“Unlock the Future: Could Investing in AMD Be Your Millionaire Move?”

Introduction

Investing in Advanced Micro Devices (AMD) has captured the attention of many investors seeking substantial returns in the ever-evolving technology sector. As a leading player in the semiconductor industry, AMD has demonstrated remarkable growth and innovation, challenging its competitors with cutting-edge products and strategic market positioning. The company’s advancements in high-performance computing, graphics, and visualization technologies have fueled its expansion into diverse markets, including gaming, data centers, and artificial intelligence. With a robust product pipeline and a commitment to technological excellence, AMD presents a compelling investment opportunity. However, the question remains: could investing in AMD truly make you a millionaire? This inquiry delves into the factors influencing AMD’s market performance, the potential for future growth, and the risks involved, providing a comprehensive analysis for investors considering this dynamic and promising company.

Understanding Advanced Micro Devices: A Comprehensive Overview

Advanced Micro Devices, commonly known as AMD, has emerged as a formidable player in the semiconductor industry, challenging the dominance of long-established competitors. To understand whether investing in AMD could potentially make one a millionaire, it is essential to delve into the company’s history, its strategic initiatives, and the broader market dynamics that influence its performance. Founded in 1969, AMD has undergone significant transformations, evolving from a second-source supplier of microchips to a leading innovator in high-performance computing, graphics, and visualization technologies. This evolution has been marked by strategic pivots and a relentless focus on research and development, which have enabled AMD to carve out a niche in the highly competitive semiconductor market.

One of the pivotal moments in AMD’s history was its decision to focus on developing advanced processors and graphics technologies. This strategic shift was underscored by the launch of the Ryzen series of processors and the Radeon line of graphics cards, which have been well-received by both consumers and industry experts. These products have not only enhanced AMD’s reputation for delivering high-performance solutions but have also contributed significantly to its financial growth. The company’s ability to innovate and deliver products that meet the evolving needs of consumers and businesses alike has been a key driver of its success.

Moreover, AMD’s strategic partnerships and acquisitions have further bolstered its market position. The acquisition of Xilinx, a leader in adaptive computing, is a testament to AMD’s commitment to expanding its technological capabilities and addressing a broader range of market segments. This acquisition is expected to enhance AMD’s product portfolio and provide new growth opportunities in areas such as data centers, automotive, and telecommunications. By integrating Xilinx’s expertise in field-programmable gate arrays (FPGAs) with its own strengths, AMD is well-positioned to capitalize on the growing demand for adaptive and intelligent computing solutions.

In addition to its strategic initiatives, AMD’s financial performance has been impressive, with consistent revenue growth and expanding profit margins. The company’s ability to generate strong cash flows has enabled it to invest in research and development, further fueling innovation and product development. This financial strength has also allowed AMD to return value to shareholders through share buybacks and potential dividends, making it an attractive option for investors seeking long-term growth.

However, investing in AMD is not without risks. The semiconductor industry is characterized by rapid technological advancements and intense competition, which can impact AMD’s market share and profitability. Additionally, global supply chain disruptions and geopolitical tensions can pose challenges to the company’s operations and financial performance. Therefore, potential investors must carefully consider these factors and conduct thorough due diligence before making investment decisions.

In conclusion, while investing in AMD presents an opportunity for significant financial gains, it is crucial to approach such investments with a comprehensive understanding of the company’s strategic direction, market position, and the broader industry landscape. By doing so, investors can make informed decisions that align with their financial goals and risk tolerance. While there are no guarantees in the world of investing, AMD’s track record of innovation and growth suggests that it remains a compelling option for those seeking exposure to the dynamic and ever-evolving semiconductor industry.

The Growth Potential of Advanced Micro Devices in the Semiconductor Industry

Advanced Micro Devices (AMD) has emerged as a formidable player in the semiconductor industry, capturing the attention of investors and technology enthusiasts alike. As the demand for high-performance computing and graphics solutions continues to surge, AMD’s growth potential appears promising. The company’s strategic initiatives, innovative product offerings, and expanding market presence suggest that investing in AMD could potentially yield substantial returns, possibly even making investors millionaires.

To understand AMD’s growth potential, it is essential to consider the broader context of the semiconductor industry. The industry is experiencing unprecedented growth, driven by the proliferation of artificial intelligence, cloud computing, and the Internet of Things (IoT). These technological advancements require powerful and efficient semiconductor solutions, creating a fertile ground for companies like AMD to thrive. As a result, AMD has positioned itself as a key player in this rapidly evolving landscape, leveraging its expertise to deliver cutting-edge products that meet the demands of modern computing.

One of the critical factors contributing to AMD’s growth potential is its innovative product lineup. The company has consistently pushed the boundaries of performance with its Ryzen processors and Radeon graphics cards. These products have gained significant traction in both consumer and enterprise markets, challenging the dominance of competitors like Intel and NVIDIA. AMD’s ability to deliver high-performance solutions at competitive prices has resonated with consumers, leading to increased market share and revenue growth. Furthermore, the company’s commitment to research and development ensures that it remains at the forefront of technological advancements, positioning it well for future growth.

In addition to its product offerings, AMD’s strategic partnerships and acquisitions have bolstered its growth prospects. Collaborations with major technology companies, such as Microsoft and Sony, have solidified AMD’s presence in the gaming console market. The company’s custom chips power popular gaming consoles like the Xbox Series X and PlayStation 5, providing a steady revenue stream and enhancing its brand recognition. Moreover, AMD’s acquisition of Xilinx, a leader in adaptive computing solutions, has expanded its capabilities and opened new avenues for growth in data centers and telecommunications.

The semiconductor industry is not without its challenges, and AMD faces competition from established players. However, the company’s ability to adapt and innovate has allowed it to navigate these challenges effectively. AMD’s focus on energy-efficient solutions and its commitment to sustainability align with the growing demand for environmentally conscious technology, further enhancing its appeal to investors and consumers alike.

While the potential for significant returns exists, it is important to acknowledge the inherent risks associated with investing in the semiconductor industry. Market volatility, supply chain disruptions, and geopolitical tensions can impact the industry’s dynamics. Therefore, investors should conduct thorough research and consider their risk tolerance before making investment decisions.

In conclusion, AMD’s growth potential in the semiconductor industry is underpinned by its innovative product offerings, strategic partnerships, and expanding market presence. As the demand for high-performance computing solutions continues to rise, AMD is well-positioned to capitalize on these opportunities. While investing in AMD carries risks, the company’s track record of innovation and adaptability suggests that it could potentially yield substantial returns for investors. Consequently, for those willing to navigate the complexities of the semiconductor industry, investing in AMD could indeed be a pathway to significant financial gains, possibly even making them millionaires.

Analyzing the Financial Health of Advanced Micro Devices

Investing in Advanced Micro Devices (AMD) has become an increasingly popular topic among investors seeking substantial returns. To determine whether AMD could potentially make you a millionaire, it is crucial to analyze the company’s financial health. This involves examining various financial metrics and understanding the broader market context in which AMD operates. By doing so, investors can make informed decisions about the potential risks and rewards associated with investing in this semiconductor giant.

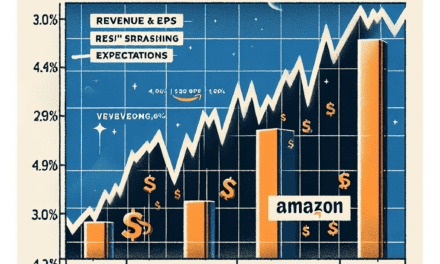

First and foremost, AMD’s revenue growth is a key indicator of its financial health. Over the past few years, the company has demonstrated impressive revenue growth, driven by its innovative product offerings and strategic market positioning. AMD’s focus on high-performance computing, graphics, and visualization technologies has allowed it to capture significant market share from competitors. This growth trajectory is further supported by the increasing demand for advanced computing solutions across various industries, including gaming, data centers, and artificial intelligence. As a result, AMD’s revenue growth has consistently outpaced industry averages, signaling strong financial health.

In addition to revenue growth, profitability is another critical aspect to consider. AMD has made significant strides in improving its profitability, as evidenced by its rising gross margins and net income. The company’s ability to enhance its operational efficiency and reduce production costs has contributed to these improvements. Moreover, AMD’s strategic partnerships and collaborations have enabled it to leverage economies of scale, further boosting its profitability. These factors suggest that AMD is well-positioned to sustain its financial health in the long term.

Furthermore, AMD’s balance sheet provides valuable insights into its financial stability. The company has maintained a healthy balance sheet, characterized by a manageable level of debt and strong liquidity. This financial stability is crucial for AMD to continue investing in research and development, which is essential for maintaining its competitive edge in the rapidly evolving semiconductor industry. Additionally, a robust balance sheet allows AMD to weather economic downturns and capitalize on growth opportunities as they arise.

While AMD’s financial health appears strong, it is important to consider the broader market dynamics that could impact its future performance. The semiconductor industry is highly competitive, with major players such as Intel and NVIDIA constantly vying for market share. AMD’s ability to innovate and differentiate its products will be critical in maintaining its competitive advantage. Moreover, global supply chain disruptions and geopolitical tensions could pose challenges to AMD’s operations and financial performance. Investors should remain vigilant and consider these external factors when evaluating AMD’s potential as an investment.

In conclusion, analyzing the financial health of Advanced Micro Devices reveals a company with strong revenue growth, improving profitability, and a stable balance sheet. These factors suggest that AMD is well-positioned to capitalize on the growing demand for advanced computing solutions. However, potential investors should also consider the competitive landscape and external risks that could impact AMD’s future performance. While investing in AMD carries inherent risks, the company’s solid financial foundation and strategic market positioning offer promising prospects for those seeking substantial returns. Ultimately, whether investing in AMD could make you a millionaire depends on a combination of the company’s continued financial success and the investor’s ability to navigate the complexities of the semiconductor industry.

Key Innovations Driving Advanced Micro Devices’ Market Position

Advanced Micro Devices (AMD) has long been a formidable player in the semiconductor industry, consistently pushing the boundaries of technology and innovation. As investors seek opportunities that could potentially yield substantial returns, AMD’s strategic advancements and market positioning warrant a closer examination. The company’s commitment to innovation is a key driver of its market position, and understanding these innovations can provide valuable insights into its potential for generating significant investor returns.

One of the most significant innovations propelling AMD’s market position is its development of high-performance computing solutions. AMD’s Ryzen processors have revolutionized the consumer and professional computing markets by offering exceptional performance at competitive prices. These processors have not only challenged the dominance of industry giants like Intel but have also set new standards for computing power and efficiency. By leveraging advanced architecture and manufacturing processes, AMD has been able to deliver products that meet the growing demands of both gamers and professionals, thereby expanding its market share and enhancing its reputation as a leader in the industry.

In addition to its success in the CPU market, AMD has made substantial strides in the graphics processing unit (GPU) sector. The company’s Radeon graphics cards have gained significant traction among gamers and creative professionals alike. With the rise of gaming, virtual reality, and content creation, the demand for powerful GPUs has surged. AMD’s focus on delivering cutting-edge graphics technology has positioned it as a strong competitor to NVIDIA, the dominant player in the GPU market. By continuously innovating and improving its GPU offerings, AMD has captured the attention of consumers and investors, further solidifying its market position.

Moreover, AMD’s strategic partnerships and collaborations have played a crucial role in driving its market success. The company’s collaboration with major technology firms, such as Microsoft and Sony, to supply custom chips for gaming consoles has been a game-changer. These partnerships have not only provided AMD with a steady revenue stream but have also enhanced its brand visibility and credibility. As the gaming industry continues to grow, AMD’s involvement in this sector positions it well for future success.

Transitioning from consumer markets to data centers, AMD’s innovations in server processors have also been noteworthy. The introduction of the EPYC line of server processors has disrupted the data center market, traditionally dominated by Intel. AMD’s EPYC processors offer superior performance and energy efficiency, making them an attractive choice for data center operators seeking to optimize their operations. This shift in the data center landscape has opened up new revenue streams for AMD and has the potential to significantly impact its financial performance.

Furthermore, AMD’s commitment to research and development underscores its dedication to staying at the forefront of technological advancements. By investing heavily in R&D, AMD ensures that it remains competitive in an ever-evolving industry. This commitment not only drives product innovation but also enhances the company’s ability to adapt to changing market dynamics and consumer preferences.

In conclusion, AMD’s key innovations in high-performance computing, graphics technology, strategic partnerships, and data center solutions have been instrumental in driving its market position. While investing in AMD carries inherent risks, as with any investment, the company’s track record of innovation and strategic growth initiatives suggests that it holds the potential to deliver substantial returns. As AMD continues to push the boundaries of technology, investors may find themselves well-positioned to benefit from the company’s ongoing success and market leadership.

Risks and Challenges Facing Advanced Micro Devices Investors

Investing in Advanced Micro Devices (AMD) has been a topic of considerable interest among investors, particularly given the company’s impressive growth trajectory in recent years. However, while the potential for substantial returns is enticing, it is crucial to understand the risks and challenges that could impact AMD’s future performance. By examining these factors, investors can make more informed decisions about whether AMD could indeed be a pathway to significant wealth.

To begin with, one of the primary risks facing AMD is the highly competitive nature of the semiconductor industry. This sector is characterized by rapid technological advancements and intense rivalry among key players, including Intel and NVIDIA. These competitors have substantial resources and established market positions, which they leverage to maintain their dominance. Consequently, AMD must continuously innovate and improve its product offerings to capture and retain market share. Failure to do so could result in a loss of competitive edge, adversely affecting its financial performance and, by extension, investor returns.

Moreover, the semiconductor industry is subject to cyclical fluctuations, which can pose challenges for AMD. Economic downturns or shifts in consumer demand can lead to reduced sales and profitability. For instance, a slowdown in the personal computer market or a decline in demand for gaming consoles could negatively impact AMD’s revenue streams. Additionally, supply chain disruptions, such as those experienced during the COVID-19 pandemic, can exacerbate these cyclical challenges by causing delays in production and delivery, further affecting the company’s bottom line.

Another significant challenge for AMD is the reliance on third-party manufacturers for chip production. AMD outsources its manufacturing to companies like Taiwan Semiconductor Manufacturing Company (TSMC), which introduces a layer of dependency that can be risky. Any issues faced by these manufacturers, such as capacity constraints or geopolitical tensions, could hinder AMD’s ability to meet market demand. This reliance also limits AMD’s control over production costs, which can fluctuate based on external factors, impacting profit margins.

In addition to these industry-specific risks, AMD must navigate broader economic and geopolitical uncertainties. Trade tensions, particularly between the United States and China, could result in tariffs or restrictions that affect AMD’s operations and access to key markets. Furthermore, changes in government regulations or policies related to technology exports and intellectual property could pose additional challenges. These factors create an unpredictable environment that requires AMD to be agile and adaptable to maintain its growth trajectory.

Despite these risks, it is important to acknowledge that AMD has demonstrated resilience and strategic acumen in recent years. The company’s focus on innovation, particularly in high-performance computing and graphics technologies, has positioned it well to capitalize on emerging trends such as artificial intelligence and data center expansion. However, investors must weigh these opportunities against the inherent risks and challenges to determine whether AMD aligns with their investment goals and risk tolerance.

In conclusion, while investing in Advanced Micro Devices holds the potential for significant financial rewards, it is not without its challenges. The competitive landscape, cyclical nature of the industry, reliance on third-party manufacturers, and broader economic uncertainties all present risks that could impact AMD’s future performance. Therefore, prospective investors should conduct thorough research and consider these factors carefully before deciding if AMD could indeed be a pathway to becoming a millionaire.

Comparing Advanced Micro Devices with Competitors: A Market Analysis

In the ever-evolving landscape of technology, investors are constantly on the lookout for opportunities that could potentially yield substantial returns. One company that has garnered significant attention in recent years is Advanced Micro Devices (AMD). As a leading player in the semiconductor industry, AMD has positioned itself as a formidable competitor to giants like Intel and NVIDIA. To understand whether investing in AMD could make you a millionaire, it is essential to compare its market position and performance with its competitors.

AMD has made remarkable strides in the semiconductor market, particularly with its Ryzen and EPYC processors. These products have not only challenged Intel’s dominance in the CPU market but have also gained a substantial market share. AMD’s focus on innovation and performance has allowed it to offer competitive alternatives to Intel’s offerings, often at a more attractive price point. This strategy has resonated well with consumers and businesses alike, leading to increased adoption of AMD products.

In contrast, Intel, a long-standing leader in the semiconductor industry, has faced challenges in recent years. Delays in the rollout of new technologies and increased competition from AMD have put pressure on Intel’s market share. However, Intel’s extensive resources and established relationships with major tech companies provide it with a strong foundation to potentially regain its footing. Despite these challenges, Intel remains a formidable competitor, and its ability to innovate and adapt will be crucial in maintaining its position in the market.

Meanwhile, NVIDIA, known for its dominance in the graphics processing unit (GPU) market, presents another layer of competition for AMD. NVIDIA’s GPUs are widely regarded as the gold standard for gaming and professional applications, and the company has successfully expanded into areas such as artificial intelligence and data centers. AMD, however, has made significant inroads with its Radeon graphics cards, offering competitive performance and value. The competition between AMD and NVIDIA in the GPU space is fierce, with both companies continuously pushing the boundaries of technology to capture a larger share of the market.

As AMD continues to challenge its competitors, it is important to consider the broader market dynamics. The semiconductor industry is characterized by rapid technological advancements and cyclical demand patterns. Companies that can consistently innovate and adapt to changing market conditions are more likely to succeed. AMD’s recent performance suggests that it is well-positioned to capitalize on these trends, but investors should remain vigilant and consider potential risks, such as supply chain disruptions and geopolitical tensions, which could impact the industry.

Furthermore, the financial health and strategic direction of AMD play a crucial role in its potential to generate substantial returns for investors. AMD’s strong revenue growth and improving profitability are positive indicators, but the company must continue to execute its strategy effectively to maintain its competitive edge. Additionally, AMD’s ability to expand into new markets and diversify its product offerings will be key factors in determining its long-term success.

In conclusion, while investing in AMD presents an intriguing opportunity, it is essential to weigh the company’s strengths against the competitive pressures it faces from industry giants like Intel and NVIDIA. The potential for significant returns exists, but it is contingent upon AMD’s ability to sustain its growth trajectory and navigate the challenges inherent in the semiconductor industry. As with any investment, thorough research and a clear understanding of market dynamics are crucial in making informed decisions that could potentially lead to substantial financial gains.

Long-term Investment Strategies for Advanced Micro Devices Stocks

Investing in Advanced Micro Devices (AMD) has become an increasingly popular topic among investors seeking long-term growth opportunities. As a leading player in the semiconductor industry, AMD has demonstrated remarkable resilience and innovation, positioning itself as a formidable competitor to giants like Intel and NVIDIA. To understand whether investing in AMD could potentially make you a millionaire, it is essential to examine the company’s strategic initiatives, market position, and growth prospects.

AMD’s success can be attributed to its relentless focus on innovation and its ability to adapt to the rapidly evolving technological landscape. The company’s strategic shift towards high-performance computing and graphics solutions has paid off significantly. With the launch of its Ryzen processors and Radeon graphics cards, AMD has captured a substantial share of the market, challenging Intel’s dominance in the CPU space and NVIDIA’s stronghold in the GPU market. This competitive edge has been further bolstered by AMD’s commitment to developing cutting-edge technologies, such as its 7nm process technology, which has set new standards for performance and efficiency.

Moreover, AMD’s strategic partnerships and acquisitions have played a crucial role in enhancing its market position. The acquisition of Xilinx, a leader in adaptive computing, has expanded AMD’s product portfolio and opened new avenues for growth in data centers, automotive, and 5G communications. This move not only diversifies AMD’s revenue streams but also strengthens its foothold in emerging markets, which are expected to drive significant demand for semiconductor solutions in the coming years.

In addition to its robust product lineup and strategic initiatives, AMD’s financial performance has been impressive. The company has consistently reported strong revenue growth, driven by increased demand for its products across various sectors. This financial stability provides a solid foundation for long-term investment, as it indicates the company’s ability to generate sustainable profits and reinvest in future growth opportunities. Furthermore, AMD’s prudent management of its balance sheet, with a focus on reducing debt and improving cash flow, enhances its financial resilience and positions it well to weather economic uncertainties.

However, while AMD’s growth prospects are promising, potential investors must also consider the inherent risks associated with investing in the semiconductor industry. The sector is characterized by rapid technological advancements, intense competition, and cyclical demand patterns, which can lead to volatility in stock prices. Additionally, geopolitical tensions and supply chain disruptions pose significant challenges that could impact AMD’s operations and profitability.

To mitigate these risks, a long-term investment strategy in AMD should involve a thorough analysis of the company’s fundamentals, competitive landscape, and industry trends. Diversifying one’s investment portfolio to include a mix of growth and value stocks can also help manage risk and enhance potential returns. Moreover, staying informed about AMD’s strategic developments and market dynamics is crucial for making informed investment decisions.

In conclusion, while investing in AMD carries certain risks, the company’s strong market position, innovative product offerings, and strategic initiatives present compelling opportunities for long-term growth. By adopting a well-researched and diversified investment strategy, investors could potentially benefit from AMD’s continued success and, over time, achieve significant financial gains. However, as with any investment, it is essential to remain vigilant and adaptable to changing market conditions to maximize the potential for wealth accumulation.

Q&A

1. **What is Advanced Micro Devices (AMD)?**

AMD is a multinational semiconductor company that develops computer processors and related technologies for business and consumer markets.

2. **What factors could contribute to AMD making you a millionaire?**

Factors include strong financial performance, innovative product development, market expansion, strategic partnerships, and effective competition against rivals like Intel and NVIDIA.

3. **What are the risks associated with investing in AMD?**

Risks include market volatility, intense competition, supply chain disruptions, technological changes, and potential regulatory challenges.

4. **How has AMD’s stock performed historically?**

AMD’s stock has experienced significant growth over the past decade, with periods of volatility, reflecting its competitive advancements and market position.

5. **What role does innovation play in AMD’s potential for growth?**

Innovation is crucial, as AMD’s ability to develop cutting-edge technology and products can drive market share gains and revenue growth.

6. **How does AMD’s competition affect its investment potential?**

Competition from companies like Intel and NVIDIA can impact AMD’s market share and pricing power, influencing its profitability and stock performance.

7. **What should investors consider before investing in AMD?**

Investors should consider AMD’s financial health, market trends, competitive landscape, product pipeline, and their own risk tolerance and investment goals.

Conclusion

Investing in Advanced Micro Devices (AMD) has the potential to yield significant returns, given its strong position in the semiconductor industry, innovative product offerings, and strategic partnerships. However, becoming a millionaire through investing in AMD depends on various factors, including the timing of the investment, the amount invested, market conditions, and the investor’s ability to manage risk. While AMD has shown impressive growth and resilience, the volatile nature of the tech industry and external economic factors can impact its stock performance. Therefore, while AMD could be a lucrative investment, achieving millionaire status would require careful planning, diversification, and a long-term investment strategy.