“Custodial vs. Non-Custodial Crypto Exchanges: Navigating Control, Security, and Freedom in Your Digital Assets.”

Introduction

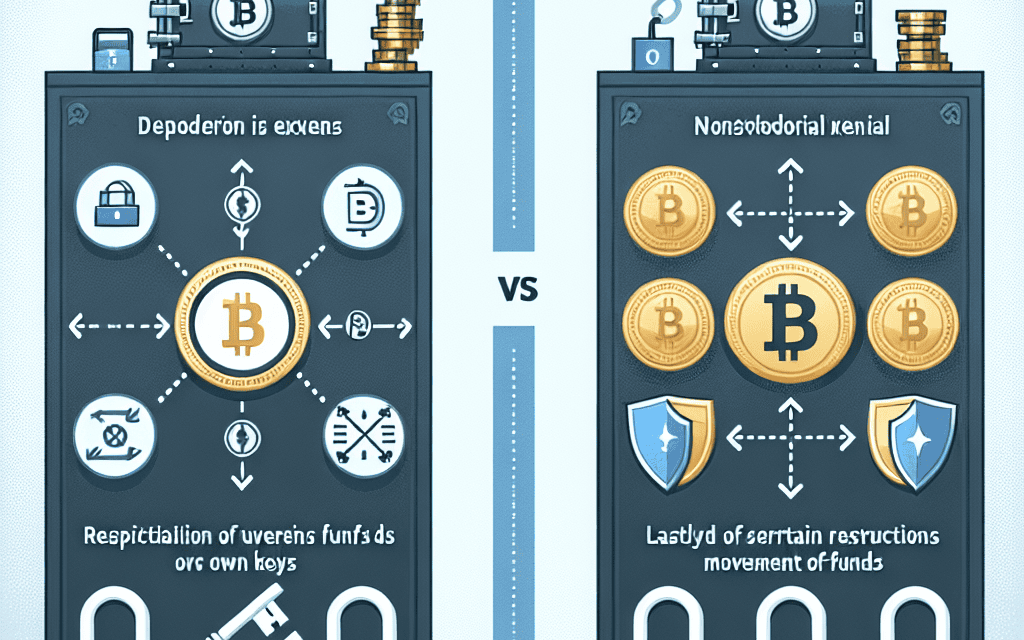

Cryptocurrency exchanges serve as pivotal platforms for trading digital assets, and understanding the distinction between custodial and non-custodial exchanges is crucial for any crypto enthusiast or investor. Custodial exchanges, akin to traditional banks, hold and manage users’ private keys, offering convenience and often enhanced security features, but at the cost of relinquishing direct control over one’s assets. In contrast, non-custodial exchanges empower users by allowing them to retain full control of their private keys, thereby enhancing privacy and security but requiring a higher level of personal responsibility and technical understanding. This fundamental difference impacts not only the security and control of digital assets but also influences user experience, transaction speed, and regulatory compliance. As the cryptocurrency landscape continues to evolve, grasping the nuances between these two types of exchanges is essential for making informed decisions aligned with one’s financial goals and risk tolerance.

Understanding Custodial Crypto Exchanges: Pros and Cons

In the rapidly evolving world of cryptocurrency, understanding the nuances of different types of exchanges is crucial for both novice and experienced investors. Custodial crypto exchanges, in particular, have garnered significant attention due to their unique characteristics and the distinct advantages and disadvantages they offer. To begin with, custodial exchanges are platforms where the exchange itself holds and manages the private keys of its users’ cryptocurrencies. This means that users entrust the exchange with the responsibility of safeguarding their digital assets, much like a bank holds and manages customers’ funds. This arrangement can be advantageous for several reasons.

Firstly, custodial exchanges often provide a user-friendly experience, which is particularly beneficial for those new to the cryptocurrency space. By managing the technical aspects of storing and securing digital assets, these exchanges allow users to focus on trading and investing without the added burden of understanding complex security protocols. Additionally, custodial exchanges typically offer a range of services that enhance the trading experience, such as advanced trading tools, customer support, and insurance against potential losses due to hacking or other security breaches. These features can provide peace of mind to users who may be concerned about the safety of their investments.

However, the convenience offered by custodial exchanges comes with certain drawbacks. One of the primary concerns is the issue of trust. By relinquishing control of their private keys, users must place a significant amount of trust in the exchange to act in their best interest and to maintain robust security measures. Unfortunately, history has shown that even the most reputable exchanges can fall victim to cyberattacks, resulting in substantial financial losses for users. Moreover, the centralized nature of custodial exchanges can make them susceptible to regulatory scrutiny and potential government intervention, which may impact users’ ability to access their funds.

In contrast, non-custodial exchanges offer an alternative that addresses some of these concerns. By allowing users to retain control of their private keys, non-custodial exchanges eliminate the need for trust in a third party. This decentralized approach can enhance security and privacy, as users are not required to share sensitive information with the exchange. However, this increased control comes with its own set of challenges. Users must take full responsibility for the security of their private keys, which can be daunting for those unfamiliar with best practices for safeguarding digital assets.

Furthermore, non-custodial exchanges may lack some of the features and services that make custodial exchanges appealing. For instance, they often have limited customer support and may not offer the same level of insurance against losses. Additionally, the user interface of non-custodial exchanges can be less intuitive, potentially posing a barrier to entry for those new to cryptocurrency trading.

In conclusion, the choice between custodial and non-custodial crypto exchanges ultimately depends on an individual’s priorities and level of expertise. Custodial exchanges offer convenience and a range of services that can simplify the trading experience, but they require users to place trust in a third party. On the other hand, non-custodial exchanges provide greater control and security, but demand a higher level of responsibility from users. As the cryptocurrency landscape continues to evolve, it is essential for investors to carefully consider these factors and make informed decisions that align with their personal preferences and risk tolerance.

Non-Custodial Crypto Exchanges: A Deep Dive into Benefits and Risks

In the rapidly evolving world of cryptocurrency, the choice between custodial and non-custodial exchanges is a critical decision for investors and traders. Non-custodial crypto exchanges, in particular, have gained significant attention due to their unique approach to security and user autonomy. Understanding the benefits and risks associated with non-custodial exchanges is essential for anyone looking to navigate the crypto landscape effectively.

Non-custodial exchanges operate on the principle of decentralization, allowing users to retain control over their private keys and, consequently, their digital assets. This fundamental difference from custodial exchanges, where the platform holds the private keys on behalf of the user, offers a significant advantage in terms of security. By maintaining control over their private keys, users are less vulnerable to hacks and breaches that have plagued many centralized exchanges. This autonomy ensures that even if the exchange itself is compromised, the user’s assets remain secure, as the exchange does not have access to them.

Moreover, non-custodial exchanges often provide a higher degree of privacy. Since these platforms do not require users to deposit their funds, there is no need for extensive personal information to be shared, reducing the risk of data breaches and identity theft. This aspect is particularly appealing to privacy-conscious individuals who prioritize anonymity in their financial transactions. Additionally, the decentralized nature of non-custodial exchanges aligns with the core philosophy of cryptocurrencies, which is to promote financial sovereignty and reduce reliance on centralized institutions.

However, the benefits of non-custodial exchanges come with their own set of challenges and risks. One of the primary concerns is the responsibility placed on users to manage their private keys. Unlike custodial exchanges, where the platform takes on the responsibility of securing assets, non-custodial exchanges require users to be vigilant in safeguarding their keys. Losing access to a private key can result in the permanent loss of funds, a risk that underscores the importance of secure key management practices.

Furthermore, non-custodial exchanges may present a steeper learning curve for newcomers to the crypto space. The user interface and experience can be less intuitive compared to custodial platforms, which often offer more user-friendly features and customer support. This complexity can deter less tech-savvy individuals from fully engaging with non-custodial exchanges, potentially limiting their accessibility to a broader audience.

In addition, the liquidity on non-custodial exchanges can sometimes be lower than that of their custodial counterparts. This is due to the decentralized nature of these platforms, which may not attract the same volume of trading activity. Consequently, users might encounter challenges in executing large trades or finding competitive prices, which can impact their overall trading experience.

Despite these challenges, the growing interest in non-custodial exchanges reflects a broader trend towards decentralization and user empowerment in the cryptocurrency ecosystem. As technology continues to advance, it is likely that the user experience on non-custodial platforms will improve, addressing some of the current limitations. For those who prioritize security, privacy, and control over their digital assets, non-custodial exchanges offer a compelling alternative to traditional custodial platforms. However, it is crucial for users to weigh the benefits against the risks and ensure they are equipped with the necessary knowledge and tools to manage their assets effectively. In doing so, they can make informed decisions that align with their individual preferences and risk tolerance in the dynamic world of cryptocurrency trading.

Security Concerns: Custodial vs. Non-Custodial Exchanges

In the rapidly evolving world of cryptocurrency, security remains a paramount concern for investors and traders alike. As digital assets continue to gain popularity, the choice between custodial and non-custodial exchanges has become a critical decision for users seeking to safeguard their investments. Understanding the security implications of each type of exchange is essential for making informed decisions in the crypto space.

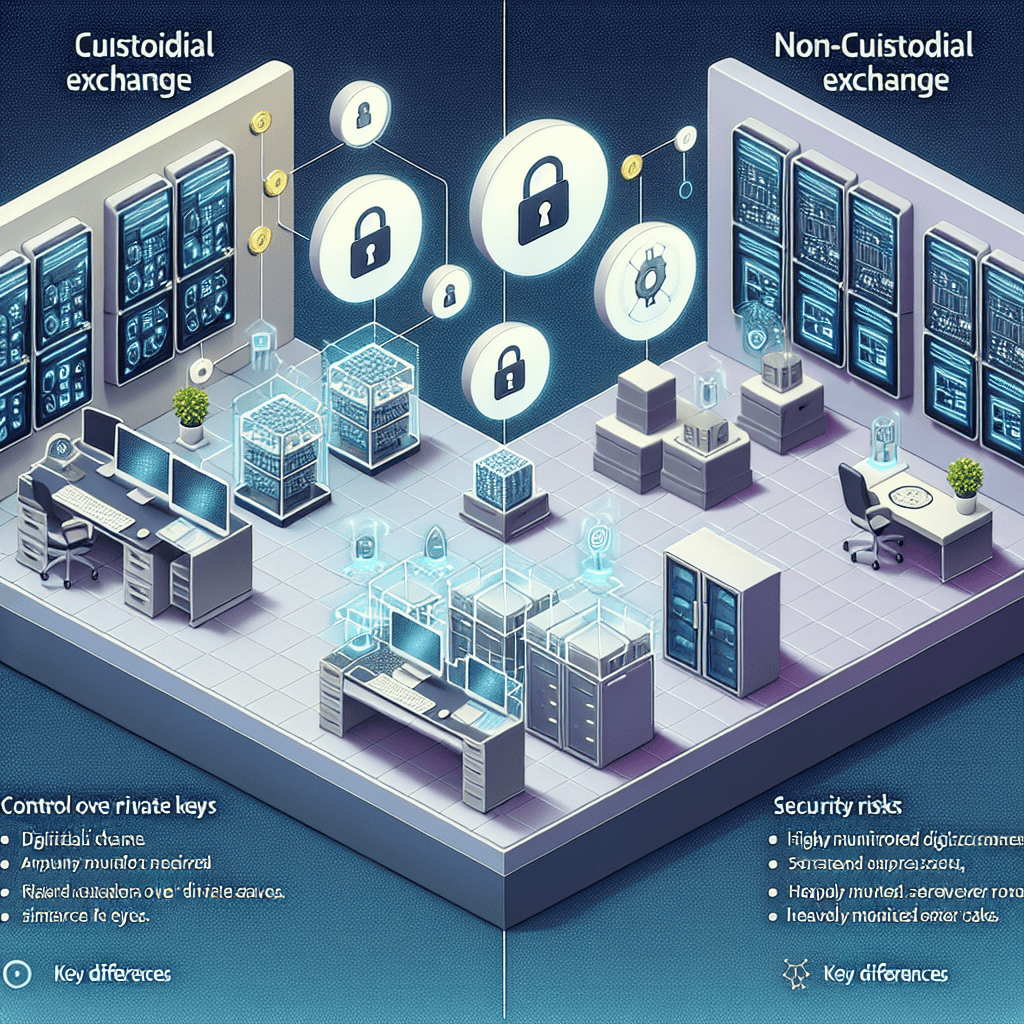

Custodial exchanges, often likened to traditional banks, hold users’ funds and private keys on their behalf. This model offers a level of convenience, as users do not need to manage their own private keys, which are crucial for accessing and transferring cryptocurrencies. However, this convenience comes with inherent risks. By entrusting their assets to a third party, users are exposed to potential security breaches and hacks. History has shown that even the most reputable custodial exchanges are not immune to cyberattacks, with several high-profile incidents resulting in significant financial losses for users. Consequently, the security of custodial exchanges largely depends on the robustness of their internal security measures and their ability to fend off external threats.

In contrast, non-custodial exchanges empower users by allowing them to retain control over their private keys. This decentralized approach eliminates the need for a central authority to manage funds, thereby reducing the risk of large-scale hacks. Users interact directly with the blockchain, ensuring that they are the sole custodians of their assets. While this model enhances security by minimizing the attack surface, it also places the onus of responsibility on the user. Managing private keys requires a certain level of technical proficiency and vigilance, as losing access to these keys can result in the permanent loss of funds. Therefore, while non-custodial exchanges offer enhanced security through decentralization, they demand a higher degree of user responsibility and awareness.

Transitioning from the security dynamics of custodial and non-custodial exchanges, it is important to consider the regulatory landscape. Custodial exchanges are often subject to stringent regulatory requirements, which can provide an additional layer of security for users. These regulations may include mandatory audits, insurance policies, and compliance with anti-money laundering (AML) and know your customer (KYC) protocols. Such measures can enhance user confidence, as they ensure that exchanges adhere to industry standards and best practices. However, regulatory compliance can also lead to increased scrutiny and potential privacy concerns for users.

On the other hand, non-custodial exchanges typically operate with fewer regulatory constraints, offering users greater privacy and anonymity. This lack of oversight can be appealing to those who prioritize privacy, but it also means that users have less recourse in the event of a dispute or loss. The absence of regulatory safeguards can be a double-edged sword, providing freedom and autonomy while simultaneously exposing users to potential risks.

In conclusion, the choice between custodial and non-custodial exchanges hinges on a delicate balance between security, convenience, and personal responsibility. Custodial exchanges offer ease of use and regulatory protection but come with the risk of centralized vulnerabilities. Non-custodial exchanges, while providing enhanced security through decentralization, require users to take on greater responsibility for their assets. As the cryptocurrency landscape continues to evolve, understanding these security concerns is crucial for users seeking to navigate the complexities of digital asset management. By weighing the pros and cons of each exchange type, individuals can make informed decisions that align with their security preferences and investment goals.

User Experience: Comparing Custodial and Non-Custodial Platforms

When navigating the world of cryptocurrency exchanges, understanding the differences between custodial and non-custodial platforms is crucial for users seeking the best experience. Both types of exchanges offer unique advantages and challenges, and the choice between them often hinges on individual preferences and priorities. To begin with, custodial exchanges are platforms where the exchange itself holds and manages the user’s private keys. This setup is akin to traditional banking systems, where the institution safeguards the user’s assets. Consequently, custodial exchanges often provide a more familiar and user-friendly experience, especially for newcomers to the cryptocurrency space. These platforms typically offer a streamlined interface, making it easier for users to buy, sell, and trade digital assets without delving into the complexities of blockchain technology.

Moreover, custodial exchanges often provide additional services such as customer support, insurance against hacks, and integrated wallets, which can enhance the overall user experience. These features can be particularly appealing to those who prioritize convenience and security assurances provided by a third party. However, it is important to note that entrusting a third party with one’s assets also introduces certain risks, such as potential security breaches or insolvency of the exchange. In contrast, non-custodial exchanges empower users by allowing them to retain control over their private keys. This autonomy aligns with the decentralized ethos of blockchain technology, offering users a higher degree of privacy and security. By eliminating the need for a central authority to manage assets, non-custodial platforms reduce the risk of hacks and mismanagement associated with centralized exchanges.

Nevertheless, the user experience on non-custodial platforms can be more complex, particularly for those unfamiliar with managing private keys and digital wallets. Users must take on the responsibility of securing their assets, which includes safeguarding their private keys and understanding the intricacies of blockchain transactions. This requirement can be daunting for beginners, potentially leading to user errors and loss of funds. Despite these challenges, non-custodial exchanges are gaining popularity among users who value control and privacy over convenience. As the cryptocurrency ecosystem evolves, many non-custodial platforms are working to improve their user interfaces and educational resources, aiming to bridge the gap between security and usability.

In addition to these considerations, the choice between custodial and non-custodial exchanges can also be influenced by the specific features and services offered by each platform. For instance, some custodial exchanges provide advanced trading tools, fiat currency support, and a wide range of cryptocurrencies, which can be attractive to experienced traders. On the other hand, non-custodial exchanges may offer unique features such as atomic swaps and decentralized finance (DeFi) integrations, appealing to users interested in cutting-edge blockchain applications. As users weigh these factors, it is essential to consider their own level of expertise, risk tolerance, and the specific goals they wish to achieve within the cryptocurrency market.

In conclusion, the decision between custodial and non-custodial crypto exchanges is not a one-size-fits-all choice. Each type of platform offers distinct advantages and challenges, and the optimal choice depends on individual preferences and priorities. By understanding the differences in user experience between these platforms, users can make informed decisions that align with their needs and enhance their journey in the dynamic world of cryptocurrency.

Regulatory Implications for Custodial and Non-Custodial Exchanges

In the rapidly evolving landscape of cryptocurrency trading, understanding the regulatory implications for custodial and non-custodial exchanges is crucial for both investors and industry stakeholders. As digital assets continue to gain mainstream acceptance, regulatory bodies worldwide are increasingly scrutinizing the platforms that facilitate their exchange. This scrutiny is particularly focused on the differences between custodial and non-custodial exchanges, each of which presents unique challenges and considerations from a regulatory perspective.

Custodial exchanges, which hold users’ funds and private keys, are often likened to traditional financial institutions. They provide a centralized platform where users can trade cryptocurrencies, with the exchange itself managing the security and storage of assets. This model offers convenience and ease of use, as users do not need to worry about the technical complexities of managing their own private keys. However, it also introduces significant regulatory implications. Because custodial exchanges control user funds, they are subject to stringent regulatory requirements similar to those imposed on banks and other financial institutions. These include Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, which require exchanges to verify the identity of their users and monitor transactions for suspicious activity. Compliance with these regulations is essential to prevent illicit activities such as money laundering and terrorist financing, but it also raises concerns about user privacy and data security.

In contrast, non-custodial exchanges operate on a decentralized model, allowing users to retain control of their private keys and funds. This approach aligns with the original ethos of cryptocurrencies, which emphasizes decentralization and user autonomy. Non-custodial exchanges facilitate peer-to-peer transactions, often using smart contracts to execute trades without the need for an intermediary. While this model offers enhanced privacy and security for users, it also presents unique regulatory challenges. The decentralized nature of non-custodial exchanges makes it difficult for regulators to enforce KYC and AML requirements, as there is no central authority to oversee user activities. This lack of oversight can potentially be exploited for illicit purposes, prompting regulators to explore new frameworks and technologies to address these concerns.

As regulators grapple with the complexities of overseeing both custodial and non-custodial exchanges, the industry is witnessing a push towards greater transparency and accountability. Some jurisdictions are introducing specific regulations for cryptocurrency exchanges, while others are adapting existing financial regulations to encompass digital assets. This regulatory evolution is driven by the need to protect consumers, ensure market integrity, and prevent financial crimes. However, it also highlights the delicate balance between fostering innovation and ensuring compliance.

In conclusion, the regulatory implications for custodial and non-custodial crypto exchanges are multifaceted and continue to evolve as the industry matures. Custodial exchanges face rigorous compliance requirements due to their centralized nature, while non-custodial exchanges challenge traditional regulatory frameworks with their decentralized operations. As the global regulatory landscape adapts to these emerging technologies, stakeholders must remain informed and proactive in navigating the complexities of compliance. Ultimately, achieving a harmonious balance between regulation and innovation will be key to the sustainable growth of the cryptocurrency ecosystem.

Choosing the Right Exchange: Custodial vs. Non-Custodial Considerations

When venturing into the world of cryptocurrency trading, one of the most crucial decisions investors face is choosing the right type of exchange. The choice between custodial and non-custodial exchanges can significantly impact the security, control, and convenience of managing digital assets. Understanding the fundamental differences between these two types of exchanges is essential for making an informed decision that aligns with individual preferences and risk tolerance.

Custodial exchanges are platforms where the exchange itself holds and manages the user’s private keys. This means that the exchange takes on the responsibility of safeguarding the user’s assets. One of the primary advantages of custodial exchanges is their user-friendly nature. They often provide a seamless experience for beginners, offering features such as easy account recovery, customer support, and integrated wallets. These exchanges typically have higher liquidity, which can lead to better pricing and faster transaction times. However, the convenience of custodial exchanges comes with certain trade-offs. By entrusting private keys to a third party, users inherently relinquish a degree of control over their assets. This centralization of control can pose security risks, as custodial exchanges are attractive targets for hackers. High-profile breaches in the past have resulted in significant losses for users, highlighting the importance of choosing a reputable and secure custodial exchange.

In contrast, non-custodial exchanges empower users by allowing them to retain control over their private keys. These platforms facilitate peer-to-peer trading, where transactions occur directly between users without the need for an intermediary to hold funds. The primary advantage of non-custodial exchanges is the enhanced security and privacy they offer. Since users maintain control of their private keys, the risk of losing assets due to an exchange hack is significantly reduced. Additionally, non-custodial exchanges often align with the decentralized ethos of cryptocurrencies, promoting financial sovereignty and reducing reliance on centralized entities. However, this increased control comes with added responsibility. Users must ensure the safe storage and management of their private keys, as losing access to them can result in the permanent loss of funds. Furthermore, non-custodial exchanges may have lower liquidity compared to their custodial counterparts, potentially leading to less favorable trading conditions.

When deciding between custodial and non-custodial exchanges, several factors should be considered. Security is paramount, and users must assess their comfort level with the risks associated with each type of exchange. Those who prioritize convenience and are willing to trust a third party with their assets may find custodial exchanges more suitable. On the other hand, individuals who value control and are confident in managing their private keys might prefer the autonomy offered by non-custodial exchanges. Additionally, the choice may depend on the specific cryptocurrencies being traded, as some assets may only be available on certain types of exchanges.

In conclusion, the decision between custodial and non-custodial exchanges is not one-size-fits-all. It requires careful consideration of individual preferences, risk tolerance, and the specific needs of the investor. By understanding the key differences and weighing the pros and cons of each option, users can make an informed choice that aligns with their goals in the dynamic and evolving landscape of cryptocurrency trading.

Future Trends: The Evolution of Custodial and Non-Custodial Exchanges

As the cryptocurrency landscape continues to evolve, the debate between custodial and non-custodial exchanges remains a pivotal topic for investors and enthusiasts alike. Understanding the nuances of these two types of exchanges is crucial for navigating the future of digital asset trading. Custodial exchanges, which hold users’ private keys and manage their assets, have traditionally dominated the market due to their user-friendly interfaces and robust liquidity. However, the rise of non-custodial exchanges, which allow users to retain control of their private keys, is reshaping the industry by offering enhanced security and privacy.

The evolution of custodial exchanges is marked by their efforts to address security concerns and regulatory compliance. As these platforms hold large amounts of cryptocurrency, they are prime targets for hackers. In response, custodial exchanges are investing heavily in advanced security measures, such as multi-signature wallets and cold storage solutions, to protect users’ assets. Furthermore, regulatory bodies worldwide are increasingly scrutinizing these exchanges, prompting them to implement stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols. This regulatory pressure is likely to intensify, pushing custodial exchanges to further enhance their compliance frameworks.

On the other hand, non-custodial exchanges are gaining traction due to their decentralized nature, which aligns with the core principles of blockchain technology. These platforms empower users by allowing them to maintain control over their private keys, thereby reducing the risk of centralized hacks. As a result, non-custodial exchanges are perceived as a safer alternative for those who prioritize security and privacy. Moreover, the advent of decentralized finance (DeFi) has fueled the growth of non-custodial exchanges, as they facilitate seamless integration with DeFi protocols, enabling users to engage in a wide array of financial activities without intermediaries.

Looking ahead, the future of custodial and non-custodial exchanges will likely be shaped by technological advancements and shifting user preferences. For custodial exchanges, the integration of artificial intelligence and machine learning could enhance security measures and streamline compliance processes. These technologies have the potential to detect fraudulent activities in real-time, thereby mitigating risks and building trust among users. Additionally, custodial exchanges may explore hybrid models that incorporate elements of decentralization, offering users greater control over their assets while maintaining the benefits of centralized platforms.

Conversely, non-custodial exchanges are expected to focus on improving user experience and scalability. As these platforms continue to grow, addressing issues such as high transaction fees and slow processing times will be paramount. Layer 2 solutions and cross-chain interoperability are promising developments that could enhance the efficiency and accessibility of non-custodial exchanges. Furthermore, as regulatory frameworks for decentralized platforms become clearer, non-custodial exchanges may need to adapt to ensure compliance while preserving their decentralized ethos.

In conclusion, the evolution of custodial and non-custodial exchanges is a dynamic process influenced by technological innovations, regulatory developments, and user demands. While custodial exchanges are likely to continue refining their security and compliance measures, non-custodial exchanges will focus on enhancing user experience and scalability. As the cryptocurrency ecosystem matures, the coexistence of these two types of exchanges will provide users with diverse options, catering to varying preferences for security, privacy, and convenience. Ultimately, the future of digital asset trading will be defined by the ability of these exchanges to adapt and innovate in response to an ever-changing landscape.

Q&A

1. **What is a custodial crypto exchange?**

A custodial crypto exchange is a platform where the exchange holds and manages users’ funds and private keys on their behalf, similar to a bank.

2. **What is a non-custodial crypto exchange?**

A non-custodial crypto exchange allows users to retain control of their private keys and funds, facilitating peer-to-peer transactions without the exchange holding assets.

3. **What are the security implications of custodial exchanges?**

Custodial exchanges can be vulnerable to hacks and breaches since they hold large amounts of users’ funds, making them attractive targets for attackers.

4. **What are the security benefits of non-custodial exchanges?**

Non-custodial exchanges offer enhanced security as users maintain control over their private keys, reducing the risk of centralized hacks.

5. **How do custodial exchanges handle user experience?**

Custodial exchanges often provide a more user-friendly experience with features like customer support, easy account recovery, and integrated wallets.

6. **What are the transaction speed differences between custodial and non-custodial exchanges?**

Custodial exchanges typically offer faster transactions since they manage liquidity and order books, while non-custodial exchanges may experience slower transactions due to reliance on blockchain confirmations.

7. **What are the regulatory considerations for custodial exchanges?**

Custodial exchanges are often subject to stricter regulatory requirements, including KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance, due to their management of user funds.

Conclusion

Custodial and non-custodial crypto exchanges each offer distinct advantages and disadvantages, catering to different user needs and preferences. Custodial exchanges provide convenience and ease of use, often with enhanced customer support and additional features, but they require users to trust the platform with their private keys, which can pose security risks. Non-custodial exchanges, on the other hand, offer greater control and security over one’s assets, as users retain their private keys, but they may require more technical knowledge and offer less user-friendly interfaces. Ultimately, the choice between custodial and non-custodial exchanges depends on an individual’s priorities regarding security, control, convenience, and trust. Users should carefully assess their own needs and risk tolerance when deciding which type of exchange to use.