“Market Momentum: Modest Inflation Fuels Stock Surge”

Introduction

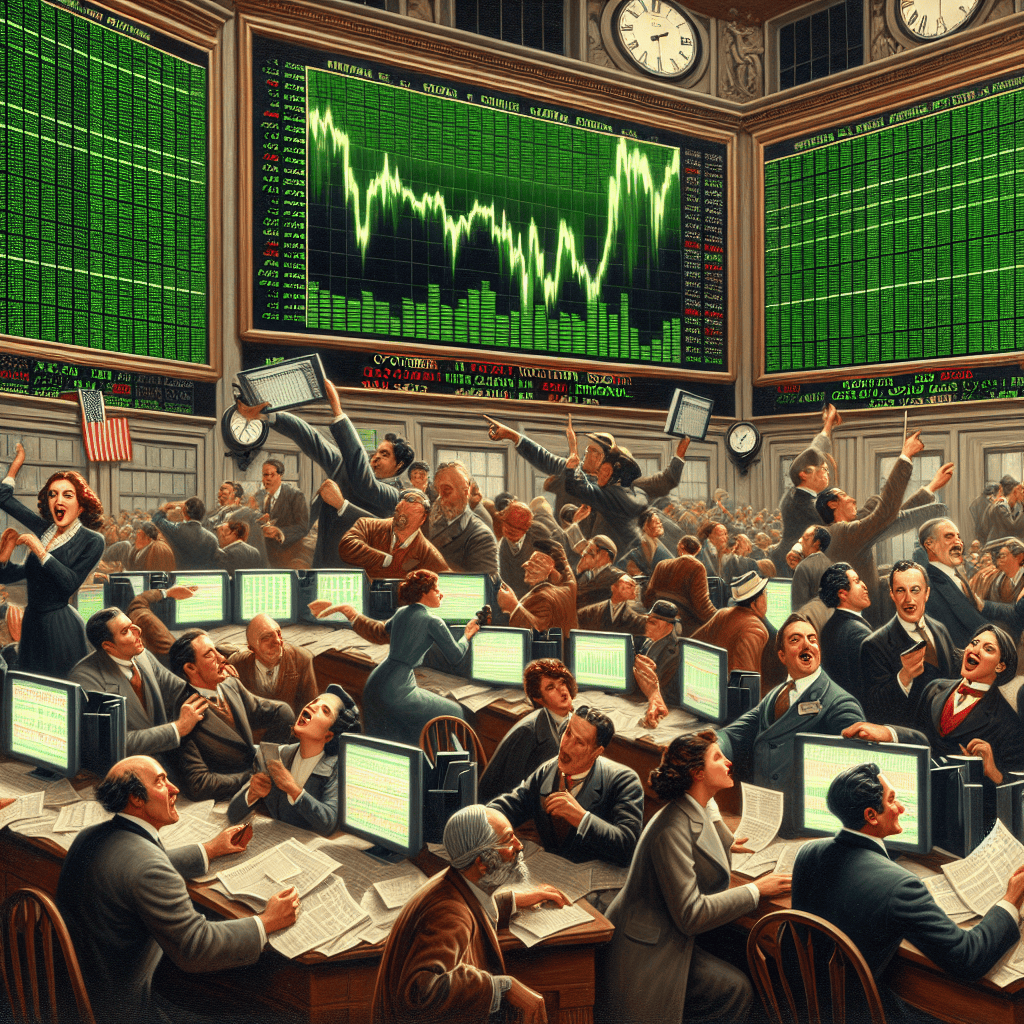

In a notable development for investors and economists alike, the stock market experienced a significant uptick following the release of October’s inflation report, which indicated a modest increase in consumer prices. This report, closely monitored by market participants, suggested that inflationary pressures may be stabilizing, alleviating some concerns about aggressive monetary policy tightening by central banks. The data revealed a tempered rise in the Consumer Price Index (CPI), signaling that while inflation remains a factor, it is not accelerating at a pace that might disrupt economic growth or consumer spending. This news provided a boost to investor confidence, leading to gains across major stock indices as market sentiment improved on the prospect of a more predictable economic environment.

Impact Of Modest Inflation On Stock Market Trends

The recent release of the October inflation report has brought a wave of optimism to the stock market, as it revealed a modest increase in inflation rates. This development has significant implications for stock market trends, as investors and analysts alike assess the potential impacts on various sectors and the broader economy. The modest rise in inflation, while not entirely unexpected, has provided a sense of relief to market participants who had been bracing for more severe inflationary pressures. Consequently, this has led to a positive response in the stock market, with indices showing upward trends.

To understand the impact of this modest inflation on stock market trends, it is essential to consider the broader economic context. Inflation, a measure of the rate at which prices for goods and services rise, can have varying effects on the stock market depending on its magnitude and the underlying economic conditions. In this case, the modest increase suggests that while prices are rising, they are doing so at a manageable pace. This is crucial because it indicates that the economy is growing steadily without overheating, which can lead to more aggressive monetary policy measures such as interest rate hikes.

The Federal Reserve plays a pivotal role in shaping market expectations through its monetary policy decisions. A modest inflation rate allows the Federal Reserve to maintain a more accommodative stance, which is generally favorable for the stock market. Low-interest rates tend to encourage borrowing and investment, providing a boost to corporate earnings and, by extension, stock prices. Therefore, the current inflation report has alleviated some concerns about potential rate hikes, contributing to the stock market’s positive performance.

Moreover, the modest inflation rate has different implications for various sectors within the stock market. For instance, consumer discretionary and technology sectors often benefit from low to moderate inflation, as it supports consumer spending and investment in innovation. On the other hand, sectors such as utilities and consumer staples, which are typically seen as defensive plays, may not experience the same level of benefit. This sectoral differentiation highlights the importance of a nuanced approach to investment strategies in response to inflationary trends.

In addition to sectoral impacts, the modest inflation rate also influences investor sentiment and market psychology. When inflation is perceived as being under control, it reduces uncertainty and fosters a more stable investment environment. This stability can lead to increased investor confidence, encouraging more participation in the stock market and potentially driving prices higher. Furthermore, the positive market response to the inflation report can create a feedback loop, where rising stock prices further bolster investor sentiment.

However, it is important to remain vigilant, as inflation dynamics can change rapidly. While the current report suggests a manageable inflationary environment, external factors such as supply chain disruptions, geopolitical tensions, or unexpected economic shocks could alter the trajectory. Investors should continue to monitor economic indicators and central bank communications to adjust their strategies accordingly.

In conclusion, the modest increase in inflation as reported in October has had a favorable impact on stock market trends, providing a sense of relief and stability to investors. By maintaining a balanced perspective on inflation’s implications across different sectors and remaining attuned to potential changes in the economic landscape, investors can better navigate the complexities of the stock market. As always, a well-informed and adaptable approach will be key to capitalizing on the opportunities presented by evolving market conditions.

October Inflation Report: Key Takeaways For Investors

The recent release of the October inflation report has provided a fresh perspective for investors, as it revealed a modest increase in inflation rates. This development has had a notable impact on the stock market, which responded positively to the news. The report indicated that consumer prices rose at a slower pace than anticipated, suggesting that inflationary pressures may be stabilizing. This has been a point of relief for investors who have been closely monitoring inflation trends, given their potential implications for monetary policy and economic growth.

In the context of the broader economic landscape, the October inflation report serves as a critical indicator of the current state of the economy. The modest increase in inflation suggests that while prices are still rising, the rate of increase is not as rapid as previously feared. This has alleviated some concerns about the potential for aggressive interest rate hikes by the Federal Reserve. Investors have been wary of such hikes, as they could dampen economic growth and negatively impact corporate earnings. Therefore, the report’s findings have been interpreted as a sign that the central bank may adopt a more measured approach in its monetary policy decisions.

Moreover, the stock market’s positive reaction to the inflation report underscores the interconnectedness of economic indicators and market performance. As inflation fears subside, investor confidence tends to strengthen, leading to increased market activity. This is particularly evident in sectors that are sensitive to interest rate changes, such as technology and consumer discretionary stocks. These sectors have experienced gains as investors anticipate a more favorable environment for growth-oriented companies.

Transitioning to the implications for individual investors, the October inflation report offers several key takeaways. First, it highlights the importance of staying informed about economic indicators and their potential impact on investment portfolios. By understanding the nuances of inflation data, investors can make more informed decisions about asset allocation and risk management. Additionally, the report serves as a reminder of the value of diversification. In times of economic uncertainty, a well-diversified portfolio can help mitigate risks associated with inflation and interest rate fluctuations.

Furthermore, the report’s findings may influence investment strategies in the coming months. With inflation showing signs of stabilization, investors might consider exploring opportunities in sectors that benefit from a stable economic environment. For instance, companies with strong pricing power and robust demand for their products may be well-positioned to thrive. Additionally, fixed-income investments could become more attractive if interest rates remain relatively low, offering a balance between risk and return.

In conclusion, the October inflation report has provided a sense of cautious optimism for investors. The modest increase in inflation has alleviated some concerns about aggressive monetary policy actions, leading to a positive response in the stock market. As investors navigate the evolving economic landscape, staying informed and maintaining a diversified portfolio will be crucial. By doing so, they can better position themselves to capitalize on opportunities and manage risks in an ever-changing market environment. As always, careful analysis and strategic planning will be essential for achieving long-term investment success.

How Inflation Influences Stock Market Performance

The stock market often reacts to economic indicators, and the recent October inflation report has been no exception. As the report revealed a modest increase in inflation, the stock market responded with a rise, reflecting the complex interplay between inflation and market performance. Understanding this relationship requires a closer examination of how inflation influences investor behavior and market dynamics.

Inflation, the rate at which the general level of prices for goods and services rises, erodes purchasing power over time. When inflation is moderate, it is often seen as a sign of a growing economy, which can be beneficial for stocks. Companies can pass on higher costs to consumers, potentially leading to increased revenues and profits. This scenario can boost investor confidence, as they anticipate better returns on their investments. Consequently, stock prices may rise, as was observed following the October inflation report.

However, the relationship between inflation and the stock market is not always straightforward. When inflation rises too quickly, it can lead to economic uncertainty. High inflation can prompt central banks to increase interest rates to curb spending and borrowing, which can dampen economic growth. Higher interest rates make borrowing more expensive for companies, potentially reducing their ability to invest in expansion and innovation. This can lead to lower future earnings, which may cause stock prices to fall. Therefore, the modest increase in inflation reported in October was likely perceived as a positive sign, suggesting that the economy is growing without the immediate threat of aggressive monetary tightening.

Moreover, inflation affects different sectors of the stock market in varying ways. For instance, consumer staples and utilities, which provide essential goods and services, tend to perform well during periods of rising inflation. These sectors can maintain stable demand even as prices increase, offering a degree of protection to investors. On the other hand, sectors such as technology and consumer discretionary may face challenges, as higher prices can lead to reduced consumer spending on non-essential items. The October report’s modest inflation increase may have contributed to a balanced performance across sectors, as investors adjusted their portfolios in response to the new data.

In addition to sector-specific impacts, inflation also influences investor sentiment and expectations. When inflation is stable and predictable, it can create a favorable environment for long-term investment planning. Investors are more likely to commit capital to the stock market when they have confidence in the economic outlook. The October inflation report, by showing only a modest increase, may have reinforced the perception of economic stability, encouraging investors to maintain or increase their stock holdings.

Furthermore, inflation expectations play a crucial role in shaping market trends. If investors anticipate that inflation will remain under control, they may be more willing to invest in equities, driving up stock prices. Conversely, if they expect inflation to rise sharply, they might seek safer assets, such as bonds or commodities, which can lead to a decline in stock market performance. The recent report’s modest figures likely helped to anchor inflation expectations, contributing to the stock market’s rise.

In conclusion, the stock market’s positive response to the October inflation report underscores the nuanced relationship between inflation and market performance. While moderate inflation can signal economic growth and boost investor confidence, excessive inflation poses risks that can lead to market volatility. By understanding these dynamics, investors can better navigate the complexities of the stock market and make informed decisions in response to changing economic conditions.

Analyzing The Stock Market’s Reaction To Inflation Data

The stock market experienced a notable rise following the release of the October inflation report, which indicated a modest increase in consumer prices. This development has sparked considerable interest among investors and analysts, as it provides insights into the current economic landscape and potential future monetary policy decisions. The inflation report, which is closely monitored by market participants, revealed that consumer prices rose at a slower pace than anticipated, suggesting that inflationary pressures may be easing. This news was met with optimism in the financial markets, as it alleviated some concerns about the potential for aggressive interest rate hikes by the Federal Reserve.

In recent months, inflation has been a central focus for both policymakers and investors, given its implications for economic growth and monetary policy. The October report’s modest increase in inflation suggests that the economy may be stabilizing, which could lead to a more measured approach by the Federal Reserve in adjusting interest rates. This prospect has been welcomed by investors, who have been wary of the potential negative impact of rapid rate hikes on economic growth and corporate earnings. Consequently, the stock market’s positive reaction can be attributed to the perception that the Federal Reserve may adopt a more cautious stance, thereby supporting continued economic expansion.

Moreover, the stock market’s rise can also be linked to the broader context of economic indicators that have been released in recent weeks. For instance, employment data has shown resilience, with job growth remaining robust and unemployment rates holding steady. These factors, combined with the latest inflation figures, paint a picture of an economy that is navigating the challenges of inflation without derailing growth. As a result, investor sentiment has been buoyed by the belief that the economy is on a sustainable path, which has contributed to the upward momentum in stock prices.

Additionally, the market’s response to the inflation report underscores the importance of expectations in shaping investor behavior. Prior to the release of the report, there was considerable speculation about the potential for higher-than-expected inflation, which could have prompted a more aggressive response from the Federal Reserve. However, the actual data, which showed a more modest increase, helped to assuage these fears and reinforced the view that inflation may be transitory. This shift in expectations has played a crucial role in driving the stock market’s positive performance, as investors recalibrate their outlook based on the latest information.

Furthermore, the stock market’s reaction highlights the interconnectedness of global financial markets. As inflation concerns have been a global phenomenon, the October report’s findings have implications beyond the United States. Investors around the world are closely watching U.S. economic data, given its influence on global monetary policy and financial markets. The modest increase in inflation has provided a sense of relief to international investors, who are also grappling with inflationary pressures in their respective economies. This interconnectedness has contributed to a broader rally in global stock markets, as the positive sentiment in the U.S. has reverberated across borders.

In conclusion, the stock market’s rise following the October inflation report reflects a complex interplay of factors, including expectations about future monetary policy, broader economic indicators, and global market dynamics. The modest increase in inflation has provided a sense of reassurance to investors, who are hopeful that the economy can continue to grow without the need for aggressive interest rate hikes. As market participants digest this latest data, the focus will likely remain on upcoming economic reports and Federal Reserve communications, which will provide further guidance on the trajectory of inflation and its implications for financial markets.

Investment Strategies Amid Modest Inflation Increases

The recent release of the October inflation report has brought a wave of optimism to the stock market, as it revealed a modest increase in inflation. This development has significant implications for investors, who are now recalibrating their strategies to navigate the evolving economic landscape. Understanding the nuances of this report and its impact on investment strategies is crucial for those looking to optimize their portfolios in the current environment.

To begin with, the October inflation report indicated a slight uptick in consumer prices, which was largely anticipated by market analysts. This modest increase suggests that inflationary pressures, while present, are not accelerating at an alarming rate. Consequently, the stock market responded positively, with major indices experiencing gains as investors interpreted the data as a sign of economic stability. This reaction underscores the delicate balance that investors must maintain between inflation concerns and growth prospects.

In light of the report, investors are now considering a range of strategies to mitigate potential risks while capitalizing on opportunities. One approach gaining traction is the diversification of portfolios to include a mix of asset classes that can perform well in an inflationary environment. For instance, equities in sectors such as technology and healthcare, which have historically shown resilience during periods of inflation, are being favored. Additionally, commodities like gold and silver, known for their ability to hedge against inflation, are also attracting interest.

Moreover, the modest inflation increase has implications for interest rates, which remain a focal point for investors. The Federal Reserve’s monetary policy decisions are closely tied to inflation trends, and a gradual rise in inflation could influence the central bank’s approach to interest rates. Investors are therefore keeping a keen eye on any signals from the Federal Reserve regarding potential rate hikes, as these could impact borrowing costs and, by extension, corporate profitability and stock valuations.

Another strategy being considered is the inclusion of inflation-protected securities in investment portfolios. Treasury Inflation-Protected Securities (TIPS), for example, offer a safeguard against inflation by adjusting their principal value in line with changes in the Consumer Price Index. This makes them an attractive option for risk-averse investors seeking to preserve their purchasing power in the face of rising prices.

Furthermore, the modest inflation increase has prompted a reevaluation of growth versus value stocks. Growth stocks, which are typically characterized by higher valuations and expectations of future earnings growth, may face headwinds if inflation leads to higher interest rates. Conversely, value stocks, which are often undervalued relative to their fundamentals, could benefit from a shift in investor sentiment towards more stable, income-generating assets.

In conclusion, the October inflation report’s modest increase has set the stage for a nuanced approach to investment strategies. Investors are now tasked with balancing the potential risks of inflation with the opportunities for growth in a dynamic market environment. By diversifying portfolios, considering inflation-protected securities, and closely monitoring interest rate trends, investors can position themselves to navigate the complexities of the current economic landscape. As always, staying informed and adaptable will be key to achieving long-term investment success amid modest inflation increases.

Sector Performance In Response To Inflation Reports

The stock market experienced a notable rise following the release of the October inflation report, which indicated a modest increase in consumer prices. This development has sparked a wave of optimism among investors, as it suggests that inflationary pressures may be stabilizing, thereby reducing the likelihood of aggressive monetary policy tightening by central banks. As a result, various sectors have responded differently to the news, reflecting their unique sensitivities to inflationary trends and interest rate expectations.

To begin with, the technology sector, which has been particularly sensitive to interest rate fluctuations, saw a significant uptick. Investors are often concerned about the impact of rising interest rates on tech companies, as these firms typically rely on future earnings growth, which can be discounted by higher rates. However, the modest inflation increase has alleviated some of these concerns, leading to a surge in tech stocks. Companies within this sector, such as those involved in software development and semiconductor manufacturing, have benefited from renewed investor confidence, as the prospect of a less aggressive rate hike trajectory becomes more plausible.

In contrast, the financial sector, which generally benefits from rising interest rates, experienced a more subdued response. Banks and other financial institutions often see improved profit margins in a higher interest rate environment, as they can charge more for loans relative to the interest they pay on deposits. However, the tempered inflation report has led to a reassessment of the pace at which rates might rise, resulting in a more cautious outlook for financial stocks. Despite this, the sector remains fundamentally strong, with many institutions well-capitalized and poised to benefit from any future rate increases.

Meanwhile, the consumer discretionary sector has shown resilience in the face of inflationary pressures. This sector, which includes industries such as retail, automotive, and leisure, is often sensitive to changes in consumer spending power. The modest rise in inflation suggests that consumers may not face as severe a squeeze on their purchasing power as previously feared. Consequently, companies within this sector have seen their stock prices buoyed by the prospect of sustained consumer demand. Retailers, in particular, have been optimistic about the upcoming holiday season, anticipating robust sales as inflation concerns ease.

On the other hand, the energy sector has experienced mixed reactions. While higher inflation often correlates with increased energy prices, the modest rise reported in October has led to a more nuanced response. Oil and gas companies have seen some volatility, as investors weigh the potential for continued demand against the backdrop of global economic uncertainties. Nevertheless, the sector remains a focal point for those seeking to hedge against inflation, given its historical performance during periods of rising prices.

In summary, the October inflation report has had a varied impact across different sectors of the stock market. While technology stocks have rallied on the prospect of a more stable interest rate environment, financial stocks have taken a more cautious stance. Consumer discretionary companies have been buoyed by the potential for sustained spending, while the energy sector continues to navigate a complex landscape. As investors digest the implications of the latest inflation data, the stock market’s response underscores the diverse ways in which different sectors are influenced by economic indicators. This dynamic interplay highlights the importance of sector-specific analysis in understanding market movements and making informed investment decisions.

Future Market Predictions Based On Current Inflation Trends

The recent release of the October inflation report has provided a fresh perspective on the future trajectory of the stock market, as it revealed a modest increase in inflation. This development has sparked a wave of optimism among investors, leading to a noticeable rise in stock market indices. As we delve into the implications of this report, it is essential to understand how current inflation trends might shape future market predictions.

To begin with, the modest increase in inflation suggests that the economy is experiencing a period of stable growth. This stability is crucial for investors, as it reduces the uncertainty that often accompanies volatile economic conditions. When inflation is kept in check, it allows businesses to plan for the future with greater confidence, which in turn encourages investment and expansion. Consequently, this environment fosters a positive sentiment in the stock market, as investors anticipate steady returns on their investments.

Moreover, the central bank’s response to inflation trends plays a pivotal role in shaping market expectations. With the October report indicating only a slight uptick in inflation, it is likely that the central bank will maintain its current monetary policy stance. This continuity in policy is reassuring for investors, as it suggests that interest rates will remain relatively low in the near term. Low interest rates are generally favorable for the stock market, as they reduce borrowing costs for companies and increase the attractiveness of equities compared to fixed-income investments.

In addition to the central bank’s policy, the broader economic context must also be considered when predicting future market movements. The modest rise in inflation can be seen as a reflection of resilient consumer demand, which is a key driver of economic growth. As consumers continue to spend, businesses are likely to see increased revenues, which can lead to higher corporate earnings. This, in turn, supports stock prices and contributes to a bullish market outlook.

However, it is important to acknowledge potential risks that could alter this optimistic scenario. Geopolitical tensions, supply chain disruptions, and unexpected shifts in consumer behavior are just a few factors that could impact inflation and, by extension, the stock market. Investors must remain vigilant and adaptable, ready to adjust their strategies in response to changing conditions.

Furthermore, while the current inflation trends are encouraging, they also underscore the importance of diversification in investment portfolios. By spreading investments across various asset classes and sectors, investors can mitigate risks associated with unforeseen economic shifts. This approach not only provides a buffer against potential downturns but also positions investors to capitalize on opportunities that may arise in different areas of the market.

In conclusion, the October inflation report’s modest increase has instilled a sense of cautious optimism in the stock market. As investors interpret these trends, they are likely to anticipate continued economic growth and stable monetary policy, both of which are conducive to a favorable market environment. Nevertheless, it is crucial for investors to remain aware of potential risks and to employ diversified strategies to navigate the complexities of the financial landscape. By doing so, they can better position themselves to achieve their investment goals in the face of evolving economic conditions.

Q&A

1. **Question:** What was the main reason for the stock market rise in October?

– **Answer:** The stock market rose due to a modest increase in the October inflation report, which eased investor concerns about aggressive interest rate hikes.

2. **Question:** How did the inflation report impact investor sentiment?

– **Answer:** The modest increase in inflation reassured investors, leading to increased confidence that the Federal Reserve might slow down its pace of interest rate hikes.

3. **Question:** Which sectors benefited the most from the stock market rise?

– **Answer:** Technology and consumer discretionary sectors often benefit from easing inflation concerns, as they are sensitive to interest rate changes.

4. **Question:** What was the percentage increase in the stock market following the report?

– **Answer:** The stock market saw a percentage increase, but the exact figure can vary; typically, major indices like the S&P 500 might rise by 1-2% on such news.

5. **Question:** How did bond yields react to the inflation report?

– **Answer:** Bond yields typically decrease when inflation reports show modest increases, as expectations for aggressive rate hikes diminish.

6. **Question:** What was the Federal Reserve’s anticipated response to the inflation report?

– **Answer:** The Federal Reserve was expected to consider a more measured approach to future interest rate hikes, potentially opting for smaller increases.

7. **Question:** How did the inflation report affect the US dollar?

– **Answer:** The US dollar might weaken slightly as a result of the report, as lower expectations for rate hikes can reduce demand for the currency.

Conclusion

The stock market experienced gains following the release of the October inflation report, which indicated a modest increase in inflation. This suggests that investors are optimistic about the economic outlook, interpreting the moderate rise in inflation as a sign that the economy is growing steadily without overheating. The restrained inflationary pressures may also alleviate concerns about aggressive monetary policy tightening by central banks, further boosting investor confidence. Overall, the market’s positive response reflects a balance between economic growth and manageable inflation, fostering a favorable environment for equities.