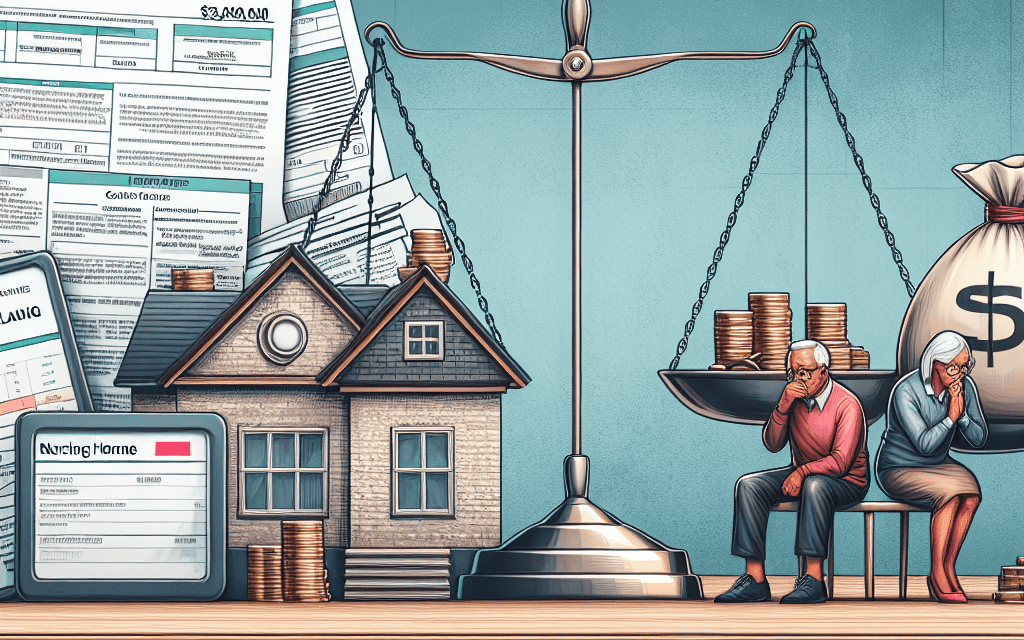

“Protect Your Nest Egg: Safeguard Your IRA from Nursing Home Claims”

Introduction

When considering long-term care options, many individuals and families face concerns about the financial implications of nursing home care, particularly regarding personal assets such as Individual Retirement Accounts (IRAs). A common question that arises is whether a nursing home can claim or access an individual’s IRA savings, which may be a significant portion of their financial resources. Understanding the legal and financial landscape surrounding this issue is crucial for effective planning and protection of one’s assets. This introduction explores the factors that determine whether a nursing home can claim IRA savings, including Medicaid eligibility, asset protection strategies, and the role of state and federal regulations in safeguarding retirement funds.

Understanding Nursing Home Claims on IRA Savings

When considering the financial implications of long-term care, many individuals and families are concerned about the potential impact on their savings, particularly Individual Retirement Accounts (IRAs). A common question that arises is whether a nursing home can claim an individual’s IRA savings, such as a $350,000 account, to cover the costs of care. To address this concern, it is essential to understand the interplay between nursing home expenses, Medicaid eligibility, and the protection of retirement assets.

Firstly, it is important to recognize that nursing homes themselves do not have the authority to directly claim or seize an individual’s IRA savings. However, the costs associated with long-term care can be substantial, often prompting individuals to seek assistance through Medicaid, a government program that helps cover medical expenses for those with limited income and resources. Medicaid eligibility requirements are stringent, and understanding these criteria is crucial for protecting one’s assets.

Medicaid considers both income and assets when determining eligibility. While IRAs are generally considered countable assets, the treatment of these accounts can vary depending on whether the individual is taking required minimum distributions (RMDs). For individuals over the age of 73, the IRS mandates RMDs from traditional IRAs, which are then treated as income. This income can affect Medicaid eligibility, as it may push an individual over the income threshold. However, the principal amount in the IRA may not be counted as an asset if the individual is receiving RMDs, thus offering some protection for the account balance.

Moreover, strategic planning can play a significant role in safeguarding IRA savings. For instance, converting a traditional IRA to a Roth IRA, where possible, may offer advantages, as Roth IRAs are not subject to RMDs during the account holder’s lifetime. This conversion, however, involves careful consideration of tax implications and should be undertaken with professional guidance.

In addition to understanding Medicaid rules, it is beneficial to explore other avenues for protecting assets. Long-term care insurance is one such option, providing coverage for nursing home expenses and potentially reducing the need to rely on Medicaid. Additionally, legal tools such as trusts can be employed to shield assets from being counted towards Medicaid eligibility. Establishing an irrevocable trust, for example, can help protect assets, but it requires advance planning due to Medicaid’s five-year look-back period, which scrutinizes asset transfers.

Furthermore, consulting with an elder law attorney or a financial advisor specializing in long-term care planning can provide personalized strategies tailored to individual circumstances. These professionals can offer insights into state-specific Medicaid rules, as regulations can vary significantly across different jurisdictions.

In conclusion, while a nursing home cannot directly claim an individual’s $350,000 IRA savings, the financial demands of long-term care necessitate careful planning to protect these assets. Understanding Medicaid eligibility criteria, exploring insurance options, and utilizing legal tools are all critical components of a comprehensive strategy to safeguard retirement savings. By taking proactive steps and seeking expert advice, individuals can better navigate the complexities of long-term care financing and ensure that their hard-earned savings are preserved for their intended purposes.

Legal Protections for IRA Savings in Nursing Homes

When considering the financial implications of long-term care, many individuals and families are concerned about the potential impact on their savings, particularly their Individual Retirement Accounts (IRAs). A common question that arises is whether a nursing home can claim or access the funds in an IRA, especially when the cost of care becomes burdensome. Understanding the legal protections surrounding IRA savings in the context of nursing home expenses is crucial for safeguarding one’s financial future.

To begin with, it is important to recognize that IRAs are generally protected from creditors under federal law. The Employee Retirement Income Security Act (ERISA) provides certain protections for retirement accounts, including IRAs, shielding them from claims by creditors in bankruptcy proceedings. However, this protection does not automatically extend to nursing home claims, which are not considered typical creditor claims. Therefore, while IRAs enjoy a degree of protection, they are not entirely immune from being used to pay for nursing home care.

In most cases, nursing homes do not have direct access to an individual’s IRA funds. Instead, the responsibility falls on the individual or their legal representative to manage the payment of nursing home expenses. This often involves withdrawing funds from the IRA to cover the costs of care. It is essential to note that such withdrawals may have tax implications, as distributions from traditional IRAs are generally subject to income tax. Consequently, individuals should carefully consider the timing and amount of withdrawals to minimize tax liabilities.

Moreover, Medicaid, a government program that assists with long-term care costs for individuals with limited financial resources, has specific rules regarding asset eligibility. When applying for Medicaid, an individual’s assets, including IRAs, are assessed to determine eligibility. In some states, IRAs are considered countable assets, which means they may need to be spent down before qualifying for Medicaid assistance. However, certain strategies, such as converting a traditional IRA to a Roth IRA or structuring withdrawals strategically, can help manage the impact on Medicaid eligibility.

Additionally, it is worth exploring the role of spousal protections in the context of IRA savings and nursing home care. The Spousal Impoverishment Protection Law allows the spouse of a nursing home resident to retain a portion of the couple’s assets, including retirement accounts, to prevent financial hardship. This provision ensures that the community spouse, the one not residing in the nursing home, can maintain a reasonable standard of living while their partner receives necessary care.

Furthermore, estate planning tools such as trusts can offer additional layers of protection for IRA savings. By placing IRA assets into certain types of trusts, individuals may be able to shield these funds from being counted as assets for Medicaid eligibility purposes. However, this approach requires careful planning and should be undertaken with the guidance of a legal professional experienced in elder law and estate planning.

In conclusion, while nursing homes do not have direct claims on IRA savings, the funds may still be used to cover the costs of care, either voluntarily or as part of Medicaid eligibility requirements. Understanding the legal protections and strategies available can help individuals and families navigate the complexities of long-term care financing. Consulting with financial advisors and legal experts is advisable to ensure that IRA savings are managed effectively, preserving financial security while meeting the needs of long-term care.

Strategies to Safeguard Your IRA from Nursing Home Costs

When considering the future, many individuals worry about the potential financial burden of long-term care, particularly the costs associated with nursing homes. One common concern is whether a nursing home can claim an individual’s Individual Retirement Account (IRA) savings, which often represent a significant portion of one’s financial security. Understanding the relationship between nursing home costs and IRA savings is crucial for developing strategies to protect these assets.

Firstly, it is important to recognize that nursing homes themselves do not directly claim an individual’s IRA savings. However, the costs associated with long-term care can indirectly impact these savings. When an individual requires nursing home care, they are typically responsible for covering the expenses, which can be substantial. If personal savings, including IRAs, are the primary source of funds, these accounts may be depleted over time to meet the financial demands of care.

To mitigate this risk, individuals can explore several strategies to safeguard their IRA savings from being exhausted by nursing home costs. One effective approach is long-term care insurance, which can provide financial support for nursing home expenses. By investing in a comprehensive long-term care insurance policy, individuals can ensure that a portion of their care costs is covered, thereby reducing the need to draw from their IRA savings. It is advisable to purchase such insurance well in advance of needing care, as premiums tend to be more affordable when one is younger and healthier.

Another strategy involves Medicaid planning. Medicaid is a government program that assists with healthcare costs for individuals with limited financial resources. To qualify for Medicaid, individuals must meet specific income and asset criteria. By engaging in Medicaid planning, individuals can structure their finances in a way that allows them to qualify for assistance while preserving their IRA savings. This often involves transferring assets or converting them into exempt resources, such as certain types of trusts. However, it is essential to navigate Medicaid planning carefully, as improper transfers can result in penalties or disqualification from the program.

Additionally, individuals may consider converting their traditional IRA into a Roth IRA. While this strategy involves paying taxes on the converted amount, a Roth IRA offers the advantage of tax-free withdrawals in retirement. This can be beneficial if nursing home costs arise, as the tax-free status of Roth IRA withdrawals can help preserve more of the account’s value. However, it is crucial to evaluate the tax implications and consult with a financial advisor to determine if this strategy aligns with one’s overall financial goals.

Furthermore, estate planning tools such as irrevocable trusts can be employed to protect IRA savings. By placing assets into an irrevocable trust, individuals can remove them from their estate, potentially shielding them from being counted as available resources for nursing home costs. This approach requires careful planning and legal guidance to ensure compliance with relevant laws and regulations.

In conclusion, while nursing homes do not directly claim IRA savings, the costs associated with long-term care can significantly impact these accounts. By exploring strategies such as long-term care insurance, Medicaid planning, Roth IRA conversions, and estate planning tools, individuals can take proactive steps to safeguard their IRA savings. It is advisable to consult with financial and legal professionals to tailor these strategies to one’s unique circumstances, ensuring that their financial future remains secure even in the face of potential nursing home expenses.

Medicaid and Its Impact on IRA Savings

When considering the financial implications of long-term care, many individuals and families find themselves grappling with the complexities of Medicaid and its impact on personal assets, particularly Individual Retirement Accounts (IRAs). A common concern is whether a nursing home can claim one’s IRA savings, especially when the amount is substantial, such as $350,000. To address this concern, it is essential to understand how Medicaid eligibility works and how IRAs are treated under its rules.

Medicaid is a joint federal and state program designed to assist individuals with limited income and resources in covering medical and long-term care costs. To qualify for Medicaid, applicants must meet specific financial criteria, which often involve stringent asset and income limits. IRAs, being a form of retirement savings, are considered part of an individual’s assets. However, the treatment of IRAs under Medicaid rules can vary significantly depending on several factors, including the state of residence and the status of the IRA.

In many states, if an IRA is in payout status, meaning the account holder is receiving regular, periodic distributions, it may be treated as an income stream rather than a countable asset. This distinction is crucial because Medicaid typically considers income differently from assets. When an IRA is in payout status, the distributions are counted as income, which may affect Medicaid eligibility but does not necessarily disqualify the individual from receiving benefits. Conversely, if the IRA is not in payout status, the entire account balance may be considered a countable asset, potentially impacting eligibility.

Furthermore, the rules governing spousal protection under Medicaid can also influence how IRAs are treated. In cases where one spouse requires nursing home care while the other remains in the community, Medicaid’s spousal impoverishment provisions come into play. These provisions are designed to prevent the community spouse from becoming impoverished due to the cost of long-term care for the institutionalized spouse. Depending on the state, a portion of the couple’s combined assets, including IRAs, may be protected for the community spouse, thereby reducing the amount that could be claimed by Medicaid.

It is also important to note that Medicaid has a five-year look-back period, during which any transfers of assets for less than fair market value may result in a penalty period of ineligibility. This rule is intended to prevent individuals from divesting assets to qualify for Medicaid. Therefore, strategic planning is essential to ensure that IRAs and other assets are managed in a way that aligns with Medicaid’s requirements while preserving financial security.

Given the complexity of Medicaid rules and the potential for variation across states, consulting with a knowledgeable elder law attorney or financial advisor is advisable. These professionals can provide guidance tailored to individual circumstances, helping to navigate the intricacies of Medicaid planning and asset protection. By understanding the nuances of how IRAs are treated under Medicaid, individuals and families can make informed decisions that safeguard their financial well-being while ensuring access to necessary long-term care services. Ultimately, while a nursing home cannot directly claim an individual’s IRA savings, the interplay between Medicaid eligibility and asset protection requires careful consideration and planning.

Estate Planning to Protect IRA Assets from Nursing Homes

When planning for the future, particularly in terms of estate management, one of the most pressing concerns for many individuals is the protection of their assets from potential claims by nursing homes. This concern becomes even more pronounced when considering significant assets such as an Individual Retirement Account (IRA), which can represent a substantial portion of one’s life savings. The question of whether a nursing home can claim a $350,000 IRA savings is complex and requires a nuanced understanding of both estate planning and Medicaid regulations.

To begin with, it is essential to understand that nursing homes themselves do not directly claim assets. Instead, the issue arises when individuals require long-term care and seek assistance through Medicaid, a government program that helps cover the costs of nursing home care for those with limited financial resources. Medicaid has strict eligibility requirements, including asset limits, which can lead to the necessity of spending down or restructuring assets to qualify for assistance. This is where the potential risk to an IRA comes into play.

IRAs are generally considered countable assets when determining Medicaid eligibility. This means that the funds within an IRA could potentially be used to pay for nursing home care before Medicaid benefits kick in. However, there are strategies within estate planning that can help protect these assets. One common approach is to convert the IRA into an annuity, which can provide a stream of income rather than a lump sum asset, potentially making it non-countable for Medicaid purposes. It is crucial, however, to ensure that the annuity is structured correctly to comply with Medicaid rules.

Another strategy involves the use of trusts. By transferring assets into an irrevocable trust, individuals may be able to shield their IRA from being considered in Medicaid eligibility calculations. This approach requires careful planning and must be executed well in advance of needing nursing home care, as Medicaid has a five-year look-back period during which asset transfers are scrutinized. Any transfers made within this period could result in penalties or delays in eligibility.

Furthermore, it is important to consider the role of spousal protections under Medicaid. If one spouse requires nursing home care while the other remains in the community, certain protections allow the community spouse to retain a portion of the couple’s assets, including retirement accounts, without affecting the institutionalized spouse’s Medicaid eligibility. This can provide a layer of security for IRA assets, but it requires precise planning and understanding of state-specific regulations.

In conclusion, while a nursing home itself does not claim IRA savings, the need for Medicaid assistance can put these assets at risk if not properly protected. Through strategic estate planning, including the use of annuities, trusts, and spousal protections, individuals can take steps to safeguard their IRA savings from being depleted by nursing home costs. It is advisable to consult with an estate planning attorney or financial advisor who specializes in elder law to navigate these complex regulations and develop a plan tailored to individual circumstances. By doing so, individuals can ensure that their hard-earned savings are preserved for their intended beneficiaries, rather than being consumed by long-term care expenses.

The Role of Trusts in Shielding IRA Savings

When considering the protection of individual retirement accounts (IRAs) from potential claims by nursing homes, the establishment of trusts emerges as a significant strategy. As individuals age, the prospect of requiring long-term care becomes increasingly likely, and with it, the concern that accumulated savings, such as a $350,000 IRA, might be vulnerable to claims by nursing homes. Understanding the role of trusts in shielding these savings is crucial for those seeking to preserve their financial legacy.

To begin with, it is essential to recognize that IRAs are generally considered part of an individual’s estate and, as such, may be subject to claims by creditors, including nursing homes. However, the use of certain types of trusts can offer a layer of protection. One such trust is the irrevocable trust, which, once established, cannot be altered or revoked by the grantor. By transferring assets into an irrevocable trust, the individual effectively removes those assets from their personal ownership, thereby shielding them from potential claims.

Moreover, the strategic use of a Medicaid Asset Protection Trust (MAPT) can be particularly beneficial. This type of trust is specifically designed to protect assets from being counted as part of an individual’s estate when determining eligibility for Medicaid, which often covers long-term care costs. By placing IRA savings into a MAPT, individuals can potentially qualify for Medicaid without exhausting their personal savings on nursing home expenses. However, it is important to note that Medicaid has a five-year “look-back” period, during which any transfers to a trust may be scrutinized. Therefore, planning well in advance is advisable.

In addition to irrevocable trusts and MAPTs, another option to consider is the use of a charitable remainder trust (CRT). This type of trust allows individuals to transfer assets, such as an IRA, into the trust while retaining the right to receive income from the trust for a specified period. After this period, the remaining assets are donated to a designated charity. While this approach provides income and potential tax benefits, it also serves to protect the principal from nursing home claims, as the assets are no longer part of the individual’s estate.

Despite the advantages of using trusts, it is crucial to approach this strategy with careful consideration and professional guidance. The legal and tax implications of transferring IRA savings into a trust can be complex, and missteps may lead to unintended consequences, such as tax penalties or disqualification from Medicaid benefits. Consulting with an estate planning attorney or a financial advisor who specializes in elder law can provide valuable insights and help tailor a plan that aligns with individual goals and circumstances.

Furthermore, while trusts offer a robust mechanism for protecting IRA savings, they are not the only option available. Long-term care insurance, for instance, can serve as an additional layer of protection by covering nursing home expenses and preserving personal assets. Combining insurance with trust planning can create a comprehensive strategy that addresses both immediate and future needs.

In conclusion, the role of trusts in shielding IRA savings from nursing home claims is multifaceted and requires careful planning. By understanding the different types of trusts available and seeking professional advice, individuals can effectively protect their $350,000 IRA savings and ensure that their financial legacy remains intact for future generations.

Financial Planning Tips to Preserve IRA Funds from Nursing Home Claims

When planning for the future, particularly in terms of financial security during retirement, it is crucial to consider the potential impact of long-term care costs, such as those associated with nursing homes. One common concern among retirees and their families is whether a nursing home can claim their Individual Retirement Account (IRA) savings, which often represent a significant portion of their financial resources. Understanding the interplay between nursing home costs and IRA funds is essential for effective financial planning and ensuring that one’s savings are preserved for their intended purpose.

To begin with, it is important to recognize that nursing homes themselves do not directly claim an individual’s IRA savings. However, the costs associated with long-term care can indirectly affect these funds. When an individual requires nursing home care, they are typically responsible for covering the expenses, which can be substantial. If the individual does not have sufficient income or other resources to pay for this care, they may need to draw from their IRA savings to meet these financial obligations. Consequently, while the nursing home does not directly access the IRA, the need to pay for care can deplete these savings over time.

In light of this, it is essential to explore strategies that can help protect IRA funds from being exhausted by nursing home costs. One effective approach is to consider long-term care insurance, which can provide coverage for nursing home expenses and reduce the need to rely on IRA savings. By paying premiums for this type of insurance, individuals can safeguard their retirement funds and ensure that they remain available for other needs.

Another strategy involves Medicaid planning. Medicaid is a government program that can help cover the costs of long-term care for individuals with limited financial resources. However, qualifying for Medicaid requires meeting specific asset and income criteria. Engaging in Medicaid planning with the assistance of a financial advisor or elder law attorney can help individuals structure their assets in a way that allows them to qualify for Medicaid benefits while preserving their IRA savings. This may involve techniques such as establishing irrevocable trusts or making strategic gifts to family members.

Furthermore, it is advisable to consider the timing of IRA withdrawals. Since IRA distributions are subject to income tax, withdrawing large sums to pay for nursing home care can result in significant tax liabilities. By carefully planning the timing and amount of withdrawals, individuals can minimize their tax burden and preserve more of their savings. Consulting with a tax advisor can provide valuable insights into optimizing IRA withdrawals in the context of long-term care expenses.

In addition to these strategies, it is important to engage in comprehensive estate planning. This involves creating legal documents such as wills, powers of attorney, and healthcare directives to ensure that one’s financial and healthcare wishes are respected. By clearly outlining how IRA funds and other assets should be managed, individuals can provide guidance to their loved ones and reduce the risk of disputes or mismanagement.

In conclusion, while nursing homes do not directly claim IRA savings, the costs associated with long-term care can significantly impact these funds. By exploring options such as long-term care insurance, Medicaid planning, and strategic IRA withdrawals, individuals can protect their savings and ensure that they are used according to their wishes. Engaging in thorough estate planning further enhances this protection, providing peace of mind for both retirees and their families.

Q&A

1. **Question:** Can a nursing home directly claim my IRA savings?

**Answer:** No, a nursing home cannot directly claim your IRA savings. However, they may require you to use your assets, including IRAs, to pay for care.

2. **Question:** Are IRA savings protected from nursing home costs?

**Answer:** IRA savings are generally not protected from nursing home costs and may be considered when determining eligibility for Medicaid.

3. **Question:** How does Medicaid view IRA savings?

**Answer:** Medicaid typically considers IRA savings as countable assets, which may affect eligibility for assistance with nursing home costs.

4. **Question:** Can I transfer my IRA to protect it from nursing home claims?

**Answer:** Transferring an IRA to protect it from nursing home claims can be complex and may result in penalties or affect Medicaid eligibility.

5. **Question:** Are there legal strategies to protect IRA savings from nursing home costs?

**Answer:** Yes, legal strategies such as setting up certain types of trusts or converting IRAs to annuities may help protect assets, but these should be done with professional advice.

6. **Question:** Does converting an IRA to a Roth IRA protect it from nursing home claims?

**Answer:** Converting to a Roth IRA does not inherently protect it from nursing home claims, as it remains a countable asset for Medicaid purposes.

7. **Question:** Should I consult a professional for advice on protecting my IRA from nursing home costs?

**Answer:** Yes, consulting with an elder law attorney or financial advisor is recommended to explore options and ensure compliance with laws.

Conclusion

A nursing home cannot directly claim your $350,000 IRA savings. However, if you or a loved one requires long-term care and applies for Medicaid, the IRA may be considered an asset that affects eligibility for Medicaid benefits. Medicaid has strict asset limits, and if the IRA is not structured properly, it may need to be spent down to qualify for assistance. It’s important to consult with an elder law attorney or financial advisor to explore options such as converting the IRA into an income stream or using other legal strategies to protect the assets while ensuring eligibility for Medicaid.