-

Table of Contents

- Introduction

- Discover’s New Debit Account: What You Need to Know

- Key Features of Discover’s Relaunched Debit Account

- How Discover’s Debit Account Stands Out in the Market

- Benefits of Using Discover’s Updated Debit Account

- Discover’s Debit Account: A Game Changer for Consumers

- Comparing Discover’s Debit Account to Other Options

- Discover’s Debit Account: Security and Convenience

- How to Maximize Rewards with Discover’s Debit Account

- Discover’s Debit Account: A Step-by-Step Guide to Enrollment

- Customer Reviews: Discover’s Relaunched Debit Account

- Q&A

- Conclusion

“Discover Debit: Your Money, Your Way, Rediscovered.”

Introduction

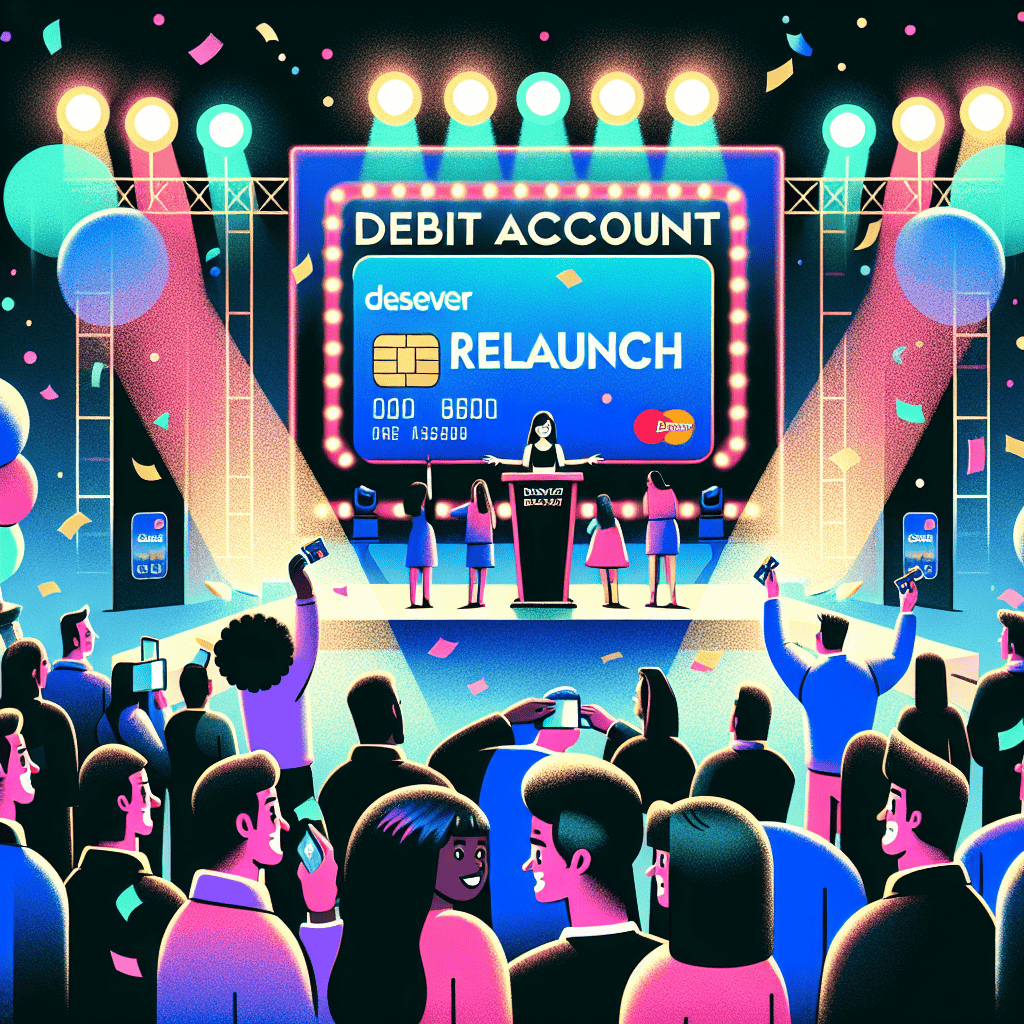

Discover Financial Services has announced the relaunch of its debit account, marking a significant step in its efforts to expand its financial product offerings and enhance customer experience. This revamped debit account aims to provide users with a more comprehensive and rewarding banking solution, integrating innovative features and benefits that cater to the evolving needs of modern consumers. With a focus on convenience, security, and value, Discover’s updated debit account is designed to attract a broader customer base while reinforcing the company’s commitment to delivering exceptional financial services.

Discover’s New Debit Account: What You Need to Know

Discover Financial Services, a prominent player in the financial industry, has recently announced the relaunch of its debit account, marking a significant development in its suite of financial products. This move comes as part of Discover’s ongoing efforts to expand its offerings and provide customers with more versatile and convenient banking solutions. The relaunch of the debit account is designed to cater to the evolving needs of consumers who are increasingly seeking flexible and user-friendly financial products.

The newly revamped debit account from Discover is set to offer a range of features that aim to enhance the customer experience. One of the standout features is the absence of monthly fees, which aligns with Discover’s commitment to providing cost-effective banking solutions. This fee-free structure is particularly appealing to consumers who are looking to minimize their banking expenses without compromising on the quality of service. Additionally, the account does not require a minimum balance, further underscoring Discover’s dedication to accessibility and customer-centricity.

Moreover, the Discover debit account offers a competitive cashback program, which is a significant draw for potential customers. Cardholders can earn cashback on eligible purchases, providing an incentive for everyday spending. This feature not only adds value to the account but also differentiates it from many other debit products in the market that do not offer similar rewards. By integrating a cashback program, Discover is effectively bridging the gap between debit and credit card benefits, offering a hybrid solution that appeals to a broad audience.

In addition to these financial incentives, Discover has placed a strong emphasis on security and convenience. The debit account is equipped with advanced security features, including fraud monitoring and zero liability protection, ensuring that customers can conduct transactions with peace of mind. Furthermore, the account is seamlessly integrated with Discover’s digital banking platform, allowing users to manage their finances effortlessly through a user-friendly mobile app. This digital integration is particularly relevant in today’s fast-paced world, where consumers increasingly rely on technology for their banking needs.

Transitioning to the broader implications of this relaunch, it is evident that Discover is positioning itself strategically within the competitive landscape of financial services. By enhancing its debit account offering, Discover is not only attracting new customers but also strengthening its relationship with existing ones. This move is indicative of a larger trend within the industry, where financial institutions are continuously innovating to meet the demands of a tech-savvy and value-conscious consumer base.

Furthermore, the relaunch of the debit account reflects Discover’s adaptability and responsiveness to market trends. As consumer preferences shift towards more digital and flexible banking solutions, Discover’s initiative to revamp its debit account demonstrates its commitment to staying ahead of the curve. This proactive approach is likely to resonate well with consumers who prioritize both functionality and value in their banking choices.

In conclusion, the relaunch of Discover’s debit account represents a significant step forward in the company’s mission to provide comprehensive and customer-focused financial solutions. With its combination of fee-free banking, cashback rewards, and robust security features, the new debit account is poised to attract a diverse range of consumers. As Discover continues to innovate and adapt to the changing financial landscape, it remains well-positioned to meet the needs of its customers and maintain its competitive edge in the industry.

Key Features of Discover’s Relaunched Debit Account

Discover has recently unveiled its revamped debit account, aiming to provide customers with an enhanced banking experience that combines convenience, security, and a range of attractive features. This relaunch marks a significant step forward in Discover’s commitment to offering innovative financial solutions tailored to the evolving needs of its clientele. As consumers increasingly seek flexible and user-friendly banking options, Discover’s updated debit account stands out with its comprehensive suite of features designed to meet these demands.

One of the most notable enhancements in Discover’s relaunched debit account is the elimination of monthly fees. In an era where financial institutions often impose a variety of charges, Discover’s decision to waive these fees is a welcome change for customers seeking to maximize their savings. This move not only underscores Discover’s dedication to customer satisfaction but also positions the company as a competitive player in the financial services industry. Furthermore, the absence of minimum balance requirements adds another layer of accessibility, allowing a broader range of individuals to benefit from the account’s offerings.

In addition to its cost-effective structure, the Discover debit account boasts a robust rewards program. Cardholders can earn cashback on eligible purchases, a feature traditionally associated with credit cards rather than debit accounts. This innovative approach provides customers with the opportunity to enjoy the benefits of a rewards program without the need to manage credit. By integrating this feature, Discover effectively bridges the gap between debit and credit, offering a unique value proposition that appeals to a diverse customer base.

Security remains a top priority for Discover, and the relaunched debit account reflects this commitment through its advanced security measures. Customers can take advantage of features such as fraud monitoring and alerts, which provide real-time notifications of suspicious activity. Additionally, the account includes zero liability protection, ensuring that cardholders are not held responsible for unauthorized transactions. These security enhancements offer peace of mind, allowing customers to conduct their financial activities with confidence.

Moreover, Discover’s debit account is designed with digital convenience in mind. The account is fully integrated with Discover’s mobile app, enabling users to manage their finances on the go. From checking balances to transferring funds and paying bills, the app provides a seamless and intuitive user experience. This digital integration is particularly appealing to tech-savvy consumers who prioritize accessibility and efficiency in their banking interactions.

Another key feature of the relaunched debit account is its extensive ATM network. Discover offers access to a vast network of ATMs nationwide, allowing customers to withdraw cash without incurring additional fees. This accessibility is further enhanced by the account’s compatibility with digital wallets, facilitating contactless payments and streamlining the transaction process.

In conclusion, Discover’s relaunch of its debit account represents a strategic effort to cater to the modern consumer’s banking preferences. By eliminating fees, offering a rewards program, prioritizing security, and embracing digital convenience, Discover has crafted a debit account that aligns with the needs and expectations of today’s customers. As the financial landscape continues to evolve, Discover’s commitment to innovation and customer-centric solutions positions it as a formidable contender in the competitive world of banking.

How Discover’s Debit Account Stands Out in the Market

In the ever-evolving landscape of financial services, Discover has made a significant move by relaunching its debit account, aiming to carve out a distinctive niche in the competitive market. This strategic initiative is designed to cater to the growing demand for flexible and user-friendly banking solutions. As consumers increasingly seek alternatives to traditional banking, Discover’s revamped debit account offers a compelling proposition that stands out due to its unique features and customer-centric approach.

One of the most notable aspects of Discover’s debit account is its fee-free structure. In an era where hidden fees and charges often burden account holders, Discover has taken a bold step by eliminating many of these common financial pitfalls. This includes waiving monthly maintenance fees, minimum balance requirements, and even fees for using out-of-network ATMs. By doing so, Discover not only alleviates the financial strain on its customers but also positions itself as a transparent and trustworthy financial partner.

Moreover, Discover’s debit account is integrated with a robust rewards program, a feature typically associated with credit cards rather than debit accounts. This innovative approach allows customers to earn cashback on their purchases, providing an added incentive to use the account for everyday transactions. The rewards program is designed to be straightforward and easy to understand, ensuring that customers can maximize their benefits without navigating complex terms and conditions. This integration of rewards into a debit account is a testament to Discover’s commitment to delivering value and enhancing the customer experience.

In addition to its financial benefits, Discover’s debit account is supported by a suite of digital tools that enhance convenience and accessibility. The account is seamlessly integrated with Discover’s mobile app, which offers a range of features such as real-time transaction alerts, budgeting tools, and the ability to freeze or unfreeze the debit card instantly. These digital capabilities empower customers to manage their finances with ease and confidence, reflecting Discover’s dedication to leveraging technology to meet the needs of modern consumers.

Furthermore, Discover has prioritized security in its debit account offering. With the increasing prevalence of cyber threats, ensuring the safety of customers’ financial information is paramount. Discover employs advanced security measures, including encryption and fraud monitoring, to protect account holders from unauthorized transactions. Additionally, the company offers a zero-liability policy, which guarantees that customers will not be held responsible for fraudulent charges, thereby providing peace of mind and reinforcing trust in the brand.

As Discover reintroduces its debit account to the market, it is clear that the company has meticulously crafted a product that addresses the evolving preferences and expectations of consumers. By focusing on fee transparency, rewards, digital innovation, and security, Discover has created a debit account that not only meets but exceeds the standards set by its competitors. This strategic relaunch is poised to attract a diverse range of customers, from tech-savvy millennials to budget-conscious individuals seeking a reliable and rewarding banking solution.

In conclusion, Discover’s debit account stands out in the market due to its comprehensive approach to addressing the needs of today’s consumers. By eliminating fees, offering rewards, enhancing digital capabilities, and prioritizing security, Discover has positioned itself as a leader in the financial services industry. As the company continues to innovate and adapt to changing market dynamics, its debit account is likely to become a preferred choice for those seeking a modern and customer-focused banking experience.

Benefits of Using Discover’s Updated Debit Account

Discover has recently relaunched its debit account, offering a range of benefits that cater to the evolving needs of modern consumers. This updated account is designed to provide users with enhanced financial flexibility, security, and convenience, making it an attractive option for those seeking a reliable and efficient banking solution. As we delve into the advantages of Discover’s revamped debit account, it becomes evident that the company has prioritized customer satisfaction and innovation.

To begin with, one of the most significant benefits of Discover’s updated debit account is its fee-free structure. In an era where banking fees can quickly accumulate, Discover stands out by eliminating many of the common charges associated with traditional accounts. Users can enjoy no monthly maintenance fees, no minimum balance requirements, and no fees for standard transactions. This approach not only alleviates financial burdens but also empowers account holders to manage their finances more effectively without the worry of unexpected costs.

Moreover, Discover’s debit account offers a robust rewards program, which is a rarity in the realm of debit cards. Account holders can earn cashback on eligible purchases, providing an incentive to use the card for everyday transactions. This feature transforms routine spending into an opportunity for financial gain, thereby enhancing the overall value of the account. The cashback rewards are automatically applied, ensuring a seamless experience for users who wish to maximize their earnings without additional effort.

In addition to financial incentives, Discover places a strong emphasis on security, which is a paramount concern for consumers today. The updated debit account includes advanced security features such as zero liability protection, which safeguards users against unauthorized transactions. Furthermore, Discover employs cutting-edge encryption technology to protect sensitive information, offering peace of mind to account holders. This commitment to security is complemented by the company’s proactive approach to fraud monitoring, which detects and addresses suspicious activity promptly.

Transitioning to the realm of convenience, Discover’s debit account is designed with user-friendly features that simplify banking. The account is seamlessly integrated with Discover’s mobile app, allowing users to manage their finances on the go. Through the app, account holders can check balances, transfer funds, and monitor transactions with ease. Additionally, the app provides real-time alerts, keeping users informed of account activity and helping them stay on top of their financial health.

Another noteworthy aspect of Discover’s updated debit account is its extensive ATM network. Account holders have access to a vast network of ATMs nationwide, enabling them to withdraw cash without incurring fees. This accessibility is particularly beneficial for individuals who frequently travel or reside in areas with limited banking options. The convenience of fee-free ATM access further enhances the appeal of Discover’s debit account, making it a practical choice for a diverse range of consumers.

In conclusion, Discover’s relaunch of its debit account brings forth a multitude of benefits that cater to the needs of today’s consumers. By offering a fee-free structure, a rewarding cashback program, robust security measures, and unparalleled convenience, Discover has positioned its debit account as a leading option in the financial landscape. As consumers continue to seek banking solutions that align with their lifestyles and priorities, Discover’s updated debit account stands out as a compelling choice that delivers both value and peace of mind.

Discover’s Debit Account: A Game Changer for Consumers

Discover Financial Services, a prominent player in the financial industry, has recently made waves with the relaunch of its debit account, a move that promises to redefine consumer banking experiences. This strategic initiative is poised to offer a fresh perspective on how consumers manage their finances, blending convenience with innovative features. As the financial landscape continues to evolve, Discover’s revamped debit account emerges as a game changer, offering a suite of benefits that cater to the modern consumer’s needs.

To begin with, the relaunch of Discover’s debit account is a testament to the company’s commitment to providing comprehensive financial solutions. By integrating advanced technology with user-friendly features, Discover aims to enhance the overall banking experience. One of the standout features of this new offering is its seamless integration with digital platforms, allowing users to manage their accounts effortlessly through mobile and online banking. This digital-first approach not only caters to tech-savvy consumers but also ensures that banking is accessible anytime, anywhere.

Moreover, Discover’s debit account is designed with a focus on security and transparency. In an era where cybersecurity threats are a growing concern, Discover has implemented robust security measures to protect consumers’ financial information. The account offers real-time transaction alerts, enabling users to monitor their spending and detect any unauthorized activity promptly. Additionally, Discover’s commitment to transparency is evident in its fee structure. The account boasts no monthly fees, no minimum balance requirements, and no fees for overdrafts, making it an attractive option for consumers seeking a cost-effective banking solution.

In addition to security and transparency, Discover’s debit account offers a range of features that enhance financial management. The account includes tools for budgeting and spending analysis, empowering users to make informed financial decisions. By providing insights into spending patterns, Discover helps consumers identify areas where they can save money and optimize their financial health. Furthermore, the account’s integration with Discover’s cashback rewards program adds an extra layer of value. Users can earn cashback on eligible purchases, turning everyday spending into an opportunity to earn rewards.

Transitioning to the broader impact of this relaunch, Discover’s debit account is set to influence the competitive landscape of consumer banking. As financial institutions strive to attract and retain customers, the emphasis on digital innovation and customer-centric features becomes increasingly important. Discover’s approach serves as a benchmark for other banks, highlighting the need to adapt to changing consumer preferences. By prioritizing convenience, security, and value, Discover is setting a new standard for what consumers can expect from their banking experience.

Furthermore, the relaunch of Discover’s debit account underscores the growing trend of digital transformation in the financial sector. As consumers increasingly rely on digital solutions for their banking needs, financial institutions must evolve to meet these demands. Discover’s initiative reflects a broader industry shift towards digital-first strategies, where technology plays a pivotal role in shaping the future of banking.

In conclusion, the relaunch of Discover’s debit account represents a significant milestone in the evolution of consumer banking. By offering a blend of convenience, security, and value, Discover is redefining the banking experience for its customers. As the financial landscape continues to evolve, Discover’s innovative approach serves as a catalyst for change, inspiring other institutions to embrace digital transformation and prioritize customer-centric solutions. This relaunch not only enhances Discover’s position in the market but also sets a new standard for excellence in consumer banking.

Comparing Discover’s Debit Account to Other Options

In the ever-evolving landscape of financial services, Discover has recently made a significant move by relaunching its debit account, aiming to provide consumers with a more competitive and user-friendly option. This development comes at a time when the demand for flexible and cost-effective banking solutions is on the rise. As we delve into the specifics of Discover’s offering, it is essential to compare it with other available options to understand its potential impact on the market.

Discover’s debit account stands out primarily due to its fee-free structure, which is a significant advantage for consumers who are increasingly wary of hidden charges. Unlike many traditional banks that impose monthly maintenance fees, overdraft fees, and minimum balance requirements, Discover’s account eliminates these burdens, allowing users to manage their finances without the fear of unexpected costs. This approach aligns with the growing trend of financial institutions moving towards more transparent and customer-centric models.

Moreover, Discover’s debit account offers a competitive interest rate on deposits, which is not commonly found in standard checking accounts. This feature provides an added incentive for consumers to choose Discover over other options, as it allows them to earn a return on their funds while maintaining easy access to their money. In comparison, many traditional banks offer negligible interest rates on checking accounts, if any at all, making Discover’s offering particularly appealing to those looking to maximize their savings.

In addition to its financial benefits, Discover’s debit account is integrated with a robust digital platform, providing users with a seamless online banking experience. The account is accessible through a user-friendly mobile app and website, enabling customers to manage their finances on the go. This digital integration is crucial in today’s fast-paced world, where convenience and accessibility are paramount. While other banks also offer digital banking services, Discover’s platform is noted for its intuitive design and comprehensive features, which include budgeting tools and real-time transaction alerts.

Furthermore, Discover’s commitment to customer service is evident in its 24/7 support, which is available to assist account holders with any inquiries or issues they may encounter. This level of support is a distinguishing factor, as it ensures that customers have access to assistance whenever they need it, enhancing their overall banking experience. In contrast, some traditional banks may have limited customer service hours, which can be inconvenient for those who require immediate assistance outside of regular business hours.

When comparing Discover’s debit account to other options, it is also important to consider the security measures in place. Discover employs advanced security protocols to protect users’ personal and financial information, offering peace of mind in an era where cyber threats are increasingly prevalent. This focus on security is a critical consideration for consumers when choosing a banking provider, and Discover’s proactive approach sets it apart from some competitors who may not prioritize this aspect as highly.

In conclusion, Discover’s relaunch of its debit account presents a compelling option for consumers seeking a cost-effective, interest-bearing, and digitally integrated banking solution. Its fee-free structure, competitive interest rates, and commitment to customer service and security make it a strong contender in the financial services market. As consumers continue to prioritize transparency, convenience, and security in their banking choices, Discover’s debit account is well-positioned to meet these demands and potentially reshape the way individuals manage their finances.

Discover’s Debit Account: Security and Convenience

Discover Financial Services has recently reintroduced its debit account, aiming to provide customers with a blend of security and convenience that aligns with modern financial needs. This relaunch marks a significant step in Discover’s ongoing commitment to enhancing its product offerings and meeting the evolving demands of its clientele. As consumers increasingly seek financial solutions that offer both ease of use and robust security features, Discover’s debit account emerges as a timely and relevant option.

One of the primary attractions of Discover’s debit account is its emphasis on security. In an era where digital transactions are becoming the norm, safeguarding personal and financial information is paramount. Discover addresses these concerns by incorporating advanced security measures into its debit account. For instance, the account includes features such as real-time transaction alerts, which notify users of any activity on their account, thereby enabling them to quickly identify and respond to any unauthorized transactions. Additionally, Discover offers a zero-liability policy, ensuring that customers are not held responsible for unauthorized purchases made with their debit card. This policy provides an added layer of protection and peace of mind for account holders.

Moreover, Discover’s debit account is designed with convenience in mind, catering to the fast-paced lifestyles of today’s consumers. The account offers seamless integration with digital wallets, allowing users to make contactless payments with ease. This feature is particularly beneficial in a world where contactless transactions are becoming increasingly prevalent, driven by the need for speed and hygiene. Furthermore, Discover’s debit account provides access to a vast network of ATMs, enabling customers to withdraw cash without incurring additional fees. This accessibility is a crucial factor for many consumers who value the ability to manage their finances without unnecessary costs.

In addition to these features, Discover’s debit account also offers a rewards program, which is relatively uncommon for debit accounts. Customers can earn cashback on eligible purchases, providing an incentive to use the debit card for everyday transactions. This rewards program not only enhances the value proposition of the account but also encourages responsible spending habits among users. By offering rewards for purchases, Discover effectively combines the benefits of a credit card with the simplicity of a debit account, appealing to a broad spectrum of consumers.

Furthermore, Discover’s commitment to customer service is evident in its approach to the debit account. The company provides 24/7 customer support, ensuring that account holders can access assistance whenever needed. This round-the-clock service is a testament to Discover’s dedication to customer satisfaction and its understanding of the importance of reliable support in the financial sector.

In conclusion, the relaunch of Discover’s debit account represents a strategic move to address the growing demand for secure and convenient financial solutions. By integrating advanced security features, offering seamless digital payment options, and providing a rewards program, Discover has crafted a debit account that meets the needs of modern consumers. As the financial landscape continues to evolve, Discover’s debit account stands out as a compelling choice for individuals seeking a reliable and rewarding banking experience. Through its focus on security, convenience, and customer service, Discover reaffirms its position as a leader in the financial services industry, poised to meet the challenges and opportunities of the future.

How to Maximize Rewards with Discover’s Debit Account

Discover has recently relaunched its debit account, offering a fresh opportunity for consumers to maximize their rewards while managing their finances with ease. This new iteration of the Discover debit account is designed to provide users with a seamless banking experience, coupled with the added benefit of earning rewards on everyday purchases. As consumers increasingly seek financial products that offer both convenience and value, Discover’s revamped debit account stands out as a compelling option.

To begin with, one of the most attractive features of Discover’s debit account is its rewards program. Unlike traditional debit accounts that typically do not offer rewards, Discover allows account holders to earn cashback on their purchases. This feature is particularly appealing to those who prefer using a debit card over a credit card but still wish to enjoy the benefits of a rewards program. By using the Discover debit card for routine transactions such as grocery shopping, dining, and online purchases, consumers can accumulate cashback rewards that can be redeemed for statement credits or deposited directly into their account.

Moreover, Discover’s debit account is designed with user convenience in mind. The account offers a user-friendly mobile app that allows customers to manage their finances on the go. Through the app, users can easily track their spending, monitor their rewards balance, and set up alerts for account activity. This level of accessibility ensures that account holders can stay informed about their financial status at all times, thereby promoting responsible spending habits.

In addition to the rewards program and mobile app, Discover’s debit account also provides a range of features that enhance security and peace of mind for its users. For instance, the account includes zero liability protection, which means that customers are not held responsible for unauthorized transactions made with their debit card. This feature is crucial in an era where digital fraud is a growing concern, as it reassures consumers that their funds are safeguarded against potential threats.

Furthermore, Discover’s debit account does not impose any monthly maintenance fees or require a minimum balance, making it an attractive option for individuals seeking a cost-effective banking solution. The absence of these fees allows account holders to maximize their savings and rewards without worrying about additional charges that could erode their financial gains. This aspect of the account is particularly beneficial for young adults and students who are just beginning to establish their financial independence.

To maximize the benefits of Discover’s debit account, consumers should consider integrating it into their broader financial strategy. By using the debit card for everyday expenses and taking advantage of the cashback rewards, individuals can effectively reduce their overall spending. Additionally, setting up direct deposits into the account can help streamline financial management and ensure that funds are readily available for both planned and unexpected expenses.

In conclusion, Discover’s relaunch of its debit account presents a valuable opportunity for consumers to enhance their financial well-being through a combination of rewards, convenience, and security. By leveraging the features of this account, individuals can enjoy the benefits of a robust rewards program while maintaining control over their finances. As the financial landscape continues to evolve, Discover’s debit account offers a modern solution that aligns with the needs and preferences of today’s consumers.

Discover’s Debit Account: A Step-by-Step Guide to Enrollment

Discover Financial Services has recently reintroduced its debit account, offering a fresh opportunity for consumers to manage their finances with ease and efficiency. This relaunch is part of Discover’s ongoing commitment to providing innovative financial solutions that cater to the evolving needs of its customers. As more individuals seek convenient and secure ways to handle their money, Discover’s debit account emerges as a compelling option. For those interested in enrolling, understanding the step-by-step process can ensure a seamless transition to this new financial tool.

To begin with, potential account holders should visit Discover’s official website, where they can find detailed information about the debit account’s features and benefits. This initial step is crucial, as it allows individuals to familiarize themselves with the account’s offerings, such as no monthly fees, access to a wide network of ATMs, and robust security measures. By thoroughly reviewing this information, prospective customers can make an informed decision about whether the Discover debit account aligns with their financial goals.

Once the decision to enroll has been made, the next step involves completing the online application form. Discover has streamlined this process to ensure it is user-friendly and efficient. Applicants will be required to provide personal information, including their name, address, and Social Security number. Additionally, they may need to verify their identity through a series of security questions or by submitting identification documents. This verification process is designed to protect both the applicant and Discover from potential fraud.

After successfully submitting the application, applicants will receive a confirmation email from Discover. This email will outline the next steps, including any additional information or documentation that may be required. It is important for applicants to promptly respond to any requests from Discover to avoid delays in the enrollment process. Once all necessary information has been provided and verified, Discover will proceed with opening the debit account.

Upon approval, new account holders will receive their Discover debit card in the mail. This card is the key to accessing the funds in the account and can be used for everyday purchases, online transactions, and ATM withdrawals. To activate the card, customers must follow the instructions provided, which typically involve calling a designated phone number or visiting Discover’s website. Activation is a straightforward process, ensuring that account holders can begin using their card without unnecessary complications.

In addition to the physical debit card, Discover offers a comprehensive online banking platform. This platform allows account holders to manage their finances from the comfort of their home or on the go. By logging into their account, users can view their transaction history, check their balance, and set up alerts for various account activities. This digital convenience is complemented by Discover’s commitment to security, with features such as two-factor authentication and encryption to safeguard personal information.

In conclusion, enrolling in Discover’s debit account is a straightforward process that begins with understanding the account’s features and benefits. By following the outlined steps, potential customers can seamlessly transition to this innovative financial tool. With its user-friendly application process, robust security measures, and convenient online banking platform, Discover’s debit account is poised to meet the needs of today’s consumers, offering a reliable and efficient way to manage personal finances.

Customer Reviews: Discover’s Relaunched Debit Account

Discover Financial Services has recently reintroduced its debit account, aiming to provide customers with a more comprehensive and rewarding banking experience. This relaunch has sparked considerable interest among consumers, prompting a wave of reviews that highlight both the strengths and potential areas for improvement in the revamped offering. As customers begin to explore the features of Discover’s new debit account, their feedback provides valuable insights into the account’s reception and functionality.

One of the most frequently praised aspects of Discover’s relaunched debit account is its fee structure. Customers appreciate the absence of monthly maintenance fees, which is a significant advantage in an era where many financial institutions impose various charges. This fee-free approach aligns with Discover’s longstanding commitment to customer-centric banking solutions, making it an attractive option for those seeking to minimize their banking costs. Additionally, the account offers free access to a vast network of ATMs, further enhancing its appeal to cost-conscious consumers.

Moreover, Discover’s debit account has garnered positive reviews for its cashback rewards program. Unlike traditional debit accounts that offer little to no rewards, Discover provides customers with the opportunity to earn cashback on their purchases. This feature is particularly appealing to individuals who prefer using debit over credit but still wish to benefit from rewards typically associated with credit card usage. Customers have noted that this program adds significant value to their everyday transactions, making the account a compelling choice for those who prioritize earning rewards.

In addition to its financial benefits, the account’s digital capabilities have also received favorable feedback. Discover has integrated a user-friendly mobile app and online banking platform, allowing customers to manage their accounts with ease. The app’s intuitive design and robust functionality enable users to monitor transactions, set up alerts, and perform various banking tasks seamlessly. This digital convenience is especially appreciated by tech-savvy customers who value the ability to manage their finances on the go.

However, while the relaunch has been met with enthusiasm, some customers have expressed concerns regarding certain limitations. For instance, a few users have pointed out that the account’s cashback rewards are capped at a certain amount each month. While this cap is not uncommon in the industry, it may be a consideration for those who frequently make large purchases and wish to maximize their rewards. Additionally, some customers have noted that the account’s ATM network, while extensive, may not be as widespread in certain regions, potentially leading to inconvenience for those residing in less populated areas.

Despite these minor drawbacks, the overall reception of Discover’s relaunched debit account has been largely positive. Customers appreciate the combination of fee-free banking, cashback rewards, and digital convenience, which collectively enhance the account’s value proposition. As Discover continues to refine its offerings based on customer feedback, it is likely that the debit account will evolve to address any existing limitations and further solidify its position in the competitive banking landscape.

In conclusion, Discover’s relaunch of its debit account has successfully captured the attention of consumers seeking a rewarding and cost-effective banking solution. The positive reviews underscore the account’s strengths, particularly its fee structure, rewards program, and digital capabilities. While there are areas for improvement, the overall customer sentiment suggests that Discover’s debit account is a promising option for those looking to optimize their banking experience. As the financial landscape continues to evolve, Discover’s commitment to innovation and customer satisfaction will undoubtedly play a crucial role in shaping the future of its debit account offerings.

Q&A

1. **What is Discover’s new debit account offering?**

Discover has relaunched its debit account with enhanced features and benefits to attract more customers.

2. **What are the key features of the relaunched Discover debit account?**

The account offers features such as no monthly fees, cashback rewards on purchases, and access to a large network of ATMs.

3. **Is there a minimum balance requirement for the Discover debit account?**

No, the relaunched Discover debit account does not require a minimum balance.

4. **What cashback rewards are available with the Discover debit account?**

Customers can earn cashback on eligible purchases made with their Discover debit card.

5. **Are there any fees associated with the Discover debit account?**

The account typically has no monthly maintenance fees, but other fees may apply for specific services.

6. **How can customers access their Discover debit account?**

Customers can access their account online, through a mobile app, and at ATMs within the Discover network.

7. **Does the Discover debit account offer overdraft protection?**

Discover may offer overdraft protection options, but terms and conditions apply.

8. **Can customers use the Discover debit card internationally?**

Yes, the Discover debit card can be used internationally, but foreign transaction fees may apply.

9. **What security features are included with the Discover debit account?**

The account includes security features such as fraud monitoring, account alerts, and zero liability protection for unauthorized transactions.

10. **How can someone open a Discover debit account?**

Interested individuals can apply for a Discover debit account online through the Discover website.

Conclusion

Discover’s relaunch of its debit account signifies a strategic move to enhance its financial product offerings and capture a larger share of the consumer banking market. By reintroducing this product, Discover aims to provide customers with more flexible and accessible banking solutions, potentially attracting a broader demographic seeking alternatives to traditional banking services. This initiative may also reflect Discover’s response to evolving consumer preferences for digital and convenient financial management tools. Overall, the relaunch could strengthen Discover’s competitive position and contribute to its growth in the financial services industry.