“Revolutionizing Homeowners Insurance: Lemonade’s Fresh Approach to Coverage”

Introduction

Lemonade, a technology-driven insurance company, is revolutionizing the homeowners insurance market with its innovative solutions. By leveraging artificial intelligence and behavioral economics, Lemonade offers a seamless, user-friendly experience that challenges traditional insurance models. The company’s approach includes a fully digital platform that allows for quick policy setup and claims processing, often within minutes. With a focus on transparency and social impact, Lemonade’s unique business model also allocates unclaimed premiums to various charitable causes, appealing to a socially conscious consumer base. This disruptive strategy not only enhances customer satisfaction but also positions Lemonade as a formidable player in the insurance industry, prompting established insurers to rethink their own offerings.

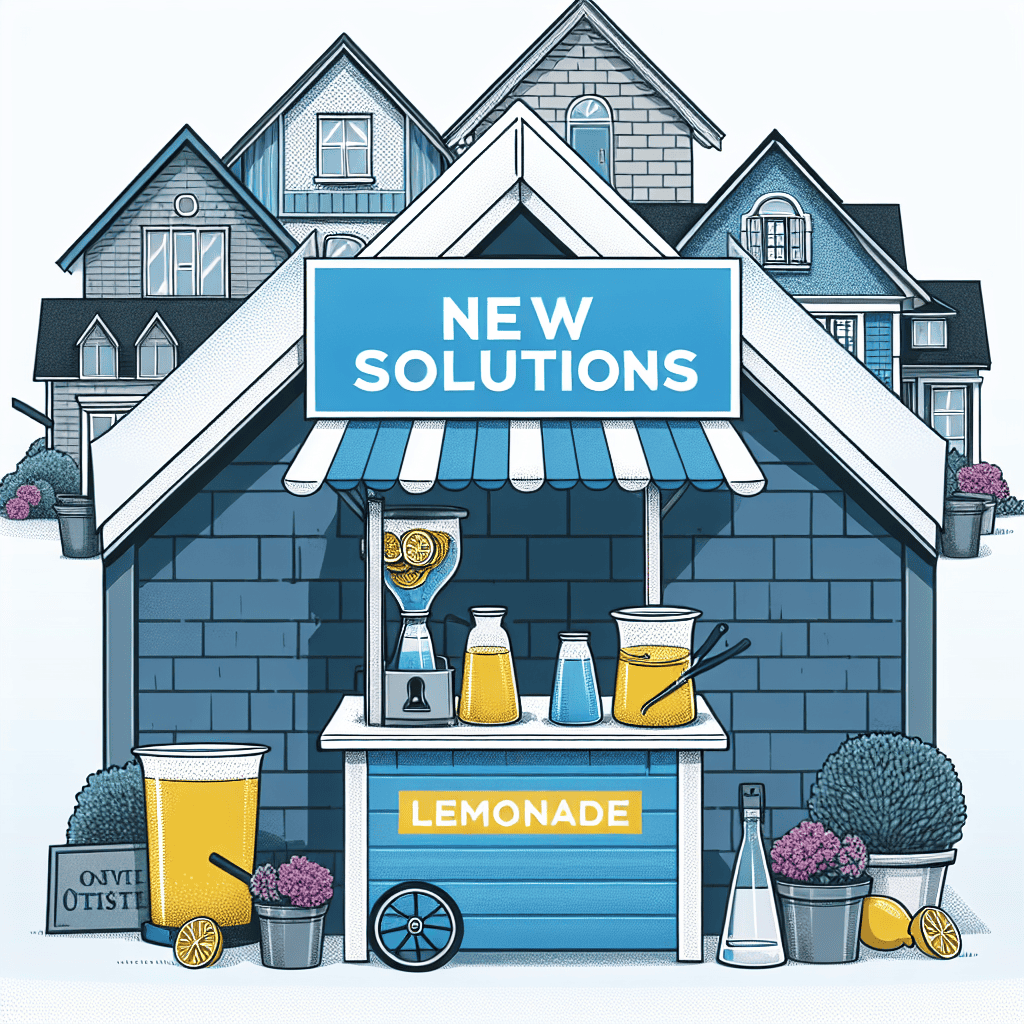

Innovative Technology: How Lemonade is Transforming Homeowners Insurance

Lemonade, a company renowned for its innovative approach to insurance, is making significant waves in the homeowners insurance market by leveraging cutting-edge technology and a customer-centric model. This transformation is not only reshaping how insurance is perceived but also how it is delivered, offering a fresh perspective on an industry traditionally viewed as cumbersome and opaque. At the heart of Lemonade’s strategy is its use of artificial intelligence and machine learning, which streamline the insurance process from start to finish. By employing AI-driven chatbots, Lemonade simplifies the initial stages of obtaining a policy, allowing potential customers to receive quotes and purchase coverage in a matter of minutes. This efficiency is a stark contrast to the lengthy and often complex procedures associated with conventional insurance providers.

Moreover, Lemonade’s technology extends beyond the initial purchase. The company has revolutionized the claims process, which is typically fraught with delays and frustration. Through its AI-powered system, Lemonade can process claims almost instantaneously, with some claims being approved in as little as three seconds. This rapid response not only enhances customer satisfaction but also reduces administrative costs, allowing Lemonade to offer competitive pricing. In addition to speed and efficiency, Lemonade’s approach is characterized by transparency and social responsibility. The company operates on a unique business model where a flat fee is taken from customer premiums, and the remaining funds are used to pay claims. Any leftover money is donated to causes chosen by policyholders, fostering a sense of community and trust. This model contrasts sharply with traditional insurers, where profits are often prioritized over customer needs.

Furthermore, Lemonade’s commitment to transparency is evident in its user-friendly app, which provides customers with clear and concise information about their policies. This accessibility empowers homeowners to make informed decisions about their coverage, enhancing their overall experience. As Lemonade continues to disrupt the market, it also addresses the evolving needs of modern homeowners. The company offers flexible coverage options that cater to a diverse range of lifestyles and living situations, from urban apartments to suburban homes. This adaptability ensures that Lemonade remains relevant in a rapidly changing world, where traditional insurance models may struggle to keep pace.

In addition to its technological advancements, Lemonade is also setting new standards for customer service. The company’s emphasis on empathy and understanding is reflected in its approach to customer interactions, where representatives are trained to prioritize the needs and concerns of policyholders. This focus on human connection, combined with technological innovation, creates a balanced and effective service model that resonates with today’s consumers. As the insurance landscape continues to evolve, Lemonade’s influence is likely to grow, prompting other companies to reevaluate their strategies and adopt similar technologies. This shift could lead to a more competitive market, ultimately benefiting consumers through improved services and lower costs.

In conclusion, Lemonade’s innovative use of technology and its commitment to transparency and social responsibility are transforming the homeowners insurance market. By prioritizing efficiency, customer satisfaction, and community engagement, Lemonade is setting a new standard for the industry. As other insurers take note and adapt, the future of homeowners insurance promises to be more dynamic, accessible, and customer-focused than ever before.

Customer-Centric Approach: Lemonade’s Unique Solutions for Policyholders

Lemonade has emerged as a formidable player in the homeowners insurance market, leveraging innovative technology and a customer-centric approach to redefine the traditional insurance experience. At the heart of Lemonade’s strategy is its commitment to providing policyholders with unique solutions that prioritize transparency, efficiency, and user satisfaction. This approach not only distinguishes Lemonade from its competitors but also sets a new standard for what customers can expect from their insurance providers.

One of the key elements of Lemonade’s customer-centric approach is its use of artificial intelligence and machine learning to streamline the insurance process. By employing advanced algorithms, Lemonade can offer instant quotes and facilitate rapid claims processing, often within minutes. This technological prowess eliminates the cumbersome paperwork and lengthy wait times typically associated with insurance claims, thereby enhancing the overall customer experience. Moreover, the use of AI allows Lemonade to continuously refine its services, learning from each interaction to better meet the needs of its policyholders.

In addition to technological innovation, Lemonade places a strong emphasis on transparency, a value that resonates deeply with modern consumers. Traditional insurance models often leave customers in the dark about how their premiums are calculated or how claims are processed. Lemonade, however, demystifies these processes by providing clear and concise information about its pricing structure and claims handling. This transparency is further reinforced by Lemonade’s unique business model, which charges a flat fee for its services and donates any unclaimed premiums to charitable causes chosen by its customers. This not only fosters trust but also aligns the company’s interests with those of its policyholders, as both parties benefit from minimizing claims.

Furthermore, Lemonade’s customer-centric approach is evident in its user-friendly digital platform, which is designed to make the insurance experience as seamless as possible. The platform’s intuitive interface allows customers to easily manage their policies, file claims, and access support, all from the convenience of their smartphones. This level of accessibility is particularly appealing to tech-savvy consumers who value the ability to handle their insurance needs on-the-go. Additionally, Lemonade’s commitment to customer service is reflected in its responsive support team, which is readily available to assist policyholders with any questions or concerns they may have.

Lemonade’s innovative solutions extend beyond technology and transparency, as the company also prioritizes social responsibility. By incorporating a giveback program into its business model, Lemonade empowers its customers to support causes they care about, thereby fostering a sense of community and shared purpose. This socially conscious approach not only differentiates Lemonade from traditional insurers but also appeals to a growing segment of consumers who prioritize ethical business practices.

In conclusion, Lemonade’s customer-centric approach to homeowners insurance is characterized by its innovative use of technology, commitment to transparency, and dedication to social responsibility. By prioritizing the needs and preferences of its policyholders, Lemonade has successfully disrupted the insurance market, setting a new benchmark for customer satisfaction and engagement. As the company continues to evolve and expand its offerings, it is poised to further transform the industry, challenging other insurers to adopt similar strategies in order to remain competitive. Through its unique solutions, Lemonade not only enhances the insurance experience for its customers but also contributes to a more equitable and sustainable future for all stakeholders involved.

AI and Automation: The Driving Forces Behind Lemonade’s Success

Lemonade, a company that has rapidly gained attention in the homeowners insurance market, is leveraging artificial intelligence and automation to redefine the industry. By integrating cutting-edge technology into their business model, Lemonade is not only streamlining the insurance process but also enhancing customer experience and satisfaction. This innovative approach is setting a new standard in an industry that has traditionally been slow to adapt to technological advancements.

At the core of Lemonade’s success is its use of artificial intelligence to automate and simplify the insurance process. Unlike traditional insurance companies that rely heavily on human agents, Lemonade employs AI-driven chatbots to handle customer interactions. These chatbots, powered by sophisticated algorithms, can efficiently guide customers through the process of obtaining a policy, filing a claim, or addressing any inquiries they may have. This automation significantly reduces the time and effort required from both the company and its customers, resulting in a more seamless and efficient experience.

Moreover, Lemonade’s AI systems are designed to learn and improve over time. By analyzing vast amounts of data, these systems can identify patterns and trends that help the company better understand customer needs and preferences. This data-driven approach allows Lemonade to offer personalized insurance solutions that are tailored to individual customers, thereby enhancing the overall value proposition. Furthermore, the use of AI in underwriting enables Lemonade to assess risk more accurately and set premiums that are both competitive and fair.

In addition to AI, automation plays a crucial role in Lemonade’s operational efficiency. The company’s automated systems handle a wide range of tasks, from processing claims to managing customer accounts. This not only reduces the need for manual intervention but also minimizes the potential for human error. As a result, Lemonade can process claims at a much faster rate than traditional insurers, often within minutes. This rapid response time is a significant advantage in an industry where timely claim resolution is critical to customer satisfaction.

The integration of AI and automation also supports Lemonade’s commitment to transparency and social responsibility. The company operates on a unique business model where a flat fee is taken from customer premiums, and any remaining funds are donated to charitable causes chosen by policyholders. This model is made possible by the efficiencies gained through technology, which allow Lemonade to maintain low operational costs while still delivering high-quality service. By aligning its business practices with the values of its customers, Lemonade is fostering a sense of trust and loyalty that is rare in the insurance industry.

As Lemonade continues to disrupt the homeowners insurance market, its success serves as a testament to the transformative power of AI and automation. By embracing these technologies, Lemonade is not only challenging the status quo but also paving the way for a more efficient, customer-centric approach to insurance. Other companies in the industry are taking note, and it is likely that we will see a broader adoption of similar technologies in the coming years. Ultimately, Lemonade’s innovative use of AI and automation is not just reshaping the insurance landscape; it is setting a new benchmark for what is possible when technology and customer service are seamlessly integrated.

Environmental Impact: Lemonade’s Commitment to Sustainable Insurance

Lemonade, a company renowned for its innovative approach to homeowners insurance, is making significant strides in addressing the environmental impact of the insurance industry. As the world becomes increasingly aware of the need for sustainable practices, Lemonade has positioned itself at the forefront of this movement by integrating eco-friendly solutions into its business model. This commitment to sustainability is not only reshaping the insurance landscape but also setting a new standard for how companies can operate responsibly in the modern era.

One of the key ways Lemonade is reducing its environmental footprint is through the use of artificial intelligence and digital platforms. By leveraging technology, Lemonade minimizes the need for paper-based processes, which are traditionally associated with the insurance industry. This digital-first approach not only streamlines operations but also significantly reduces the consumption of natural resources. Furthermore, the use of AI allows for more accurate risk assessments, which can lead to more efficient resource allocation and reduced waste.

In addition to its technological innovations, Lemonade has implemented a unique business model that aligns with its environmental goals. Unlike traditional insurance companies that profit from unclaimed premiums, Lemonade operates on a flat fee structure. This means that any leftover premiums are donated to causes chosen by policyholders, including environmental organizations. This model not only fosters transparency and trust but also encourages policyholders to engage in sustainable practices, knowing that their unclaimed premiums will support environmental initiatives.

Moreover, Lemonade’s commitment to sustainability extends to its investment strategies. The company has pledged to invest its reserves in environmentally responsible assets, thereby supporting the growth of green industries. This approach not only aligns with Lemonade’s values but also contributes to the broader effort of transitioning to a more sustainable economy. By prioritizing investments in renewable energy and other eco-friendly sectors, Lemonade is helping to drive the shift towards a low-carbon future.

Lemonade’s efforts to promote sustainability are further exemplified by its focus on educating policyholders about the environmental impact of their choices. Through its digital platform, Lemonade provides resources and information on how homeowners can reduce their carbon footprint and make more sustainable decisions. This educational component is crucial in empowering individuals to take action and contribute to the fight against climate change.

In addition to these initiatives, Lemonade is actively involved in advocating for policy changes that support environmental sustainability. By collaborating with industry leaders and policymakers, Lemonade is working to create a regulatory environment that encourages sustainable practices within the insurance sector. This advocacy is essential in driving systemic change and ensuring that the industry as a whole moves towards more environmentally responsible operations.

In conclusion, Lemonade’s commitment to sustainable insurance is a testament to the company’s forward-thinking approach and dedication to making a positive impact on the environment. By integrating technology, adopting a unique business model, investing responsibly, educating policyholders, and advocating for policy changes, Lemonade is not only disrupting the homeowners insurance market but also setting a new benchmark for sustainability in the industry. As more companies follow suit, the potential for meaningful environmental change within the insurance sector becomes increasingly attainable, paving the way for a more sustainable future.

Simplified Claims Process: How Lemonade is Redefining Customer Experience

Lemonade, a technology-driven insurance company, is making significant strides in the homeowners insurance market by redefining the customer experience through a simplified claims process. This innovative approach is not only transforming how policyholders interact with their insurance providers but also setting new standards for efficiency and transparency in the industry. By leveraging artificial intelligence and machine learning, Lemonade is able to streamline the claims process, making it faster and more user-friendly for its customers.

Traditionally, filing an insurance claim has been a cumbersome and time-consuming task, often involving extensive paperwork and prolonged waiting periods. However, Lemonade has disrupted this norm by introducing a digital-first approach that significantly reduces the complexity and duration of the claims process. Through its user-friendly mobile app, policyholders can file a claim in just a few minutes, eliminating the need for lengthy phone calls or in-person meetings. This digital interface guides users through each step, ensuring that all necessary information is collected efficiently and accurately.

Moreover, Lemonade’s use of artificial intelligence plays a crucial role in expediting claims. The company’s AI-powered chatbot, known as “AI Jim,” is capable of handling claims instantly, often approving and paying out simple claims within minutes. This rapid response is a stark contrast to the traditional insurance model, where claims can take days or even weeks to process. By automating routine tasks and utilizing machine learning algorithms, Lemonade is able to reduce human error and increase the speed of claim resolutions, thereby enhancing customer satisfaction.

In addition to speed, transparency is another key aspect of Lemonade’s claims process. The company operates on a unique business model that aligns its interests with those of its policyholders. Unlike traditional insurers that profit from denying claims, Lemonade charges a flat fee and donates any leftover funds to charitable causes chosen by its customers. This model not only fosters trust but also encourages a more transparent relationship between the insurer and the insured. Policyholders are kept informed throughout the claims process, with real-time updates provided via the app, ensuring that they are never left in the dark about the status of their claims.

Furthermore, Lemonade’s commitment to transparency extends to its policy offerings. The company provides clear and concise policy documents, free from the jargon and complexity that often characterize insurance contracts. This clarity empowers customers to make informed decisions about their coverage, further enhancing their overall experience.

As Lemonade continues to innovate and refine its approach, it is setting a new benchmark for customer experience in the homeowners insurance market. By prioritizing speed, transparency, and user-friendliness, the company is not only meeting the evolving needs of modern consumers but also challenging traditional insurers to rethink their own processes. As a result, Lemonade’s simplified claims process is not just a competitive advantage but a catalyst for broader industry change.

In conclusion, Lemonade’s disruption of the homeowners insurance market through its simplified claims process is a testament to the power of technology and innovation in enhancing customer experience. By leveraging AI and a customer-centric business model, the company is redefining what policyholders can expect from their insurers, paving the way for a more efficient, transparent, and satisfying insurance experience. As the industry continues to evolve, Lemonade’s approach serves as a compelling example of how embracing change can lead to significant improvements in service delivery and customer satisfaction.

Competitive Pricing: Lemonade’s Strategy to Attract Homeowners

Lemonade, a technology-driven insurance company, has been making waves in the homeowners insurance market with its innovative approach and competitive pricing strategies. By leveraging artificial intelligence and behavioral economics, Lemonade has managed to offer policies that are not only affordable but also tailored to the needs of modern homeowners. This approach has allowed the company to carve out a significant niche in a market traditionally dominated by established insurance giants.

One of the key elements of Lemonade’s strategy is its use of technology to streamline the insurance process. By employing AI-driven algorithms, Lemonade can quickly assess risk and provide quotes in a matter of minutes. This efficiency not only reduces operational costs but also translates into lower premiums for customers. Furthermore, the company’s digital-first approach appeals to tech-savvy consumers who prefer managing their insurance needs through a user-friendly app rather than dealing with cumbersome paperwork and lengthy phone calls.

In addition to technological innovation, Lemonade’s pricing model is designed to be transparent and customer-centric. Unlike traditional insurers that profit from denying claims, Lemonade charges a flat fee and uses the remaining funds to pay claims and cover reinsurance. Any leftover money is donated to causes chosen by policyholders, fostering a sense of community and trust. This unique model not only differentiates Lemonade from its competitors but also aligns with the values of socially conscious consumers who are increasingly seeking ethical business practices.

Moreover, Lemonade’s competitive pricing is further enhanced by its ability to attract a younger demographic. Millennials and Gen Z, who are now entering the housing market, are drawn to Lemonade’s modern approach and affordable rates. By understanding the financial constraints and digital preferences of these generations, Lemonade has positioned itself as a go-to option for first-time homeowners. This focus on younger customers not only helps Lemonade grow its customer base but also ensures long-term loyalty as these individuals progress through different stages of homeownership.

Another factor contributing to Lemonade’s competitive edge is its commitment to continuous improvement and adaptation. The company regularly updates its algorithms and processes based on customer feedback and market trends, ensuring that it remains at the forefront of the industry. This agility allows Lemonade to quickly respond to changes in the market and adjust its pricing strategies accordingly, maintaining its appeal to cost-conscious consumers.

Furthermore, Lemonade’s entry into the homeowners insurance market has prompted traditional insurers to reevaluate their own pricing models and customer engagement strategies. As a result, the industry as a whole is experiencing a shift towards more competitive pricing and improved customer service. This increased competition ultimately benefits consumers, who now have access to a wider range of affordable and innovative insurance options.

In conclusion, Lemonade’s competitive pricing strategy is a multifaceted approach that combines technological innovation, transparency, and a focus on younger consumers. By challenging the status quo and offering a fresh perspective on homeowners insurance, Lemonade has successfully disrupted the market and set new standards for what consumers can expect from their insurance providers. As the company continues to grow and evolve, it will be interesting to see how its strategies influence the broader insurance landscape and inspire further innovation within the industry.

Future Trends: What Lemonade’s Innovations Mean for the Insurance Industry

Lemonade, a company that has rapidly gained attention in the insurance industry, is redefining the landscape of homeowners insurance with its innovative approach. As the insurance sector grapples with the challenges of digital transformation, Lemonade’s solutions offer a glimpse into the future of how insurance might evolve. By leveraging technology and data analytics, Lemonade is not only streamlining the insurance process but also enhancing customer experience, which is a critical factor in today’s competitive market.

One of the most significant innovations introduced by Lemonade is its use of artificial intelligence and machine learning to expedite the insurance process. Traditional insurance models often involve lengthy procedures and extensive paperwork, which can be cumbersome for policyholders. In contrast, Lemonade employs AI-driven chatbots to handle claims and customer inquiries, significantly reducing the time required to process claims. This efficiency not only benefits customers by providing faster service but also allows the company to operate with lower overhead costs, which can translate into more competitive pricing for consumers.

Moreover, Lemonade’s business model is built on transparency and social responsibility, which are increasingly important to modern consumers. Unlike traditional insurers that profit from unclaimed premiums, Lemonade takes a flat fee from premiums and donates any remaining funds to causes chosen by policyholders. This approach not only aligns with the values of socially conscious consumers but also fosters trust and loyalty, as customers feel more connected to the company and its mission. As a result, Lemonade is setting a new standard for corporate responsibility in the insurance industry.

In addition to its innovative business model, Lemonade is also pioneering the use of big data to assess risk more accurately. By analyzing vast amounts of data, Lemonade can tailor policies to individual needs and offer personalized pricing. This data-driven approach allows for more precise risk assessment, which can lead to lower premiums for low-risk customers. Furthermore, it enables the company to identify trends and potential risks more effectively, allowing for proactive measures that can mitigate losses before they occur.

As Lemonade continues to disrupt the homeowners insurance market, its innovations are likely to influence the broader insurance industry. Traditional insurers may need to adapt by incorporating similar technologies and adopting more customer-centric business models to remain competitive. This shift could lead to a more efficient and transparent insurance market, benefiting consumers and companies alike.

However, the rise of technology-driven insurance solutions also raises questions about data privacy and security. As companies like Lemonade collect and analyze vast amounts of personal data, ensuring the protection of this information becomes paramount. The industry will need to address these concerns by implementing robust data security measures and maintaining transparency about how data is used.

In conclusion, Lemonade’s innovative approach to homeowners insurance is setting a new precedent for the industry. By embracing technology, transparency, and social responsibility, the company is not only enhancing the customer experience but also challenging traditional insurance models. As the industry evolves, other insurers may follow suit, leading to a more dynamic and customer-focused market. While challenges such as data privacy remain, the potential benefits of these innovations are significant, promising a future where insurance is more accessible, efficient, and aligned with the values of modern consumers.

Q&A

1. **What is Lemonade?**

Lemonade is an insurance company that uses artificial intelligence and behavioral economics to offer homeowners, renters, and pet insurance, among other products.

2. **How does Lemonade disrupt the homeowners insurance market?**

Lemonade disrupts the market by using AI-driven technology to streamline the insurance process, offering quick policy issuance and claims processing, often within minutes.

3. **What technology does Lemonade use to enhance its services?**

Lemonade employs AI chatbots and machine learning algorithms to handle customer interactions, underwriting, and claims, reducing the need for traditional insurance agents.

4. **What is unique about Lemonade’s business model?**

Lemonade operates on a flat-fee model, taking a fixed percentage of premiums for operations and donating leftover funds to charitable causes, which aligns with its social impact mission.

5. **How does Lemonade’s claims process differ from traditional insurers?**

Lemonade’s claims process is largely automated, allowing for rapid approval and payment, often within minutes, compared to the lengthy process typical of traditional insurers.

6. **What role does behavioral economics play in Lemonade’s approach?**

Lemonade uses behavioral economics to design its user experience, encouraging honesty and transparency from customers, which helps reduce fraud and improve customer satisfaction.

7. **What impact has Lemonade had on the insurance industry?**

Lemonade has pushed the industry towards digital transformation, prompting traditional insurers to adopt similar technologies and customer-centric approaches to remain competitive.

Conclusion

Lemonade has significantly disrupted the homeowners insurance market by leveraging technology and innovative solutions to streamline the insurance process. By utilizing artificial intelligence and behavioral economics, Lemonade offers a more efficient, transparent, and customer-friendly experience compared to traditional insurers. Their model, which includes a flat fee structure and a focus on social impact through charitable donations, appeals to a younger, tech-savvy demographic. This approach not only reduces costs and processing times but also builds trust and loyalty among consumers. As a result, Lemonade has set a new standard in the industry, prompting traditional insurers to adapt and innovate in response to this competitive pressure.