“Market Waves: Dollar Rides High with GOP, Dips with Harris Triumph”

Introduction

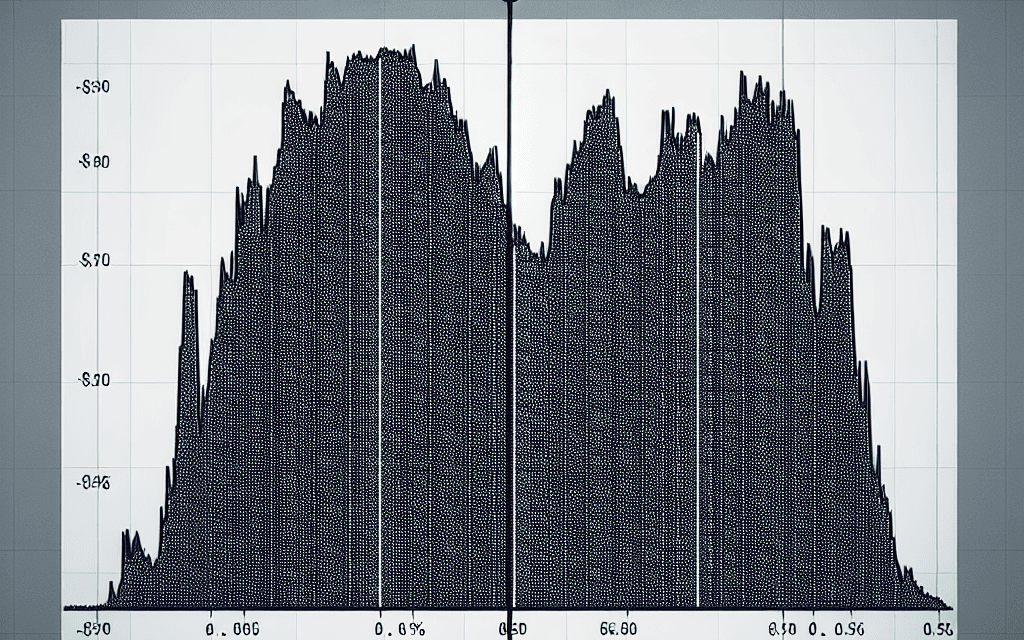

JPMorgan analysts have projected significant movements in the U.S. dollar contingent upon the outcomes of upcoming political events. According to their forecasts, a Republican victory in the elections could lead to a surge in the dollar’s value, driven by anticipated policy shifts favoring business and economic growth. Conversely, a win by Vice President Kamala Harris is expected to result in a decline in the dollar, as markets may react to potential policy changes emphasizing regulatory measures and social spending. These predictions underscore the profound impact political dynamics can have on financial markets, highlighting the dollar’s sensitivity to shifts in the U.S. political landscape.

Impact Of GOP Win On The U.S. Dollar: JPMorgan’s Predictions

JPMorgan Chase, one of the leading financial institutions globally, has recently released a report that delves into the potential impact of the upcoming U.S. elections on the value of the U.S. dollar. The report suggests that a victory for the Republican Party, often referred to as the GOP, could lead to a significant surge in the dollar’s value. Conversely, a win for Vice President Kamala Harris, should she decide to run and secure the presidency, might result in a decline in the dollar’s strength. This analysis is rooted in the economic policies traditionally associated with each political party and their anticipated effects on the financial markets.

Historically, Republican administrations have been perceived as more business-friendly, often advocating for tax cuts, deregulation, and policies that stimulate economic growth. These measures can lead to increased investor confidence, thereby boosting the demand for the U.S. dollar. JPMorgan’s analysis suggests that a GOP victory could reinforce this trend, as investors might anticipate a continuation or intensification of such policies. The expectation of a robust economic environment under Republican leadership could attract foreign investment, further strengthening the dollar.

In contrast, a potential victory for Kamala Harris, representing the Democratic Party, might signal a shift towards policies that prioritize social welfare, environmental concerns, and regulatory oversight. While these policies aim to address long-standing societal issues, they may also lead to increased government spending and higher taxes on corporations and the wealthy. Such fiscal strategies could raise concerns among investors about the potential for inflation and increased national debt, which might weaken the dollar. JPMorgan’s report highlights that these economic uncertainties could lead to a decline in the dollar’s value as investors seek more stable or higher-yielding alternatives.

Moreover, the report underscores the importance of geopolitical factors in influencing currency markets. A GOP win might be perceived as a continuation of a more assertive foreign policy stance, which could impact global trade dynamics and, consequently, the dollar’s position in international markets. On the other hand, a Harris administration might focus on rebuilding alliances and fostering multilateral cooperation, which could have mixed effects on the dollar depending on the global economic climate at the time.

It is crucial to note that while JPMorgan’s predictions provide valuable insights, currency markets are inherently volatile and influenced by a myriad of factors beyond domestic politics. Economic indicators such as interest rates, inflation, and employment figures, as well as unforeseen global events, can all play significant roles in determining the dollar’s trajectory. Therefore, while the potential outcomes of the U.S. elections are important considerations, they represent just one piece of a complex puzzle.

In conclusion, JPMorgan’s analysis offers a thought-provoking perspective on how the upcoming U.S. elections could impact the U.S. dollar. A GOP victory might lead to a surge in the dollar’s value due to anticipated pro-business policies, while a Harris win could result in a decline due to potential economic uncertainties. However, investors and policymakers alike must remain vigilant and consider a wide range of factors when assessing the future of the dollar in an ever-evolving global economic landscape.

How A Harris Victory Could Weaken The Dollar: Insights From JPMorgan

In the intricate world of global finance, currency fluctuations are often influenced by a myriad of factors, ranging from economic indicators to geopolitical events. Recently, JPMorgan Chase, a leading financial institution, has provided insights into how the upcoming U.S. elections could impact the strength of the U.S. dollar. According to their analysis, a victory for the Republican Party, often referred to as the GOP, could lead to a surge in the dollar’s value. Conversely, a win for Vice President Kamala Harris, should she decide to run and secure the presidency, might result in a decline of the dollar. This prediction is rooted in the anticipated economic policies and market perceptions associated with each potential administration.

To understand these projections, it is essential to consider the economic philosophies typically associated with the two political parties. Historically, Republican administrations have been perceived as more business-friendly, often advocating for tax cuts, deregulation, and policies that are believed to stimulate economic growth. Such measures can lead to increased investor confidence, potentially resulting in a stronger dollar as capital flows into the U.S. markets. Moreover, a GOP victory might signal continuity in certain economic policies that prioritize fiscal conservatism, which could further bolster the dollar’s appeal on the global stage.

On the other hand, a Harris victory could introduce a different set of economic priorities. The Democratic Party, with which Harris is affiliated, often emphasizes social welfare programs, environmental initiatives, and regulatory measures aimed at addressing income inequality and climate change. While these policies are designed to promote long-term sustainable growth and social equity, they may initially be perceived by investors as less conducive to rapid economic expansion. This perception could lead to a decrease in investor confidence, thereby weakening the dollar as capital might seek more immediate returns elsewhere.

Furthermore, the potential for increased government spending under a Harris administration could raise concerns about inflation and national debt levels. Such concerns might prompt investors to reassess the attractiveness of holding dollar-denominated assets, especially if interest rates remain low. In this context, the dollar could face downward pressure as market participants anticipate a shift in fiscal policy that might not align with their expectations for economic growth.

It is also important to consider the broader geopolitical landscape and how it might influence currency markets. A Harris administration could prioritize multilateralism and international cooperation, potentially leading to changes in trade policies and foreign relations. While these shifts could foster global stability, they might also introduce uncertainties that could affect the dollar’s strength. In contrast, a GOP-led government might focus on unilateral trade agreements and assertive foreign policies, which could have different implications for the dollar’s trajectory.

In conclusion, JPMorgan’s predictions regarding the U.S. dollar’s future underscore the complex interplay between political outcomes and economic perceptions. While a GOP victory might be seen as a catalyst for a stronger dollar due to anticipated pro-business policies, a Harris win could lead to a more cautious outlook among investors, potentially resulting in a weaker dollar. As the election approaches, market participants will undoubtedly keep a close eye on the evolving political landscape, ready to adjust their strategies in response to the anticipated economic policies of the next administration.

The Role Of Political Outcomes In Currency Fluctuations: A JPMorgan Analysis

In the intricate world of global finance, currency fluctuations are often influenced by a myriad of factors, with political outcomes playing a pivotal role. JPMorgan, a leading financial institution, has recently provided an analysis that underscores the potential impact of upcoming political events on the U.S. dollar. According to their projections, a Republican victory in the forthcoming elections could lead to a significant surge in the dollar’s value, whereas a win by Vice President Kamala Harris might result in a decline. This analysis highlights the complex interplay between political dynamics and currency markets, offering insights into how investors might navigate these turbulent waters.

To understand the rationale behind JPMorgan’s predictions, it is essential to consider the broader economic policies typically associated with each political party. Historically, Republican administrations have been perceived as more business-friendly, often advocating for tax cuts, deregulation, and policies that stimulate economic growth. Such measures can bolster investor confidence, leading to increased capital inflows and a stronger dollar. In contrast, Democratic administrations, including the current one, have focused on social spending, regulatory oversight, and addressing income inequality. While these policies aim to create a more equitable society, they may also lead to concerns about fiscal deficits and inflation, potentially exerting downward pressure on the dollar.

Moreover, the global economic landscape plays a crucial role in shaping currency movements. A Republican victory could signal a continuation or intensification of policies that prioritize domestic energy production and trade negotiations favoring U.S. interests. This might enhance the dollar’s appeal as a safe-haven currency, especially in times of geopolitical uncertainty. Conversely, a Harris victory could be interpreted as a continuation of the current administration’s approach, which includes a focus on multilateralism and climate change initiatives. While these policies are vital for long-term global stability, they may not immediately translate into a stronger dollar.

In addition to domestic policies, international relations are another critical factor influencing currency valuations. A Republican administration might adopt a more assertive stance in foreign policy, potentially leading to heightened geopolitical tensions. Such scenarios often result in a flight to safety, with investors flocking to the dollar. On the other hand, a Harris-led administration might emphasize diplomacy and collaboration, fostering a more stable international environment. While this approach is beneficial for global harmony, it may not provide the immediate impetus for a dollar rally.

Furthermore, market sentiment and investor expectations are integral to understanding currency fluctuations. Financial markets are inherently forward-looking, and any anticipated changes in fiscal or monetary policy can lead to preemptive adjustments in currency valuations. A Republican win might be perceived as a harbinger of pro-growth policies, prompting investors to increase their dollar holdings. In contrast, a Harris victory could lead to expectations of continued fiscal spending and accommodative monetary policy, potentially weakening the dollar.

In conclusion, JPMorgan’s analysis of the potential impact of political outcomes on the U.S. dollar underscores the intricate relationship between politics and currency markets. While a Republican victory is projected to boost the dollar, a Harris win might lead to its decline. Investors must remain vigilant, considering not only domestic policies but also international relations and market sentiment. As political landscapes evolve, so too will the factors influencing currency valuations, making it imperative for stakeholders to stay informed and adaptable in their strategies.

GOP Victory And Its Economic Implications: Dollar Surge Explained

In the complex world of global finance, the interplay between political outcomes and economic indicators often presents a fascinating dynamic. Recently, JPMorgan, a leading financial institution, has projected significant movements in the U.S. dollar contingent upon the results of the upcoming presidential election. According to their analysis, a victory for the Republican Party, often referred to as the GOP, could lead to a surge in the dollar’s value. Conversely, a win for Vice President Kamala Harris, should she decide to run and secure the presidency, might result in a decline of the dollar. This prediction is rooted in the anticipated economic policies and market reactions associated with each potential administration.

To understand why a GOP victory might bolster the dollar, it is essential to consider the party’s traditional economic stance. Historically, Republican administrations have favored policies that are perceived as business-friendly, such as tax cuts, deregulation, and a focus on reducing government spending. These measures are often welcomed by investors, as they can lead to increased corporate profitability and economic growth. Consequently, such policies can enhance investor confidence, attracting foreign capital and driving up demand for the dollar. Moreover, the expectation of a robust economic environment under a GOP leadership could lead to higher interest rates, further strengthening the dollar as investors seek higher returns.

In contrast, a potential Harris presidency might be associated with different economic priorities. As a member of the Democratic Party, Harris is likely to advocate for policies that emphasize social welfare, climate change initiatives, and increased government spending on infrastructure and healthcare. While these policies aim to address long-standing social issues and promote sustainable growth, they may also lead to concerns about fiscal deficits and inflation. Such concerns could dampen investor enthusiasm, potentially resulting in a weaker dollar. Additionally, the prospect of increased regulation under a Democratic administration might be viewed unfavorably by certain sectors, further influencing market sentiment and currency valuation.

It is important to note that these predictions are not certainties but rather informed speculations based on historical trends and current economic conditions. The global financial landscape is influenced by a myriad of factors, including geopolitical events, trade relations, and central bank policies, all of which can impact currency values. Therefore, while political outcomes can provide a framework for expectations, they are just one piece of a larger puzzle.

Furthermore, the potential impact of either administration on the dollar will also depend on their ability to implement their proposed policies effectively. Political gridlock, unforeseen economic challenges, or shifts in public opinion could alter the anticipated trajectory of the dollar. As such, investors and policymakers alike must remain vigilant and adaptable in the face of evolving circumstances.

In conclusion, JPMorgan’s prediction of a dollar surge with a GOP win and a decline with a Harris victory underscores the intricate relationship between politics and economics. While the outcome of the election will undoubtedly influence market dynamics, it is crucial to approach these forecasts with a nuanced understanding of the broader economic context. As the election unfolds, stakeholders will be closely monitoring developments, ready to adjust their strategies in response to the ever-changing financial landscape.

Kamala Harris And The Dollar: JPMorgan’s Forecast On Potential Decline

In the ever-evolving landscape of global finance, the value of the U.S. dollar remains a pivotal concern for investors, policymakers, and economists alike. Recently, JPMorgan Chase, one of the world’s leading financial institutions, has released a forecast that has captured the attention of market watchers. The bank predicts a significant surge in the dollar’s value should the Republican Party secure a victory in the upcoming elections. Conversely, a win for Vice President Kamala Harris is anticipated to lead to a decline in the dollar’s strength. This projection is rooted in the complex interplay of political, economic, and fiscal policies that are expected to unfold under different administrations.

To understand the rationale behind JPMorgan’s forecast, it is essential to consider the broader economic policies typically associated with the Republican Party. Historically, Republican administrations have been perceived as more business-friendly, often advocating for tax cuts, deregulation, and fiscal conservatism. These policies are generally viewed as conducive to economic growth, potentially leading to increased investor confidence and a stronger dollar. A GOP victory could signal a continuation or intensification of such policies, thereby bolstering the dollar’s appeal on the global stage.

In contrast, a victory for Kamala Harris, representing the Democratic Party, is expected to bring about a different set of economic priorities. The Democratic platform often emphasizes increased government spending on social programs, infrastructure, and climate initiatives, which may necessitate higher taxes and increased borrowing. While these policies aim to address long-standing social and economic inequalities, they could also lead to concerns about fiscal sustainability and inflationary pressures. Such concerns might weigh on the dollar, as investors could perceive a potential erosion of the currency’s value in the face of rising national debt and expansive fiscal policies.

Moreover, the international dimension of U.S. economic policy cannot be overlooked. A Republican administration might adopt a more aggressive stance on trade and foreign policy, potentially leading to geopolitical tensions that could impact global markets. On the other hand, a Harris-led administration might prioritize multilateralism and diplomatic engagement, which could foster a more stable international environment but might also involve compromises that affect the dollar’s standing.

It is also important to consider the role of the Federal Reserve in this equation. The central bank’s monetary policy decisions, particularly regarding interest rates, are crucial determinants of the dollar’s value. A Republican administration might exert pressure on the Fed to maintain or even tighten monetary policy to curb inflation, thereby supporting the dollar. Conversely, a Democratic administration might favor a more accommodative monetary stance to support economic recovery, which could exert downward pressure on the currency.

In conclusion, JPMorgan’s forecast underscores the intricate relationship between political outcomes and currency markets. While the bank’s predictions are based on historical trends and current policy expectations, it is crucial to acknowledge the inherent uncertainties in such forecasts. The global economic landscape is influenced by a myriad of factors, including unforeseen geopolitical events, technological advancements, and shifts in consumer behavior. As such, while a GOP victory might indeed lead to a dollar surge and a Harris win could result in a decline, the actual outcomes will depend on a complex interplay of domestic and international dynamics. Investors and policymakers alike must remain vigilant and adaptable as they navigate the uncertainties of the future.

Understanding JPMorgan’s Currency Predictions In The Context Of U.S. Politics

In the intricate world of global finance, currency predictions often serve as a barometer for economic and political sentiment. Recently, JPMorgan Chase, a leading financial institution, has made headlines with its bold predictions regarding the U.S. dollar’s trajectory in the context of upcoming political events. According to the bank’s analysts, the dollar is poised for a significant surge should the Republican Party secure a victory in the next election cycle. Conversely, a win for Vice President Kamala Harris, should she decide to run and succeed, could lead to a decline in the dollar’s value. These predictions are not merely speculative; they are grounded in a complex interplay of economic policies, market perceptions, and historical trends.

To understand JPMorgan’s forecasts, it is essential to consider the broader economic policies typically associated with the Republican Party. Historically, Republican administrations have been perceived as more business-friendly, often advocating for tax cuts, deregulation, and fiscal conservatism. These policies are generally viewed favorably by investors, as they can lead to increased corporate profitability and economic growth. Consequently, a Republican victory could bolster investor confidence, leading to increased demand for the dollar as capital flows into the U.S. markets. This anticipated surge in the dollar’s value reflects the market’s expectation of a robust economic environment under Republican leadership.

On the other hand, a potential victory for Kamala Harris, representing the Democratic Party, might signal a different economic approach. The Democratic platform often emphasizes social welfare programs, increased government spending, and regulatory measures aimed at addressing income inequality and climate change. While these policies can lead to long-term economic benefits, they may also result in short-term fiscal challenges, such as increased national debt and inflationary pressures. Investors might perceive these factors as potential risks, leading to a decrease in demand for the dollar. Thus, JPMorgan’s prediction of a dollar decline under Harris’s leadership is rooted in the market’s cautious outlook on the fiscal implications of Democratic policies.

Moreover, it is crucial to recognize the role of geopolitical factors in shaping currency dynamics. A Republican administration might adopt a more aggressive stance on international trade and foreign policy, potentially leading to heightened geopolitical tensions. While such an approach could initially strengthen the dollar due to its safe-haven status, prolonged uncertainty might eventually weigh on its value. Conversely, a Democratic administration might prioritize diplomatic engagement and multilateral cooperation, which could foster global economic stability but might also lead to a more competitive currency environment.

In addition to these political considerations, it is important to acknowledge the influence of the Federal Reserve’s monetary policy on the dollar’s performance. Regardless of the election outcome, the Fed’s decisions on interest rates and quantitative easing will play a pivotal role in determining the dollar’s strength. A Republican victory might prompt the Fed to adopt a more hawkish stance, while a Democratic win could lead to a more accommodative monetary policy. These potential shifts in monetary policy further underscore the complexity of JPMorgan’s currency predictions.

In conclusion, JPMorgan’s forecasts regarding the dollar’s future in the context of U.S. politics highlight the intricate relationship between political outcomes and economic expectations. By analyzing the potential impacts of Republican and Democratic victories, the bank provides valuable insights into how political developments can shape currency markets. As investors and policymakers navigate this uncertain landscape, understanding these dynamics will be crucial in making informed decisions that align with their financial objectives.

The Intersection Of Politics And Currency: JPMorgan’s Take On The Dollar’s Future

In the intricate world of global finance, the interplay between politics and currency often dictates market movements and investor strategies. Recently, JPMorgan Chase, a leading financial institution, has provided insights into how upcoming political events in the United States might influence the trajectory of the U.S. dollar. According to their analysis, the outcome of the next presidential election could significantly impact the dollar’s strength, with a potential surge if the Republican Party secures a victory and a decline if Vice President Kamala Harris wins the presidency.

To understand this prediction, it is essential to consider the broader context of how political outcomes can affect economic policies and, consequently, currency valuations. Historically, Republican administrations have been associated with policies that favor deregulation, tax cuts, and a focus on boosting domestic industries. Such measures are often perceived as conducive to economic growth, which can enhance investor confidence and attract foreign capital. This influx of capital typically strengthens the dollar, as demand for the currency increases to facilitate investments in the U.S. market.

Conversely, a Democratic victory, particularly one led by Kamala Harris, might signal a continuation or expansion of policies that prioritize social spending, regulatory oversight, and environmental initiatives. While these policies aim to address long-term societal challenges, they may also lead to increased government spending and potential tax hikes. Such fiscal strategies could raise concerns about inflation and national debt, potentially weakening the dollar as investors seek more stable or higher-yielding alternatives.

Moreover, the global perception of U.S. political stability and policy direction plays a crucial role in currency valuation. A Republican win might be viewed as a return to more traditional economic policies, which could reassure international markets. On the other hand, a Harris presidency might introduce uncertainties regarding regulatory changes and international trade relations, factors that could contribute to a less favorable outlook for the dollar.

It is also important to consider the Federal Reserve’s role in this dynamic. The central bank’s monetary policy decisions, influenced by the prevailing economic environment and political landscape, are critical in shaping currency strength. A Republican administration might pressure the Fed to maintain lower interest rates to stimulate growth, potentially supporting a stronger dollar. In contrast, a Democratic administration might focus on addressing inflationary pressures, which could lead to higher interest rates and a more complex impact on the dollar’s value.

While JPMorgan’s predictions offer a compelling narrative, it is crucial to acknowledge the inherent uncertainties in forecasting currency movements. Political landscapes are fluid, and unforeseen events can rapidly alter economic conditions and investor sentiment. Additionally, global factors such as geopolitical tensions, trade dynamics, and economic performance in other major economies can significantly influence the dollar’s trajectory, regardless of domestic political outcomes.

In conclusion, JPMorgan’s analysis underscores the intricate relationship between politics and currency markets. As the U.S. approaches its next presidential election, investors and policymakers alike will closely monitor the evolving political landscape and its potential implications for the dollar. While predictions provide valuable insights, they also serve as a reminder of the complexities and uncertainties inherent in the global financial system. As such, stakeholders must remain vigilant and adaptable, ready to respond to the myriad factors that will ultimately shape the future of the U.S. dollar.

Q&A

1. **What is JPMorgan’s prediction regarding the U.S. dollar if the GOP wins?**

JPMorgan predicts that the U.S. dollar will surge if the GOP wins.

2. **What is the expected impact on the U.S. dollar if Kamala Harris wins?**

The U.S. dollar is expected to decline if Kamala Harris wins.

3. **Why does JPMorgan believe a GOP win would strengthen the dollar?**

A GOP win is often associated with policies that favor business and economic growth, which can boost investor confidence and strengthen the dollar.

4. **What are the potential reasons for a dollar decline with a Harris victory?**

A Harris victory might be associated with increased government spending and regulatory changes, which could lead to concerns about fiscal policy and weaken the dollar.

5. **How does political uncertainty affect currency markets according to JPMorgan?**

Political uncertainty can lead to volatility in currency markets as investors react to potential changes in economic policy and geopolitical dynamics.

6. **What role do fiscal policies play in JPMorgan’s currency predictions?**

Fiscal policies, such as government spending and taxation, play a significant role in shaping economic outlooks and investor confidence, influencing currency strength.

7. **How might global investors react to these political outcomes in terms of currency trading?**

Global investors might adjust their portfolios based on anticipated policy changes, leading to increased buying or selling of the dollar depending on the election outcome.

Conclusion

JPMorgan’s analysis suggests that a Republican victory in the upcoming elections could lead to a surge in the U.S. dollar, driven by expectations of pro-business policies, tax cuts, and deregulation that typically accompany GOP leadership. Conversely, a victory by Kamala Harris, or a Democratic win, might result in a decline of the dollar due to anticipated increases in government spending, higher taxes, and regulatory measures that could impact economic growth. These predictions reflect the market’s perception of the differing economic policies between the two parties and their potential impact on the U.S. economy and currency strength.