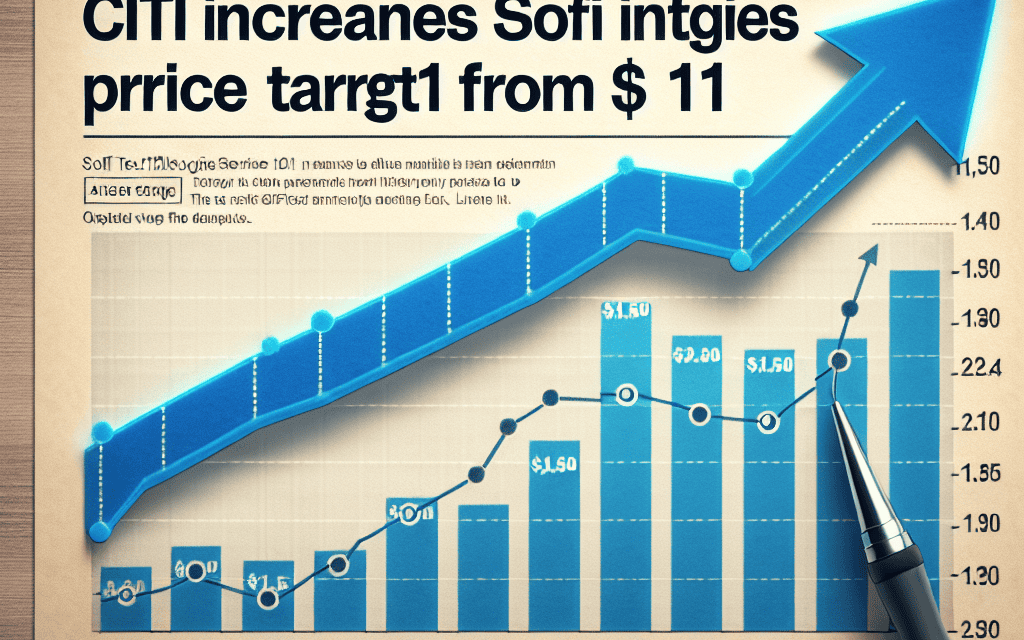

“Boosting Confidence: Citi Elevates SoFi Technologies’ Price Target to $12.50!”

Introduction

Citi has recently adjusted its price target for SoFi Technologies, raising it from $11 to $12.50. This revision reflects Citi’s updated analysis and outlook on SoFi’s financial performance and market position. The increase in the price target suggests a more optimistic view of SoFi’s potential for growth and profitability, taking into account recent developments and strategic initiatives undertaken by the company. This adjustment may influence investor sentiment and trading activity related to SoFi Technologies in the financial markets.

Impact Of Citi’s Price Target Increase On SoFi Technologies’ Stock Performance

Citi’s recent decision to increase the price target for SoFi Technologies from $11 to $12.50 has sparked considerable interest among investors and market analysts. This adjustment reflects a growing confidence in SoFi’s business model and its potential for future growth. As a prominent player in the financial technology sector, SoFi Technologies has been on the radar of many investors, and Citi’s revised price target serves as a significant endorsement of the company’s strategic direction and operational performance.

The impact of Citi’s price target increase on SoFi Technologies’ stock performance is multifaceted. Firstly, such an upward revision often acts as a catalyst for investor sentiment, potentially leading to increased buying activity. When a reputable financial institution like Citi expresses optimism about a company’s future prospects, it can instill confidence among existing shareholders and attract new investors. This heightened interest can drive up the stock price, reflecting the market’s positive reception of the revised target.

Moreover, the increase in the price target may also influence the perception of SoFi Technologies within the broader financial community. Analysts and investors often look to major financial institutions for guidance, and Citi’s endorsement could prompt other analysts to reevaluate their own assessments of SoFi. This could lead to a ripple effect, with other firms potentially adjusting their price targets and recommendations, further amplifying the positive momentum around the stock.

In addition to influencing investor sentiment, Citi’s revised price target underscores the underlying strengths of SoFi Technologies. The company has been making significant strides in expanding its product offerings and enhancing its technological infrastructure. By increasing its price target, Citi is acknowledging these efforts and signaling confidence in SoFi’s ability to capitalize on emerging opportunities in the fintech space. This recognition can serve as a validation of SoFi’s strategic initiatives, reinforcing the company’s position as a leader in the industry.

Furthermore, the increased price target may also have implications for SoFi’s future capital-raising activities. A higher stock price can enhance the company’s ability to raise funds through equity offerings, providing it with additional resources to fuel growth and innovation. This financial flexibility can be instrumental in enabling SoFi to pursue strategic acquisitions, invest in research and development, and expand its market presence. Consequently, the revised price target not only reflects Citi’s confidence in SoFi’s current performance but also its potential for long-term success.

However, it is important to note that while Citi’s price target increase is a positive development, it does not guarantee immediate or sustained stock price appreciation. The stock market is influenced by a myriad of factors, including macroeconomic conditions, industry trends, and company-specific developments. Therefore, investors should exercise caution and conduct thorough research before making investment decisions based solely on price target revisions.

In conclusion, Citi’s decision to raise the price target for SoFi Technologies from $11 to $12.50 is a significant development that has the potential to impact the company’s stock performance positively. By boosting investor confidence and validating SoFi’s strategic initiatives, this revision underscores the company’s strengths and growth prospects. While the increased price target is a positive signal, investors should remain mindful of the broader market dynamics and conduct comprehensive due diligence before making investment decisions.

Analyzing The Reasons Behind Citi’s Revised Price Target For SoFi Technologies

Citi’s recent decision to increase the price target for SoFi Technologies from $11 to $12.50 has garnered significant attention from investors and market analysts alike. This adjustment reflects a growing confidence in SoFi’s business model and its potential for future growth. To understand the rationale behind this revised price target, it is essential to delve into the factors that have influenced Citi’s analysis and the broader market dynamics at play.

Firstly, SoFi Technologies has demonstrated robust performance in its core business areas, which include lending, financial services, and technology platforms. The company’s ability to diversify its revenue streams has been a critical factor in its resilience and growth. SoFi’s lending segment, particularly in personal loans and student loan refinancing, has shown consistent growth, driven by competitive interest rates and a streamlined digital application process. This growth is further supported by the company’s strategic partnerships and acquisitions, which have expanded its customer base and enhanced its technological capabilities.

Moreover, SoFi’s financial services segment, which includes its popular SoFi Invest and SoFi Money products, has seen increased adoption. The rise in retail investing and the growing demand for digital banking solutions have positioned SoFi well within the financial technology landscape. The company’s focus on providing a comprehensive suite of financial products under a single platform has resonated with consumers seeking convenience and efficiency. This integrated approach not only enhances customer retention but also increases cross-selling opportunities, thereby boosting overall revenue potential.

In addition to its strong business fundamentals, SoFi’s commitment to innovation and technology has been a significant driver of its success. The company’s investment in its Galileo platform, a leading provider of digital payment processing solutions, underscores its dedication to staying at the forefront of financial technology. This strategic move not only enhances SoFi’s technological infrastructure but also opens up new revenue streams through B2B partnerships. As digital payments continue to gain traction globally, SoFi’s position as a key player in this space is likely to contribute positively to its long-term growth prospects.

Furthermore, the macroeconomic environment has played a role in Citi’s revised price target. With interest rates remaining relatively low, the demand for refinancing and personal loans is expected to persist, benefiting SoFi’s lending business. Additionally, the ongoing digital transformation in the financial sector presents opportunities for fintech companies like SoFi to capture market share from traditional financial institutions. As consumers increasingly embrace digital solutions, SoFi’s comprehensive platform is well-positioned to capitalize on this trend.

Citi’s decision to raise the price target also reflects confidence in SoFi’s management team and their strategic vision. The leadership’s ability to execute on growth initiatives, manage risks, and adapt to changing market conditions has been instrumental in driving the company’s success. Their focus on customer-centric innovation and operational efficiency has not only strengthened SoFi’s competitive position but also enhanced its financial performance.

In conclusion, Citi’s revised price target for SoFi Technologies is underpinned by a combination of strong business fundamentals, strategic investments in technology, favorable macroeconomic conditions, and effective leadership. As SoFi continues to expand its product offerings and leverage its technological capabilities, it is well-positioned to achieve sustained growth and deliver value to its shareholders. This optimistic outlook is reflected in Citi’s increased price target, signaling a positive trajectory for SoFi Technologies in the evolving financial landscape.

What Citi’s Price Target Increase Means For SoFi Technologies Investors

Citi’s recent decision to increase the price target for SoFi Technologies from $11 to $12.50 has captured the attention of investors and market analysts alike. This adjustment reflects a growing confidence in SoFi’s business model and its potential for future growth. For investors, understanding the implications of this revised price target is crucial in making informed decisions about their portfolios.

To begin with, a price target is an analyst’s projection of a stock’s future price, based on various factors such as the company’s financial performance, market conditions, and industry trends. When a reputable financial institution like Citi raises its price target for a company, it often signals a positive outlook for that company’s future. In the case of SoFi Technologies, this upward revision suggests that Citi sees promising developments on the horizon that could enhance the company’s value.

One of the primary reasons behind Citi’s increased price target could be SoFi’s recent strategic initiatives and their potential to drive growth. SoFi has been expanding its product offerings and enhancing its digital platform to attract a broader customer base. By diversifying its services, which include lending, investing, and personal finance management, SoFi aims to become a one-stop financial solution for its users. This comprehensive approach not only increases customer engagement but also creates multiple revenue streams, thereby strengthening the company’s financial position.

Moreover, SoFi’s focus on technology and innovation is another factor that likely influenced Citi’s decision. The company has been investing heavily in its technological infrastructure to improve user experience and operational efficiency. By leveraging cutting-edge technology, SoFi can offer personalized financial solutions, which is increasingly important in today’s digital age. This technological edge could give SoFi a competitive advantage over traditional financial institutions, potentially leading to increased market share and profitability.

In addition to these strategic moves, SoFi’s recent financial performance may have also played a role in Citi’s revised price target. The company has shown resilience in navigating the challenges posed by the economic environment, demonstrating strong revenue growth and an expanding customer base. These positive financial indicators suggest that SoFi is on a solid growth trajectory, which could justify a higher valuation.

Furthermore, the broader economic context cannot be overlooked when considering Citi’s price target increase. As the financial sector continues to evolve, driven by technological advancements and changing consumer preferences, companies like SoFi that are at the forefront of this transformation are well-positioned to capitalize on emerging opportunities. Citi’s revised price target may reflect an anticipation of these broader industry trends and their potential impact on SoFi’s future performance.

For investors, Citi’s increased price target for SoFi Technologies serves as a signal to reassess their investment strategies. While a higher price target does not guarantee future stock performance, it does indicate a level of confidence from a major financial institution. Investors should consider this information alongside their own research and analysis to make well-informed decisions.

In conclusion, Citi’s decision to raise the price target for SoFi Technologies to $12.50 underscores a positive outlook for the company, driven by strategic initiatives, technological innovation, and strong financial performance. As the financial landscape continues to evolve, SoFi’s ability to adapt and thrive could present significant opportunities for investors. Therefore, staying informed about such developments is essential for those looking to navigate the complexities of the investment world.

Comparing SoFi Technologies’ New Price Target With Industry Peers

Citi’s recent decision to increase the price target for SoFi Technologies from $11 to $12.50 has sparked considerable interest among investors and industry analysts alike. This adjustment reflects a growing confidence in SoFi’s business model and its potential for future growth. To better understand the implications of this revised price target, it is essential to compare SoFi Technologies with its industry peers, examining the factors that contribute to its valuation and how it stands out in the competitive landscape of financial technology companies.

SoFi Technologies, a prominent player in the fintech sector, has been making significant strides in expanding its product offerings and customer base. The company’s comprehensive suite of financial services, which includes lending, investing, and banking, positions it as a versatile competitor in the market. This diversification strategy is a key factor in Citi’s decision to raise the price target, as it suggests a robust potential for revenue growth and market penetration. In contrast, many of SoFi’s industry peers focus on niche markets or specific financial products, which can limit their growth opportunities.

Moreover, SoFi’s commitment to innovation and technology-driven solutions sets it apart from traditional financial institutions and some fintech competitors. The company’s emphasis on user-friendly digital platforms and personalized financial advice resonates well with the tech-savvy millennial and Gen Z demographics. This focus on technology not only enhances customer experience but also drives operational efficiency, contributing to improved financial performance. As a result, SoFi’s ability to leverage technology effectively is a critical factor in its favorable valuation compared to its peers.

In addition to its technological prowess, SoFi’s strategic partnerships and acquisitions have played a significant role in its growth trajectory. By aligning with key industry players and acquiring complementary businesses, SoFi has been able to expand its capabilities and reach new customer segments. This strategic approach is another reason why Citi has confidence in SoFi’s future prospects, as it demonstrates the company’s ability to adapt and thrive in a rapidly evolving market. In comparison, some of SoFi’s competitors may lack the same level of strategic foresight, which can hinder their ability to capitalize on emerging opportunities.

Furthermore, SoFi’s focus on regulatory compliance and risk management is an important consideration in its valuation. The financial services industry is heavily regulated, and companies that can navigate this complex landscape effectively are better positioned for long-term success. SoFi’s proactive approach to compliance not only mitigates potential risks but also enhances its reputation among investors and customers. This focus on regulatory adherence is a distinguishing factor when comparing SoFi to its industry peers, some of whom may face challenges in this area.

While Citi’s increased price target for SoFi Technologies is a positive indicator of the company’s potential, it is important to consider the broader market context. The fintech industry is characterized by rapid innovation and intense competition, with new entrants constantly challenging established players. Therefore, SoFi must continue to innovate and adapt to maintain its competitive edge. Nevertheless, the company’s strong foundation, strategic initiatives, and commitment to technology position it favorably against its peers, justifying Citi’s optimistic outlook.

In conclusion, Citi’s decision to raise SoFi Technologies’ price target to $12.50 underscores the company’s strengths and growth potential within the fintech industry. By comparing SoFi with its peers, it becomes evident that its diversified product offerings, technological innovation, strategic partnerships, and focus on compliance contribute to its favorable valuation. As the fintech landscape continues to evolve, SoFi’s ability to navigate these changes will be crucial in maintaining its competitive position and achieving sustained growth.

The Role Of Financial Analysts In Influencing Stock Prices: A Case Study Of SoFi Technologies

Financial analysts play a crucial role in shaping investor perceptions and influencing stock prices. Their assessments, often encapsulated in price targets and ratings, can significantly impact a company’s market valuation. A recent example of this dynamic is Citi’s decision to increase the price target for SoFi Technologies from $11 to $12.50. This adjustment not only reflects Citi’s revised outlook on SoFi’s potential but also underscores the broader influence that financial analysts wield in the stock market.

To understand the implications of Citi’s revised price target, it is essential to consider the factors that typically drive such changes. Analysts base their evaluations on a myriad of elements, including a company’s financial health, market conditions, competitive landscape, and growth prospects. In the case of SoFi Technologies, a fintech company known for its innovative approach to personal finance, Citi’s increased price target likely reflects an optimistic view of the company’s strategic initiatives and market positioning. This optimism may be fueled by SoFi’s recent product expansions, partnerships, or improvements in its financial performance, which analysts believe could enhance its long-term profitability.

The impact of an analyst’s price target adjustment extends beyond the immediate reaction in the stock market. When a reputable institution like Citi revises its outlook, it can trigger a ripple effect among investors and other analysts. Investors often rely on these expert opinions to guide their investment decisions, especially in a complex and volatile market environment. Consequently, a positive revision can lead to increased investor confidence, potentially driving up the stock price as demand for the shares rises. Conversely, a negative adjustment might prompt investors to reassess their positions, leading to a decline in the stock’s value.

Moreover, the influence of financial analysts is not limited to individual investors. Institutional investors, who manage large portfolios, also pay close attention to analyst reports. These investors often have significant sway over market movements due to the volume of shares they trade. Therefore, when an analyst like those at Citi issues a revised price target, it can prompt institutional investors to adjust their strategies, further amplifying the impact on the stock’s price.

However, it is important to recognize that while analysts’ opinions are influential, they are not infallible. The stock market is inherently unpredictable, and various external factors can affect a company’s performance and stock price. Economic shifts, regulatory changes, and unforeseen events can all alter the landscape in which a company operates, sometimes rendering even the most well-reasoned analyses obsolete. As such, while Citi’s increased price target for SoFi Technologies may signal confidence in the company’s future, investors should consider it as one of many factors in their decision-making process.

In conclusion, the role of financial analysts in influencing stock prices is both significant and multifaceted. Through their assessments and price target adjustments, analysts like those at Citi provide valuable insights that can shape investor behavior and market trends. The case of SoFi Technologies illustrates how a single revision can have far-reaching effects, highlighting the importance of these financial experts in the broader investment ecosystem. As investors navigate the complexities of the stock market, the guidance offered by analysts remains an indispensable tool in their arsenal.

Future Growth Prospects For SoFi Technologies Following Citi’s Price Target Update

Citi’s recent decision to increase the price target for SoFi Technologies from $11 to $12.50 has sparked considerable interest among investors and market analysts. This adjustment reflects a growing confidence in SoFi’s potential for future growth and its ability to capitalize on emerging opportunities within the financial technology sector. As we delve into the implications of this revised price target, it is essential to consider the factors contributing to SoFi’s promising outlook and the challenges it may face in achieving these projections.

To begin with, SoFi Technologies has been making significant strides in expanding its product offerings and enhancing its technological capabilities. The company’s comprehensive suite of financial services, which includes lending, investing, and personal finance management, positions it as a formidable player in the fintech landscape. By leveraging its digital-first approach, SoFi has been able to attract a diverse customer base, ranging from millennials seeking student loan refinancing to seasoned investors looking for innovative financial solutions. This broad appeal is a crucial factor in Citi’s optimistic assessment of SoFi’s growth prospects.

Moreover, SoFi’s strategic acquisitions and partnerships have played a pivotal role in bolstering its market position. The acquisition of Galileo Financial Technologies, for instance, has enabled SoFi to strengthen its infrastructure and offer a more seamless user experience. Additionally, partnerships with established financial institutions have facilitated SoFi’s entry into new markets and expanded its reach. These strategic moves not only enhance SoFi’s competitive edge but also underscore its commitment to long-term growth and innovation.

In addition to its strategic initiatives, SoFi’s robust financial performance has been a key driver of Citi’s revised price target. The company has consistently demonstrated strong revenue growth, driven by increased member engagement and a diversified revenue stream. SoFi’s ability to maintain a healthy balance sheet and manage risk effectively further reinforces its potential for sustained growth. As the company continues to scale its operations and optimize its business model, it is well-positioned to capitalize on the growing demand for digital financial services.

However, it is important to acknowledge the challenges that SoFi may encounter on its growth trajectory. The fintech industry is highly competitive, with numerous players vying for market share. To maintain its competitive advantage, SoFi must continue to innovate and differentiate its offerings. Additionally, regulatory changes and economic uncertainties could pose potential risks to SoFi’s business operations. Navigating these challenges will require strategic foresight and adaptability.

Furthermore, the broader economic environment will play a crucial role in shaping SoFi’s future growth prospects. As interest rates fluctuate and consumer behavior evolves, SoFi must remain agile in its approach to meet changing market demands. The company’s ability to anticipate and respond to these external factors will be instrumental in achieving its growth objectives.

In conclusion, Citi’s decision to raise SoFi Technologies’ price target to $12.50 reflects a positive outlook on the company’s future growth prospects. SoFi’s strategic initiatives, strong financial performance, and commitment to innovation position it well for success in the dynamic fintech landscape. While challenges remain, SoFi’s ability to navigate these hurdles and capitalize on emerging opportunities will be key to realizing its full potential. As investors and market participants continue to monitor SoFi’s progress, the company’s trajectory will undoubtedly be a focal point of interest in the financial technology sector.

How Citi’s Price Target Revision Reflects On SoFi Technologies’ Business Strategy

Citi’s recent decision to increase the price target for SoFi Technologies from $11 to $12.50 is a significant development that reflects positively on the company’s business strategy. This revision is not merely a numerical adjustment but rather an endorsement of SoFi’s strategic initiatives and growth potential. As investors and market analysts scrutinize this change, it is essential to understand the underlying factors that have contributed to this upward revision and what it signifies for SoFi’s future.

To begin with, SoFi Technologies has been making substantial strides in diversifying its product offerings and expanding its customer base. The company’s efforts to transform from a niche player in student loan refinancing to a comprehensive financial services platform have not gone unnoticed. By broadening its portfolio to include personal loans, home loans, credit cards, and investment services, SoFi has positioned itself as a one-stop-shop for financial needs. This diversification strategy not only mitigates risks associated with reliance on a single revenue stream but also enhances customer retention by offering a holistic financial ecosystem.

Moreover, SoFi’s focus on technological innovation has been a critical driver of its growth. The company’s commitment to leveraging cutting-edge technology to improve user experience and operational efficiency is evident in its robust digital platform. By prioritizing user-friendly interfaces and seamless integration across services, SoFi has been able to attract a tech-savvy clientele that values convenience and accessibility. This technological edge is a crucial differentiator in the highly competitive fintech landscape, where customer experience can significantly influence market share.

In addition to product diversification and technological innovation, SoFi’s strategic acquisitions have played a pivotal role in its growth trajectory. The acquisition of Galileo Financial Technologies, a leading provider of digital payments infrastructure, is a case in point. This acquisition has not only enhanced SoFi’s technological capabilities but also expanded its reach into the B2B sector, providing a new revenue stream and further solidifying its position in the fintech industry. Such strategic moves demonstrate SoFi’s proactive approach to growth and its ability to identify and capitalize on opportunities that align with its long-term vision.

Furthermore, SoFi’s recent achievement of obtaining a national bank charter is a testament to its strategic foresight. This milestone allows SoFi to offer a broader range of banking products and services, thereby increasing its competitiveness against traditional banks. The bank charter also provides SoFi with greater control over its financial products, enabling it to offer more attractive rates and terms to its customers. This development is likely to enhance SoFi’s profitability and market position, making it an attractive proposition for investors.

Citi’s revised price target is a reflection of these strategic initiatives and their potential to drive sustainable growth for SoFi Technologies. By acknowledging the company’s efforts to diversify its offerings, leverage technology, pursue strategic acquisitions, and secure a bank charter, Citi is signaling confidence in SoFi’s ability to navigate the challenges of the fintech industry and capitalize on emerging opportunities. As SoFi continues to execute its business strategy, the increased price target serves as a validation of its approach and a positive indicator for its future prospects. Investors and stakeholders will undoubtedly be watching closely as SoFi Technologies continues to evolve and shape the future of financial services.

Q&A

1. **What company increased the price target for SoFi Technologies?**

Citi.

2. **What is the new price target set by Citi for SoFi Technologies?**

$12.50.

3. **What was the previous price target for SoFi Technologies set by Citi?**

$11.

4. **What is the percentage increase in the price target from the previous target?**

Approximately 13.64%.

5. **What is the primary reason for Citi’s increase in the price target for SoFi Technologies?**

Specific reasons are not provided in the question, but such increases are typically due to positive financial performance, growth prospects, or market conditions.

6. **How might this price target increase affect investor sentiment towards SoFi Technologies?**

It could potentially improve investor sentiment, leading to increased interest and investment in the company.

7. **What impact could this revised price target have on SoFi Technologies’ stock price?**

The stock price might experience upward movement as investors react to the positive outlook from a reputable financial institution like Citi.

Conclusion

Citi’s decision to increase the price target for SoFi Technologies from $11 to $12.50 suggests a positive outlook on the company’s future performance. This adjustment indicates that Citi analysts have identified factors that could drive SoFi’s stock value higher than previously anticipated. The revised target reflects confidence in SoFi’s business model, growth prospects, or market conditions that could enhance its financial performance. Investors might interpret this as a signal of potential upside in SoFi’s stock, prompting increased interest or investment in the company.