“Clear the Clutter, Clear the Debt: Dave Ramsey’s Guide to Financial Freedom.”

Introduction

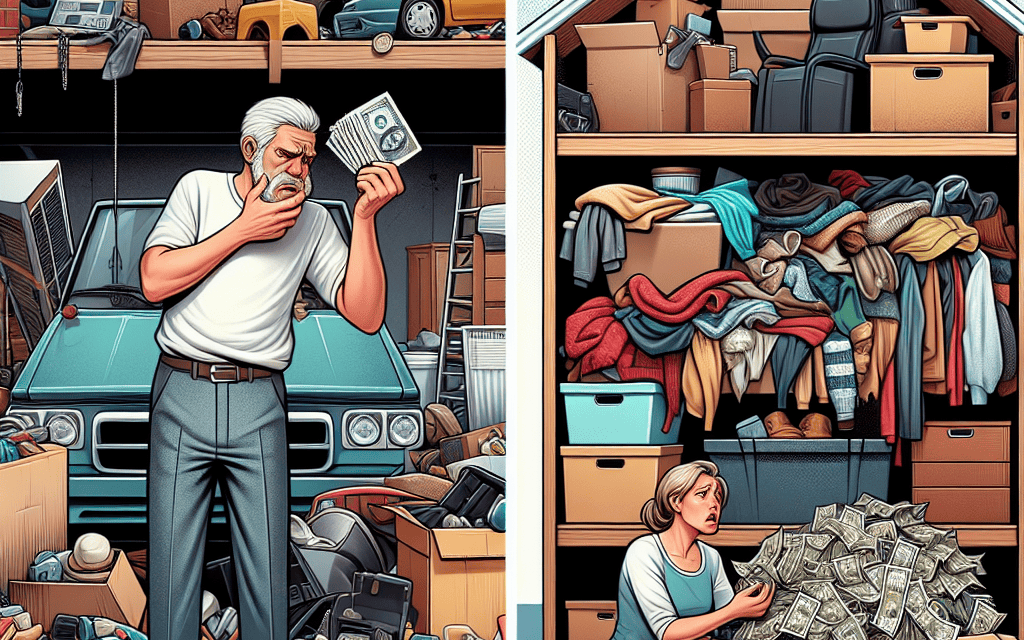

Dave Ramsey, a renowned personal finance expert and radio show host, has long been a vocal advocate for financial responsibility and debt-free living. In his discussions on financial well-being, Ramsey often highlights the impact of consumer habits on personal finances, pointing out that cluttered garages and attics are symptomatic of a larger issue: the tendency of many Americans to accumulate unnecessary possessions. This accumulation not only leads to physical clutter but also reflects a deeper financial strain, as individuals often spend beyond their means on items that do not contribute to their financial goals. Ramsey argues that by decluttering and adopting a more intentional approach to spending, individuals can alleviate financial stress and work towards a more secure financial future.

Understanding the Connection Between Clutter and Financial Stress

Dave Ramsey, a well-known personal finance expert, has long advocated for financial discipline and responsibility. His insights often highlight the less obvious factors contributing to financial stress, one of which is the clutter that fills many American homes. Cluttered garages and attics, he argues, are not merely a matter of disorganization but are symptomatic of deeper financial issues. Understanding the connection between physical clutter and financial stress requires examining the psychological and economic implications of accumulating unnecessary possessions.

To begin with, clutter can be a manifestation of impulsive spending habits. Many individuals purchase items on a whim, driven by short-term desires rather than long-term needs. This behavior often leads to the accumulation of goods that serve little purpose, eventually finding their way into garages and attics. The financial impact of such spending is significant, as it diverts funds away from essential expenses and savings. Over time, these impulsive purchases can contribute to mounting debt, creating a cycle of financial strain that is difficult to break.

Moreover, clutter can also reflect a lack of financial planning and prioritization. When individuals fail to establish clear financial goals, they may find themselves spending money on items that do not align with their long-term objectives. This lack of direction can result in a home filled with unused or underutilized possessions, each representing a missed opportunity to invest in more meaningful financial pursuits. By contrast, those who prioritize their financial goals are more likely to make deliberate purchasing decisions, reducing the likelihood of accumulating unnecessary clutter.

In addition to its financial implications, clutter can have a profound psychological impact. A cluttered environment can lead to feelings of stress and anxiety, which can, in turn, affect one’s financial decision-making abilities. When individuals are overwhelmed by their surroundings, they may struggle to focus on managing their finances effectively. This can result in poor financial choices, such as neglecting to pay bills on time or failing to save for future needs. By addressing the physical clutter in their homes, individuals can create a more conducive environment for making sound financial decisions.

Furthermore, the presence of clutter can obscure the true value of one’s possessions. When items are buried under piles of other belongings, it becomes challenging to assess their worth or utility. This can lead to duplicate purchases, as individuals may forget they already own a particular item. Such redundancy not only wastes money but also contributes to further clutter, perpetuating the cycle of financial stress. By organizing their possessions and eliminating unnecessary items, individuals can gain a clearer understanding of what they truly need, allowing them to make more informed purchasing decisions in the future.

In conclusion, the clutter that fills many American garages and attics is more than just a matter of physical disorganization; it is a reflection of deeper financial habits and attitudes. By recognizing the connection between clutter and financial stress, individuals can take steps to address both issues simultaneously. This involves not only decluttering their physical spaces but also reevaluating their spending habits and financial priorities. Through this process, they can alleviate financial strain and create a more stable and fulfilling financial future. Dave Ramsey’s insights serve as a reminder that achieving financial well-being often requires looking beyond the numbers and addressing the underlying behaviors that contribute to financial stress.

How Decluttering Can Lead to Better Financial Decisions

Dave Ramsey, a well-known personal finance expert, often emphasizes the importance of financial discipline and prudent money management. One of his intriguing assertions is that cluttered garages and attics are symptomatic of deeper financial issues faced by many Americans. This perspective invites a closer examination of how decluttering can lead to better financial decisions and ultimately improve one’s financial health.

To begin with, clutter in garages and attics often represents unexamined spending habits. Many individuals accumulate items over time, purchasing things they believe they need or want, only to store them away, forgotten and unused. This behavior reflects a lack of intentionality in spending, where purchases are made impulsively rather than thoughtfully. By decluttering these spaces, individuals are forced to confront their past purchasing decisions, providing an opportunity to reflect on their spending habits. This reflection can lead to more mindful consumption in the future, as individuals become more aware of the distinction between needs and wants.

Moreover, decluttering can have a psychological impact that extends to financial decision-making. A cluttered environment often contributes to feelings of stress and overwhelm, which can cloud judgment and lead to poor financial choices. In contrast, a tidy and organized space can foster a sense of control and clarity, enabling individuals to make more rational and informed financial decisions. By creating a physical environment that promotes mental well-being, individuals are better positioned to tackle financial challenges with a clear mind.

In addition to the psychological benefits, decluttering can also have direct financial advantages. Selling unused or unwanted items can generate additional income, which can be used to pay down debt, build an emergency fund, or invest for the future. This process not only provides immediate financial relief but also reinforces the value of resourcefulness and financial responsibility. Furthermore, by reducing the number of possessions, individuals may find that they require less storage space, potentially leading to cost savings on storage solutions or even allowing for downsizing to a smaller, more affordable living space.

Another important aspect to consider is the environmental impact of decluttering. By donating or selling items rather than discarding them, individuals contribute to a more sustainable economy, reducing waste and promoting the reuse of goods. This environmentally conscious approach can also translate into financial savings, as individuals become more inclined to purchase second-hand items or seek out sustainable alternatives, which are often more cost-effective in the long run.

Finally, the process of decluttering can serve as a catalyst for broader lifestyle changes that support financial well-being. As individuals become more intentional about their physical possessions, they may also begin to adopt a minimalist mindset in other areas of their lives. This shift can lead to a reduction in overall consumption, prioritizing experiences and relationships over material goods, and ultimately fostering a more fulfilling and financially stable life.

In conclusion, while the notion that cluttered garages and attics are linked to financial struggles may seem simplistic at first glance, it underscores a deeper truth about the relationship between our physical environment and financial behavior. By embracing the practice of decluttering, individuals can gain valuable insights into their spending habits, improve their mental clarity, and make more informed financial decisions. As Dave Ramsey suggests, addressing the clutter in our lives can be a powerful step toward achieving financial freedom and security.

Dave Ramsey’s Tips for Organizing Your Garage and Attic

Dave Ramsey, a renowned personal finance expert, often emphasizes the importance of financial discipline and organization in achieving financial freedom. One of his intriguing insights is the connection between cluttered garages and attics and the financial struggles faced by many Americans. According to Ramsey, the state of one’s physical environment can significantly impact their financial well-being. This perspective encourages individuals to consider how decluttering and organizing their living spaces, particularly garages and attics, can lead to improved financial health.

To begin with, cluttered spaces often reflect a lack of organization and control, which can extend to one’s financial habits. When garages and attics are filled with unused items, it suggests a tendency to accumulate possessions without discernment. This habit can mirror financial behaviors such as impulsive spending and poor budgeting. By addressing the physical clutter, individuals can cultivate a mindset of intentionality and discipline, which are crucial for effective money management. Ramsey advocates for a systematic approach to decluttering, urging individuals to assess the value and utility of each item. This process not only frees up physical space but also encourages a more mindful approach to spending and saving.

Furthermore, organizing garages and attics can uncover hidden financial opportunities. Many people are unaware of the valuable items they possess, which are often buried under piles of clutter. By sorting through these spaces, individuals may discover items that can be sold, generating additional income. This newfound cash can be directed towards paying off debt, building an emergency fund, or investing for the future. Ramsey highlights that selling unused items not only provides financial benefits but also reinforces the principle of living within one’s means. It serves as a practical exercise in distinguishing between wants and needs, a fundamental concept in personal finance.

In addition to financial gains, organizing these spaces can lead to psychological benefits that indirectly support financial stability. A tidy and organized environment fosters a sense of calm and control, reducing stress and anxiety. This mental clarity can enhance decision-making abilities, enabling individuals to make more informed financial choices. Ramsey often points out that financial success is not solely about numbers; it is also about cultivating a mindset that supports long-term goals. By creating an organized living space, individuals can develop the mental resilience needed to navigate financial challenges.

Moreover, the process of decluttering can instill a sense of accomplishment and motivation. As individuals witness the transformation of their garages and attics, they may feel empowered to tackle other areas of their lives, including their finances. This momentum can lead to the establishment of positive financial habits, such as regular budgeting, saving, and investing. Ramsey emphasizes that small, consistent actions can lead to significant financial progress over time. Therefore, the act of organizing one’s physical space can serve as a catalyst for broader financial change.

In conclusion, Dave Ramsey’s insights into the relationship between cluttered garages and attics and financial struggles offer a unique perspective on personal finance. By encouraging individuals to declutter and organize these spaces, Ramsey highlights the potential for improved financial habits, increased income, and enhanced mental well-being. This holistic approach underscores the interconnectedness of physical and financial organization, ultimately guiding individuals towards greater financial freedom and stability.

The Psychological Impact of Clutter on Financial Health

Dave Ramsey, a well-known personal finance expert, has long advocated for financial discipline and responsibility. One of his intriguing assertions is that cluttered garages and attics are symptomatic of deeper financial issues faced by many Americans. This perspective invites a closer examination of the psychological impact of clutter on financial health, revealing a complex interplay between physical disorganization and fiscal instability.

To begin with, clutter is often more than just a physical accumulation of items; it represents unmade decisions and postponed actions. When individuals allow their garages and attics to overflow with unused possessions, it often reflects a broader tendency to avoid confronting financial realities. This avoidance can manifest in various ways, such as neglecting to budget, failing to save for emergencies, or accumulating debt. Consequently, the clutter becomes a physical manifestation of financial procrastination, symbolizing the chaos that can ensue when financial matters are not addressed proactively.

Moreover, the psychological burden of clutter can exacerbate stress and anxiety, which are already prevalent in financial struggles. Studies have shown that cluttered environments can lead to feelings of overwhelm and helplessness, making it difficult for individuals to focus on important tasks, including managing their finances. This mental clutter can hinder one’s ability to make sound financial decisions, as the stress of a disorganized space often spills over into other areas of life. As a result, individuals may find themselves trapped in a cycle where financial disarray leads to more clutter, which in turn perpetuates financial disarray.

In addition to the psychological impact, clutter can have tangible financial consequences. For instance, when garages and attics are filled with forgotten items, individuals may end up purchasing duplicates of things they already own but cannot locate. This unnecessary spending contributes to financial strain, diverting funds that could be better allocated toward savings or debt reduction. Furthermore, clutter can decrease the value of one’s home, as potential buyers may be deterred by the lack of organization and perceived neglect. Thus, the financial implications of clutter extend beyond immediate spending habits, affecting long-term financial health and stability.

Transitioning from the problem to potential solutions, it is essential to recognize that addressing clutter can be a powerful step toward improving financial well-being. By decluttering, individuals not only create a more organized living space but also cultivate a mindset of intentionality and discipline. This process encourages individuals to evaluate their spending habits, prioritize their financial goals, and make informed decisions about their possessions and finances. As individuals gain control over their physical environment, they often experience a renewed sense of empowerment and clarity, which can translate into more effective financial management.

Furthermore, adopting a minimalist approach can lead to significant financial benefits. By focusing on acquiring only what is necessary and valuable, individuals can reduce unnecessary expenditures and allocate resources more efficiently. This shift in mindset can foster a culture of saving and investing, ultimately contributing to greater financial security and independence.

In conclusion, Dave Ramsey’s assertion that cluttered garages and attics are indicative of financial struggles highlights the intricate relationship between physical and financial well-being. By understanding the psychological impact of clutter and taking proactive steps to address it, individuals can pave the way for improved financial health. Through intentional living and disciplined financial practices, it is possible to break free from the cycle of clutter and achieve lasting financial stability.

Steps to Declutter and Improve Your Financial Situation

Dave Ramsey, a renowned personal finance expert, often emphasizes the connection between physical clutter and financial disarray. He argues that cluttered garages and attics are not merely a matter of disorganization but are symptomatic of deeper financial issues. Many Americans find themselves financially strapped, and Ramsey suggests that decluttering can be a pivotal step toward improving one’s financial situation. By examining the relationship between clutter and finances, individuals can begin to take actionable steps to regain control over both their living spaces and their financial health.

To begin with, clutter often represents unmade decisions and postponed actions. Items that accumulate in garages and attics are frequently things that people intend to deal with later, whether by selling, donating, or discarding. This procrastination can mirror financial habits, such as delaying budgeting or avoiding debt management. By addressing physical clutter, individuals can practice making decisions and taking action, which can translate into better financial habits. For instance, setting aside time to sort through stored items can encourage a mindset of organization and prioritization, skills that are equally valuable in managing finances.

Moreover, decluttering can lead to financial gains. Many items stored in garages and attics have resale value, and selling these unused possessions can provide an immediate financial boost. Platforms like eBay, Craigslist, and Facebook Marketplace offer convenient avenues for selling items, turning clutter into cash. This process not only generates extra income but also instills a sense of financial empowerment. As individuals see the tangible benefits of decluttering, they may be more motivated to apply similar principles to their financial lives, such as identifying unnecessary expenses and redirecting funds toward savings or debt repayment.

In addition to the potential for financial gain, decluttering can also reduce expenses. A cluttered home often leads to inefficiencies, such as purchasing duplicates of items that are already owned but cannot be found amidst the chaos. By organizing and inventorying possessions, individuals can avoid unnecessary purchases, thereby saving money. Furthermore, a decluttered space is easier to maintain, potentially reducing costs associated with cleaning and home maintenance. This streamlined environment can also contribute to mental clarity, allowing individuals to focus more effectively on financial planning and goal setting.

Transitioning from a cluttered to an organized space requires a strategic approach. One effective method is the “one in, one out” rule, which involves removing an item for every new one brought into the home. This practice helps prevent the accumulation of new clutter and encourages mindful consumption. Additionally, setting specific goals for decluttering sessions, such as tackling one room or category of items at a time, can make the process more manageable and less overwhelming. As individuals make progress, they may find that the discipline and focus required for decluttering naturally extend to their financial management practices.

Ultimately, the act of decluttering is not just about creating a more orderly living space; it is about fostering a mindset of intentionality and control. By addressing the physical manifestations of clutter, individuals can gain insights into their financial behaviors and take steps toward improvement. Dave Ramsey’s perspective highlights the interconnectedness of our physical and financial environments, suggesting that by decluttering our homes, we can also declutter our financial lives. As individuals embark on this journey, they may discover that the path to financial stability is not only about numbers but also about creating a harmonious and intentional living space.

Real-Life Success Stories: Decluttering and Financial Freedom

In the realm of personal finance, Dave Ramsey has long been a guiding light for individuals seeking to regain control over their financial lives. His teachings emphasize the importance of budgeting, saving, and living within one’s means. However, an often-overlooked aspect of his philosophy is the impact of physical clutter on financial well-being. Ramsey posits that cluttered garages and attics are not merely organizational nuisances but are symptomatic of deeper financial issues. This perspective has resonated with many Americans who have found that decluttering their homes can lead to significant financial freedom.

The connection between clutter and financial distress may not be immediately apparent, yet it is deeply intertwined. Clutter often represents unexamined spending habits, where individuals accumulate items they neither need nor use. This accumulation can lead to a cycle of consumption that drains financial resources and creates a sense of overwhelm. By addressing the physical clutter in their lives, individuals can begin to confront the underlying financial behaviors that contribute to their economic struggles.

Real-life success stories abound, illustrating the transformative power of decluttering. For instance, consider the case of a family who, inspired by Ramsey’s teachings, decided to tackle their overflowing garage. As they sorted through years of accumulated possessions, they discovered numerous items that could be sold or donated. The process not only generated extra income but also instilled a sense of discipline and mindfulness about future purchases. This newfound awareness helped them to prioritize their spending, ultimately leading to a more stable financial situation.

Moreover, decluttering can have psychological benefits that extend beyond the immediate financial gains. A clutter-free environment often leads to reduced stress and increased productivity, which can positively impact one’s ability to manage finances effectively. When individuals are not bogged down by the chaos of their surroundings, they are better equipped to focus on financial planning and goal setting. This mental clarity can be a crucial factor in achieving long-term financial success.

Transitioning from a cluttered to a clutter-free lifestyle requires a shift in mindset. It involves recognizing that material possessions do not equate to happiness or success. Instead, financial freedom and security are more valuable than any physical item. This shift can be challenging, particularly in a consumer-driven society that equates ownership with status. However, those who embrace this change often find that the benefits far outweigh the initial discomfort.

Furthermore, the act of decluttering can serve as a catalyst for broader financial changes. As individuals begin to see the tangible benefits of a simplified lifestyle, they may be more inclined to adopt other aspects of Ramsey’s financial advice, such as creating a budget, building an emergency fund, and investing for the future. The process of decluttering can thus be a powerful first step on the journey to financial independence.

In conclusion, Dave Ramsey’s assertion that cluttered garages and attics contribute to financial strain is supported by numerous real-life success stories. By addressing the physical clutter in their lives, individuals can gain insight into their spending habits, reduce stress, and create a more focused approach to financial management. As these stories demonstrate, the path to financial freedom often begins with the simple act of decluttering, leading to profound and lasting change.

The Role of Minimalism in Achieving Financial Peace

Dave Ramsey, a well-known personal finance expert, often emphasizes the importance of minimalism in achieving financial peace. He argues that cluttered garages and attics are not just physical manifestations of disorganization but also symbolic of the financial chaos that many Americans experience. This perspective invites a deeper exploration into how minimalism can play a crucial role in fostering financial stability and peace of mind.

To begin with, the accumulation of unnecessary items often reflects a broader pattern of impulsive spending and poor financial management. Many individuals purchase items on a whim, driven by temporary desires rather than genuine needs. Over time, these purchases accumulate, filling garages and attics with items that serve little purpose. This clutter is not only a physical burden but also a financial one, as it represents money that could have been saved or invested more wisely. By adopting a minimalist mindset, individuals can begin to break free from the cycle of consumerism, focusing instead on purchasing only what is truly necessary and valuable.

Moreover, minimalism encourages individuals to reassess their priorities and align their spending habits with their long-term financial goals. When people declutter their living spaces, they often find themselves reevaluating what is truly important to them. This process can lead to a more intentional approach to spending, where financial decisions are made with a clear understanding of their impact on one’s overall financial health. By reducing unnecessary expenditures, individuals can allocate more resources towards paying off debt, building an emergency fund, or investing for the future.

In addition to promoting better financial habits, minimalism can also contribute to improved mental well-being. A cluttered environment can lead to feelings of stress and overwhelm, which can, in turn, affect one’s ability to make sound financial decisions. By simplifying their surroundings, individuals often experience a sense of relief and clarity, which can translate into more disciplined and thoughtful financial behavior. This mental shift is crucial, as financial peace is not solely about numbers but also about achieving a state of mind where one feels in control and confident about their financial future.

Furthermore, minimalism can foster a sense of contentment and gratitude, reducing the desire for constant consumption. When individuals focus on appreciating what they already have, they are less likely to seek fulfillment through material possessions. This shift in mindset can lead to significant savings, as individuals become more discerning about their purchases and less influenced by societal pressures to acquire more. By embracing a minimalist lifestyle, people can cultivate a sense of satisfaction that is not dependent on external acquisitions, thereby reducing financial strain.

In conclusion, Dave Ramsey’s assertion that cluttered garages and attics are indicative of financial distress highlights the broader implications of consumerism on personal finance. By adopting minimalism, individuals can not only declutter their physical spaces but also transform their financial lives. This approach encourages intentional spending, aligns financial habits with personal values, and promotes mental well-being. Ultimately, minimalism offers a pathway to financial peace, empowering individuals to take control of their finances and build a more secure and fulfilling future. Through this lens, the journey towards minimalism becomes not just a means of organizing one’s home but a transformative process that can lead to lasting financial stability and peace of mind.

Q&A

1. **What is the main argument presented by Dave Ramsey regarding cluttered garages and attics?**

– Dave Ramsey argues that cluttered garages and attics symbolize poor financial habits and decision-making, leading to financial strain for many Americans.

2. **How does clutter relate to financial issues according to Dave Ramsey?**

– Clutter often represents unnecessary purchases and a lack of organization, which can reflect broader financial mismanagement and contribute to financial stress.

3. **What financial behavior does Dave Ramsey suggest to combat clutter?**

– He suggests adopting a minimalist approach, focusing on needs over wants, and regularly decluttering to maintain financial discipline.

4. **Why does Dave Ramsey believe clutter can lead to financial problems?**

– Clutter can lead to financial problems because it often involves spending money on non-essential items, which can detract from savings and investment opportunities.

5. **What is a practical step recommended by Dave Ramsey to address clutter?**

– A practical step is to conduct regular clean-outs of storage spaces and sell or donate items that are no longer needed, potentially generating extra income.

6. **How does Dave Ramsey link clutter to budgeting?**

– He links clutter to poor budgeting practices, suggesting that a lack of financial planning can result in unnecessary purchases that contribute to clutter.

7. **What mindset change does Dave Ramsey advocate for reducing clutter and improving finances?**

– He advocates for a mindset shift towards valuing experiences over possessions and prioritizing financial goals over material accumulation.

Conclusion

Dave Ramsey argues that cluttered garages and attics symbolize the excessive consumerism and poor financial habits that contribute to many Americans being financially strapped. By accumulating unnecessary items, individuals often prioritize short-term gratification over long-term financial stability. This behavior reflects a broader issue of mismanaged finances, where money is spent on non-essential goods rather than saved or invested. Ramsey suggests that decluttering and adopting a more minimalist lifestyle can lead to better financial health by encouraging more mindful spending and saving practices.