“Exxon Mobil: Streamlining for the Future by Divesting Bakken Shale Assets”

Introduction

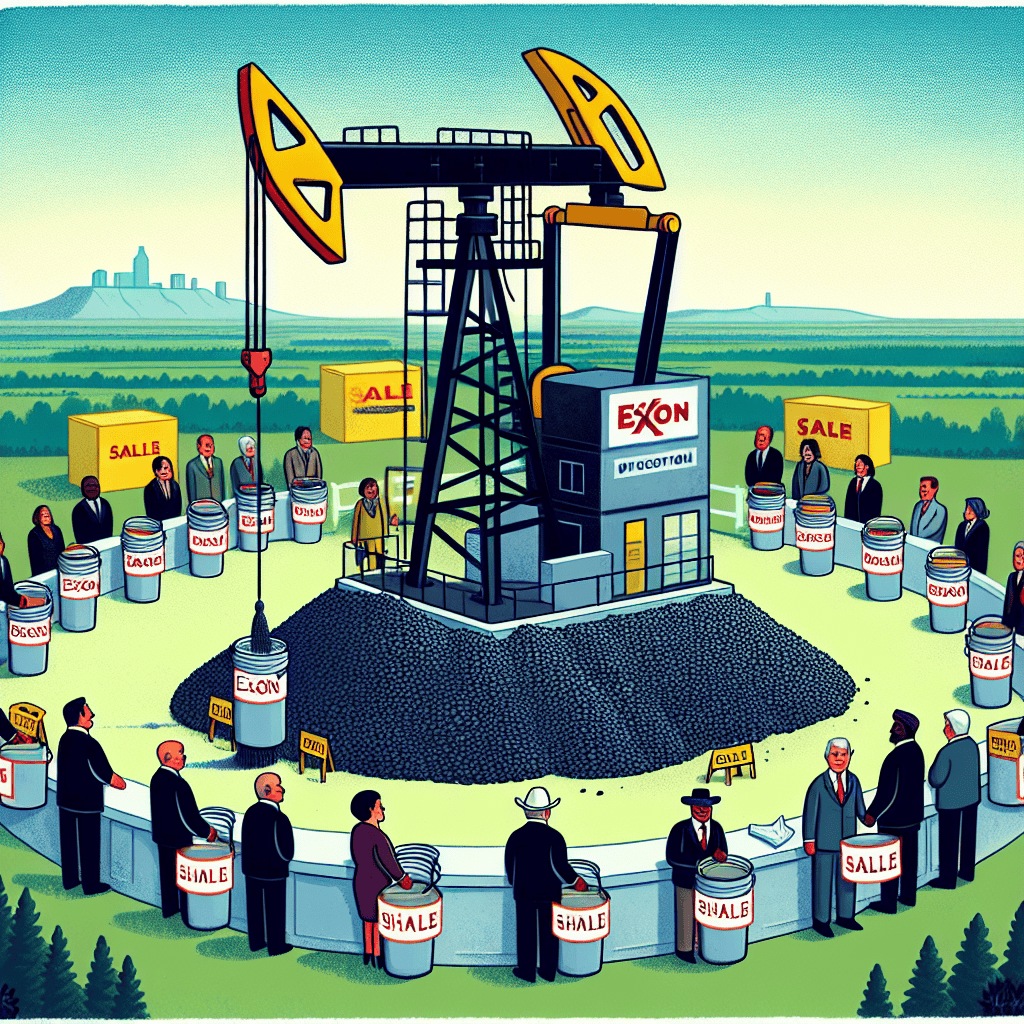

Exxon Mobil Corporation, one of the world’s largest publicly traded energy providers, is reportedly seeking buyers for a portion of its assets in the Bakken shale region of North Dakota. This strategic move aligns with the company’s broader efforts to streamline its portfolio and focus on high-return projects. The Bakken shale, known for its rich deposits of oil and natural gas, has been a significant area of production for Exxon. However, as the company aims to optimize its asset base and enhance shareholder value, it is exploring the sale of certain holdings in this prolific region. This decision reflects Exxon’s ongoing strategy to divest non-core assets and concentrate on more lucrative opportunities in its global operations.

Exxon’s Strategic Shift: Selling Assets in North Dakota’s Bakken Shale

ExxonMobil, one of the world’s largest publicly traded oil and gas companies, is reportedly seeking buyers for a portion of its assets in North Dakota’s Bakken shale. This move marks a significant shift in the company’s strategic approach to its portfolio management, reflecting broader trends in the energy sector. The Bakken shale, a prolific oil-producing region, has been a cornerstone of Exxon’s operations in the United States. However, the decision to divest some of these assets underscores the company’s evolving priorities and its response to changing market dynamics.

The Bakken formation, spanning parts of North Dakota, Montana, and Canada, has been a major contributor to the U.S. shale boom over the past decade. It has attracted significant investment from major oil companies due to its rich reserves and the technological advancements that have made extraction more economically viable. Despite its potential, the Bakken has faced challenges, including fluctuating oil prices, regulatory hurdles, and environmental concerns. These factors have prompted companies like Exxon to reassess their positions and optimize their asset portfolios.

Exxon’s decision to sell a portion of its Bakken assets aligns with its broader strategy to streamline operations and focus on high-return projects. In recent years, the company has been under pressure to improve its financial performance and deliver value to shareholders. By divesting non-core assets, Exxon aims to concentrate its resources on more lucrative opportunities, such as its operations in the Permian Basin and offshore projects in Guyana and Brazil. This strategic shift is indicative of a larger trend among energy companies, which are increasingly prioritizing capital discipline and operational efficiency.

Moreover, the sale of Bakken assets is part of Exxon’s efforts to adapt to the global energy transition. As the world moves towards cleaner energy sources, oil and gas companies are facing mounting pressure to reduce their carbon footprints and invest in sustainable technologies. Exxon has announced plans to achieve net-zero greenhouse gas emissions by 2050 and is exploring investments in carbon capture and storage, hydrogen, and biofuels. By reallocating capital from mature assets like those in the Bakken, Exxon can better position itself to meet these long-term sustainability goals.

The potential sale also reflects the current state of the oil market, which has been characterized by volatility and uncertainty. The COVID-19 pandemic led to a sharp decline in oil demand, causing prices to plummet and forcing companies to reevaluate their strategies. Although the market has shown signs of recovery, the long-term outlook remains uncertain, with factors such as geopolitical tensions, supply chain disruptions, and the pace of the energy transition influencing future demand. In this context, Exxon’s decision to divest Bakken assets can be seen as a prudent move to mitigate risk and enhance financial resilience.

In conclusion, Exxon’s plan to sell a portion of its assets in North Dakota’s Bakken shale represents a strategic realignment in response to evolving market conditions and the global energy transition. By focusing on high-return projects and sustainable investments, the company aims to strengthen its competitive position and ensure long-term growth. As the energy landscape continues to change, Exxon’s ability to adapt and innovate will be crucial in navigating the challenges and opportunities that lie ahead.

Impact of Exxon’s Asset Sale on the Bakken Shale Industry

Exxon’s decision to seek buyers for a portion of its assets in North Dakota’s Bakken shale represents a significant development in the energy sector, with potential implications for the region’s industry dynamics. This move comes as part of Exxon’s broader strategy to streamline its portfolio and focus on more lucrative ventures, particularly in areas where it can achieve higher returns on investment. As the company looks to divest some of its holdings, the impact on the Bakken shale industry could be multifaceted, influencing everything from local economies to the competitive landscape among energy producers.

The Bakken shale formation, known for its rich deposits of oil and natural gas, has been a focal point of energy production in the United States for over a decade. It has attracted numerous companies seeking to capitalize on its resources, contributing significantly to the country’s energy independence. However, the industry has faced challenges, including fluctuating oil prices, regulatory changes, and environmental concerns. Exxon’s decision to sell part of its assets could be seen as a response to these challenges, as well as an opportunity to reallocate resources to areas with more promising prospects.

For potential buyers, acquiring Exxon’s assets in the Bakken shale presents an opportunity to expand their footprint in a well-established oil-producing region. These assets could be particularly attractive to smaller or mid-sized companies looking to increase their production capacity and market share. Moreover, with Exxon’s established infrastructure and operational expertise, new entrants could benefit from a relatively smooth transition, allowing them to quickly ramp up production and capitalize on existing wells and facilities.

On the other hand, Exxon’s asset sale could also lead to increased competition among remaining players in the Bakken shale. As new companies enter the market or existing ones expand their operations, there may be a push to optimize production techniques and reduce costs. This could drive innovation and efficiency improvements across the industry, potentially leading to more sustainable practices and better resource management. However, it could also result in heightened competition for labor and services, potentially driving up costs for all operators in the region.

The local economies in North Dakota could also feel the effects of Exxon’s asset sale. The energy sector has been a significant contributor to the state’s economic growth, providing jobs and supporting local businesses. A change in ownership of these assets could lead to shifts in employment patterns, with potential job losses or gains depending on the strategies of the new operators. Additionally, local governments may need to adapt to changes in tax revenues and community investments, which are often tied to the activities of major energy companies like Exxon.

In conclusion, Exxon’s decision to seek buyers for a portion of its assets in the Bakken shale is a strategic move that could have wide-ranging implications for the industry and the region. While it presents opportunities for new and existing players to enhance their operations, it also introduces uncertainties that could reshape the competitive landscape and impact local communities. As the situation unfolds, stakeholders will need to navigate these changes carefully, balancing the potential benefits with the challenges that may arise.

Financial Implications of Exxon’s Divestment in North Dakota

ExxonMobil’s recent decision to seek buyers for a portion of its assets in North Dakota’s Bakken shale represents a significant shift in the company’s strategic focus, with substantial financial implications. This move comes as part of Exxon’s broader strategy to streamline its portfolio and concentrate on high-return projects, particularly in regions where it can leverage its technological and operational expertise to maximize profitability. The Bakken shale, once a cornerstone of the U.S. shale revolution, has seen fluctuating production levels and profitability due to volatile oil prices and increasing competition from other shale plays. Consequently, Exxon’s divestment in this area reflects a calculated response to these market dynamics.

The financial implications of this divestment are multifaceted. On one hand, selling off these assets could provide Exxon with a significant influx of capital, which can be redirected towards more lucrative ventures. This capital reallocation is crucial as the company seeks to enhance shareholder value and maintain its competitive edge in an industry that is rapidly evolving due to technological advancements and shifting energy policies. Moreover, by divesting from less profitable or non-core assets, Exxon can reduce its operational costs and focus on optimizing its existing operations, thereby improving its overall financial health.

On the other hand, the sale of these assets could also impact Exxon’s production levels in the short term. The Bakken shale has been a significant contributor to Exxon’s oil output, and divesting from this region may lead to a temporary decline in production volumes. However, Exxon is likely to mitigate this impact by ramping up production in other key areas, such as the Permian Basin, where it has been investing heavily in recent years. The Permian Basin offers more favorable economics and scalability, making it a more attractive option for Exxon as it seeks to balance its production portfolio.

Furthermore, the divestment could influence Exxon’s financial performance by altering its risk profile. By shedding assets in a region characterized by high operational costs and regulatory challenges, Exxon can reduce its exposure to potential financial risks associated with these factors. This strategic realignment allows the company to focus on regions with more stable regulatory environments and lower production costs, thereby enhancing its long-term financial stability.

In addition to these direct financial implications, Exxon’s decision to divest from the Bakken shale may also have broader market repercussions. The sale of these assets could attract interest from smaller, more nimble operators who are better positioned to capitalize on the remaining opportunities in the Bakken. This influx of new players could lead to increased competition and potentially drive innovation in extraction techniques and cost management strategies within the region.

In conclusion, Exxon’s decision to seek buyers for a portion of its assets in North Dakota’s Bakken shale is a strategic move with significant financial implications. By reallocating capital to more profitable ventures, optimizing its production portfolio, and reducing its risk exposure, Exxon aims to enhance its financial performance and maintain its competitive position in the global energy market. As the company navigates this transition, the broader industry will be watching closely to see how these changes impact both Exxon and the dynamics of the U.S. shale sector.

Potential Buyers for Exxon’s Bakken Shale Assets

ExxonMobil, one of the world’s largest publicly traded oil and gas companies, has recently announced its intention to divest a portion of its assets in North Dakota’s Bakken shale. This strategic move comes as part of the company’s broader effort to streamline its portfolio and focus on more lucrative ventures. The Bakken shale, known for its rich deposits of oil and natural gas, has been a significant contributor to the U.S. energy landscape. However, with fluctuating oil prices and evolving market dynamics, Exxon is seeking to optimize its asset base by offloading some of its holdings in this region.

Potential buyers for Exxon’s Bakken shale assets are likely to include a mix of established energy companies and private equity firms. Established players in the oil and gas sector may view this as an opportunity to expand their footprint in a proven resource area. Companies with existing operations in the Bakken may find it particularly advantageous to acquire additional assets, as they can leverage their existing infrastructure and expertise to maximize production efficiency. Moreover, these companies may be better positioned to navigate the regulatory and environmental challenges associated with shale development.

On the other hand, private equity firms, which have shown increasing interest in the energy sector, may also emerge as potential buyers. These firms often seek undervalued or underperforming assets that can be improved and later sold at a profit. The Bakken shale, with its established production history and potential for technological advancements, could present an attractive investment opportunity for private equity investors looking to capitalize on the cyclical nature of the oil market. Additionally, private equity firms may bring innovative financial strategies and operational efficiencies that could enhance the value of these assets.

In evaluating potential buyers, Exxon is likely to consider several factors, including the financial strength and operational capabilities of the interested parties. The company will aim to ensure that the buyers have the necessary resources and expertise to manage and develop the assets effectively. Furthermore, Exxon may also assess the strategic alignment of the buyers’ goals with its own long-term objectives, as it seeks to maintain a positive relationship with stakeholders and preserve its reputation in the industry.

The sale of Exxon’s Bakken shale assets is expected to attract significant interest, given the region’s established infrastructure and production potential. However, the transaction will also be influenced by broader market conditions, including oil price trends and regulatory developments. As the energy sector continues to evolve, companies are increasingly focused on optimizing their portfolios to remain competitive and resilient. Exxon’s decision to divest some of its Bakken assets reflects this trend, as it seeks to allocate resources to areas with higher growth potential and returns.

In conclusion, the potential sale of Exxon’s Bakken shale assets presents a unique opportunity for both established energy companies and private equity firms. As the market responds to this development, the outcome will likely have implications for the broader energy landscape, influencing investment strategies and operational priorities. Ultimately, the successful divestment of these assets will depend on Exxon’s ability to identify buyers that align with its strategic goals and possess the capabilities to unlock the full potential of the Bakken shale.

Exxon’s Asset Sale: A Move Towards Sustainable Energy?

ExxonMobil, one of the world’s largest publicly traded oil and gas companies, has recently announced its intention to sell a portion of its assets in North Dakota’s Bakken shale. This decision comes at a time when the energy industry is undergoing significant transformation, driven by the global push towards sustainable energy solutions. The move by ExxonMobil to divest some of its Bakken assets could be seen as a strategic shift in response to these evolving market dynamics.

The Bakken shale, a prolific oil-producing region, has been a significant contributor to the United States’ energy output. Over the years, it has attracted substantial investment from major oil companies, including ExxonMobil, due to its rich reserves and potential for high returns. However, the landscape of the energy sector is changing rapidly. With increasing pressure from governments, investors, and environmental groups to reduce carbon emissions, energy companies are being compelled to reassess their portfolios and align their operations with more sustainable practices.

ExxonMobil’s decision to seek buyers for its Bakken assets may be indicative of a broader strategy to pivot towards cleaner energy sources. By divesting from certain oil and gas holdings, the company could potentially reallocate resources towards renewable energy projects and technologies that promise lower environmental impact. This shift is not unique to ExxonMobil; many oil and gas companies are exploring similar paths as they navigate the transition to a low-carbon future.

Moreover, the sale of these assets could provide ExxonMobil with the financial flexibility needed to invest in research and development of innovative energy solutions. The funds generated from the sale might be directed towards advancing technologies such as carbon capture and storage, hydrogen production, and biofuels, which are increasingly seen as critical components of the energy transition. By investing in these areas, ExxonMobil could enhance its competitive position in a market that is gradually moving away from fossil fuels.

In addition to financial considerations, regulatory and societal pressures are also influencing ExxonMobil’s decision-making process. Governments around the world are implementing stricter regulations to curb greenhouse gas emissions, and there is a growing expectation for companies to demonstrate their commitment to environmental stewardship. By reducing its footprint in traditional oil and gas operations, ExxonMobil could improve its environmental, social, and governance (ESG) profile, which is becoming an important factor for investors.

However, it is important to note that the transition to sustainable energy is complex and fraught with challenges. While divesting from certain assets may align with long-term sustainability goals, it also involves navigating short-term market volatility and ensuring continued profitability. ExxonMobil will need to carefully balance these considerations as it charts its course in the evolving energy landscape.

In conclusion, ExxonMobil’s decision to seek buyers for a portion of its assets in North Dakota’s Bakken shale reflects the broader industry trend towards sustainable energy. As the company evaluates its portfolio and strategic priorities, it is likely to focus on aligning its operations with the global shift towards cleaner energy sources. This move not only positions ExxonMobil to adapt to changing market conditions but also underscores the growing importance of sustainability in shaping the future of the energy sector.

Market Reactions to Exxon’s Bakken Shale Divestiture

ExxonMobil’s recent decision to seek buyers for a portion of its assets in North Dakota’s Bakken shale has sparked significant interest and speculation within the energy market. This move, which aligns with the company’s broader strategy to streamline its portfolio and focus on high-return projects, has prompted a variety of reactions from market analysts, investors, and industry stakeholders. As ExxonMobil looks to divest these assets, the implications for the market and the broader energy landscape are multifaceted.

To begin with, Exxon’s decision is seen as a strategic shift towards optimizing its asset base. By divesting from the Bakken shale, the company aims to reallocate resources to more lucrative ventures, particularly those with lower breakeven costs and higher potential returns. This is consistent with Exxon’s recent emphasis on capital discipline and its commitment to enhancing shareholder value. Consequently, the market has responded with a mix of optimism and caution. On one hand, investors are hopeful that the proceeds from the sale will be reinvested into projects with higher growth potential, thereby boosting Exxon’s long-term profitability. On the other hand, there is a degree of uncertainty regarding the valuation of the Bakken assets and the potential impact on Exxon’s production levels.

Moreover, the divestiture has broader implications for the Bakken shale region itself. As one of the major players in the area, Exxon’s exit could lead to shifts in the competitive landscape. Smaller operators and private equity firms may view this as an opportunity to acquire assets at a potentially discounted rate, thereby increasing their foothold in the region. This could lead to a wave of consolidation, as companies seek to achieve economies of scale and enhance operational efficiencies. However, the success of such transactions will largely depend on the prevailing market conditions, including oil prices and regulatory developments.

In addition to affecting the competitive dynamics, Exxon’s divestiture may also influence the region’s production levels. The Bakken shale has been a significant contributor to U.S. oil output, and any changes in investment patterns could impact overall production. While some analysts believe that new entrants could maintain or even increase production levels, others caution that a reduction in capital expenditure could lead to a decline in output over time. This uncertainty is further compounded by the ongoing volatility in global oil markets, which continues to pose challenges for producers.

Furthermore, Exxon’s move is reflective of a broader trend within the oil and gas industry, where companies are increasingly focusing on core assets and divesting non-core operations. This trend is driven by the need to adapt to a rapidly changing energy landscape, characterized by the transition towards cleaner energy sources and heightened environmental scrutiny. As such, Exxon’s divestiture is not only a financial decision but also a strategic response to the evolving market dynamics.

In conclusion, Exxon’s decision to seek buyers for its Bakken shale assets has elicited a range of reactions from the market. While it presents opportunities for new entrants and potential benefits for Exxon’s strategic focus, it also introduces uncertainties regarding asset valuation and production levels. As the situation unfolds, stakeholders will be closely monitoring the developments to assess the long-term implications for both ExxonMobil and the broader energy market.

Future of Oil Production in North Dakota Post-Exxon Sale

The recent announcement by ExxonMobil to seek buyers for a portion of its assets in North Dakota’s Bakken shale has sparked considerable interest and speculation about the future of oil production in the region. As one of the largest oil producers in the United States, Exxon’s decision to divest some of its holdings in the Bakken formation is a significant development that could have far-reaching implications for the local economy, energy markets, and the broader oil industry.

To understand the potential impact of Exxon’s asset sale, it is essential to consider the strategic motivations behind this move. The company has been actively reshaping its portfolio to focus on high-return projects and reduce its carbon footprint. By divesting non-core assets, Exxon aims to streamline operations and allocate resources more efficiently. This strategy aligns with the broader industry trend of optimizing asset portfolios in response to fluctuating oil prices and increasing pressure to transition towards more sustainable energy sources.

The Bakken shale, known for its rich deposits of oil and natural gas, has been a significant contributor to the United States’ energy production. However, the region has faced challenges in recent years, including volatile oil prices, regulatory changes, and environmental concerns. Exxon’s decision to sell a portion of its Bakken assets could be seen as a response to these challenges, as well as an opportunity to capitalize on the current market conditions. By selling these assets, Exxon can potentially unlock value and reinvest in projects that align more closely with its long-term strategic goals.

For potential buyers, acquiring Exxon’s Bakken assets presents both opportunities and challenges. On one hand, the assets offer access to a well-established oil-producing region with existing infrastructure and proven reserves. This could be particularly attractive to smaller or mid-sized companies looking to expand their footprint in the shale industry. On the other hand, buyers must navigate the complexities of operating in a region that is subject to environmental scrutiny and regulatory oversight. Additionally, they must be prepared to invest in technology and innovation to enhance production efficiency and reduce environmental impact.

The sale of Exxon’s Bakken assets also raises questions about the future of oil production in North Dakota. While the state has benefited from the economic boost provided by the shale boom, it must now consider how to sustain growth in a changing energy landscape. This may involve diversifying the local economy, investing in renewable energy projects, and supporting workforce development initiatives to ensure that the region remains competitive.

Moreover, the potential change in ownership of these assets could lead to shifts in production strategies and operational practices. New operators may bring fresh perspectives and innovative approaches to resource extraction, which could influence the overall dynamics of the Bakken shale industry. As such, stakeholders, including local communities, policymakers, and industry players, must engage in dialogue to address the challenges and opportunities presented by this transition.

In conclusion, Exxon’s decision to seek buyers for a portion of its assets in North Dakota’s Bakken shale marks a pivotal moment for the region’s oil production landscape. While the sale presents opportunities for new entrants and potential economic benefits, it also underscores the need for strategic planning and collaboration to navigate the evolving energy market. As the industry continues to adapt to changing conditions, the future of oil production in North Dakota will depend on the ability of stakeholders to embrace innovation, sustainability, and resilience.

Q&A

1. **What is Exxon seeking to sell?**

Exxon is seeking to sell a portion of its assets in North Dakota’s Bakken shale.

2. **Why is Exxon selling these assets?**

Exxon is selling these assets as part of its strategy to streamline operations and focus on more profitable ventures.

3. **How much are the assets valued at?**

The assets are valued at approximately $5 billion.

4. **What does the sale include?**

The sale includes oil and gas wells, as well as associated infrastructure in the Bakken shale region.

5. **How much production do these assets currently generate?**

These assets currently generate around 20,000 barrels of oil equivalent per day.

6. **Who are potential buyers for these assets?**

Potential buyers could include other oil and gas companies looking to expand their operations in the Bakken region.

7. **What impact could this sale have on Exxon’s operations?**

The sale could allow Exxon to reallocate resources to more strategic projects and improve its overall financial performance.

Conclusion

ExxonMobil’s decision to seek buyers for a portion of its assets in North Dakota’s Bakken shale reflects a strategic shift in the company’s portfolio management, likely aimed at optimizing its asset base and focusing on more profitable or strategically aligned ventures. This move could be driven by several factors, including fluctuating oil prices, the need to reduce debt, or a reallocation of resources towards more sustainable energy projects. By divesting from the Bakken shale, ExxonMobil may be positioning itself to enhance its financial flexibility and invest in areas with higher growth potential or lower carbon intensity, aligning with broader industry trends towards energy transition and sustainability.