“Unlocking Hidden Profits: The Power of Maximal Extractable Value in Blockchain.”

Introduction

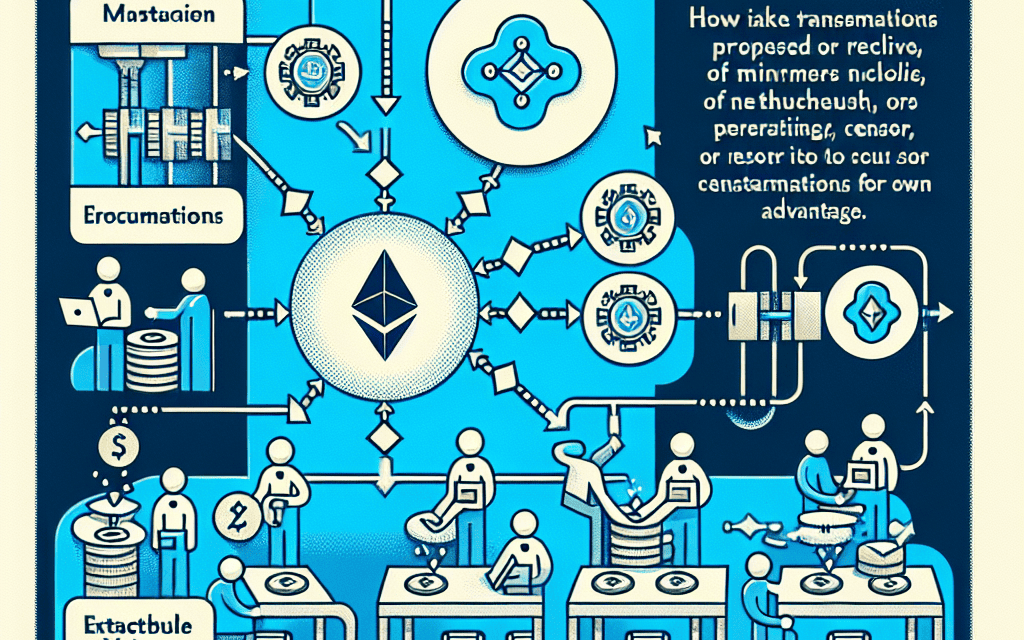

Maximal Extractable Value (MEV) refers to the maximum value that can be extracted from block production in blockchain networks, particularly those that support smart contracts like Ethereum. MEV arises from the ability of miners or validators to include, exclude, or reorder transactions within a block to their advantage. This phenomenon can lead to significant financial gains by exploiting arbitrage opportunities, front-running, or other transaction manipulation strategies. MEV has become a critical topic in the blockchain ecosystem due to its implications for network fairness, security, and efficiency, as it can lead to increased transaction costs and centralization risks if not properly managed.

Understanding Maximal Extractable Value: A Comprehensive Guide

Maximal Extractable Value (MEV) is a concept that has gained significant attention in the realm of blockchain technology, particularly within the context of decentralized finance (DeFi). At its core, MEV refers to the maximum value that can be extracted from block production in excess of the standard block reward and gas fees. This value is often captured by miners or validators who have the power to reorder, include, or exclude transactions within a block. Understanding MEV is crucial for anyone involved in blockchain ecosystems, as it has profound implications for network security, fairness, and efficiency.

To begin with, MEV arises from the unique structure of blockchain networks, where transactions are not immediately final but instead are subject to inclusion in a block by miners or validators. These entities have the discretion to determine the order of transactions, which can lead to opportunities for profit. For instance, by strategically ordering transactions, a miner can front-run a trade, executing their transaction before others to capitalize on price movements. This practice, while potentially lucrative, raises ethical and technical concerns, as it can lead to a less equitable system where those with power over transaction ordering can exploit regular users.

Moreover, MEV is not limited to front-running. It encompasses a range of strategies, including back-running and transaction reordering, all aimed at extracting additional value. Back-running involves placing a transaction immediately after another to benefit from the resulting market conditions, while transaction reordering can be used to manipulate outcomes in various DeFi protocols. These practices highlight the complexity and multifaceted nature of MEV, as well as the challenges it poses to maintaining a fair and transparent blockchain environment.

In addition to its impact on fairness, MEV has significant implications for network security. The potential for high MEV extraction can incentivize malicious behavior, such as chain reorganization attacks, where miners attempt to rewrite blockchain history to capture MEV. This not only threatens the integrity of the blockchain but also undermines trust in the system. Consequently, addressing MEV is essential for ensuring the long-term stability and security of blockchain networks.

Efforts to mitigate MEV are ongoing and involve a combination of technical and economic solutions. One approach is the development of more sophisticated consensus mechanisms that limit the ability of miners to reorder transactions. For example, some protocols are exploring the use of cryptographic techniques to enforce fair transaction ordering. Additionally, economic incentives can be aligned to discourage MEV extraction, such as by redistributing extracted value to network participants or implementing penalties for manipulative behavior.

Furthermore, the rise of MEV has spurred innovation in the form of MEV-aware tools and services. These solutions aim to provide users with greater transparency and control over their transactions, helping them to avoid being exploited by MEV strategies. By empowering users and promoting fair practices, these tools contribute to a more equitable blockchain ecosystem.

In conclusion, Maximal Extractable Value is a critical concept in the blockchain space, with far-reaching implications for fairness, security, and efficiency. As the blockchain industry continues to evolve, understanding and addressing MEV will be essential for fostering a sustainable and trustworthy environment. Through a combination of technical innovation and economic incentives, the challenges posed by MEV can be mitigated, paving the way for a more equitable and secure future in decentralized finance.

The Impact of MEV on Blockchain Transactions

Maximal Extractable Value (MEV) is a concept that has garnered significant attention within the blockchain community, particularly in the context of Ethereum and other smart contract platforms. MEV refers to the maximum value that can be extracted from block production beyond the standard block reward and gas fees. This value is typically extracted by reordering, including, or excluding transactions within a block. As blockchain technology continues to evolve, understanding the impact of MEV on blockchain transactions becomes increasingly important.

To begin with, MEV can significantly influence the behavior of validators and miners, who are responsible for adding new blocks to the blockchain. These actors have the power to manipulate the order of transactions within a block to maximize their own profits. For instance, they might prioritize transactions that offer higher fees or engage in practices such as front-running, where they insert their own transactions ahead of others to capitalize on price changes. This ability to reorder transactions can lead to a misalignment of incentives, where the focus shifts from securing the network to maximizing personal gain.

Moreover, the presence of MEV can lead to increased transaction costs for users. As miners and validators seek to extract maximum value, they may prioritize transactions with higher fees, leading to a bidding war among users who wish to have their transactions included in the next block. This competition can drive up gas prices, making it more expensive for users to interact with the blockchain. Consequently, the overall user experience may be negatively impacted, as individuals and businesses face higher costs and potential delays in transaction processing.

In addition to affecting transaction costs, MEV can also introduce a level of unpredictability into the blockchain ecosystem. When miners and validators engage in practices such as front-running or back-running, they can alter the expected outcomes of transactions. For example, a user might submit a transaction to purchase a particular asset at a specific price, only to find that a miner has inserted their own transaction ahead of it, driving up the price and reducing the user’s potential profit. This unpredictability can undermine trust in the blockchain system, as users may feel that their transactions are subject to manipulation.

Furthermore, the impact of MEV extends beyond individual transactions to the broader blockchain network. As miners and validators focus on extracting maximum value, they may become less incentivized to prioritize network security and stability. This shift in focus can lead to a concentration of power among a few actors who are able to consistently extract high levels of MEV, potentially resulting in centralization. Centralization poses a significant risk to the decentralized nature of blockchain technology, as it can lead to reduced security and increased vulnerability to attacks.

In response to the challenges posed by MEV, various solutions have been proposed to mitigate its impact. These include the development of new consensus mechanisms that limit the ability of miners and validators to reorder transactions, as well as the implementation of privacy-enhancing technologies that obscure transaction details. Additionally, some projects are exploring the use of decentralized finance (DeFi) protocols to create more transparent and fair transaction ordering processes.

In conclusion, while MEV presents opportunities for profit within the blockchain ecosystem, it also poses significant challenges that can affect transaction costs, predictability, and network security. As the blockchain industry continues to grow, addressing the impact of MEV will be crucial to ensuring a fair and efficient system for all participants. By exploring innovative solutions and fostering collaboration among stakeholders, the blockchain community can work towards minimizing the negative effects of MEV and promoting a more equitable environment for users.

Strategies to Mitigate MEV in Decentralized Finance

Maximal Extractable Value (MEV) has emerged as a significant concern within the decentralized finance (DeFi) ecosystem, posing challenges to the integrity and fairness of blockchain transactions. MEV refers to the maximum value that can be extracted from block production in excess of the standard block reward and gas fees, primarily through the reordering, inclusion, or exclusion of transactions within a block. This phenomenon is particularly prevalent in Ethereum and other smart contract platforms, where the decentralized nature of the network allows for various actors, such as miners and validators, to exploit transaction ordering for financial gain. As the DeFi landscape continues to evolve, it becomes imperative to explore strategies that can effectively mitigate the adverse effects of MEV.

One of the primary strategies to address MEV involves enhancing the transparency and predictability of transaction ordering. By implementing protocols that ensure fair ordering, the opportunities for malicious actors to manipulate transactions can be significantly reduced. For instance, the use of First-In-First-Out (FIFO) ordering mechanisms can help ensure that transactions are processed in the order they are received, thereby minimizing the potential for MEV extraction. Additionally, the adoption of cryptographic techniques, such as commit-reveal schemes, can further enhance transaction privacy and reduce the likelihood of front-running attacks, a common form of MEV exploitation.

Another promising approach to mitigating MEV is the development of decentralized auction systems for block space. These systems can facilitate a more equitable distribution of transaction inclusion rights by allowing users to bid for priority in a transparent and decentralized manner. By decentralizing the auction process, the influence of individual miners or validators is diminished, thereby reducing the potential for collusion and manipulation. Moreover, decentralized auctions can incentivize honest behavior among network participants, as the competitive nature of the bidding process encourages fair pricing and reduces the likelihood of MEV-driven distortions.

Furthermore, the implementation of layer-2 scaling solutions presents an effective means of alleviating MEV concerns. Layer-2 solutions, such as rollups and state channels, operate on top of existing blockchain networks and can process transactions off-chain before settling them on the main chain. By reducing the volume of transactions that need to be processed on-chain, these solutions can alleviate congestion and decrease the opportunities for MEV extraction. Additionally, layer-2 solutions often incorporate mechanisms for transaction batching and aggregation, which can further obscure transaction details and reduce the potential for front-running.

In addition to technical solutions, community-driven initiatives play a crucial role in addressing MEV. Educating users about the risks associated with MEV and promoting best practices for transaction submission can empower individuals to make informed decisions and reduce their vulnerability to exploitation. Moreover, fostering collaboration among developers, researchers, and industry stakeholders can facilitate the development of innovative solutions and promote the adoption of MEV-resistant protocols.

In conclusion, while MEV presents a formidable challenge to the DeFi ecosystem, a combination of technical innovations and community-driven efforts can effectively mitigate its impact. By enhancing transaction ordering transparency, implementing decentralized auction systems, leveraging layer-2 solutions, and fostering community engagement, the DeFi space can move towards a more equitable and secure future. As the industry continues to mature, ongoing research and collaboration will be essential in developing robust strategies to address the evolving landscape of MEV and ensure the long-term sustainability of decentralized finance.

The Role of MEV in Ethereum’s Ecosystem

Maximal Extractable Value, commonly referred to as MEV, plays a pivotal role in the Ethereum ecosystem, influencing both the technical and economic dimensions of the network. At its core, MEV represents the maximum value that can be extracted from block production beyond the standard block reward and gas fees. This value is primarily derived from the ability of miners or validators to reorder, include, or exclude transactions within a block. As Ethereum continues to evolve, understanding the implications of MEV is crucial for stakeholders across the network.

To begin with, MEV has significant implications for the efficiency and fairness of the Ethereum network. By allowing miners to manipulate transaction order, MEV can lead to scenarios where certain users gain an unfair advantage. For instance, in decentralized finance (DeFi) applications, MEV can be exploited through techniques such as front-running, back-running, and sandwich attacks. These strategies enable miners to profit by inserting their transactions at strategic points within a block, often at the expense of regular users. Consequently, this can lead to increased transaction costs and reduced trust in the network, as users may feel disadvantaged by the opaque nature of transaction ordering.

Moreover, MEV has a direct impact on the economic incentives for miners and validators. As they seek to maximize their profits, the potential for extracting additional value through MEV becomes an attractive proposition. This can lead to a competitive environment where miners prioritize transactions that offer the highest extractable value, potentially at the cost of network efficiency and user experience. However, it is important to note that while MEV can be lucrative for miners, it also introduces risks. The pursuit of MEV can lead to network congestion and increased latency, as miners may prioritize complex transaction strategies over straightforward block production.

In addition to its economic implications, MEV also poses technical challenges for the Ethereum ecosystem. The presence of MEV necessitates the development of sophisticated tools and strategies to mitigate its negative effects. For example, solutions such as Flashbots have emerged to provide a more transparent and efficient way for miners to capture MEV. By creating a private communication channel between miners and traders, Flashbots aim to reduce the negative externalities associated with MEV, such as network congestion and increased gas fees. This highlights the ongoing efforts within the Ethereum community to address the challenges posed by MEV and ensure a more equitable network for all participants.

Furthermore, the role of MEV in Ethereum’s ecosystem is likely to evolve as the network undergoes significant upgrades. The transition to Ethereum 2.0, with its shift from proof-of-work to proof-of-stake, may alter the dynamics of MEV extraction. Validators, who will replace miners in the new consensus mechanism, may face different incentives and challenges in capturing MEV. This transition presents an opportunity to reassess the impact of MEV and explore new strategies for mitigating its potential downsides.

In conclusion, MEV is an integral aspect of the Ethereum ecosystem, influencing both the economic incentives for network participants and the technical challenges faced by developers. As the network continues to grow and evolve, understanding and addressing the implications of MEV will be crucial for maintaining a fair and efficient blockchain environment. Through ongoing innovation and collaboration, the Ethereum community can work towards minimizing the negative effects of MEV while harnessing its potential benefits.

MEV and Its Influence on Cryptocurrency Markets

Maximal Extractable Value, commonly referred to as MEV, is a concept that has gained significant attention within the cryptocurrency markets. It represents the maximum value that can be extracted from block production in excess of the standard block reward and gas fees. This value is typically extracted by reordering, including, or excluding transactions within a block. As blockchain technology continues to evolve, understanding MEV and its implications is crucial for both developers and investors in the cryptocurrency space.

To begin with, MEV is primarily associated with Ethereum and other smart contract platforms where transactions are not merely transfers of value but can involve complex interactions with decentralized applications (dApps). Miners, or validators in proof-of-stake systems, have the power to determine the order of transactions within a block. This ability allows them to potentially extract additional value by prioritizing certain transactions over others. For instance, they might choose to include a transaction that allows them to profit from arbitrage opportunities or front-run a large trade by executing their own transaction first.

The influence of MEV on cryptocurrency markets is multifaceted. On one hand, it can lead to inefficiencies and increased costs for users. When miners prioritize transactions that maximize their own profits, it can result in higher gas fees and longer wait times for other transactions. This can be particularly problematic during periods of high network congestion, where users are forced to pay a premium to ensure their transactions are processed in a timely manner. Moreover, the presence of MEV can undermine the fairness and transparency that are foundational to blockchain technology, as it introduces an element of manipulation into the transaction ordering process.

On the other hand, MEV has also spurred innovation within the cryptocurrency ecosystem. The recognition of MEV as a significant factor has led to the development of various tools and strategies aimed at mitigating its negative effects. For example, Flashbots, a research and development organization, has created a system that allows users to submit transactions directly to miners, bypassing the public mempool where transactions are typically queued. This approach not only reduces the likelihood of front-running but also provides miners with a more efficient way to capture MEV without disrupting the broader market.

Furthermore, the concept of MEV has prompted discussions around the design of future blockchain protocols. Developers are exploring ways to minimize MEV through changes in consensus mechanisms or transaction ordering rules. Some proposals suggest implementing auction-based systems where users can bid for transaction priority, thereby aligning incentives more closely with network efficiency and fairness. These discussions highlight the dynamic nature of blockchain technology and the ongoing efforts to address its challenges.

In conclusion, MEV is a complex and influential factor in cryptocurrency markets that presents both challenges and opportunities. While it can lead to inefficiencies and increased costs for users, it has also driven innovation and prompted important discussions about the future of blockchain technology. As the cryptocurrency ecosystem continues to mature, understanding and addressing MEV will be essential for ensuring the long-term viability and fairness of decentralized networks. By fostering collaboration between developers, miners, and users, the industry can work towards solutions that balance the interests of all stakeholders and enhance the overall integrity of blockchain systems.

Exploring MEV: Risks and Opportunities for Traders

Maximal Extractable Value (MEV) is a concept that has gained significant attention in the world of blockchain and cryptocurrency trading. It refers to the maximum value that can be extracted from block production in excess of the standard block reward and gas fees by including, excluding, or reordering transactions within a block. As blockchain technology continues to evolve, understanding MEV becomes crucial for traders who wish to navigate the complex landscape of decentralized finance (DeFi).

To begin with, MEV presents both risks and opportunities for traders. On one hand, it offers the potential for increased profits through strategic transaction ordering. For instance, traders can capitalize on arbitrage opportunities by reordering transactions to their advantage. This can be particularly lucrative in DeFi platforms where price discrepancies between different exchanges can be exploited. However, the pursuit of MEV is not without its challenges. The competition among traders to extract maximum value can lead to network congestion and increased transaction fees, which can erode potential profits.

Moreover, the presence of MEV can introduce significant risks to the stability and fairness of blockchain networks. When miners or validators prioritize transactions that offer higher MEV, it can lead to a phenomenon known as “front-running.” This occurs when a trader’s transaction is anticipated and preemptively executed by another party, often resulting in unfavorable outcomes for the original trader. Consequently, this undermines the trust and transparency that are foundational to blockchain technology.

In addition to front-running, MEV can also give rise to “back-running” and “sandwich attacks.” Back-running involves placing a transaction immediately after a target transaction to capitalize on its effects, while sandwich attacks involve placing transactions both before and after a target transaction to manipulate its outcome. These tactics can be detrimental to unsuspecting traders and can distort market dynamics, leading to inefficiencies and reduced confidence in DeFi platforms.

Despite these risks, MEV also presents opportunities for innovation and improvement within the blockchain ecosystem. For instance, the development of MEV-aware protocols and tools can help mitigate the negative impacts of MEV. By designing systems that minimize the potential for transaction manipulation, developers can enhance the security and reliability of blockchain networks. Furthermore, the emergence of decentralized exchanges (DEXs) that incorporate MEV-resistant mechanisms can provide traders with more equitable trading environments.

Additionally, the study of MEV has spurred interest in alternative consensus mechanisms and transaction ordering strategies. For example, some projects are exploring the use of randomized transaction ordering or auction-based systems to reduce the influence of MEV on transaction prioritization. These innovations have the potential to create more robust and resilient blockchain networks that are less susceptible to manipulation.

In conclusion, while MEV poses significant challenges to the blockchain and cryptocurrency trading landscape, it also offers opportunities for growth and improvement. Traders must remain vigilant and informed about the potential risks associated with MEV, while also exploring innovative solutions that can enhance the security and fairness of blockchain networks. As the industry continues to evolve, a deeper understanding of MEV will be essential for traders seeking to navigate the complexities of decentralized finance and capitalize on the opportunities it presents.

Future Trends in MEV and Blockchain Technology

Maximal Extractable Value (MEV) has emerged as a significant concept in the blockchain ecosystem, particularly within decentralized finance (DeFi). As blockchain technology continues to evolve, understanding the future trends in MEV becomes crucial for developers, investors, and users alike. MEV refers to the maximum value that can be extracted from block production beyond the standard block reward and gas fees. This value is often captured by miners or validators who can reorder, include, or exclude transactions within a block. As the blockchain landscape advances, the implications of MEV are becoming increasingly profound.

To begin with, the growing complexity of DeFi protocols is likely to amplify the opportunities for MEV extraction. As these protocols become more sophisticated, they offer a wider array of arbitrage and liquidation opportunities. Consequently, the potential for MEV extraction increases, attracting more participants who seek to capitalize on these opportunities. This trend is expected to continue as DeFi protocols innovate and expand their offerings, thereby creating a more dynamic and competitive environment for MEV extraction.

Moreover, the evolution of blockchain technology itself is poised to influence MEV dynamics. With the transition of Ethereum to Ethereum 2.0 and the adoption of proof-of-stake (PoS) consensus mechanisms, the role of validators in MEV extraction is set to change. Unlike proof-of-work (PoW) systems, where miners compete to solve complex puzzles, PoS systems rely on validators who are selected based on the number of tokens they hold and are willing to “stake” as collateral. This shift could democratize MEV extraction, as it may become less dependent on computational power and more accessible to a broader range of participants.

In addition, the development of layer 2 solutions and cross-chain interoperability is likely to impact MEV. Layer 2 solutions, which aim to improve scalability and reduce transaction costs, could alter the landscape of MEV by changing how and where transactions are processed. Similarly, cross-chain interoperability, which allows different blockchain networks to communicate and interact, could create new avenues for MEV extraction by enabling arbitrage opportunities across multiple chains. These technological advancements are expected to reshape the strategies employed by those seeking to extract MEV, as well as the tools and techniques used to mitigate its impact.

Furthermore, the increasing awareness of MEV and its potential negative effects on users and the overall blockchain ecosystem is driving efforts to develop solutions that minimize its impact. Researchers and developers are exploring various approaches, such as MEV auctions and fair transaction ordering protocols, to address the challenges posed by MEV. These solutions aim to create a more equitable environment by ensuring that the value extracted from block production is distributed more fairly among participants. As these initiatives gain traction, they could lead to significant changes in how MEV is perceived and managed within the blockchain community.

In conclusion, the future trends in MEV and blockchain technology are characterized by a complex interplay of technological advancements, evolving protocols, and growing awareness of MEV’s implications. As the blockchain ecosystem continues to mature, it is essential for stakeholders to stay informed about these trends and their potential impact. By doing so, they can better navigate the challenges and opportunities presented by MEV, ultimately contributing to a more robust and equitable blockchain landscape.

Q&A

1. **What is MEV?**

Maximal Extractable Value (MEV) refers to the maximum value that can be extracted from block production in blockchain networks by including, excluding, or reordering transactions within a block.

2. **How does MEV occur?**

MEV occurs when miners or validators manipulate the order of transactions in a block to maximize their profits, often at the expense of regular users.

3. **Why is MEV significant?**

MEV is significant because it can lead to increased transaction costs, unfair advantages for certain users, and potential centralization risks in blockchain networks.

4. **What are some common MEV strategies?**

Common MEV strategies include front-running, back-running, and sandwich attacks, where transactions are strategically placed to exploit price changes or arbitrage opportunities.

5. **How does MEV impact users?**

MEV can negatively impact users by increasing transaction fees, causing delays, and creating an uneven playing field where certain participants can profit at the expense of others.

6. **What are potential solutions to MEV?**

Potential solutions to MEV include implementing fair transaction ordering protocols, using privacy-preserving technologies, and developing decentralized exchanges with built-in MEV resistance.

7. **How is the blockchain community addressing MEV?**

The blockchain community is addressing MEV through research, developing new consensus mechanisms, and creating tools and platforms that aim to reduce or eliminate the opportunities for MEV extraction.

Conclusion

Maximal Extractable Value (MEV) refers to the maximum value that can be extracted from block production in blockchain networks by including, excluding, or reordering transactions within a block. It is primarily associated with Ethereum and other smart contract platforms where miners or validators can manipulate the order of transactions to their advantage, often at the expense of regular users. MEV can lead to inefficiencies and unfair practices, such as front-running and back-running, where certain actors gain profits by exploiting transaction ordering. While MEV can incentivize miners to secure the network, it also poses challenges to the fairness and integrity of blockchain systems, prompting ongoing research and development of solutions to mitigate its negative impacts.