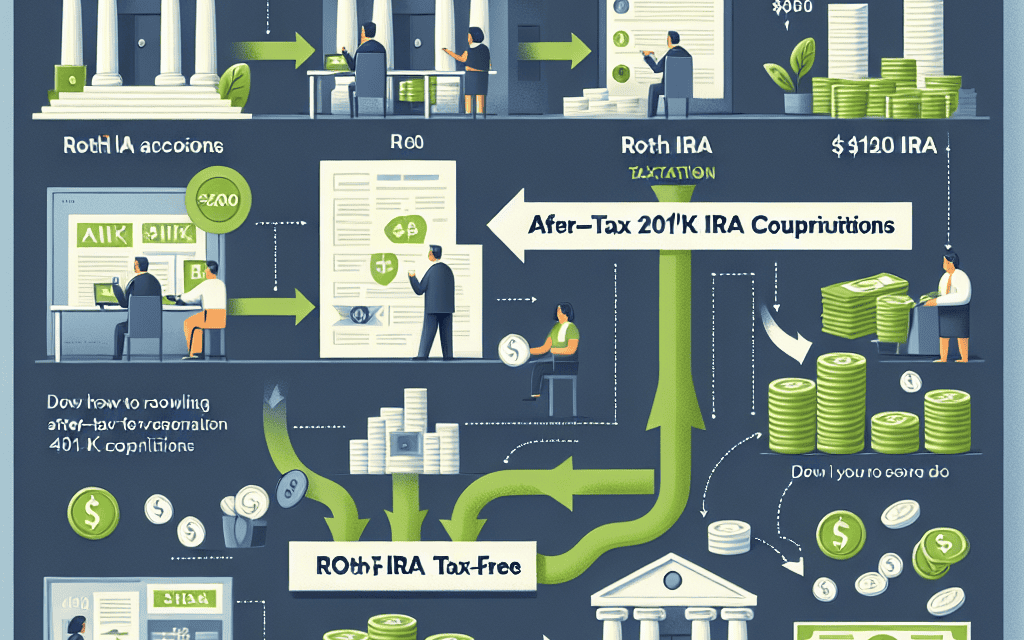

“Unlock Tax-Free Growth: Seamlessly Roll Over $120k from After-Tax 401(k) to Roth IRA!”

Introduction

Rolling over after-tax 401(k) contributions to a Roth IRA can be a strategic move for individuals looking to maximize their retirement savings and take advantage of tax-free growth. If you have accumulated $120,000 in after-tax contributions within your 401(k), you have the opportunity to convert these funds into a Roth IRA without incurring additional taxes, provided certain conditions are met. This process involves understanding the specific rules and regulations governing rollovers, ensuring compliance with IRS guidelines, and executing the rollover correctly to avoid any tax liabilities. By doing so, you can benefit from the Roth IRA’s tax-free withdrawals in retirement, offering a significant advantage in managing your long-term financial planning.

Understanding After-Tax 401(k) Contributions

Understanding the nuances of retirement savings can be a daunting task, especially when it comes to maximizing the benefits of after-tax 401(k) contributions. For individuals who have accumulated $120,000 in after-tax contributions within their 401(k) plans, the prospect of rolling these funds into a Roth IRA tax-free presents a compelling opportunity. This strategy not only allows for tax-free growth but also provides tax-free withdrawals in retirement, making it an attractive option for those looking to optimize their retirement savings.

To begin with, it is essential to differentiate between pre-tax and after-tax contributions within a 401(k) plan. Pre-tax contributions are deducted from your salary before taxes, reducing your taxable income for the year. In contrast, after-tax contributions are made with income that has already been taxed. While pre-tax contributions lower your immediate tax burden, after-tax contributions offer the potential for tax-free growth if rolled over into a Roth IRA. This distinction is crucial as it forms the basis for understanding how to execute a tax-free rollover.

The process of rolling over after-tax 401(k) contributions to a Roth IRA involves several steps, each requiring careful consideration. Initially, it is important to confirm with your plan administrator that your 401(k) plan allows for in-service rollovers. Not all plans offer this feature, so verifying this option is a critical first step. Once confirmed, you can proceed with the rollover process, ensuring that you adhere to the specific guidelines set forth by the IRS to maintain the tax-free status of the transaction.

One of the key aspects of this rollover is the separation of after-tax contributions from any earnings they may have generated. The IRS mandates that only the after-tax contributions themselves can be rolled over to a Roth IRA tax-free. Any earnings on these contributions are subject to taxation if rolled over into a Roth IRA. Therefore, it is advisable to roll over the earnings into a traditional IRA to avoid immediate taxation. This strategic separation ensures that the after-tax contributions can grow tax-free within the Roth IRA, while the earnings continue to grow tax-deferred in a traditional IRA.

Moreover, timing plays a significant role in executing this rollover effectively. It is beneficial to perform the rollover when the market is stable or experiencing growth, as this can maximize the potential for tax-free growth within the Roth IRA. Additionally, consulting with a financial advisor or tax professional can provide personalized guidance tailored to your financial situation, ensuring that you navigate the complexities of the rollover process with confidence.

In conclusion, rolling over $120,000 in after-tax 401(k) contributions to a Roth IRA tax-free is a strategic move that can significantly enhance your retirement savings. By understanding the distinctions between pre-tax and after-tax contributions, confirming plan allowances, and carefully separating contributions from earnings, you can successfully execute this rollover. This approach not only leverages the benefits of tax-free growth but also positions you for a more financially secure retirement. As with any financial decision, thorough research and professional advice are invaluable in making informed choices that align with your long-term financial goals.

Benefits of Rolling Over to a Roth IRA

Rolling over after-tax 401(k) contributions to a Roth IRA can be a strategic financial move, offering several benefits that align with long-term wealth-building goals. Understanding the advantages of this process is crucial for individuals seeking to maximize their retirement savings while minimizing tax liabilities. By carefully navigating the rollover process, one can enjoy the tax-free growth potential of a Roth IRA, which stands out as a compelling option for those with significant after-tax contributions in their 401(k) plans.

One of the primary benefits of rolling over after-tax 401(k) contributions to a Roth IRA is the opportunity for tax-free growth. Unlike traditional IRAs, where withdrawals are taxed as ordinary income, Roth IRAs allow for tax-free withdrawals of both contributions and earnings, provided certain conditions are met. This feature can be particularly advantageous for individuals who anticipate being in a higher tax bracket during retirement or who wish to minimize their taxable income in their later years. By transferring after-tax contributions to a Roth IRA, individuals can effectively shield their investment gains from future taxation, thereby enhancing their overall retirement portfolio.

Moreover, a Roth IRA offers greater flexibility in terms of withdrawal rules compared to other retirement accounts. For instance, Roth IRAs do not have required minimum distributions (RMDs) during the account holder’s lifetime, allowing the funds to grow undisturbed for a longer period. This can be especially beneficial for those who do not need to tap into their retirement savings immediately upon reaching retirement age. The absence of RMDs provides the account holder with the autonomy to decide when and how much to withdraw, based on personal financial needs and market conditions. This flexibility can be a significant advantage in managing retirement income and estate planning.

In addition to tax-free growth and flexible withdrawal options, rolling over to a Roth IRA can also simplify the management of retirement accounts. Many individuals accumulate multiple retirement accounts over their careers, which can become cumbersome to manage. Consolidating after-tax 401(k) contributions into a Roth IRA can streamline account management, making it easier to track investments and plan for future financial needs. This consolidation can also reduce administrative fees associated with maintaining multiple accounts, thereby preserving more of the individual’s retirement savings.

Furthermore, the process of rolling over after-tax 401(k) contributions to a Roth IRA can be executed without incurring immediate tax liabilities, provided it is done correctly. It is essential to ensure that only after-tax contributions are rolled over to avoid triggering taxable events. Consulting with a financial advisor or tax professional can help navigate the complexities of the rollover process, ensuring compliance with IRS regulations and optimizing the tax benefits.

In conclusion, rolling over $120k in after-tax 401(k) contributions to a Roth IRA offers numerous benefits that can significantly enhance one’s retirement strategy. The potential for tax-free growth, coupled with the flexibility and simplicity of managing a Roth IRA, makes this option an attractive choice for individuals looking to maximize their retirement savings. By understanding the advantages and carefully executing the rollover process, individuals can position themselves for a more secure and financially rewarding retirement.

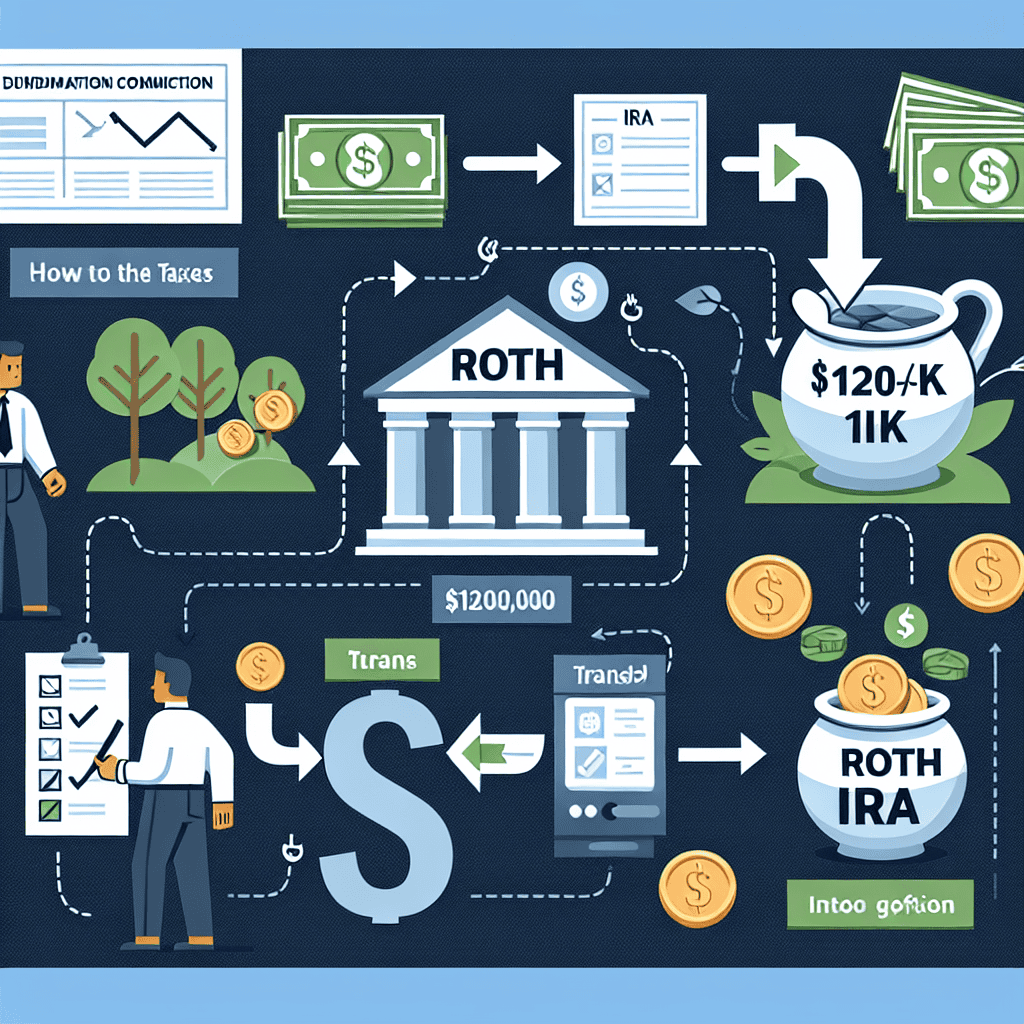

Step-by-Step Guide to a Tax-Free Rollover

Rolling over after-tax 401(k) contributions to a Roth IRA can be a strategic move for individuals seeking to maximize their retirement savings while minimizing tax liabilities. This process, when executed correctly, allows for the conversion of after-tax contributions into a Roth IRA, where future earnings can grow tax-free. To achieve this, it is essential to follow a series of steps meticulously, ensuring compliance with IRS regulations and avoiding unnecessary tax implications.

The first step in this process is to confirm the eligibility of your 401(k) plan for such a rollover. Not all employer-sponsored plans permit rollovers of after-tax contributions, so it is crucial to review your plan’s specific rules or consult with your plan administrator. Once you have verified that your plan allows for this type of rollover, the next step is to determine the amount of after-tax contributions available for transfer. This figure is typically found on your 401(k) statement, which details the breakdown of pre-tax, after-tax, and employer contributions.

After confirming the eligibility and amount, the next phase involves initiating the rollover process. Contact your 401(k) plan administrator to request a direct rollover of your after-tax contributions to a Roth IRA. It is important to specify that you want a direct rollover to avoid any potential tax withholding that might occur with an indirect rollover. During this process, you will need to provide the details of your Roth IRA account, including the account number and the financial institution where it is held.

Once the rollover is initiated, it is crucial to monitor the transfer closely. Ensure that the funds are deposited directly into your Roth IRA account without any detours into a personal account, as this could trigger tax consequences. The direct rollover method is designed to prevent any tax withholding, thereby preserving the full amount of your after-tax contributions for the Roth IRA.

Upon successful completion of the rollover, it is advisable to keep detailed records of the transaction. This includes documentation from your 401(k) plan administrator confirming the rollover, as well as statements from your Roth IRA provider showing the receipt of funds. These records will be invaluable for tax reporting purposes and in the event of an IRS audit.

In addition to the procedural steps, it is important to consider the timing of the rollover. Conducting this transaction at the end of the year can simplify tax reporting, as it consolidates the activity into a single tax year. However, it is essential to ensure that the rollover is completed within 60 days to avoid any penalties or taxes.

Finally, while the process of rolling over after-tax 401(k) contributions to a Roth IRA can be complex, seeking the guidance of a financial advisor or tax professional can provide additional assurance. These experts can offer personalized advice tailored to your financial situation, helping you navigate any potential pitfalls and optimize your retirement strategy.

In conclusion, rolling over $120k in after-tax 401(k) contributions to a Roth IRA tax-free requires careful planning and execution. By following the outlined steps and maintaining diligent records, individuals can successfully enhance their retirement savings while enjoying the benefits of tax-free growth in a Roth IRA.

Key IRS Rules and Regulations

Rolling over after-tax 401(k) contributions to a Roth IRA can be a strategic move for individuals seeking to maximize their retirement savings while minimizing tax liabilities. Understanding the key IRS rules and regulations governing this process is essential to ensure a tax-free rollover. The IRS allows individuals to roll over after-tax contributions from a 401(k) plan to a Roth IRA, but it is crucial to follow specific guidelines to avoid unintended tax consequences.

To begin with, it is important to distinguish between pre-tax and after-tax contributions within a 401(k) plan. Pre-tax contributions are made before taxes are deducted, meaning taxes are deferred until withdrawal. In contrast, after-tax contributions are made with income that has already been taxed, allowing for the potential of tax-free growth if rolled over correctly. The IRS permits the rollover of after-tax contributions to a Roth IRA, where the funds can continue to grow tax-free, provided certain conditions are met.

One of the primary conditions is that the rollover must be a direct transfer from the 401(k) plan to the Roth IRA. This means that the funds should not be distributed to the account holder before being deposited into the Roth IRA. A direct rollover ensures that the transaction is seamless and avoids any immediate tax liabilities. It is advisable to work closely with the plan administrator to facilitate this process, ensuring that the transfer is executed correctly.

Moreover, it is essential to consider the pro-rata rule when rolling over after-tax contributions. The pro-rata rule requires that any distribution from a 401(k) plan that includes both pre-tax and after-tax contributions must be proportionally divided between the two. This means that if an individual has both pre-tax and after-tax funds in their 401(k), they cannot selectively roll over only the after-tax portion to a Roth IRA. Instead, the rollover must include a proportional amount of pre-tax funds, which would be subject to taxation upon conversion to a Roth IRA.

To navigate this complexity, individuals may consider rolling over the pre-tax portion of their 401(k) to a traditional IRA first. This separation allows for a subsequent rollover of the after-tax contributions to a Roth IRA, thereby avoiding the pro-rata rule’s implications. By isolating the after-tax contributions, individuals can ensure that only these funds are transferred to the Roth IRA, maintaining their tax-free status.

Additionally, it is important to be aware of the five-year rule associated with Roth IRAs. This rule stipulates that for earnings on contributions to be tax-free, the Roth IRA must have been established for at least five years. Therefore, individuals planning to roll over after-tax 401(k) contributions should consider the timing of their rollover in relation to their retirement plans, ensuring that they meet the five-year requirement before accessing the funds.

In conclusion, rolling over $120k in after-tax 401(k) contributions to a Roth IRA can be a beneficial strategy for maximizing tax-free growth. However, it is imperative to adhere to IRS rules and regulations to avoid unintended tax consequences. By ensuring a direct rollover, understanding the pro-rata rule, and considering the five-year rule, individuals can effectively navigate this process. Consulting with financial advisors or tax professionals can provide additional guidance, ensuring that the rollover is executed smoothly and in compliance with IRS guidelines.

Potential Pitfalls and How to Avoid Them

Rolling over after-tax 401(k) contributions to a Roth IRA can be a strategic move for many investors seeking to maximize their retirement savings. However, this process is not without its potential pitfalls, and understanding how to navigate these challenges is crucial to ensuring a tax-free transition. To begin with, it is essential to recognize the distinction between pre-tax and after-tax contributions within a 401(k) plan. While pre-tax contributions reduce taxable income in the year they are made, after-tax contributions do not offer this immediate tax benefit. However, the advantage of after-tax contributions lies in their potential for tax-free growth when rolled over into a Roth IRA.

One of the primary pitfalls in this process is the inadvertent commingling of pre-tax and after-tax funds. When rolling over funds, it is vital to ensure that only after-tax contributions are transferred to the Roth IRA. Mixing pre-tax and after-tax funds can lead to unintended tax consequences, as pre-tax funds are subject to taxation upon conversion. To avoid this, it is advisable to request a direct rollover from the 401(k) plan administrator, specifying that only after-tax contributions should be transferred to the Roth IRA. This direct rollover method minimizes the risk of errors and ensures that the transaction is executed correctly.

Another potential challenge is the timing of the rollover. It is important to consider the tax implications of the rollover in the context of one’s overall financial situation. For instance, executing a rollover in a year when one’s income is unusually high could push the individual into a higher tax bracket, thereby increasing the tax liability on any pre-tax funds inadvertently included in the rollover. To mitigate this risk, careful planning and consultation with a financial advisor or tax professional are recommended. They can provide guidance on the optimal timing for the rollover, taking into account the individual’s income, tax bracket, and long-term financial goals.

Additionally, it is crucial to be aware of the rules governing rollovers and conversions. The IRS imposes specific regulations on the rollover process, and failure to comply with these rules can result in penalties or taxes. For example, the “five-year rule” stipulates that earnings on Roth IRA contributions must remain in the account for at least five years before they can be withdrawn tax-free. Understanding these rules and ensuring compliance is essential to avoid unexpected tax liabilities.

Furthermore, it is important to maintain accurate records of the rollover transaction. Documentation should include details of the amounts rolled over, the dates of the transactions, and any correspondence with the plan administrator. This information will be invaluable in the event of an IRS audit or if questions arise regarding the tax treatment of the rollover.

In conclusion, while rolling over $120k in after-tax 401(k) contributions to a Roth IRA can be a beneficial strategy for achieving tax-free growth, it requires careful planning and attention to detail. By avoiding the pitfalls of commingling funds, considering the timing of the rollover, adhering to IRS regulations, and maintaining thorough documentation, individuals can successfully navigate this process and enhance their retirement savings. Consulting with financial professionals can further ensure that the rollover is executed smoothly and in alignment with one’s broader financial objectives.

Comparing Roth IRA and Traditional IRA Rollovers

When considering the transition of after-tax 401(k) contributions to a Roth IRA, it is essential to understand the nuances between Roth IRA and Traditional IRA rollovers. This knowledge can significantly impact your financial strategy, especially when dealing with substantial sums like $120,000. The primary distinction between these two types of IRAs lies in their tax treatment. A Roth IRA allows for tax-free growth and withdrawals, provided certain conditions are met, whereas a Traditional IRA offers tax-deferred growth, with taxes paid upon withdrawal. This fundamental difference plays a crucial role in deciding how to manage after-tax 401(k) contributions.

To roll over after-tax 401(k) contributions to a Roth IRA without incurring taxes, one must first ensure that the contributions are indeed after-tax. This means that taxes have already been paid on these contributions, distinguishing them from pre-tax contributions, which are taxed upon withdrawal. The IRS permits the rollover of after-tax contributions directly into a Roth IRA, allowing the funds to grow tax-free. This process is often referred to as a “mega backdoor Roth conversion,” and it can be a powerful tool for maximizing retirement savings.

The first step in executing this rollover is to contact your 401(k) plan administrator to confirm that your plan allows for in-service distributions or rollovers. Not all plans offer this flexibility, so it is crucial to verify this detail. Once confirmed, you can request a direct rollover of your after-tax contributions to a Roth IRA. It is important to specify that you want a direct rollover to avoid any potential tax complications. A direct rollover ensures that the funds are transferred directly from your 401(k) to your Roth IRA, bypassing your personal accounts and minimizing the risk of incurring taxes.

In contrast, rolling over after-tax 401(k) contributions to a Traditional IRA does not offer the same tax-free growth benefits. While the contributions themselves are not taxed again, any earnings on those contributions will be subject to taxes upon withdrawal. This is a significant consideration for those looking to maximize their retirement savings and minimize tax liabilities. Therefore, for individuals with substantial after-tax contributions, the Roth IRA rollover is often the more advantageous option.

Moreover, it is essential to consider the timing of the rollover. Conducting the rollover at the beginning of the year can maximize the potential for tax-free growth within the Roth IRA. Additionally, it is advisable to consult with a financial advisor or tax professional to ensure compliance with IRS regulations and to optimize the rollover strategy. They can provide personalized guidance based on your financial situation and retirement goals.

In conclusion, understanding the differences between Roth IRA and Traditional IRA rollovers is crucial when managing after-tax 401(k) contributions. By opting for a Roth IRA rollover, individuals can take advantage of tax-free growth and withdrawals, making it a strategic choice for those with significant after-tax contributions. Ensuring that your 401(k) plan allows for direct rollovers and consulting with financial professionals can further enhance the benefits of this strategy, ultimately contributing to a more secure and tax-efficient retirement plan.

Maximizing Tax Benefits with Strategic Rollovers

Rolling over after-tax 401(k) contributions to a Roth IRA can be a strategic move to maximize tax benefits, particularly for individuals seeking to optimize their retirement savings. This process, when executed correctly, allows for the conversion of after-tax contributions into a Roth IRA, where future earnings can grow tax-free. Understanding the nuances of this strategy is crucial to ensure compliance with tax regulations and to fully capitalize on the potential benefits.

To begin with, it is essential to recognize the distinction between pre-tax and after-tax contributions within a 401(k) plan. Pre-tax contributions are made before taxes are deducted, reducing taxable income in the year they are made, but they are subject to taxation upon withdrawal. In contrast, after-tax contributions are made with income that has already been taxed, allowing for the possibility of tax-free growth if rolled over into a Roth IRA. This distinction is pivotal when considering a rollover strategy.

The first step in this process involves confirming that your 401(k) plan allows for in-service rollovers of after-tax contributions. Not all plans offer this feature, so it is important to consult with your plan administrator to understand the specific provisions and requirements. Once confirmed, the next step is to initiate the rollover process. This typically involves completing the necessary paperwork and coordinating with both the 401(k) plan provider and the financial institution managing the Roth IRA.

A critical aspect of this strategy is ensuring that only the after-tax contributions are rolled over into the Roth IRA. Any earnings on these contributions, which are typically pre-tax, should be rolled over into a traditional IRA to avoid immediate taxation. This separation is vital to maintain the tax-free status of the Roth IRA and to prevent any unintended tax liabilities. It is advisable to work with a financial advisor or tax professional to ensure that the rollover is executed correctly and in compliance with IRS regulations.

Moreover, timing plays a significant role in maximizing the benefits of this rollover strategy. By rolling over after-tax contributions to a Roth IRA, individuals can take advantage of the tax-free growth potential of the account. This is particularly beneficial for those who anticipate being in a higher tax bracket during retirement, as it allows for withdrawals to be made tax-free, thereby reducing the overall tax burden.

In addition to the tax advantages, rolling over after-tax 401(k) contributions to a Roth IRA can also provide greater flexibility in retirement planning. Roth IRAs do not have required minimum distributions (RMDs) during the account holder’s lifetime, allowing for more control over the timing and amount of withdrawals. This can be especially advantageous for individuals who wish to leave a tax-free inheritance to their beneficiaries.

In conclusion, rolling over $120k in after-tax 401(k) contributions to a Roth IRA can be a powerful strategy for maximizing tax benefits and enhancing retirement savings. By understanding the intricacies of this process and working with knowledgeable professionals, individuals can ensure a smooth transition and fully leverage the advantages of tax-free growth. As with any financial decision, careful planning and consideration of individual circumstances are essential to achieving the desired outcomes.

Q&A

1. **What is a rollover?**

A rollover is the process of moving funds from one retirement account to another, such as from a 401(k) to an IRA, without incurring taxes or penalties.

2. **What is an after-tax 401(k) contribution?**

After-tax 401(k) contributions are contributions made to a 401(k) plan with money that has already been taxed, unlike pre-tax contributions.

3. **Can after-tax 401(k) contributions be rolled over to a Roth IRA?**

Yes, after-tax 401(k) contributions can be rolled over to a Roth IRA, allowing for tax-free growth and withdrawals in retirement.

4. **What is the benefit of rolling over after-tax 401(k) contributions to a Roth IRA?**

The primary benefit is that qualified withdrawals from a Roth IRA are tax-free, and the funds can grow tax-free over time.

5. **How do you initiate a rollover from a 401(k) to a Roth IRA?**

Contact your 401(k) plan administrator to request a direct rollover to your Roth IRA. Ensure you have a Roth IRA account set up to receive the funds.

6. **Are there any taxes or penalties for rolling over after-tax contributions to a Roth IRA?**

There are no taxes or penalties for rolling over after-tax contributions to a Roth IRA, as the contributions have already been taxed.

7. **What should you consider before rolling over to a Roth IRA?**

Consider the Roth IRA’s investment options, fees, and any potential impact on your tax situation, especially if you have earnings on the after-tax contributions, which may be subject to taxes.

Conclusion

Rolling over $120,000 in after-tax 401(k) contributions to a Roth IRA tax-free involves a strategic process to ensure compliance with IRS regulations and to maximize tax benefits. First, confirm that your 401(k) plan allows for in-service distributions or rollovers of after-tax contributions. Next, initiate a direct rollover of the after-tax contributions to a Roth IRA, ensuring that any earnings on those contributions are rolled over to a traditional IRA to avoid immediate taxation. This separation is crucial because only the after-tax contributions can be moved to a Roth IRA without incurring taxes. By carefully executing this rollover, you can effectively convert your after-tax 401(k) contributions into a Roth IRA, allowing for tax-free growth and withdrawals in retirement, provided certain conditions are met. Always consult with a financial advisor or tax professional to ensure compliance with current tax laws and to tailor the strategy to your specific financial situation.