“Stellantis: Navigating Revenue Challenges with Strategic Inventory Streamlining”

Introduction

Stellantis, one of the world’s leading automakers, has recently reported a decline in revenue, primarily attributed to its strategic efforts to reduce inventory levels. This move comes as part of the company’s broader initiative to streamline operations and enhance efficiency across its global supply chain. By focusing on inventory reduction, Stellantis aims to better align production with market demand, minimize excess stock, and improve overall financial health. However, this strategic shift has temporarily impacted the company’s revenue figures, reflecting the challenges and complexities of balancing operational efficiency with financial performance in the highly competitive automotive industry.

Impact Of Inventory Reduction On Stellantis Revenue

Stellantis, a prominent player in the global automotive industry, has recently reported a decline in revenue, a development that has captured the attention of industry analysts and stakeholders alike. This downturn is primarily attributed to the company’s strategic efforts to reduce inventory levels, a move that, while aimed at long-term sustainability, has had immediate financial repercussions. Understanding the impact of these inventory reduction efforts on Stellantis’ revenue requires a closer examination of the underlying factors and the broader context within which these decisions were made.

To begin with, inventory management is a critical aspect of any manufacturing business, particularly in the automotive sector, where the balance between supply and demand can significantly influence financial performance. Stellantis, formed from the merger of Fiat Chrysler Automobiles and PSA Group, has been navigating a complex landscape marked by fluctuating consumer demand, supply chain disruptions, and evolving market dynamics. In response to these challenges, the company has prioritized reducing excess inventory, a strategy intended to streamline operations and enhance efficiency.

However, this focus on inventory reduction has inevitably led to a decrease in production volumes, which, in turn, has impacted revenue. By producing fewer vehicles, Stellantis has limited its immediate sales potential, a decision that reflects a calculated trade-off between short-term revenue and long-term operational health. While this approach may seem counterintuitive at first glance, it underscores the company’s commitment to maintaining a leaner, more agile production model that can better adapt to market changes.

Moreover, the decision to reduce inventory is not made in isolation but is part of a broader industry trend. Many automotive manufacturers are reevaluating their inventory strategies in light of recent global events, such as the COVID-19 pandemic and the semiconductor shortage, which have exposed vulnerabilities in traditional supply chain models. By proactively addressing these issues, Stellantis aims to mitigate risks associated with overproduction and excess stock, which can lead to increased costs and reduced profitability.

In addition to these operational considerations, Stellantis’ inventory reduction efforts are also influenced by its strategic focus on sustainability and innovation. As the automotive industry undergoes a transformative shift towards electric vehicles (EVs) and advanced technologies, Stellantis is investing heavily in research and development to position itself as a leader in this new era of mobility. By reallocating resources towards these initiatives, the company is laying the groundwork for future growth, even if it means accepting a temporary dip in revenue.

Furthermore, it is important to recognize that the impact of inventory reduction on Stellantis’ revenue is not solely negative. By optimizing inventory levels, the company can improve cash flow, reduce holding costs, and enhance its ability to respond to consumer preferences. This strategic flexibility is crucial in an industry where consumer tastes and technological advancements are constantly evolving.

In conclusion, while Stellantis’ recent revenue decline may raise concerns among investors and market observers, it is essential to view this development within the context of the company’s long-term strategic objectives. The decision to reduce inventory is a deliberate move aimed at strengthening Stellantis’ operational resilience and positioning it for future success in a rapidly changing automotive landscape. As the company continues to navigate these challenges, its focus on innovation, sustainability, and efficiency will likely play a pivotal role in shaping its trajectory in the years to come.

Strategies Stellantis Is Implementing To Combat Revenue Declines

Stellantis, the multinational automotive manufacturing corporation, has recently faced a decline in revenue, primarily attributed to its strategic decision to reduce inventory levels. This move, while initially impacting financial performance, is part of a broader strategy aimed at long-term sustainability and market adaptability. To combat the immediate effects of revenue declines, Stellantis is implementing a series of strategies designed to enhance operational efficiency, optimize supply chain management, and innovate product offerings.

One of the key strategies Stellantis is employing involves streamlining its production processes. By adopting lean manufacturing principles, the company aims to minimize waste and improve efficiency across its production lines. This approach not only reduces costs but also allows Stellantis to respond more swiftly to changes in consumer demand. Furthermore, the company is investing in advanced manufacturing technologies, such as automation and robotics, to enhance precision and reduce production times. These technological advancements are expected to yield significant improvements in productivity, thereby offsetting some of the revenue losses experienced due to inventory reductions.

In addition to refining its production processes, Stellantis is focusing on optimizing its supply chain management. The company recognizes that a well-coordinated supply chain is crucial for maintaining competitiveness in the automotive industry. To this end, Stellantis is leveraging data analytics and artificial intelligence to gain deeper insights into its supply chain operations. By analyzing data in real-time, the company can identify potential bottlenecks and inefficiencies, allowing for more informed decision-making. This proactive approach not only enhances supply chain resilience but also ensures that Stellantis can meet customer demands more effectively, even in the face of external disruptions.

Moreover, Stellantis is placing a strong emphasis on innovation to drive future growth. The company is accelerating its efforts in the development of electric vehicles (EVs) and autonomous driving technologies. Recognizing the global shift towards sustainable transportation, Stellantis is investing heavily in research and development to expand its EV portfolio. By introducing new models that cater to diverse consumer preferences, the company aims to capture a larger share of the growing EV market. Additionally, Stellantis is exploring partnerships with technology firms to advance its capabilities in autonomous driving, positioning itself as a leader in the next generation of automotive technology.

To further bolster its market position, Stellantis is also enhancing its customer engagement strategies. The company is leveraging digital platforms to create more personalized and interactive experiences for its customers. By utilizing data-driven insights, Stellantis can tailor its marketing efforts to better align with consumer preferences and behaviors. This customer-centric approach not only strengthens brand loyalty but also drives sales by ensuring that Stellantis’ offerings resonate with its target audience.

In conclusion, while Stellantis faces challenges due to its inventory reduction efforts, the company is proactively implementing strategies to mitigate revenue declines. By streamlining production processes, optimizing supply chain management, and fostering innovation, Stellantis is positioning itself for long-term success in an evolving automotive landscape. Furthermore, its focus on enhancing customer engagement underscores its commitment to meeting the needs of its consumers. As these strategies take effect, Stellantis is poised to navigate the current challenges and emerge as a more resilient and competitive player in the global automotive industry.

Analyzing Stellantis’ Financial Performance In The Current Market

Stellantis, the multinational automotive manufacturing corporation formed from the merger of Fiat Chrysler Automobiles and PSA Group, has recently reported a decline in revenue, a development that has captured the attention of industry analysts and investors alike. This downturn in financial performance is primarily attributed to the company’s strategic efforts to reduce inventory levels, a move that reflects broader trends and challenges within the automotive sector. As the global market continues to grapple with supply chain disruptions and shifting consumer demands, Stellantis’ approach offers a compelling case study in balancing short-term financial pressures with long-term strategic goals.

To understand the nuances of Stellantis’ current financial performance, it is essential to consider the context in which these inventory reduction efforts are taking place. The automotive industry has been significantly impacted by the global semiconductor shortage, which has constrained production capabilities and led to fluctuating inventory levels across the board. In response, Stellantis has opted to prioritize the optimization of its supply chain and inventory management processes. By doing so, the company aims to enhance operational efficiency and better align production with actual market demand, thereby avoiding the pitfalls of overproduction and excess stock.

However, this strategic pivot has not come without its financial repercussions. The deliberate reduction in inventory has inevitably led to a decrease in sales volume, which, in turn, has contributed to the observed decline in revenue. While this may raise concerns among stakeholders, it is important to recognize that Stellantis’ decision is rooted in a long-term vision of sustainability and resilience. By focusing on inventory reduction, the company is positioning itself to weather future market fluctuations more effectively, ensuring that it remains agile and responsive to changing consumer preferences.

Moreover, Stellantis’ financial performance must be viewed through the lens of its broader strategic initiatives. The company has been actively investing in the development of electric vehicles (EVs) and other innovative technologies, recognizing the growing importance of sustainability in the automotive industry. These investments, while initially costly, are expected to yield significant returns in the coming years as the demand for EVs continues to rise. Consequently, the current decline in revenue may be seen as a temporary setback in the context of a larger, forward-looking strategy aimed at securing Stellantis’ position as a leader in the evolving automotive landscape.

In addition to its focus on inventory management and technological innovation, Stellantis is also navigating the complexities of a rapidly changing regulatory environment. With governments worldwide implementing stricter emissions standards and incentivizing the adoption of cleaner technologies, the company is under pressure to adapt its product offerings accordingly. This necessitates substantial investment in research and development, further impacting short-term financial performance but ultimately contributing to long-term competitiveness.

In conclusion, while Stellantis’ recent revenue decline may initially appear concerning, it is essential to consider the broader strategic context in which these financial results are situated. The company’s efforts to reduce inventory levels, invest in electric vehicle technology, and adapt to regulatory changes are indicative of a proactive approach to navigating the challenges of the current market. As Stellantis continues to refine its strategies and align its operations with emerging industry trends, it is well-positioned to achieve sustainable growth and maintain its competitive edge in the years to come.

The Role Of Supply Chain Challenges In Stellantis’ Revenue Drop

Stellantis, the multinational automotive manufacturer formed from the merger of Fiat Chrysler Automobiles and PSA Group, has recently reported a decline in revenue, a development that has drawn significant attention from industry analysts and stakeholders. This downturn is largely attributed to the company’s strategic efforts to reduce inventory levels, a move that has been necessitated by ongoing supply chain challenges. As the global automotive industry grapples with these disruptions, understanding the intricate role they play in Stellantis’ financial performance is crucial.

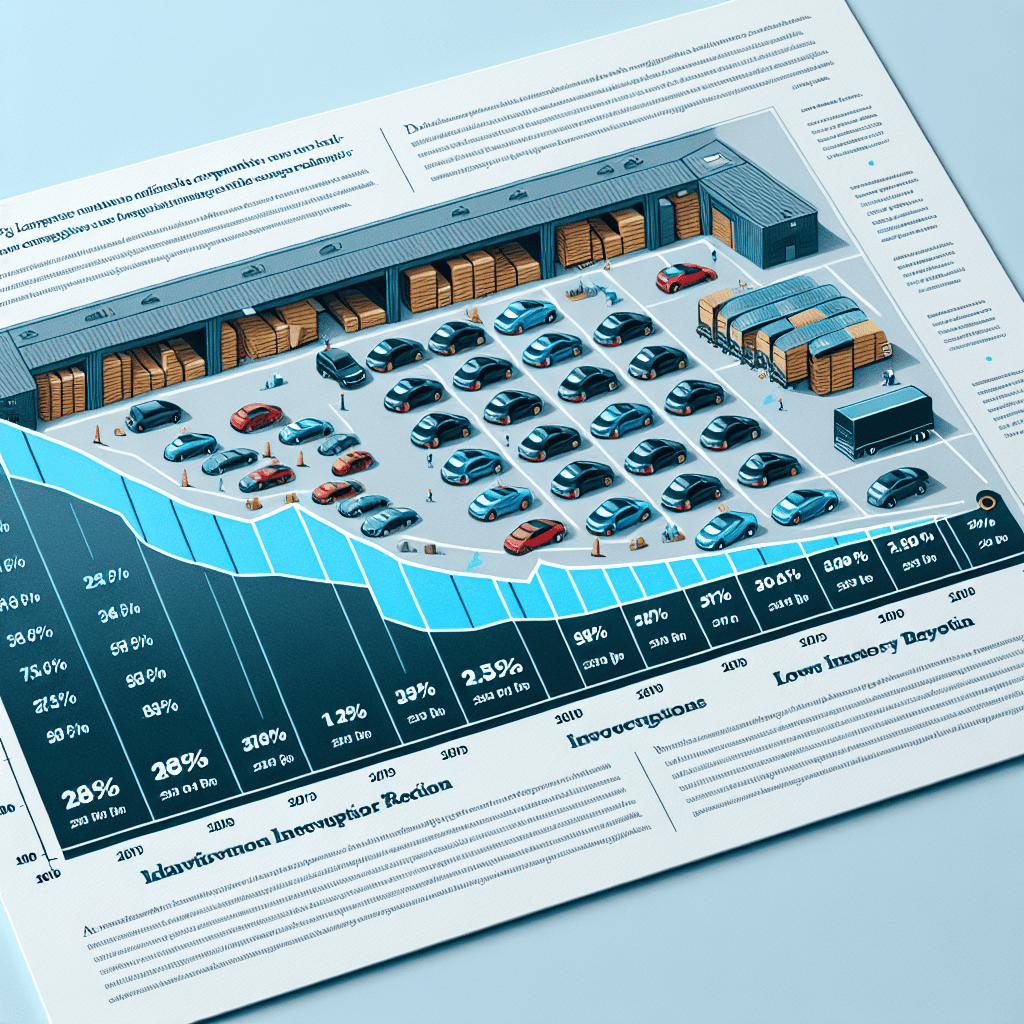

To begin with, the automotive sector has been significantly impacted by supply chain disruptions over the past few years, with the COVID-19 pandemic exacerbating existing vulnerabilities. These disruptions have manifested in various forms, including semiconductor shortages, logistical bottlenecks, and fluctuating raw material prices. For Stellantis, these challenges have necessitated a reevaluation of their production and inventory strategies. By reducing inventory levels, the company aims to mitigate the risks associated with holding excess stock in an unpredictable market environment. However, this strategy, while prudent in the long term, has contributed to a short-term decline in revenue.

Moreover, the semiconductor shortage has been particularly detrimental to Stellantis’ operations. Semiconductors are critical components in modern vehicles, powering everything from infotainment systems to advanced driver-assistance features. The scarcity of these components has forced Stellantis to scale back production, directly impacting sales and revenue. This situation is not unique to Stellantis; it is a challenge faced by the entire automotive industry. Nevertheless, Stellantis’ proactive approach to inventory management, while necessary, has resulted in reduced sales volumes, thereby affecting the company’s top line.

In addition to semiconductor shortages, logistical challenges have further compounded Stellantis’ supply chain woes. The global shipping industry has experienced unprecedented disruptions, with port congestion and container shortages leading to delays and increased costs. For Stellantis, these logistical hurdles have made it difficult to maintain a steady flow of components and finished vehicles, further complicating inventory management efforts. Consequently, the company’s decision to reduce inventory levels is a strategic response to these logistical uncertainties, aimed at maintaining operational efficiency and financial stability.

Furthermore, the fluctuating prices of raw materials have added another layer of complexity to Stellantis’ supply chain challenges. The cost of essential materials such as steel, aluminum, and plastics has been volatile, driven by factors such as geopolitical tensions and changing demand patterns. This volatility has made it challenging for Stellantis to forecast production costs accurately, prompting the company to adopt a more conservative approach to inventory management. By reducing inventory levels, Stellantis seeks to minimize the financial impact of raw material price fluctuations, albeit at the expense of short-term revenue.

In conclusion, Stellantis’ recent revenue decline is a direct consequence of the company’s efforts to navigate the complex landscape of supply chain challenges. While the decision to reduce inventory levels is a strategic move aimed at ensuring long-term sustainability, it has inevitably led to a temporary dip in revenue. As the global automotive industry continues to adapt to these challenges, Stellantis’ experience underscores the importance of agile supply chain management and strategic foresight. By addressing these issues head-on, Stellantis is positioning itself to emerge stronger in the face of ongoing uncertainties, ultimately paving the way for future growth and success.

Comparing Stellantis’ Revenue Trends With Industry Peers

Stellantis, the multinational automotive manufacturing corporation formed from the merger of Fiat Chrysler Automobiles and PSA Group, has recently reported a decline in revenue, a development that has captured the attention of industry analysts and stakeholders alike. This downturn is primarily attributed to the company’s strategic efforts to reduce inventory levels, a move that, while potentially beneficial in the long term, has immediate implications for its financial performance. To better understand Stellantis’ current position, it is essential to compare its revenue trends with those of its industry peers, providing a broader context for the challenges and opportunities it faces.

In recent years, the automotive industry has been navigating a complex landscape marked by supply chain disruptions, fluctuating consumer demand, and the ongoing transition to electric vehicles. These factors have compelled many automakers to reassess their production and inventory strategies. Stellantis, in particular, has opted to focus on inventory reduction, a decision that aligns with its broader goal of enhancing operational efficiency and reducing excess stock. However, this approach has inevitably led to a short-term decline in revenue, as fewer vehicles are available for sale.

When comparing Stellantis’ revenue trends with those of its competitors, it becomes evident that the company is not alone in facing these challenges. For instance, other major players in the automotive sector, such as General Motors and Ford, have also experienced fluctuations in revenue due to similar inventory management strategies. These companies have recognized the importance of maintaining a leaner inventory to better respond to market demands and mitigate the risks associated with overproduction. Consequently, they have also reported revenue declines in certain quarters, underscoring the widespread impact of these industry-wide adjustments.

Despite the immediate financial implications, Stellantis’ decision to reduce inventory levels may prove advantageous in the long run. By aligning production more closely with demand, the company can minimize the costs associated with excess inventory, such as storage and depreciation. Moreover, this strategy allows Stellantis to be more agile in responding to shifts in consumer preferences, particularly as the market increasingly gravitates towards electric and hybrid vehicles. In this regard, Stellantis’ inventory reduction efforts can be seen as a proactive measure to position itself for future growth and competitiveness.

In contrast, some of Stellantis’ peers have adopted different approaches to navigate the current market conditions. For example, Toyota has focused on maintaining a robust supply chain to ensure steady production and delivery of vehicles, thereby sustaining its revenue levels. This strategy highlights the diversity of responses within the industry, as companies tailor their approaches based on their unique strengths and market positions. While Toyota’s approach has yielded positive results in terms of revenue stability, it also underscores the inherent trade-offs involved in inventory management decisions.

In conclusion, Stellantis’ recent revenue decline, driven by its inventory reduction efforts, reflects a broader trend within the automotive industry as companies adapt to evolving market dynamics. By comparing Stellantis’ revenue trends with those of its peers, it becomes clear that the challenges it faces are not unique but rather indicative of a sector-wide shift towards more efficient and responsive production models. As Stellantis continues to refine its strategy, its ability to balance short-term financial performance with long-term growth objectives will be crucial in determining its success in an increasingly competitive and rapidly changing market.

Long-term Implications Of Stellantis’ Inventory Management Decisions

Stellantis, the multinational automotive manufacturing corporation, has recently reported a decline in revenue, a development that has sparked considerable discussion within the industry. This downturn is primarily attributed to the company’s strategic decision to reduce inventory levels, a move that reflects a broader trend in the automotive sector towards more efficient inventory management. While the immediate financial impact may appear concerning, it is essential to consider the long-term implications of such a strategy, which could ultimately position Stellantis for greater success in an increasingly competitive market.

To understand the rationale behind Stellantis’ inventory reduction efforts, it is crucial to recognize the challenges faced by the automotive industry in recent years. The sector has been grappling with supply chain disruptions, fluctuating demand, and the rapid pace of technological advancements. In response, many automakers, including Stellantis, have sought to streamline their operations by adopting leaner inventory practices. By reducing excess stock, Stellantis aims to minimize costs associated with storage and obsolescence, thereby enhancing operational efficiency.

Moreover, the decision to cut inventory levels aligns with Stellantis’ broader strategic objectives. The company is keenly aware of the need to remain agile and responsive to market changes. By maintaining a leaner inventory, Stellantis can better adapt to shifts in consumer preferences and emerging trends, such as the growing demand for electric vehicles. This flexibility is particularly important as the automotive industry undergoes a significant transformation, driven by environmental concerns and regulatory pressures.

In addition to operational benefits, Stellantis’ inventory management strategy may also yield financial advantages in the long run. While the immediate impact on revenue is negative, the reduction in inventory levels can lead to improved cash flow and a stronger balance sheet. By freeing up capital that would otherwise be tied up in unsold vehicles, Stellantis can invest in research and development, innovation, and other growth initiatives. This proactive approach could enhance the company’s competitive edge and drive future profitability.

Furthermore, Stellantis’ inventory reduction efforts may have positive implications for its relationships with suppliers and dealers. By aligning production more closely with actual demand, the company can foster stronger partnerships and improve supply chain efficiency. This collaborative approach can lead to more reliable delivery schedules, reduced lead times, and ultimately, higher customer satisfaction. In an industry where brand loyalty is paramount, these factors can contribute to long-term success.

However, it is important to acknowledge the potential risks associated with Stellantis’ inventory management decisions. A leaner inventory strategy requires precise demand forecasting and robust supply chain management. Any miscalculations or disruptions could result in stockouts, lost sales, and damage to the brand’s reputation. Therefore, Stellantis must invest in advanced analytics and technology to ensure accurate demand planning and mitigate these risks.

In conclusion, while Stellantis’ recent revenue decline may raise concerns, the company’s inventory reduction efforts should be viewed within the context of its long-term strategic goals. By embracing a leaner inventory model, Stellantis is positioning itself to navigate the challenges of the automotive industry more effectively. The potential benefits, including enhanced operational efficiency, improved financial performance, and stronger stakeholder relationships, underscore the importance of this strategic decision. As Stellantis continues to adapt to the evolving market landscape, its inventory management approach will likely play a pivotal role in shaping its future success.

How Stellantis Plans To Recover From Recent Revenue Declines

Stellantis, the multinational automotive manufacturing corporation formed from the merger of Fiat Chrysler Automobiles and PSA Group, has recently faced a decline in revenue, primarily attributed to its strategic efforts to reduce inventory levels. This decision, while initially impacting financial performance, is part of a broader plan to streamline operations and enhance long-term profitability. As the company navigates these challenges, it is crucial to understand the strategies Stellantis is implementing to recover from the recent revenue declines and position itself for future growth.

To begin with, Stellantis is focusing on optimizing its supply chain management. By reducing excess inventory, the company aims to create a more agile and responsive production system. This approach not only minimizes holding costs but also allows Stellantis to better align production with market demand. Consequently, the company can reduce the risk of overproduction and the associated financial burdens. Moreover, this strategy enables Stellantis to swiftly adapt to changing consumer preferences and technological advancements, ensuring that its product offerings remain competitive and relevant.

In addition to supply chain optimization, Stellantis is investing heavily in research and development to drive innovation across its product lineup. Recognizing the automotive industry’s shift towards electrification and sustainable mobility, the company is channeling resources into the development of electric vehicles (EVs) and hybrid models. By expanding its portfolio of environmentally friendly vehicles, Stellantis aims to capture a larger share of the growing EV market, thereby offsetting the revenue declines experienced in traditional vehicle segments. This commitment to innovation not only enhances the company’s competitive edge but also aligns with global efforts to reduce carbon emissions and promote sustainable transportation solutions.

Furthermore, Stellantis is leveraging strategic partnerships and collaborations to bolster its recovery efforts. By joining forces with technology companies and other industry players, Stellantis can access new technologies and expertise that accelerate the development of advanced automotive solutions. These partnerships facilitate the integration of cutting-edge features such as autonomous driving capabilities, connectivity, and enhanced safety systems into Stellantis vehicles. As a result, the company can offer consumers a more compelling value proposition, driving demand and ultimately boosting revenue.

Another critical component of Stellantis’ recovery strategy is its focus on expanding into emerging markets. By tapping into regions with high growth potential, such as Asia and Latin America, Stellantis can diversify its revenue streams and reduce its reliance on mature markets. This geographic expansion not only provides access to new customer bases but also allows the company to capitalize on favorable economic conditions and increasing automotive demand in these regions. Through targeted marketing efforts and tailored product offerings, Stellantis aims to establish a strong foothold in these markets, contributing to its overall revenue growth.

Lastly, Stellantis is committed to enhancing operational efficiency across its global operations. By implementing cost-saving measures and streamlining processes, the company seeks to improve its financial performance and create a more sustainable business model. This focus on efficiency extends to all aspects of the organization, from manufacturing and logistics to sales and marketing. By reducing waste and optimizing resource allocation, Stellantis can achieve significant cost reductions, thereby improving its bottom line and supporting its recovery from recent revenue declines.

In conclusion, Stellantis is undertaking a comprehensive approach to recover from its recent revenue declines, with a focus on supply chain optimization, innovation, strategic partnerships, market expansion, and operational efficiency. Through these efforts, the company aims to not only overcome current challenges but also position itself for long-term success in the rapidly evolving automotive industry. As Stellantis continues to execute its recovery plan, stakeholders can expect a more resilient and competitive organization poised to thrive in the years to come.

Q&A

1. **What is Stellantis?**

Stellantis is a multinational automotive manufacturing corporation formed in 2021 through the merger of Fiat Chrysler Automobiles (FCA) and Groupe PSA.

2. **Why is Stellantis experiencing revenue declines?**

Stellantis is experiencing revenue declines primarily due to efforts to reduce inventory levels, which can impact sales volume and revenue generation.

3. **What are inventory reduction efforts?**

Inventory reduction efforts involve strategies to decrease the amount of unsold stock, often to improve cash flow, reduce holding costs, and align production with demand.

4. **How do inventory reduction efforts affect revenue?**

These efforts can lead to temporary revenue declines as the company may produce and sell fewer vehicles to clear existing stock, impacting short-term sales figures.

5. **What are the potential benefits of inventory reduction for Stellantis?**

Benefits include improved cash flow, reduced storage costs, better alignment of supply with market demand, and potentially higher profit margins on future sales.

6. **How might Stellantis offset the revenue declines?**

Stellantis might offset revenue declines by optimizing production, enhancing sales strategies, launching new models, or increasing focus on high-demand markets.

7. **What is the long-term outlook for Stellantis amid these efforts?**

The long-term outlook could be positive if inventory reduction leads to more efficient operations, better market responsiveness, and stronger financial health, positioning Stellantis for sustainable growth.

Conclusion

Stellantis, a major player in the global automotive industry, has experienced a decline in revenue attributed to its strategic efforts to reduce inventory levels. This decision, likely aimed at optimizing operational efficiency and aligning production with market demand, reflects a broader industry trend of managing supply chain challenges and adapting to fluctuating consumer preferences. While the immediate impact is a decrease in revenue, the long-term benefits may include improved cash flow, reduced holding costs, and enhanced agility in responding to market changes. Stellantis’ focus on inventory reduction underscores its commitment to sustainable business practices and positions the company for potential growth as market conditions stabilize.