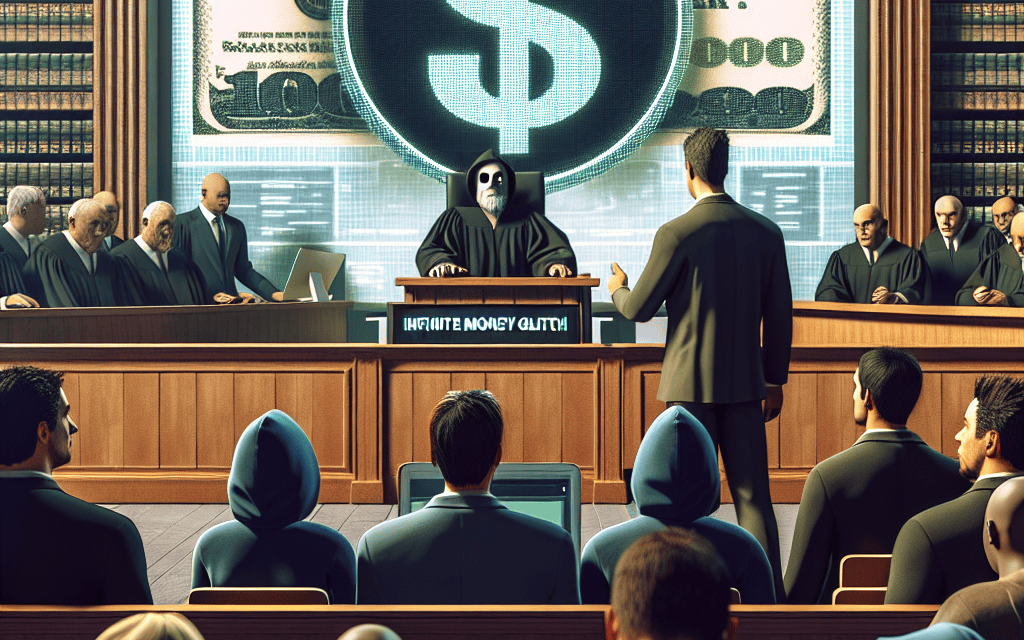

“JPMorgan Strikes Back: Legal Action Against ‘Infinite Money Glitch’ Exploiters”

Introduction

JPMorgan Chase & Co., one of the largest financial institutions in the world, has initiated legal action against several individuals accused of exploiting a critical flaw in the bank’s systems, colloquially referred to as the ‘Infinite Money Glitch.’ This glitch allegedly allowed the defendants to withdraw funds far exceeding their actual account balances, resulting in the theft of thousands of dollars. The lawsuit underscores the ongoing challenges banks face in safeguarding their digital infrastructure against increasingly sophisticated forms of financial fraud. As JPMorgan seeks restitution and damages, the case highlights the broader implications of cybersecurity vulnerabilities in the banking sector and the legal repercussions for those who attempt to exploit them.

Legal Implications of Exploiting Financial System Vulnerabilities

In recent developments, JPMorgan Chase & Co. has initiated legal proceedings against several individuals accused of exploiting a vulnerability in the bank’s financial system, colloquially referred to as the “infinite money glitch.” This case underscores the significant legal implications associated with exploiting vulnerabilities within financial systems, highlighting the intersection of technology, finance, and law. The individuals involved allegedly manipulated the bank’s systems to withdraw funds far exceeding their actual account balances, effectively creating money from nothing. This exploitation of a system flaw not only raises questions about the security measures in place at major financial institutions but also about the legal ramifications for those who take advantage of such vulnerabilities.

The legal framework surrounding financial system exploitation is complex, involving both criminal and civil liabilities. In this instance, JPMorgan’s lawsuit is likely to focus on theft and fraud charges, as the individuals are accused of intentionally deceiving the bank to gain unauthorized access to funds. The legal system treats such actions as serious offenses, given the potential to undermine trust in financial institutions and the broader economic system. Moreover, the case may set a precedent for how similar incidents are handled in the future, particularly as digital banking becomes increasingly prevalent.

Transitioning to the technological aspect, the incident highlights the critical importance of robust cybersecurity measures in the banking sector. Financial institutions are prime targets for cybercriminals due to the vast amounts of money and sensitive data they handle. As such, banks invest heavily in security infrastructure to protect against unauthorized access and data breaches. However, as this case demonstrates, even the most sophisticated systems can have vulnerabilities that, if exploited, can lead to significant financial losses and reputational damage. This situation serves as a stark reminder for banks to continuously assess and update their security protocols to safeguard against emerging threats.

Furthermore, the case raises ethical questions about the responsibility of individuals who discover such vulnerabilities. While some may argue that exploiting a system flaw for personal gain is inherently unethical, others might contend that the discovery of such vulnerabilities could be used to improve system security if reported responsibly. This ethical dilemma is compounded by the potential for significant financial gain, which can be a powerful motivator for individuals to act against legal and ethical norms.

In addition to the immediate legal and financial implications, this case may also influence regulatory policies concerning financial system security. Regulators may use this incident as a catalyst to implement stricter guidelines and oversight to ensure that banks are adequately protecting their systems against exploitation. This could involve more rigorous testing of security measures, increased transparency in reporting vulnerabilities, and enhanced collaboration between financial institutions and regulatory bodies to share information about potential threats.

In conclusion, the lawsuit filed by JPMorgan against individuals exploiting the “infinite money glitch” serves as a critical reminder of the legal, technological, and ethical challenges associated with financial system vulnerabilities. As digital banking continues to evolve, it is imperative for financial institutions, regulators, and individuals to work collaboratively to address these challenges, ensuring the security and integrity of the financial system. This case not only highlights the need for robust cybersecurity measures but also underscores the importance of a comprehensive legal framework to deter and address exploitation effectively.

The Role of Cybersecurity in Preventing Banking Fraud

In recent years, the financial sector has witnessed a surge in cyber threats, with banks becoming prime targets for fraudsters seeking to exploit vulnerabilities in digital systems. A recent case involving JPMorgan Chase highlights the critical role of cybersecurity in safeguarding financial institutions against such threats. The bank has filed a lawsuit against individuals accused of exploiting what has been dubbed an “infinite money glitch,” a sophisticated scheme that allegedly allowed them to siphon off thousands of dollars. This incident underscores the urgent need for robust cybersecurity measures to prevent banking fraud and protect both financial institutions and their customers.

The “infinite money glitch” refers to a flaw in the bank’s digital infrastructure that was reportedly manipulated by the accused to create unauthorized transactions. Such vulnerabilities can arise from various factors, including outdated software, inadequate security protocols, or human error. As financial institutions increasingly rely on digital platforms to conduct transactions and manage customer accounts, the potential for cybercriminals to exploit these weaknesses has grown exponentially. Consequently, banks must prioritize cybersecurity to mitigate the risk of fraud and maintain the integrity of their operations.

To address these challenges, financial institutions are investing heavily in advanced cybersecurity technologies and strategies. These include the implementation of multi-factor authentication, encryption, and real-time monitoring systems designed to detect and respond to suspicious activities swiftly. By employing these measures, banks can significantly reduce the likelihood of unauthorized access to their systems and protect sensitive customer information from falling into the wrong hands. Moreover, the integration of artificial intelligence and machine learning into cybersecurity frameworks has enabled banks to identify and neutralize threats more effectively, as these technologies can analyze vast amounts of data to detect patterns indicative of fraudulent behavior.

In addition to technological solutions, the human element remains a crucial component of effective cybersecurity. Financial institutions must ensure that their employees are well-trained in recognizing and responding to potential cyber threats. Regular training sessions and awareness programs can equip staff with the knowledge and skills necessary to identify phishing attempts, social engineering tactics, and other common methods used by cybercriminals. By fostering a culture of vigilance and accountability, banks can enhance their overall security posture and reduce the risk of internal breaches.

Furthermore, collaboration between financial institutions, regulatory bodies, and law enforcement agencies is essential in combating banking fraud. By sharing information about emerging threats and best practices, these entities can work together to develop comprehensive strategies for preventing cybercrime. Regulatory frameworks that mandate stringent cybersecurity standards and regular audits can also incentivize banks to maintain robust defenses against potential attacks.

In conclusion, the lawsuit filed by JPMorgan Chase against individuals exploiting the “infinite money glitch” serves as a stark reminder of the ever-present threat of cybercrime in the banking sector. As digital platforms continue to evolve, so too must the strategies employed by financial institutions to protect themselves and their customers from fraud. By investing in advanced technologies, fostering a culture of security awareness, and collaborating with external partners, banks can fortify their defenses against cyber threats and ensure the continued trust and confidence of their clients. As the landscape of cyber threats continues to shift, the role of cybersecurity in preventing banking fraud will remain a critical priority for financial institutions worldwide.

How Financial Institutions Respond to Digital Exploitation

In an era where digital transactions have become the norm, financial institutions are increasingly vigilant about safeguarding their systems against exploitation. Recently, JPMorgan Chase, one of the largest banks in the United States, has taken legal action against individuals accused of exploiting a so-called “infinite money glitch.” This glitch, a term often used in gaming and digital finance circles, refers to a loophole that allows users to manipulate systems to generate funds illicitly. The case highlights the ongoing challenges financial institutions face in maintaining the integrity of their digital platforms and the measures they employ to combat such threats.

The incident in question involved a group of individuals who allegedly discovered a vulnerability within JPMorgan’s digital banking system. By exploiting this flaw, they were able to transfer thousands of dollars into their accounts without the bank’s immediate detection. This breach not only resulted in financial losses for the bank but also raised significant concerns about the security of digital banking systems. Consequently, JPMorgan has filed a lawsuit against these individuals, accusing them of theft and seeking restitution for the funds unlawfully obtained.

In response to such digital exploitation, financial institutions like JPMorgan are continually enhancing their cybersecurity measures. This includes investing in advanced technologies such as artificial intelligence and machine learning to detect and prevent fraudulent activities. By analyzing transaction patterns and identifying anomalies, these technologies can alert banks to potential threats in real-time, allowing for swift action to mitigate risks. Moreover, financial institutions are also focusing on strengthening their internal protocols and conducting regular audits to ensure that their systems remain robust against emerging threats.

Furthermore, collaboration between financial institutions and regulatory bodies plays a crucial role in addressing digital exploitation. By sharing information about potential threats and vulnerabilities, banks can collectively enhance their defenses and develop industry-wide standards for cybersecurity. Regulatory bodies, in turn, provide guidance and oversight to ensure that financial institutions adhere to best practices in safeguarding their systems. This collaborative approach not only helps in preventing incidents like the “infinite money glitch” but also fosters a more secure digital banking environment for consumers.

In addition to technological and collaborative efforts, financial institutions are also emphasizing the importance of customer education. By informing customers about potential risks and encouraging them to adopt secure banking practices, banks can further protect their systems from exploitation. This includes advising customers to use strong, unique passwords, enabling two-factor authentication, and being vigilant about phishing attempts. Educated customers are less likely to fall victim to scams, thereby reducing the likelihood of unauthorized access to their accounts.

The JPMorgan case serves as a stark reminder of the vulnerabilities that exist within digital banking systems and the need for continuous vigilance. As financial institutions strive to provide seamless and convenient services to their customers, they must also prioritize the security of their platforms. By leveraging advanced technologies, fostering collaboration, and promoting customer education, banks can better protect themselves and their customers from digital exploitation. Ultimately, the ongoing battle against cyber threats requires a multifaceted approach, combining technological innovation, regulatory support, and consumer awareness to ensure the safety and integrity of the financial system.

The Ethical Dilemma of Discovering and Using System Glitches

In recent developments, JPMorgan Chase has initiated legal proceedings against several individuals accused of exploiting a system glitch, colloquially referred to as the “infinite money glitch,” to illicitly obtain thousands of dollars. This incident has sparked a broader conversation about the ethical implications of discovering and utilizing system vulnerabilities for personal gain. As technology continues to advance, the occurrence of such glitches is not entirely unexpected. However, the ethical considerations surrounding their exploitation remain complex and multifaceted.

The case against the individuals involved in the JPMorgan incident highlights the fine line between opportunistic behavior and criminal activity. On one hand, discovering a system glitch can be seen as a stroke of luck, akin to finding a loophole in a game. On the other hand, deliberately exploiting such a glitch for financial gain raises significant ethical questions. The individuals in question reportedly manipulated the bank’s systems to transfer funds into their accounts without proper authorization, an act that JPMorgan categorizes as theft.

From a legal standpoint, exploiting a system glitch for personal enrichment is often considered fraudulent behavior. Financial institutions, like JPMorgan, invest heavily in cybersecurity measures to protect their systems and customers. When individuals exploit these systems, it not only undermines the trust between the institution and its clients but also poses a threat to the financial stability of the organization. Consequently, legal actions are typically pursued to deter such behavior and to recover any financial losses incurred.

However, the ethical dilemma extends beyond legal considerations. It raises questions about the responsibility of individuals who discover such glitches. Should they report the vulnerability to the institution, potentially earning a reward or recognition for their honesty? Or is it acceptable to take advantage of the situation for personal benefit, especially if the glitch appears to be a victimless crime? These questions do not have straightforward answers, as they often depend on individual moral compasses and societal norms.

Moreover, the incident with JPMorgan underscores the importance of robust cybersecurity measures and the need for continuous monitoring and updating of financial systems. As technology evolves, so do the methods employed by those seeking to exploit vulnerabilities. Financial institutions must remain vigilant and proactive in identifying and addressing potential weaknesses in their systems. This includes fostering a culture of transparency and encouraging individuals to report discovered glitches without fear of retribution.

In addition to institutional responsibilities, there is also a role for education in addressing the ethical implications of exploiting system glitches. By incorporating discussions on digital ethics and cybersecurity into educational curricula, individuals can be better equipped to navigate the complex landscape of technology and its potential pitfalls. Understanding the broader impact of their actions on society and the economy can help individuals make more informed decisions when faced with ethical dilemmas.

In conclusion, the JPMorgan lawsuit against individuals exploiting the “infinite money glitch” serves as a poignant reminder of the ethical challenges posed by technological advancements. While the legal ramifications are clear, the ethical considerations remain nuanced and require careful deliberation. As society continues to grapple with these issues, it is imperative for both institutions and individuals to work collaboratively towards fostering a secure and ethically responsible digital environment.

Case Study: JPMorgan’s Legal Battle Against Exploiters

In a recent legal confrontation that has captured the attention of the financial world, JPMorgan Chase & Co. has initiated a lawsuit against several individuals accused of exploiting a so-called “infinite money glitch.” This glitch, a term often associated with video games, refers to a loophole in the bank’s systems that allegedly allowed these individuals to withdraw funds far exceeding their actual account balances. The case underscores the vulnerabilities that even the most robust financial institutions can face in the digital age, where technology and finance intersect in increasingly complex ways.

The lawsuit, filed in a federal court, accuses the defendants of orchestrating a scheme to defraud the bank of thousands of dollars. According to court documents, the individuals discovered a flaw in JPMorgan’s online banking system that permitted them to manipulate transaction records. By exploiting this vulnerability, they were able to make it appear as though they had sufficient funds to cover large withdrawals, when in reality, their accounts held only a fraction of the required amounts. This manipulation, the bank claims, resulted in significant financial losses.

JPMorgan’s legal team argues that the actions of these individuals constitute theft and fraud, as they knowingly took advantage of a system error for personal gain. The bank is seeking restitution for the funds lost, as well as punitive damages to deter similar conduct in the future. This case highlights the ongoing challenges financial institutions face in safeguarding their digital platforms against increasingly sophisticated forms of cybercrime.

As the case unfolds, it raises important questions about the responsibility of banks to protect their systems from exploitation and the extent to which individuals can be held accountable for exploiting such vulnerabilities. While JPMorgan is taking a firm stance against the defendants, the case also serves as a reminder of the need for continuous improvement in cybersecurity measures. Financial institutions must remain vigilant and proactive in identifying and addressing potential weaknesses in their systems to prevent similar incidents.

Moreover, this legal battle sheds light on the broader implications of digital banking and the potential risks associated with technological advancements. As banks continue to innovate and offer more convenient online services, they must also contend with the evolving tactics of cybercriminals. This dynamic environment necessitates a delicate balance between providing seamless customer experiences and ensuring robust security protocols.

In addition to the technical aspects, the case also touches on ethical considerations. The defendants, if found guilty, will have exploited a system flaw for personal enrichment, raising questions about moral responsibility in the digital age. This aspect of the case may influence public perception and contribute to the ongoing discourse on the ethical use of technology.

In conclusion, JPMorgan’s lawsuit against individuals accused of exploiting an “infinite money glitch” serves as a stark reminder of the challenges and responsibilities that come with digital banking. As the legal proceedings continue, the outcome may have significant implications for both the financial industry and the individuals involved. Ultimately, this case underscores the importance of robust cybersecurity measures and ethical considerations in navigating the complex landscape of modern finance.

The Impact of Financial Fraud on Consumer Trust

In recent developments, JPMorgan Chase has initiated legal proceedings against several individuals accused of exploiting a so-called “infinite money glitch,” resulting in the theft of thousands of dollars. This incident underscores the persistent challenges financial institutions face in safeguarding their systems against fraudulent activities. As technology continues to evolve, so too do the methods employed by those seeking to exploit vulnerabilities within financial systems. Consequently, this case serves as a stark reminder of the ongoing battle between financial institutions and cybercriminals, highlighting the broader implications for consumer trust in the banking sector.

The “infinite money glitch” refers to a loophole or vulnerability within a financial system that allows individuals to manipulate transactions to their advantage, often resulting in unauthorized access to funds. In this particular case, the individuals allegedly exploited a flaw in JPMorgan’s systems, enabling them to withdraw funds far exceeding their actual account balances. While the specifics of the glitch remain undisclosed due to ongoing investigations, the repercussions of such fraudulent activities are far-reaching, affecting not only the financial institution but also its customers.

Financial fraud, such as the one perpetrated in this instance, poses a significant threat to consumer trust. When customers entrust their money to a bank, they expect a certain level of security and reliability. However, incidents of fraud can severely undermine this trust, leading to a loss of confidence in the institution’s ability to protect their assets. This erosion of trust can have long-lasting effects, as customers may become hesitant to engage with the bank, potentially seeking alternatives that they perceive as more secure.

Moreover, the impact of financial fraud extends beyond individual customers to the broader financial ecosystem. Banks invest heavily in security measures to protect their systems and customer data. However, as fraudsters become increasingly sophisticated, financial institutions must continuously adapt and enhance their security protocols. This ongoing arms race between banks and cybercriminals not only incurs significant costs but also diverts resources that could otherwise be used to improve customer services and innovate new financial products.

In response to incidents like the one involving JPMorgan, financial institutions are compelled to reassess their security measures and implement more robust systems to detect and prevent fraudulent activities. This often involves leveraging advanced technologies such as artificial intelligence and machine learning to identify unusual patterns and behaviors indicative of fraud. While these technologies offer promising solutions, they also raise concerns about privacy and the potential for false positives, which can inadvertently affect legitimate customers.

Furthermore, regulatory bodies play a crucial role in maintaining consumer trust by enforcing stringent standards and guidelines for financial institutions. In the wake of fraud incidents, regulators may impose fines or sanctions on banks found to have inadequate security measures, thereby incentivizing them to prioritize the protection of customer assets. However, the effectiveness of these regulatory measures depends on their ability to keep pace with the rapidly evolving landscape of financial fraud.

In conclusion, the case of JPMorgan suing individuals for exploiting an “infinite money glitch” highlights the ongoing challenges faced by financial institutions in combating fraud. The implications for consumer trust are significant, as incidents of fraud can erode confidence in the banking sector. As financial institutions continue to enhance their security measures and regulatory bodies enforce stringent standards, the hope is that consumer trust can be restored and maintained. Nevertheless, the dynamic nature of financial fraud necessitates a proactive and adaptive approach to ensure the continued security and reliability of financial systems.

Lessons Learned from High-Profile Banking Fraud Cases

In recent years, the financial sector has witnessed a series of high-profile fraud cases that have not only captured public attention but also highlighted vulnerabilities within banking systems. One such case involves JPMorgan Chase, which recently filed a lawsuit against individuals accused of exploiting what has been dubbed the “infinite money glitch.” This incident serves as a stark reminder of the persistent challenges banks face in safeguarding their assets and maintaining the integrity of their operations.

The “infinite money glitch” refers to a sophisticated scheme where individuals allegedly manipulated banking systems to illicitly withdraw thousands of dollars. While the specifics of the glitch remain undisclosed due to ongoing legal proceedings, it is understood that the perpetrators exploited a loophole in the bank’s digital infrastructure. This case underscores the critical importance of robust cybersecurity measures and the need for continuous monitoring and updating of banking systems to prevent such breaches.

Transitioning from the technical aspects, it is essential to consider the broader implications of this case on the banking industry. Fraud cases like these not only result in financial losses but also erode customer trust, which is paramount for any financial institution. Banks must, therefore, prioritize transparency and communication with their clients, especially when breaches occur. By doing so, they can mitigate reputational damage and reassure customers of their commitment to security.

Moreover, this incident highlights the necessity for banks to invest in advanced technologies such as artificial intelligence and machine learning. These tools can enhance the detection of unusual patterns and potential fraud, enabling banks to respond swiftly to threats. However, technology alone is not a panacea. Human oversight remains crucial, as experienced professionals can provide insights that algorithms might overlook. Thus, a balanced approach that combines cutting-edge technology with skilled personnel is vital for effective fraud prevention.

In addition to technological and human resources, regulatory frameworks play a pivotal role in shaping banks’ responses to fraud. The JPMorgan case serves as a reminder for regulators to continually assess and update policies to address emerging threats. By fostering a collaborative environment between financial institutions and regulatory bodies, the industry can develop more comprehensive strategies to combat fraud.

Furthermore, this case offers valuable lessons for individuals and businesses alike. It underscores the importance of vigilance and the need to be aware of potential scams and fraudulent activities. Customers should regularly monitor their accounts and report any suspicious transactions immediately. Financial literacy programs can also empower individuals with the knowledge to protect themselves from fraud, thereby contributing to a more secure banking environment.

In conclusion, the JPMorgan lawsuit against individuals exploiting the “infinite money glitch” is a significant event that sheds light on the ongoing battle against banking fraud. It emphasizes the need for robust cybersecurity measures, the integration of advanced technologies, and the importance of regulatory oversight. As the financial landscape continues to evolve, banks must remain vigilant and proactive in their efforts to safeguard their operations and maintain customer trust. By learning from such high-profile cases, the industry can strengthen its defenses and work towards a more secure and resilient future.

Q&A

1. **What is the ‘Infinite Money Glitch’?**

The ‘Infinite Money Glitch’ refers to a loophole or exploit in a financial system that allows individuals to withdraw or transfer more money than they actually have, often due to a technical error or oversight.

2. **Who is being sued by JPMorgan?**

JPMorgan is suing individuals who allegedly exploited this glitch to illegally obtain thousands of dollars from the bank.

3. **How did the individuals exploit the glitch?**

The individuals reportedly manipulated the bank’s systems to withdraw or transfer funds beyond their actual account balances, taking advantage of the glitch.

4. **What are the legal grounds for JPMorgan’s lawsuit?**

JPMorgan is likely suing on grounds of theft, fraud, and breach of contract, as the individuals unlawfully took funds from the bank.

5. **What is the potential impact on the individuals involved?**

The individuals could face significant legal consequences, including fines, restitution, and possibly criminal charges, depending on the severity of the exploitation.

6. **How is JPMorgan addressing the glitch?**

JPMorgan is likely working to identify and fix the technical vulnerabilities that allowed the glitch, as well as implementing stricter security measures to prevent future occurrences.

7. **What are the broader implications for the banking industry?**

This incident highlights the importance of robust cybersecurity and system integrity in the banking industry, prompting other financial institutions to review and strengthen their own systems to prevent similar exploits.

Conclusion

JPMorgan’s lawsuit against individuals exploiting the ‘infinite money glitch’ underscores the critical importance of robust security measures and ethical conduct in financial transactions. The case highlights vulnerabilities in digital banking systems that can be manipulated for unauthorized gain, posing significant risks to financial institutions and their clients. By pursuing legal action, JPMorgan aims to deter similar fraudulent activities and reinforce the integrity of its operations. This situation serves as a reminder for banks to continuously enhance their cybersecurity protocols and for individuals to adhere to legal and ethical standards in financial dealings.