“Wall Street Bets Big: Nvidia Set for a 38% Leap!”

Introduction

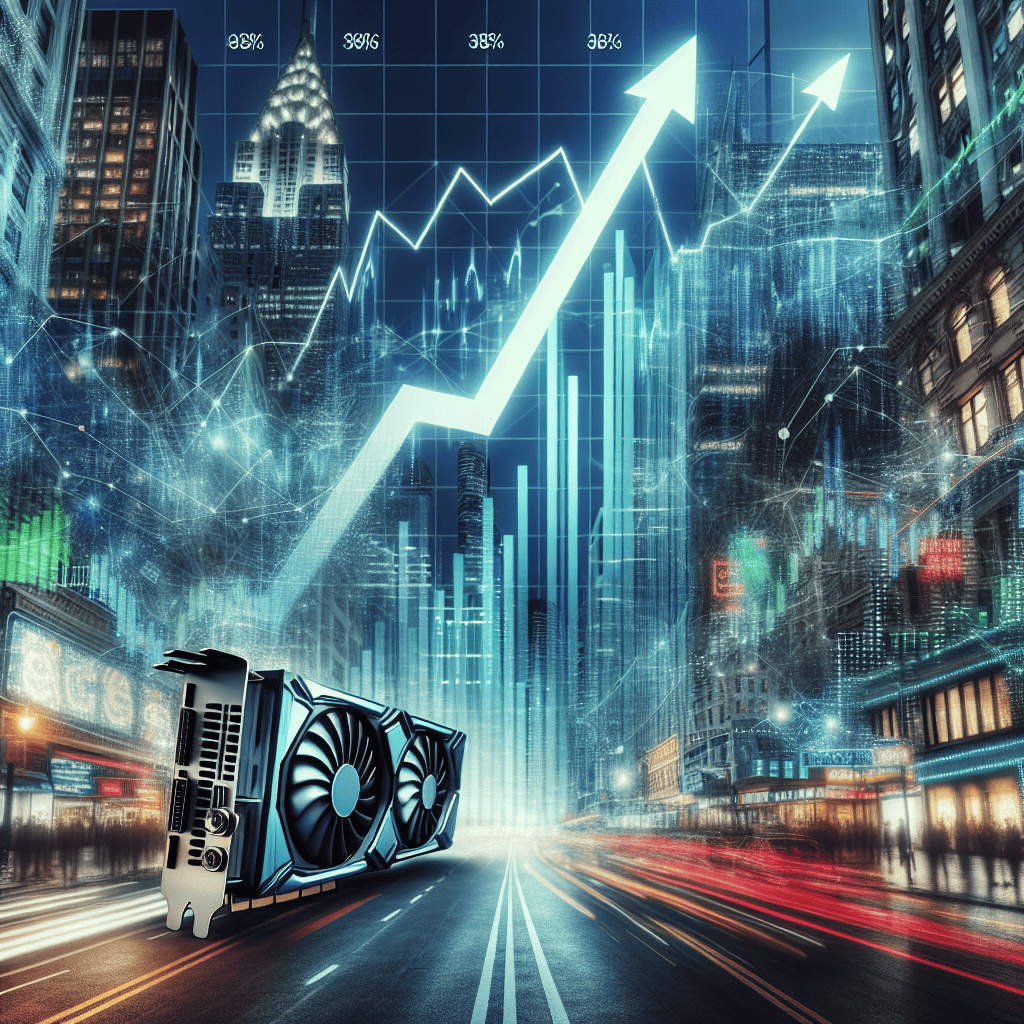

Nvidia, a leading player in the semiconductor industry, is poised for a significant market upswing, according to a recent analysis by a prominent Wall Street firm. The firm has projected a remarkable 38% surge in Nvidia’s stock value, driven by the company’s robust performance in the graphics processing unit (GPU) market and its strategic advancements in artificial intelligence (AI) and data center technologies. This optimistic forecast underscores Nvidia’s potential to capitalize on the growing demand for high-performance computing solutions, positioning it as a key beneficiary in the evolving tech landscape. As investors closely monitor these developments, Nvidia’s stock is set to capture substantial attention in the financial markets.

Impact Of Wall Street Predictions On Nvidia’s Market Performance

Wall Street’s influence on market dynamics is undeniable, and recent predictions regarding Nvidia’s stock performance have captured significant attention. A prominent Wall Street firm has forecasted a remarkable 38% surge in Nvidia’s stock, a projection that has sparked discussions among investors and analysts alike. This prediction is not merely a speculative assertion but is grounded in a comprehensive analysis of Nvidia’s current market position, technological advancements, and future growth potential.

Nvidia, a leader in the semiconductor industry, has consistently demonstrated its prowess in developing cutting-edge graphics processing units (GPUs) and artificial intelligence (AI) technologies. The firm’s prediction is largely based on Nvidia’s strategic initiatives and its ability to capitalize on emerging trends in technology. For instance, the increasing demand for AI-driven applications and the expansion of data centers have positioned Nvidia favorably in the market. As businesses continue to integrate AI into their operations, the need for high-performance computing solutions, such as those offered by Nvidia, is expected to rise significantly.

Moreover, Nvidia’s recent ventures into the automotive sector, particularly in autonomous vehicle technology, have further bolstered its growth prospects. The company’s partnerships with major automotive manufacturers to develop AI-powered systems for self-driving cars underscore its commitment to innovation and diversification. This strategic move not only enhances Nvidia’s revenue streams but also solidifies its position as a key player in the evolving landscape of technology.

In addition to these factors, Nvidia’s robust financial performance has reinforced investor confidence. The company’s consistent revenue growth, driven by strong sales in gaming and data center segments, has been a testament to its operational efficiency and market adaptability. Furthermore, Nvidia’s focus on research and development ensures that it remains at the forefront of technological advancements, thereby sustaining its competitive edge.

The Wall Street firm’s prediction also considers the broader economic environment and its impact on Nvidia’s market performance. As global economies recover from recent disruptions, there is an anticipated increase in consumer spending and business investments in technology. This macroeconomic trend is likely to benefit Nvidia, as its products and services are integral to various sectors, including gaming, professional visualization, and cloud computing.

However, it is important to acknowledge the inherent uncertainties in stock market predictions. While the forecasted 38% surge is optimistic, market conditions can be volatile, influenced by factors such as geopolitical tensions, regulatory changes, and shifts in consumer preferences. Investors are advised to exercise caution and conduct thorough due diligence before making investment decisions based on such predictions.

In conclusion, the Wall Street firm’s projection of a 38% increase in Nvidia’s stock reflects a confluence of factors, including the company’s strategic initiatives, technological advancements, and favorable market conditions. While the prediction has generated enthusiasm among investors, it also serves as a reminder of the complexities involved in stock market forecasting. As Nvidia continues to innovate and expand its footprint across various industries, its market performance will undoubtedly be closely monitored by stakeholders seeking to capitalize on its growth trajectory.

Analyzing The Factors Behind Nvidia’s Projected 38% Stock Surge

Nvidia, a leading player in the semiconductor industry, has recently captured the attention of investors and analysts alike, with a prominent Wall Street firm predicting a remarkable 38% surge in its stock value. This optimistic forecast is not without reason, as several key factors contribute to the anticipated growth. Understanding these elements provides valuable insight into Nvidia’s potential trajectory and the broader implications for the technology sector.

To begin with, Nvidia’s strong position in the artificial intelligence (AI) and machine learning markets is a significant driver of its projected stock surge. The company’s advanced graphics processing units (GPUs) are integral to AI applications, which are increasingly being adopted across various industries. As businesses continue to integrate AI into their operations, the demand for Nvidia’s cutting-edge technology is expected to rise, thereby boosting the company’s revenue and stock performance. Furthermore, Nvidia’s strategic investments in AI research and development underscore its commitment to maintaining a competitive edge in this rapidly evolving field.

In addition to its AI prowess, Nvidia’s expansion into the data center market is another critical factor contributing to the optimistic stock forecast. The company’s GPUs are not only essential for AI but also for powering data centers, which are the backbone of cloud computing services. As the demand for cloud-based solutions continues to grow, Nvidia is well-positioned to capitalize on this trend. The firm’s recent acquisitions and partnerships in the data center space further enhance its capabilities and market reach, reinforcing the positive outlook for its stock.

Moreover, Nvidia’s foray into the automotive industry, particularly in the realm of autonomous vehicles, presents another avenue for growth. The company’s DRIVE platform, which provides AI-powered solutions for self-driving cars, has garnered significant interest from major automotive manufacturers. As the race towards fully autonomous vehicles accelerates, Nvidia’s technology is poised to play a crucial role, potentially leading to substantial revenue streams and, consequently, a surge in its stock value.

Transitioning to the gaming sector, Nvidia’s dominance in the graphics card market cannot be overlooked. The company’s GeForce GPUs are highly sought after by gamers worldwide, and the ongoing demand for high-performance gaming hardware continues to drive Nvidia’s sales. With the gaming industry experiencing sustained growth, Nvidia’s stronghold in this market segment is likely to contribute positively to its stock performance.

Additionally, Nvidia’s financial health and strategic management decisions further bolster confidence in its projected stock surge. The company has consistently demonstrated robust financial performance, with impressive revenue growth and profitability. Its prudent management of resources and strategic investments in emerging technologies position Nvidia favorably for future success. This financial stability, coupled with a clear vision for innovation, enhances investor confidence and supports the optimistic stock forecast.

In conclusion, the predicted 38% surge in Nvidia’s stock is underpinned by a confluence of factors, including its leadership in AI and machine learning, expansion into data centers, ventures into autonomous vehicles, and dominance in the gaming industry. These elements, combined with strong financial health and strategic foresight, paint a promising picture for Nvidia’s future. As the company continues to innovate and adapt to evolving market demands, its stock is poised for significant growth, reflecting its pivotal role in shaping the technological landscape.

How Nvidia’s Innovations Drive Investor Confidence

Nvidia Corporation, a leading player in the semiconductor industry, has consistently captured the attention of investors and analysts alike with its groundbreaking innovations and strategic market positioning. Recently, a prominent Wall Street firm projected a remarkable 38% surge in Nvidia’s stock, underscoring the company’s robust growth potential and the confidence it inspires among investors. This optimistic forecast is rooted in Nvidia’s continuous advancements in technology, its strategic expansion into new markets, and its ability to adapt to the ever-evolving demands of the digital age.

At the heart of Nvidia’s success is its relentless pursuit of innovation, particularly in the realm of graphics processing units (GPUs). These GPUs have become indispensable in a variety of applications, ranging from gaming and professional visualization to data centers and artificial intelligence (AI). Nvidia’s leadership in AI, in particular, has been a significant driver of its stock performance. The company’s GPUs are widely recognized for their superior performance in AI workloads, making them the preferred choice for tech giants and research institutions engaged in AI development. As AI continues to permeate various sectors, Nvidia’s role as a key enabler of this technology positions it favorably for sustained growth.

Moreover, Nvidia’s strategic acquisitions have further bolstered its market position and expanded its technological capabilities. The acquisition of Mellanox Technologies, for instance, has enhanced Nvidia’s data center offerings, allowing it to provide comprehensive solutions that address the growing demand for high-performance computing. This move not only strengthens Nvidia’s foothold in the data center market but also aligns with the broader industry trend towards cloud computing and big data analytics. As businesses increasingly rely on data-driven insights, Nvidia’s ability to deliver cutting-edge solutions becomes even more critical.

In addition to its technological prowess, Nvidia’s expansion into new markets has been a key factor in driving investor confidence. The company’s foray into the automotive sector, particularly with its autonomous vehicle technology, exemplifies its commitment to diversifying its revenue streams. Nvidia’s DRIVE platform, which provides the computational power necessary for self-driving cars, has garnered significant interest from automakers and tech companies alike. As the automotive industry undergoes a transformative shift towards automation and electrification, Nvidia’s early investments in this space are likely to yield substantial returns.

Furthermore, Nvidia’s strategic partnerships and collaborations have played a crucial role in reinforcing its market leadership. By aligning with industry leaders and fostering a collaborative ecosystem, Nvidia has been able to accelerate innovation and expand its reach. These partnerships not only enhance Nvidia’s product offerings but also create synergies that drive growth across multiple sectors.

In conclusion, Nvidia’s ability to consistently innovate, strategically expand into new markets, and forge meaningful partnerships has solidified its reputation as a leader in the semiconductor industry. The Wall Street firm’s prediction of a 38% surge in Nvidia’s stock reflects the confidence that investors have in the company’s growth trajectory. As Nvidia continues to push the boundaries of technology and adapt to emerging trends, it remains well-positioned to capitalize on the opportunities presented by the digital revolution. Consequently, Nvidia’s stock is likely to remain an attractive proposition for investors seeking exposure to the dynamic and rapidly evolving tech landscape.

The Role Of AI And Gaming In Nvidia’s Growth Prospects

Nvidia Corporation, a leading player in the semiconductor industry, has been at the forefront of technological innovation, particularly in the realms of artificial intelligence (AI) and gaming. Recently, a prominent Wall Street firm predicted a 38% surge in Nvidia’s stock, attributing this optimistic forecast to the company’s strategic positioning in these rapidly growing sectors. As we delve into the factors driving Nvidia’s growth prospects, it becomes evident that the convergence of AI and gaming technologies is playing a pivotal role in shaping the company’s future.

To begin with, Nvidia’s advancements in AI have been nothing short of transformative. The company’s graphics processing units (GPUs) are not only essential for high-performance gaming but have also become integral to AI applications. These GPUs are designed to handle complex computations at high speeds, making them ideal for training AI models. As industries increasingly adopt AI to enhance efficiency and innovation, Nvidia’s technology is in high demand. This demand is further fueled by the rise of machine learning and deep learning applications across various sectors, including healthcare, automotive, and finance. Consequently, Nvidia’s AI-driven solutions are poised to capture a significant share of this burgeoning market, thereby contributing to the anticipated stock surge.

In addition to AI, the gaming industry remains a cornerstone of Nvidia’s business model. The company’s GPUs are renowned for delivering exceptional graphics performance, which is crucial for an immersive gaming experience. As the gaming industry continues to expand, driven by the proliferation of eSports and the growing popularity of virtual reality (VR) and augmented reality (AR) games, Nvidia is well-positioned to capitalize on these trends. The introduction of next-generation gaming consoles and the increasing demand for high-quality gaming PCs further bolster Nvidia’s prospects. By continuously innovating and enhancing its product offerings, Nvidia ensures that it remains a preferred choice for gamers worldwide.

Moreover, the synergy between AI and gaming is creating new opportunities for Nvidia. AI technologies are being integrated into gaming to enhance user experiences, from creating more realistic non-player characters (NPCs) to developing adaptive gameplay that responds to individual player styles. Nvidia’s expertise in both AI and gaming allows it to lead this integration, offering solutions that push the boundaries of what is possible in interactive entertainment. This dual focus not only strengthens Nvidia’s market position but also opens up new revenue streams, reinforcing the firm’s growth trajectory.

Furthermore, Nvidia’s strategic partnerships and acquisitions play a crucial role in its growth strategy. By collaborating with leading tech companies and acquiring innovative startups, Nvidia is expanding its technological capabilities and market reach. These strategic moves enable Nvidia to stay ahead of the competition and adapt to the ever-evolving tech landscape. As a result, the company is better equipped to leverage emerging trends and maintain its leadership position in both AI and gaming sectors.

In conclusion, the predicted 38% surge in Nvidia’s stock is underpinned by the company’s robust growth prospects in AI and gaming. By harnessing the potential of these dynamic industries, Nvidia is not only driving technological advancements but also creating significant value for its stakeholders. As AI and gaming continue to evolve and intersect, Nvidia’s strategic focus on these areas positions it for sustained success in the years to come.

Comparing Nvidia’s Stock Forecast With Industry Peers

Nvidia, a leading player in the semiconductor industry, has recently captured the attention of investors and analysts alike, with a prominent Wall Street firm predicting a remarkable 38% surge in its stock value. This optimistic forecast has sparked discussions about Nvidia’s position in the market, especially when compared to its industry peers. To understand the implications of this prediction, it is essential to examine the factors driving Nvidia’s growth and how these compare to the strategies and performances of other companies in the semiconductor sector.

Nvidia’s success can be attributed to its strong foothold in the graphics processing unit (GPU) market, which has seen increasing demand due to advancements in artificial intelligence (AI), gaming, and data centers. The company’s innovative approach to developing high-performance GPUs has positioned it as a leader in these rapidly growing sectors. Moreover, Nvidia’s strategic acquisitions, such as the purchase of Mellanox Technologies, have expanded its capabilities and market reach, further solidifying its competitive edge.

In contrast, some of Nvidia’s industry peers have faced challenges in maintaining similar growth trajectories. For instance, Intel, another major player in the semiconductor industry, has struggled with production delays and increased competition. While Intel remains a dominant force in the central processing unit (CPU) market, its attempts to diversify into GPUs and other areas have not yet yielded the same level of success as Nvidia’s endeavors. Consequently, Intel’s stock performance has been more volatile, reflecting the uncertainties surrounding its strategic direction.

Similarly, Advanced Micro Devices (AMD), a key competitor to Nvidia, has experienced its own set of challenges. Although AMD has made significant strides in the CPU market, its GPU segment has not achieved the same level of dominance as Nvidia’s. Despite this, AMD’s stock has shown resilience, driven by its strong performance in the CPU space and its efforts to capture a larger share of the GPU market. However, the Wall Street firm’s prediction for Nvidia suggests that Nvidia’s growth potential may outpace that of AMD in the near future.

Transitioning to another aspect of the semiconductor industry, companies like Qualcomm and Broadcom have focused on different segments, such as mobile processors and communication technologies. While these companies have demonstrated robust growth, their market dynamics differ from those of Nvidia, making direct comparisons challenging. Nevertheless, the overall health of the semiconductor industry remains strong, with demand for chips continuing to rise across various applications.

In light of these comparisons, Nvidia’s forecasted 38% stock surge highlights the company’s unique position within the industry. Its ability to capitalize on emerging technologies and maintain a strong pipeline of innovative products sets it apart from its peers. Furthermore, Nvidia’s strategic investments in AI and data center technologies align with broader industry trends, suggesting that the company is well-positioned to sustain its growth momentum.

In conclusion, while Nvidia’s predicted stock surge underscores its leadership in the semiconductor industry, it also reflects the broader dynamics at play among its peers. As the industry continues to evolve, companies must navigate a complex landscape of technological advancements and competitive pressures. Nvidia’s success story serves as a testament to the importance of innovation and strategic foresight in achieving sustained growth, offering valuable insights for investors and industry stakeholders alike.

Investor Strategies For Capitalizing On Nvidia’s Predicted Growth

Investors are constantly on the lookout for opportunities that promise substantial returns, and the recent prediction by a prominent Wall Street firm regarding Nvidia’s stock presents such a prospect. The firm forecasts a remarkable 38% surge in Nvidia’s stock value, a projection that has captured the attention of both seasoned investors and newcomers alike. Understanding how to strategically capitalize on this anticipated growth is crucial for those looking to enhance their investment portfolios.

To begin with, it is essential to comprehend the factors driving this optimistic forecast. Nvidia, a leader in the semiconductor industry, has consistently demonstrated innovation and adaptability, particularly in the realms of artificial intelligence, gaming, and data centers. The company’s robust product pipeline and strategic partnerships have positioned it favorably in the market. Moreover, the increasing demand for high-performance computing solutions and the expansion of AI applications across various sectors further bolster Nvidia’s growth prospects. Consequently, these elements contribute to the Wall Street firm’s positive outlook on the stock.

Given this context, investors should consider several strategies to maximize their potential gains. One approach is to adopt a long-term investment perspective. By holding Nvidia stock over an extended period, investors can benefit from the company’s sustained growth and innovation. This strategy aligns with the broader market trend of technology stocks appreciating over time, driven by continuous advancements and increasing adoption of tech solutions.

Additionally, diversification remains a fundamental principle in investment strategy. While Nvidia’s predicted growth is enticing, it is prudent to balance one’s portfolio with a mix of assets. This approach mitigates risk and ensures that investors are not overly reliant on a single stock’s performance. Including a variety of technology stocks, alongside Nvidia, can provide a buffer against market volatility and enhance overall portfolio stability.

Furthermore, investors might explore options trading as a means to capitalize on Nvidia’s anticipated stock surge. Options provide the flexibility to leverage stock movements without the need to own the underlying asset. By purchasing call options, investors can potentially profit from Nvidia’s stock increase while limiting their exposure to downside risks. However, it is important to note that options trading requires a thorough understanding of market dynamics and carries its own set of risks.

In addition to these strategies, staying informed about Nvidia’s developments and market trends is crucial. Regularly reviewing financial reports, industry news, and analyst insights can provide valuable information that aids in making informed investment decisions. Engaging with financial advisors or investment professionals can also offer personalized guidance tailored to individual investment goals and risk tolerance.

In conclusion, the predicted 38% surge in Nvidia’s stock presents a compelling opportunity for investors. By adopting a long-term perspective, diversifying portfolios, exploring options trading, and staying informed, investors can strategically position themselves to capitalize on Nvidia’s growth potential. As with any investment, it is essential to conduct thorough research and consider one’s financial objectives and risk appetite. With careful planning and execution, investors can potentially reap significant rewards from Nvidia’s anticipated stock performance.

Historical Accuracy Of Wall Street Predictions For Tech Stocks

Wall Street firms have long been regarded as influential players in the financial markets, with their predictions often swaying investor sentiment and impacting stock prices. Recently, a prominent Wall Street firm predicted a 38% surge for Nvidia stock, capturing the attention of investors and analysts alike. To understand the potential implications of such a forecast, it is essential to examine the historical accuracy of Wall Street predictions for tech stocks, as this can provide valuable insights into the reliability of these forecasts.

Historically, Wall Street firms have had a mixed track record when it comes to predicting the performance of tech stocks. On one hand, these firms employ teams of analysts who utilize sophisticated models and extensive data to make informed predictions. This analytical rigor can lead to accurate forecasts, as seen in past instances where Wall Street correctly anticipated the rise of tech giants like Apple and Amazon. For example, in the early 2000s, several firms accurately predicted Apple’s resurgence, driven by the success of the iPod and later the iPhone, which resulted in substantial gains for investors who heeded these forecasts.

On the other hand, the volatile nature of the tech industry can make accurate predictions challenging. The rapid pace of technological innovation, coupled with shifting consumer preferences and regulatory changes, can lead to unforeseen developments that impact stock performance. For instance, during the dot-com bubble of the late 1990s, many Wall Street firms issued overly optimistic predictions for internet companies, only for these stocks to plummet when the bubble burst. This serves as a cautionary tale, highlighting the potential pitfalls of relying too heavily on Wall Street forecasts.

Moreover, the accuracy of Wall Street predictions can be influenced by external factors beyond the control of analysts. Economic conditions, geopolitical events, and market sentiment can all play significant roles in determining stock performance. For example, the global financial crisis of 2008 led to widespread market turmoil, rendering many Wall Street predictions obsolete as tech stocks experienced sharp declines. Similarly, the COVID-19 pandemic in 2020 introduced unprecedented uncertainty, challenging analysts to adapt their models to account for rapidly changing circumstances.

Despite these challenges, Wall Street predictions remain a valuable tool for investors seeking to navigate the complexities of the tech sector. By analyzing historical data and trends, these forecasts can provide a framework for understanding potential future developments. However, it is crucial for investors to approach these predictions with a degree of skepticism and to consider them as one of many factors in their decision-making process.

In the case of Nvidia, the Wall Street firm’s prediction of a 38% surge may be based on several factors, such as the company’s strong position in the semiconductor industry, its advancements in artificial intelligence, and its strategic partnerships. While these elements may indeed contribute to future growth, investors should also consider potential risks, such as increased competition and regulatory scrutiny, which could impact Nvidia’s performance.

In conclusion, while Wall Street predictions for tech stocks can offer valuable insights, their historical accuracy is not guaranteed. Investors should remain vigilant, conducting their own research and considering a range of factors before making investment decisions. By doing so, they can better navigate the uncertainties of the tech sector and make informed choices that align with their financial goals.

Q&A

1. **Question:** Which Wall Street firm predicted a 38% surge for Nvidia stock?

**Answer:** Morgan Stanley.

2. **Question:** What is the primary reason for the predicted surge in Nvidia’s stock?

**Answer:** The anticipated growth in demand for Nvidia’s AI and data center products.

3. **Question:** By how much is Nvidia’s stock expected to increase according to the prediction?

**Answer:** 38%.

4. **Question:** What sector is primarily driving Nvidia’s expected stock surge?

**Answer:** The artificial intelligence (AI) sector.

5. **Question:** What is Nvidia’s role in the AI industry that supports the stock surge prediction?

**Answer:** Nvidia is a leading provider of GPUs and AI hardware essential for AI development and deployment.

6. **Question:** How has Nvidia’s stock performed in the past year prior to this prediction?

**Answer:** Nvidia’s stock has shown significant growth, driven by strong demand for its AI and gaming products.

7. **Question:** What impact does the prediction have on investor sentiment towards Nvidia?

**Answer:** The prediction likely boosts investor confidence and interest in Nvidia as a key player in the AI market.

Conclusion

Nvidia’s stock is projected to experience a significant increase, with a Wall Street firm forecasting a 38% surge. This optimistic outlook likely stems from Nvidia’s strong position in the technology sector, driven by its advancements in AI, data centers, and gaming. The firm’s prediction suggests confidence in Nvidia’s ability to capitalize on emerging market trends and maintain its competitive edge. Investors may view this as an opportunity for substantial returns, although they should also consider potential market volatility and broader economic factors that could impact the stock’s performance.