“Discover Where You Stand: Unveiling Net Worth Across Income Levels”

Introduction

Understanding how your financial standing compares to others can provide valuable insights into your economic health and future planning. One effective way to gauge this is by examining the average net worth across different income levels. Net worth, the total value of an individual’s assets minus liabilities, serves as a comprehensive measure of financial stability and success. By comparing net worth across various income brackets, individuals can better understand where they stand financially relative to their peers. This comparison not only highlights disparities in wealth accumulation but also underscores the impact of income on financial growth and security. Analyzing these differences can help individuals set realistic financial goals, identify areas for improvement, and make informed decisions about saving, investing, and spending.

Understanding Net Worth: A Comprehensive Guide

Understanding net worth is a crucial aspect of personal finance, as it provides a comprehensive snapshot of an individual’s financial health. Net worth is calculated by subtracting total liabilities from total assets, offering a clear picture of what one truly owns. This metric is not only a reflection of one’s current financial status but also a tool for planning future financial goals. When comparing net worth across different income levels, it becomes evident that income is a significant, yet not the sole, determinant of net worth. Various factors, including spending habits, investment strategies, and financial planning, play pivotal roles in shaping an individual’s net worth.

To begin with, individuals in higher income brackets generally have a greater potential to accumulate wealth, primarily due to their increased capacity to save and invest. However, it is essential to recognize that a high income does not automatically translate to a high net worth. For instance, individuals with substantial incomes may also have significant liabilities, such as mortgages, loans, or credit card debt, which can offset their asset accumulation. Consequently, their net worth may not be as high as one might expect based solely on their income level. This highlights the importance of prudent financial management and the need to balance income with responsible spending and saving habits.

Conversely, individuals in lower income brackets may face challenges in building their net worth due to limited financial resources. Despite these challenges, it is possible for individuals with modest incomes to achieve a respectable net worth through disciplined saving, strategic investing, and careful financial planning. By prioritizing savings and making informed investment decisions, individuals can gradually increase their net worth over time. This underscores the notion that while income is a critical factor, it is not the only determinant of financial success.

Moreover, the role of investments in enhancing net worth cannot be overstated. Investments, whether in stocks, real estate, or other assets, have the potential to significantly increase an individual’s net worth over time. The power of compound interest, for example, can exponentially grow one’s wealth if investments are made wisely and held over the long term. Therefore, individuals across all income levels should consider incorporating investment strategies into their financial planning to maximize their net worth.

In addition to investments, effective debt management is another crucial component in the pursuit of a higher net worth. Reducing high-interest debt, such as credit card balances, can free up more resources for saving and investing, thereby contributing to an increase in net worth. By focusing on paying down debt and avoiding unnecessary liabilities, individuals can improve their financial standing and work towards a more secure financial future.

In conclusion, while income level is an important factor in determining net worth, it is not the sole indicator of financial health. A comprehensive approach that includes disciplined saving, strategic investing, and effective debt management is essential for building and maintaining a robust net worth. By understanding the various elements that contribute to net worth, individuals can make informed decisions that align with their financial goals, ultimately leading to greater financial stability and success.

Income Levels and Their Impact on Net Worth

Understanding the relationship between income levels and net worth is crucial for individuals seeking to assess their financial health and plan for the future. Net worth, which is the difference between what you own and what you owe, serves as a comprehensive measure of financial stability. It is influenced by various factors, including income, spending habits, investments, and debt management. By examining average net worth across different income levels, one can gain valuable insights into how income impacts financial standing and the potential for wealth accumulation.

To begin with, it is important to recognize that higher income levels generally correlate with higher net worth. This is primarily because individuals with higher incomes have more disposable income to allocate towards savings and investments. Consequently, they are better positioned to accumulate assets over time. For instance, those in the top income brackets often have access to financial advisors and investment opportunities that can significantly enhance their wealth. However, it is essential to note that a high income does not automatically guarantee a high net worth. Effective financial management, including prudent spending and strategic investment, plays a critical role in converting income into wealth.

Conversely, individuals in lower income brackets may face challenges in building their net worth. Limited disposable income often means that a larger proportion of earnings is directed towards essential expenses, leaving less room for savings and investments. Additionally, those with lower incomes may have less access to financial education and resources, which can hinder their ability to make informed financial decisions. Despite these challenges, it is possible for individuals with modest incomes to build significant net worth over time through disciplined saving, budgeting, and investing.

Moreover, the impact of income on net worth is not solely determined by the amount of money earned. Lifestyle choices and financial habits also play a significant role. For example, individuals who prioritize saving and investing, regardless of their income level, are more likely to see their net worth grow. On the other hand, those who engage in excessive spending or accumulate high levels of debt may find their net worth stagnating or even declining, despite having a substantial income. Therefore, cultivating sound financial habits is essential for individuals across all income levels to enhance their net worth.

Furthermore, it is important to consider the role of age and life stage in the relationship between income and net worth. Younger individuals, who are typically in the early stages of their careers, may have lower net worth due to student loans and limited time to accumulate assets. However, as they progress in their careers and increase their earning potential, their net worth is likely to grow. In contrast, older individuals nearing retirement may have a higher net worth, having had decades to build wealth through savings, investments, and home equity.

In conclusion, while income level is a significant factor in determining net worth, it is not the sole determinant. Effective financial management, lifestyle choices, and life stage all contribute to an individual’s overall financial health. By understanding the interplay between these elements, individuals can make informed decisions to improve their net worth, regardless of their income level. Ultimately, achieving financial stability and building wealth requires a comprehensive approach that goes beyond merely earning a high income.

How to Calculate Your Net Worth Accurately

Calculating your net worth accurately is a crucial step in understanding your financial health and comparing it to the average net worth by income level. To begin with, net worth is essentially the difference between what you own and what you owe. It provides a snapshot of your financial standing at a particular point in time. To calculate your net worth, you must first list all your assets. These include cash in savings and checking accounts, investments in stocks and bonds, retirement accounts, real estate properties, and any other valuable possessions such as vehicles or jewelry. It is important to use current market values for these assets to ensure accuracy.

Once you have a comprehensive list of your assets, the next step is to account for your liabilities. Liabilities are the debts and obligations you owe to others. Common liabilities include mortgages, car loans, student loans, credit card debt, and any other personal loans. By subtracting the total value of your liabilities from the total value of your assets, you arrive at your net worth. This figure can be positive or negative, depending on whether your assets exceed your liabilities or vice versa.

Understanding your net worth is not only about knowing a number; it is about gaining insight into your financial situation. It allows you to assess whether you are on track to meet your financial goals, such as saving for retirement or purchasing a home. Moreover, comparing your net worth to the average net worth by income level can provide valuable context. For instance, if your net worth is significantly lower than the average for your income bracket, it may indicate a need to reevaluate your spending habits or investment strategies.

To make meaningful comparisons, it is essential to consider the average net worth figures for different income levels. Typically, higher income levels correlate with higher net worth, as individuals with greater earnings have more opportunities to save and invest. However, it is crucial to recognize that income alone does not determine net worth. Factors such as spending habits, investment choices, and life circumstances also play significant roles.

When comparing your net worth to others, it is important to remember that averages can be skewed by outliers. For example, a few individuals with exceptionally high net worths can raise the average for an entire income group. Therefore, it may be more insightful to consider median net worth figures, which represent the middle point of a data set and are less affected by extreme values.

In addition to comparing your net worth to others, tracking changes in your net worth over time can be a powerful tool for financial planning. Regularly updating your net worth calculation allows you to monitor your progress and make informed decisions about budgeting, saving, and investing. It can also help you identify trends, such as increasing debt or declining asset values, that may require attention.

In conclusion, accurately calculating your net worth is a fundamental aspect of personal finance management. By understanding your net worth and comparing it to average figures for your income level, you can gain valuable insights into your financial health and make informed decisions to improve it. Whether you are aiming to increase your savings, reduce debt, or invest more wisely, knowing your net worth is an essential step in achieving your financial goals.

The Role of Assets and Liabilities in Net Worth

In the realm of personal finance, understanding net worth is crucial for evaluating one’s financial health. Net worth, essentially the difference between what you own and what you owe, provides a snapshot of your financial standing at any given time. It is influenced by a variety of factors, including income level, assets, and liabilities. To comprehend how net worth varies across different income levels, it is essential to delve into the roles that assets and liabilities play in shaping this financial metric.

Assets, which include everything from cash and investments to real estate and personal property, form the foundation of net worth. They represent the resources that an individual can leverage to generate income or meet financial obligations. For individuals with higher income levels, assets often include a diversified portfolio of investments, such as stocks, bonds, and mutual funds, which can significantly enhance their net worth over time. Additionally, real estate holdings, whether primary residences or investment properties, contribute substantially to the asset side of the equation. These assets not only provide potential appreciation in value but also offer opportunities for generating rental income, further boosting net worth.

Conversely, liabilities encompass all financial obligations, such as mortgages, car loans, student loans, and credit card debt. These obligations detract from net worth, as they represent money that must be repaid over time. For individuals with lower income levels, liabilities can pose a significant challenge to building net worth. High levels of debt, particularly those with high-interest rates like credit card debt, can erode financial stability and limit the ability to accumulate assets. Therefore, managing liabilities effectively is crucial for improving net worth, regardless of income level.

The interplay between assets and liabilities becomes particularly evident when comparing net worth across different income brackets. Higher-income individuals often have greater access to financial resources, enabling them to acquire and maintain valuable assets while managing liabilities more effectively. This access can lead to a compounding effect, where the growth of assets outpaces the accumulation of liabilities, resulting in a higher net worth. In contrast, those with lower incomes may struggle to acquire significant assets, and their liabilities can quickly overshadow their financial gains, leading to a lower net worth.

Moreover, the composition of assets and liabilities can vary significantly across income levels. For instance, individuals in higher income brackets may have a larger proportion of their net worth tied up in investments and real estate, which tend to appreciate over time. On the other hand, those in lower income brackets might have a greater portion of their net worth in more liquid assets, such as savings accounts, which offer stability but limited growth potential. This difference in asset composition can further widen the net worth gap between income levels.

In conclusion, the roles of assets and liabilities are pivotal in determining net worth across different income levels. While higher-income individuals often benefit from a robust asset base and manageable liabilities, those with lower incomes may face challenges in accumulating assets and managing debt. Understanding these dynamics is essential for individuals seeking to improve their financial health and build wealth over time. By focusing on strategies to enhance assets and reduce liabilities, individuals can work towards a more favorable net worth, regardless of their income level.

Strategies to Increase Your Net Worth Over Time

Increasing your net worth over time is a goal shared by many, yet achieving it requires a strategic approach that takes into account various financial factors. Understanding the average net worth by income level can provide valuable insights into where you stand financially and help you identify areas for improvement. As you embark on this journey, it is essential to consider several strategies that can effectively enhance your financial standing.

To begin with, one of the most fundamental strategies is to establish a comprehensive budget. A well-structured budget allows you to track your income and expenses meticulously, ensuring that you live within your means. By doing so, you can allocate a portion of your income towards savings and investments, which are crucial for building wealth over time. Moreover, a budget helps identify unnecessary expenditures, enabling you to redirect those funds towards more productive financial goals.

In addition to budgeting, diversifying your income streams can significantly impact your net worth. Relying solely on a single source of income can be risky, especially in uncertain economic times. Therefore, exploring opportunities for additional income, such as part-time work, freelance projects, or passive income through investments, can provide a financial cushion and accelerate wealth accumulation. This diversification not only enhances your financial security but also offers more flexibility in managing your finances.

Furthermore, investing wisely is a cornerstone of increasing net worth. While saving money is important, investing allows your wealth to grow exponentially over time. It is crucial to educate yourself about different investment options, such as stocks, bonds, real estate, and mutual funds, to make informed decisions that align with your risk tolerance and financial goals. Additionally, seeking advice from financial advisors can provide valuable insights and help tailor an investment strategy that suits your individual circumstances.

Another effective strategy is to focus on reducing debt. High levels of debt can significantly hinder your ability to increase your net worth, as interest payments can consume a substantial portion of your income. Prioritizing debt repayment, particularly high-interest debt such as credit card balances, can free up resources that can be redirected towards savings and investments. Implementing a debt repayment plan, such as the snowball or avalanche method, can provide a structured approach to eliminating debt efficiently.

Moreover, continuously enhancing your skills and education can have a profound impact on your earning potential and, consequently, your net worth. Investing in yourself through education, training, or acquiring new skills can open doors to higher-paying job opportunities or career advancements. This not only increases your income but also contributes to long-term financial stability and growth.

Lastly, it is important to regularly review and adjust your financial strategies. As your financial situation evolves, so too should your approach to managing your wealth. Periodic assessments of your financial goals, investments, and expenditures can help ensure that you remain on track to achieving your desired net worth. Being adaptable and open to change is key to navigating the dynamic financial landscape effectively.

In conclusion, increasing your net worth over time requires a multifaceted approach that encompasses budgeting, diversifying income, investing wisely, reducing debt, enhancing skills, and regularly reviewing financial strategies. By implementing these strategies, you can work towards improving your financial standing and achieving greater financial security. Understanding where you stand in comparison to the average net worth by income level can serve as a benchmark, guiding you in making informed decisions that align with your long-term financial objectives.

Comparing Net Worth Across Different Income Brackets

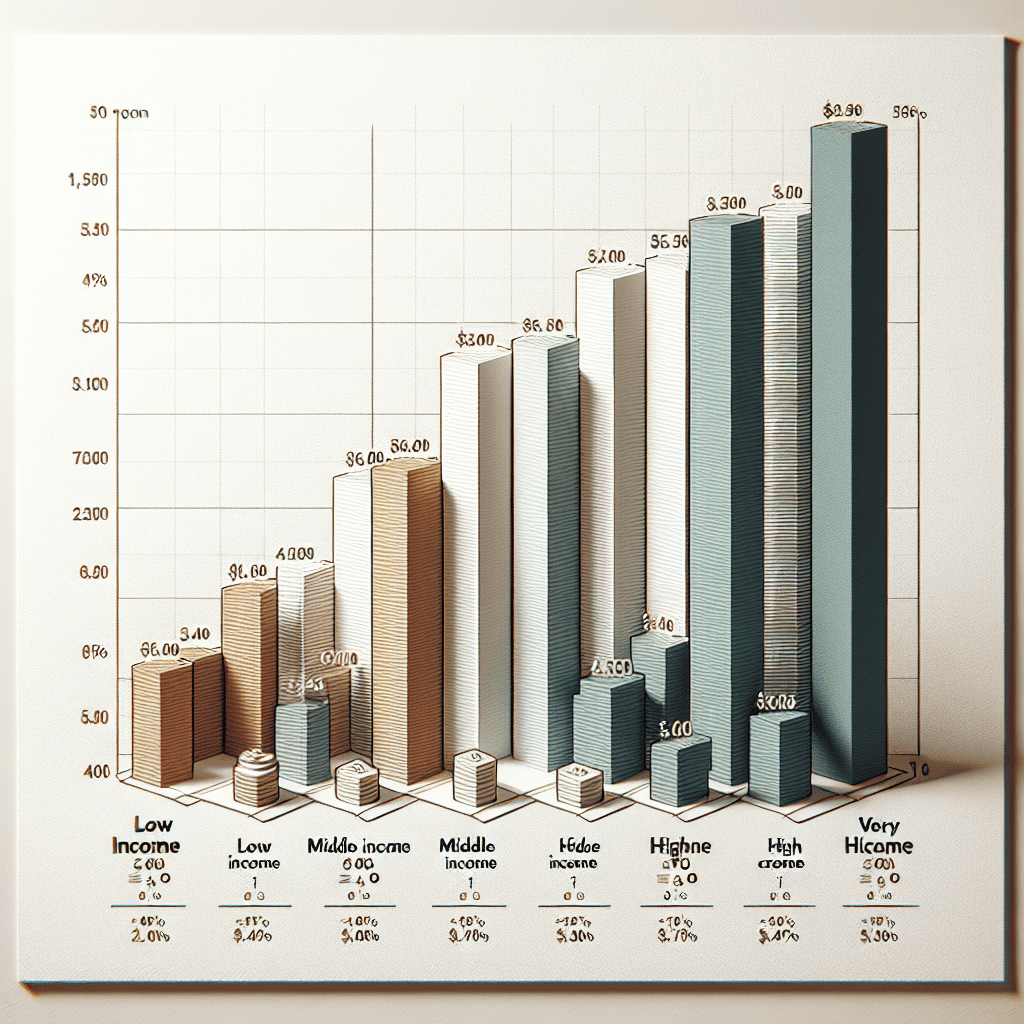

When examining personal financial health, net worth serves as a crucial indicator, offering a comprehensive snapshot of an individual’s financial standing. Net worth is calculated by subtracting total liabilities from total assets, providing a clear picture of what one truly owns. Understanding how net worth varies across different income levels can offer valuable insights into financial planning and wealth accumulation strategies. By comparing net worth across various income brackets, individuals can better assess their financial position relative to others and identify potential areas for improvement.

To begin with, it is essential to recognize that income and net worth, while related, are distinct financial metrics. Income refers to the money earned through work, investments, or other sources over a specific period, typically a year. In contrast, net worth is a cumulative measure that reflects the total value of an individual’s financial and non-financial assets minus their liabilities. Consequently, individuals with similar incomes can have vastly different net worths depending on their spending habits, investment strategies, and debt levels.

In lower income brackets, individuals often face challenges in accumulating significant net worth due to limited disposable income. Many in this group prioritize essential expenses such as housing, food, and healthcare, leaving little room for savings or investments. As a result, their net worth may primarily consist of tangible assets like vehicles or modest home equity, with liabilities such as credit card debt or student loans further impacting their financial standing. Despite these challenges, individuals in this bracket can still work towards increasing their net worth by focusing on debt reduction and gradually building an emergency fund.

Moving up the income scale, middle-income earners typically have more opportunities to enhance their net worth. With higher disposable income, they can allocate funds towards savings and investments, such as retirement accounts or stock portfolios. Additionally, middle-income individuals often have access to employer-sponsored benefits like 401(k) plans, which can significantly contribute to long-term wealth accumulation. However, it is crucial for those in this bracket to maintain a balanced approach to spending and saving, as lifestyle inflation can quickly erode potential gains in net worth.

For high-income earners, the potential for substantial net worth growth is considerably greater. With significant disposable income, these individuals can invest in a diverse range of assets, including real estate, stocks, and private equity. Moreover, high-income earners often have access to sophisticated financial planning tools and resources, enabling them to optimize their investment strategies and minimize tax liabilities. Nevertheless, it is important to note that a high income does not automatically translate to a high net worth. Overspending, poor investment choices, or excessive debt can still hinder wealth accumulation, underscoring the importance of prudent financial management.

In conclusion, comparing net worth across different income brackets reveals the diverse financial landscapes individuals navigate. While income level plays a significant role in determining one’s ability to accumulate wealth, it is not the sole factor. Effective financial planning, disciplined saving, and strategic investing are critical components in building and maintaining a healthy net worth. By understanding the nuances of net worth across income levels, individuals can better position themselves to achieve their financial goals and secure their financial future.

The Importance of Financial Planning for Wealth Growth

Understanding the dynamics of wealth accumulation is crucial for effective financial planning. One of the key metrics often used to gauge financial health is net worth, which is essentially the difference between what you own and what you owe. By examining the average net worth across different income levels, individuals can gain valuable insights into their financial standing and identify areas for improvement. This understanding is not only beneficial for personal financial growth but also essential for setting realistic financial goals.

To begin with, it is important to recognize that income and net worth, while related, are not synonymous. Income refers to the money earned through work, investments, or other sources, whereas net worth provides a more comprehensive picture of financial health by accounting for assets and liabilities. Consequently, individuals with similar incomes can have vastly different net worths depending on their spending habits, investment strategies, and debt management. This distinction underscores the importance of financial planning in wealth growth, as it highlights the need for strategic management of both income and expenses.

Moreover, analyzing average net worth by income level reveals significant disparities that can inform financial planning strategies. For instance, individuals in higher income brackets typically have a greater capacity to save and invest, leading to a higher average net worth. However, this does not automatically translate to financial security, as lifestyle inflation can erode potential savings. Therefore, even those with substantial incomes must prioritize disciplined financial planning to ensure long-term wealth accumulation. On the other hand, individuals in lower income brackets may face more challenges in building net worth, but with careful budgeting and strategic investments, they can still achieve significant financial growth over time.

In addition to income, other factors such as age, education, and geographic location also play a role in determining net worth. Younger individuals, for example, may have lower net worths due to student loans and limited time in the workforce, but they also have the advantage of time to grow their wealth through compound interest and strategic investments. Education can also impact net worth, as higher educational attainment often correlates with higher earning potential. Furthermore, geographic location can influence living costs and, consequently, the ability to save and invest. Understanding these factors can help individuals tailor their financial planning strategies to their unique circumstances.

Transitioning from understanding these disparities to actionable steps, it is clear that effective financial planning involves setting clear, achievable goals and developing a comprehensive strategy to reach them. This includes creating a budget to manage expenses, establishing an emergency fund to cover unexpected costs, and investing in a diversified portfolio to grow wealth over time. Additionally, reducing high-interest debt can significantly improve net worth by freeing up resources for savings and investments. By focusing on these key areas, individuals can enhance their financial stability and work towards increasing their net worth, regardless of their income level.

In conclusion, comparing average net worth by income level provides valuable insights into the importance of financial planning for wealth growth. While income is a critical component of financial health, it is not the sole determinant of net worth. By understanding the various factors that influence net worth and implementing strategic financial planning, individuals can effectively manage their finances and work towards achieving their long-term financial goals. This proactive approach not only fosters financial security but also empowers individuals to make informed decisions that support sustainable wealth growth.

Q&A

1. **What is net worth?**

Net worth is the total value of an individual’s assets minus their liabilities.

2. **How is average net worth calculated by income level?**

Average net worth by income level is calculated by aggregating the net worth of individuals within a specific income bracket and dividing by the number of individuals in that bracket.

3. **Why is net worth a better indicator of wealth than income?**

Net worth provides a comprehensive view of financial health by considering both assets and debts, whereas income only reflects earnings.

4. **What factors can influence net worth across different income levels?**

Factors include savings habits, investment returns, debt levels, and lifestyle choices.

5. **How does age impact average net worth by income level?**

Generally, older individuals tend to have higher net worth due to accumulated savings and investments over time.

6. **What role does education play in net worth differences by income level?**

Higher education often leads to higher income potential, which can contribute to greater net worth accumulation.

7. **How can individuals improve their net worth regardless of income level?**

Strategies include budgeting, reducing debt, investing wisely, and increasing savings.

Conclusion

When comparing average net worth by income level, it becomes evident that higher income levels generally correlate with greater net worth. This relationship is influenced by several factors, including the ability to save and invest more substantial amounts, access to financial advice, and opportunities for wealth accumulation through diverse asset portfolios. However, disparities in net worth can also be attributed to differences in financial literacy, spending habits, and economic background. While income is a significant determinant of net worth, it is not the sole factor, as effective financial management and strategic investment decisions play crucial roles in wealth accumulation across all income levels.