“Seize the Dip: Invest in Top S&P 500 Dividend Stocks for Long-Term Growth!”

Introduction

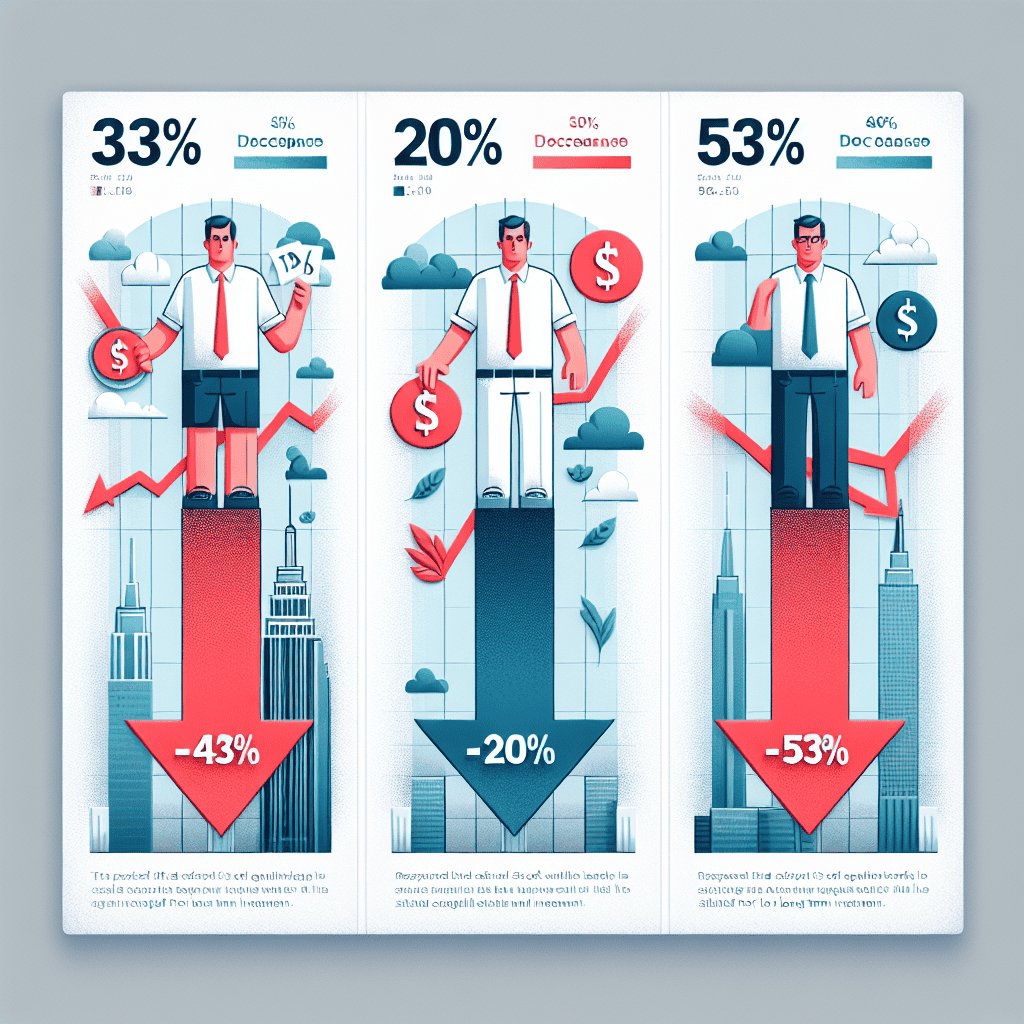

Investing in dividend stocks can be a strategic approach for long-term investors seeking both income and potential capital appreciation. Within the S&P 500, several high-quality dividend-paying companies have recently experienced significant price declines, presenting potential opportunities for value-focused investors. Notably, some of these stocks are down by 43%, 20%, and 53%, respectively, from their recent highs. These declines may be attributed to various market factors, including economic uncertainties, sector-specific challenges, or broader market corrections. However, for investors with a long-term perspective, these price drops could offer attractive entry points into fundamentally strong companies with a history of reliable dividend payments. By focusing on these top S&P 500 dividend stocks, investors can potentially benefit from both the recovery in stock prices and the steady income stream provided by dividends, making them a compelling choice for those looking to build a resilient investment portfolio.

Understanding The S&P 500: A Guide To Dividend Stocks

The S&P 500, a benchmark index that represents 500 of the largest publicly traded companies in the United States, is often regarded as a barometer of the overall health of the U.S. stock market. Within this index, dividend stocks hold a special place for investors seeking both income and potential capital appreciation. Dividend stocks are shares in companies that return a portion of their earnings to shareholders in the form of dividends. These stocks are particularly attractive to long-term investors who value steady income streams and the potential for compounding returns over time. However, even within the realm of dividend stocks, not all are created equal, and some may experience significant price fluctuations.

In recent times, certain top S&P 500 dividend stocks have seen their prices decline by substantial margins, with some down 43%, 20%, and even 53%. While such declines might initially appear alarming, they can present unique opportunities for long-term investors. A stock’s price drop does not necessarily reflect a deterioration in the company’s fundamentals. Instead, it may be influenced by broader market trends, sector-specific challenges, or temporary setbacks. Therefore, understanding the underlying reasons for these declines is crucial for making informed investment decisions.

One of the primary reasons investors are drawn to dividend stocks is their ability to provide a reliable income stream. Companies that consistently pay dividends often have stable cash flows and a commitment to returning value to shareholders. This characteristic can be particularly appealing during periods of market volatility, as dividends can offer a cushion against price fluctuations. Moreover, reinvesting dividends can lead to compounding returns, significantly enhancing the long-term growth potential of an investment portfolio.

When evaluating dividend stocks that have experienced significant price declines, it is essential to assess the sustainability of their dividend payments. A thorough analysis of the company’s financial health, including its earnings, cash flow, and payout ratio, can provide insights into its ability to maintain or even increase dividend payments in the future. Additionally, understanding the industry dynamics and competitive positioning of the company can help investors gauge its long-term prospects.

Furthermore, it is important to consider the broader economic environment and its impact on dividend stocks. Interest rates, inflation, and economic growth can all influence the performance of dividend-paying companies. For instance, rising interest rates may lead to increased borrowing costs for companies, potentially affecting their profitability and ability to pay dividends. Conversely, a robust economic environment can bolster corporate earnings, supporting dividend growth.

In conclusion, while the recent declines in certain top S&P 500 dividend stocks may raise concerns, they also offer potential opportunities for long-term investors. By conducting thorough research and analysis, investors can identify fundamentally strong companies with sustainable dividend payments and attractive valuations. These stocks can serve as valuable components of a diversified investment portfolio, providing both income and growth potential over the long term. As always, it is crucial for investors to align their investment choices with their financial goals, risk tolerance, and time horizon, ensuring a well-rounded approach to building wealth through dividend stocks.

Top S&P 500 Dividend Stocks Down 43%: Investment Opportunities

In the ever-evolving landscape of financial markets, investors are constantly on the lookout for opportunities that promise both growth and stability. Among the myriad of investment options, dividend stocks have long been favored for their ability to provide a steady income stream while also offering potential for capital appreciation. Within the S&P 500, a benchmark index that tracks the performance of 500 of the largest companies listed on stock exchanges in the United States, certain dividend stocks have recently experienced significant declines in their market value. Specifically, some of these stocks have seen their prices drop by 43%, 20%, and 53%, respectively, presenting intriguing opportunities for long-term investors.

To begin with, a 43% decline in a dividend stock’s price may initially appear alarming. However, it is essential to delve deeper into the underlying factors contributing to this drop. Often, such declines can be attributed to short-term market volatility, sector-specific challenges, or temporary setbacks faced by the company. For astute investors, these situations can present a chance to acquire shares at a discounted price, thereby enhancing the potential for future returns. Moreover, if the company’s fundamentals remain strong and its dividend payout is sustainable, the stock could offer an attractive yield, making it a compelling addition to a diversified portfolio.

Similarly, a 20% decrease in another S&P 500 dividend stock might signal a more moderate opportunity. While a 20% drop is less severe than a 43% decline, it still warrants careful consideration. Investors should assess whether the decline is due to broader market trends or specific issues within the company. If the latter, it is crucial to evaluate whether these issues are likely to be resolved in the near term. A company with a robust business model, strong cash flow, and a commitment to returning value to shareholders through dividends can still be a worthwhile investment, even amidst temporary setbacks.

On the other hand, a 53% decline in a dividend stock’s price is significant and may raise concerns about the company’s long-term viability. However, it is important to recognize that such a steep decline could also be an overreaction by the market, driven by fear or uncertainty. In these cases, conducting thorough due diligence is paramount. Investors should examine the company’s financial health, competitive position, and management’s strategy for navigating current challenges. If the company demonstrates resilience and the ability to adapt, the stock may offer substantial upside potential, particularly if the dividend yield remains attractive.

In conclusion, while declines of 43%, 20%, and 53% in S&P 500 dividend stocks may initially seem daunting, they can also present unique opportunities for long-term investors. By carefully analyzing the reasons behind these declines and assessing the underlying strength of the companies involved, investors can make informed decisions that align with their financial goals. It is crucial to maintain a balanced perspective, recognizing that market fluctuations are an inherent part of investing. Ultimately, those who are willing to look beyond short-term volatility and focus on the long-term potential of these dividend stocks may find themselves well-positioned to reap the rewards of their strategic investments.

Analyzing S&P 500 Stocks Down 20%: Long-Term Dividend Potential

In the ever-evolving landscape of the stock market, investors often seek opportunities that promise both growth and stability. Among the myriad of options, dividend stocks within the S&P 500 index have consistently attracted attention due to their potential for providing a steady income stream. However, even these stalwarts are not immune to market fluctuations, and some have experienced significant declines. Notably, certain S&P 500 dividend stocks have seen their values drop by 43%, 20%, and 53%, respectively. Despite these downturns, they may present compelling opportunities for long-term investment, particularly for those focused on dividend potential.

To begin with, it is essential to understand the nature of dividend stocks. These are shares in companies that distribute a portion of their earnings to shareholders in the form of dividends. Such stocks are often favored by investors seeking regular income, as they can provide a buffer against market volatility. When evaluating dividend stocks that have experienced a decline, it is crucial to consider the underlying reasons for the drop. Factors such as economic downturns, industry-specific challenges, or company-specific issues can all contribute to a decrease in stock value. However, these factors do not necessarily diminish the long-term potential of a company, especially if it has a strong track record of dividend payments.

One of the key aspects to consider when analyzing these stocks is the sustainability of their dividend payouts. A company that has consistently paid dividends over the years, even during challenging times, demonstrates resilience and financial stability. This is often indicative of a robust business model and effective management. Therefore, when a dividend stock experiences a decline, it is worthwhile to assess whether the company can maintain its dividend payments. A thorough examination of the company’s financial health, including its cash flow, debt levels, and earnings, can provide valuable insights into its ability to sustain dividends in the future.

Moreover, the current market environment can also play a significant role in shaping the prospects of dividend stocks. For instance, in a low-interest-rate environment, dividend stocks become particularly attractive as they offer higher yields compared to traditional fixed-income investments. This can lead to increased demand and potential price recovery over time. Additionally, as the economy recovers from downturns, companies with strong fundamentals are likely to benefit from improved market conditions, further enhancing their long-term investment appeal.

Furthermore, diversification is a critical strategy for investors considering dividend stocks that have experienced significant declines. By spreading investments across different sectors and industries, investors can mitigate risks associated with individual companies or market segments. This approach not only enhances the potential for capital appreciation but also ensures a more stable income stream from dividends.

In conclusion, while a decline in the value of S&P 500 dividend stocks by 43%, 20%, and 53% may initially seem concerning, it is essential to look beyond the immediate downturn. By focusing on the sustainability of dividend payouts, the broader market environment, and diversification strategies, investors can uncover opportunities for long-term growth and income. Ultimately, these stocks may offer a compelling proposition for those willing to navigate the complexities of the market with a focus on dividend potential.

S&P 500 Dividend Stocks Down 53%: Risk Vs. Reward

Investing in the stock market often involves a delicate balance between risk and reward, particularly when considering dividend stocks within the S&P 500. These stocks, known for providing regular income through dividends, can be attractive to long-term investors seeking stability and growth. However, even the most reliable dividend stocks can experience significant price fluctuations, as evidenced by some top S&P 500 dividend stocks currently down by 43%, 20%, and even 53%. This presents a unique opportunity for investors to weigh the potential risks against the rewards.

When a dividend stock experiences a substantial decline, such as a 53% drop, it can be tempting to view this as a red flag. However, it is crucial to delve deeper into the underlying reasons for the decline. Often, such drops can be attributed to broader market conditions, sector-specific challenges, or company-specific issues. For instance, economic downturns or shifts in industry dynamics can adversely affect stock prices, even for companies with strong fundamentals. Therefore, understanding the context behind the decline is essential for making informed investment decisions.

Moreover, a significant drop in stock price can lead to an attractive dividend yield, as the yield is inversely related to the stock price. This can be particularly appealing for income-focused investors. However, it is important to assess whether the company can sustain its dividend payments in the long term. Analyzing the company’s financial health, including its cash flow, debt levels, and payout ratio, can provide insights into its ability to maintain or even grow its dividends. A high yield may be enticing, but it should not come at the expense of financial stability.

Furthermore, investing in dividend stocks that have experienced a substantial decline requires a long-term perspective. While short-term volatility can be unsettling, it is essential to focus on the company’s long-term growth prospects. Companies with strong competitive advantages, robust business models, and a history of weathering economic cycles are more likely to recover and thrive over time. Therefore, identifying such companies amidst the current market downturn can offer significant rewards for patient investors.

Additionally, diversification plays a crucial role in managing risk when investing in dividend stocks. By spreading investments across various sectors and industries, investors can mitigate the impact of sector-specific downturns. This approach not only reduces risk but also enhances the potential for returns, as different sectors may perform differently under varying economic conditions. Therefore, while individual stocks may experience significant declines, a diversified portfolio can provide a buffer against such volatility.

In conclusion, while the prospect of investing in S&P 500 dividend stocks that are down by as much as 53% may seem daunting, it also presents a unique opportunity for long-term investors. By carefully analyzing the reasons behind the decline, assessing the company’s financial health, and maintaining a diversified portfolio, investors can navigate the risks and potentially reap substantial rewards. Ultimately, the key lies in adopting a disciplined approach, focusing on long-term growth prospects, and remaining patient amidst market fluctuations. This strategy can help investors capitalize on the potential of dividend stocks, even in challenging market conditions.

Strategies For Investing In S&P 500 Dividend Stocks

Investing in S&P 500 dividend stocks has long been a favored strategy for those seeking both income and growth potential. These stocks, representing some of the largest and most established companies in the United States, offer investors the dual benefits of regular dividend payments and the possibility of capital appreciation. However, even within this seemingly stable category, market fluctuations can lead to significant price declines, presenting both challenges and opportunities for long-term investors. In this context, examining stocks that have experienced substantial declines—such as those down 43%, 20%, and 53%—can provide valuable insights into strategic investment decisions.

To begin with, a stock that has fallen by 43% may initially appear to be a risky proposition. However, such a decline often prompts investors to delve deeper into the underlying reasons. It is crucial to assess whether the drop is due to temporary market conditions or more fundamental issues within the company. For instance, a company might face short-term setbacks due to economic downturns or sector-specific challenges, yet maintain strong fundamentals and a robust business model. In such cases, the stock’s lower price could represent a buying opportunity for investors with a long-term perspective, especially if the company continues to pay consistent dividends.

Similarly, a stock that has decreased by 20% might be experiencing a correction after a period of overvaluation. This scenario is not uncommon in the stock market, where prices can sometimes outpace the intrinsic value of a company. For dividend investors, a 20% decline might offer a more attractive entry point, allowing them to purchase shares at a reduced price while still benefiting from the company’s dividend yield. Moreover, if the company’s financial health remains strong, the dividend payments can provide a steady income stream, cushioning the impact of market volatility.

On the other hand, a stock that has plummeted by 53% warrants a more cautious approach. Such a significant drop often signals deeper issues that could affect the company’s ability to sustain its dividend payments. Investors should conduct thorough due diligence, examining factors such as the company’s debt levels, cash flow, and overall market position. If the decline is attributed to structural changes in the industry or a loss of competitive advantage, the risks may outweigh the potential rewards. However, if the company is taking steps to address these challenges and has a credible turnaround plan, it might still be a viable option for those willing to accept higher risk for the possibility of substantial returns.

In conclusion, investing in S&P 500 dividend stocks that have experienced significant declines requires a careful and informed approach. By analyzing the reasons behind the price drops and evaluating the company’s long-term prospects, investors can identify opportunities that align with their risk tolerance and investment goals. While market downturns can be unsettling, they also present the chance to acquire quality stocks at discounted prices. For those committed to a long-term investment strategy, these opportunities can lead to both income generation and capital growth, ultimately enhancing the overall performance of their investment portfolio.

The Impact Of Market Fluctuations On S&P 500 Dividend Stocks

The impact of market fluctuations on S&P 500 dividend stocks is a topic of considerable interest to long-term investors. These fluctuations can present both challenges and opportunities, particularly for those focused on dividend-yielding stocks. In recent times, several top S&P 500 dividend stocks have experienced significant declines, with some down by as much as 43%, 20%, and even 53%. Understanding the dynamics behind these movements is crucial for investors aiming to make informed decisions.

Market fluctuations are often driven by a myriad of factors, including economic indicators, geopolitical events, and changes in interest rates. For dividend stocks, these fluctuations can be particularly pronounced. When interest rates rise, for instance, dividend stocks may become less attractive compared to fixed-income securities, leading to a decline in their prices. Conversely, in a low-interest-rate environment, dividend stocks often gain favor as investors seek higher yields. This interplay between interest rates and dividend stocks is a fundamental aspect of market dynamics.

Moreover, economic downturns or recessions can also impact dividend stocks significantly. During such periods, companies may face reduced earnings, leading to potential cuts in dividend payouts. This can result in a decline in stock prices as investors react to the reduced income potential. However, it is essential to note that not all dividend stocks are equally affected. Companies with strong balance sheets and a history of stable earnings are often better positioned to weather economic storms, maintaining their dividend payouts even in challenging times.

The recent declines in some top S&P 500 dividend stocks, down 43%, 20%, and 53%, can be attributed to a combination of these factors. For instance, companies in sectors heavily impacted by global supply chain disruptions or regulatory changes may see their stock prices fall as investors reassess their growth prospects. Additionally, shifts in consumer behavior or technological advancements can render certain business models less viable, further contributing to stock price declines.

Despite these challenges, long-term investors can find opportunities in these market fluctuations. A decline in stock price can present a buying opportunity for those with a long-term perspective, particularly if the underlying fundamentals of the company remain strong. By focusing on companies with a track record of consistent dividend payments and robust financial health, investors can potentially benefit from both capital appreciation and dividend income over time.

Furthermore, diversification remains a key strategy for mitigating the risks associated with market fluctuations. By spreading investments across various sectors and industries, investors can reduce their exposure to sector-specific risks. This approach not only helps in managing volatility but also enhances the potential for stable returns.

In conclusion, while market fluctuations can pose challenges for S&P 500 dividend stocks, they also offer opportunities for astute investors. By understanding the factors driving these fluctuations and focusing on companies with strong fundamentals, long-term investors can navigate the complexities of the market effectively. As always, maintaining a diversified portfolio and a long-term investment horizon are essential strategies for achieving financial goals amidst the ever-changing market landscape.

Building A Diversified Portfolio With S&P 500 Dividend Stocks

In the ever-evolving landscape of financial markets, building a diversified portfolio remains a cornerstone strategy for investors seeking to mitigate risk while maximizing potential returns. Among the myriad of investment options, S&P 500 dividend stocks have consistently attracted attention due to their potential for providing steady income and capital appreciation. However, even within this seemingly stable category, market fluctuations can present unique opportunities for long-term investors. Notably, some top S&P 500 dividend stocks have experienced significant declines, with prices down 43%, 20%, and 53%, respectively. These downturns, while initially concerning, may offer strategic entry points for those looking to enhance their portfolios.

To begin with, the appeal of dividend stocks lies in their ability to generate regular income through dividend payments, which can be particularly attractive in volatile markets. Companies that consistently pay dividends often exhibit strong fundamentals and a commitment to returning value to shareholders. However, when these stocks experience substantial price declines, it is crucial to delve deeper into the underlying reasons. A 43% drop in a dividend stock’s price, for instance, may be attributed to sector-specific challenges, macroeconomic factors, or company-specific issues. By conducting thorough research and analysis, investors can discern whether the decline is temporary or indicative of deeper problems.

Moreover, a 20% decrease in another dividend stock might reflect broader market trends or short-term investor sentiment rather than a deterioration in the company’s financial health. In such cases, the stock’s fundamentals, such as revenue growth, profit margins, and cash flow stability, should be carefully evaluated. If these metrics remain robust, the price drop could represent a buying opportunity for long-term investors who believe in the company’s resilience and growth prospects. Additionally, the dividend yield, which inversely correlates with stock price, becomes more attractive as prices fall, potentially enhancing the stock’s appeal.

Furthermore, a more pronounced decline of 53% in a dividend stock may initially raise red flags. However, it is essential to consider the broader context. Economic downturns, regulatory changes, or shifts in consumer behavior can disproportionately impact certain sectors, leading to steep declines in stock prices. For investors with a long-term horizon, these situations may present a chance to acquire shares at a significant discount. It is imperative, though, to assess the company’s ability to sustain its dividend payments and navigate the challenges it faces. A strong balance sheet, manageable debt levels, and a history of prudent financial management are indicators that the company may weather the storm and eventually recover.

In conclusion, while the allure of S&P 500 dividend stocks lies in their potential for stable income and growth, market volatility can create opportunities for astute investors. By carefully analyzing the reasons behind significant price declines of 43%, 20%, and 53%, investors can make informed decisions about incorporating these stocks into a diversified portfolio. Emphasizing a long-term perspective, thorough research, and a focus on fundamentals can help investors capitalize on these opportunities while managing risk. Ultimately, the goal is to build a resilient portfolio that not only withstands market fluctuations but also thrives in the face of uncertainty, ensuring sustained growth and income over time.

Q&A

1. **What is the significance of dividend stocks in the S&P 500?**

Dividend stocks in the S&P 500 are significant because they provide investors with regular income through dividends, which can be especially appealing during volatile market conditions.

2. **Why might a dividend stock be down 43%, 20%, or 53%?**

A dividend stock might be down due to various factors such as market volatility, company-specific issues, changes in industry dynamics, or broader economic conditions affecting investor sentiment.

3. **What are the potential benefits of investing in dividend stocks that are down?**

Investing in dividend stocks that are down can offer potential benefits like buying at a lower price, higher dividend yields, and the possibility of capital appreciation if the stock recovers.

4. **What risks are associated with investing in these down dividend stocks?**

Risks include the possibility of further declines in stock price, dividend cuts or suspensions, and underlying business challenges that may not be resolved.

5. **How can investors assess the long-term potential of these dividend stocks?**

Investors can assess long-term potential by analyzing the company’s financial health, dividend history, payout ratio, industry position, and growth prospects.

6. **What role does diversification play in investing in dividend stocks?**

Diversification helps mitigate risk by spreading investments across different sectors and companies, reducing the impact of any single stock’s poor performance on the overall portfolio.

7. **What should investors consider before investing in these stocks for the long term?**

Investors should consider their risk tolerance, investment goals, the company’s fundamentals, economic conditions, and the sustainability of the dividend before investing for the long term.

Conclusion

Investing in top S&P 500 dividend stocks that are currently down by 43%, 20%, and 53% can present a strategic opportunity for long-term investors. These stocks, despite their recent declines, may offer attractive entry points due to their potential for recovery and the continued payment of dividends, which can provide a steady income stream. Historically, high-quality dividend-paying stocks have shown resilience and the ability to rebound over time, making them appealing for investors seeking both income and capital appreciation. However, it is crucial to conduct thorough research and consider the underlying fundamentals of each company to ensure they have the financial health and business model to sustain and grow their dividends in the future. Diversification and a long-term perspective are key to mitigating risks associated with market volatility and achieving investment goals.