“Expanding Horizons: Aon Fortifies Global Reach with Strategic P&C Broker Acquisition”

Introduction

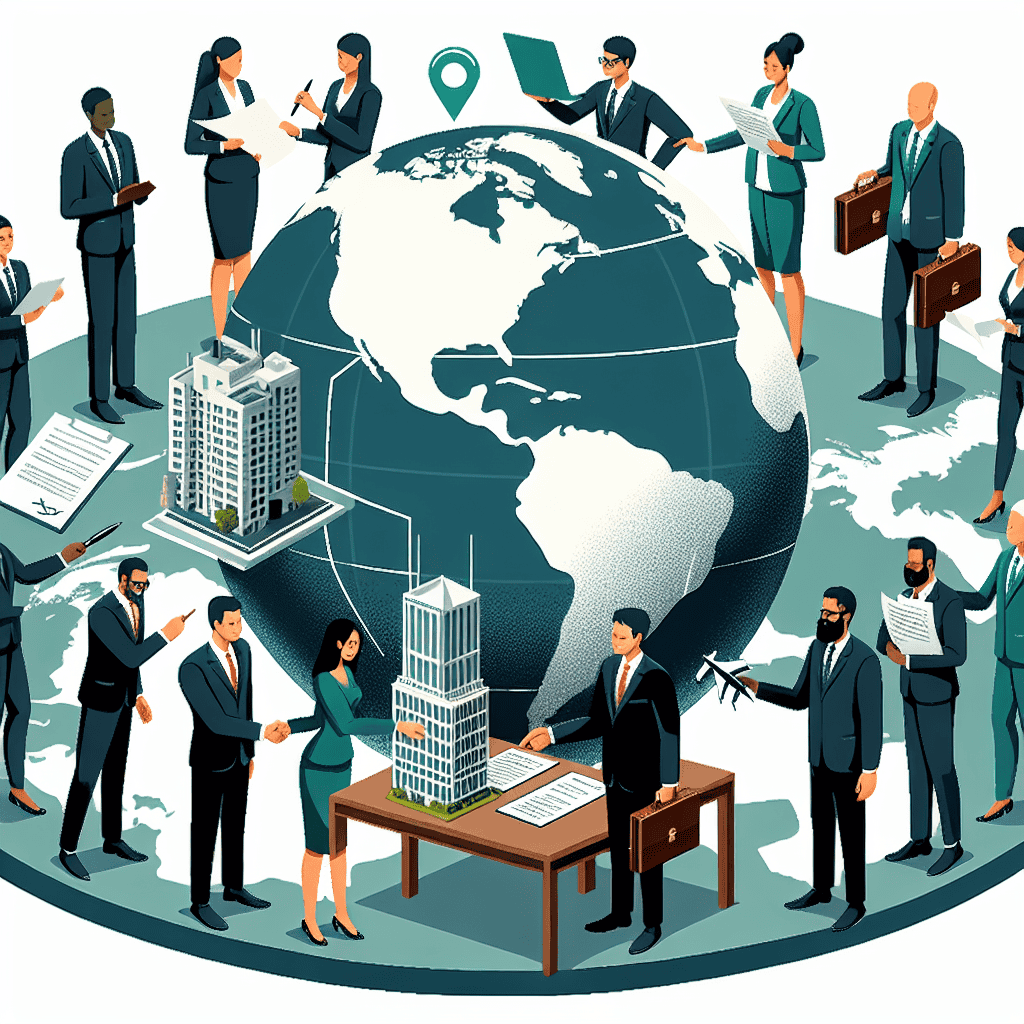

Aon, a leading global professional services firm, has successfully completed its acquisition of a prominent property and casualty (P&C) brokerage firm, marking a significant step in enhancing its global portfolio. This strategic acquisition is set to bolster Aon’s capabilities in delivering comprehensive risk management and insurance solutions to clients worldwide. By integrating the expertise and resources of the acquired brokerage, Aon aims to expand its reach and offer more robust services in the P&C sector, further solidifying its position as a key player in the global insurance and risk management industry. This move underscores Aon’s commitment to growth and innovation, ensuring that it continues to meet the evolving needs of its diverse client base.

Strategic Implications of Aon’s Acquisition of P&C Broker

Aon’s recent acquisition of a prominent property and casualty (P&C) broker marks a significant milestone in the company’s strategic expansion efforts, underscoring its commitment to enhancing its global portfolio. This acquisition is not merely a transaction but a strategic maneuver designed to bolster Aon’s capabilities in the competitive insurance brokerage landscape. By integrating the P&C broker’s expertise and resources, Aon aims to deliver more comprehensive solutions to its clients, thereby reinforcing its position as a leader in the industry.

The acquisition aligns with Aon’s long-term strategy of expanding its footprint in key markets and diversifying its service offerings. As the insurance industry continues to evolve, driven by technological advancements and shifting client needs, Aon recognizes the importance of adapting to these changes. The integration of the P&C broker’s operations is expected to provide Aon with a broader range of products and services, enabling the company to better address the complex risk management needs of its clients. This move is particularly timely, given the increasing demand for tailored insurance solutions that cater to specific industry sectors.

Moreover, the acquisition is anticipated to enhance Aon’s ability to leverage data and analytics, a critical component in today’s insurance landscape. The P&C broker brings with it a wealth of data-driven insights and analytical tools that Aon can integrate into its existing platforms. This synergy is expected to result in more accurate risk assessments and improved decision-making processes, ultimately benefiting Aon’s clients. By harnessing the power of data, Aon can offer more personalized and effective solutions, thereby strengthening client relationships and fostering long-term loyalty.

In addition to expanding its service offerings, the acquisition also presents an opportunity for Aon to tap into new markets and client segments. The P&C broker’s established presence in various regions provides Aon with a strategic advantage, allowing it to penetrate markets that were previously less accessible. This geographic expansion is crucial for Aon as it seeks to diversify its revenue streams and mitigate risks associated with market volatility. By broadening its global reach, Aon can better navigate the challenges posed by economic fluctuations and regulatory changes, ensuring sustained growth and stability.

Furthermore, the acquisition is expected to drive operational efficiencies and cost synergies, a key consideration in any strategic merger or acquisition. By consolidating resources and streamlining processes, Aon can achieve significant cost savings, which can be reinvested into further innovation and development. This focus on efficiency not only enhances Aon’s competitive edge but also positions the company to deliver greater value to its shareholders.

In conclusion, Aon’s acquisition of the P&C broker represents a strategic initiative aimed at strengthening its global portfolio and enhancing its capabilities in the insurance brokerage sector. Through this acquisition, Aon is poised to offer more comprehensive and data-driven solutions, expand its market presence, and achieve operational efficiencies. As the company continues to adapt to the evolving industry landscape, this acquisition underscores Aon’s commitment to delivering exceptional value to its clients and stakeholders. The strategic implications of this acquisition are far-reaching, setting the stage for Aon’s continued success and leadership in the global insurance market.

How Aon’s Latest Acquisition Enhances Its Global Portfolio

Aon’s recent acquisition of a prominent property and casualty (P&C) broker marks a significant milestone in its strategic efforts to enhance its global portfolio. This move underscores Aon’s commitment to expanding its capabilities and offerings in the insurance brokerage industry, thereby reinforcing its position as a leading global professional services firm. By integrating the acquired broker’s expertise and resources, Aon aims to deliver more comprehensive solutions to its clients, addressing their evolving needs in an increasingly complex risk environment.

The acquisition aligns with Aon’s broader strategy to diversify its service offerings and strengthen its presence in key markets worldwide. As the insurance landscape continues to evolve, driven by factors such as technological advancements, regulatory changes, and shifting client expectations, Aon recognizes the importance of adapting to these dynamics. By acquiring a well-established P&C broker, Aon not only broadens its product and service portfolio but also gains access to a wider client base and deeper market insights. This strategic move enables Aon to offer more tailored and innovative solutions, thereby enhancing its value proposition to clients across various industries.

Moreover, the integration of the acquired broker’s capabilities into Aon’s existing operations is expected to yield significant synergies. By leveraging the combined expertise and resources, Aon can optimize its service delivery, improve operational efficiencies, and drive innovation. This integration process involves aligning the organizational cultures, systems, and processes of both entities to ensure a seamless transition and maximize the benefits of the acquisition. Through this collaborative approach, Aon aims to create a more agile and responsive organization that can effectively address the diverse and complex needs of its clients.

In addition to enhancing its service offerings, the acquisition also strengthens Aon’s competitive position in the global insurance brokerage market. By expanding its footprint and capabilities, Aon is better positioned to compete with other major players in the industry. This increased competitiveness is crucial in an environment where clients are seeking more value-driven and customized solutions to manage their risks. Aon’s ability to offer a broader range of services and leverage its global network provides a distinct advantage in meeting these demands and securing long-term client relationships.

Furthermore, the acquisition reflects Aon’s commitment to investing in growth opportunities that align with its strategic objectives. By selectively acquiring firms that complement its existing strengths and address emerging market trends, Aon demonstrates its proactive approach to staying ahead of industry developments. This forward-thinking strategy not only enhances Aon’s growth prospects but also reinforces its reputation as a trusted advisor and partner to its clients.

In conclusion, Aon’s acquisition of a leading P&C broker represents a strategic move to enhance its global portfolio and strengthen its position in the insurance brokerage industry. By integrating the acquired broker’s capabilities, Aon can offer more comprehensive and innovative solutions to its clients, thereby addressing their evolving needs in a dynamic risk environment. This acquisition not only enhances Aon’s service offerings and competitive position but also reflects its commitment to investing in growth opportunities that align with its strategic objectives. As Aon continues to adapt to the changing landscape, this acquisition serves as a testament to its dedication to delivering value and excellence to its clients worldwide.

The Impact of Aon’s Expansion on the Insurance Industry

Aon’s recent acquisition of a prominent property and casualty (P&C) broker marks a significant milestone in the company’s strategic expansion efforts, with far-reaching implications for the global insurance industry. This move is not merely a consolidation of market share but a calculated step towards enhancing Aon’s capabilities and service offerings. As the insurance landscape becomes increasingly complex, Aon’s expansion is poised to influence industry dynamics, competitive strategies, and client expectations.

The acquisition underscores Aon’s commitment to broadening its portfolio and strengthening its position as a leader in risk management and insurance brokerage. By integrating the acquired broker’s expertise and resources, Aon aims to deliver more comprehensive solutions to its clients, addressing a wider array of risks and challenges. This strategic alignment is expected to enhance Aon’s ability to provide tailored services, leveraging the combined knowledge and experience of both entities. Consequently, clients can anticipate more innovative and effective risk management strategies, which are crucial in today’s rapidly evolving risk environment.

Moreover, the acquisition is likely to stimulate competitive pressures within the insurance industry. As Aon expands its capabilities, other major players may feel compelled to reassess their own strategies, potentially leading to further mergers and acquisitions. This could result in a more consolidated market, where a few large firms dominate, thereby intensifying competition for smaller brokers. However, this consolidation could also drive innovation, as companies strive to differentiate themselves through unique service offerings and technological advancements.

In addition to reshaping competitive dynamics, Aon’s expansion is expected to influence client expectations and demands. As Aon enhances its service offerings, clients may begin to expect similar levels of service and expertise from other brokers. This shift in expectations could prompt a broader transformation within the industry, as firms seek to meet the evolving needs of their clients. Consequently, brokers may need to invest in new technologies, expand their service portfolios, and develop more specialized expertise to remain competitive.

Furthermore, the acquisition highlights the growing importance of data and analytics in the insurance industry. By integrating the acquired broker’s data capabilities, Aon can enhance its analytical tools and insights, providing clients with more precise risk assessments and tailored solutions. This focus on data-driven decision-making is becoming increasingly critical, as clients demand more accurate and actionable insights to navigate complex risk landscapes. As a result, the industry may witness a greater emphasis on data analytics, with firms investing in advanced technologies to enhance their service offerings.

In conclusion, Aon’s acquisition of a P&C broker represents a strategic move with significant implications for the global insurance industry. By expanding its capabilities and service offerings, Aon is poised to influence competitive dynamics, client expectations, and the role of data analytics within the industry. As the insurance landscape continues to evolve, Aon’s expansion serves as a reminder of the importance of strategic growth and innovation in maintaining a competitive edge. The ripple effects of this acquisition are likely to be felt across the industry, prompting other firms to adapt and innovate in response to the changing market environment.

Key Benefits for Clients Following Aon’s Acquisition

Aon’s recent acquisition of a prominent property and casualty (P&C) broker marks a significant milestone in the company’s strategic expansion efforts, aimed at enhancing its global portfolio and delivering superior value to its clients. This acquisition is not merely a business transaction; it represents a concerted effort to integrate complementary strengths and capabilities that will ultimately benefit clients across various sectors. As Aon continues to solidify its position as a leader in the insurance brokerage industry, the key benefits for clients following this acquisition are manifold.

First and foremost, the acquisition enables Aon to broaden its service offerings, providing clients with a more comprehensive suite of risk management solutions. By integrating the acquired broker’s expertise and resources, Aon can offer a wider array of products tailored to meet the specific needs of diverse industries. This expanded portfolio ensures that clients have access to innovative solutions that address emerging risks and challenges in an increasingly complex global environment. Consequently, clients can expect more personalized and effective risk management strategies that align with their unique business objectives.

Moreover, the acquisition enhances Aon’s geographic reach, allowing the company to serve clients in new and existing markets with greater efficiency and effectiveness. The acquired broker’s established presence in key regions complements Aon’s global footprint, facilitating seamless service delivery and local market insights. This expanded reach not only strengthens Aon’s ability to support multinational clients but also provides local businesses with access to world-class expertise and resources. As a result, clients can benefit from a more cohesive and integrated approach to risk management, regardless of their location.

In addition to geographic expansion, the acquisition brings together a wealth of talent and expertise from both organizations. The combined team of professionals is poised to deliver unparalleled service and insights, drawing on a diverse range of experiences and perspectives. This collaboration fosters innovation and drives the development of cutting-edge solutions that address the evolving needs of clients. By leveraging the collective knowledge and skills of its workforce, Aon is well-positioned to anticipate and respond to emerging trends and challenges in the insurance industry.

Furthermore, the acquisition underscores Aon’s commitment to investing in technology and data analytics, which are critical components of modern risk management. The integration of advanced technological capabilities from the acquired broker enhances Aon’s ability to harness data-driven insights and deliver more precise and actionable recommendations to clients. This focus on technology not only improves operational efficiency but also empowers clients to make informed decisions based on real-time data and predictive analytics. As a result, clients can better navigate uncertainties and optimize their risk management strategies.

Finally, the acquisition reinforces Aon’s dedication to fostering long-term relationships with its clients. By expanding its capabilities and resources, Aon is better equipped to support clients throughout their business lifecycle, offering guidance and solutions that evolve with their changing needs. This client-centric approach ensures that Aon remains a trusted partner, committed to delivering value and driving success for its clients.

In conclusion, Aon’s acquisition of a leading P&C broker represents a strategic move that brings numerous benefits to its clients. Through expanded service offerings, enhanced geographic reach, a wealth of talent and expertise, advanced technology, and a commitment to long-term relationships, Aon is poised to deliver exceptional value and support to its clients in an ever-changing global landscape. As the company continues to integrate and innovate, clients can look forward to a future of enhanced risk management solutions and unparalleled service.

Aon’s Growth Strategy: Insights from the P&C Broker Acquisition

Aon’s recent acquisition of a prominent property and casualty (P&C) broker marks a significant milestone in its strategic growth plan, aimed at enhancing its global portfolio and expanding its market presence. This acquisition is not merely a transaction but a calculated move that underscores Aon’s commitment to strengthening its capabilities and offering comprehensive solutions to its clients worldwide. By integrating the expertise and resources of the acquired broker, Aon is poised to deliver enhanced value to its stakeholders, thereby reinforcing its position as a leader in the insurance and risk management industry.

The decision to acquire a P&C broker aligns with Aon’s broader strategy of diversifying its service offerings and tapping into new markets. This acquisition allows Aon to leverage the broker’s established networks and client base, thereby facilitating a smoother entry into regions where it seeks to expand its footprint. Moreover, the integration of the broker’s specialized knowledge and innovative solutions into Aon’s existing framework is expected to create synergies that will drive operational efficiencies and foster innovation. This strategic move is indicative of Aon’s proactive approach to addressing the evolving needs of its clients, who are increasingly seeking tailored solutions to manage complex risks in a rapidly changing global landscape.

Furthermore, the acquisition reflects Aon’s recognition of the growing importance of the P&C sector within the broader insurance industry. As businesses face an array of emerging risks, from climate change to cyber threats, the demand for robust P&C solutions has surged. By acquiring a broker with a strong track record in this domain, Aon is well-positioned to capitalize on these opportunities and provide its clients with cutting-edge risk management strategies. This move also highlights Aon’s commitment to investing in areas that offer significant growth potential, thereby ensuring its long-term sustainability and competitiveness.

In addition to expanding its service offerings, the acquisition is expected to enhance Aon’s ability to deliver personalized and data-driven insights to its clients. The integration of advanced analytics and technology from the acquired broker will enable Aon to offer more precise risk assessments and customized solutions, thereby enhancing client satisfaction and loyalty. This focus on leveraging technology to drive client outcomes is a testament to Aon’s forward-thinking approach and its dedication to staying ahead of industry trends.

Moreover, the acquisition is likely to have a positive impact on Aon’s financial performance. By broadening its revenue streams and increasing its market share, Aon is poised to achieve greater financial stability and resilience. This, in turn, will enable the company to reinvest in its core capabilities and pursue further growth opportunities, thereby creating a virtuous cycle of expansion and innovation.

In conclusion, Aon’s acquisition of a P&C broker is a strategic move that aligns with its growth objectives and underscores its commitment to delivering exceptional value to its clients. By enhancing its global portfolio and expanding its capabilities, Aon is well-equipped to navigate the complexities of the modern risk landscape and maintain its leadership position in the industry. As the company continues to integrate the acquired broker’s resources and expertise, it is poised to set new benchmarks in the insurance and risk management sector, ultimately benefiting its clients, employees, and shareholders alike.

Challenges and Opportunities in Aon’s Recent Acquisition

Aon’s recent acquisition of a prominent property and casualty (P&C) broker marks a significant milestone in the company’s strategic efforts to enhance its global portfolio. This move, while promising substantial opportunities, also presents a series of challenges that Aon must navigate to ensure a seamless integration and to maximize the potential benefits of this acquisition. As the insurance industry continues to evolve, Aon’s decision to expand its capabilities through this acquisition reflects a broader trend of consolidation aimed at achieving greater market share and operational efficiency.

One of the primary challenges Aon faces in this acquisition is the integration of the acquired broker’s operations, culture, and technology with its own. Merging two distinct corporate cultures can be a complex process, requiring careful management to ensure that employees from both organizations feel valued and aligned with the new, unified company vision. This cultural integration is crucial for maintaining morale and productivity, as well as for fostering a collaborative environment that can drive innovation and growth.

In addition to cultural integration, Aon must also address the technological challenges that come with merging two companies. The integration of IT systems is often one of the most daunting tasks in any acquisition, as it involves aligning different platforms, databases, and processes. Ensuring data security and maintaining the integrity of client information are paramount during this transition. Aon will need to invest in robust IT solutions and possibly develop new systems to facilitate a smooth technological integration, which will be essential for delivering consistent and high-quality services to clients.

Despite these challenges, the acquisition presents numerous opportunities for Aon to strengthen its position in the global insurance market. By acquiring a P&C broker with a strong presence in key markets, Aon can expand its geographic reach and diversify its client base. This expansion not only enhances Aon’s ability to serve multinational clients but also positions the company to tap into emerging markets where demand for insurance products is growing rapidly. Furthermore, the acquisition allows Aon to broaden its product offerings, providing clients with a more comprehensive suite of services that can address a wider range of risk management needs.

Moreover, the acquisition aligns with Aon’s strategic objective of leveraging data and analytics to deliver more personalized and effective solutions to clients. By integrating the acquired broker’s expertise and resources, Aon can enhance its data-driven capabilities, enabling the company to offer more tailored risk management strategies. This focus on data and analytics is increasingly important in an industry where clients demand more precise and predictive insights to manage their risks effectively.

In conclusion, while Aon’s acquisition of a P&C broker presents several challenges, it also offers significant opportunities for growth and innovation. By successfully integrating the acquired company’s operations, culture, and technology, Aon can strengthen its global portfolio and enhance its ability to deliver value to clients. As the insurance landscape continues to change, Aon’s strategic acquisition positions the company to remain competitive and responsive to the evolving needs of its clients. Through careful management and a focus on leveraging synergies, Aon can turn this acquisition into a catalyst for long-term success and industry leadership.

Future Prospects for Aon Post-Acquisition of P&C Broker

Aon’s recent acquisition of a prominent property and casualty (P&C) broker marks a significant milestone in its strategic expansion efforts, positioning the company to enhance its global portfolio and service offerings. This acquisition is not merely a consolidation of resources but a strategic maneuver aimed at fortifying Aon’s presence in the competitive insurance brokerage landscape. As the company integrates the newly acquired assets, it is poised to leverage synergies that promise to deliver enhanced value to its clients and stakeholders.

The acquisition aligns with Aon’s long-term vision of expanding its capabilities and market reach. By incorporating the expertise and client base of the P&C broker, Aon is set to broaden its service offerings, particularly in risk management and insurance solutions. This move is expected to provide Aon with a more comprehensive suite of services, enabling it to cater to a wider array of client needs across different industries. Furthermore, the integration of the P&C broker’s specialized knowledge and innovative solutions is anticipated to bolster Aon’s ability to address complex risk challenges, thereby enhancing its competitive edge.

In addition to expanding its service portfolio, Aon is likely to benefit from increased operational efficiencies as a result of the acquisition. The consolidation of resources and expertise is expected to streamline operations, reduce redundancies, and optimize processes. This, in turn, could lead to cost savings and improved profitability, allowing Aon to reinvest in further innovation and growth initiatives. Moreover, the acquisition is anticipated to enhance Aon’s bargaining power with insurers, potentially leading to more favorable terms and conditions for its clients.

The acquisition also presents an opportunity for Aon to strengthen its global footprint. By integrating the P&C broker’s established presence in key markets, Aon can accelerate its international expansion efforts. This is particularly significant in emerging markets where the demand for sophisticated risk management solutions is on the rise. Aon’s enhanced global presence is expected to facilitate cross-border collaborations and knowledge sharing, further enriching its service offerings and client relationships.

However, the successful integration of the P&C broker into Aon’s operations will be crucial in realizing the full potential of this acquisition. Aon will need to navigate the complexities of merging different corporate cultures, systems, and processes. Effective communication and change management strategies will be essential to ensure a smooth transition and to maintain employee morale and client satisfaction. Additionally, Aon will need to address any regulatory challenges that may arise as a result of the acquisition, ensuring compliance with local and international laws.

Looking ahead, Aon’s acquisition of the P&C broker is poised to create significant value for the company and its stakeholders. By expanding its capabilities, enhancing operational efficiencies, and strengthening its global presence, Aon is well-positioned to capitalize on emerging opportunities in the insurance brokerage industry. As the company continues to integrate the acquired assets and realize synergies, it is expected to deliver innovative solutions that meet the evolving needs of its clients. Ultimately, this acquisition represents a strategic step forward in Aon’s journey to becoming a leading global provider of risk management and insurance solutions.

Q&A

1. **What company did Aon acquire?**

Aon acquired a property and casualty (P&C) brokerage firm.

2. **Why did Aon acquire this P&C broker?**

Aon acquired the P&C broker to strengthen its global portfolio and enhance its capabilities in the insurance brokerage sector.

3. **How does this acquisition benefit Aon?**

The acquisition expands Aon’s market presence, diversifies its service offerings, and potentially increases its client base and revenue streams.

4. **What is the strategic significance of this acquisition for Aon?**

Strategically, the acquisition allows Aon to enhance its competitive position in the global insurance market and better serve its clients with a broader range of services.

5. **How might this acquisition impact Aon’s clients?**

Aon’s clients may benefit from improved service offerings, access to a wider range of insurance products, and potentially more competitive pricing.

6. **What are the financial implications of this acquisition for Aon?**

Financially, the acquisition could lead to increased revenue and profitability for Aon, though it may also involve significant integration costs and investment.

7. **What challenges might Aon face post-acquisition?**

Post-acquisition, Aon might face challenges such as integrating the acquired company’s operations, aligning corporate cultures, and realizing anticipated synergies.

Conclusion

The acquisition of the P&C broker by Aon represents a strategic move to enhance its global portfolio, reinforcing its position in the insurance brokerage industry. By integrating the acquired firm’s expertise and resources, Aon aims to expand its service offerings, improve client solutions, and increase its competitive edge in the market. This acquisition is likely to drive growth, foster innovation, and create synergies that benefit both Aon and its clients worldwide.