corporation (LEA): Adapting to Automotive Market Shifts

Lear Corporation (LEA), a prominent player in the automotive industry, has consistently demonstrated its ability to adapt to the ever-evolving market landscape. As the automotive sector undergoes significant transformations driven by technological advancements and shifting consumer preferences, Lear Corporation has strategically positioned itself to capitalize on these changes. This adaptability is crucial in maintaining its competitive edge and ensuring long-term growth.

One of the key factors contributing to Lear’s success is its focus on innovation. The company has invested heavily in research and development to create cutting-edge products that meet the demands of modern vehicles. For instance, Lear has been at the forefront of developing advanced seating systems and electrical distribution systems, which are integral to the functionality and comfort of contemporary automobiles. By prioritizing innovation, Lear not only enhances its product offerings but also strengthens its relationships with major automotive manufacturers who seek reliable and forward-thinking partners.

In addition to innovation, Lear Corporation has embraced sustainability as a core component of its business strategy. As environmental concerns become increasingly prominent, the automotive industry is under pressure to reduce its carbon footprint. Lear has responded by developing eco-friendly materials and processes that align with the industry’s sustainability goals. This commitment to sustainability not only addresses regulatory requirements but also appeals to environmentally conscious consumers, thereby expanding Lear’s market reach.

Moreover, Lear’s strategic acquisitions have played a pivotal role in its ability to adapt to market shifts. By acquiring companies with complementary technologies and expertise, Lear has enhanced its capabilities and expanded its product portfolio. These acquisitions have enabled Lear to enter new markets and diversify its revenue streams, thereby mitigating risks associated with market volatility. This strategic approach has proven effective in maintaining Lear’s resilience in the face of economic uncertainties.

Furthermore, Lear Corporation’s global presence has been instrumental in its adaptability. With operations in multiple countries, Lear is well-positioned to respond to regional market trends and customer needs. This global footprint allows Lear to leverage its resources efficiently and optimize its supply chain, ensuring timely delivery of products to its clients. Additionally, Lear’s international operations provide valuable insights into emerging markets, enabling the company to identify growth opportunities and tailor its strategies accordingly.

The company’s commitment to digital transformation is another factor that underscores its adaptability. By integrating digital technologies into its operations, Lear has improved its manufacturing processes, enhanced product quality, and increased operational efficiency. This digitalization effort not only reduces costs but also enables Lear to respond swiftly to market demands, thereby maintaining its competitive advantage.

In conclusion, Lear Corporation’s ability to adapt to automotive market shifts is a testament to its strategic foresight and commitment to innovation, sustainability, and digital transformation. By continuously evolving its business model and embracing new opportunities, Lear has positioned itself as a leader in the automotive industry. As the market continues to evolve, Lear’s proactive approach will likely ensure its continued success and relevance in the ever-changing automotive landscape. Through strategic investments, global expansion, and a focus on sustainability, Lear Corporation remains well-equipped to navigate the challenges and opportunities that lie ahead.

Velto (VLTO): Emerging Trends in the Technology Sector

In the rapidly evolving landscape of the technology sector, Velto (VLTO) has emerged as a noteworthy player, capturing the attention of investors and analysts alike. As the industry continues to expand and innovate, understanding the emerging trends that influence companies like Velto is crucial for stakeholders aiming to make informed decisions. The technology sector, characterized by its dynamic nature, is driven by continuous advancements and the integration of cutting-edge solutions across various industries. Velto, with its strategic focus and innovative approach, is well-positioned to capitalize on these trends, thereby enhancing its market presence and competitive edge.

One of the most significant trends impacting Velto is the increasing demand for artificial intelligence (AI) and machine learning (ML) technologies. These technologies are transforming industries by enabling automation, improving decision-making processes, and enhancing customer experiences. Velto’s investment in AI and ML capabilities not only aligns with this trend but also positions the company as a leader in providing advanced technological solutions. By leveraging AI and ML, Velto can offer more efficient and effective products and services, thereby meeting the evolving needs of its clients and maintaining a competitive advantage in the market.

Moreover, the growing emphasis on data analytics and big data is another trend that Velto is poised to benefit from. As organizations across sectors recognize the value of data-driven insights, the demand for robust data analytics solutions is on the rise. Velto’s expertise in this area allows it to offer comprehensive analytics services that help businesses harness the power of their data. This capability not only enhances Velto’s value proposition but also strengthens its position as a key player in the technology sector.

In addition to AI, ML, and data analytics, the shift towards cloud computing is reshaping the technology landscape. The adoption of cloud-based solutions is accelerating as businesses seek scalable, flexible, and cost-effective alternatives to traditional IT infrastructure. Velto’s strategic investments in cloud technologies enable it to provide innovative solutions that cater to this growing demand. By offering cloud-based services, Velto can deliver enhanced operational efficiencies and improved business outcomes for its clients, further solidifying its market position.

Furthermore, the increasing focus on cybersecurity is a critical trend that Velto is addressing through its comprehensive security solutions. As cyber threats become more sophisticated, the need for robust cybersecurity measures is paramount. Velto’s commitment to developing advanced security technologies ensures that its clients are well-protected against potential threats. This focus on cybersecurity not only enhances client trust but also reinforces Velto’s reputation as a reliable technology partner.

In conclusion, Velto’s strategic alignment with emerging trends in the technology sector positions it for sustained growth and success. By capitalizing on the increasing demand for AI, ML, data analytics, cloud computing, and cybersecurity solutions, Velto is well-equipped to navigate the complexities of the modern technological landscape. As the sector continues to evolve, Velto’s innovative approach and commitment to excellence will undoubtedly play a pivotal role in shaping its future trajectory. Investors and stakeholders should closely monitor these trends and Velto’s strategic initiatives to fully understand the potential opportunities and challenges that lie ahead.

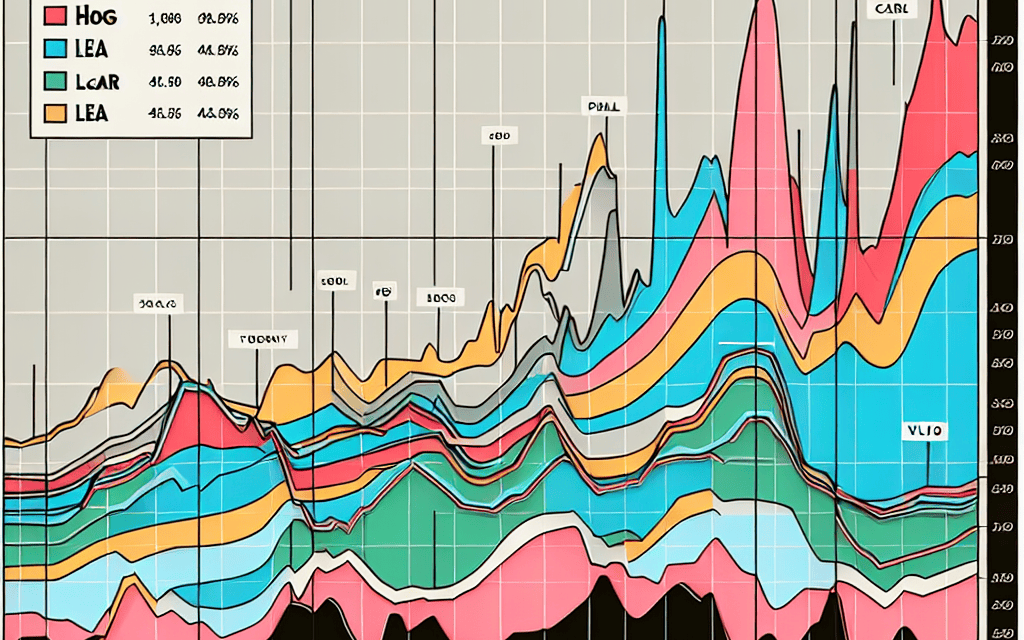

Comparative Market Insights: SNY, CME, HOG, PCAR, LEA, and VLTO

In the ever-evolving landscape of global markets, understanding the dynamics of key players is crucial for investors and analysts alike. This article delves into the comparative market insights of six prominent companies: Sanofi (SNY), CME Group (CME), Harley-Davidson (HOG), PACCAR Inc. (PCAR), Lear Corporation (LEA), and Veralto Corporation (VLTO). Each of these companies operates in distinct sectors, offering a diverse perspective on market trends and economic indicators.

Sanofi, a leading pharmaceutical company, continues to be a significant player in the healthcare sector. With a robust portfolio of prescription medicines, vaccines, and consumer healthcare products, Sanofi’s market performance is often influenced by regulatory changes, research and development breakthroughs, and global health trends. The company’s strategic focus on innovation and expansion into emerging markets has positioned it well to capitalize on the growing demand for healthcare solutions. Moreover, Sanofi’s commitment to sustainability and corporate responsibility further enhances its reputation and market appeal.

Transitioning to the financial sector, CME Group stands out as a global leader in derivatives trading. The company’s extensive range of products, including futures and options across various asset classes, provides investors with essential tools for risk management and speculation. CME’s market performance is closely tied to economic indicators such as interest rates, commodity prices, and geopolitical events. The group’s continuous investment in technology and infrastructure ensures efficient and secure trading, thereby maintaining its competitive edge in the financial markets.

In the realm of consumer goods, Harley-Davidson represents an iconic brand in the motorcycle industry. Known for its distinctive design and loyal customer base, Harley-Davidson’s market position is influenced by consumer preferences, economic conditions, and regulatory developments. The company’s efforts to diversify its product line and expand into international markets are crucial strategies to sustain growth amid changing consumer trends. Additionally, Harley-Davidson’s focus on electric motorcycles reflects its adaptability to evolving environmental standards and consumer demands for sustainable transportation options.

Shifting gears to the industrial sector, PACCAR Inc. is a leading manufacturer of commercial vehicles, including trucks and engines. The company’s market performance is closely linked to economic cycles, infrastructure investments, and technological advancements in vehicle manufacturing. PACCAR’s emphasis on innovation, quality, and customer service has solidified its reputation as a reliable partner in the transportation industry. Furthermore, the company’s strategic investments in electric and autonomous vehicle technologies position it well for future growth in a rapidly changing market landscape.

Lear Corporation, a key player in the automotive industry, specializes in seating and electrical systems. The company’s market dynamics are influenced by trends in vehicle production, consumer preferences for comfort and connectivity, and advancements in automotive technology. Lear’s commitment to innovation and sustainability is evident in its development of lightweight materials and energy-efficient systems. As the automotive industry undergoes a transformation towards electric and autonomous vehicles, Lear’s strategic focus on research and development will be pivotal in maintaining its competitive advantage.

Finally, Veralto Corporation, a relatively new entrant, operates in the technology sector, focusing on advanced solutions for data management and analytics. The company’s market performance is driven by the increasing demand for data-driven decision-making across industries. Veralto’s innovative approach to harnessing the power of data analytics positions it as a valuable partner for businesses seeking to enhance operational efficiency and gain competitive insights. As digital transformation continues to reshape industries, Veralto’s strategic investments in cutting-edge technologies will be instrumental in capturing market opportunities.

In conclusion, the comparative analysis of Sanofi, CME Group, Harley-Davidson, PACCAR Inc., Lear Corporation, and Veralto Corporation provides valuable insights into the diverse factors influencing market performance across different sectors. By understanding these dynamics, investors and analysts can make informed decisions and navigate the complexities of the global market landscape.

Q&A

1. **Sanofi (SNY):** Sanofi is a global healthcare leader engaged in the research, development, manufacturing, and marketing of therapeutic solutions. Market insights suggest that Sanofi’s focus on specialty care, vaccines, and consumer healthcare continues to drive growth, with a strong pipeline in immunology and oncology.

2. **CME Group (CME):** CME Group operates one of the world’s largest financial derivatives exchanges. Market insights indicate that CME benefits from increased volatility and trading volumes, particularly in interest rate and equity index products, as well as its expansion into cryptocurrency derivatives.

3. **Harley-Davidson (HOG):** Harley-Davidson is a leading manufacturer of motorcycles. Market insights highlight challenges due to changing consumer preferences and competition, but the company is focusing on electric motorcycles and expanding its product lineup to attract younger riders.

4. **PACCAR Inc (PCAR):** PACCAR is a global technology leader in the design and manufacture of premium trucks. Market insights show strong demand for trucks, driven by economic growth and e-commerce, with PACCAR investing in electric and autonomous vehicle technologies.

5. **Lear Corporation (LEA):** Lear Corporation is a leading supplier of automotive seating and electrical systems. Market insights suggest that Lear is benefiting from the trend towards electric vehicles and increased demand for advanced seating and connectivity solutions.

6. **Veralto Corporation (VLTO):** Veralto is a diversified industrial company. Market insights indicate that Veralto’s focus on innovation and operational efficiency supports its growth, with strong performance in its core segments of water quality and product identification.

7. **General Market Trends:** Across these companies, there is a noticeable trend towards innovation, sustainability, and adaptation to changing consumer preferences. Companies are investing in technology and expanding their product offerings to capture new market opportunities and address global challenges.

Conclusion

The market insights for the companies SNY (Sanofi), CME (CME Group), HOG (Harley-Davidson), PCAR (PACCAR Inc), LEA (Lear Corporation), and VLTO (Veralto Corporation) reveal a diverse range of industry dynamics and financial performance. Sanofi, a major player in the pharmaceutical industry, continues to leverage its strong product pipeline and global presence to drive growth, although it faces challenges from patent expirations and regulatory pressures. CME Group, a leading derivatives marketplace, benefits from increased market volatility and demand for risk management solutions, positioning it well for sustained revenue growth. Harley-Davidson, a renowned motorcycle manufacturer, is navigating a competitive landscape by focusing on product innovation and expanding its electric vehicle offerings, though it must address shifting consumer preferences and economic uncertainties. PACCAR Inc, a leader in the design and manufacture of high-quality trucks, is capitalizing on strong demand in the transportation sector, supported by its robust supply chain and technological advancements. Lear Corporation, specializing in automotive seating and electrical systems, is adapting to the evolving automotive industry by investing in electric and autonomous vehicle technologies, while managing supply chain disruptions. Lastly, Veralto Corporation, a diversified industrial company, is poised for growth through strategic acquisitions and a focus on operational efficiency, although it must remain vigilant to macroeconomic fluctuations. Overall, these companies exhibit varied opportunities and challenges, reflecting their respective industry conditions and strategic initiatives.