“Lam Research Soars: Defying Trends, Outpacing ASML Post-Earnings!”

Introduction

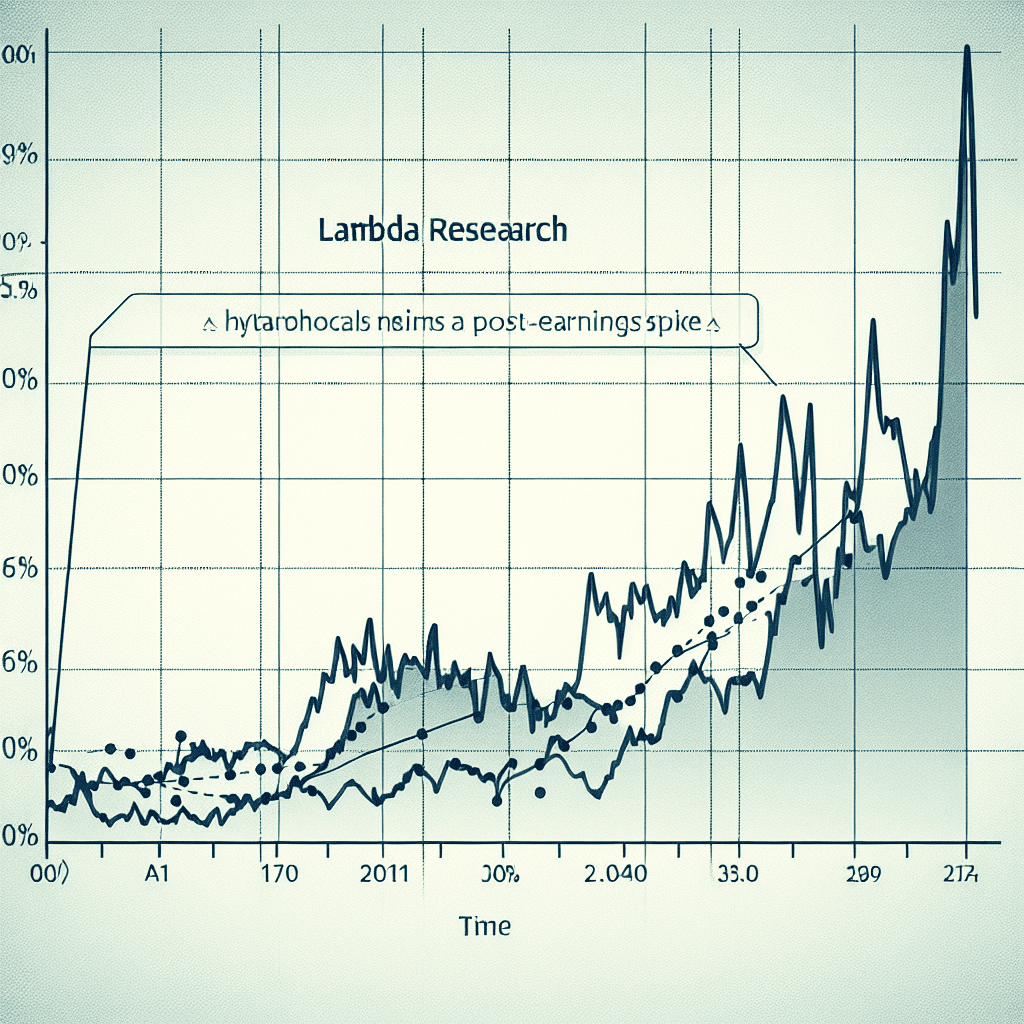

Lam Research’s stock experienced a notable climb following the release of its earnings report, marking a distinct divergence from the trajectory of its industry peer, ASML. The semiconductor equipment manufacturer reported financial results that exceeded market expectations, driven by robust demand and strategic operational efficiencies. This positive performance has bolstered investor confidence, setting Lam Research apart in a sector characterized by volatility and intense competition. In contrast, ASML, another key player in the semiconductor equipment industry, has faced challenges that have impacted its stock performance, highlighting the differing market dynamics and company-specific factors influencing these two giants.

Lam Research’s Earnings Beat Expectations: Key Drivers Behind the Stock Surge

Lam Research’s recent earnings report has captured the attention of investors and analysts alike, as the company’s stock experienced a notable surge following the announcement. This positive market reaction stands in contrast to the trajectory of ASML, a fellow semiconductor equipment manufacturer, whose stock has not mirrored Lam Research’s upward movement. The divergence in their paths can be attributed to several key factors that have influenced Lam Research’s performance and investor sentiment.

To begin with, Lam Research’s earnings exceeded market expectations, a primary driver behind the stock’s ascent. The company reported robust revenue growth, which was bolstered by strong demand for its semiconductor manufacturing equipment. This demand is largely fueled by the ongoing expansion of the semiconductor industry, as technological advancements and the proliferation of digital devices continue to drive the need for more sophisticated and efficient manufacturing processes. Lam Research’s ability to capitalize on these industry trends has positioned it favorably in the eyes of investors.

Moreover, the company’s strategic initiatives have played a crucial role in its recent success. Lam Research has been proactive in expanding its product portfolio and enhancing its technological capabilities. By investing in research and development, the company has been able to introduce innovative solutions that cater to the evolving needs of its clients. This commitment to innovation not only strengthens Lam Research’s competitive edge but also reinforces investor confidence in its long-term growth prospects.

In addition to its strategic initiatives, Lam Research’s operational efficiency has contributed to its impressive financial performance. The company has implemented cost-control measures and optimized its supply chain, resulting in improved profit margins. These efforts have enabled Lam Research to navigate the challenges posed by global supply chain disruptions and rising material costs, which have affected many industries. By maintaining operational resilience, the company has demonstrated its ability to deliver consistent results, further boosting investor trust.

While Lam Research’s stock has climbed, ASML’s performance has not followed the same trajectory. This divergence can be attributed to differing market dynamics and company-specific factors. ASML, a leader in lithography systems, faces unique challenges related to its niche market. The company’s reliance on a few key customers and its exposure to geopolitical tensions have introduced uncertainties that may have tempered investor enthusiasm. Additionally, ASML’s recent earnings report, while solid, did not surpass expectations to the same extent as Lam Research’s, contributing to the contrasting stock movements.

Furthermore, the broader semiconductor industry landscape has influenced the performance of both companies. While demand for semiconductor equipment remains strong, the industry is not without its challenges. Supply chain constraints, geopolitical tensions, and fluctuating demand patterns continue to pose risks. However, Lam Research’s ability to effectively manage these challenges and capitalize on growth opportunities has set it apart from its peers.

In conclusion, Lam Research’s stock surge following its earnings report can be attributed to a combination of factors, including its earnings beat, strategic initiatives, and operational efficiency. These elements have not only driven the company’s recent success but also differentiated it from ASML, whose stock has not experienced the same upward momentum. As the semiconductor industry continues to evolve, Lam Research’s proactive approach and strong market position are likely to sustain investor confidence and support its growth trajectory in the coming quarters.

Comparing Lam Research and ASML: Divergent Paths in the Semiconductor Industry

Lam Research and ASML, two giants in the semiconductor industry, have recently demonstrated divergent paths in their stock performance, particularly following their respective earnings reports. This divergence highlights the distinct roles and market dynamics each company faces within the broader semiconductor landscape. Lam Research, a key player in wafer fabrication equipment, has seen its stock climb post-earnings, a testament to its robust financial performance and strategic positioning. In contrast, ASML, renowned for its cutting-edge lithography machines, has experienced a different trajectory, reflecting the unique challenges and opportunities it encounters.

Lam Research’s recent earnings report exceeded market expectations, driven by strong demand for its equipment used in the manufacturing of semiconductors. The company’s ability to capitalize on the ongoing expansion of semiconductor production has been pivotal. As the world increasingly relies on digital technologies, the demand for semiconductors continues to surge, benefiting companies like Lam Research that provide essential tools for chipmakers. Furthermore, Lam’s strategic investments in research and development have enabled it to offer innovative solutions that meet the evolving needs of its customers, thereby solidifying its market position.

In contrast, ASML’s stock performance has been more subdued, despite its critical role in the semiconductor supply chain. ASML’s lithography machines are indispensable for producing advanced chips, particularly those used in cutting-edge technologies such as artificial intelligence and high-performance computing. However, the company’s stock has faced headwinds due to broader market concerns and geopolitical tensions that have impacted the semiconductor industry. Additionally, ASML’s reliance on a few key customers for a significant portion of its revenue can lead to volatility in its financial performance, as any fluctuations in demand from these customers can have a pronounced effect.

The divergence in stock performance between Lam Research and ASML can also be attributed to their differing market strategies and customer bases. Lam Research has a more diversified customer portfolio, serving a wide range of semiconductor manufacturers across various segments. This diversification provides a buffer against market fluctuations and allows Lam to capture growth opportunities across different areas of the semiconductor industry. On the other hand, ASML’s focus on high-end lithography equipment means it caters to a more niche market, which, while lucrative, can be more susceptible to shifts in technology trends and customer investment cycles.

Moreover, the semiconductor industry is currently navigating a complex landscape characterized by supply chain disruptions and geopolitical uncertainties. These factors have influenced investor sentiment and contributed to the varying stock performances of companies within the sector. Lam Research’s ability to adapt to these challenges and maintain a steady supply of its equipment has been a key factor in its recent stock climb. Conversely, ASML’s exposure to geopolitical risks, particularly in relation to its dealings with China, has added an element of uncertainty to its outlook.

In conclusion, the recent divergence in stock performance between Lam Research and ASML underscores the distinct paths these companies are taking within the semiconductor industry. While Lam Research benefits from strong demand and a diversified customer base, ASML faces unique challenges related to its specialized market focus and geopolitical considerations. As the semiconductor industry continues to evolve, both companies will need to navigate these dynamics carefully to sustain their growth and maintain their competitive edge.

Market Reactions: Why Lam Research Stock Climbed Post-Earnings

Lam Research Corporation recently experienced a notable surge in its stock price following the release of its quarterly earnings report, a development that has captured the attention of investors and market analysts alike. This upward trajectory stands in contrast to the path taken by ASML Holding, another major player in the semiconductor equipment industry, whose stock has not mirrored the same positive momentum. Understanding the factors contributing to Lam Research’s stock climb requires a closer examination of the company’s financial performance, strategic initiatives, and broader market conditions.

To begin with, Lam Research’s earnings report exceeded market expectations, providing a strong foundation for the subsequent rise in its stock price. The company reported robust revenue growth, driven by increased demand for its semiconductor manufacturing equipment. This demand is largely fueled by the ongoing expansion of the semiconductor industry, which continues to experience heightened activity due to the proliferation of advanced technologies such as artificial intelligence, 5G, and the Internet of Things. As a result, Lam Research has been able to capitalize on these trends, translating them into impressive financial results that have reassured investors about the company’s growth prospects.

Moreover, Lam Research’s strategic initiatives have played a crucial role in bolstering investor confidence. The company has been actively investing in research and development to enhance its product offerings and maintain its competitive edge in the market. By focusing on innovation and technological advancements, Lam Research has positioned itself as a leader in the semiconductor equipment sector, capable of meeting the evolving needs of its customers. This commitment to innovation not only strengthens the company’s market position but also signals to investors that Lam Research is well-prepared to navigate the challenges and opportunities that lie ahead.

In contrast, ASML Holding has faced a different set of circumstances that have influenced its stock performance. While ASML remains a dominant force in the semiconductor equipment industry, it has encountered certain headwinds that have tempered investor enthusiasm. For instance, supply chain disruptions and geopolitical tensions have posed challenges to ASML’s operations, impacting its ability to meet demand and deliver products in a timely manner. These external factors have created a degree of uncertainty around ASML’s near-term outlook, leading to a more cautious approach from investors.

Furthermore, the broader market conditions have also played a role in shaping the divergent paths of Lam Research and ASML. The semiconductor industry is inherently cyclical, with periods of rapid growth often followed by phases of consolidation and adjustment. As such, companies within this sector must navigate these cycles carefully to sustain their growth trajectories. Lam Research’s recent performance suggests that it has effectively managed these dynamics, leveraging its strengths to capitalize on favorable market conditions. On the other hand, ASML’s challenges highlight the complexities and risks associated with operating in a highly competitive and volatile industry.

In conclusion, Lam Research’s stock climb post-earnings can be attributed to a combination of strong financial performance, strategic investments in innovation, and favorable market conditions. These factors have collectively reinforced investor confidence in the company’s ability to sustain its growth momentum. Meanwhile, ASML’s divergent path underscores the importance of navigating industry-specific challenges and external uncertainties. As the semiconductor industry continues to evolve, both companies will need to adapt and innovate to maintain their competitive positions and deliver value to their shareholders.

Analyzing Lam Research’s Financial Performance: What Investors Need to Know

Lam Research Corporation, a prominent player in the semiconductor equipment industry, recently reported its quarterly earnings, which have sparked a notable climb in its stock price. This upward trajectory stands in contrast to the path taken by ASML Holding, another key entity in the same sector. Investors are keenly analyzing the financial performance of Lam Research to understand the factors contributing to this divergence and to assess the potential implications for future investments.

To begin with, Lam Research’s latest earnings report exceeded market expectations, showcasing robust revenue growth and improved profit margins. The company’s ability to deliver strong financial results in a challenging economic environment has been a key driver of investor confidence. Notably, Lam Research has demonstrated resilience in navigating supply chain disruptions and fluctuating demand, which have been prevalent issues across the semiconductor industry. By effectively managing these challenges, the company has positioned itself favorably in the eyes of investors.

Furthermore, Lam Research’s strategic focus on innovation and technological advancement has played a crucial role in its financial success. The company has consistently invested in research and development to enhance its product offerings and maintain a competitive edge. This commitment to innovation has enabled Lam Research to capitalize on the growing demand for advanced semiconductor equipment, particularly in areas such as memory and logic devices. As a result, the company has been able to capture a larger market share and drive revenue growth.

In contrast, ASML Holding, despite being a leader in the semiconductor lithography market, has faced its own set of challenges. The company’s recent earnings report revealed some headwinds, including delays in customer deliveries and increased operational costs. These factors have contributed to a more subdued performance compared to Lam Research. While ASML remains a dominant force in its niche, the divergence in stock performance highlights the varying dynamics within the semiconductor equipment industry.

Transitioning to the broader market context, the semiconductor sector as a whole has been experiencing significant volatility. Geopolitical tensions, trade restrictions, and evolving consumer demands have all contributed to an unpredictable landscape. In this environment, companies like Lam Research that demonstrate adaptability and strategic foresight are better positioned to thrive. Investors are increasingly looking for firms that can not only weather short-term disruptions but also capitalize on long-term growth opportunities.

Moreover, Lam Research’s financial health is underscored by its strong balance sheet and prudent capital allocation strategies. The company has maintained a disciplined approach to managing its finances, ensuring sufficient liquidity to support ongoing operations and future investments. This financial stability provides a solid foundation for Lam Research to pursue strategic initiatives and expand its market presence.

In conclusion, Lam Research’s recent stock climb post-earnings reflects a combination of strong financial performance, strategic innovation, and effective risk management. While ASML Holding continues to be a formidable competitor, the divergence in their stock trajectories underscores the importance of adaptability and strategic execution in the semiconductor equipment industry. As investors evaluate their portfolios, understanding the nuances of each company’s financial performance and market positioning will be crucial in making informed investment decisions. Lam Research’s ability to navigate current challenges while capitalizing on future opportunities positions it as a compelling choice for those seeking exposure to the dynamic semiconductor sector.

The Impact of Global Semiconductor Demand on Lam Research’s Stock Performance

Lam Research’s stock has recently experienced an upward trajectory following the release of its latest earnings report, a development that stands in contrast to the path taken by ASML, another major player in the semiconductor industry. This divergence highlights the nuanced dynamics within the global semiconductor market, where demand fluctuations and company-specific strategies play pivotal roles in shaping stock performance. Understanding the factors that have contributed to Lam Research’s recent success requires a closer examination of the broader semiconductor landscape and the company’s strategic positioning within it.

The global demand for semiconductors has been on a rollercoaster ride, influenced by a myriad of factors ranging from technological advancements to geopolitical tensions. As industries such as automotive, consumer electronics, and telecommunications increasingly rely on semiconductor technology, the demand for these critical components has surged. However, supply chain disruptions and geopolitical uncertainties have occasionally tempered this demand, creating a complex environment for companies operating in this sector. Lam Research, a key supplier of wafer fabrication equipment, has adeptly navigated these challenges, leveraging its technological prowess and strategic initiatives to capitalize on the growing demand.

One of the primary drivers behind Lam Research’s recent stock performance is its ability to innovate and deliver cutting-edge solutions that meet the evolving needs of semiconductor manufacturers. The company’s focus on developing advanced equipment for etching and deposition processes has positioned it as a leader in enabling the production of next-generation chips. This technological edge has not only bolstered its market position but also enhanced its financial performance, as evidenced by its robust earnings report. By investing in research and development, Lam Research has ensured that it remains at the forefront of technological advancements, thereby attracting increased investor confidence.

In contrast, ASML, a leading provider of photolithography equipment, has faced its own set of challenges. While ASML’s technology is indispensable for the production of advanced chips, the company has encountered supply chain bottlenecks that have impacted its ability to meet demand. These constraints have, in turn, affected its stock performance, highlighting the importance of supply chain resilience in the semiconductor industry. The divergent paths of Lam Research and ASML underscore the significance of strategic agility and operational efficiency in navigating the complexities of the global semiconductor market.

Moreover, Lam Research’s strategic partnerships and customer-centric approach have further contributed to its stock’s upward momentum. By fostering strong relationships with key customers and collaborating on innovative solutions, the company has solidified its position as a trusted partner in the semiconductor ecosystem. This customer-centric strategy has not only driven revenue growth but also enhanced its reputation in the industry, providing a competitive edge over its peers.

In conclusion, the recent climb in Lam Research’s stock post-earnings reflects the company’s adeptness at capitalizing on global semiconductor demand. Through technological innovation, strategic partnerships, and a focus on operational excellence, Lam Research has successfully navigated the challenges of the semiconductor landscape, setting itself apart from competitors like ASML. As the demand for semiconductors continues to evolve, companies that can effectively adapt to changing market dynamics and deliver value to their customers are likely to emerge as leaders in this critical industry. Lam Research’s recent performance serves as a testament to the importance of strategic foresight and operational resilience in achieving sustained success in the ever-changing world of semiconductors.

Lam Research vs. ASML: Strategic Differences and Market Implications

Lam Research’s recent stock performance has captured the attention of investors and analysts alike, particularly in the wake of its latest earnings report. The company’s shares have climbed, marking a divergence from the trajectory of its industry peer, ASML. This divergence underscores the strategic differences between the two semiconductor equipment giants and highlights the varying market implications of their respective approaches.

Lam Research, a key player in the semiconductor manufacturing equipment sector, has demonstrated resilience and adaptability in a rapidly evolving market. The company’s recent earnings report exceeded expectations, driven by robust demand for its advanced wafer fabrication equipment. This demand is largely fueled by the ongoing expansion of semiconductor manufacturing capacity worldwide, as industries ranging from consumer electronics to automotive increasingly rely on advanced chips. Lam’s ability to capitalize on this demand has been a testament to its strategic focus on innovation and customer-centric solutions.

In contrast, ASML, known for its cutting-edge lithography systems, has faced a different set of challenges. While ASML remains a dominant force in the semiconductor equipment market, its stock performance has been more subdued. This can be attributed to several factors, including supply chain disruptions and geopolitical tensions that have impacted its operations. Moreover, ASML’s reliance on a smaller customer base, primarily concentrated in the high-end lithography segment, has made it more vulnerable to fluctuations in demand from a few key players.

The strategic differences between Lam Research and ASML are further highlighted by their respective approaches to research and development. Lam has consistently invested in broadening its product portfolio, focusing on areas such as etch and deposition technologies. This diversification strategy has allowed Lam to capture a wider range of market opportunities and mitigate risks associated with reliance on a single product line. On the other hand, ASML’s strategy has been heavily centered on its EUV (extreme ultraviolet) lithography technology, which, while revolutionary, represents a significant concentration of resources and risk.

Furthermore, the market implications of these strategic differences are profound. Lam’s diversified approach positions it well to benefit from the increasing complexity and variety of semiconductor devices being developed. As industries push the boundaries of technology, requiring more specialized and varied chip designs, Lam’s broad product offerings provide a competitive edge. Conversely, ASML’s focus on EUV technology, while potentially transformative for the semiconductor industry, ties its fortunes closely to the adoption rate and success of this specific technology.

In addition, the geopolitical landscape plays a crucial role in shaping the market dynamics for both companies. Lam Research, with its diversified customer base and product offerings, may be better insulated from geopolitical risks that could impact specific regions or technologies. ASML, however, faces unique challenges due to its reliance on a few major customers and the geopolitical sensitivities surrounding its advanced lithography systems.

In conclusion, the recent divergence in stock performance between Lam Research and ASML reflects their distinct strategic paths and the broader market implications of these choices. Lam’s adaptability and diversified approach have positioned it favorably in a dynamic market, while ASML’s focused strategy presents both opportunities and challenges. As the semiconductor industry continues to evolve, the strategic decisions made by these companies will undoubtedly shape their future trajectories and influence the broader market landscape.

Future Outlook: What Lam Research’s Earnings Mean for the Semiconductor Sector

Lam Research’s recent earnings report has sparked significant interest in the semiconductor sector, as the company’s stock experienced a notable climb, diverging from the trajectory of its industry peer, ASML. This divergence highlights the nuanced dynamics within the semiconductor industry, where individual company performance can vary significantly despite overarching market trends. Lam Research’s positive earnings report not only underscores its robust operational strategies but also provides insights into the broader implications for the semiconductor sector.

The semiconductor industry, known for its cyclical nature, has been navigating a complex landscape marked by supply chain disruptions and fluctuating demand. In this context, Lam Research’s ability to post strong earnings is indicative of its strategic agility and operational resilience. The company’s focus on innovation and its commitment to addressing the evolving needs of its clients have been pivotal in driving its recent success. By investing in cutting-edge technologies and expanding its product offerings, Lam Research has positioned itself as a key player capable of capitalizing on emerging opportunities within the sector.

Moreover, the divergence between Lam Research and ASML’s stock performance can be attributed to several factors. While both companies operate within the semiconductor equipment space, their business models and market focuses differ. Lam Research’s emphasis on etching and deposition equipment, critical for semiconductor manufacturing, has allowed it to benefit from the increasing demand for advanced chips. In contrast, ASML, a leader in photolithography equipment, faces distinct challenges and opportunities, particularly in the context of its reliance on EUV technology. This divergence underscores the importance of understanding the specific market dynamics and technological advancements that influence each company’s performance.

Looking ahead, Lam Research’s earnings report offers valuable insights into the future outlook of the semiconductor sector. The company’s strong performance suggests a continued demand for semiconductor equipment, driven by the proliferation of technologies such as artificial intelligence, 5G, and the Internet of Things. As these technologies become increasingly integrated into various industries, the demand for advanced semiconductor solutions is expected to rise, providing growth opportunities for companies like Lam Research.

Furthermore, Lam Research’s success highlights the critical role of strategic partnerships and collaborations in the semiconductor industry. By fostering strong relationships with key clients and suppliers, the company has been able to navigate supply chain challenges effectively and maintain a competitive edge. This approach not only enhances operational efficiency but also positions Lam Research to respond swiftly to market shifts and technological advancements.

In conclusion, Lam Research’s recent earnings report and subsequent stock climb offer a glimpse into the future trajectory of the semiconductor sector. The company’s ability to outperform expectations amidst a challenging market environment underscores the importance of strategic innovation and adaptability. As the semiconductor industry continues to evolve, driven by technological advancements and changing consumer demands, companies like Lam Research that prioritize innovation and strategic partnerships are likely to thrive. This divergence from ASML’s path further emphasizes the need for investors and industry stakeholders to consider the unique attributes and market positions of individual companies within the broader semiconductor landscape. Ultimately, Lam Research’s success serves as a testament to the dynamic and multifaceted nature of the semiconductor sector, where strategic foresight and operational excellence are key determinants of long-term success.

Q&A

1. **What caused Lam Research’s stock to climb post-earnings?**

Lam Research’s stock climbed post-earnings due to better-than-expected financial results, including strong revenue and profit figures, which exceeded analysts’ expectations.

2. **How did Lam Research’s earnings compare to expectations?**

Lam Research’s earnings surpassed expectations, with higher-than-anticipated revenue and profit margins, indicating robust demand for its semiconductor manufacturing equipment.

3. **What factors contributed to Lam Research’s strong performance?**

Factors contributing to Lam Research’s strong performance included increased demand for semiconductor equipment, effective cost management, and successful execution of strategic initiatives.

4. **How did Lam Research’s performance differ from ASML’s?**

While Lam Research reported strong earnings and stock growth, ASML faced challenges such as supply chain issues or market conditions that led to a different financial outcome, causing a divergence in their stock performance.

5. **What market trends are influencing Lam Research’s growth?**

Market trends influencing Lam Research’s growth include the ongoing demand for semiconductors, advancements in technology requiring more sophisticated manufacturing equipment, and the global push for increased chip production capacity.

6. **What are analysts saying about Lam Research’s future prospects?**

Analysts are generally optimistic about Lam Research’s future prospects, citing its strong market position, continued demand for semiconductor equipment, and potential for growth in emerging technologies.

7. **How is Lam Research positioned in the semiconductor industry compared to its competitors?**

Lam Research is well-positioned in the semiconductor industry, with a strong portfolio of products and services, a solid customer base, and a reputation for innovation, allowing it to compete effectively against other major players like ASML.

Conclusion

Lam Research’s stock experienced an upward movement following its earnings report, indicating positive investor sentiment and confidence in the company’s financial performance and future prospects. This divergence from ASML’s path suggests that while both companies operate within the semiconductor equipment industry, their individual financial results, market strategies, and external factors such as supply chain dynamics or customer demand may have influenced their stock trajectories differently. Lam Research’s ability to outperform expectations or address market challenges effectively could have contributed to its stock climb, setting it apart from ASML’s performance during the same period.