“ASML Shares Tumble: Navigating Uncertainty After Unexpected Guidance Cut”

Introduction

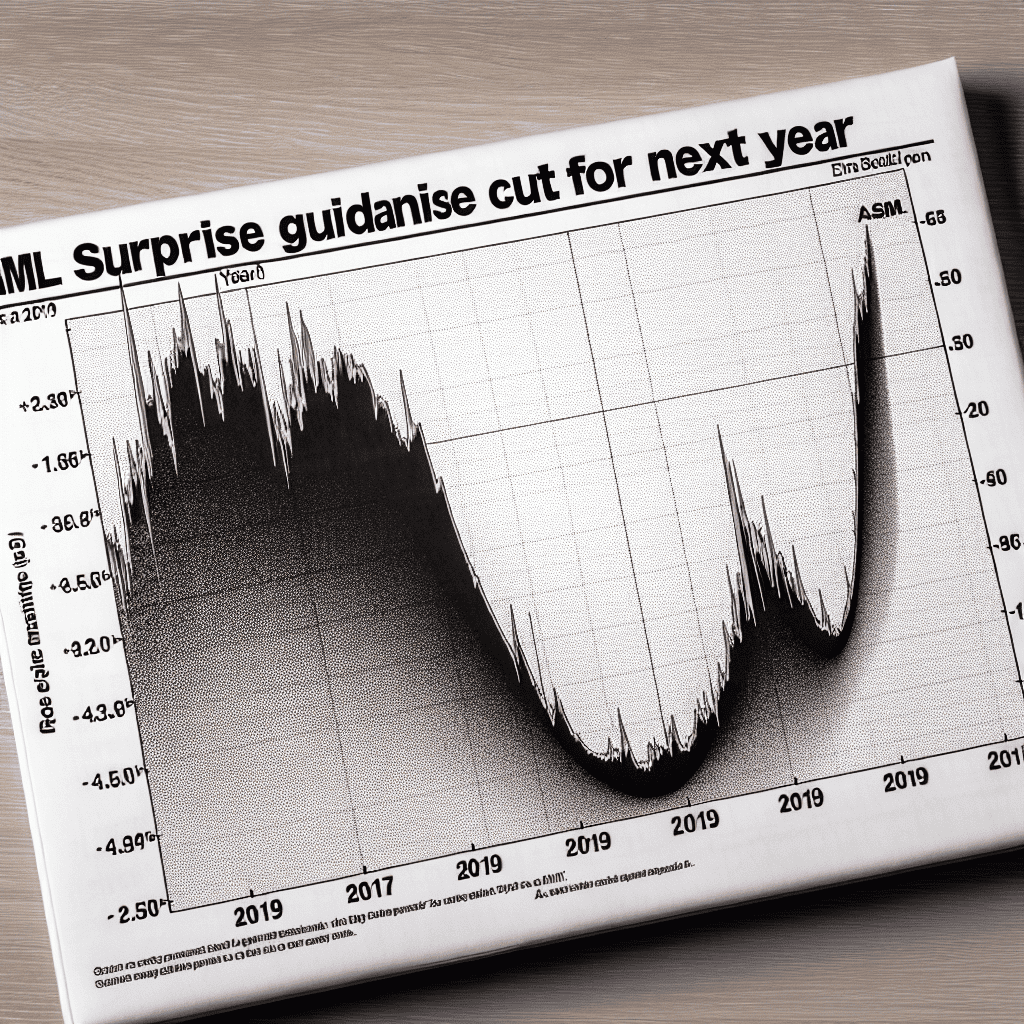

ASML Holding NV, a leading supplier of semiconductor manufacturing equipment, recently experienced a significant drop in its share price following an unexpected revision of its financial guidance for the upcoming year. The company, renowned for its advanced lithography machines essential for producing cutting-edge microchips, announced a downward adjustment in its revenue projections, citing a slowdown in demand from key customers and broader market uncertainties. This surprise guidance cut has raised concerns among investors about the near-term growth prospects of the semiconductor industry, which has been grappling with fluctuating demand and supply chain disruptions. The announcement has prompted a reevaluation of ASML’s market position and future performance, leading to a sharp decline in its stock value as stakeholders reassess their investment strategies in light of the revised outlook.

Impact Of ASML’s Guidance Cut On The Semiconductor Industry

ASML Holding NV, a pivotal player in the semiconductor industry, recently sent ripples through the market with an unexpected guidance cut for the upcoming year. This announcement has led to a significant plunge in its share prices, raising concerns about the broader implications for the semiconductor sector. As the leading supplier of photolithography equipment, ASML’s performance is often seen as a bellwether for the health of the semiconductor industry. Therefore, its revised outlook has prompted stakeholders to reassess their expectations for the sector’s growth trajectory.

The semiconductor industry, already grappling with a myriad of challenges, now faces additional uncertainty due to ASML’s guidance cut. The company cited a slowdown in demand from key customers as a primary reason for its revised forecast. This development is particularly concerning given the industry’s recent struggles with supply chain disruptions and geopolitical tensions. ASML’s announcement suggests that the anticipated recovery in semiconductor demand may not materialize as swiftly as previously hoped, potentially delaying the industry’s return to pre-pandemic growth levels.

Moreover, ASML’s guidance cut has implications for its customers, which include some of the largest chipmakers in the world. These companies rely heavily on ASML’s advanced lithography machines to produce cutting-edge semiconductors. A slowdown in ASML’s business could signal a corresponding deceleration in the production capabilities of these chipmakers, potentially exacerbating existing supply shortages. This scenario could have a cascading effect on industries that depend on semiconductors, such as consumer electronics, automotive, and telecommunications, further complicating the global economic recovery.

In addition to supply chain concerns, ASML’s guidance cut raises questions about the competitive dynamics within the semiconductor industry. The company’s dominance in the photolithography market has been a critical factor in enabling chipmakers to push the boundaries of Moore’s Law. However, if ASML’s growth prospects are dimming, it may open the door for competitors to gain ground. This could lead to increased competition and innovation in the sector, as companies strive to develop alternative technologies and processes to maintain their competitive edge.

Furthermore, the market’s reaction to ASML’s announcement underscores the sensitivity of semiconductor stocks to shifts in industry sentiment. The sharp decline in ASML’s share price reflects investor apprehension about the sector’s near-term prospects. This volatility may prompt investors to adopt a more cautious approach, potentially leading to reduced capital inflows into semiconductor companies. Such a scenario could hinder the industry’s ability to invest in research and development, which is crucial for driving future innovation and growth.

Despite these challenges, it is important to recognize that the semiconductor industry remains a cornerstone of the global economy. The demand for semiconductors is expected to continue growing over the long term, driven by trends such as digitalization, artificial intelligence, and the Internet of Things. While ASML’s guidance cut presents a near-term setback, it does not fundamentally alter the industry’s positive long-term outlook. Stakeholders will need to navigate the current uncertainties with a focus on resilience and adaptability, ensuring that they are well-positioned to capitalize on future opportunities.

In conclusion, ASML’s surprise guidance cut has significant implications for the semiconductor industry, highlighting both immediate challenges and potential shifts in competitive dynamics. As the sector grapples with these developments, it will be crucial for companies to remain agile and forward-thinking, leveraging innovation to overcome obstacles and drive sustainable growth.

Investor Reactions To ASML’s Unexpected Guidance Reduction

ASML Holding NV, a pivotal player in the semiconductor industry, recently experienced a significant drop in its share price following an unexpected guidance cut for the upcoming fiscal year. This development has sent ripples through the investment community, prompting a reevaluation of the company’s future prospects. The Dutch company, renowned for its advanced lithography machines essential for chip manufacturing, has long been considered a bellwether for the semiconductor sector. Therefore, any adjustments in its financial outlook are closely scrutinized by investors and analysts alike.

The announcement of the guidance cut came as a surprise to many, given ASML’s strong performance in recent years. The company has consistently reported robust earnings, driven by the insatiable demand for semiconductors across various industries, including consumer electronics, automotive, and telecommunications. However, the revised guidance suggests that ASML anticipates a slowdown in growth, which has raised concerns about potential headwinds facing the broader semiconductor market.

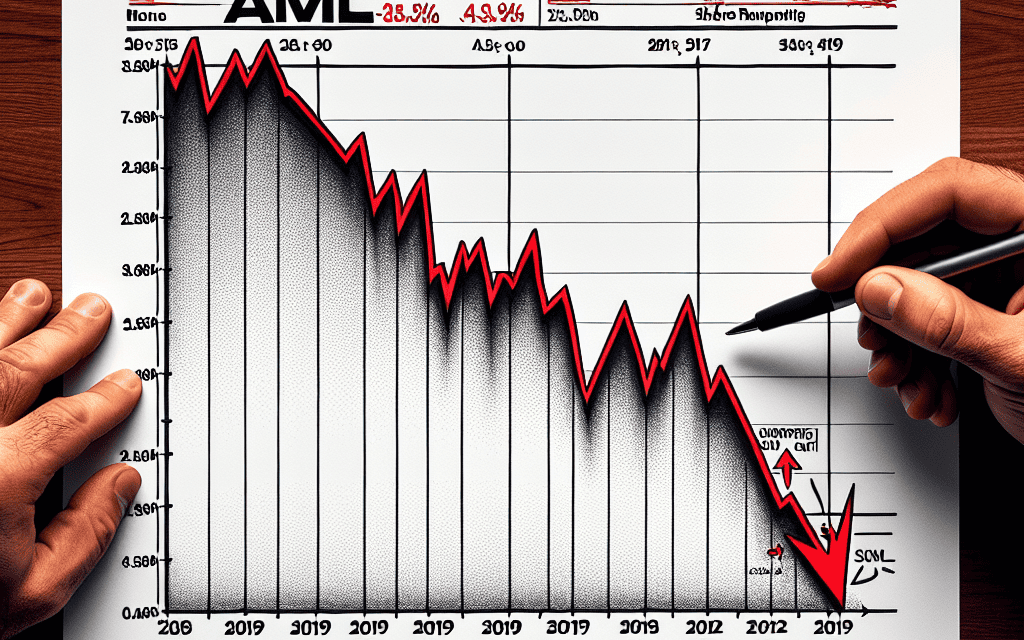

In response to the guidance cut, ASML’s shares plunged, reflecting investor apprehension about the company’s ability to maintain its growth trajectory. The market reaction underscores the sensitivity of ASML’s stock to changes in its financial outlook, as investors weigh the implications of the revised guidance on their investment strategies. The decline in share price also highlights the broader market’s vulnerability to shifts in the semiconductor industry’s dynamics, which have been characterized by cyclical fluctuations and supply chain disruptions.

Several factors may have contributed to ASML’s decision to lower its guidance. One possibility is the ongoing geopolitical tensions, which have created an uncertain environment for global trade and technology exchange. These tensions could potentially impact ASML’s ability to secure critical components or access key markets, thereby affecting its revenue streams. Additionally, the semiconductor industry is grappling with supply chain challenges, including shortages of raw materials and logistical bottlenecks, which could hinder ASML’s production capabilities and delivery timelines.

Moreover, the anticipated slowdown in demand for consumer electronics, as economies around the world face inflationary pressures and potential recessions, may have influenced ASML’s revised outlook. As consumers tighten their spending, the demand for devices that rely on semiconductors could diminish, leading to a ripple effect throughout the supply chain. This scenario could prompt semiconductor manufacturers to scale back their capital expenditures, thereby affecting ASML’s order book.

Despite the immediate negative reaction from investors, some analysts remain cautiously optimistic about ASML’s long-term prospects. They argue that the company’s technological leadership and strategic positioning in the semiconductor industry provide a solid foundation for future growth. ASML’s cutting-edge extreme ultraviolet (EUV) lithography technology, which is critical for producing advanced chips, continues to be in high demand among leading semiconductor manufacturers. This technological edge could enable ASML to capitalize on emerging opportunities as the industry evolves.

In conclusion, ASML’s surprise guidance cut has undoubtedly shaken investor confidence, leading to a sharp decline in its share price. However, the company’s fundamental strengths and strategic importance in the semiconductor ecosystem may offer a silver lining for long-term investors. As the industry navigates through current challenges, ASML’s ability to adapt and innovate will be crucial in determining its future trajectory. Investors will be closely monitoring the company’s performance and strategic initiatives in the coming months, as they seek to assess the potential impact of the revised guidance on their investment portfolios.

Analyzing The Factors Behind ASML’s Share Price Decline

ASML Holding NV, a pivotal player in the semiconductor industry, recently experienced a significant decline in its share price following an unexpected revision of its financial guidance for the upcoming year. This development has sent ripples through the market, prompting investors and analysts to scrutinize the underlying factors contributing to this downturn. Understanding the reasons behind ASML’s guidance cut requires a comprehensive examination of both internal and external influences affecting the company and the broader semiconductor sector.

To begin with, ASML’s decision to lower its guidance can be attributed to a confluence of macroeconomic challenges that have been impacting the global economy. The semiconductor industry, which is highly sensitive to economic fluctuations, has been grappling with a slowdown in demand due to geopolitical tensions, inflationary pressures, and supply chain disruptions. These factors have collectively created an environment of uncertainty, leading to cautious spending by key customers and a subsequent reduction in orders for ASML’s advanced lithography equipment.

Moreover, the cyclical nature of the semiconductor industry plays a crucial role in ASML’s current predicament. The industry is known for its boom-and-bust cycles, where periods of rapid growth are often followed by phases of contraction. ASML, being a major supplier of photolithography machines essential for chip manufacturing, is inherently tied to these cycles. The recent guidance cut suggests that the industry may be entering a phase of slower growth, as demand for consumer electronics and other semiconductor-dependent products stabilizes after a period of heightened activity driven by the pandemic.

In addition to these macroeconomic and cyclical factors, ASML is also facing increased competition from emerging players in the semiconductor equipment market. While ASML has long been a leader in the development of extreme ultraviolet (EUV) lithography technology, which is critical for producing smaller and more efficient chips, competitors are making strides in advancing their own technologies. This intensifying competition could potentially erode ASML’s market share and put pressure on its pricing power, thereby affecting its revenue projections.

Furthermore, regulatory challenges and trade restrictions have added another layer of complexity to ASML’s operating environment. The semiconductor industry is heavily influenced by international trade policies, and recent geopolitical tensions have led to tighter export controls and restrictions on technology transfers. These measures can hinder ASML’s ability to access certain markets or supply critical components, thereby impacting its production capabilities and financial outlook.

Despite these challenges, it is important to note that ASML remains a fundamentally strong company with a robust technological foundation. The company’s commitment to innovation and its strategic investments in research and development position it well for long-term growth. However, in the short term, the combination of economic headwinds, industry dynamics, competitive pressures, and regulatory hurdles has necessitated a more cautious financial outlook.

In conclusion, the recent plunge in ASML’s share price following its surprise guidance cut underscores the complex interplay of factors influencing the semiconductor industry. While the company faces significant challenges, its leadership in cutting-edge technology and its strategic initiatives provide a solid foundation for future recovery. Investors and stakeholders will be closely monitoring how ASML navigates these turbulent times, as the company’s performance is not only critical to its own success but also to the broader semiconductor ecosystem.

Future Outlook For ASML Amidst Guidance Adjustments

ASML Holding NV, a pivotal player in the semiconductor industry, recently experienced a significant drop in its share value following an unexpected revision of its financial guidance for the upcoming year. This development has sent ripples through the market, prompting investors and analysts to reassess the company’s future prospects. As the leading supplier of photolithography machines, which are essential for producing advanced microchips, ASML’s performance is closely watched by stakeholders across the technology sector. The company’s decision to lower its guidance has raised questions about the broader implications for the semiconductor industry and the potential challenges that lie ahead.

The revised guidance comes amidst a backdrop of fluctuating demand in the semiconductor market. Over the past few years, the industry has experienced a rollercoaster of demand surges and supply chain disruptions, largely driven by the global pandemic and geopolitical tensions. ASML, known for its cutting-edge extreme ultraviolet (EUV) lithography technology, has been at the forefront of meeting the industry’s needs. However, the company’s recent announcement suggests that it anticipates a slowdown in orders, which could be attributed to several factors, including inventory adjustments by major chipmakers and a potential cooling of the tech boom that characterized the early 2020s.

In light of these developments, ASML’s management has emphasized the importance of strategic adjustments to navigate the evolving landscape. The company remains committed to its long-term growth strategy, which includes continued investment in research and development to maintain its technological edge. By focusing on innovation, ASML aims to enhance its product offerings and address the future demands of the semiconductor industry. Moreover, the company is exploring opportunities to expand its customer base and diversify its revenue streams, thereby mitigating the impact of any potential downturns in specific market segments.

Despite the immediate concerns reflected in the share price decline, industry experts maintain a cautiously optimistic outlook for ASML’s future. The semiconductor industry is poised for sustained growth, driven by the increasing adoption of technologies such as artificial intelligence, 5G, and the Internet of Things. These advancements necessitate more sophisticated and efficient microchips, underscoring the critical role of ASML’s lithography machines. Furthermore, as countries around the world invest in bolstering their semiconductor manufacturing capabilities, ASML is well-positioned to capitalize on these initiatives.

Nevertheless, the company must navigate several challenges to realize its long-term vision. Supply chain constraints, geopolitical uncertainties, and competitive pressures are among the factors that could influence ASML’s trajectory. The company will need to demonstrate agility and resilience in addressing these issues while maintaining its commitment to innovation and customer satisfaction. Additionally, fostering strong relationships with key stakeholders, including suppliers, customers, and governments, will be crucial in ensuring sustained success.

In conclusion, while ASML’s recent guidance cut has understandably caused concern among investors, it is essential to consider the broader context and the company’s strategic initiatives. By focusing on innovation, diversification, and strategic partnerships, ASML is well-equipped to navigate the challenges ahead and capitalize on the opportunities presented by the evolving semiconductor landscape. As the industry continues to evolve, ASML’s ability to adapt and innovate will be key determinants of its future success, offering a promising outlook despite the current uncertainties.

How ASML’s Guidance Cut Affects Global Chip Supply Chains

ASML Holding NV, a pivotal player in the semiconductor industry, recently sent ripples through global markets with its unexpected guidance cut for the upcoming year. This announcement has not only led to a significant plunge in ASML’s share prices but has also raised concerns about the broader implications for global chip supply chains. As the world’s leading supplier of photolithography machines, which are essential for producing advanced microchips, ASML’s performance and projections are closely watched by industry stakeholders. The company’s revised guidance suggests a slowdown in demand, which could have far-reaching effects on the semiconductor supply chain, impacting everything from consumer electronics to automotive manufacturing.

The semiconductor industry has been grappling with a series of challenges over the past few years, including supply chain disruptions, geopolitical tensions, and fluctuating demand patterns. ASML’s guidance cut adds another layer of complexity to this already intricate landscape. The company’s decision to lower its revenue forecasts is primarily attributed to a deceleration in orders from key customers, who are themselves adjusting to changing market conditions. This move is indicative of a broader trend where chipmakers are becoming more cautious in their production and investment strategies, reflecting uncertainties in end-user demand.

Moreover, ASML’s announcement comes at a time when the semiconductor industry is striving to recover from the global chip shortage that has plagued various sectors. The shortage, exacerbated by the COVID-19 pandemic, highlighted the vulnerabilities in the supply chain and underscored the critical role that companies like ASML play in maintaining the flow of semiconductor components. A reduction in ASML’s output could potentially exacerbate these supply chain issues, leading to further delays and bottlenecks in chip production.

In addition to supply chain concerns, ASML’s guidance cut also raises questions about the future of technological innovation. The company’s advanced lithography machines are crucial for the development of cutting-edge technologies, including artificial intelligence, 5G networks, and autonomous vehicles. A slowdown in ASML’s operations could hinder the pace at which these technologies are developed and deployed, affecting industries that rely on the latest semiconductor advancements to drive innovation and growth.

Furthermore, the impact of ASML’s guidance cut is likely to be felt across various regions, given the global nature of the semiconductor supply chain. Countries that are heavily invested in semiconductor manufacturing, such as Taiwan, South Korea, and the United States, may experience shifts in their production dynamics. This could lead to increased competition among chipmakers as they vie for limited resources and seek to secure their supply chains against future disruptions.

In conclusion, ASML’s surprise guidance cut serves as a stark reminder of the interconnectedness of the global semiconductor industry and the delicate balance that must be maintained to ensure its smooth functioning. While the immediate effects are being felt in the form of declining share prices and market uncertainty, the long-term implications could be more profound, influencing everything from supply chain strategies to technological innovation. As stakeholders across the industry navigate this challenging environment, the focus will likely remain on enhancing resilience and adaptability to mitigate the impact of such unforeseen developments.

Comparing ASML’s Performance With Competitors After Guidance Cut

ASML Holding NV, a pivotal player in the semiconductor industry, recently experienced a significant drop in its share value following an unexpected revision of its financial guidance for the upcoming year. This development has sent ripples through the market, prompting investors and analysts to reassess the company’s position relative to its competitors. As the leading supplier of photolithography equipment, ASML’s performance is often seen as a bellwether for the broader semiconductor sector. Therefore, understanding how this guidance cut impacts its competitive standing is crucial for stakeholders.

To begin with, ASML’s revised guidance has raised concerns about potential slowdowns in the semiconductor industry, which has been experiencing robust growth over the past few years. The company’s decision to lower its financial expectations suggests that demand for its advanced lithography machines, particularly the cutting-edge extreme ultraviolet (EUV) systems, may not be as strong as previously anticipated. This has inevitably led to comparisons with other major players in the semiconductor equipment market, such as Applied Materials, Lam Research, and Tokyo Electron, which have also been navigating the complexities of fluctuating demand and supply chain disruptions.

In contrast to ASML, some of its competitors have maintained a more optimistic outlook, buoyed by their diversified product portfolios and strategic investments in emerging technologies. For instance, Applied Materials has been capitalizing on the growing demand for its deposition and etching equipment, which are essential for manufacturing advanced semiconductor devices. This diversification has allowed Applied Materials to mitigate the impact of any potential downturns in specific segments of the market, thereby providing a buffer against the volatility that ASML is currently experiencing.

Similarly, Lam Research has been focusing on expanding its presence in the memory and logic device markets, which continue to exhibit strong growth prospects. By aligning its product offerings with the evolving needs of these sectors, Lam Research has managed to sustain its revenue streams and maintain investor confidence, even as uncertainties loom over the broader industry. This strategic positioning contrasts with ASML’s heavy reliance on its EUV technology, which, while revolutionary, is subject to the cyclical nature of semiconductor demand.

Moreover, Tokyo Electron has been leveraging its expertise in process technology to enhance its competitive edge. The company’s emphasis on innovation and customer collaboration has enabled it to adapt swiftly to changing market dynamics, ensuring a steady flow of orders and a resilient financial performance. This adaptability is particularly noteworthy in light of ASML’s recent guidance cut, which underscores the challenges of predicting market trends in an industry characterized by rapid technological advancements and shifting consumer preferences.

In light of these comparisons, it becomes evident that ASML’s current predicament is not solely a reflection of its operational capabilities but also indicative of broader industry trends. The semiconductor sector is inherently cyclical, and companies must continuously innovate and diversify to navigate its ebbs and flows successfully. While ASML’s leadership in EUV technology remains undisputed, its recent guidance cut serves as a reminder of the importance of strategic agility and market foresight.

In conclusion, ASML’s share price decline following its guidance revision has prompted a reevaluation of its competitive standing within the semiconductor equipment industry. By examining the strategies employed by its peers, it is clear that diversification and adaptability are key to weathering market uncertainties. As the industry continues to evolve, ASML and its competitors must remain vigilant and responsive to maintain their positions in this highly dynamic landscape.

Strategies For Investors In Light Of ASML’s Revised Forecast

ASML Holding NV, a pivotal player in the semiconductor industry, recently sent ripples through the financial markets with its unexpected guidance cut for the upcoming year. This announcement has led to a significant plunge in its share prices, leaving investors in a state of uncertainty. As the dust begins to settle, it is crucial for investors to reassess their strategies in light of ASML’s revised forecast. Understanding the implications of this development and exploring potential strategies can help investors navigate this challenging landscape.

To begin with, ASML’s guidance cut reflects broader concerns within the semiconductor industry, which has been grappling with fluctuating demand and supply chain disruptions. The company’s decision to lower its forecast is indicative of potential headwinds that could affect its revenue and profitability. Consequently, investors must consider the underlying factors contributing to this adjustment. By analyzing these elements, investors can gain a clearer perspective on the company’s future prospects and make informed decisions.

In response to ASML’s revised forecast, diversification emerges as a prudent strategy for investors. By spreading investments across a range of sectors and asset classes, investors can mitigate the risks associated with a single company’s performance. This approach not only reduces exposure to ASML’s specific challenges but also provides a buffer against broader market volatility. Moreover, diversification allows investors to capitalize on opportunities in other sectors that may exhibit growth potential, thereby enhancing their overall portfolio resilience.

Furthermore, investors should closely monitor ASML’s strategic initiatives and technological advancements. Despite the guidance cut, ASML remains a leader in the development of advanced lithography machines, which are essential for producing cutting-edge semiconductors. The company’s continued investment in research and development could yield significant breakthroughs, potentially reversing its current trajectory. By staying informed about ASML’s innovations and strategic partnerships, investors can better assess the company’s long-term growth potential and adjust their strategies accordingly.

In addition to diversification and monitoring technological advancements, investors may also consider adopting a long-term perspective. While short-term fluctuations in share prices can be unsettling, it is important to recognize that the semiconductor industry is characterized by cyclical trends. Historically, periods of downturn have often been followed by robust recoveries, driven by technological advancements and increasing demand for semiconductors across various sectors. By maintaining a long-term outlook, investors can position themselves to benefit from potential rebounds in ASML’s performance and the broader industry.

Moreover, investors should remain vigilant about macroeconomic factors that could influence ASML’s operations. Geopolitical tensions, trade policies, and regulatory changes can all have significant impacts on the semiconductor industry. By staying informed about these external factors, investors can anticipate potential challenges and adjust their strategies accordingly. This proactive approach enables investors to navigate uncertainties and make well-informed decisions that align with their financial goals.

In conclusion, ASML’s surprise guidance cut has undoubtedly created a challenging environment for investors. However, by adopting a diversified approach, monitoring technological advancements, maintaining a long-term perspective, and staying informed about macroeconomic factors, investors can effectively navigate this period of uncertainty. While the road ahead may be fraught with challenges, these strategies provide a framework for investors to make informed decisions and potentially capitalize on future opportunities within the semiconductor industry. As always, careful analysis and strategic planning remain essential components of successful investing.

Q&A

1. **What caused ASML shares to plunge?**

ASML shares plunged due to a surprise guidance cut for the next year.

2. **What is ASML?**

ASML is a Dutch company that is a leading supplier of photolithography equipment used in the semiconductor industry.

3. **What was the market’s reaction to the guidance cut?**

The market reacted negatively, leading to a significant drop in ASML’s share price.

4. **How did the guidance cut affect investor sentiment?**

The guidance cut likely led to decreased investor confidence and concerns about future growth prospects.

5. **What specific guidance was cut by ASML?**

ASML reduced its revenue or earnings forecast for the upcoming year, though specific figures would be detailed in their announcement.

6. **What are the potential reasons for ASML’s guidance cut?**

Potential reasons could include reduced demand, supply chain issues, or macroeconomic factors affecting the semiconductor industry.

7. **How might this guidance cut impact the semiconductor industry?**

The guidance cut could signal broader challenges in the semiconductor industry, potentially affecting other companies and market dynamics.

Conclusion

ASML’s shares experienced a significant decline following an unexpected reduction in its guidance for the upcoming year. This development has raised concerns among investors about the company’s future growth prospects and market conditions. The guidance cut suggests potential challenges in demand or operational hurdles that could impact ASML’s financial performance. As a key player in the semiconductor industry, any negative outlook from ASML can have broader implications for the sector, influencing investor sentiment and market dynamics. The share price drop reflects the market’s reaction to the revised expectations, highlighting the sensitivity of ASML’s stock to changes in its financial outlook.