“BRICS: Pioneering a New Era in Digital Payments, Redefining Global Financial Norms.”

Introduction

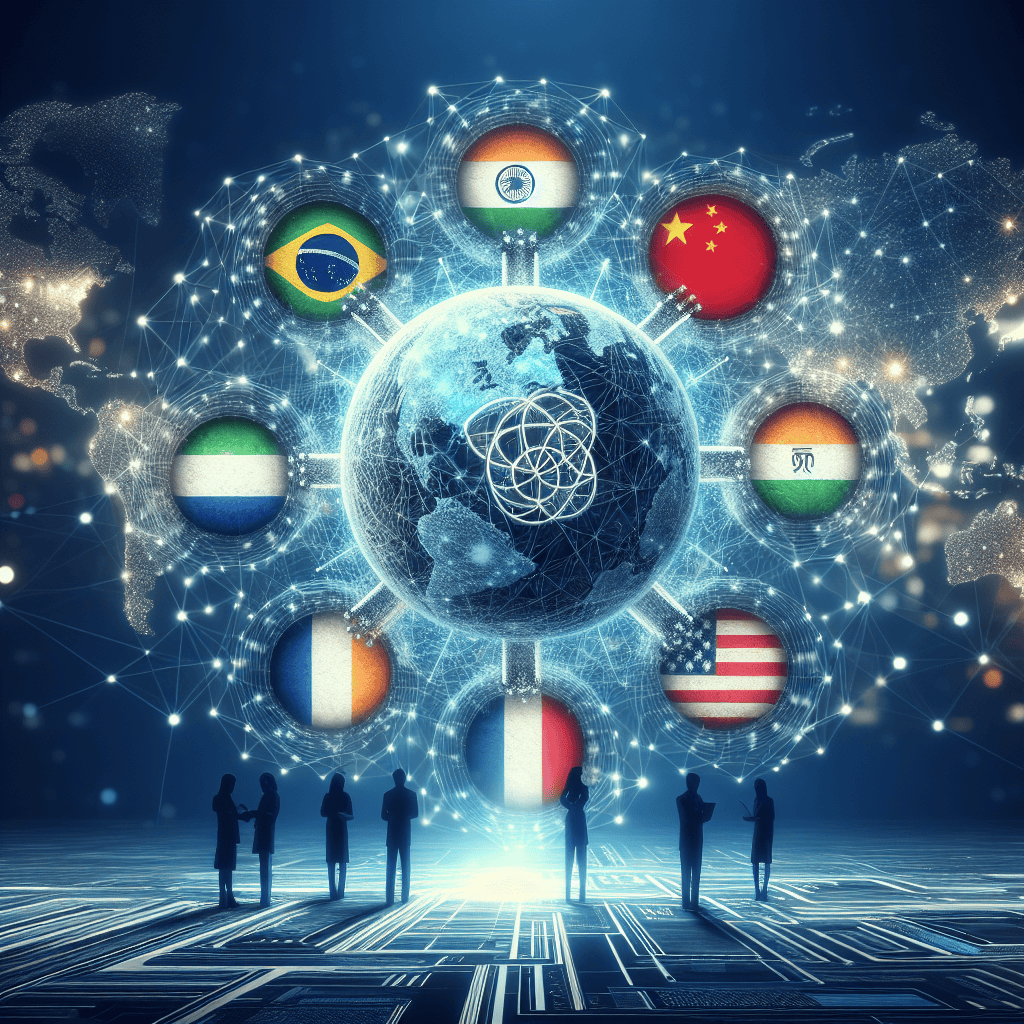

BRICS, an acronym for the emerging economies of Brazil, Russia, India, China, and South Africa, is advancing plans to establish a new digital payment system aimed at challenging existing global financial norms. This initiative seeks to enhance financial cooperation among member countries and reduce dependency on traditional Western-dominated financial systems. By leveraging cutting-edge technology and fostering economic integration, the BRICS digital payment system aspires to facilitate seamless cross-border transactions, promote financial inclusion, and strengthen the economic sovereignty of its member states. This strategic move underscores the bloc’s commitment to reshaping the global financial landscape and asserting its influence in the international economic arena.

Understanding BRICS’ Vision for a New Digital Payment System

The BRICS nations, comprising Brazil, Russia, India, China, and South Africa, have long been recognized as a formidable economic bloc with aspirations to reshape global economic dynamics. In recent years, these countries have increasingly sought to assert their influence on the world stage, challenging established norms and institutions. One of the most ambitious initiatives currently under discussion is the development of a new digital payment system. This endeavor aims to not only enhance financial cooperation among member states but also to challenge the dominance of existing global payment systems, which are often perceived as being heavily influenced by Western interests.

The motivation behind this initiative is multifaceted. Firstly, the BRICS nations are keen to reduce their reliance on the US dollar, which has traditionally been the dominant currency in international trade and finance. By creating a digital payment system that operates independently of the dollar, these countries hope to insulate themselves from the volatility and geopolitical risks associated with dollar-denominated transactions. This move is particularly pertinent in light of recent global economic uncertainties and the increasing use of financial sanctions as a tool of foreign policy.

Moreover, the proposed digital payment system is envisioned as a means to foster greater economic integration among BRICS countries. By facilitating seamless cross-border transactions, the system could significantly boost trade and investment flows within the bloc. This, in turn, would enhance the economic resilience of member states, enabling them to better withstand external shocks. Additionally, a shared digital payment infrastructure could pave the way for more collaborative ventures in areas such as technology, infrastructure, and energy, further solidifying the economic ties that bind these nations together.

In terms of technological implementation, the BRICS digital payment system is expected to leverage cutting-edge innovations such as blockchain and distributed ledger technology. These technologies offer several advantages, including enhanced security, transparency, and efficiency. By adopting a decentralized approach, the system could mitigate the risks of fraud and cyberattacks, which are increasingly prevalent in the digital age. Furthermore, the use of blockchain could streamline transaction processes, reducing costs and processing times for businesses and consumers alike.

However, the path to realizing this vision is not without challenges. One of the primary obstacles is the need for consensus among BRICS nations on the design and governance of the digital payment system. Given the diverse economic and political landscapes of these countries, reaching an agreement on key issues such as currency interoperability, regulatory frameworks, and data privacy will require careful negotiation and compromise. Additionally, the initiative may face resistance from established financial institutions and countries that have a vested interest in maintaining the status quo.

Despite these challenges, the potential benefits of a BRICS digital payment system are significant. By providing an alternative to existing global payment networks, the system could enhance financial sovereignty for member states and promote a more multipolar world order. Furthermore, it could serve as a catalyst for innovation in the financial sector, driving the development of new products and services that cater to the unique needs of emerging markets.

In conclusion, the BRICS nations’ plan to develop a new digital payment system represents a bold step towards redefining global financial norms. While the road ahead is fraught with challenges, the initiative holds the promise of fostering greater economic cooperation and resilience among member states. As the world continues to grapple with the complexities of globalization, the success of this endeavor could have far-reaching implications for the future of international finance.

How BRICS’ Digital Payment System Could Reshape Global Trade

The BRICS nations—Brazil, Russia, India, China, and South Africa—are embarking on an ambitious project to develop a new digital payment system that could potentially reshape global trade dynamics. This initiative aims to challenge the existing financial norms dominated by Western countries and create a more balanced economic landscape. As these emerging economies continue to grow in influence, their collective effort to establish a digital payment system signifies a strategic move to enhance their financial autonomy and reduce dependency on traditional Western financial systems.

The proposed digital payment system is envisioned to facilitate seamless transactions among BRICS countries, thereby promoting intra-group trade and investment. By leveraging cutting-edge technology, the system aims to offer a secure, efficient, and cost-effective alternative to existing payment mechanisms. This could significantly reduce transaction costs and time delays, which are often associated with cross-border payments. Moreover, the digital payment system is expected to support multiple currencies, allowing member countries to conduct trade in their local currencies rather than relying on the US dollar as the primary medium of exchange.

Transitioning to a digital payment system could also enhance financial inclusion within BRICS nations. By providing a platform that is accessible to a broader segment of the population, the system could empower small and medium-sized enterprises (SMEs) and individuals who are currently underserved by traditional banking services. This democratization of financial services could stimulate economic growth and development, particularly in regions where access to banking infrastructure is limited.

Furthermore, the establishment of a BRICS digital payment system could have significant geopolitical implications. By reducing reliance on Western financial institutions and the US dollar, BRICS countries could gain greater control over their monetary policies and reduce their vulnerability to external economic pressures. This shift could also encourage other emerging economies to explore similar initiatives, potentially leading to a more multipolar global financial system.

However, the implementation of such a system is not without challenges. Ensuring interoperability among diverse financial systems, regulatory frameworks, and technological infrastructures across BRICS nations will require substantial coordination and collaboration. Additionally, addressing concerns related to cybersecurity, data privacy, and fraud prevention will be crucial to gaining the trust of users and stakeholders.

Despite these challenges, the potential benefits of a BRICS digital payment system are significant. By fostering closer economic ties among member countries, the system could enhance regional cooperation and contribute to a more resilient global economy. Moreover, by setting new standards for digital payments, BRICS could play a pivotal role in shaping the future of global trade.

In conclusion, the BRICS nations’ plan to develop a digital payment system represents a bold step towards redefining global financial norms. While the path to implementation may be fraught with challenges, the potential rewards in terms of economic growth, financial inclusion, and geopolitical influence are substantial. As the world continues to evolve in the digital age, the success of this initiative could serve as a catalyst for broader changes in the global financial landscape, ultimately leading to a more equitable and diversified economic order.

The Role of Technology in BRICS’ Digital Payment Initiative

The BRICS nations—Brazil, Russia, India, China, and South Africa—are embarking on an ambitious initiative to develop a new digital payment system, aiming to challenge the existing global financial norms. This endeavor is not merely a financial undertaking but a technological one, as it seeks to leverage cutting-edge advancements to create a robust, secure, and efficient payment infrastructure. The role of technology in this initiative is pivotal, as it underpins the entire framework of the proposed system, ensuring its viability and competitiveness on the global stage.

To begin with, the integration of blockchain technology is central to the BRICS digital payment system. Blockchain offers a decentralized ledger that enhances transparency and security, two critical components for any financial system. By utilizing blockchain, the BRICS nations aim to reduce the risk of fraud and cyberattacks, which are prevalent concerns in digital transactions. Moreover, blockchain’s ability to facilitate real-time processing of transactions can significantly enhance the efficiency of cross-border payments, a key objective of the BRICS initiative.

In addition to blockchain, the use of artificial intelligence (AI) and machine learning (ML) is expected to play a significant role in the development of the digital payment system. AI and ML can be employed to analyze transaction data, identify patterns, and predict potential security threats, thereby enabling proactive measures to safeguard the system. Furthermore, these technologies can help in personalizing user experiences, making the payment system more user-friendly and accessible to a diverse population across the BRICS nations.

Another technological aspect that the BRICS digital payment system is likely to incorporate is the use of digital currencies. With the rise of cryptocurrencies and central bank digital currencies (CBDCs), the BRICS nations are exploring the potential of integrating digital currencies into their payment system. This move could not only streamline transactions but also reduce dependency on traditional banking systems and the US dollar, thereby challenging the current global financial hegemony.

Moreover, the development of a digital payment system by BRICS necessitates a robust cybersecurity framework. As digital transactions become more prevalent, the risk of cyber threats increases exponentially. Therefore, investing in advanced cybersecurity measures is crucial to protect the integrity of the system. Technologies such as encryption, multi-factor authentication, and biometric verification are likely to be integral components of the security infrastructure, ensuring that the system remains resilient against potential breaches.

The role of technology in the BRICS digital payment initiative extends beyond the technical aspects to include regulatory and policy considerations. As the system is developed, it will be essential to establish a regulatory framework that accommodates technological innovations while ensuring compliance with international standards. This will require collaboration among the BRICS nations to harmonize regulations and create a conducive environment for the digital payment system to thrive.

In conclusion, technology is at the heart of the BRICS digital payment initiative, driving its development and shaping its future. By harnessing the power of blockchain, AI, digital currencies, and robust cybersecurity measures, the BRICS nations are poised to create a payment system that not only challenges existing global norms but also sets new standards for efficiency, security, and inclusivity. As this initiative progresses, it will be crucial for the BRICS nations to continue investing in technological advancements and fostering international cooperation to realize their vision of a transformative digital payment system.

Potential Economic Impacts of BRICS’ Digital Payment System

The BRICS nations—Brazil, Russia, India, China, and South Africa—are collectively exploring the development of a new digital payment system, a move that could significantly alter the global economic landscape. This initiative aims to challenge the existing financial norms dominated by Western countries and institutions, potentially reshaping international trade and finance. As these emerging economies collaborate on this ambitious project, the potential economic impacts are multifaceted and warrant careful consideration.

To begin with, the introduction of a BRICS digital payment system could enhance financial inclusion within these countries. By leveraging digital technology, the system could provide millions of unbanked individuals with access to financial services, thereby fostering economic growth and reducing poverty. This increased accessibility could stimulate domestic consumption and investment, driving economic development in regions that have historically been underserved by traditional banking systems. Moreover, by facilitating cross-border transactions, the digital payment system could strengthen economic ties among BRICS nations, promoting regional integration and cooperation.

In addition to fostering financial inclusion, the BRICS digital payment system could also reduce dependency on the US dollar, which currently serves as the dominant global reserve currency. By creating an alternative platform for international transactions, BRICS nations could mitigate the risks associated with currency fluctuations and geopolitical tensions. This shift could lead to a more balanced global financial system, where multiple currencies play significant roles in international trade. Consequently, countries outside the BRICS bloc might also consider diversifying their foreign exchange reserves, potentially leading to a decline in the dollar’s hegemony.

Furthermore, the establishment of a BRICS digital payment system could enhance the economic sovereignty of member nations. By developing their own financial infrastructure, these countries could reduce their reliance on Western-dominated payment networks such as SWIFT. This independence could prove particularly advantageous in the face of economic sanctions or other forms of financial coercion. As a result, BRICS nations might enjoy greater autonomy in pursuing their economic and political agendas, free from external pressures.

However, the implementation of a BRICS digital payment system is not without challenges. Ensuring the security and stability of the platform will be paramount, as any vulnerabilities could undermine trust and deter adoption. Additionally, harmonizing regulatory frameworks across diverse legal and economic environments will require significant coordination and cooperation among member states. Overcoming these obstacles will be crucial to the system’s success and its ability to compete with established global payment networks.

Moreover, the potential economic impacts of the BRICS digital payment system extend beyond the member nations. As the system gains traction, it could encourage other countries to explore similar initiatives, leading to increased competition and innovation in the global financial sector. This could result in more efficient and cost-effective payment solutions, benefiting consumers and businesses worldwide. However, it could also exacerbate existing geopolitical tensions, as countries vie for influence in the evolving financial landscape.

In conclusion, the BRICS digital payment system represents a bold step towards redefining global economic norms. By enhancing financial inclusion, reducing dependency on the US dollar, and promoting economic sovereignty, the initiative holds the potential to reshape international trade and finance. Nevertheless, its success will depend on overcoming significant challenges and navigating the complex geopolitical environment. As the world watches closely, the outcome of this endeavor could have far-reaching implications for the future of the global economy.

Challenges and Opportunities for BRICS’ Digital Payment System

The BRICS nations—Brazil, Russia, India, China, and South Africa—are embarking on an ambitious project to develop a new digital payment system that aims to challenge existing global financial norms. This initiative is driven by a desire to reduce dependency on Western financial systems and to foster economic cooperation among member countries. However, the path to establishing such a system is fraught with both challenges and opportunities that could significantly impact its success.

One of the primary challenges facing the BRICS digital payment system is the need for technological integration across diverse economies. Each member country has its own financial infrastructure, regulatory environment, and level of technological advancement. For instance, while China has made significant strides in digital payments with platforms like Alipay and WeChat Pay, other member countries may not have the same level of technological infrastructure. This disparity necessitates a harmonized approach to technology adoption and regulatory compliance, which could prove to be a complex and time-consuming process.

Moreover, the geopolitical landscape presents another layer of complexity. The BRICS nations have varying political interests and relationships with Western countries, which could influence their commitment to a unified digital payment system. For example, Russia’s strained relations with Western nations might drive it to push for a system that minimizes Western influence, while other BRICS members might be more cautious in their approach. Navigating these geopolitical dynamics will require diplomatic finesse and a shared vision for the system’s objectives.

Despite these challenges, the potential opportunities offered by a BRICS digital payment system are significant. By creating an alternative to Western-dominated financial systems, BRICS could enhance its economic sovereignty and reduce vulnerability to external economic pressures. This could be particularly beneficial in mitigating the impact of sanctions or economic downturns that disproportionately affect developing economies. Additionally, a successful digital payment system could facilitate increased trade and investment among BRICS countries, fostering economic growth and development.

Furthermore, the initiative could serve as a catalyst for innovation in digital finance. By leveraging the collective expertise and resources of its member nations, BRICS has the potential to develop cutting-edge technologies that could set new standards in the global financial landscape. This could include advancements in blockchain technology, cybersecurity measures, and cross-border payment solutions that enhance efficiency and security.

In addition to technological innovation, the BRICS digital payment system could also promote financial inclusion. Many individuals in BRICS countries remain unbanked or underbanked, lacking access to traditional financial services. A digital payment system tailored to the needs of these populations could provide a more accessible and affordable means of participating in the global economy. This, in turn, could contribute to poverty reduction and improved quality of life for millions of people.

In conclusion, while the BRICS digital payment system faces significant challenges, it also presents a unique opportunity to reshape the global financial landscape. By addressing technological disparities, navigating geopolitical complexities, and fostering innovation, the BRICS nations have the potential to create a system that not only challenges existing norms but also promotes economic growth and financial inclusion. As the project progresses, the world will be watching closely to see how these emerging economies navigate the intricate balance of cooperation and competition in their quest to redefine global financial norms.

Comparing BRICS’ Digital Payment System with Existing Global Norms

The BRICS nations—Brazil, Russia, India, China, and South Africa—are embarking on an ambitious project to develop a new digital payment system that aims to challenge existing global norms. This initiative is not merely a technological endeavor but a strategic move to reshape the financial landscape, offering an alternative to the current systems dominated by Western countries. As the world becomes increasingly interconnected, the need for efficient, secure, and inclusive payment systems has never been more critical. The BRICS digital payment system seeks to address these needs while also asserting the economic influence of its member countries.

To understand the potential impact of the BRICS digital payment system, it is essential to compare it with existing global norms. Currently, the global payment landscape is largely dominated by systems like SWIFT, Visa, and Mastercard, which are deeply entrenched in the financial infrastructure of most countries. These systems have set the standard for international transactions, offering reliability and security. However, they are also subject to the geopolitical influences of their home countries, which can lead to restrictions and sanctions that affect global trade and finance. In contrast, the BRICS digital payment system aims to provide a more neutral platform, free from the political constraints that often accompany Western-dominated systems.

One of the key differences between the BRICS initiative and existing systems is the emphasis on inclusivity and accessibility. The BRICS nations collectively represent over 40% of the world’s population, many of whom are underserved by current financial systems. By developing a digital payment system tailored to the needs of emerging markets, BRICS hopes to facilitate greater financial inclusion. This could potentially empower millions of people who currently lack access to traditional banking services, thereby fostering economic growth and development in these regions.

Moreover, the BRICS digital payment system is expected to leverage cutting-edge technologies such as blockchain and artificial intelligence to enhance security and efficiency. These technologies offer the potential to reduce transaction costs and processing times, making cross-border payments more seamless and less expensive. In comparison, existing global payment systems are often criticized for their high fees and slow processing times, which can be prohibitive for smaller businesses and individuals. By addressing these issues, the BRICS system could offer a compelling alternative that appeals to a broad range of users.

However, the success of the BRICS digital payment system is not guaranteed. It will face significant challenges, including the need to establish trust and credibility in a market dominated by well-established players. Additionally, the system must navigate the complex regulatory environments of its member countries, each with its own financial regulations and policies. Despite these hurdles, the potential benefits of a successful BRICS digital payment system are substantial, offering a new paradigm for international finance that could redefine global norms.

In conclusion, the BRICS digital payment system represents a bold attempt to challenge the status quo and offer a viable alternative to existing global payment systems. By focusing on inclusivity, leveraging advanced technologies, and providing a politically neutral platform, it has the potential to reshape the financial landscape. As the project progresses, it will be crucial to monitor its development and assess its impact on both the member countries and the broader global economy. Whether it succeeds or not, the initiative underscores the growing influence of the BRICS nations and their determination to play a more prominent role in shaping the future of global finance.

The Future of International Finance with BRICS’ Digital Payment System

The global financial landscape is on the brink of a significant transformation as the BRICS nations—Brazil, Russia, India, China, and South Africa—embark on an ambitious project to develop a new digital payment system. This initiative aims to challenge the existing global financial norms dominated by Western countries and institutions. As the world becomes increasingly interconnected, the need for a more inclusive and diversified financial system has become apparent. The BRICS digital payment system seeks to address this need by providing an alternative that could potentially reshape international finance.

The motivation behind this initiative is multifaceted. Firstly, the BRICS nations collectively represent a substantial portion of the world’s population and economic output. Despite their economic prowess, these countries have often found themselves at the periphery of the global financial system, which is largely influenced by Western powers. By creating their own digital payment system, the BRICS countries aim to reduce their dependency on the US dollar and other Western currencies, thereby enhancing their financial sovereignty. This move is particularly significant in the context of increasing geopolitical tensions and economic sanctions, which have underscored the vulnerabilities associated with reliance on a single dominant currency.

Moreover, the development of a BRICS digital payment system aligns with the broader global trend towards digitalization in finance. As digital currencies and blockchain technology gain traction, there is a growing recognition of their potential to enhance efficiency, reduce transaction costs, and increase transparency in financial transactions. The BRICS nations are keen to leverage these technological advancements to create a payment system that is not only secure and efficient but also accessible to a wider range of users, including those in developing countries who have traditionally been excluded from the global financial system.

In addition to technological considerations, the BRICS digital payment system is also driven by economic and strategic imperatives. By facilitating trade and investment among member countries, the system could strengthen economic ties within the bloc and promote regional integration. This, in turn, could enhance the collective bargaining power of the BRICS nations on the global stage, enabling them to play a more influential role in shaping international financial norms and policies.

However, the path to realizing this vision is fraught with challenges. The BRICS countries must navigate a complex web of regulatory, technical, and political hurdles to develop a cohesive and interoperable payment system. Ensuring the security and privacy of transactions will be paramount, as will be the need to build trust among users and stakeholders. Furthermore, the success of the BRICS digital payment system will depend on its ability to gain acceptance and adoption beyond the member countries, which will require effective marketing and outreach efforts.

In conclusion, the BRICS digital payment system represents a bold and strategic move to redefine the future of international finance. By offering an alternative to the existing global financial architecture, it has the potential to promote greater inclusivity and equity in the global economy. While significant challenges remain, the initiative underscores the determination of the BRICS nations to assert their influence and shape the financial norms of the future. As the project unfolds, it will be closely watched by policymakers, economists, and financial experts around the world, eager to understand its implications for the global financial order.

Q&A

1. **What is BRICS?**

BRICS is an acronym for a group of five major emerging economies: Brazil, Russia, India, China, and South Africa.

2. **What is the new digital payment system proposed by BRICS?**

BRICS plans to develop a new digital payment system aimed at facilitating transactions among member countries and reducing reliance on the US dollar.

3. **Why is BRICS developing this digital payment system?**

The initiative seeks to challenge existing global financial norms, enhance economic cooperation among member countries, and provide an alternative to Western-dominated financial systems.

4. **How might this system impact global trade?**

If successful, the system could increase trade efficiency among BRICS nations, reduce transaction costs, and potentially shift some global trade away from dollar dependency.

5. **What technologies might be used in the BRICS digital payment system?**

The system could leverage blockchain technology, digital currencies, and other fintech innovations to ensure secure and efficient transactions.

6. **What are the potential challenges for the BRICS digital payment system?**

Challenges include technological integration, regulatory differences among member countries, cybersecurity risks, and gaining widespread adoption.

7. **How does this initiative align with BRICS’ broader goals?**

The digital payment system aligns with BRICS’ goals of promoting economic growth, enhancing financial independence, and increasing geopolitical influence.

Conclusion

The BRICS nations’ plan to develop a new digital payment system represents a strategic move to challenge the existing global financial norms dominated by Western countries and institutions. By creating an alternative payment infrastructure, BRICS aims to enhance financial independence, reduce reliance on the US dollar, and foster economic cooperation among member countries. This initiative could potentially reshape global trade dynamics, offering a more diversified and multipolar financial landscape. However, the success of this system will depend on overcoming technical, regulatory, and geopolitical challenges, as well as achieving widespread adoption and trust among international stakeholders.