“Elevance Faces the Fall: Navigating the Medicaid Maze”

Introduction

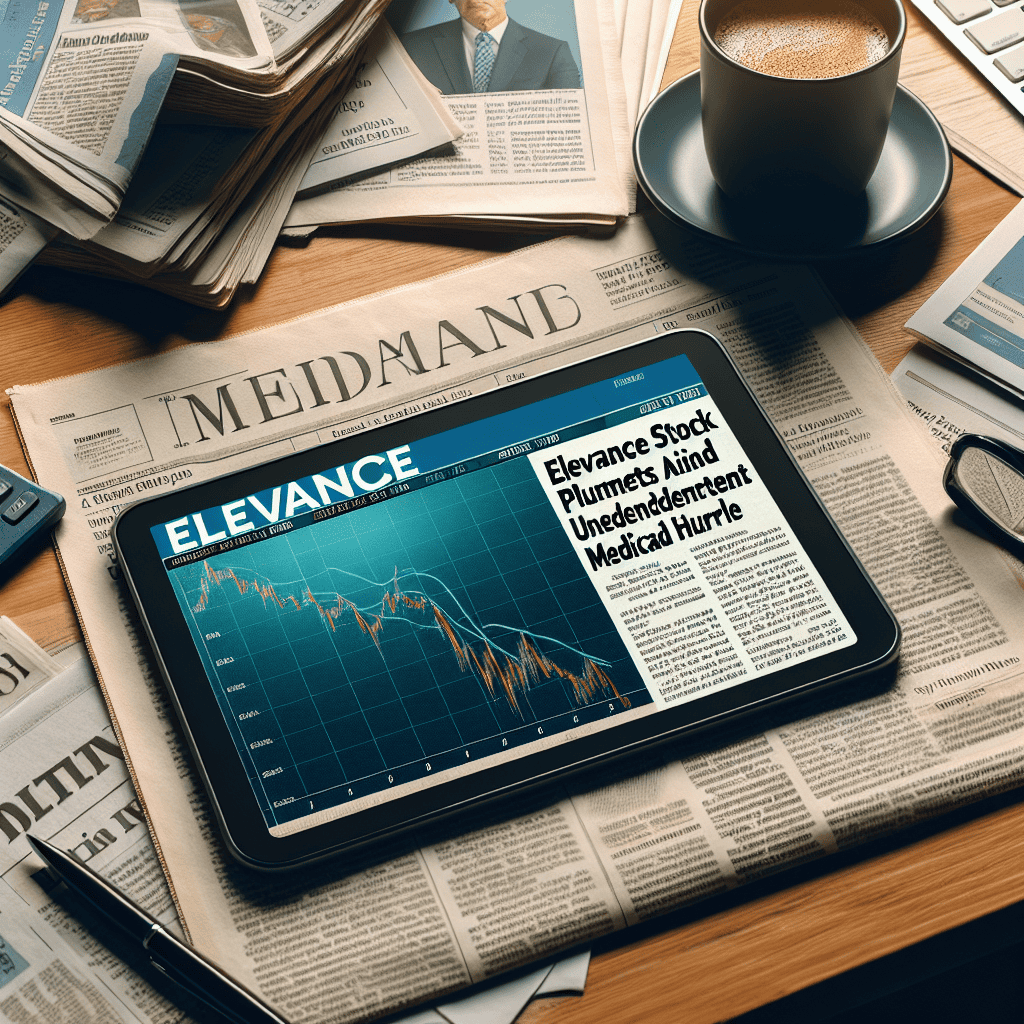

Elevance Health Inc., a prominent player in the healthcare insurance sector, recently faced a significant downturn in its stock value, triggered by an unprecedented challenge within the Medicaid landscape. The company’s shares experienced a sharp decline as investors reacted to emerging obstacles in Medicaid enrollment and reimbursement processes, which have raised concerns about future revenue streams and profitability. This unexpected hurdle has not only impacted Elevance’s financial outlook but also highlighted broader systemic issues within the Medicaid program, prompting analysts and stakeholders to closely scrutinize the implications for the healthcare insurance industry at large.

Impact Of Medicaid Challenges On Elevance Stock Performance

Elevance Health, a prominent player in the healthcare sector, has recently faced a significant downturn in its stock performance, primarily attributed to unprecedented challenges within the Medicaid landscape. This decline has raised concerns among investors and analysts alike, as the company grapples with the complexities of navigating a rapidly evolving healthcare environment. The impact of these Medicaid challenges on Elevance’s stock performance is multifaceted, reflecting broader issues within the healthcare industry and the company’s strategic responses.

To begin with, Medicaid, a critical component of the U.S. healthcare system, provides essential health coverage to millions of low-income individuals and families. Elevance, like many healthcare companies, relies heavily on Medicaid contracts to sustain its revenue streams. However, recent policy shifts and regulatory changes have introduced a level of uncertainty that has unsettled the market. These changes include potential alterations in reimbursement rates, eligibility criteria, and administrative processes, all of which have the potential to disrupt the financial stability of companies like Elevance.

Moreover, the economic ramifications of the COVID-19 pandemic have further complicated the Medicaid landscape. As unemployment rates fluctuated and economic conditions shifted, the demand for Medicaid services surged, placing additional strain on state budgets and healthcare providers. Elevance, in particular, has had to adapt to these changing dynamics, balancing the need to provide quality care with the financial pressures of increased enrollment and potential funding shortfalls. This delicate balancing act has not gone unnoticed by investors, who are keenly aware of the risks associated with such volatility.

In addition to these external factors, Elevance’s internal strategies have also played a role in shaping its stock performance. The company has been proactive in attempting to mitigate the impact of Medicaid challenges by diversifying its portfolio and investing in technology-driven solutions. For instance, Elevance has made significant strides in expanding its telehealth services, aiming to enhance accessibility and reduce costs. While these initiatives hold promise for long-term growth, they require substantial upfront investment, which can weigh on short-term financial results and, consequently, stock performance.

Furthermore, the competitive landscape within the healthcare sector has intensified, with numerous players vying for a share of the Medicaid market. Elevance faces competition not only from traditional healthcare providers but also from emerging tech-driven companies that are leveraging innovative solutions to capture market share. This heightened competition necessitates continuous innovation and strategic agility, both of which are critical for maintaining a competitive edge and ensuring sustainable growth.

In light of these challenges, Elevance’s stock performance serves as a barometer for the broader healthcare industry’s response to Medicaid-related uncertainties. Investors are closely monitoring the company’s ability to navigate these hurdles while maintaining its commitment to delivering quality care. The road ahead is fraught with challenges, but it also presents opportunities for Elevance to redefine its role within the healthcare ecosystem.

In conclusion, the plummet in Elevance’s stock amid unprecedented Medicaid challenges underscores the intricate interplay between policy changes, economic conditions, and corporate strategy. As the company endeavors to address these multifaceted issues, its stock performance will likely continue to reflect the broader dynamics at play within the healthcare sector. For investors and stakeholders, understanding these complexities is crucial for making informed decisions in an ever-evolving market landscape.

Analyzing The Financial Implications Of Elevance’s Medicaid Setback

Elevance Health, a prominent player in the healthcare insurance sector, recently faced a significant financial setback as its stock experienced a sharp decline. This downturn was primarily attributed to an unprecedented challenge related to Medicaid, a critical component of the company’s business model. As investors and analysts scramble to understand the implications of this development, it is essential to delve into the factors contributing to this situation and explore the potential long-term effects on Elevance’s financial health.

To begin with, Medicaid, a government program providing health coverage to low-income individuals and families, has been a substantial revenue stream for Elevance. The company has long relied on its Medicaid contracts to bolster its financial performance, given the program’s expansive reach and the steady flow of government funding. However, recent changes in Medicaid policies have introduced a level of uncertainty that Elevance was seemingly unprepared to navigate. Specifically, the federal government’s decision to reassess eligibility criteria and tighten enrollment processes has led to a significant reduction in the number of beneficiaries. Consequently, Elevance has witnessed a decline in its Medicaid membership, directly impacting its revenue projections.

Moreover, the financial implications of this Medicaid hurdle extend beyond immediate revenue losses. The reduction in Medicaid enrollment has forced Elevance to reevaluate its operational strategies and cost structures. In an effort to mitigate the impact, the company may need to implement cost-cutting measures, which could include workforce reductions or scaling back on certain initiatives. Such actions, while potentially necessary, could also lead to decreased employee morale and a potential loss of talent, further complicating Elevance’s path to recovery.

In addition to internal adjustments, Elevance must also contend with external pressures from investors and market analysts. The stock’s plummet has undoubtedly shaken investor confidence, prompting questions about the company’s ability to adapt to the evolving healthcare landscape. As a result, Elevance’s management team faces the daunting task of restoring trust and demonstrating resilience in the face of adversity. This may involve transparent communication with stakeholders, outlining a clear plan to address the Medicaid challenge and highlighting any potential opportunities for growth in other areas of the business.

Furthermore, the broader implications of Elevance’s Medicaid setback cannot be overlooked. The healthcare insurance industry as a whole is closely monitoring this situation, as it may signal a shift in the dynamics of government-funded healthcare programs. Other companies with significant Medicaid exposure may need to reassess their strategies and prepare for similar challenges. This could lead to increased competition as insurers vie for a shrinking pool of eligible beneficiaries, potentially driving innovation and efficiency improvements across the sector.

In conclusion, Elevance’s recent stock decline serves as a stark reminder of the complexities and uncertainties inherent in the healthcare insurance industry. The company’s ability to navigate this unprecedented Medicaid hurdle will be crucial in determining its future financial stability and market position. While the road ahead may be fraught with challenges, it also presents an opportunity for Elevance to demonstrate resilience and adaptability. By addressing the immediate financial implications and strategically positioning itself for long-term success, Elevance can potentially emerge stronger and more competitive in the ever-evolving healthcare landscape.

Investor Reactions To Elevance’s Stock Decline

The recent decline in Elevance Health’s stock has sent ripples through the investment community, prompting a range of reactions from stakeholders. As the company grapples with an unprecedented challenge related to Medicaid, investors are keenly observing the unfolding situation. The stock’s plummet can be attributed to a confluence of factors, primarily centered around the unexpected hurdles in Medicaid operations. This has led to a reassessment of the company’s financial health and future prospects, causing a stir among investors who are now recalibrating their strategies.

Initially, the news of the Medicaid-related issues caught many investors off guard. Elevance Health, known for its robust performance and strategic growth initiatives, had been a favorite among investors seeking stability and long-term gains. However, the revelation of complications in its Medicaid operations has introduced a level of uncertainty that has not been seen in recent years. Consequently, investors are now faced with the challenge of determining whether this is a temporary setback or indicative of deeper systemic issues within the company.

In response to the stock’s decline, some investors have adopted a cautious approach, opting to hold their positions while awaiting further clarity from the company’s management. These investors are hopeful that Elevance Health will swiftly address the Medicaid challenges and restore confidence in its operational capabilities. They argue that the company’s strong fundamentals and history of resilience in the face of adversity suggest that it can overcome this hurdle. Moreover, they emphasize the importance of not making hasty decisions based on short-term market fluctuations.

Conversely, other investors have chosen to divest from Elevance Health, driven by concerns over the potential long-term impact of the Medicaid issues. For these investors, the stock’s decline serves as a signal to reevaluate their portfolios and reduce exposure to perceived risks. They are particularly wary of the possibility that the Medicaid challenges could lead to regulatory scrutiny or financial penalties, which could further erode the company’s profitability. This group of investors is actively seeking alternative investment opportunities that offer more stability and less exposure to regulatory uncertainties.

Amid these divergent reactions, financial analysts have been closely monitoring the situation, providing insights and recommendations to their clients. Many analysts have adjusted their ratings for Elevance Health, reflecting the increased risk associated with the company’s current predicament. While some have downgraded their outlook, others maintain a neutral stance, advising investors to remain vigilant and informed about any developments. Analysts underscore the importance of understanding the broader implications of the Medicaid issues, including potential impacts on the healthcare sector as a whole.

In conclusion, the decline in Elevance Health’s stock has elicited a spectrum of reactions from investors, ranging from cautious optimism to decisive divestment. As the company navigates this challenging period, the investment community remains attentive to any updates that could influence their strategies. The situation underscores the dynamic nature of the stock market, where unforeseen challenges can swiftly alter investor sentiment and necessitate a reevaluation of investment decisions. Ultimately, the resolution of Elevance Health’s Medicaid issues will be pivotal in determining the company’s trajectory and restoring investor confidence.

Strategic Responses By Elevance To Address Medicaid Issues

Elevance Health, a prominent player in the healthcare insurance industry, has recently faced a significant challenge that has sent ripples through its financial standing. The company’s stock has plummeted, largely due to unprecedented hurdles associated with Medicaid. This situation has prompted Elevance to devise strategic responses aimed at addressing these issues and stabilizing its market position. Understanding the intricacies of these strategies is crucial for stakeholders and industry observers alike.

To begin with, Elevance has recognized the need to reassess its Medicaid operations, which have been at the core of the recent financial downturn. The company is focusing on enhancing its operational efficiency within this segment. By streamlining processes and reducing administrative overhead, Elevance aims to improve its service delivery and cost management. This approach not only seeks to address immediate financial concerns but also positions the company for long-term sustainability in the Medicaid market.

In addition to operational improvements, Elevance is investing in technology to better manage its Medicaid services. The integration of advanced data analytics and artificial intelligence is expected to provide deeper insights into patient needs and service utilization patterns. This technological enhancement will enable Elevance to tailor its offerings more precisely, ensuring that resources are allocated effectively and that patient care is optimized. By leveraging technology, the company hopes to mitigate some of the risks associated with Medicaid’s complex regulatory environment.

Moreover, Elevance is actively engaging with policymakers and regulatory bodies to navigate the evolving landscape of Medicaid. By fostering open communication and collaboration, the company aims to influence policy decisions that could impact its operations. This proactive approach is intended to ensure that Elevance remains compliant with regulatory requirements while advocating for changes that could benefit both the company and its beneficiaries. Through these efforts, Elevance seeks to build a more resilient framework for its Medicaid services.

Furthermore, Elevance is exploring strategic partnerships and alliances to bolster its Medicaid offerings. By collaborating with other healthcare providers and organizations, the company can expand its reach and enhance the quality of care provided to Medicaid recipients. These partnerships are designed to create synergies that improve service delivery and patient outcomes, thereby strengthening Elevance’s position in the Medicaid market. Such alliances also offer opportunities for shared learning and innovation, which are critical in addressing the challenges posed by Medicaid.

In response to the financial impact of the Medicaid hurdle, Elevance is also revisiting its financial strategies. The company is evaluating its investment portfolio and capital allocation to ensure that resources are directed towards areas with the highest potential for growth and stability. This financial recalibration is aimed at restoring investor confidence and stabilizing the company’s stock performance. By demonstrating fiscal prudence and strategic foresight, Elevance hopes to reassure stakeholders of its commitment to overcoming the current challenges.

In conclusion, Elevance Health is undertaking a multifaceted approach to address the unprecedented Medicaid hurdle that has affected its stock performance. Through operational enhancements, technological investments, regulatory engagement, strategic partnerships, and financial recalibration, the company is striving to navigate this complex landscape. While the road ahead may be challenging, Elevance’s strategic responses reflect a comprehensive effort to stabilize its position and ensure long-term success in the healthcare insurance industry. As the situation unfolds, stakeholders will be keenly observing how these strategies impact the company’s trajectory in the Medicaid market.

Long-term Outlook For Elevance Amid Medicaid Hurdles

Elevance Health, a prominent player in the healthcare insurance industry, has recently faced a significant challenge that has sent ripples through its stock performance. The company’s stock has plummeted, largely due to an unprecedented hurdle related to Medicaid. This development has raised concerns among investors and analysts alike, prompting a closer examination of the long-term outlook for Elevance in the face of these Medicaid challenges.

To understand the implications of this situation, it is essential to first consider the role of Medicaid in Elevance’s business model. Medicaid, a government program providing health coverage to low-income individuals and families, represents a substantial portion of Elevance’s revenue stream. The company has long been a key player in managing Medicaid plans across various states, leveraging its expertise to deliver healthcare services to millions of beneficiaries. However, recent changes in Medicaid policies and regulations have introduced complexities that Elevance must navigate carefully.

One of the primary challenges Elevance faces is the evolving landscape of Medicaid eligibility and enrollment. As states reassess their Medicaid programs, driven by both economic pressures and policy shifts, Elevance must adapt to these changes. The redetermination of eligibility for millions of beneficiaries, a process accelerated by the end of the COVID-19 public health emergency, has created uncertainty. This uncertainty is compounded by the potential for significant fluctuations in enrollment numbers, which directly impact Elevance’s revenue and profitability.

Moreover, the financial implications of these Medicaid hurdles cannot be understated. As Elevance grapples with the administrative burden of managing eligibility redeterminations, the company incurs additional costs. These costs, coupled with potential reductions in Medicaid enrollment, pose a threat to Elevance’s financial stability. Consequently, investors have reacted with caution, leading to a decline in the company’s stock value. This reaction underscores the market’s sensitivity to the challenges associated with Medicaid and the broader implications for Elevance’s financial health.

Despite these challenges, Elevance remains committed to its long-term strategy. The company has emphasized its dedication to innovation and efficiency in managing Medicaid plans. By leveraging technology and data analytics, Elevance aims to streamline administrative processes and enhance the quality of care for beneficiaries. This strategic focus not only addresses immediate challenges but also positions Elevance for sustainable growth in the future.

Furthermore, Elevance’s ability to adapt to changing regulatory environments will be crucial in determining its long-term success. The company has a track record of navigating complex healthcare landscapes, and its experience in managing Medicaid programs provides a foundation for resilience. By actively engaging with policymakers and stakeholders, Elevance seeks to influence the direction of Medicaid policies in a manner that aligns with its business objectives.

In conclusion, while Elevance faces significant challenges related to Medicaid, its long-term outlook remains cautiously optimistic. The company’s commitment to innovation, efficiency, and adaptability positions it to weather the current storm and emerge stronger. However, the path forward will require careful navigation of regulatory changes and a proactive approach to managing Medicaid enrollment dynamics. As Elevance continues to address these hurdles, its ability to maintain investor confidence and deliver value to stakeholders will be paramount. Ultimately, the company’s resilience and strategic foresight will determine its trajectory in the evolving healthcare landscape.

Comparing Elevance’s Situation With Industry Peers Facing Medicaid Challenges

Elevance Health, a prominent player in the healthcare insurance sector, has recently experienced a significant decline in its stock value, primarily attributed to challenges associated with Medicaid. This situation, while alarming for Elevance, is not entirely unique within the industry. Many of its peers are grappling with similar issues, as the landscape of Medicaid undergoes substantial changes. To understand the broader implications of Elevance’s predicament, it is essential to compare its situation with that of other industry players facing analogous Medicaid challenges.

Medicaid, a critical component of the U.S. healthcare system, provides health coverage to millions of low-income individuals and families. However, recent policy shifts and economic pressures have introduced complexities that insurers must navigate. Elevance’s stock plummet can be traced back to these evolving dynamics, which have also affected other insurers. For instance, companies like Centene and Molina Healthcare have reported similar pressures, as they too rely heavily on Medicaid contracts for a significant portion of their revenue.

One of the primary challenges facing Elevance and its peers is the redetermination process, which has been reinstated following the expiration of the continuous coverage requirement that was in place during the COVID-19 pandemic. This process involves reassessing the eligibility of Medicaid beneficiaries, potentially leading to a reduction in the number of enrollees. For Elevance, this has translated into uncertainty regarding future revenue streams, as a decrease in Medicaid enrollment could significantly impact its financial performance. Similarly, Centene and Molina have expressed concerns about the potential loss of enrollees, which could adversely affect their bottom lines.

Moreover, the financial strain on state budgets has led to increased scrutiny of Medicaid spending, prompting states to negotiate more aggressively with insurers. Elevance, like its counterparts, is facing pressure to deliver cost-effective solutions while maintaining quality care. This balancing act is further complicated by the rising costs of healthcare services and pharmaceuticals, which continue to outpace inflation. As a result, insurers are caught in a challenging position, striving to manage costs without compromising the quality of care provided to beneficiaries.

In addition to these shared challenges, Elevance’s situation is exacerbated by its specific market exposure and strategic decisions. Unlike some of its peers, Elevance has a more diversified portfolio, with significant investments in commercial and Medicare Advantage plans. While this diversification can be advantageous, it also means that Elevance must allocate resources across multiple segments, potentially diluting its focus on Medicaid. In contrast, companies like Centene have a more concentrated focus on government-sponsored programs, allowing them to tailor their strategies more closely to Medicaid’s unique demands.

Furthermore, Elevance’s recent efforts to expand its Medicaid footprint in certain states have encountered regulatory hurdles and competitive pressures. These obstacles have delayed anticipated growth and contributed to investor apprehension. In comparison, some of its peers have adopted a more cautious approach, opting to consolidate their existing Medicaid operations rather than pursue aggressive expansion.

In conclusion, while Elevance Health’s stock decline amid Medicaid challenges is concerning, it is reflective of broader industry trends affecting many insurers. The redetermination process, state budget constraints, and rising healthcare costs are common hurdles that Elevance and its peers must navigate. However, Elevance’s unique market position and strategic choices add layers of complexity to its situation. As the healthcare landscape continues to evolve, insurers will need to adapt swiftly and strategically to mitigate risks and capitalize on opportunities within the Medicaid sector.

Expert Opinions On Elevance’s Future In The Wake Of Stock Plummet

Elevance Health, a prominent player in the healthcare insurance sector, recently faced a significant setback as its stock experienced a sharp decline. This downturn was primarily attributed to an unprecedented challenge in the Medicaid landscape, which has raised concerns among investors and industry experts alike. As the company navigates this turbulent period, expert opinions on Elevance’s future provide valuable insights into the potential paths forward and the strategies that may be employed to regain stability.

To begin with, the recent plummet in Elevance’s stock can be traced back to changes in Medicaid policies that have introduced unforeseen complexities. These changes have resulted in a substantial increase in administrative burdens and compliance costs for healthcare insurers, including Elevance. Consequently, the company’s financial performance has been adversely affected, leading to a loss of investor confidence. In light of these developments, industry analysts are closely examining the implications for Elevance’s long-term prospects.

One perspective suggests that Elevance’s ability to adapt to the evolving Medicaid environment will be crucial in determining its future trajectory. Experts emphasize the importance of strategic agility, highlighting that companies capable of swiftly adjusting their operations and business models are more likely to weather such challenges successfully. In this context, Elevance’s investment in technology and data analytics could play a pivotal role. By leveraging advanced analytics, the company may enhance its ability to navigate regulatory changes, optimize resource allocation, and improve overall efficiency.

Moreover, some analysts argue that Elevance’s strong market position and diversified portfolio could serve as a buffer against the current headwinds. The company’s extensive network of healthcare providers and its broad range of insurance products may provide a degree of resilience, allowing it to mitigate the impact of Medicaid-related disruptions. However, this optimistic view is tempered by the recognition that sustained efforts will be required to maintain competitive advantage and customer loyalty in an increasingly complex healthcare landscape.

In addition to internal strategies, external factors are also likely to influence Elevance’s future. The broader economic environment, including potential shifts in government healthcare policies and funding, will play a significant role in shaping the company’s prospects. Experts caution that ongoing political debates and legislative changes could introduce further volatility, necessitating a proactive approach to risk management and strategic planning.

Furthermore, collaboration with stakeholders, including government agencies, healthcare providers, and community organizations, is seen as a critical component of Elevance’s path forward. By fostering partnerships and engaging in dialogue with key stakeholders, the company may be better positioned to advocate for policies that support sustainable growth and address the needs of vulnerable populations. This collaborative approach could also enhance Elevance’s reputation and strengthen its relationships with customers and partners.

In conclusion, while Elevance Health faces a formidable challenge in the form of unprecedented Medicaid hurdles, expert opinions suggest that the company’s future is not without hope. By embracing strategic agility, leveraging technology, and fostering collaboration, Elevance may navigate this period of uncertainty and emerge stronger. Nevertheless, the road ahead is fraught with complexities, and the company’s ability to adapt and innovate will be paramount in determining its long-term success. As the situation continues to evolve, stakeholders will be watching closely to see how Elevance responds to these challenges and seizes opportunities for growth.

Q&A

1. **What caused Elevance stock to plummet?**

Elevance stock plummeted due to challenges related to Medicaid redeterminations, which led to a loss of Medicaid members and impacted the company’s financial outlook.

2. **How significant was the stock drop for Elevance?**

The stock experienced a significant decline, reflecting investor concerns over the company’s ability to manage the Medicaid redetermination process and its impact on revenue.

3. **What is Medicaid redetermination?**

Medicaid redetermination is the process of reviewing and verifying the eligibility of Medicaid beneficiaries to ensure they still qualify for the program, which can lead to disenrollment if criteria are not met.

4. **How did the Medicaid hurdle affect Elevance’s financial performance?**

The Medicaid hurdle led to a decrease in membership and revenue from Medicaid plans, affecting Elevance’s overall financial performance and future earnings projections.

5. **What are investors concerned about regarding Elevance’s future?**

Investors are concerned about Elevance’s ability to navigate the Medicaid redetermination process, retain members, and stabilize its financial performance amid these challenges.

6. **Has Elevance taken any steps to address the Medicaid issue?**

Elevance has been working on strategies to assist members in maintaining their Medicaid coverage and exploring ways to mitigate the financial impact of the redetermination process.

7. **What is the broader impact of Medicaid redetermination on the healthcare industry?**

Medicaid redetermination poses challenges for the healthcare industry by potentially reducing the number of insured individuals, impacting revenue for insurers, and increasing the uninsured rate, which can strain healthcare systems.

Conclusion

Elevance Health’s stock has experienced a significant decline due to an unexpected challenge related to Medicaid. This downturn reflects investor concerns over the company’s ability to navigate the complexities of Medicaid reimbursements and regulatory changes. The unprecedented nature of the hurdle suggests potential long-term impacts on Elevance’s financial performance and market position. As the company addresses these challenges, its strategies and adaptability will be crucial in restoring investor confidence and stabilizing its stock value.