“Market Jitters: Dow Dips on Inflation Woes, Disney Shines Before Powell’s Address”

Introduction

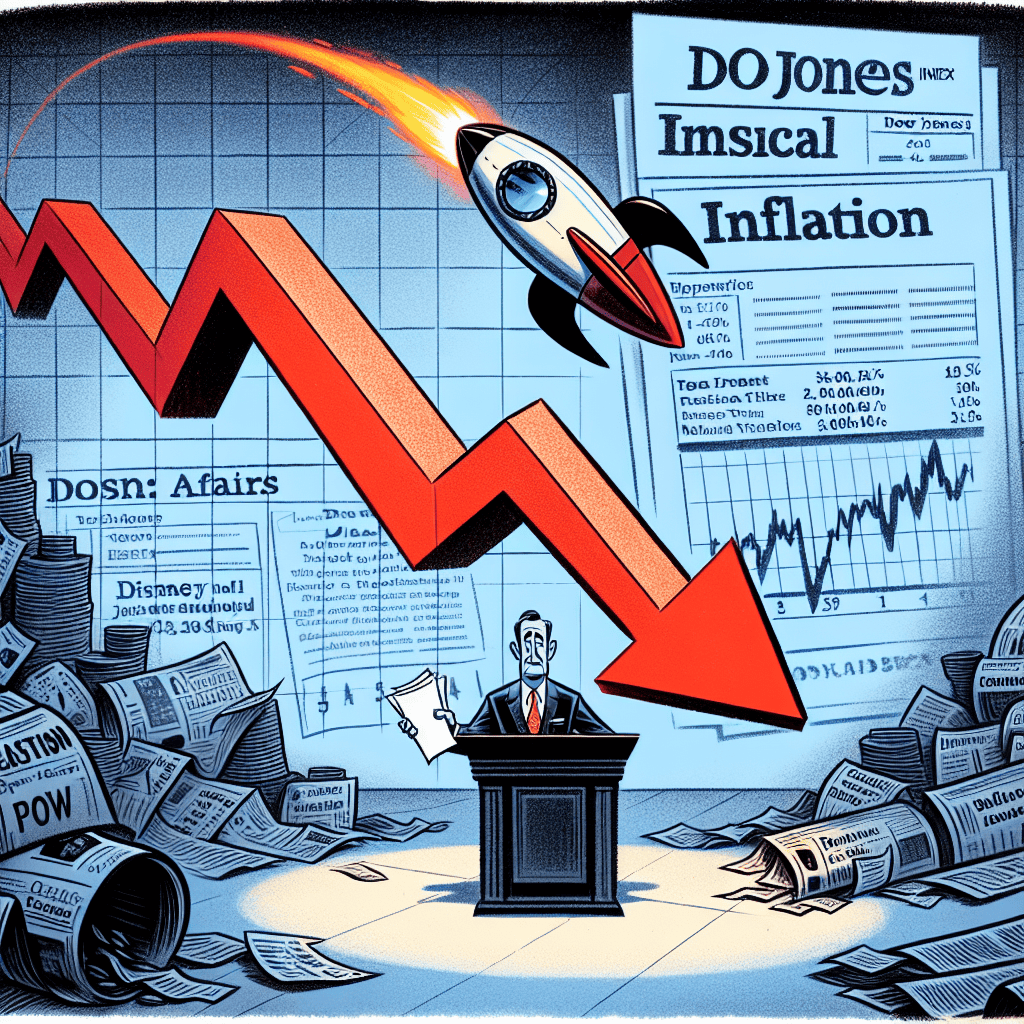

The Dow Jones Industrial Average experienced a decline following the release of new inflation data, which has heightened investor concerns about potential interest rate hikes. This economic indicator has cast a shadow over the market, prompting caution among traders. Meanwhile, Disney’s stock saw a significant surge after the company reported strong earnings, exceeding analysts’ expectations and showcasing robust performance across its various business segments. As investors digest these developments, all eyes are on Federal Reserve Chair Jerome Powell’s upcoming speech, which is anticipated to provide further insights into the central bank’s monetary policy stance in light of the current economic conditions.

Impact Of Inflation Data On Dow Jones: A Closer Look

The recent fluctuations in the Dow Jones Industrial Average have captured the attention of investors and analysts alike, as the index experienced a notable drop following the release of new inflation data. This development has sparked discussions about the broader implications for the U.S. economy and the potential responses from policymakers. As inflation continues to be a focal point for economic observers, understanding its impact on the stock market becomes increasingly crucial. The latest data revealed that inflation rates have remained persistently high, raising concerns about the purchasing power of consumers and the cost pressures faced by businesses. Consequently, these inflationary trends have led to heightened uncertainty in the financial markets, with the Dow Jones reflecting this sentiment through its recent decline.

In the context of these economic indicators, investors are keenly aware of the Federal Reserve’s role in managing inflation and its potential influence on market dynamics. The anticipation surrounding Federal Reserve Chair Jerome Powell’s upcoming speech adds another layer of complexity to the current market environment. Market participants are eager to glean insights into the Fed’s future policy direction, particularly regarding interest rates and monetary tightening measures. Powell’s remarks are expected to provide guidance on how the central bank plans to navigate the challenges posed by inflation, which could, in turn, impact investor confidence and market stability.

Amidst these developments, it is noteworthy that not all sectors are experiencing the same level of volatility. For instance, Disney has emerged as a standout performer, with its stock soaring on the back of strong earnings reports. The entertainment giant’s robust financial performance has been attributed to a combination of strategic initiatives and a resurgence in consumer demand for its diverse offerings. Disney’s success serves as a reminder that even in times of economic uncertainty, companies with solid fundamentals and adaptive strategies can thrive. This divergence in performance between Disney and the broader market underscores the importance of sector-specific analysis when assessing investment opportunities.

As investors navigate this complex landscape, it is essential to consider the interplay between macroeconomic factors and individual company performance. While inflation data exerts downward pressure on indices like the Dow Jones, it also presents opportunities for companies that can effectively manage cost pressures and capitalize on shifting consumer preferences. Moreover, the market’s reaction to inflation data and subsequent policy announcements will likely continue to evolve, necessitating a vigilant approach to investment decision-making.

In conclusion, the recent drop in the Dow Jones amid inflation data highlights the intricate relationship between economic indicators and market performance. As investors await further clarity from Jerome Powell’s speech, the focus remains on understanding how inflationary pressures will shape the future trajectory of the U.S. economy. Meanwhile, Disney’s impressive earnings demonstrate that even in challenging times, companies with strong fundamentals can achieve remarkable success. By maintaining a nuanced perspective on these developments, investors can better position themselves to navigate the complexities of the current financial landscape. As the situation unfolds, staying informed and adaptable will be key to making sound investment choices in an ever-changing economic environment.

Disney’s Earnings Surge: What It Means For Investors

Disney’s recent earnings report has captured the attention of investors and analysts alike, as the entertainment giant posted results that exceeded market expectations. This surge in earnings comes at a time when the broader market, represented by the Dow Jones Industrial Average, is experiencing volatility due to concerns over inflation data. As investors navigate these turbulent waters, Disney’s performance offers a beacon of optimism, highlighting the company’s resilience and strategic prowess in an uncertain economic landscape.

The impressive earnings report from Disney can be attributed to several key factors. First and foremost, the company’s streaming service, Disney+, continues to be a significant growth driver. With a robust content lineup and strategic international expansion, Disney+ has managed to attract a substantial subscriber base, thereby contributing positively to the company’s revenue streams. This success in the streaming sector underscores Disney’s ability to adapt to changing consumer preferences, particularly as traditional media consumption patterns evolve.

Moreover, Disney’s theme parks and resorts have shown a remarkable recovery following the disruptions caused by the COVID-19 pandemic. As travel restrictions ease and consumer confidence returns, the pent-up demand for leisure and entertainment experiences has led to increased foot traffic and spending at Disney’s iconic destinations. This resurgence in the parks and resorts segment not only boosts Disney’s financial performance but also reaffirms the enduring appeal of its brand.

In addition to these operational successes, Disney’s strategic initiatives have played a crucial role in its earnings surge. The company has been proactive in optimizing its content portfolio, investing in high-quality productions that resonate with diverse audiences. By leveraging its vast intellectual property, Disney has been able to create synergies across its various business segments, thereby enhancing its competitive edge in the entertainment industry.

For investors, Disney’s strong earnings report offers several implications. Firstly, it reinforces the company’s position as a leader in the entertainment sector, with a diversified business model that can weather economic uncertainties. This resilience makes Disney an attractive option for investors seeking stability and growth potential in their portfolios. Furthermore, the company’s focus on innovation and strategic expansion suggests that it is well-positioned to capitalize on emerging opportunities in the digital and global markets.

However, it is important for investors to remain cognizant of potential challenges that could impact Disney’s future performance. The ongoing concerns about inflation and its effects on consumer spending could pose risks to discretionary sectors, including entertainment. Additionally, competitive pressures in the streaming industry continue to intensify, with new entrants and existing players vying for market share. As such, investors should closely monitor Disney’s strategic responses to these challenges, as well as broader economic indicators that could influence its trajectory.

In conclusion, Disney’s earnings surge amidst a backdrop of market volatility and inflation concerns highlights the company’s robust operational capabilities and strategic foresight. As the Dow Jones grapples with economic uncertainties, Disney’s performance serves as a testament to its enduring appeal and adaptability. For investors, this presents an opportunity to consider Disney as a resilient and forward-looking investment, while remaining vigilant of the broader economic landscape and industry dynamics.

Analyzing The Dow Jones Drop: Key Factors And Implications

The recent fluctuations in the Dow Jones Industrial Average have captured the attention of investors and analysts alike, as the index experienced a notable drop amid the release of new inflation data. This decline, however, was juxtaposed with a surge in Disney’s stock, which soared following the company’s impressive earnings report. As market participants digest these developments, all eyes are now on Federal Reserve Chair Jerome Powell’s upcoming speech, which is expected to provide further insights into the central bank’s monetary policy stance.

The Dow Jones drop can be attributed primarily to the latest inflation figures, which have reignited concerns about the pace and persistence of rising prices. The Consumer Price Index (CPI) revealed that inflation remains stubbornly high, exceeding economists’ expectations and suggesting that the cost pressures affecting consumers and businesses are not abating as quickly as hoped. This data has fueled speculation that the Federal Reserve may need to maintain its aggressive interest rate hikes to combat inflation, a prospect that typically weighs on equity markets due to the potential for higher borrowing costs and reduced corporate profitability.

In contrast, Disney’s stock performance provided a bright spot in an otherwise turbulent market environment. The entertainment giant reported earnings that surpassed Wall Street’s forecasts, driven by strong growth in its streaming services and a rebound in its theme park operations. Disney’s ability to adapt to changing consumer preferences and capitalize on its diverse portfolio of assets has reassured investors about its long-term growth prospects. This optimism was reflected in the stock’s upward trajectory, highlighting the importance of company-specific factors in driving market movements even amid broader economic uncertainties.

As investors navigate these mixed signals, attention is increasingly turning to Jerome Powell’s forthcoming speech, which is anticipated to offer crucial guidance on the Federal Reserve’s policy direction. Market participants are eager to discern whether the central bank will continue its current trajectory of interest rate hikes or if it might signal a more dovish approach in response to evolving economic conditions. Powell’s remarks will be scrutinized for any indications of how the Fed plans to balance its dual mandate of promoting maximum employment and ensuring price stability, particularly in light of the persistent inflationary pressures.

The implications of these developments extend beyond the immediate market reactions. The interplay between inflation data, corporate earnings, and central bank policy underscores the complexity of the current economic landscape. Investors must grapple with the challenge of interpreting a multitude of factors that can influence asset prices, from macroeconomic indicators to company-specific performance metrics. This environment necessitates a nuanced approach to investment decision-making, as market participants seek to position themselves strategically amid ongoing volatility.

In conclusion, the recent drop in the Dow Jones, coupled with Disney’s robust earnings performance, exemplifies the dynamic nature of financial markets. As inflation concerns persist and the Federal Reserve’s policy path remains uncertain, investors are tasked with navigating a landscape characterized by both risks and opportunities. Jerome Powell’s upcoming speech will likely play a pivotal role in shaping market sentiment, as stakeholders look for clarity on the central bank’s response to the prevailing economic challenges. Ultimately, the ability to adapt to these evolving conditions will be crucial for investors seeking to achieve their financial objectives in an ever-changing market environment.

How Disney’s Performance Is Defying Market Trends

In a market environment characterized by volatility and uncertainty, Disney’s recent performance stands out as a beacon of resilience. While the Dow Jones Industrial Average has experienced a downturn, largely influenced by the latest inflation data, Disney has managed to defy these broader market trends, buoyed by its impressive earnings report. This divergence highlights the unique factors contributing to Disney’s success and underscores the company’s strategic positioning in an ever-evolving economic landscape.

The recent drop in the Dow Jones can be attributed to investor concerns over rising inflation, which has prompted fears of potential interest rate hikes by the Federal Reserve. As inflationary pressures mount, market participants are increasingly wary of the implications for economic growth and corporate profitability. In this context, many companies have struggled to maintain investor confidence, leading to a decline in stock prices. However, Disney’s robust earnings report has provided a stark contrast to this prevailing sentiment, capturing the attention of investors and analysts alike.

Disney’s ability to outperform market expectations can be traced to several key factors. First and foremost, the company’s diversified portfolio has proven to be a significant asset. With interests spanning media networks, theme parks, and streaming services, Disney has successfully mitigated risks associated with any single sector. This diversification has allowed the company to capitalize on growth opportunities in areas such as streaming, where its Disney+ platform continues to gain traction and expand its subscriber base. The success of Disney+ has been instrumental in offsetting challenges faced by other segments, such as theme parks, which have been impacted by fluctuating consumer behavior and travel restrictions.

Moreover, Disney’s strategic investments in content creation have further bolstered its competitive edge. By producing high-quality, original content that resonates with audiences worldwide, Disney has strengthened its brand loyalty and expanded its market reach. This content-driven approach not only enhances the value proposition of its streaming services but also reinforces the company’s position as a leader in the entertainment industry. As a result, Disney has been able to maintain a steady revenue stream, even as other companies grapple with the effects of inflation and economic uncertainty.

In addition to its operational strengths, Disney’s financial management has played a crucial role in its ability to navigate the current market landscape. The company has demonstrated prudent fiscal discipline, effectively managing its debt levels and optimizing its capital structure. This financial resilience has provided Disney with the flexibility to invest in growth initiatives and weather potential economic headwinds. Consequently, investors have responded positively to Disney’s earnings report, driving the stock higher despite broader market declines.

As Federal Reserve Chair Jerome Powell prepares to deliver a highly anticipated speech, market participants are keenly focused on any signals regarding future monetary policy. While the outcome of this address remains uncertain, Disney’s recent performance offers a compelling case study of how strategic foresight and operational excellence can enable a company to thrive amid challenging conditions. By leveraging its diversified portfolio, investing in content, and maintaining financial discipline, Disney has not only defied market trends but also positioned itself for sustained success in the years to come. As such, Disney’s trajectory serves as a testament to the power of adaptability and innovation in an ever-changing economic environment.

Jerome Powell’s Upcoming Speech: What To Expect

As investors keenly await Federal Reserve Chair Jerome Powell’s upcoming speech, the financial markets are abuzz with speculation and anticipation. Powell’s address is expected to provide crucial insights into the Federal Reserve’s monetary policy direction, especially in light of the recent inflation data that has sent ripples through the Dow Jones Industrial Average. The Dow’s recent drop can be attributed to heightened concerns over inflationary pressures, which have reignited fears of potential interest rate hikes. In this context, Powell’s speech is poised to play a pivotal role in shaping market expectations and investor sentiment.

The latest inflation figures have painted a complex picture for policymakers. On one hand, the data indicates a persistent rise in consumer prices, driven by factors such as supply chain disruptions and increased demand. On the other hand, there are signs that some inflationary pressures may be transitory, as certain sectors begin to stabilize. This duality presents a challenging scenario for the Federal Reserve, which must balance the need to curb inflation with the imperative to support economic growth. Consequently, Powell’s remarks will be scrutinized for any hints regarding the Fed’s approach to interest rates and its broader monetary policy strategy.

In the midst of these economic uncertainties, Disney has emerged as a standout performer, with its stock soaring on the back of strong earnings. The entertainment giant’s robust financial results have provided a welcome boost to investor confidence, underscoring the resilience of certain sectors even in the face of broader market volatility. Disney’s success can be attributed to a combination of factors, including the resurgence of its theme parks, the continued growth of its streaming services, and strategic content investments. This positive performance has not only buoyed Disney’s stock but also offered a glimmer of optimism to investors navigating a turbulent market landscape.

As Powell prepares to deliver his speech, market participants are eager to discern the Fed’s stance on tapering its asset purchase program. The timing and pace of tapering are critical considerations, as they will influence liquidity conditions and interest rates. A more aggressive tapering schedule could signal the Fed’s commitment to combating inflation, but it also risks unsettling markets that have grown accustomed to accommodative monetary policy. Conversely, a cautious approach may reassure investors but could exacerbate inflationary pressures if perceived as too lenient.

Moreover, Powell’s speech will likely address the broader economic outlook, including labor market dynamics and global economic conditions. The interplay between domestic and international factors is increasingly relevant, as global supply chain disruptions and geopolitical tensions continue to impact economic performance. Powell’s insights into these issues will be instrumental in shaping market expectations and guiding investment strategies.

In conclusion, Jerome Powell’s upcoming speech represents a critical juncture for financial markets grappling with inflation concerns and economic uncertainty. As the Dow Jones reacts to inflation data and Disney’s earnings provide a counterbalance, investors are keenly focused on the Federal Reserve’s next moves. Powell’s address will not only offer guidance on monetary policy but also serve as a barometer for the broader economic landscape. As such, it holds significant implications for market dynamics and investor confidence in the months ahead.

Inflation Concerns And Their Effect On Stock Markets

The recent fluctuations in the stock market have been a focal point for investors and analysts alike, as inflation concerns continue to cast a shadow over economic stability. The Dow Jones Industrial Average recently experienced a notable decline, driven by the latest inflation data that has reignited fears of prolonged economic challenges. This downturn in the Dow Jones underscores the sensitivity of the stock market to inflationary pressures, which have been a persistent concern for policymakers and investors. As inflation rates remain elevated, the potential for increased interest rates looms large, creating an environment of uncertainty that has led to cautious trading behaviors.

In contrast to the broader market’s struggles, Disney has emerged as a standout performer, buoyed by its impressive earnings report. The entertainment giant’s robust financial results have provided a glimmer of optimism amid the prevailing economic concerns. Disney’s success can be attributed to its strategic initiatives, including the expansion of its streaming services and the reopening of its theme parks, which have collectively bolstered its revenue streams. This positive performance has not only lifted Disney’s stock but also offered a counter-narrative to the otherwise bearish sentiment in the market.

The juxtaposition of Disney’s ascent and the Dow Jones’ decline highlights the complex interplay between individual corporate successes and broader economic indicators. While Disney’s achievements are noteworthy, they do not entirely mitigate the overarching concerns about inflation and its potential impact on the economy. Investors remain vigilant, as the Federal Reserve’s response to inflationary pressures will be crucial in shaping the market’s trajectory. The anticipation surrounding Federal Reserve Chair Jerome Powell’s upcoming speech adds another layer of intrigue to the current economic landscape. Market participants are keenly awaiting Powell’s insights, hoping for clarity on the central bank’s approach to managing inflation and interest rates.

As the market navigates these turbulent waters, the role of inflation data cannot be overstated. Recent reports have shown that inflation remains stubbornly high, driven by factors such as supply chain disruptions and increased consumer demand. These elements have contributed to rising prices across various sectors, from energy to consumer goods, further complicating the economic recovery. The Federal Reserve faces the delicate task of balancing the need to curb inflation with the desire to support economic growth, a challenge that has significant implications for both the stock market and the broader economy.

In this context, the market’s reaction to inflation data serves as a barometer of investor sentiment and economic confidence. The decline in the Dow Jones reflects a cautious approach, as investors weigh the potential for tighter monetary policy against the backdrop of persistent inflation. Conversely, Disney’s strong performance offers a reminder that individual companies can thrive even in challenging economic conditions, provided they adapt and innovate effectively.

Ultimately, the interplay between inflation concerns and stock market dynamics underscores the complexity of the current economic environment. As investors and policymakers alike grapple with these challenges, the need for strategic decision-making and clear communication becomes paramount. The coming weeks will be critical in determining how these factors evolve, with the potential to shape the economic landscape for months to come. As such, all eyes remain on the Federal Reserve and its response to the ongoing inflationary pressures, as well as on companies like Disney that continue to navigate these uncertain times with resilience and foresight.

The Role Of Earnings Reports In Market Volatility

Earnings reports play a pivotal role in shaping market volatility, serving as a barometer for investors to gauge the financial health and future prospects of companies. These reports, released quarterly, provide a comprehensive overview of a company’s performance, including revenue, profit margins, and future guidance. As such, they are closely scrutinized by investors, analysts, and market participants, who use the data to make informed decisions about buying, holding, or selling stocks. The recent fluctuations in the Dow Jones Industrial Average, juxtaposed with Disney’s impressive earnings, underscore the profound impact that earnings reports can have on market dynamics.

In the context of the Dow Jones, the recent drop can be attributed to a confluence of factors, with inflation data playing a significant role. Inflation, a critical economic indicator, affects consumer purchasing power and corporate profit margins. When inflation rises, it often leads to increased costs for businesses, which can erode profitability. Consequently, investors become wary, leading to sell-offs that contribute to market volatility. The latest inflation data, indicating persistent price pressures, has heightened concerns about the Federal Reserve’s monetary policy trajectory. As investors brace for potential interest rate hikes, market sentiment has turned cautious, resulting in downward pressure on the Dow Jones.

Conversely, Disney’s stock has soared following its robust earnings report, illustrating how positive financial performance can buoy investor confidence. Disney’s earnings exceeded analysts’ expectations, driven by strong growth in its streaming services and theme park divisions. This performance not only highlights the company’s resilience in navigating economic challenges but also reassures investors about its strategic direction. The market’s positive reaction to Disney’s earnings underscores the importance of corporate performance in influencing stock prices. When a company demonstrates strong financial health and growth potential, it can attract investor interest, leading to stock price appreciation even amid broader market uncertainties.

The interplay between earnings reports and market volatility is further complicated by external factors, such as upcoming speeches by influential figures like Federal Reserve Chair Jerome Powell. Powell’s speeches are closely monitored for insights into the Fed’s policy outlook, particularly in relation to interest rates and inflation control. As investors anticipate Powell’s remarks, market volatility can be exacerbated by speculation and uncertainty. In this environment, earnings reports serve as a stabilizing force, providing concrete data that can either mitigate or amplify market reactions to external events.

Moreover, the timing of earnings reports can influence market dynamics. Companies that report early in the earnings season can set the tone for investor sentiment, while those reporting later may face heightened scrutiny as market participants look for confirmation of broader economic trends. In this regard, Disney’s strong earnings report not only boosted its stock but also provided a positive signal to the market, potentially offsetting some of the negative sentiment stemming from inflation concerns.

In conclusion, earnings reports are a critical component of market volatility, offering valuable insights into corporate performance and influencing investor behavior. As demonstrated by the recent movements in the Dow Jones and Disney’s stock, these reports can either exacerbate or alleviate market fluctuations, depending on the broader economic context and investor expectations. As such, they remain an essential tool for market participants seeking to navigate the complexities of the financial landscape.

Q&A

1. **What caused the Dow Jones to drop?**

The Dow Jones dropped due to concerns over inflation data.

2. **How did Disney perform in the stock market?**

Disney’s stock soared following strong earnings reports.

3. **What was the market’s focus regarding economic data?**

The market was focused on inflation data and its implications.

4. **What event was anticipated involving Jerome Powell?**

Investors were anticipating a speech by Federal Reserve Chair Jerome Powell.

5. **How did inflation data impact investor sentiment?**

Inflation data heightened concerns about potential interest rate hikes, affecting investor sentiment negatively.

6. **What sector did Disney’s earnings impact positively?**

Disney’s earnings positively impacted the entertainment and media sector.

7. **What was the broader market reaction to the economic indicators?**

The broader market reacted with caution, leading to a drop in major indices like the Dow Jones.

Conclusion

The Dow Jones Industrial Average experienced a decline following the release of inflation data, which likely raised concerns about potential interest rate hikes and economic stability. In contrast, Disney’s stock saw a significant increase due to strong earnings performance, highlighting the company’s resilience and growth potential. Investors are now turning their attention to an upcoming speech by Federal Reserve Chair Jerome Powell, anticipating insights into future monetary policy and its implications for the market. Overall, the mixed market reactions underscore the ongoing tension between inflationary pressures and corporate earnings performance.