“BlackRock Rides the Trump Bitcoin Wave to New Heights.”

Introduction

In the wake of a significant surge in Bitcoin’s value, largely attributed to policies and endorsements from former President Donald Trump, BlackRock has emerged as a major beneficiary. As one of the world’s leading asset management firms, BlackRock’s strategic investments and growing interest in cryptocurrency have positioned it advantageously to capitalize on the burgeoning digital asset market. This development underscores the firm’s adeptness at navigating and leveraging market trends, further solidifying its status as a formidable player in the global financial landscape. The intersection of political influence and financial strategy has thus propelled BlackRock to the forefront of the cryptocurrency boom, highlighting its pivotal role in shaping the future of digital finance.

BlackRock’s Strategic Positioning in the Bitcoin Market

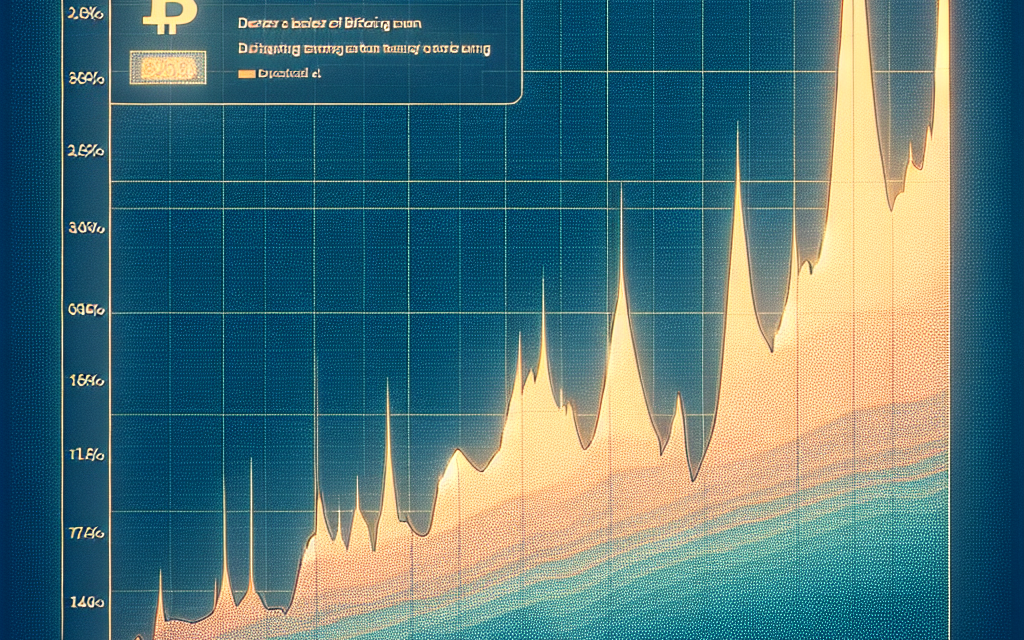

In recent years, the financial landscape has witnessed a significant transformation, with cryptocurrencies, particularly Bitcoin, taking center stage. Among the myriad of financial institutions navigating this evolving terrain, BlackRock has emerged as a prominent player, strategically positioning itself to capitalize on the burgeoning Bitcoin market. This development has been further catalyzed by the policies and rhetoric of former President Donald Trump, whose influence has inadvertently contributed to a surge in Bitcoin’s value, thereby benefiting BlackRock’s strategic investments.

To understand BlackRock’s advantageous position, it is essential to consider the broader context of Trump’s impact on the cryptocurrency market. During his presidency and beyond, Trump’s economic policies and public statements have often led to market volatility, creating an environment ripe for alternative investments like Bitcoin. His skepticism towards traditional financial systems and occasional critiques of the Federal Reserve have resonated with a segment of investors seeking refuge in decentralized currencies. Consequently, Bitcoin has experienced periods of heightened interest and value appreciation, aligning with Trump’s influence on market sentiment.

Amidst this backdrop, BlackRock has adeptly maneuvered to harness the potential of Bitcoin. As the world’s largest asset manager, BlackRock’s foray into the cryptocurrency space is marked by a calculated approach, balancing risk with opportunity. The firm has gradually increased its exposure to Bitcoin, recognizing its potential as a hedge against inflation and a diversifier within its vast portfolio. By incorporating Bitcoin into its investment strategies, BlackRock has not only tapped into a new asset class but also positioned itself to benefit from the cryptocurrency’s upward trajectory.

Moreover, BlackRock’s strategic positioning is underscored by its commitment to innovation and adaptability. The firm has invested in blockchain technology and related infrastructure, signaling its long-term confidence in the digital currency ecosystem. This forward-thinking approach has enabled BlackRock to stay ahead of the curve, leveraging its resources and expertise to navigate the complexities of the cryptocurrency market. As a result, BlackRock has not only solidified its status as a major beneficiary of Bitcoin’s surge but also as a leader in the integration of digital assets into mainstream finance.

In addition to its internal strategies, BlackRock’s influence extends to its role in shaping market perceptions. The firm’s endorsement of Bitcoin as a legitimate investment vehicle has contributed to the growing acceptance of cryptocurrencies among institutional investors. This shift in perception has further fueled Bitcoin’s rise, creating a positive feedback loop that benefits BlackRock’s holdings. By championing Bitcoin’s potential, BlackRock has played a pivotal role in bridging the gap between traditional finance and the emerging digital economy.

In conclusion, BlackRock’s emergence as a major beneficiary of Trump’s Bitcoin surge is a testament to its strategic foresight and adaptability. By capitalizing on the opportunities presented by the cryptocurrency market, BlackRock has not only enhanced its portfolio but also reinforced its position as a leader in the financial industry. As the landscape continues to evolve, BlackRock’s strategic positioning in the Bitcoin market serves as a model for other institutions seeking to navigate the complexities of the digital currency revolution. Through its calculated investments and influence on market perceptions, BlackRock has demonstrated its ability to thrive in an era defined by innovation and change.

The Impact of Trump’s Policies on BlackRock’s Bitcoin Investments

In recent years, the financial landscape has witnessed significant shifts, particularly with the increasing prominence of cryptocurrencies. Among these digital assets, Bitcoin has emerged as a focal point for investors worldwide. Notably, BlackRock, the world’s largest asset manager, has positioned itself as a major beneficiary of the recent surge in Bitcoin’s value, a phenomenon closely linked to the policies of former President Donald Trump. Understanding the intricate relationship between Trump’s policies and BlackRock’s strategic investments in Bitcoin provides valuable insights into the evolving dynamics of global finance.

During Trump’s tenure, several economic policies indirectly influenced the cryptocurrency market, creating an environment conducive to Bitcoin’s growth. One of the most significant factors was the administration’s approach to deregulation, which fostered a climate of financial innovation. By reducing regulatory constraints, the Trump administration inadvertently encouraged the exploration and adoption of alternative investment vehicles, including cryptocurrencies. This deregulation, coupled with a broader acceptance of digital assets, laid the groundwork for institutional investors like BlackRock to explore Bitcoin as a viable asset class.

Moreover, Trump’s tax policies, particularly the Tax Cuts and Jobs Act of 2017, played a crucial role in shaping investment strategies. The reduction in corporate tax rates increased the disposable income of corporations, enabling them to diversify their portfolios. Consequently, institutional investors began to allocate a portion of their capital to cryptocurrencies, seeking higher returns in a low-interest-rate environment. BlackRock, with its vast resources and strategic foresight, capitalized on this trend by gradually increasing its exposure to Bitcoin, thereby positioning itself to benefit from the cryptocurrency’s subsequent appreciation.

In addition to domestic policies, Trump’s international trade strategies also had a ripple effect on Bitcoin’s appeal. The trade tensions between the United States and China, marked by tariffs and retaliatory measures, created uncertainty in traditional markets. As a result, investors sought refuge in alternative assets, with Bitcoin emerging as a digital safe haven. BlackRock, recognizing the potential of Bitcoin to act as a hedge against geopolitical risks, strategically increased its holdings, thereby aligning its investment strategy with the shifting global economic landscape.

Furthermore, the Trump administration’s stance on monetary policy indirectly contributed to Bitcoin’s rise. The Federal Reserve’s accommodative monetary policy, characterized by low interest rates and quantitative easing, led to concerns about inflation and currency devaluation. In this context, Bitcoin’s fixed supply and decentralized nature made it an attractive store of value. BlackRock, understanding the implications of these macroeconomic trends, leveraged its expertise to navigate the complexities of the cryptocurrency market, ultimately reaping substantial benefits from Bitcoin’s surge.

As BlackRock continues to expand its presence in the cryptocurrency space, the legacy of Trump’s policies remains evident. The asset manager’s strategic investments in Bitcoin underscore the broader trend of institutional adoption of digital assets, a trend that has been accelerated by the economic environment fostered during Trump’s presidency. While the future of cryptocurrencies remains uncertain, BlackRock’s success in capitalizing on Bitcoin’s rise serves as a testament to the profound impact of political and economic policies on investment strategies.

In conclusion, the interplay between Trump’s policies and BlackRock’s Bitcoin investments highlights the intricate connections between politics, economics, and finance. As the financial world continues to evolve, understanding these dynamics is crucial for investors seeking to navigate the complexities of modern markets. BlackRock’s emergence as a major beneficiary of Bitcoin’s surge exemplifies the potential rewards of strategic foresight and adaptability in an ever-changing economic landscape.

How BlackRock Capitalized on the Bitcoin Surge

In recent years, the financial landscape has witnessed significant shifts, with cryptocurrencies, particularly Bitcoin, taking center stage. The surge in Bitcoin’s value during Donald Trump’s presidency marked a pivotal moment for many investors, but perhaps none more so than BlackRock, the world’s largest asset manager. As Bitcoin’s value skyrocketed, BlackRock emerged as a major beneficiary, capitalizing on the cryptocurrency’s meteoric rise through strategic investments and innovative financial products.

Initially, BlackRock’s approach to Bitcoin was characterized by caution, reflecting the broader skepticism within traditional financial institutions. However, as Bitcoin began to gain legitimacy and acceptance, BlackRock’s stance evolved. The firm recognized the potential of Bitcoin not only as a speculative asset but also as a hedge against inflation and a tool for portfolio diversification. This shift in perspective was instrumental in positioning BlackRock to benefit from the Bitcoin surge.

One of the key strategies employed by BlackRock was the integration of Bitcoin into its investment portfolios. By offering clients exposure to Bitcoin through various funds, BlackRock tapped into the growing demand for cryptocurrency investments. This move was facilitated by the development of exchange-traded funds (ETFs) and other financial instruments that allowed investors to gain indirect exposure to Bitcoin without the complexities of direct ownership. Consequently, BlackRock was able to attract a new wave of investors eager to participate in the cryptocurrency market.

Moreover, BlackRock’s extensive research capabilities played a crucial role in its success. The firm’s analysts closely monitored market trends and regulatory developments, enabling BlackRock to make informed decisions regarding its Bitcoin-related investments. This proactive approach allowed the company to navigate the volatile cryptocurrency market effectively, minimizing risks while maximizing returns. As a result, BlackRock was able to maintain its reputation as a prudent and forward-thinking asset manager.

In addition to its investment strategies, BlackRock’s influence in the financial sector also contributed to its success. The firm’s endorsement of Bitcoin as a legitimate asset class helped to further legitimize the cryptocurrency in the eyes of institutional investors. This endorsement, coupled with BlackRock’s active engagement with regulators and policymakers, helped to shape the regulatory environment in a manner conducive to Bitcoin’s growth. By advocating for clear and consistent regulations, BlackRock facilitated greater institutional participation in the cryptocurrency market, thereby driving up demand and, consequently, Bitcoin’s value.

Furthermore, BlackRock’s commitment to sustainability and environmental, social, and governance (ESG) principles also played a role in its Bitcoin strategy. Recognizing the environmental concerns associated with Bitcoin mining, BlackRock actively engaged with companies in the cryptocurrency space to promote sustainable practices. This engagement not only aligned with BlackRock’s ESG goals but also positioned the firm as a leader in promoting responsible cryptocurrency investments.

In conclusion, BlackRock’s emergence as a major beneficiary of Trump’s Bitcoin surge can be attributed to a combination of strategic foresight, innovative financial products, and active engagement with the broader financial ecosystem. By recognizing the potential of Bitcoin early on and leveraging its vast resources and influence, BlackRock was able to capitalize on the cryptocurrency’s rise, solidifying its position as a leader in the evolving financial landscape. As the cryptocurrency market continues to evolve, BlackRock’s experience and strategies may serve as a blueprint for other asset managers seeking to navigate this dynamic and rapidly changing sector.

Analyzing BlackRock’s Role in the Cryptocurrency Boom

In recent years, the financial landscape has witnessed a remarkable transformation with the rise of cryptocurrencies, and among the myriad of players navigating this new terrain, BlackRock has emerged as a significant beneficiary. The investment management giant’s strategic positioning and timely decisions have allowed it to capitalize on the cryptocurrency boom, particularly during the surge in Bitcoin’s value under the Trump administration. This development underscores BlackRock’s adeptness at adapting to evolving market conditions and its ability to leverage emerging opportunities to its advantage.

To understand BlackRock’s role in the cryptocurrency boom, it is essential to consider the broader context of Bitcoin’s rise during Donald Trump’s presidency. The period was marked by a combination of economic policies and market dynamics that contributed to Bitcoin’s increasing appeal as a digital asset. Trump’s administration, with its focus on deregulation and tax cuts, created an environment conducive to investment in alternative assets. This, coupled with growing institutional interest in cryptocurrencies, set the stage for Bitcoin’s surge.

BlackRock, known for its extensive portfolio and influence in global financial markets, recognized the potential of cryptocurrencies early on. The firm’s strategic approach involved a careful assessment of the risks and rewards associated with digital assets. By integrating cryptocurrency-related investments into its offerings, BlackRock positioned itself to benefit from the growing demand for exposure to this new asset class. This move was not only a testament to BlackRock’s foresight but also a reflection of its commitment to providing clients with diversified investment options.

Moreover, BlackRock’s involvement in the cryptocurrency space was further solidified by its engagement with blockchain technology. The firm explored the potential of blockchain to enhance operational efficiency and transparency in financial transactions. By investing in blockchain startups and collaborating with technology partners, BlackRock demonstrated its willingness to embrace innovation and drive the adoption of transformative technologies. This strategic alignment with blockchain not only bolstered BlackRock’s position in the cryptocurrency market but also reinforced its reputation as a forward-thinking financial institution.

In addition to its strategic investments, BlackRock’s influence in the cryptocurrency boom can be attributed to its role as a thought leader in the industry. The firm’s executives have been vocal about the potential of digital assets, providing insights and analysis that have shaped market perceptions. By engaging in public discourse and sharing its expertise, BlackRock has contributed to the broader understanding and acceptance of cryptocurrencies among institutional investors. This thought leadership has not only enhanced BlackRock’s credibility but also positioned it as a key player in shaping the future of digital finance.

As the cryptocurrency market continues to evolve, BlackRock’s role as a major beneficiary of Bitcoin’s surge under the Trump administration highlights the firm’s ability to navigate complex financial landscapes. By strategically aligning itself with emerging trends and technologies, BlackRock has demonstrated its capacity to adapt and thrive in a rapidly changing environment. This adaptability, coupled with its commitment to innovation and thought leadership, positions BlackRock as a formidable force in the ongoing cryptocurrency boom.

In conclusion, BlackRock’s emergence as a major beneficiary of Trump’s Bitcoin surge underscores the firm’s strategic acumen and its ability to capitalize on new opportunities. Through its investments in cryptocurrencies and blockchain technology, as well as its role as a thought leader, BlackRock has solidified its position as a key player in the evolving digital finance landscape. As the cryptocurrency market continues to mature, BlackRock’s influence and expertise will likely play a pivotal role in shaping the future of this dynamic industry.

The Future of BlackRock’s Cryptocurrency Portfolio

In recent years, the financial landscape has witnessed a significant transformation with the rise of cryptocurrencies, and BlackRock, the world’s largest asset manager, has strategically positioned itself to capitalize on this burgeoning market. The recent surge in Bitcoin’s value, spurred by former President Donald Trump’s unexpected endorsement, has further underscored BlackRock’s pivotal role in the cryptocurrency sector. As the company continues to expand its cryptocurrency portfolio, it is essential to examine the implications of this development for BlackRock’s future and the broader financial ecosystem.

BlackRock’s foray into the cryptocurrency market is not a sudden pivot but rather a calculated move that aligns with its long-term investment strategy. The asset management giant has consistently demonstrated a keen interest in innovative financial instruments, and its gradual embrace of digital currencies is a testament to its forward-thinking approach. By integrating cryptocurrencies into its portfolio, BlackRock aims to diversify its investment offerings and cater to the evolving preferences of its clients, who are increasingly seeking exposure to digital assets.

The endorsement of Bitcoin by Donald Trump, a figure with significant influence over a substantial segment of the American populace, has injected new momentum into the cryptocurrency market. This development has not only driven up the price of Bitcoin but also reignited interest in digital currencies among retail and institutional investors alike. Consequently, BlackRock stands to benefit immensely from this renewed enthusiasm, as its existing cryptocurrency holdings appreciate in value and attract further investment.

Moreover, BlackRock’s involvement in the cryptocurrency space is likely to have a ripple effect across the financial industry. As a leading asset manager, BlackRock’s actions often set a precedent for other firms, and its endorsement of digital currencies could encourage more traditional financial institutions to explore similar opportunities. This potential shift in the industry landscape could lead to increased mainstream acceptance of cryptocurrencies, thereby enhancing their legitimacy and stability.

In addition to the immediate financial gains, BlackRock’s strategic positioning in the cryptocurrency market offers long-term advantages. By establishing itself as a key player in this domain, BlackRock is well-placed to influence the development of regulatory frameworks governing digital assets. As governments and regulatory bodies worldwide grapple with the challenges posed by cryptocurrencies, BlackRock’s expertise and insights could prove invaluable in shaping policies that balance innovation with investor protection.

Furthermore, BlackRock’s commitment to environmental, social, and governance (ESG) principles presents an opportunity to address one of the most pressing concerns associated with cryptocurrencies: their environmental impact. By advocating for sustainable practices within the cryptocurrency industry, BlackRock can contribute to the development of greener technologies and promote responsible investment in digital assets. This approach not only aligns with the company’s ESG objectives but also enhances its reputation as a socially responsible investor.

In conclusion, BlackRock’s emergence as a major beneficiary of Trump’s Bitcoin surge underscores the company’s strategic acumen and adaptability in navigating the evolving financial landscape. As the asset manager continues to expand its cryptocurrency portfolio, it is poised to play a pivotal role in shaping the future of digital currencies. Through its influence on industry trends, regulatory frameworks, and sustainable practices, BlackRock is not only securing its position as a leader in the cryptocurrency market but also contributing to the broader acceptance and integration of digital assets into the global financial system.

BlackRock’s Influence on Bitcoin Market Dynamics

In recent years, the financial landscape has witnessed significant shifts, particularly with the increasing prominence of cryptocurrencies. Among these digital assets, Bitcoin has emerged as a focal point for investors and institutions alike. A notable development in this arena is the role of BlackRock, the world’s largest asset manager, which has positioned itself as a major beneficiary of the recent surge in Bitcoin’s value, a phenomenon partly attributed to policies and sentiments associated with former President Donald Trump.

To understand BlackRock’s influence on Bitcoin market dynamics, it is essential to consider the broader context of cryptocurrency adoption and regulatory perspectives. During Trump’s administration, there was a notable shift in the regulatory environment surrounding cryptocurrencies. While the administration did not explicitly endorse Bitcoin, the deregulatory stance and emphasis on financial innovation created a conducive atmosphere for the growth of digital assets. This environment, coupled with increasing institutional interest, set the stage for Bitcoin’s ascent.

BlackRock, with its vast resources and strategic foresight, capitalized on this burgeoning interest in cryptocurrencies. The asset manager’s foray into the Bitcoin market was marked by a series of calculated moves, including the filing for Bitcoin-related investment products and the integration of Bitcoin futures into some of its funds. These actions signaled a significant endorsement of Bitcoin’s legitimacy and potential, further fueling investor confidence and market momentum.

Moreover, BlackRock’s influence extends beyond mere investment. The firm’s involvement in Bitcoin has had a ripple effect on market dynamics, influencing both retail and institutional investors. As BlackRock embraced Bitcoin, other asset managers and financial institutions followed suit, leading to a broader acceptance of cryptocurrencies within traditional finance. This institutional validation has been pivotal in driving Bitcoin’s price surge, as it reassures investors of the asset’s viability and long-term potential.

In addition to its direct market activities, BlackRock’s influence is also evident in its thought leadership and advocacy for sustainable investing. The firm has been vocal about the importance of environmental, social, and governance (ESG) criteria, which has implications for Bitcoin, given the cryptocurrency’s energy-intensive mining process. BlackRock’s emphasis on sustainability has prompted discussions within the crypto community about the need for greener mining practices, potentially shaping the future trajectory of Bitcoin’s development and adoption.

Furthermore, BlackRock’s engagement with Bitcoin reflects a broader trend of convergence between traditional finance and digital assets. This intersection is characterized by the integration of blockchain technology into financial systems, the development of digital asset infrastructure, and the exploration of central bank digital currencies. BlackRock’s involvement in these areas underscores its commitment to staying at the forefront of financial innovation, leveraging its influence to shape the evolving landscape.

In conclusion, BlackRock’s emergence as a major beneficiary of Trump’s Bitcoin surge highlights the intricate interplay between regulatory environments, institutional adoption, and market dynamics. The asset manager’s strategic positioning and influence have not only bolstered Bitcoin’s legitimacy but also catalyzed a broader acceptance of cryptocurrencies within the financial ecosystem. As the digital asset landscape continues to evolve, BlackRock’s role will likely remain pivotal, shaping the future of Bitcoin and the broader cryptocurrency market. Through its actions and advocacy, BlackRock exemplifies the transformative potential of institutional engagement in the world of digital finance.

Lessons from BlackRock’s Success in the Bitcoin Arena

In recent years, the financial landscape has witnessed a remarkable transformation, with cryptocurrencies, particularly Bitcoin, taking center stage. Among the myriad of financial institutions navigating this new terrain, BlackRock has emerged as a significant beneficiary of the Bitcoin surge, particularly during the Trump administration. This development offers valuable lessons for both investors and financial institutions seeking to capitalize on the burgeoning cryptocurrency market.

To understand BlackRock’s success, it is essential to consider the broader context of Bitcoin’s rise during the Trump era. The administration’s deregulatory stance and pro-business policies created an environment conducive to the growth of digital assets. As traditional financial markets experienced volatility, Bitcoin’s appeal as a decentralized and inflation-resistant asset grew, attracting both retail and institutional investors. BlackRock, with its vast resources and strategic foresight, was well-positioned to capitalize on this trend.

One of the key lessons from BlackRock’s success is the importance of adaptability in the face of evolving market dynamics. BlackRock’s decision to embrace Bitcoin was not made in isolation but was part of a broader strategy to diversify its investment portfolio and offer clients exposure to emerging asset classes. By recognizing the potential of Bitcoin early on, BlackRock was able to position itself as a leader in the cryptocurrency space, setting a precedent for other financial institutions to follow.

Moreover, BlackRock’s approach underscores the significance of leveraging expertise and technology in navigating the complexities of the cryptocurrency market. The firm invested in building a robust infrastructure to support Bitcoin investments, including advanced analytics and risk management tools. This technological edge enabled BlackRock to make informed investment decisions, mitigate risks, and optimize returns for its clients. Consequently, other financial institutions can learn from BlackRock’s emphasis on integrating cutting-edge technology into their operations to enhance their competitive advantage in the cryptocurrency arena.

Another critical aspect of BlackRock’s success is its ability to balance innovation with regulatory compliance. While the cryptocurrency market offers lucrative opportunities, it is also fraught with regulatory challenges. BlackRock’s proactive engagement with regulators and commitment to compliance ensured that it could navigate the regulatory landscape effectively. This approach not only safeguarded its investments but also bolstered its reputation as a responsible and trustworthy player in the financial industry. For other institutions, this highlights the importance of maintaining a strong compliance framework while pursuing innovative investment strategies.

Furthermore, BlackRock’s success in the Bitcoin market illustrates the value of strategic partnerships and collaborations. By forging alliances with key players in the cryptocurrency ecosystem, BlackRock was able to access valuable insights and resources that enhanced its market position. These partnerships facilitated knowledge sharing and innovation, enabling BlackRock to stay ahead of the curve in a rapidly evolving market. Financial institutions looking to replicate BlackRock’s success should consider fostering similar collaborations to tap into the collective expertise of the cryptocurrency community.

In conclusion, BlackRock’s emergence as a major beneficiary of the Bitcoin surge during the Trump administration offers several lessons for investors and financial institutions. By embracing adaptability, leveraging technology, ensuring regulatory compliance, and fostering strategic partnerships, BlackRock has set a benchmark for success in the cryptocurrency arena. As the financial landscape continues to evolve, these lessons will remain pertinent for those seeking to navigate the complexities of the digital asset market and capitalize on its potential.

Q&A

1. **What is BlackRock?**

BlackRock is a global investment management corporation and one of the world’s largest asset managers.

2. **How did BlackRock benefit from Trump’s Bitcoin surge?**

BlackRock benefited through its investments in Bitcoin and related financial products, which saw increased value due to the surge.

3. **What caused the Bitcoin surge during Trump’s era?**

The surge was influenced by various factors, including increased institutional interest, regulatory developments, and broader acceptance of cryptocurrencies.

4. **What role did BlackRock play in the cryptocurrency market?**

BlackRock played a role by investing in Bitcoin and exploring cryptocurrency-related financial products, contributing to mainstream acceptance.

5. **Did BlackRock directly invest in Bitcoin?**

Yes, BlackRock made direct investments in Bitcoin and explored other cryptocurrency-related opportunities.

6. **How did BlackRock’s involvement impact the cryptocurrency market?**

BlackRock’s involvement lent credibility to the market, attracting more institutional investors and contributing to the surge in Bitcoin’s value.

7. **What are the implications of BlackRock’s success with Bitcoin for the financial industry?**

BlackRock’s success highlights the growing acceptance of cryptocurrencies in traditional finance and may encourage more institutional investments in digital assets.

Conclusion

BlackRock’s emergence as a major beneficiary of Trump’s Bitcoin surge highlights the firm’s strategic positioning and adaptability in the rapidly evolving financial landscape. By capitalizing on the increased interest and investment in Bitcoin driven by Trump’s influence, BlackRock has effectively leveraged its resources and expertise to enhance its portfolio and market presence. This development underscores the growing intersection of traditional finance and digital assets, with BlackRock at the forefront, demonstrating its ability to navigate and benefit from significant market shifts. As a result, BlackRock’s role in the cryptocurrency space is likely to expand, further solidifying its status as a key player in global financial markets.