“Unlocking the World of Crypto: Behind the Scenes of OTC Desks and Their Impact on the Market”

Introduction

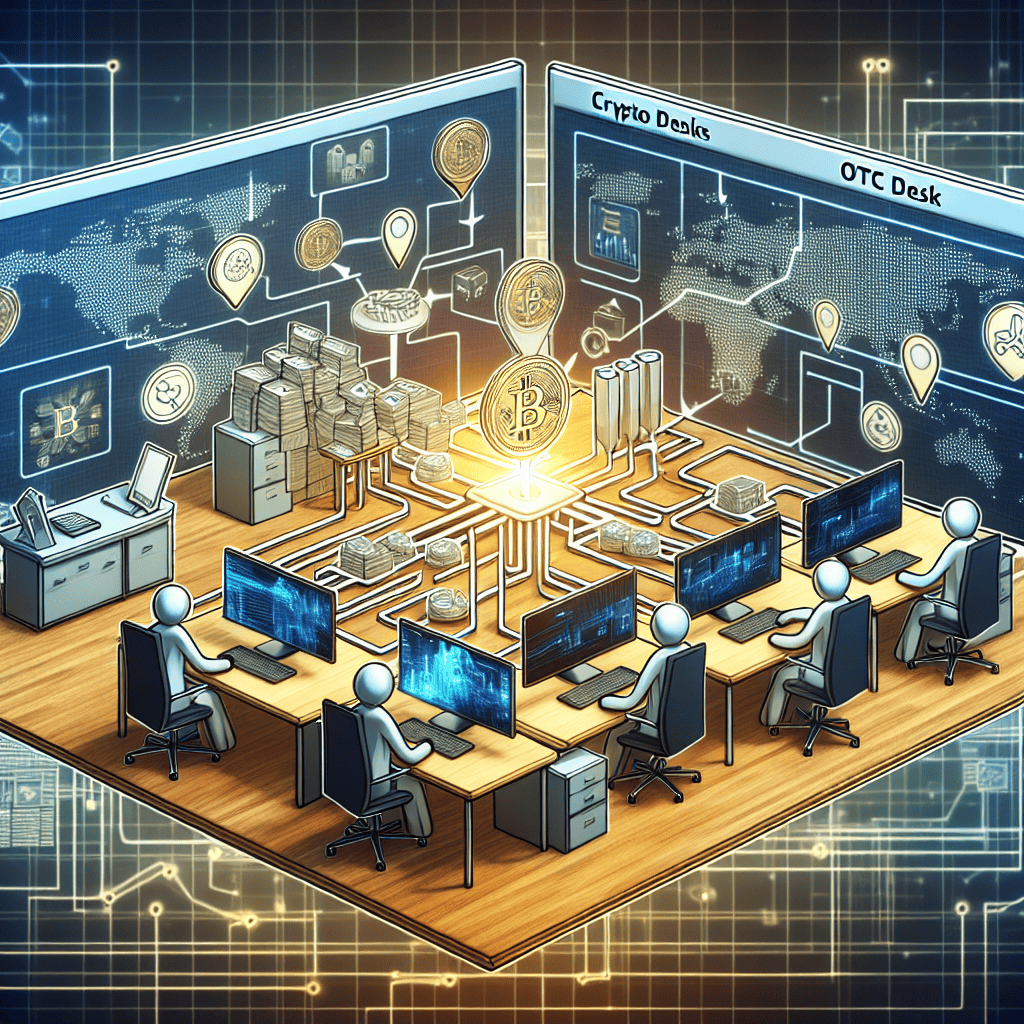

Over-the-counter (OTC) crypto desks play a crucial role in the cryptocurrency ecosystem, providing a platform for large-volume trades that might otherwise disrupt the market. Unlike traditional exchanges, OTC desks facilitate direct transactions between buyers and sellers, offering a more personalized and discreet service. These desks are essential for high-net-worth individuals, institutional investors, and companies looking to execute substantial trades without causing significant price fluctuations. By offering enhanced privacy, tailored services, and often better pricing for large trades, OTC desks help maintain market stability and liquidity. Their operation involves a network of brokers and traders who negotiate terms and ensure the secure transfer of assets, making them a vital component of the cryptocurrency market infrastructure.

Understanding Crypto OTC Desks: An Overview

Over-the-counter (OTC) desks play a pivotal role in the cryptocurrency market, providing a crucial service for large-scale investors seeking to trade significant amounts of digital assets without causing substantial market disruptions. Unlike traditional exchanges, where trades are executed on a public order book, OTC desks facilitate private transactions directly between buyers and sellers. This method of trading is particularly advantageous for institutional investors, high-net-worth individuals, and entities looking to move large volumes of cryptocurrency discreetly and efficiently.

The operation of crypto OTC desks is characterized by personalized service and tailored solutions. When a client approaches an OTC desk, they typically engage with a dedicated broker who assesses their specific needs and trading objectives. This personalized approach allows for the negotiation of terms that are mutually beneficial, including price, settlement time, and transaction size. The broker then leverages their network of liquidity providers to find a counterparty willing to fulfill the trade. This network often includes other institutional investors, hedge funds, and proprietary trading firms, all of whom are capable of handling large transactions.

One of the primary reasons OTC desks are essential in the crypto ecosystem is their ability to provide liquidity without impacting market prices. In a public exchange, executing a large order can lead to significant price slippage, where the act of buying or selling a substantial amount of cryptocurrency causes the price to move unfavorably. OTC desks mitigate this risk by conducting trades off-exchange, ensuring that large transactions do not affect the broader market. This capability is particularly important in the relatively volatile and less liquid cryptocurrency markets, where price stability is a concern for large investors.

Moreover, OTC desks offer a level of privacy and confidentiality that is not available on public exchanges. For many investors, especially those managing large portfolios, discretion is paramount. Publicly visible trades can attract unwanted attention and potentially influence market sentiment. By conducting transactions through OTC desks, investors can maintain anonymity and protect their trading strategies from being exposed to competitors or the public.

In addition to providing liquidity and privacy, OTC desks also offer a range of ancillary services that enhance the trading experience. These services may include market insights, risk management advice, and assistance with regulatory compliance. Given the complex and rapidly evolving nature of cryptocurrency regulations, having access to expert guidance can be invaluable for investors navigating this landscape. OTC desks often employ teams of specialists who are well-versed in the legal and regulatory aspects of cryptocurrency trading, ensuring that clients remain compliant with relevant laws and regulations.

Furthermore, the role of OTC desks extends beyond mere transaction facilitation; they also contribute to the overall maturation and stability of the cryptocurrency market. By providing a mechanism for large trades to occur without disrupting market equilibrium, OTC desks help to reduce volatility and foster a more stable trading environment. This stability, in turn, attracts more institutional participation, which is crucial for the long-term growth and legitimacy of the cryptocurrency industry.

In conclusion, crypto OTC desks are an integral component of the digital asset ecosystem, offering unique advantages that cater to the needs of large-scale investors. Through personalized service, enhanced privacy, and market stability, they enable significant transactions to occur smoothly and efficiently. As the cryptocurrency market continues to evolve, the importance of OTC desks is likely to grow, underscoring their role in shaping the future of digital finance.

The Role of Liquidity in Crypto OTC Transactions

In the rapidly evolving world of cryptocurrency, over-the-counter (OTC) desks play a pivotal role in facilitating large transactions that might otherwise disrupt the market. Understanding the role of liquidity in these transactions is crucial to appreciating how OTC desks operate and why they are essential to the crypto ecosystem. Liquidity, in the context of financial markets, refers to the ease with which an asset can be bought or sold without causing a significant impact on its price. In the cryptocurrency market, where volatility is a common characteristic, liquidity becomes even more critical. OTC desks provide a solution by offering a private and efficient way to execute large trades, thereby maintaining market stability.

To comprehend the significance of liquidity in crypto OTC transactions, it is important to first recognize the challenges faced by large-scale traders. When substantial amounts of cryptocurrency are traded on public exchanges, the sheer volume can lead to slippage, where the execution price deviates from the expected price due to insufficient liquidity. This is where OTC desks come into play, offering a more controlled environment for executing large trades. By matching buyers and sellers directly, OTC desks can facilitate transactions without the need to go through public order books, thus minimizing the risk of slippage and price manipulation.

Moreover, OTC desks contribute to market liquidity by providing a platform for institutional investors, high-net-worth individuals, and other large players to enter or exit positions without causing market disruptions. This is particularly important in the cryptocurrency market, where liquidity can vary significantly between different assets and exchanges. By aggregating liquidity from various sources, OTC desks ensure that large trades can be executed smoothly, thereby enhancing overall market efficiency.

In addition to providing liquidity, OTC desks offer several other advantages that make them an attractive option for large traders. One such advantage is the level of privacy they afford. Unlike public exchanges, where trades are visible to all market participants, OTC transactions are conducted off-exchange, allowing traders to maintain confidentiality. This is particularly appealing to institutional investors who may not wish to disclose their trading strategies or positions.

Furthermore, OTC desks often provide personalized services, including tailored pricing and settlement solutions, which can be particularly beneficial for complex transactions. This level of customization is not typically available on public exchanges, making OTC desks a preferred choice for those seeking bespoke trading solutions. Additionally, the expertise and market insights offered by OTC desk operators can be invaluable to traders navigating the often-volatile crypto landscape.

While the role of liquidity in crypto OTC transactions is paramount, it is also important to consider the potential risks associated with these trades. Counterparty risk, for instance, is a concern, as OTC transactions are not subject to the same regulatory oversight as those conducted on public exchanges. However, reputable OTC desks mitigate this risk by conducting thorough due diligence and implementing robust risk management practices.

In conclusion, the role of liquidity in crypto OTC transactions cannot be overstated. By providing a mechanism for executing large trades without impacting market prices, OTC desks play a crucial role in maintaining market stability and efficiency. Their ability to offer privacy, personalized services, and market insights further enhances their appeal to large traders. As the cryptocurrency market continues to mature, the importance of OTC desks and the liquidity they provide is likely to grow, underscoring their significance in the broader financial ecosystem.

Key Differences Between Crypto Exchanges and OTC Desks

In the rapidly evolving landscape of cryptocurrency trading, understanding the key differences between crypto exchanges and over-the-counter (OTC) desks is crucial for both novice and seasoned investors. While both platforms facilitate the buying and selling of digital assets, they operate in distinct ways and serve different purposes within the market. To begin with, crypto exchanges are digital marketplaces where buyers and sellers meet to trade cryptocurrencies. These platforms, such as Binance and Coinbase, are characterized by their public order books, where all buy and sell orders are visible to participants. This transparency allows for price discovery, as the market determines the value of a cryptocurrency based on supply and demand dynamics. However, this visibility can also lead to price volatility, especially when large orders are placed, as they can significantly impact the market price.

In contrast, OTC desks operate differently by providing a private and personalized trading experience. These desks cater to institutional investors or high-net-worth individuals who wish to execute large trades without causing market disruptions. By conducting transactions off the public exchanges, OTC desks offer a level of discretion and confidentiality that is not available on traditional exchanges. This privacy is particularly appealing to those who wish to avoid the potential slippage and price fluctuations that can occur with large trades on public platforms. Furthermore, OTC desks often provide a more tailored service, offering clients personalized quotes and the ability to negotiate terms directly with a broker. This bespoke approach can be advantageous for those seeking to execute complex trades or requiring specific settlement terms.

Another significant difference between crypto exchanges and OTC desks lies in their liquidity provision. Exchanges rely on the collective activity of their users to provide liquidity, which can vary depending on market conditions and the popularity of the traded asset. In contrast, OTC desks typically have access to a network of liquidity providers, enabling them to facilitate large trades more efficiently. This access to deep liquidity pools allows OTC desks to offer competitive pricing and execute trades swiftly, even for substantial volumes. Consequently, for investors looking to move large amounts of cryptocurrency, OTC desks can often provide a more stable and predictable trading environment.

Moreover, the regulatory landscape for crypto exchanges and OTC desks can differ significantly. Exchanges are often subject to stringent regulatory requirements, including know-your-customer (KYC) and anti-money laundering (AML) protocols. These regulations are designed to protect investors and ensure the integrity of the financial system. While OTC desks are not exempt from these requirements, they may operate under different regulatory frameworks depending on their jurisdiction. This can result in varying levels of oversight and compliance obligations, which may influence an investor’s choice between using an exchange or an OTC desk.

In conclusion, while both crypto exchanges and OTC desks play vital roles in the cryptocurrency market, they cater to different needs and preferences. Exchanges offer a transparent and accessible platform for retail investors, while OTC desks provide a discreet and customized service for those executing large trades. Understanding these key differences is essential for investors to make informed decisions and optimize their trading strategies. As the cryptocurrency market continues to mature, the coexistence of these platforms will likely remain integral to its development, offering diverse options to meet the varied demands of market participants.

How Crypto OTC Desks Ensure Privacy and Security

In the rapidly evolving world of cryptocurrency, over-the-counter (OTC) desks have emerged as pivotal players, particularly for large-scale transactions. These platforms facilitate the buying and selling of digital assets directly between parties, bypassing traditional exchanges. One of the primary reasons for their growing popularity is the enhanced privacy and security they offer, which are crucial for high-net-worth individuals and institutional investors. Understanding how crypto OTC desks ensure these aspects can provide valuable insights into their operation and significance.

To begin with, privacy is a cornerstone of OTC transactions. Unlike public exchanges where trades are recorded on an open order book, OTC desks conduct transactions off the public ledger. This means that the details of the trade, including the identities of the parties involved and the amount transacted, remain confidential. This level of privacy is particularly appealing to investors who wish to avoid market speculation or the potential impact of large trades on market prices. By keeping transactions discreet, OTC desks help maintain market stability and protect the interests of their clients.

Moreover, OTC desks employ stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols to ensure that all parties involved in a transaction are verified and legitimate. This not only enhances the security of the transaction but also builds trust between the parties. By adhering to these regulatory requirements, OTC desks mitigate the risk of fraud and illicit activities, which are prevalent concerns in the cryptocurrency space. The rigorous vetting process acts as a safeguard, ensuring that only credible participants engage in transactions.

In addition to privacy, security is another critical aspect that OTC desks prioritize. They implement advanced technological solutions to protect the digital assets involved in transactions. For instance, many OTC desks utilize multi-signature wallets, which require multiple private keys to authorize a transaction. This adds an extra layer of security, making it significantly more challenging for unauthorized parties to access the funds. Furthermore, OTC desks often employ cold storage solutions, where digital assets are stored offline, away from potential cyber threats. This reduces the risk of hacking, a common concern in the cryptocurrency industry.

Another way OTC desks ensure security is through the use of escrow services. In an OTC transaction, an escrow service acts as a neutral third party that holds the assets until both parties fulfill their obligations. This arrangement provides assurance to both the buyer and the seller, as it ensures that the transaction will only be completed once all conditions are met. By minimizing the risk of default, escrow services enhance the overall security of the transaction process.

In conclusion, crypto OTC desks play a crucial role in the cryptocurrency ecosystem by offering enhanced privacy and security for large-scale transactions. Through discreet trading practices, stringent KYC and AML protocols, advanced technological solutions, and the use of escrow services, these platforms provide a secure and private environment for investors. As the cryptocurrency market continues to grow and mature, the importance of OTC desks is likely to increase, making them an indispensable component of the digital asset landscape. Their ability to ensure privacy and security not only attracts high-net-worth individuals and institutional investors but also contributes to the overall stability and integrity of the cryptocurrency market.

The Impact of OTC Desks on Cryptocurrency Market Prices

Over-the-counter (OTC) desks play a pivotal role in the cryptocurrency market, significantly impacting market prices and dynamics. These platforms facilitate large-volume trades outside of traditional exchanges, offering a discreet and efficient way for institutional investors and high-net-worth individuals to buy or sell substantial amounts of cryptocurrency. As the cryptocurrency market matures, understanding the influence of OTC desks on market prices becomes increasingly important.

To begin with, OTC desks provide liquidity to the cryptocurrency market, which is crucial for maintaining price stability. Unlike public exchanges, where large trades can lead to significant price slippage due to limited order book depth, OTC desks allow for the execution of large transactions without directly affecting the market price. This is achieved by matching buyers and sellers off-exchange, thus preventing large orders from causing sudden price fluctuations. Consequently, OTC desks help maintain a more stable market environment, which is beneficial for both traders and investors.

Moreover, the presence of OTC desks can lead to more accurate price discovery in the cryptocurrency market. By facilitating large trades privately, these desks gather valuable information about the demand and supply dynamics of various cryptocurrencies. This information, although not publicly disclosed, can influence the pricing strategies of market participants. As a result, OTC desks indirectly contribute to a more informed and efficient market, where prices better reflect the underlying value of the assets.

In addition to providing liquidity and aiding in price discovery, OTC desks also play a role in reducing market volatility. By absorbing large trades that would otherwise disrupt the market, these platforms help mitigate the impact of sudden price swings. This is particularly important in the cryptocurrency market, which is known for its high volatility. By offering a more controlled environment for large transactions, OTC desks contribute to a more stable market, which can attract more institutional investors seeking to minimize risk.

Furthermore, the operations of OTC desks can have a ripple effect on the broader cryptocurrency market. As these platforms handle significant trading volumes, they can influence market sentiment and investor behavior. For instance, a surge in OTC trading activity might signal increased interest from institutional investors, which could lead to a positive shift in market sentiment. Conversely, a decline in OTC activity might indicate waning interest, potentially leading to bearish market conditions. Thus, the activity levels of OTC desks can serve as an indicator of broader market trends.

It is also worth noting that the regulatory environment surrounding OTC desks can impact their influence on market prices. As regulators around the world continue to develop frameworks for cryptocurrency trading, the operations of OTC desks may be subject to increased scrutiny. This could lead to changes in how these platforms operate, potentially affecting their ability to provide liquidity and influence market prices. Therefore, staying informed about regulatory developments is essential for understanding the future impact of OTC desks on the cryptocurrency market.

In conclusion, OTC desks are integral to the cryptocurrency market, providing liquidity, aiding in price discovery, and reducing volatility. Their operations have a significant impact on market prices and dynamics, influencing both institutional and retail investor behavior. As the market continues to evolve, the role of OTC desks will likely remain crucial, underscoring the importance of understanding their impact on cryptocurrency market prices.

Navigating Regulatory Challenges in Crypto OTC Trading

In the rapidly evolving landscape of cryptocurrency trading, over-the-counter (OTC) desks have emerged as pivotal players, offering a unique avenue for large-scale transactions. These platforms facilitate the buying and selling of substantial amounts of digital assets outside the traditional exchanges, providing a level of privacy and efficiency that is often sought by institutional investors and high-net-worth individuals. However, as the popularity of crypto OTC desks continues to rise, so too does the scrutiny from regulatory bodies worldwide. Navigating the regulatory challenges in crypto OTC trading has become a critical aspect of their operation, requiring a nuanced understanding of both the financial and legal landscapes.

To begin with, the primary appeal of OTC desks lies in their ability to execute large trades without causing significant market disruptions. Unlike public exchanges, where large orders can lead to price slippage and increased volatility, OTC desks offer a more controlled environment. This is achieved through direct negotiations between buyers and sellers, often facilitated by brokers who ensure that both parties agree on the terms of the trade. However, this very feature that makes OTC trading attractive also raises concerns among regulators, who are tasked with ensuring market integrity and preventing illicit activities such as money laundering and fraud.

In response to these concerns, regulatory bodies have been increasingly focused on implementing frameworks that ensure transparency and compliance in OTC trading. For instance, Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations are now standard requirements for OTC desks, necessitating thorough verification processes for all participants. These measures are designed to prevent the misuse of crypto assets for illegal purposes, thereby safeguarding the financial system. Nevertheless, the decentralized and often anonymous nature of cryptocurrencies presents inherent challenges in enforcing these regulations, prompting ongoing debates about the most effective approaches.

Moreover, the global nature of cryptocurrency trading adds another layer of complexity to the regulatory landscape. Different jurisdictions have varying rules and standards, leading to a fragmented regulatory environment. For OTC desks operating across borders, this means navigating a patchwork of regulations, each with its own set of compliance requirements. Consequently, many OTC desks have adopted a proactive approach, engaging with regulators and industry bodies to help shape policies that balance innovation with security. This collaborative effort is crucial in fostering an environment where crypto OTC trading can thrive while adhering to legal standards.

Furthermore, technological advancements are playing a significant role in addressing regulatory challenges. Blockchain analytics tools, for example, are being employed to enhance transparency and traceability in OTC transactions. These tools enable the monitoring of transaction flows, helping to identify suspicious activities and ensure compliance with regulatory requirements. By leveraging such technologies, OTC desks can not only meet regulatory expectations but also build trust with their clients, who are increasingly demanding greater accountability and security.

In conclusion, while crypto OTC desks offer significant advantages for large-scale traders, they operate within a complex regulatory framework that requires careful navigation. The challenges posed by regulatory requirements are multifaceted, involving issues of transparency, compliance, and cross-border coordination. However, through proactive engagement with regulators and the adoption of innovative technologies, OTC desks are well-positioned to address these challenges. As the cryptocurrency market continues to mature, the role of OTC desks will undoubtedly remain integral, underscoring the importance of a balanced regulatory approach that supports both growth and security in the digital asset space.

The Future of Crypto OTC Desks in a Growing Market

As the cryptocurrency market continues to expand, the role of over-the-counter (OTC) desks becomes increasingly significant. These platforms, which facilitate the direct trading of large volumes of cryptocurrencies between buyers and sellers, operate outside of traditional exchanges. This unique positioning allows them to offer several advantages, particularly in terms of liquidity and privacy, which are crucial for institutional investors and high-net-worth individuals. Understanding how crypto OTC desks function and their potential future in a burgeoning market is essential for stakeholders looking to navigate the evolving landscape of digital assets.

To begin with, crypto OTC desks provide a tailored service that caters to the specific needs of their clients. Unlike public exchanges, where large trades can significantly impact market prices, OTC desks enable transactions to occur discreetly and without causing price slippage. This is achieved through a network of liquidity providers and counterparties, which allows OTC desks to match buy and sell orders efficiently. By doing so, they maintain market stability and offer competitive pricing, which is particularly appealing to those executing substantial trades.

Moreover, the operational framework of OTC desks is designed to ensure a high level of confidentiality. Transactions conducted through these platforms are not recorded on public order books, thereby preserving the anonymity of the parties involved. This aspect is particularly attractive to institutional investors who prioritize discretion in their trading activities. Additionally, OTC desks often provide personalized services, including dedicated account managers and bespoke trading strategies, which further enhance their appeal to sophisticated market participants.

As the cryptocurrency market matures, the demand for OTC services is expected to grow. This growth is driven by several factors, including the increasing interest from institutional investors and the ongoing development of regulatory frameworks. Institutional players, such as hedge funds and asset managers, are gradually entering the crypto space, seeking exposure to digital assets as part of their diversified portfolios. OTC desks, with their ability to handle large transactions efficiently and discreetly, are well-positioned to accommodate this influx of institutional capital.

Furthermore, the evolving regulatory landscape is likely to play a pivotal role in shaping the future of crypto OTC desks. As governments and regulatory bodies worldwide work towards establishing clear guidelines for cryptocurrency trading, OTC desks are expected to adapt to these changes by enhancing their compliance measures. This could involve implementing more robust know-your-customer (KYC) and anti-money laundering (AML) protocols, which would not only ensure adherence to regulations but also bolster the credibility and trustworthiness of OTC services.

In addition to regulatory developments, technological advancements are poised to influence the future trajectory of crypto OTC desks. Innovations such as blockchain analytics and artificial intelligence could enhance the efficiency and security of OTC transactions, providing clients with even greater confidence in these services. As technology continues to evolve, OTC desks may also explore new avenues for growth, such as expanding their offerings to include a wider range of digital assets or integrating decentralized finance (DeFi) solutions.

In conclusion, crypto OTC desks play a crucial role in the cryptocurrency ecosystem by facilitating large-scale trades with minimal market disruption. As the market continues to grow and attract institutional interest, the demand for OTC services is likely to increase. By adapting to regulatory changes and leveraging technological advancements, OTC desks can position themselves as indispensable players in the future of digital asset trading. Their ability to provide liquidity, privacy, and personalized service will remain key factors in their continued relevance and success in a dynamic and rapidly evolving market.

Q&A

1. **What is a Crypto OTC Desk?**

A Crypto OTC (Over-the-Counter) Desk is a service that facilitates the direct trading of large quantities of cryptocurrencies between buyers and sellers, bypassing public exchanges.

2. **How do Crypto OTC Desks operate?**

They operate by connecting buyers and sellers directly, often through brokers or trading platforms, to negotiate trades privately, ensuring liquidity and minimizing market impact.

3. **Why do traders use Crypto OTC Desks?**

Traders use OTC desks to execute large trades without causing significant price fluctuations on public exchanges, to maintain privacy, and to access better pricing and liquidity.

4. **What are the advantages of using a Crypto OTC Desk?**

Advantages include reduced slippage, enhanced privacy, personalized service, and the ability to trade large volumes efficiently.

5. **What are the risks associated with Crypto OTC Desks?**

Risks include counterparty risk, lack of transparency, potential for fraud, and regulatory uncertainties.

6. **How do Crypto OTC Desks ensure security?**

They ensure security through measures like KYC/AML compliance, secure transaction protocols, and sometimes using escrow services to mitigate counterparty risk.

7. **Why do Crypto OTC Desks matter in the cryptocurrency market?**

They matter because they provide essential liquidity, enable large-scale transactions, and contribute to market stability by preventing large trades from disrupting public exchange prices.

Conclusion

Crypto OTC (Over-the-Counter) desks play a crucial role in the cryptocurrency market by facilitating large-volume trades that might otherwise disrupt the market if executed on traditional exchanges. These desks operate by connecting buyers and sellers directly, often providing personalized service and better pricing for substantial transactions. They offer increased privacy, reduced slippage, and enhanced liquidity, making them attractive to institutional investors and high-net-worth individuals. By enabling these large trades, OTC desks contribute to market stability and liquidity, supporting the broader adoption and maturation of the cryptocurrency ecosystem.